Five Star Business Finance Bundle

How Does Five Star Business Finance Dominate the SME Lending Market?

Discover the innovative Five Star Business Finance SWOT Analysis and the strategies behind its remarkable success in the competitive financial services landscape. This in-depth analysis unveils the company's dynamic sales strategy, marketing strategy, and how it has captured a significant share of the business finance company market. Learn how Five Star Business Finance has effectively targeted and served micro-entrepreneurs and small business owners.

Five Star Business Finance's impressive growth, including a 28% PAT increase in Q4FY25, highlights the effectiveness of its sales and marketing alignment. The company's focus on customer acquisition and lead generation, particularly within the underserved SME sector, has been a key differentiator. This exploration will delve into the specific tactics used, from digital marketing strategies to customer retention practices, providing valuable insights for financial professionals and business strategists alike. Understanding the Five Star Business Finance Company marketing plan offers a blueprint for success in the financial industry.

How Does Five Star Business Finance Reach Its Customers?

The sales and marketing strategy of Five Star Business Finance Company revolves around a direct and localized approach. Their primary sales channel is a robust in-house direct sales team supported by an extensive physical branch network. This strategy is crucial for effective customer acquisition and management, particularly in the specific markets they target.

The company's growth strategy emphasizes direct sourcing. This allows Five Star Business Finance to maintain control over customer quality and disbursement processes, which contributes to better asset quality. Their customer acquisition is entirely in-house, driven by branch-led local marketing efforts.

As of December 31, 2024, the company operated 729 branches across 10 states and Union Territories, a substantial increase from 480 branches as of December 31, 2023, and 373 branches in March 2023. The expansion plan aims for roughly 700 branches by FY26. This on-the-ground presence is vital for collections and maintaining portfolio quality, given their clientele's risk profile.

Five Star Business Finance utilizes a widespread branch network as its primary sales channel. This network is supported by a dedicated in-house sales team, focusing on direct customer engagement. This approach is essential for managing collections and maintaining portfolio quality.

Customer acquisition is 100% in-house, driven by branch-led local marketing. This includes door-to-door outreach and referral marketing, which is particularly effective in smaller towns. This direct approach allows for a relationship-driven sales process.

The company's marketing efforts are closely aligned with its sales strategy, focusing on local and direct engagement. This alignment helps in generating leads and acquiring customers efficiently. The average outstanding per borrower was ₹0.24 million as of March 2023, reflecting their focus on lower ticket-size segments.

Five Star Business Finance has achieved organic growth through its direct sales and referral-based marketing. This strategy has allowed them to expand without relying on expensive mass media campaigns. You can read more about their business model in this article: Revenue Streams & Business Model of Five Star Business Finance.

Five Star Business Finance's sales strategy focuses on direct customer engagement through a strong branch network and in-house sales teams. Their marketing strategy emphasizes local, relationship-driven approaches, particularly in semi-urban markets. This approach is crucial for lead generation and customer acquisition.

- Extensive Branch Network: A wide physical presence for direct customer interaction.

- In-House Sales Teams: Dedicated teams focused on direct customer engagement and relationship building.

- Local Marketing: Branch-led marketing efforts, including door-to-door outreach and referrals.

- Targeted Approach: Focus on lower ticket-size segments since 2017.

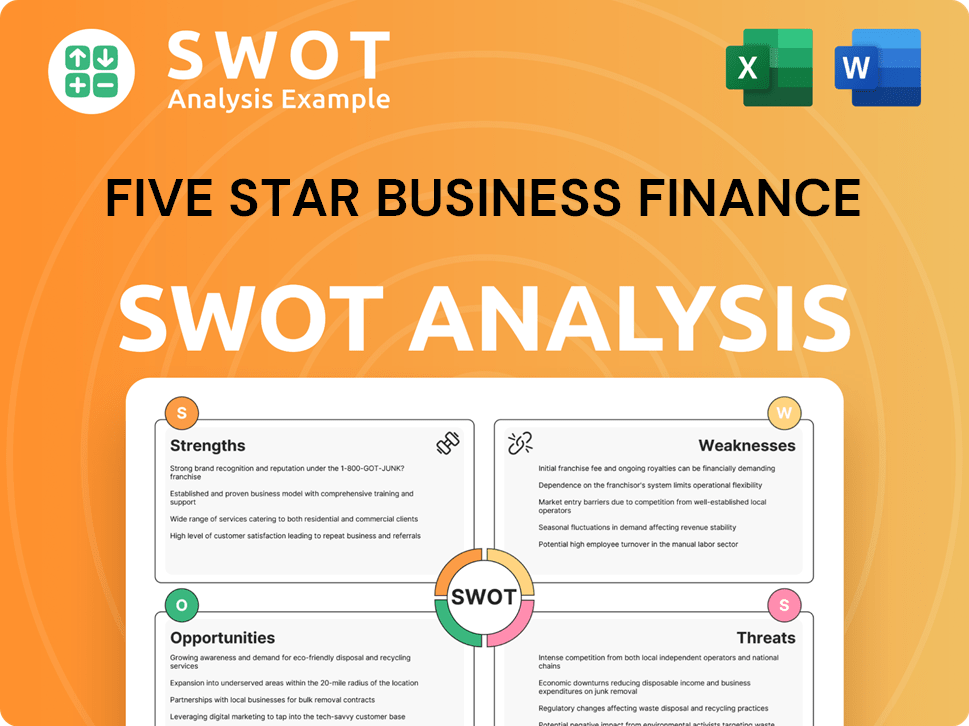

Five Star Business Finance SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Five Star Business Finance Use?

The marketing tactics of Five Star Business Finance Company, a business finance company, are characterized by a 'quietly powerful' approach. This emphasizes building strong local relationships and maintaining an excellent reputation over flashy advertising or mass media campaigns. Their sales strategy and marketing strategy are tailored to the specific needs of India's smaller towns and semi-urban markets, where trust and personal connections are essential.

Their approach reflects the reality of lending in these areas, where word-of-mouth and community trust are more effective than traditional marketing methods. This strategy has allowed them to establish a strong presence and foster growth within their target markets, focusing on customer acquisition and retention through personalized interactions and community engagement.

This approach has been successful in generating leads and acquiring customers, allowing the company to expand its reach and impact within the financial services sector.

The company's marketing mix includes several key elements designed to build trust and drive growth. These tactics are particularly effective in the context of their target markets, where personal relationships are highly valued. Their sales strategy focuses on building strong relationships and providing excellent customer service to foster loyalty and encourage referrals.

- Community Trust Building: Five Star's branches actively cultivate relationships within neighborhoods, acting as trusted financial partners. The company invests heavily in building personal rapport with customers, local brokers, and community influencers who serve as brand ambassadors.

- Referral-Driven Growth: Customer acquisition is predominantly fueled by word-of-mouth referrals and established broker networks. Satisfied borrowers and community leaders play a significant role in organic expansion, reducing the need for extensive marketing expenditures.

- Localized Outreach: The company conducts targeted local events and financial literacy programs. These initiatives educate Micro, Small, and Medium Enterprises (MSMEs) and individuals about credit and loans, thereby establishing credibility and demystifying the borrowing process.

- No Consumer Advertising: Unlike many NBFCs or fintech lenders that engage in mass media or digital advertising, Five Star Business Finance consciously avoids such campaigns. They believe that secured lending is a relationship-driven business that thrives on trust, not hype.

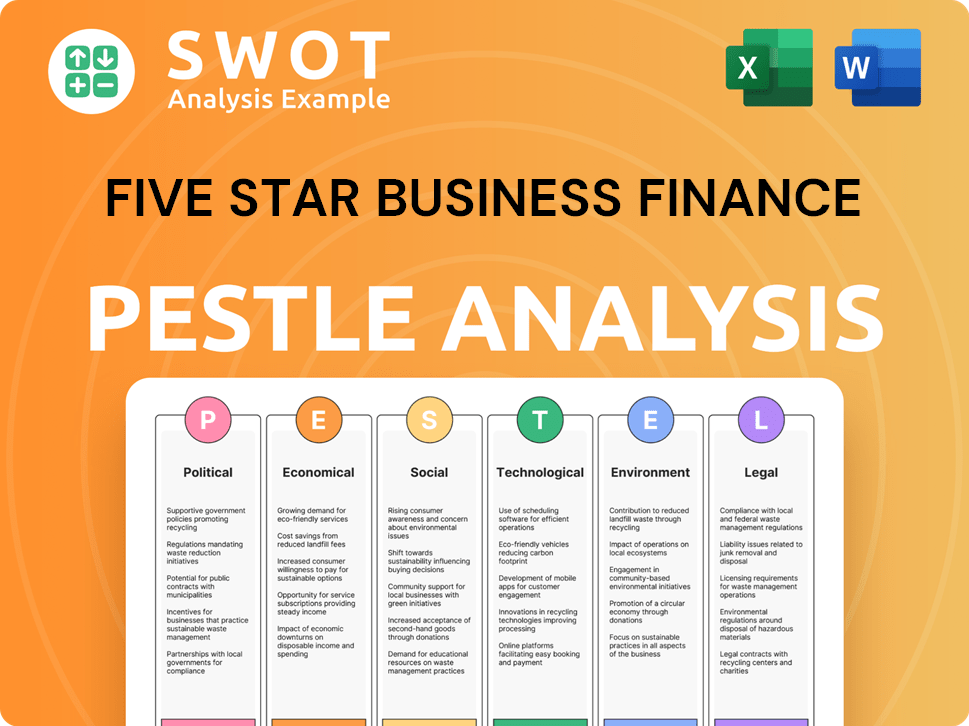

Five Star Business Finance PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Five Star Business Finance Positioned in the Market?

The brand positioning of the company centers on being a dependable financial partner for micro-entrepreneurs and small business owners who are underserved by traditional banking. This financial services provider differentiates itself by offering customized financial solutions to small and medium-sized enterprises (SMEs) that struggle to access mainstream financial products. The focus is on the 'unbanked or underbanked' segments, extending credit in areas often overlooked by larger financial institutions.

The company's brand identity emphasizes reliability and accessibility, particularly in urban, semi-urban, and rapidly growing rural areas. Their appeal to the target audience comes from their ability to assess creditworthiness through non-traditional means and their emphasis on a relationship-driven approach. They offer personalized services and flexible repayment structures. The company highlights its deep understanding of the unique needs of SMEs and self-employed individuals.

The company's consistent communication with investors and partners strengthens its position as a stable, reliable player in a segment that can be perceived as risky. The company also maintains a low loan-to-value (LTV) ratio, typically around 40-50%, providing a significant cushion against delinquencies and reflecting a conservative risk management approach that enhances trust. This consistent approach across its extensive branch network, which grew to 748 branches across 11 states/UTs by Q4FY25, ensures a uniform customer experience and reinforces its brand promise of accessibility and reliability.

The company's brand is built on key attributes that resonate with its target audience and differentiate it in the market. These attributes are crucial for its customer acquisition strategies for finance companies and overall success.

- Accessibility: Focused on serving the 'unbanked' and 'underbanked' segments in urban, semi-urban, and rural areas.

- Reliability: Consistent communication with investors and a conservative risk management approach.

- Customization: Tailored financial solutions for SMEs and self-employed individuals.

- Relationship-Driven: Personalized services and flexible repayment structures.

- Trust: Low loan-to-value ratios and a strong emphasis on in-house sourcing.

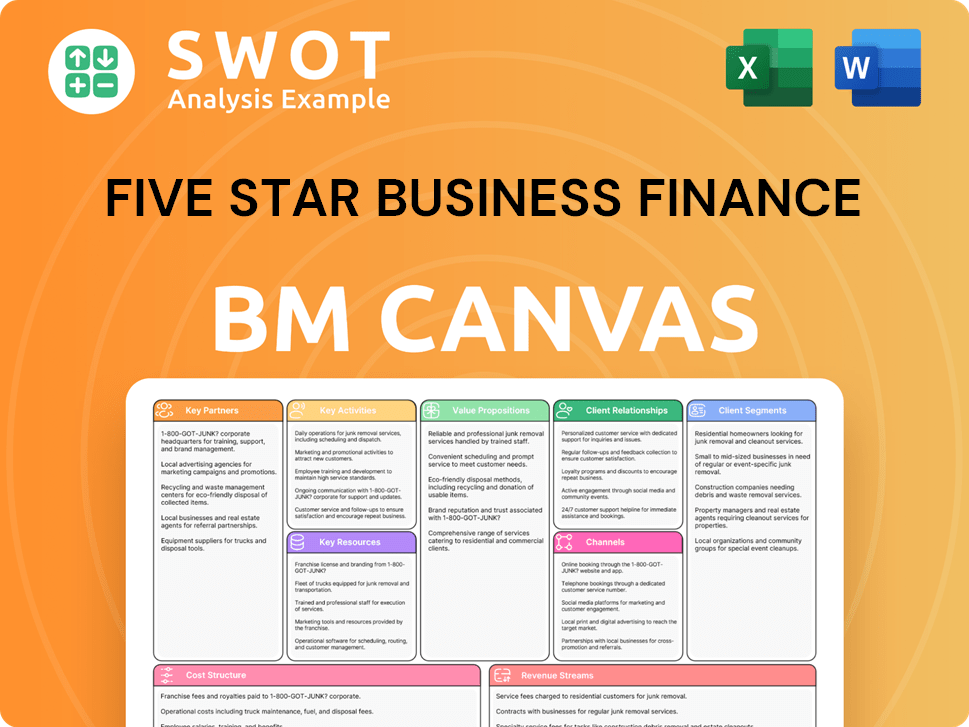

Five Star Business Finance Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Five Star Business Finance’s Most Notable Campaigns?

The sales and marketing strategy of the company centers around strong local relationships and a solid reputation, rather than relying on large-scale advertising. Instead of traditional 'campaigns,' their key initiatives are integrated into their operational model and direct customer engagement. This approach has proven effective in driving growth and maintaining high asset quality within the financial services sector.

A core element of the company's strategy involves consistent branch expansion and an in-house sourcing model. This organic growth is fueled by a dedicated sales team that focuses on door-to-door efforts, local marketing, and referrals. This direct engagement allows for meticulous customer selection, which has resulted in robust asset quality and impressive financial results. Their marketing strategy for financial products is deeply rooted in community engagement.

Another key focus is on financial literacy and community trust-building initiatives. These programs aim to educate MSMEs and individuals about credit and loans, which helps to build credibility and demystify borrowing. This localized outreach fosters strong personal relationships, leading to a largely referral-driven customer acquisition model. This approach supports a strong sales strategy for business loans.

The company consistently expands its branch network to increase market penetration. They added 69 branches in Q3FY25, reaching a total of 729 branches by December 31, 2024. By Q4FY25, they had a total of 748 branches across 11 states/UTs. This expansion is driven by a 100% in-house sales team. The company uses a direct sales approach for lead generation.

The company invests in financial literacy programs to educate MSMEs and individuals. This approach builds trust and demystifies borrowing, which is essential for customer acquisition strategies for finance companies. These initiatives contribute to a referral-driven customer acquisition model. A strong focus on community engagement supports their marketing plan.

The company's sales strategy has resulted in significant growth and strong financial performance. The asset under management (AUM) grew by 25% year-on-year to ₹111,781 million as of December 31, 2024. Their PAT grew by 28% to ₹1,073 crore in FY25, compared to ₹836 crore in FY24. The customer retention rate was 85% in FY 2022-23, and they maintained high yields of approximately 24% by catering to unbanked customers. To learn more about the company's growth strategy, read this article: Growth Strategy of Five Star Business Finance.

- AUM growth of 25% year-on-year as of December 31, 2024.

- PAT grew by 28% in FY25.

- Customer retention rate of 85% in FY 2022-23.

- High yields of approximately 24%.

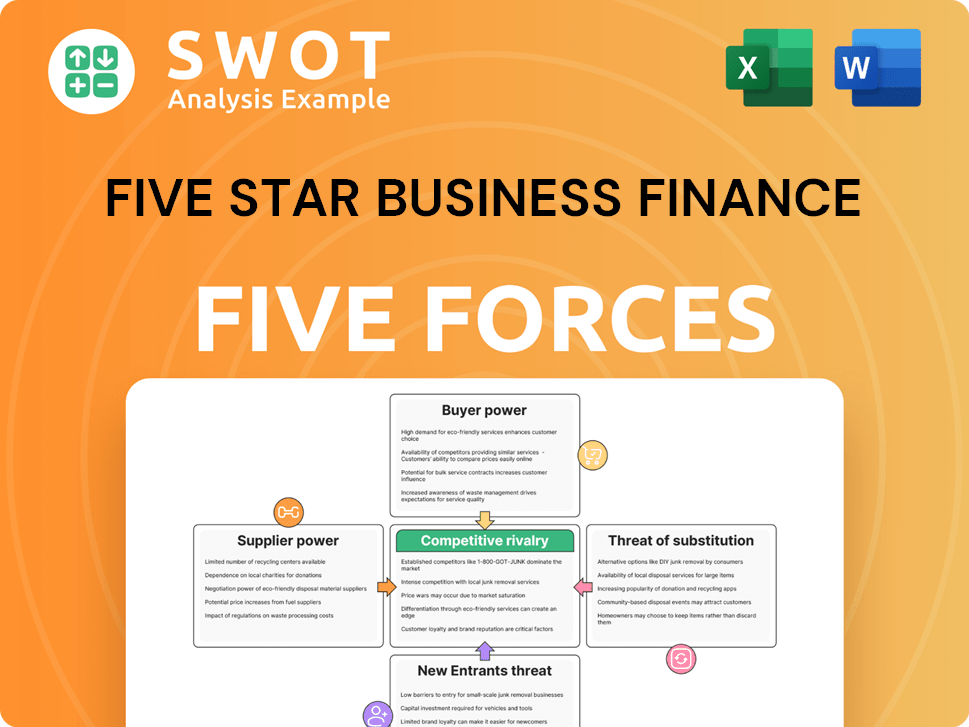

Five Star Business Finance Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Five Star Business Finance Company?

- What is Competitive Landscape of Five Star Business Finance Company?

- What is Growth Strategy and Future Prospects of Five Star Business Finance Company?

- How Does Five Star Business Finance Company Work?

- What is Brief History of Five Star Business Finance Company?

- Who Owns Five Star Business Finance Company?

- What is Customer Demographics and Target Market of Five Star Business Finance Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.