Formosa Petrochemical Bundle

How Does Formosa Petrochemical Company Thrive in the Petrochemical Industry?

Formosa Petrochemical Corporation (FPCC), a powerhouse within the Formosa Plastics Group, is a leading Taiwanese company shaping the global energy and petrochemical landscape. It's a key player in refining crude oil and producing essential petrochemicals like olefins and plastics. Its massive refining complex in Mailiao highlights its significant operational scale. Understanding FPCC's operations is crucial for anyone interested in the Formosa Petrochemical SWOT Analysis.

This in-depth exploration will uncover how Formosa Petrochemical Company generates value, examining its diverse revenue streams and strategic initiatives. We'll analyze its competitive position within the dynamic petrochemical industry and investigate its role in Taiwan's energy self-sufficiency. The company's performance offers insights into broader trends in the oil refinery market and global energy demand, making it a vital subject for investors and industry watchers.

What Are the Key Operations Driving Formosa Petrochemical’s Success?

Formosa Petrochemical Company (FPC) creates value by integrating crude oil refining with the production and sale of various petrochemical products. This Taiwanese company is a key player in the petrochemical industry, offering a diverse range of products. These products serve multiple industries, from everyday goods to advanced technologies.

The core of Formosa Petrochemical’s operations is its large-scale refining complex in Mailiao. This complex has a daily refining capacity of 540,000 barrels. This setup ensures a stable supply of raw materials and helps keep costs down. FPC's supply chain benefits from vertical integration, including oil and gas production, transportation, and natural gas processing.

FPC's focus on efficiency and innovation is evident in its use of advanced refining techniques and the integration of AI technology to improve production. This commitment to quality and efficiency allows Formosa to consistently deliver high-quality products. For more insights into FPC's strategic approach, you can explore the Growth Strategy of Formosa Petrochemical.

FPC's product range includes refined petroleum products and essential petrochemical materials. Refined products include gasoline, diesel, and jet fuel. Petrochemical materials consist of olefins, aromatics, and plastics.

Vertical integration and continuous process improvements are key to FPC's strong cost position. Advanced refining techniques transform crude oil into various products. The company leverages its own fleet of ships for transport.

Customers benefit from consistent product quality and performance. These products are essential in numerous manufacturing processes. FPC's focus on efficiency and innovation ensures it meets the needs of diverse industries.

Formosa Petrochemical is increasingly incorporating AI technology. This enhances production efficiency and product quality. This focus on technology helps maintain its competitive edge.

FPC's operations are centered around its Mailiao refining complex, a major hub for its production. The company's commitment to vertical integration and technological advancements underscores its operational effectiveness. The company's ability to produce a wide range of products ensures its relevance across various sectors.

- Daily refining capacity of 540,000 barrels.

- Vertical integration across the supply chain.

- Use of AI to improve production efficiency.

- Focus on quality and consistent product performance.

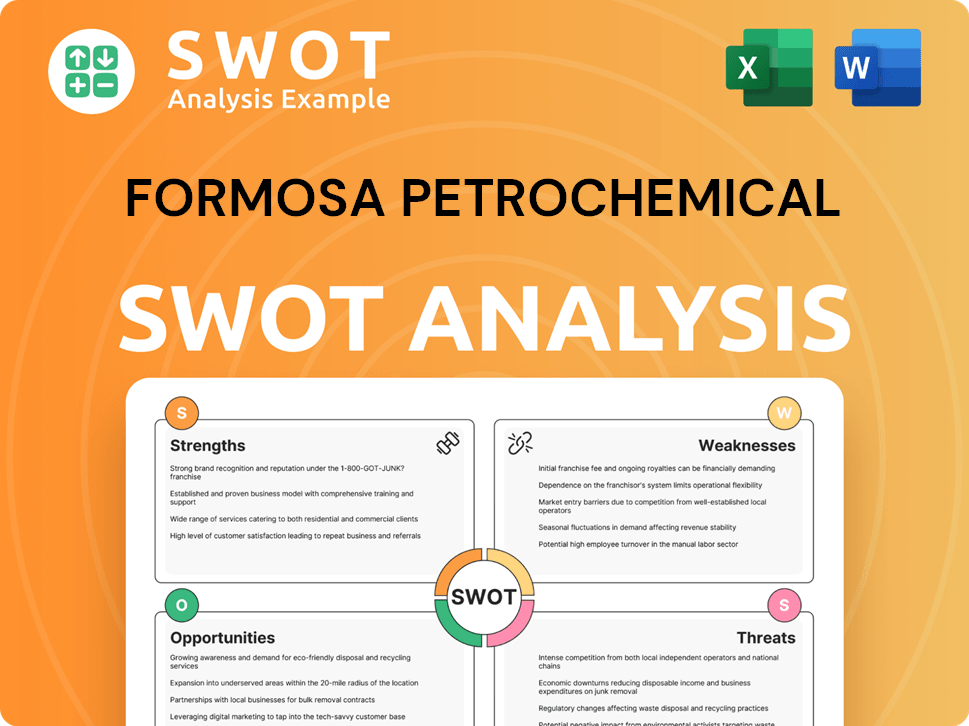

Formosa Petrochemical SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Formosa Petrochemical Make Money?

Formosa Petrochemical Company (Formosa) generates revenue primarily from two key segments: the Petrochemical segment and the Public Utility segment. The Petrochemical segment is the main driver, focusing on the production and sale of petroleum and petrochemical products. The Public Utility segment contributes by producing and selling water, electricity, and steam.

Formosa Petrochemical's financial performance highlights its market position and operational efficiency. The company's revenue streams are diversified across the petrochemical and public utility sectors, ensuring a robust financial foundation.

As of March 31, 2025, Formosa Petrochemical reported a trailing 12-month revenue of approximately $20.5 billion USD. In 2024, the company's revenue was $20.63 billion USD, a decrease from $22.91 billion USD in 2023. The revenue in 2025 (TTM) was reported as $20.49 billion USD. In terms of TWD, Formosa Petrochemical Corp's revenue amounted to 665.9 billion TWD as of March 31, 2025. The company's revenue in 2024 fell by 6.84% from 712.58 billion TWD to 663.82 billion TWD.

Formosa's monetization strategies are centered on optimizing refining margins through its integrated upstream and downstream operations. By producing high-value petrochemical products and leveraging economies of scale, the company aims for competitive pricing and stable revenue streams. Additionally, Formosa has focused on expanding its market share in domestic oil products.

- The company sells gasoline and diesel through gas station franchises across Taiwan since September 2000, achieving approximately 22.4% market share as of December 2023.

- Formosa also offers term supplies for gasoil, such as its 2025 term supplies for 10ppm and 500ppm sulphur gasoil.

- For more information about the company's ownership and financial structure, you can read an article about Owners & Shareholders of Formosa Petrochemical.

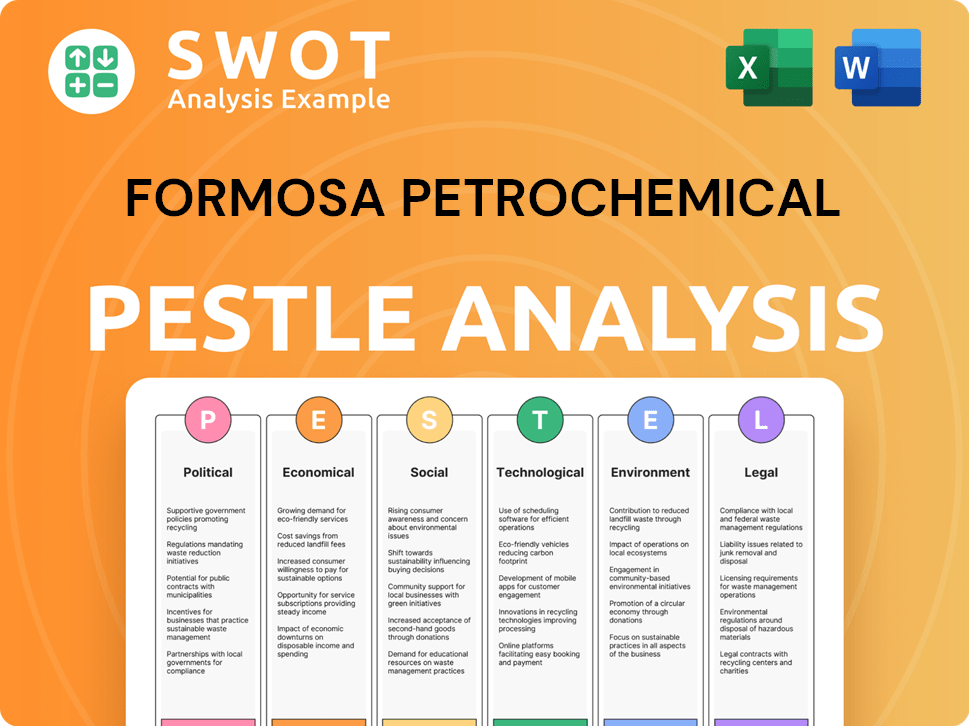

Formosa Petrochemical PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Formosa Petrochemical’s Business Model?

Established in 1992, Formosa Petrochemical Company (FPCC) quickly became a major player in the petrochemical industry. Its foundation was closely tied to Taiwan's Sixth Naphtha Cracker Project, a critical initiative approved in 1986. This project was a cornerstone of FPCC's early operations, with subsequent expansions significantly boosting its production capacity.

The company's strategic moves have been marked by significant investments in its infrastructure. The phased commissioning of naphtha crackers, culminating in the completion of No. 3 in 2007, increased ethylene production capacity to 2.935 million tons annually. This expansion played a key role in achieving 100% ethylene self-sufficiency for Taiwan by 2023.

Despite its robust infrastructure, Formosa Petrochemical has faced operational challenges, including market volatility and financial pressures. The company has responded to these pressures by adjusting its operational strategies, such as refinery run rates and feedstock procurement, to maintain profitability.

The Sixth Naphtha Cracker Project, approved in 1986, was pivotal. Naphtha cracker No. 1 and No. 2 began production in 1999 and 2000. No. 3 started in 2007, bringing total ethylene production capacity to 2.935 million tons per year.

FPCC has adjusted refinery run rates and feedstock procurement. In April 2025, the refinery operated at 68% capacity due to maintenance. The company also purchases LPG cargoes to substitute naphtha.

S&P Global downgraded Formosa Plastics Group's credit assessment to negative in October 2023. Moody's cut Formosa's credit rating in January 2025 from A3 to Baa1. Weak profitability and increased debt levels have contributed to these ratings.

FPCC benefits from vertical integration and continuous process improvements. It is part of the Formosa Plastics Group, which has an integrated system. The company is also focusing on digital transformation and sustainability.

Formosa Petrochemical maintains a strong cost position through vertical integration and continuous investment in process improvements. The company is part of the Formosa Plastics Group, which provides an integrated production system. FPCC is also embracing digital transformation, incorporating AI, and focusing on low-carbon business models to enhance its competitiveness. For more details, see Brief History of Formosa Petrochemical.

- Vertical integration across oil refining, chemicals, plastics, fibers, and electronics.

- Emphasis on digital transformation and AI for process improvements.

- Focus on low-carbon business models to drive industrial upgrades.

- Diversified product portfolio to mitigate market risks.

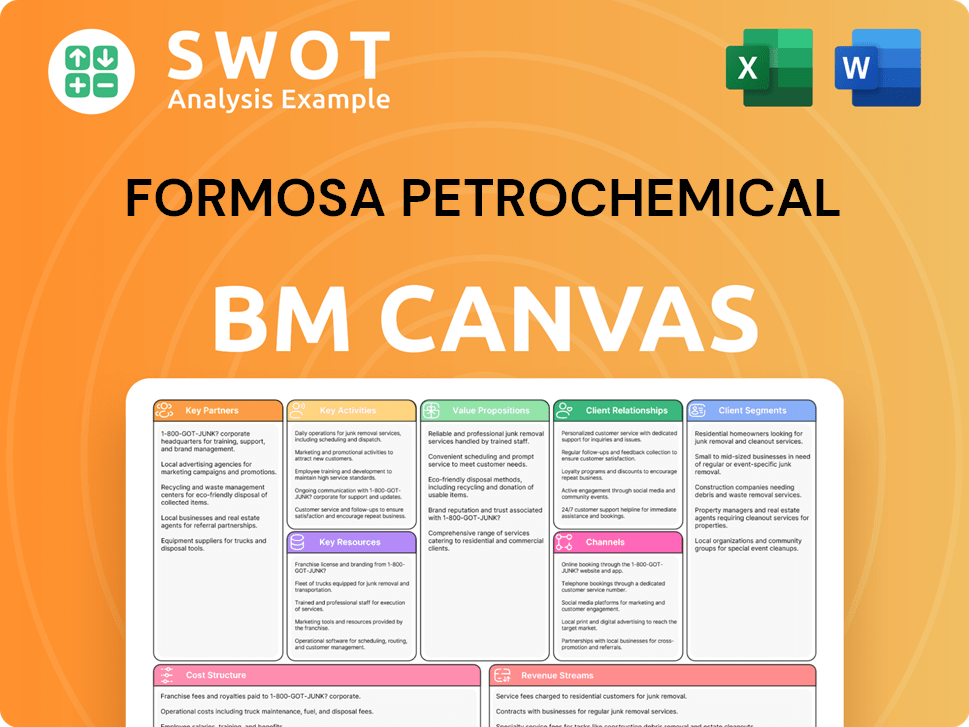

Formosa Petrochemical Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Formosa Petrochemical Positioning Itself for Continued Success?

The Formosa Petrochemical Company (FPC) holds a prominent position in the petrochemical industry, particularly within Taiwan. As the sole private entity in Taiwan operating a refining plant and naphtha cracker, it has established a significant market share. Its operations are centered around the Mailiao complex, one of Asia's largest, with a daily refining capacity of 540,000 barrels.

However, FPC faces several challenges. The company must navigate global overcapacity in the petrochemical sector, weak demand growth, and increasing environmental regulations. These factors, alongside the company's comparatively limited global presence, shape its strategic outlook and operational decisions.

FPC is a key player in Taiwan's oil and petrochemical sectors. It has a substantial domestic market share, holding approximately 22.4% of Taiwan's domestic oil products market as of December 2023. The company's Mailiao complex is a major asset in Asia, contributing significantly to its refining capabilities. Despite this, FPC competes with smaller players in Asian markets.

Several risks affect FPC's operations. Global overcapacity in the petrochemical sector, especially in polyethylene, and weak demand growth are major concerns. Regulatory changes and the shift away from fossil fuels pose further challenges. The company's proposed petrochemical complex in Louisiana faced difficulties. Competitors Landscape of Formosa Petrochemical indicates that FPC must also navigate a competitive environment.

FPC is focusing on 'transformation' and sustainable development. It is promoting cutting-edge technology and products related to digital and energy transformation, the circular economy, and new business development. The company aims to develop differentiated and high-value-added products. FPC plans to reduce emissions to 49.18 million tons by 2025.

FPC has set targets to reduce Scope 1 and 2 emissions by 22% by 2025 and 28% by 2030 from a 2007 baseline. However, it has not set Scope 3 targets, which constitute 80% of its total emissions. The company's emissions intensities do not currently align with a 1.5°C pathway. FPC is working on energy conservation and emission reduction.

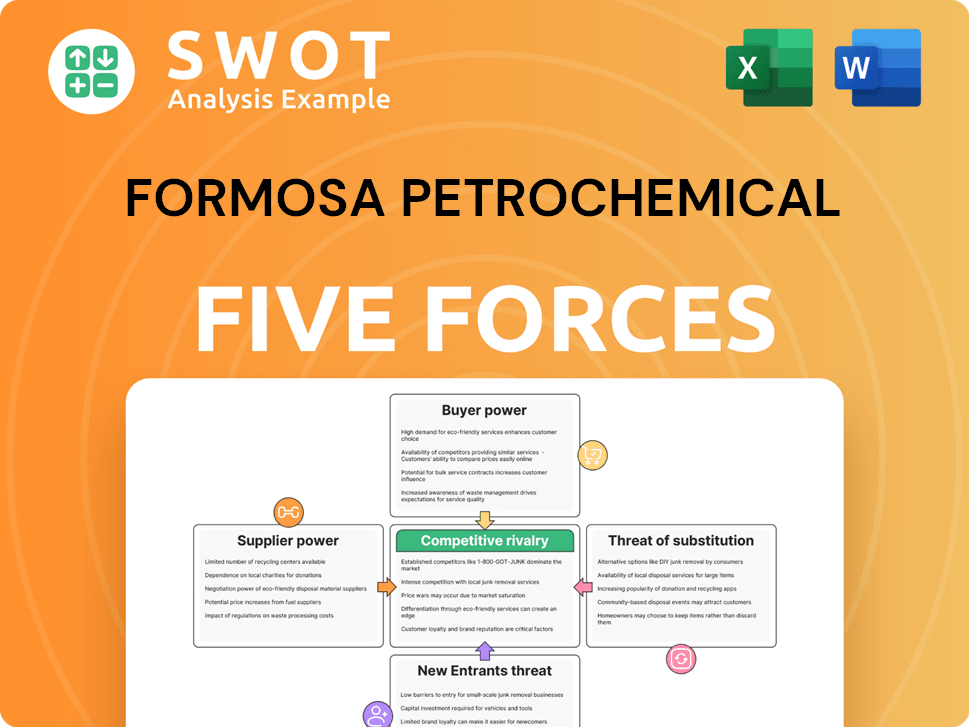

Formosa Petrochemical Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Formosa Petrochemical Company?

- What is Competitive Landscape of Formosa Petrochemical Company?

- What is Growth Strategy and Future Prospects of Formosa Petrochemical Company?

- What is Sales and Marketing Strategy of Formosa Petrochemical Company?

- What is Brief History of Formosa Petrochemical Company?

- Who Owns Formosa Petrochemical Company?

- What is Customer Demographics and Target Market of Formosa Petrochemical Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.