Formosa Petrochemical Bundle

Can Formosa Petrochemical Navigate the Shifting Sands of the Global Petrochemical Market?

The petrochemical industry is a battlefield of fluctuating prices, environmental pressures, and overcapacity. Formosa Petrochemical Company (FPCC), a significant player in this arena, faces a complex web of rivals and industry dynamics. Understanding the Formosa Petrochemical SWOT Analysis is crucial to grasping its position.

This analysis dives deep into the competitive landscape of Formosa Petrochemical, evaluating its market share and financial performance amidst a challenging environment. We will dissect the company's competitive advantages, major rivals, and the industry outlook, providing a comprehensive Formosa Petrochemical company profile. By examining Formosa Petrochemical's key products and recent developments, we aim to uncover the challenges and opportunities shaping its future, offering actionable insights for investors and industry observers alike. This detailed industry analysis will help you understand Formosa's competitive strategy and its impact on the petrochemical industry.

Where Does Formosa Petrochemical’ Stand in the Current Market?

Formosa Petrochemical Corporation (FPCC) holds a significant position within the Taiwanese energy and petrochemical industries. As the only private entity in Taiwan operating both a refining plant and a naphtha cracker, FPCC's integrated model gives it a strategic advantage. The company's diverse product portfolio, ranging from gasoline and diesel to petrochemical basic materials, caters to both domestic and international markets, solidifying its role as a key player in the competitive landscape.

FPCC's core operations are centered in Taiwan, but its parent company, Formosa Plastics Group, has a global footprint. This international presence supports FPCC's ability to distribute its products worldwide. The company's focus on both petroleum products and petrochemicals allows it to serve a wide array of industries, from transportation to manufacturing. Understanding the Brief History of Formosa Petrochemical can provide further context to its current market position.

As of December 2022, FPCC held approximately a 22.8% market share in Taiwan's domestic oil products market, particularly through its gas station franchises. Its primary product lines include gasoline, diesel, jet fuel, and petrochemicals like ethylene and propylene. This significant market share reflects FPCC's strong presence in the Taiwanese market.

FPCC's market share in the domestic oil products market was approximately 22.8% as of December 2022. This indicates a strong hold in the Taiwanese market, particularly in gasoline and diesel sales through its gas station franchises. The company's significant market share underscores its importance in the competitive landscape of the petrochemical company.

FPCC's product portfolio includes a wide range of petroleum products such as gasoline, diesel, and jet fuel, as well as petrochemical basic materials like ethylene and propylene. This diverse product range allows FPCC to cater to a broad customer base. The variety in products helps to stabilize the company's position in the market.

As of March 31, 2025, Formosa Petrochemical reported a trailing 12-month revenue of $20.5 billion and a net income of $142.6 million. However, the company has experienced a decline in revenue since 2021. The company's earnings have been declining at an average annual rate of -13.3%, while the overall oil and gas industry has seen earnings growing at 19% annually.

FPCC's geographic presence extends beyond Taiwan, with its parent company, Formosa Plastics Group, having operations in the U.S., China, Vietnam, the Philippines, and Indonesia. This global footprint supports FPCC's international sales and market reach. The company's ability to operate globally enhances its competitive strategy.

FPCC faces challenges due to weakening profitability and rising debt levels, leading to credit rating downgrades. The oversupplied global petrochemical market presents further difficulties. However, its integrated operations and diverse product portfolio offer opportunities for resilience and growth.

- Declining earnings at an average annual rate of -13.3% versus the industry's 19% growth.

- Credit rating downgrades by Moody's in January 2025 and Standard & Poor's in October 2023.

- Significant decline in revenue since 2021.

- Strong market share in the domestic oil products market.

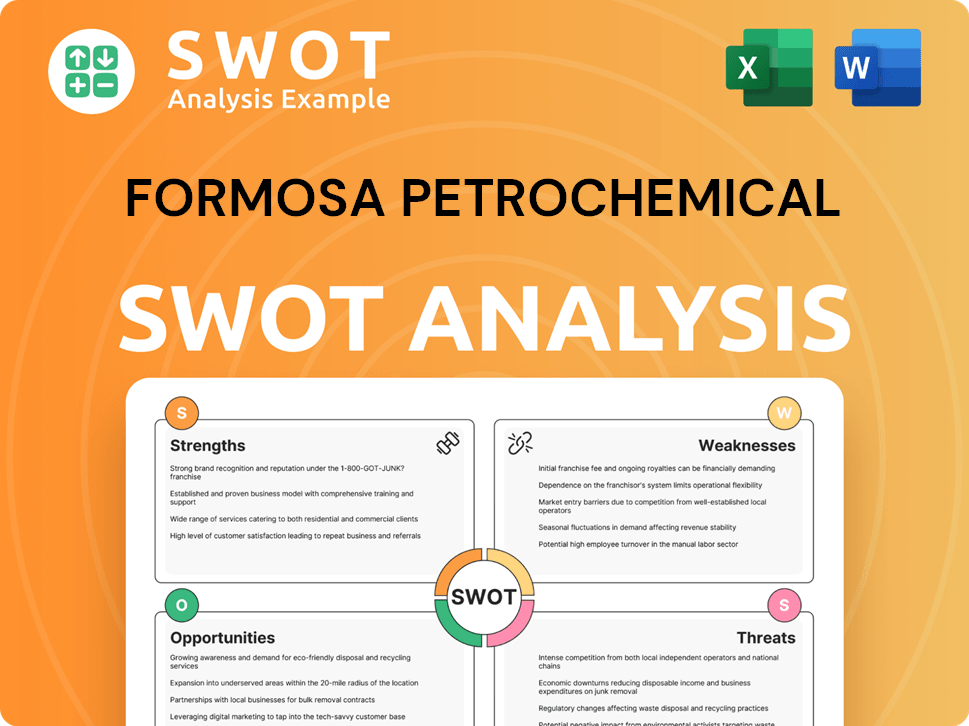

Formosa Petrochemical SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Formosa Petrochemical?

The Formosa Petrochemical operates within a highly competitive global petrochemical and refining market. Understanding the competitive landscape is crucial for assessing its market position and strategic challenges. Key competitors include major international and regional players, influencing its market share and financial performance.

This petrochemical company faces challenges from various rivals. These competitors challenge Formosa through pricing, innovation, geographic reach, and diversification strategies. The market dynamics are significantly impacted by oversupply and evolving industry trends.

The primary competitors of Formosa Petrochemical Company include Sinopec Shanghai Petrochemical, Citgo Petroleum, Gazprom neftekhim Salavat, Gazprom, and Moeve. Other significant players in the broader petrochemical and energy sectors are RAK Petroleum, Marathon Petroleum, Independent Petroleum Group, Fujian Petrochemical Group, Jiangxi Communications Investment, Jiangxi Natural Gas, Refinería La Pampilla, Kuwait Petroleum Corporation (KPC), PETRONAS, Bahrain Petroleum Company (Bapco), China National Petroleum Corporation (CNPC), Wanhua Chemical Group Co Ltd, Sinopec Shanghai Petrochemical Co Ltd, Yunnan Yuntianhua Co Ltd, and Xinjiang Zhongtai Chemical Co Ltd.

The petrochemical market is currently oversupplied, leading to downward pressure on prices and profits. China's increased production capacity has intensified price wars and competition. This oversupply is a major factor influencing the financial performance of companies like Formosa.

Competitors are investing in new technologies and sustainable solutions. While Formosa focuses on process improvements and AI, it must keep pace with industry advancements. Innovation is a key factor in the competitive advantages of Formosa Petrochemical.

Large international players often have a wider global presence and established distribution networks. This challenges Formosa's market reach, particularly with trade policies and tariffs impacting exports. Analyzing Formosa Petrochemical's global presence is essential.

Some competitors are more diversified in their product offerings or have stronger footholds in specialized segments. This provides them with more resilience against market fluctuations. Diversification affects Formosa Petrochemical's market position analysis.

The overall weakening profitability of the petrochemical sector is evident, particularly in Asia-Pacific. Overcapacity and weak demand are prevalent. Understanding these market trends is important for Formosa Petrochemical's strategic planning.

Operating rates of ethylene production facilities globally are at historic lows. More capacity is expected to come online in 2025, intensifying competition. This impacts the Formosa Petrochemical industry outlook.

The Formosa Petrochemical Company's competitors are constantly evolving their strategies. For example, China’s petrochemical production capacity doubled from 12% of global production in 2015 to 25% in 2023, significantly impacting market dynamics. Taiwanese producers, including Formosa, have been affected by reduced operating rates due to weak downstream demand and regional competition, with ethylene exports to China dropping to zero in the past year. This situation highlights the challenges and opportunities Formosa faces. For a deeper dive, consider reading about 0.

Several factors influence the competitive strategy of Formosa Petrochemical and its rivals. These factors include price, innovation, geographic reach, and diversification. The Formosa Petrochemical SWOT analysis should consider these points.

- Price Competition: Driven by oversupply, especially in commodity products.

- Technological Advancements: Investments in new technologies and sustainable solutions.

- Market Access: The ability to reach key markets and navigate trade policies.

- Product Diversification: Offering a broader range of products to mitigate risks.

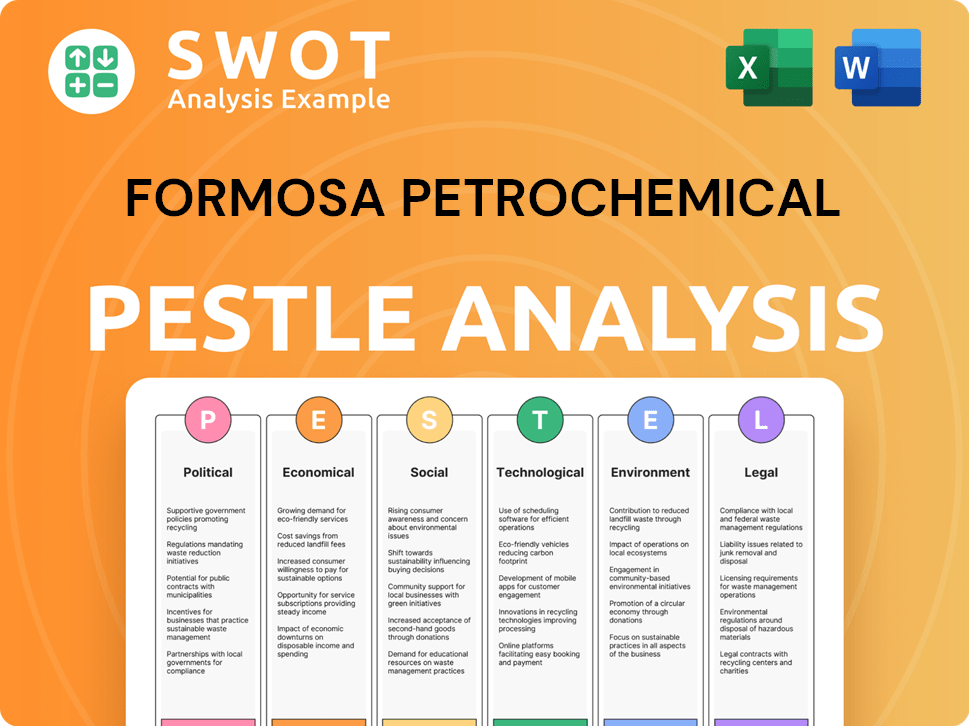

Formosa Petrochemical PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Formosa Petrochemical a Competitive Edge Over Its Rivals?

The Formosa Petrochemical (FPCC) faces a dynamic competitive landscape, navigating challenges and opportunities within the global petrochemical industry. A deep dive into the Formosa Petrochemical Company's competitive advantages reveals its strategic positioning and operational strengths. Understanding these elements is crucial for assessing the company's market position and future prospects. This analysis provides insights into the company's key strengths and the external factors shaping its trajectory.

Analyzing the Formosa Petrochemical is essential for investors and stakeholders. The company's ability to adapt to market changes and maintain its competitive edge is critical. This chapter examines the core elements that define the company's competitive strategy and its impact on the petrochemical sector. The following sections will detail the company's key advantages and challenges.

Examining the Formosa Petrochemical's competitive strengths provides a clear view of its market position. Its integrated operations and focus on high-quality products are key differentiators. This analysis will provide a comprehensive overview of these advantages, along with an assessment of the challenges the company faces in a competitive global market. For a broader understanding of the company's mission and strategy, consider reading about the Growth Strategy of Formosa Petrochemical.

FPCC benefits from its vertical integration within the Formosa Plastics Group. This includes upstream refining and downstream manufacturing, reducing costs. The Mailiao Industrial Complex, with its 56 plants, supports stable raw material supply and international competitiveness. This integrated approach allows for effective planning and coordination across the value chain.

The company operates Taiwan's only privately-owned refinery and naphtha cracking plant. Its naphtha crackers have a total production capacity of 2.935 million tons of ethylene per year. FPCC actively uses AI for process improvement, with 18 AI-related projects completed in 2021, yielding benefits of up to NT$4 billion.

FPCC focuses on high-quality gasoline and diesel, meeting international standards. Its food-grade white oil products are certified by JHOSPA. The company's petrochemical products, such as ethylene, propylene, and butadiene, have obtained REACH registration. FPCC is also venturing into sustainable aviation fuel (SAF) production.

Trial production of SAF began in late 2024 at the Mailiao facility, with an expected production of 5,500 metric tons in 2025. This move towards environmentally friendly products is a strategic step to enhance its international competitiveness. These efforts are crucial for navigating the downturn in the petrochemical industry.

Despite its advantages, FPCC faces challenges from global overcapacity, particularly from China. The rise of shale gas in other regions leads to lower ethylene costs for competitors. These external pressures require FPCC to continuously innovate and adapt.

- Overcapacity in the petrochemical market.

- Competition from lower-cost producers.

- Impact of shale gas on ethylene costs.

- Need for continuous innovation and adaptation.

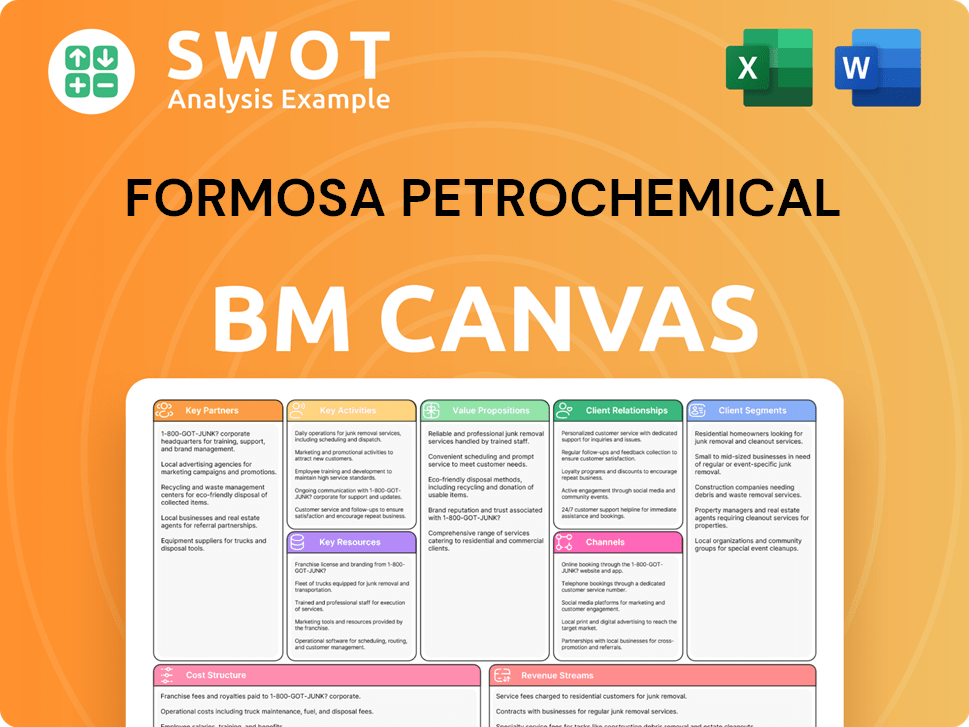

Formosa Petrochemical Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Formosa Petrochemical’s Competitive Landscape?

The Formosa Petrochemical (FPCC) faces a dynamic competitive landscape, significantly shaped by global oversupply, especially from China, and the growing emphasis on sustainability. The petrochemical company is navigating a complex market, with its industry analysis highlighting both immediate risks and long-term opportunities. Understanding these elements is crucial for assessing the Formosa Petrochemical market position analysis and its future prospects.

The Formosa Petrochemical has seen a decline in revenue since 2021, which has affected its financial standing. Rising debt levels have led to credit rating downgrades, reflecting the challenges it faces. However, the company is actively seeking to adapt, focusing on sustainable products and technological advancements. For a deeper dive into the company's strategic direction, consider exploring the Target Market of Formosa Petrochemical.

The petrochemical industry is experiencing oversupply, particularly from China, leading to intense price competition. There's a significant shift towards sustainable commodities and decarbonization, putting pressure on companies to reduce emissions. Technological advancements and volatile energy prices also play a crucial role in shaping the market.

Declining profitability and increased debt pose significant challenges for FPCC, as indicated by recent financial performance. Intensified competition from China and increasing environmental regulations add to the pressure. Transitioning to green energy and sustainable products presents both challenges and opportunities.

FPCC has opportunities in sustainable aviation fuel (SAF) production, with trial production already underway and an expected output of 5,500 metric tons in 2025. Developing high-value-added products, implementing digital transformation, and embracing circular economy initiatives offer additional avenues for growth and sustainability.

FPCC's competitive position will evolve under pressure from global oversupply and the shift towards sustainability. Strategies include promoting energy transitions, circular economy practices, and strengthening risk management for climate change. The company is focusing on environmentally friendly products to enhance competitiveness.

To navigate the challenges and capitalize on opportunities, FPCC is implementing several key strategies. These include a focus on sustainable products, such as fully recyclable plastics, and investments in digital transformation to improve efficiency and reduce costs. These efforts aim to strengthen the company's competitive advantages of Formosa Petrochemical.

- Promoting energy transitions and circular economy practices.

- Strengthening risk management for climate change.

- Developing environmentally friendly and medical-grade products.

- Continued investment in digital transformation and AI implementation.

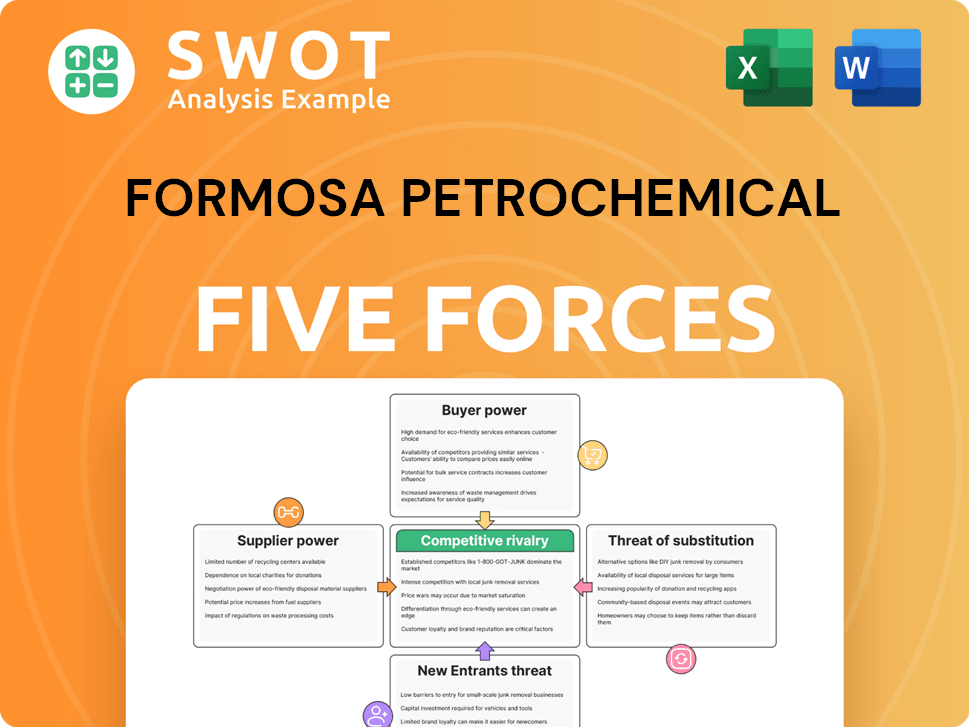

Formosa Petrochemical Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Formosa Petrochemical Company?

- What is Growth Strategy and Future Prospects of Formosa Petrochemical Company?

- How Does Formosa Petrochemical Company Work?

- What is Sales and Marketing Strategy of Formosa Petrochemical Company?

- What is Brief History of Formosa Petrochemical Company?

- Who Owns Formosa Petrochemical Company?

- What is Customer Demographics and Target Market of Formosa Petrochemical Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.