Formosa Petrochemical Bundle

Can Formosa Petrochemical Continue Its Petrochemical Industry Dominance?

Formosa Petrochemical Corporation (FPCC) has long been a cornerstone of the global Formosa Petrochemical SWOT Analysis, but what does the future hold? As a key player within the Formosa Plastics Group, FPCC's evolution from a crude oil refiner to a petrochemical powerhouse is a testament to strategic foresight and operational excellence. This article delves into FPCC's ambitious growth strategy and explores the potential for continued expansion and innovation in a rapidly changing market.

Understanding Formosa Petrochemical's Growth Strategy is crucial for investors and analysts alike, especially when considering its Future Prospects. We'll examine the company's strategic initiatives, financial performance, and market positioning to provide a comprehensive Business Analysis. This deep dive will help you understand the Company Performance and its ability to navigate the complexities of the Petrochemical Industry, providing actionable insights for informed decision-making.

How Is Formosa Petrochemical Expanding Its Reach?

Formosa Petrochemical's (FPCC) Growth Strategy is centered on expanding its operations and diversifying its product offerings. The company is actively involved in new energy ventures and traditional petrochemical production, alongside sustainable initiatives. This multi-pronged approach aims to strengthen its market position and capitalize on emerging opportunities within the Petrochemical Industry.

The company's Future Prospects are closely tied to its ability to navigate challenges and leverage opportunities in the global market. Expansion plans include investments in new technologies and geographical diversification. FPCC's strategic moves reflect a commitment to sustainable practices and adapting to evolving market demands, which is crucial for long-term success.

FPCC's parent company, Formosa Plastics Group, is constructing a lithium iron phosphate battery cell factory in Taiwan, which began in 2023. This project aligns with the group's focus on energy-related initiatives. The company is also promoting overseas investment and expansion, such as increasing petrochemical raw material production capacity at its Ningbo Plant.

FPCC initiated trial production of Sustainable Aviation Fuel (SAF) at its Mailiao facility at the end of 2024. The company anticipates producing 5,500 metric tons of SAF in 2025. This initiative is a response to the growing global demand for greener aviation fuels, with the EU proposing a blending mandate gradually increasing from 2% in 2025 to 63% by 2050.

For 2024, FPCC has set sales targets of 5,169 thousand kiloliters of gasoline and 10,261 thousand kiloliters of diesel. The company is focusing on digital transition through the 'Formosa Oil APP' and expanding marketing channels. In 2023, domestic petroleum product sales grew by 4.6% compared to 2022, and aviation fuel sales surged by 49.8%.

The 2024 sales target for petrochemical products is 2,389 thousand tons. FPCC's strategy involves optimizing sales and distribution channels. These efforts are designed to maintain a strong market presence and adapt to changing consumer behaviors.

Despite expansion efforts, FPCC has faced challenges, including setbacks with its proposed petrochemical complex in Louisiana due to legal and environmental concerns. However, the company is exploring growth opportunities in Texas, with approved water rights for a new reservoir and potential expansions at its Point Comfort facility. These expansions include plants for caustic soda, chlorine, propylene, PVC, and vinyl chloride monomer.

FPCC's expansion strategy includes new energy ventures, product diversification, and increased production capacity. The company is aiming to strengthen its position in the global market through strategic investments and sustainable initiatives. These initiatives are critical for achieving long-term growth and maintaining a competitive edge.

- New energy projects, including battery cell manufacturing.

- Production of Sustainable Aviation Fuel (SAF).

- Focus on digital transformation and expanded marketing channels.

- Exploration of growth opportunities in Texas.

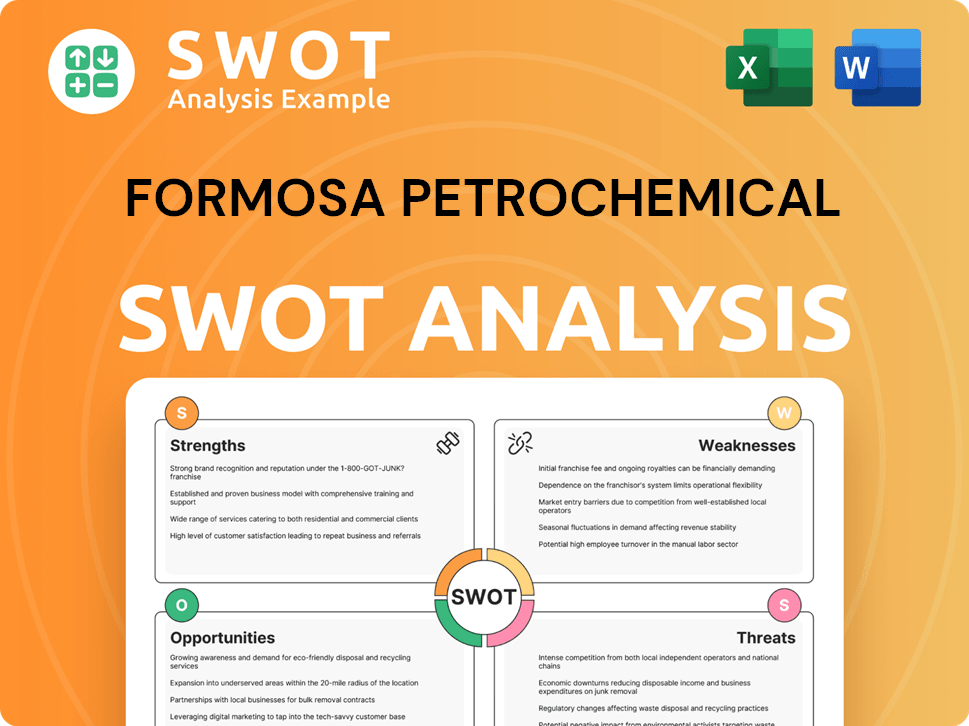

Formosa Petrochemical SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Formosa Petrochemical Invest in Innovation?

Formosa Petrochemical is strategically employing innovation and technology to foster sustained growth within the dynamic petrochemical industry. The company's approach integrates advanced technologies to enhance operational efficiency, reduce costs, and promote sustainability. This strategic focus is crucial for navigating the evolving landscape of the global market and ensuring long-term competitiveness.

The company's growth strategy emphasizes digital transformation, the circular economy, and new business development. These initiatives are designed to meet the changing demands of customers and stakeholders while also addressing environmental concerns. By focusing on these areas, Formosa Petrochemical aims to strengthen its position in the petrochemical industry and drive future investment plans.

A key element of Formosa Petrochemical's strategy involves the application of Artificial Intelligence (AI) in process improvement. This is complemented by the integration of economic, environmental, and risk management considerations. These efforts aim to enhance competitiveness and facilitate industrial upgrades, positioning the company for sustained success. For more insights, you can explore the Mission, Vision & Core Values of Formosa Petrochemical.

Formosa Petrochemical launched the 'Formosa Oil APP' in 2024. This app is designed to develop and maintain target customer segments. It also implements strategic marketing initiatives to reduce costs and improve customer engagement.

In 2023, Formosa Petrochemical completed 58 sustainability projects. These projects yielded annual benefits of approximately 181 million TWD. The company is focused on emission reduction, energy conservation, and water conservation.

Formosa introduced FormoleneEco™ in 2024, its first polypropylene product with 50% recycled content. The company is working to expand its range of products with recycled content. The Point Comfort, Texas facility received ISCC PLUS certification in 2024.

Formosa is investing in solar power projects. The Livingston, New Jersey headquarters has produced over 6.99 GWh of power. This provides approximately 94% renewable energy for the building. The Baton Rouge, Louisiana facility added solar panels in 2024.

Formosa Plastics Corporation, U.S.A. plans to convert over 100 vehicles to EV/hybrid. They also plan to provide more than 100 charging stations across its facilities. This is part of the company's long-term growth potential.

In 2023, improvement initiatives resulted in annual emission reductions of 274 thousand tons. Electricity savings amounted to 185 million kWh. Water savings reached 57 thousand tons.

Formosa Petrochemical is focusing on several key areas to drive innovation and enhance its company performance. These include digital transformation, energy transformation, the circular economy, and new business development. These initiatives are crucial for navigating the challenges and opportunities within the petrochemical industry.

- Digital Transformation: Implementing digital tools and platforms to improve operational efficiency and customer engagement.

- Energy Transformation: Investing in renewable energy sources and sustainable practices to reduce environmental impact.

- Circular Economy: Developing products with recycled content and promoting sustainable materials.

- New Business Development: Exploring new business opportunities and expanding the petrochemical product portfolio.

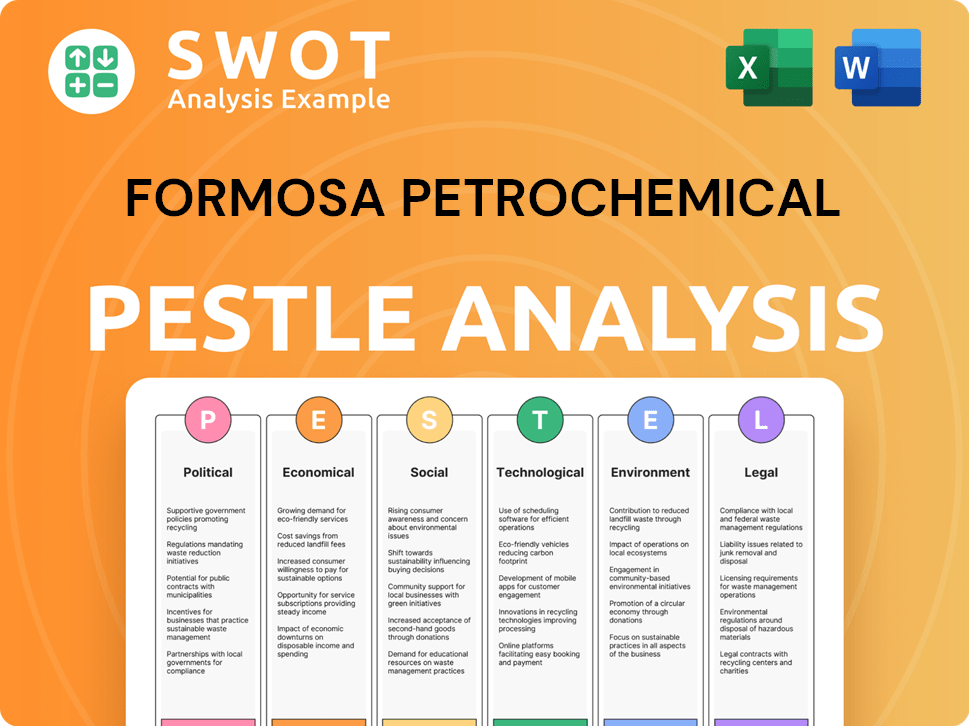

Formosa Petrochemical PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Formosa Petrochemical’s Growth Forecast?

The financial outlook for Formosa Petrochemical presents a complex scenario. The company has faced significant challenges, including declining revenues and profitability, alongside rising debt levels. These issues have led to credit rating downgrades from major agencies, reflecting concerns about its financial health and ability to navigate current market conditions.

Despite these headwinds, Formosa Petrochemical continues to operate within the petrochemical industry, focusing on operational efficiencies and strategic planning to stabilize its financial position. The company's performance is closely tied to global economic trends, including China's economic recovery and fluctuations in oil prices, which significantly impact its refining and petrochemical operations.

As of March 31, 2025, Formosa Petrochemical reported a trailing 12-month revenue of $20.5 billion. However, the company's financial performance has been under pressure, with a notable decline in revenue since 2021. This downturn has affected the company's stock performance and overall profitability, leading to underperformance compared to broader market indices like the Taiwan Index, S&P 500, and the Materials Select Sector SPDR Fund. For a deeper dive into the company's strategies, consider exploring the Marketing Strategy of Formosa Petrochemical.

Moody's downgraded Formosa's credit rating from A3 to Baa1 in January 2025, citing deteriorating fundamentals. Standard and Poor's had previously downgraded Formosa's credit assessment to negative in October 2023, due to weak profitability.

The petroleum refining division experienced a significant profit decline of 69.3% in 2023. Despite this, the division achieved a 3.2% year-over-year increase in average daily throughput, reaching 442,000 barrels in 2023.

Formosa Petrochemical's sales targets for 2024 include 5,169 thousand kiloliters of gasoline and 10,261 thousand kiloliters of diesel. These targets reflect the company's operational focus and market expectations for the year.

The board approved a cash dividend of TWD 0.8 per share, payable on July 25, 2025. The company aims to improve its debt leverage to close to 2x in 2024, from about 3x in 2023, through improving EBITDA and debt reductions.

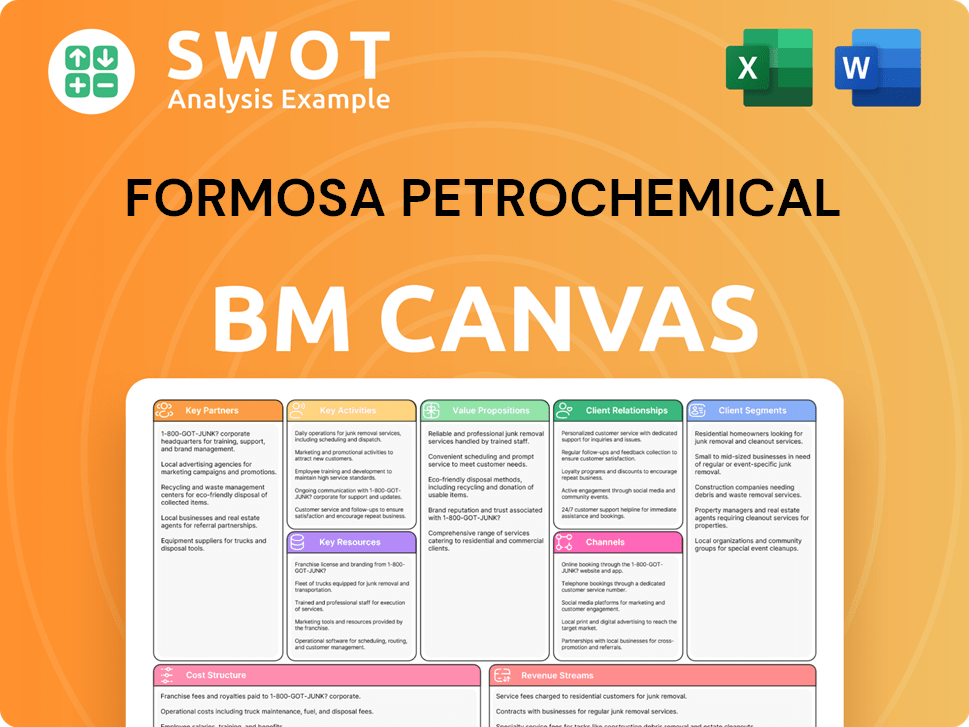

Formosa Petrochemical Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Formosa Petrochemical’s Growth?

The growth strategy and future prospects of Formosa Petrochemical face significant challenges. The petrochemical industry is experiencing overcapacity, particularly with increased production in China, leading to intense price competition. This situation, coupled with environmental and regulatory pressures, creates a complex landscape for the company.

Formosa Petrochemical's future is also impacted by its large-scale projects and its commitment to sustainability. The company's financial health and strategic direction are significantly influenced by its ability to navigate these risks effectively. Understanding the potential risks and obstacles is crucial for assessing Formosa Petrochemical's long-term viability and investment potential.

Formosa Petrochemical's growth strategy is intertwined with the broader trends in the petrochemical sector. The company must adapt to evolving market conditions, including shifts in demand, environmental regulations, and technological advancements. The company's ability to manage these factors will determine its future success.

The petrochemical industry is grappling with overcapacity, especially due to increased production in China. This oversupply leads to heightened price competition and weaker global demand. Operating rates for ethylene production facilities globally are at historic lows.

The proposed petrochemical complex in St. James Parish, Louisiana, faces substantial risks. The project has been stalled by legal challenges and environmental concerns, including permit revocations. Some analyses have deemed the project financially unviable.

Formosa Petrochemical faces environmental risks, including litigation related to toxic releases and high greenhouse gas emissions. While the company has set emission reduction targets, it lacks Scope 3 targets, which accounted for 80% of its total emissions in 2021.

Both Moody's and Standard & Poor's have downgraded Formosa's credit rating due to concerns over profitability and rising debt levels. The ongoing economic slowdown and geopolitical factors contribute to economic uncertainty in 2024.

The shift towards more sustainable commodities and regulations to curtail plastics use pose market risks. The company must adapt to these changes to remain competitive. The market is evolving rapidly, requiring strategic agility.

Geopolitical instability and global economic slowdowns complicate the outlook for Formosa Petrochemical. These factors can impact demand, supply chains, and overall profitability. The company must navigate these uncertainties.

Formosa Petrochemical is employing various strategies to mitigate risks. These include investments in AI applications, clean energy adoption, and carbon capture technologies. Management is actively engaged in sustainability initiatives to reduce environmental impacts. The company's approach involves assessing risks through various frameworks.

Concerns about profitability and rising debt levels have led to credit rating downgrades. The company's financial health is under scrutiny, especially considering the capital-intensive nature of its projects. The ability to manage debt and maintain profitability is critical.

The petrochemical industry faces challenges due to overcapacity and weak demand growth. The company must adapt to changing market dynamics. The demand for virgin plastic production is dwindling, affecting project viability.

Formosa Petrochemical has set targets to reduce Scope 1 and 2 emissions. However, the absence of Scope 3 targets raises concerns. The company's sustainability performance is crucial for long-term viability. The company aims for carbon neutrality by 2050.

To understand the context of the company's operations, a Brief History of Formosa Petrochemical can provide valuable insights.

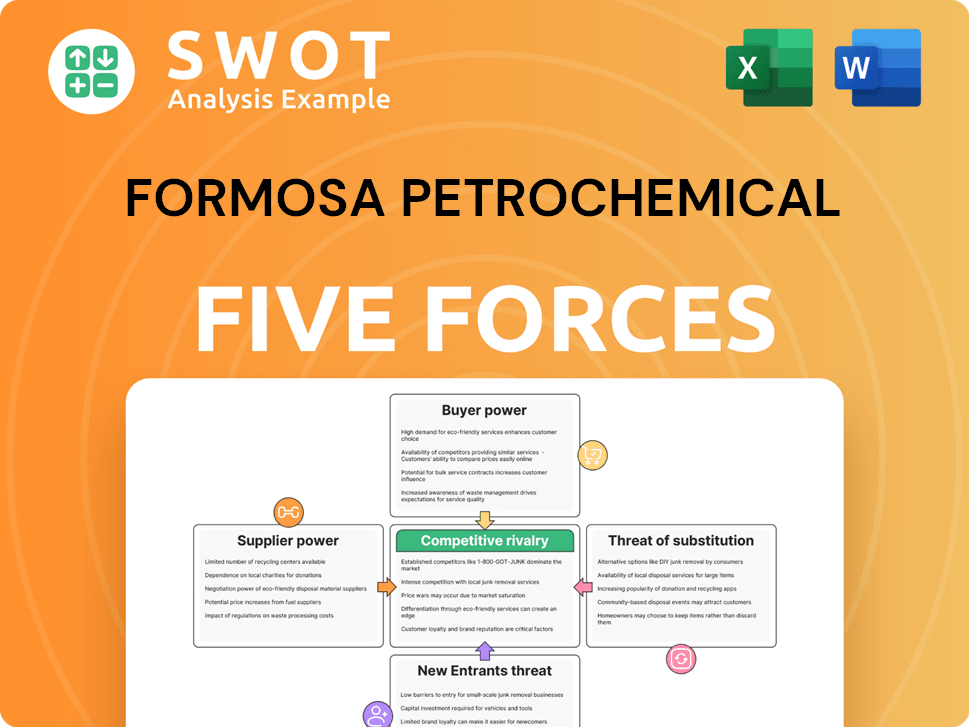

Formosa Petrochemical Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Formosa Petrochemical Company?

- What is Competitive Landscape of Formosa Petrochemical Company?

- How Does Formosa Petrochemical Company Work?

- What is Sales and Marketing Strategy of Formosa Petrochemical Company?

- What is Brief History of Formosa Petrochemical Company?

- Who Owns Formosa Petrochemical Company?

- What is Customer Demographics and Target Market of Formosa Petrochemical Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.