Formosa Petrochemical Bundle

Who Buys From Formosa Petrochemical?

Understanding the customer base is critical for any company's success, and for Formosa Petrochemical (FPCC), it's essential for navigating the global petrochemical industry. Founded in 1992, FPCC has become a major player, initially focusing on domestic supply but expanding into East Asia. This exploration delves into who FPCC's customers are, their needs, and how FPCC adapts.

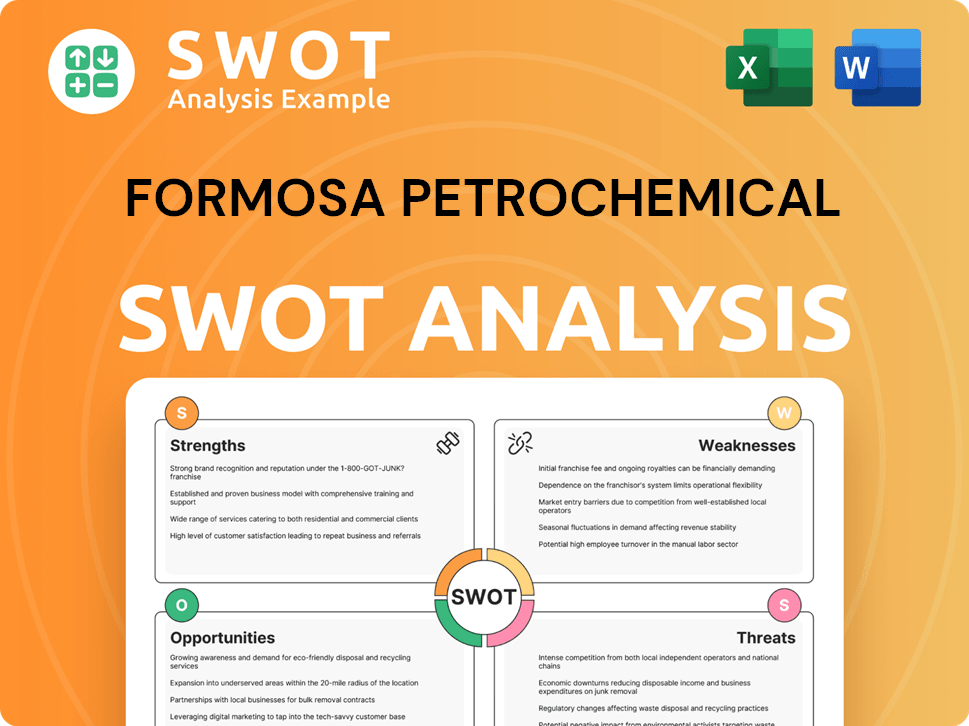

FPCC's Formosa Petrochemical SWOT Analysis reveals crucial insights into its target market. As of March 31, 2025, with a trailing 12-month revenue of $20.5 billion USD, Formosa Petrochemical's customer demographics and market segmentation strategies are key to its continued growth. This analysis will identify Formosa Petrochemical's customer profile, including industry sectors and regional distribution, providing a comprehensive view of its market position and customer purchasing behavior.

Who Are Formosa Petrochemical’s Main Customers?

Understanding the customer demographics and target market analysis for Formosa Petrochemical Company (FPCC) is crucial. As a major player in the petrochemical industry, FPCC primarily operates within a Business-to-Business (B2B) model. This means its focus is on supplying essential materials to other businesses rather than directly to consumers. This article will explore who FPCC's main customers are and how they are segmented.

FPCC's core business involves supplying petrochemical products and refined petroleum products. These are then used by various industries. Therefore, the Formosa customer profile is defined by the industrial needs of its clients. Key products like olefins (ethylene and propylene), aromatics, and plastics are essential raw materials for a wide range of manufacturing processes. The company's success is closely tied to the demand from these industrial sectors.

To further understand FPCC's target market, it's important to note that the company has a diverse customer base. This includes manufacturers in sectors such as home appliances, automotive parts, food packaging, toys, and daily necessities. While specific demographic breakdowns are not applicable in a B2B context, the characteristics of these groups are defined by their industrial requirements, production scales, and specific product specifications.

FPCC serves a wide array of industrial clients. These include manufacturers in sectors like home appliances, automotive parts, food packaging, toys, and daily necessities. The demand for polymers is driven by growth in the automotive and packaging industries.

Formosa Plastics and Formosa Chemicals & Fibre, both part of the larger Formosa Plastics Group, are significant customers. In 2020, these two companies accounted for 20% and 16% of FPCC's sales respectively. This demonstrates a strong internal supply chain relationship.

FPCC's customer base spans numerous regions. These include Mainland China, Hong Kong, Macau, the Americas, Africa, Europe, Oceania, Japan, South Korea, and Southeast Asia. This global presence highlights the company's extensive market reach.

As of December 2023, FPCC held approximately 22.4% of the domestic oil products market share in Taiwan. This illustrates the company's strong position in its home market. For more information, you can read a brief history of Formosa Petrochemical.

Changes in FPCC's target segments are influenced by global market dynamics. These include increased production capacity in China, leading to price wars, and shifts towards more sustainable commodities. The company must adapt to these changes to maintain its market position.

- Global market dynamics significantly impact FPCC's strategy.

- Increased production capacity in China has led to price competition.

- Shifts toward sustainable commodities influence product offerings.

- FPCC must adapt to maintain its market position.

Formosa Petrochemical SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Formosa Petrochemical’s Customers Want?

The customer base of Formosa Petrochemical (FPCC) primarily consists of industrial businesses that rely on petrochemical products. Understanding the needs and preferences of these customers is crucial for FPCC's success in the competitive petrochemical industry. This analysis explores the key drivers behind customer decisions and the factors influencing their purchasing behavior.

Key customer needs include a consistent supply of high-quality products at competitive prices. These businesses also require adherence to specific technical specifications and reliable supply chain operations. FPCC's ability to meet these demands directly impacts its relationships with customers and its market position.

The target market analysis for FPCC reveals that customers are heavily influenced by global commodity prices, production demands, and the stability of the supply chain. For example, the demand for ethylene and propylene, essential for producing polyethylene and polypropylene, is critical. Customers in the manufacturing sector need specific grades of plastics and petrochemicals to meet their production requirements.

Customers prioritize a reliable and steady supply of petrochemicals to maintain their production schedules. Product quality and adherence to specifications are also critical to ensure the final products meet industry standards.

Price competitiveness is a significant factor, reflecting the influence of global commodity prices. FPCC's pricing strategies must align with market dynamics to attract and retain customers.

Customers value technical support and the ability of suppliers to meet large-volume demands. FPCC's role as a major producer in Taiwan, with an ethylene capacity of 2.935 million tons annually, is crucial for domestic industries.

Compliance with national standards and rigorous inspection processes are essential. FPCC emphasizes these aspects to address customer concerns about product quality and safety.

FPCC's vertical integration, such as producing PC Alloy Resin, demonstrates efforts to offer high price-performance ratio products. This approach can enhance customer value and loyalty.

FPCC adapts to market conditions, such as reducing production in response to oversupply, to support product profitability. This responsiveness is crucial for maintaining customer relationships.

Decision-making criteria for FPCC's B2B customers involve supply reliability, technical support, and the ability to meet large-volume demands. The company's focus on vertical integration, as seen with its PC Alloy Resin, suggests an effort to supply customers with high price-performance ratio products. Furthermore, in response to market oversupply in the plastics sector, FPCC has reduced production to maintain prices, indicating an adaptation to market conditions. For more insights into the company's structure, consider reading about Owners & Shareholders of Formosa Petrochemical.

Understanding the customer demographics and target market is crucial for FPCC's success in the petrochemical industry. The company must focus on meeting the specific needs of its industrial customers.

- Reliable Supply: Ensuring a consistent and adequate supply of essential raw materials is a top priority.

- Product Quality: Adherence to specifications and rigorous quality control processes are essential.

- Competitive Pricing: Pricing strategies must align with global commodity prices to remain competitive.

- Technical Support: Providing technical assistance and meeting large-volume demands are critical.

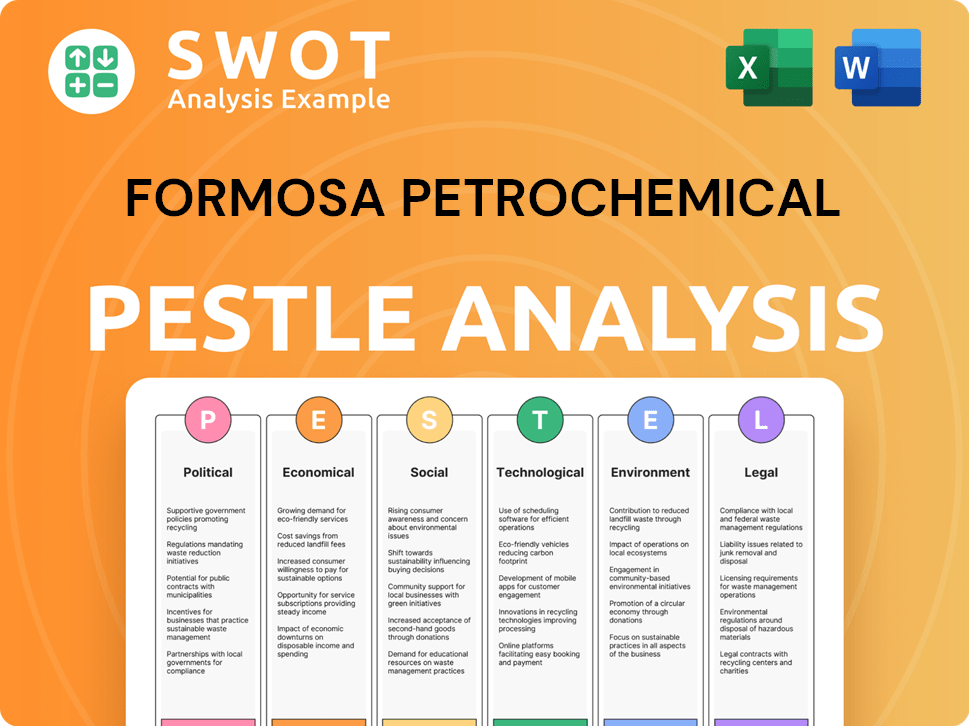

Formosa Petrochemical PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Formosa Petrochemical operate?

The geographical market presence of Formosa Petrochemical (FPCC) is primarily centered in Taiwan, where its core operations, including its oil refinery and naphtha cracker plants, are located. This focus is crucial for understanding the company's customer demographics and target market analysis. Domestic sales have historically been a significant revenue driver, with approximately 68% of revenue coming from Taiwan in 2020.

As of December 2023, FPCC held about a 22.4% share of the domestic oil products market in Taiwan. This indicates a strong market position, although it represents a slight decrease from previous years. This shift reflects changes in the competitive landscape and market dynamics within the petrochemical industry.

Beyond Taiwan, FPCC has a notable presence in East Asia and operates internationally, including in Australia, South Korea, the Philippines, Singapore, Malaysia, and Mainland China. Understanding these regions is key to a comprehensive Formosa customer profile.

FPCC's main operations and a substantial portion of its revenue are derived from its domestic market in Taiwan. The company's strong domestic presence is a key aspect of its target market analysis. This focus allows FPCC to leverage its infrastructure and established customer relationships.

FPCC has a significant presence in East Asia, expanding its customer base and market reach. This expansion is part of its market segmentation strategies. The company's operations in East Asia are crucial for long-term growth.

FPCC operates internationally, with activities in Australia, South Korea, the Philippines, Singapore, Malaysia, and Mainland China. These international operations contribute to the company's revenue. These diverse markets reflect the global nature of the petrochemical industry.

Mainland China is a significant market for FPCC, being the world's second-largest economy and Taiwan's largest export market. However, in 2023, the company saw a 17% decrease in total revenue in China compared to 2022, resulting in a loss of approximately NT$5.9 billion. This highlights the challenges in this market.

Differences in customer demographics, preferences, and buying power across these regions are primarily driven by varied industrial landscapes and economic development levels. For example, the increasing foreign direct investments in refining capacity in Asia-Pacific, particularly in China and India, indicate a high demand for petrochemical-based products in these regions. For more insights, explore the Marketing Strategy of Formosa Petrochemical.

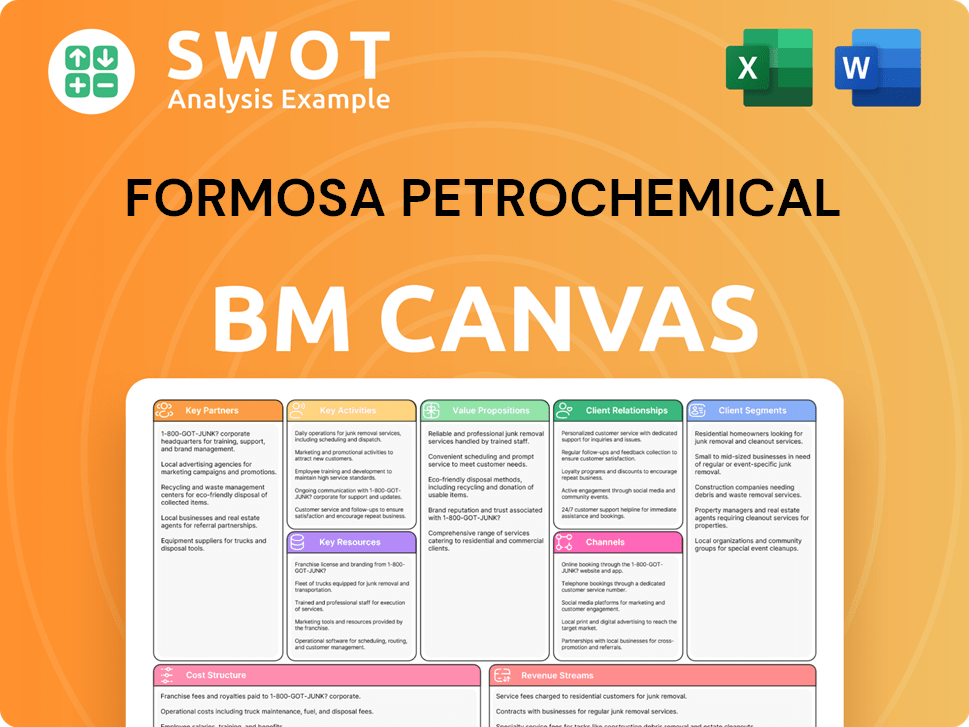

Formosa Petrochemical Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Formosa Petrochemical Win & Keep Customers?

Formosa Petrochemical Company (FPCC) employs a multi-faceted approach to customer acquisition and retention, primarily focused on strengthening its B2B relationships and expanding its market reach. For its petroleum products, FPCC emphasizes expanding sales channels and increasing petroleum sales in the domestic market. They have utilized diverse marketing channels to raise brand awareness and expand their customer base, aiming to capture a broader customer demographics profile.

A key initiative for customer acquisition and retention in the B2C segment (for petroleum products) was the collaboration with President Chain Store Corporation to launch 'Formosa Member Day On Saturday' in September 2021. This was designed to attract members to refuel at Formosa petrol stations. Additionally, increasing brand exposure through well-known TV programs and sports events has been a strategy to strengthen brand image and enhance Formosa Petrochemical's market presence.

For its core petrochemical business, customer retention hinges on consistent supply, product quality, and competitive pricing, which are crucial for industrial clients. The company's vertical integration within the Formosa Plastics Group ensures a stable customer base for its olefins and other petrochemical raw materials, with Formosa Plastics and Formosa Chemicals & Fibre being major customers. Analyzing the target market analysis reveals a dual approach, with distinct strategies for its B2B and B2C segments.

FPCC focuses on long-term contracts and relationships with industrial clients. Consistent product supply, adherence to national standards, and competitive pricing are paramount. The company's vertical integration within the Formosa Plastics Group supports a stable customer base. This ensures a steady supply of raw materials to its key customers within the group.

FPCC uses diverse marketing channels to raise brand awareness. The 'Formosa Member Day On Saturday' initiative with President Chain Store Corporation helped attract customers. Increasing brand exposure through TV programs and sports events strengthens brand image and attracts new customers. In 2024, FPCC set sales targets of 5,169 thousand liters of gasoline and 10,261 thousand liters of diesel.

FPCC adapts its strategies based on market conditions, such as adjusting production to maintain prices during oversupply in the plastics sector. The focus on profitable orders and controlling volume to maintain prices indicates a strategic approach to optimize profitability and customer relationships. The company's strategic marketing initiatives include a digital transition through the 'Formosa Oil APP' to develop and maintain target segments.

- Emphasis on long-term contracts with industrial clients.

- Focus on consistent product supply and quality.

- Utilization of diverse marketing channels for brand awareness.

- Strategic partnerships to enhance customer engagement.

- Digital transition through the 'Formosa Oil APP'.

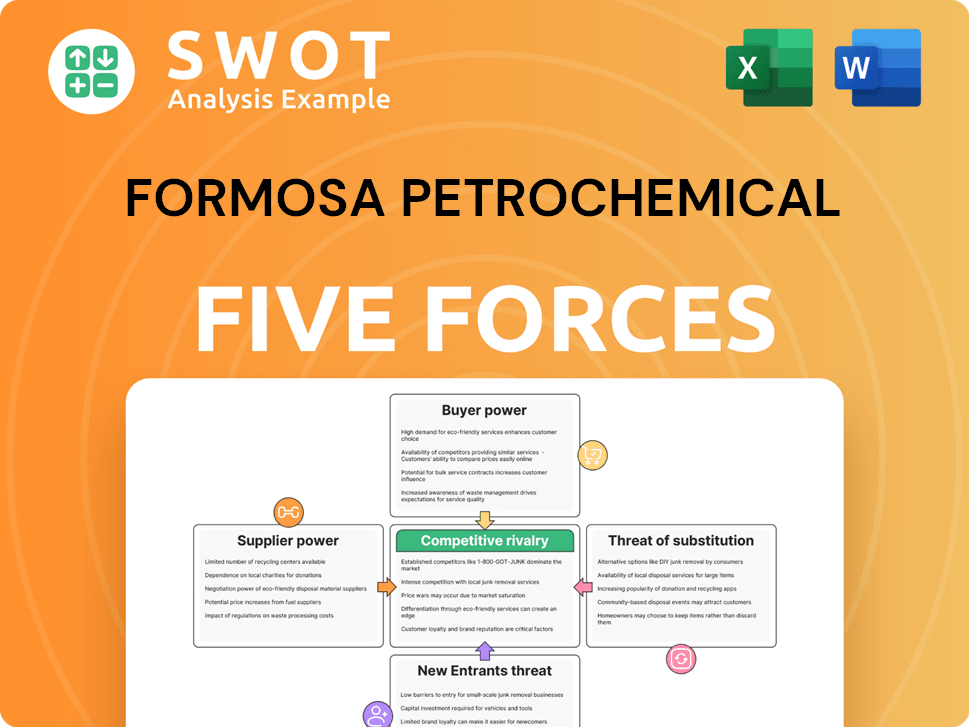

Formosa Petrochemical Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Formosa Petrochemical Company?

- What is Competitive Landscape of Formosa Petrochemical Company?

- What is Growth Strategy and Future Prospects of Formosa Petrochemical Company?

- How Does Formosa Petrochemical Company Work?

- What is Sales and Marketing Strategy of Formosa Petrochemical Company?

- What is Brief History of Formosa Petrochemical Company?

- Who Owns Formosa Petrochemical Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.