Kesko Bundle

How Does Kesko Dominate the Northern European Retail Scene?

Kesko, a Finnish retail giant, has carved a significant presence in Northern European commerce since its inception in 1940. From its humble beginnings as a collaboration of wholesale companies, Kesko has strategically evolved into a diversified retail powerhouse. This evolution showcases its ability to adapt and thrive in a dynamic market, making it a compelling subject for competitive analysis.

Understanding the Kesko SWOT Analysis is crucial to grasping its competitive landscape. This analysis will delve into Kesko's market analysis, identifying its key competitors and evaluating its strengths and weaknesses. By examining Kesko's business strategy and financial performance, we can uncover how it maintains its leading position in the industry. This exploration of Kesko's competitive environment provides valuable insights for anyone interested in the retail sector's dynamics.

Where Does Kesko’ Stand in the Current Market?

Kesko maintains a strong market position across its diverse operational segments, particularly within Northern Europe. The company's strategic focus on grocery, building and technical trade, and car trade allows it to cater to a broad range of consumer and business needs. Kesko's financial performance, as demonstrated by its net sales and EBIT, underscores its significant scale and influence within the retail sector.

The company's operations are segmented into grocery trade, building and technical trade, and car trade. This diversification helps Kesko manage market fluctuations and cater to different customer segments. Kesko's commitment to digital transformation and e-commerce further enhances its market position by adapting to evolving consumer preferences.

For the fiscal year 2023, Kesko's net sales reached €11,798 million, reflecting its substantial presence in the retail industry. Its comparable earnings before interest and taxes (EBIT) for 2023 were €712.9 million, indicating strong financial health. These figures highlight Kesko's robust financial performance and competitive standing.

Kesko's grocery trade includes K-Citymarket, K-Supermarket, K-Market, and Neste K service stations. These stores offer a wide variety of products, from everyday groceries to specialized food items. This segment is a key component of Kesko's market strategy, particularly in Finland, where it competes directly with S Group.

The building and technical trade segment, operating under brands like K-Rauta, Onninen, and Byggmakker, serves both consumers and professionals. This segment provides building materials, home improvement products, and technical wholesale solutions. This part of the business is crucial for Kesko's overall market presence, especially in the Nordic region.

Kesko's car trade segment, primarily through K-Auto, focuses on the import and retail of vehicles, including Volkswagen, Audi, SEAT, CUPRA, and Porsche. This segment also provides related services. The car trade segment is a significant part of Kesko's business, particularly in Finland.

Kesko has a strong presence in Finland, Sweden, Norway, Estonia, Latvia, Lithuania, and Poland. The company's strategic focus on digital transformation and e-commerce enhances its ability to meet evolving customer preferences. This geographical spread helps Kesko maintain a competitive edge.

Kesko's competitive landscape is shaped by its diverse operations and strategic focus on key markets. The company's ability to adapt to changing consumer behaviors and leverage its extensive store network with e-commerce capabilities is crucial. Additionally, Kesko's financial strength, as reflected in its net sales and EBIT, allows it to invest in growth and maintain a strong market position.

- Strong market position in Finland's grocery and building and technical trade markets.

- Strategic emphasis on digital transformation and e-commerce to meet evolving customer needs.

- Diversified business segments to mitigate market risks and cater to a broad customer base.

- Significant financial performance, with net sales of €11,798 million and EBIT of €712.9 million in 2023.

For more insights into the company's strategic approach, consider reviewing the Marketing Strategy of Kesko.

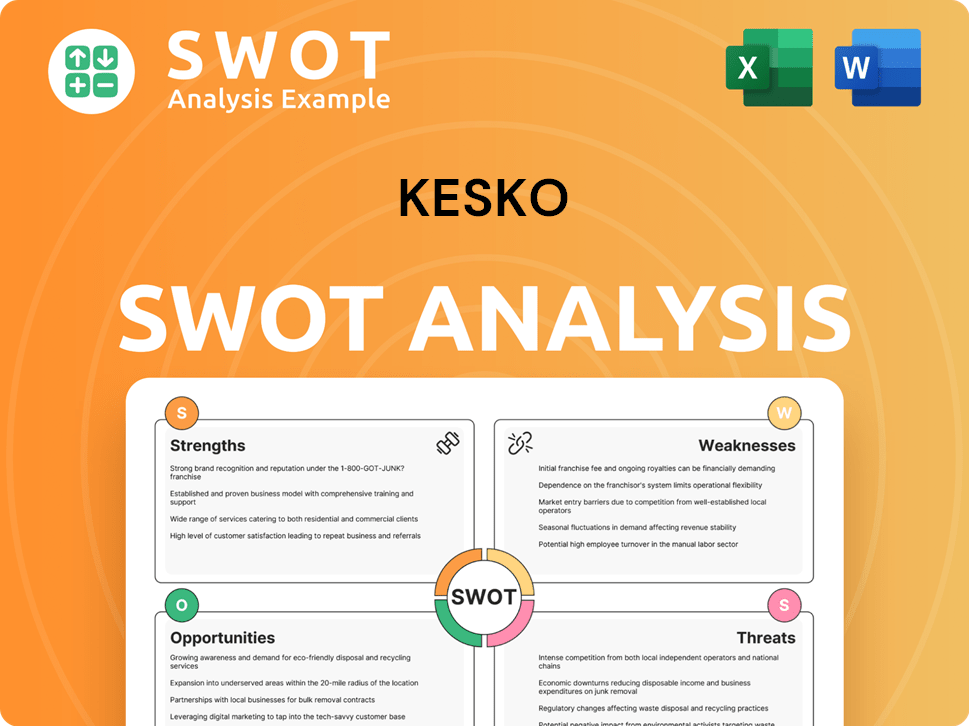

Kesko SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Kesko?

Understanding the Kesko competitive landscape is crucial for assessing its market position and strategic direction. Kesko operates in three primary segments: grocery trade, building and technical trade, and car trade, each facing unique competitive pressures. This Kesko market analysis highlights the key players and dynamics shaping its business environment.

The company's ability to navigate this complex landscape influences its financial performance and future growth. Analyzing the Kesko competitors provides insights into the strategies and challenges the company encounters. This analysis will explore the competitive pressures Kesko faces in each of its core business areas.

In the Finnish grocery market, Kesko's main rival is S Group. S Group operates a wide network of stores, including Prisma hypermarkets, S-market supermarkets, and Alepa local stores. Lidl, a discount retailer, also poses a significant challenge with its competitive pricing strategies.

In the building and technical trade, Kesko's K-Rauta and Onninen brands compete with international chains such as Bauhaus and Byggmax. Local hardware stores and specialized wholesalers also provide competition, particularly in niche markets. The competitive landscape is characterized by price sensitivity and service quality.

Kesko's car trade segment, through K-Auto, faces competition from other major car importers and dealership networks. These include companies representing brands like Toyota, Mercedes-Benz, and BMW. Competition centers on vehicle pricing, financing options, and after-sales services.

The retail sector is experiencing ongoing consolidation, with e-commerce platforms influencing competitive dynamics across all segments. The rise of electric vehicles and new mobility solutions introduces future challenges in the car trade. Market share battles are common in the grocery sector.

Kesko's business strategy involves competitive pricing, extensive store networks, and strong loyalty programs. The company focuses on adapting to changing consumer preferences and technological advancements. Kesko aims to maintain its market share through strategic initiatives.

For the fiscal year 2023, Kesko reported strong results, with net sales reaching €11.8 billion. The grocery trade segment saw increased sales, while the building and technical trade also performed well. These results reflect Kesko's ability to navigate the competitive landscape.

Several factors influence Kesko's competitive position. These include pricing strategies, store network size, brand reputation, and customer service. Understanding these factors is crucial for assessing Kesko's competitive advantages and disadvantages.

- Pricing: Competitive pricing is essential, especially in the grocery and building trade.

- Store Network: An extensive store network provides greater market coverage.

- Customer Loyalty: Loyalty programs help retain customers and drive sales.

- E-commerce: A strong online presence is vital for competing in the modern retail environment.

- Sustainability: Growing emphasis on sustainable practices impacts consumer choices.

To further understand Kesko's position, consider reading about the Growth Strategy of Kesko. This provides a comprehensive overview of the company's strategic initiatives and market approach.

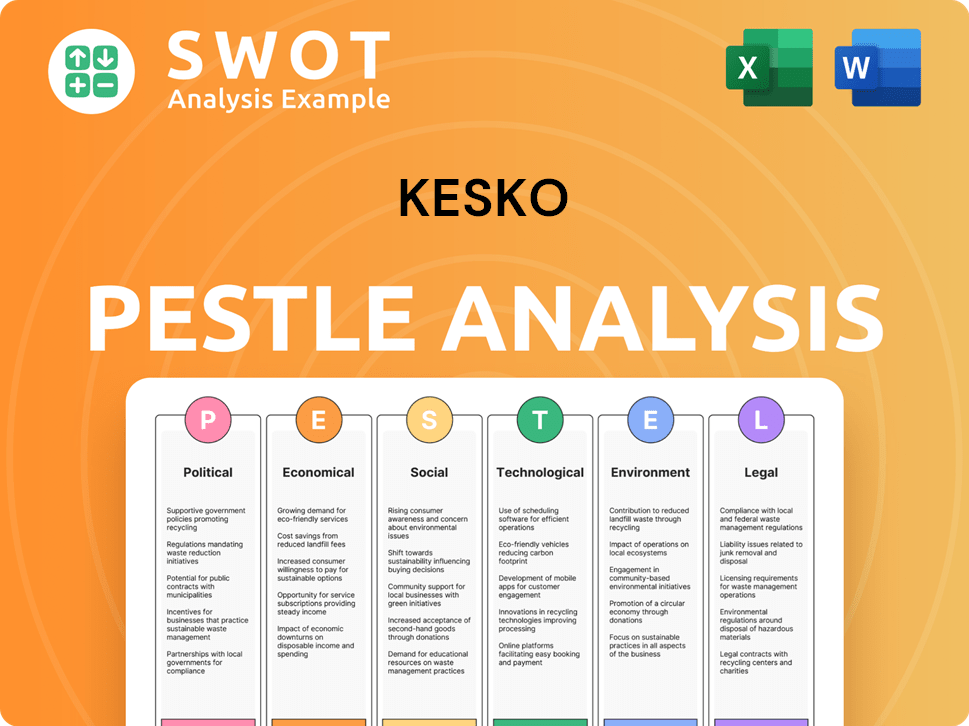

Kesko PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Kesko a Competitive Edge Over Its Rivals?

The competitive advantages of Kesko are rooted in its diversified business model, strong brand portfolio, and extensive distribution network. This strategic setup allows Kesko to navigate market fluctuations and maintain a robust presence across key retail sectors. Understanding the Revenue Streams & Business Model of Kesko is crucial for grasping its competitive edge within the industry.

Kesko's operations span grocery, building and home improvement, and car trade, which mitigates risks associated with any single market. The company's well-known brands, such as K-Citymarket and K-Rauta, foster customer loyalty and trust. Furthermore, Kesko's commitment to digitalization and sustainability enhances operational efficiency and resonates with environmentally conscious consumers.

The company's financial performance reflects its strategic positioning. Recent data indicates that Kesko has maintained a strong market share in its core segments, supported by its ability to adapt to changing consumer behaviors and market dynamics. This is critical in the Kesko competitive landscape. Its focus on innovation and customer experience continues to drive growth and solidify its position in the market.

Kesko operates across grocery, building and home improvement, and car trade, providing multiple revenue streams. This diversification helps in mitigating risks associated with market fluctuations. The stability of the grocery trade often offsets cyclicality in other sectors, contributing to consistent financial performance.

Kesko leverages well-recognized brands like K-Citymarket, K-Supermarket, and K-Rauta. These brands have built customer loyalty and trust over decades. This brand recognition is a key factor in maintaining market share and attracting new customers in a competitive environment.

Kesko's physical store network across Finland, Sweden, Norway, and the Baltics offers significant reach. This widespread presence is complemented by robust e-commerce capabilities, catering to both online and offline customer needs. The extensive network ensures accessibility and supports efficient logistics.

The company invests in online platforms, data analytics, and personalized customer experiences. Kesko's commitment to sustainability, including responsible sourcing, resonates with environmentally conscious consumers. These initiatives enhance operational efficiency and brand reputation.

Kesko's competitive advantages include a diversified business model, a strong brand portfolio, and an extensive distribution network. These factors enable the company to maintain its market leadership and adapt to industry changes. Strategic investments in digitalization and sustainability further enhance its competitive position.

- Diversified Revenue Streams: Spanning grocery, building and home improvement, and car trade.

- Strong Brand Equity: Through brands like K-Citymarket and K-Rauta.

- Extensive Network: Physical stores and robust e-commerce capabilities.

- Digital Transformation: Investments in online platforms and data analytics.

- Sustainability Initiatives: Responsible sourcing and energy efficiency.

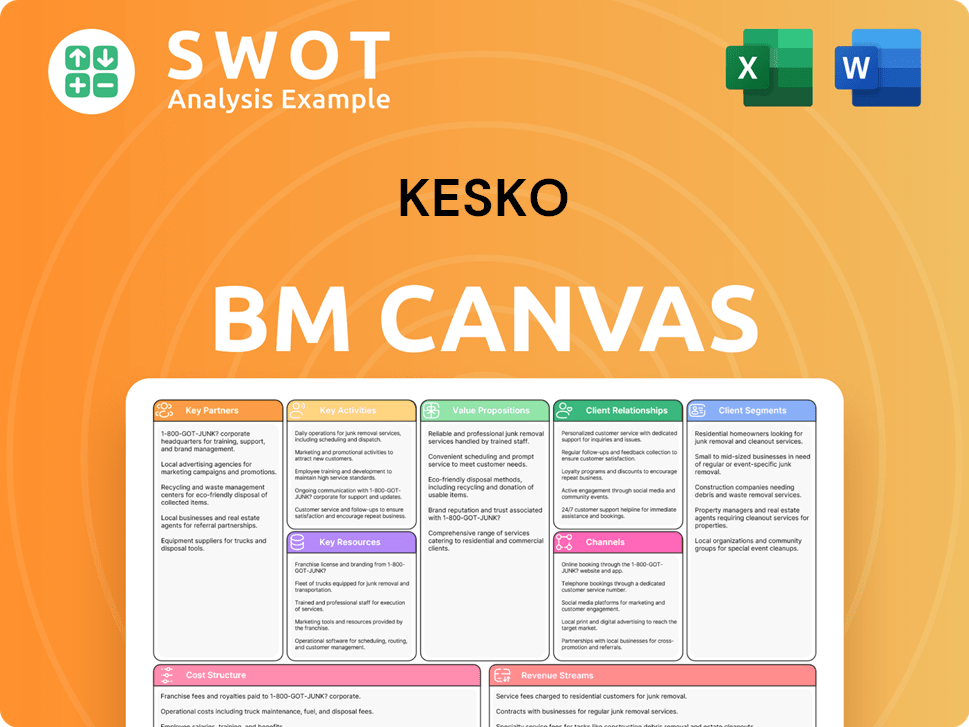

Kesko Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Kesko’s Competitive Landscape?

The retail industry is experiencing significant shifts, impacting companies like Kesko. These changes are driven by technological advancements, evolving consumer preferences, and regulatory pressures. Understanding these trends is crucial for assessing Kesko's Kesko competitive landscape and future prospects. This Kesko market analysis examines the key factors shaping the company's environment, including its Kesko competitors and strategic responses.

The Kesko business strategy must adapt to navigate these challenges and seize opportunities. This overview explores potential threats, such as aggressive competition and rising costs, while also highlighting growth areas like emerging markets and product innovation. Analyzing the Kesko industry overview provides insights into the company's financial performance and strategic direction.

E-commerce continues to grow, with online retail sales in Finland reaching approximately €6.6 billion in 2023. Sustainability is a major focus, with consumers increasingly seeking eco-friendly products and transparent supply chains. Regulatory changes, such as those related to carbon emissions, are also impacting the industry. These trends shape the Kesko competitive landscape.

Rising operational costs, including energy and labor expenses, pose a challenge. Competition from international retailers and disruptive direct-to-consumer brands intensifies the pressure on pricing and market share. Adapting to the rapid transition to electric vehicles in the car trade requires significant strategic adjustments. These factors influence Kesko's main competitors in Finland.

Expansion in emerging markets within Northern Europe, particularly in building and technical trades, offers growth potential. Innovations in smart home technologies and sustainable building materials create new revenue streams. Strategic partnerships with technology providers can enhance competitiveness. These opportunities impact Kesko's future growth prospects and opportunities.

Kesko can leverage its strong brand presence and diversified portfolio to adapt. Investing in digital platforms and omnichannel experiences is essential. Focusing on customer-centric strategies and personalized offerings can enhance loyalty. Sustainability initiatives are crucial for brand image and consumer appeal. Learn more about the company's performance from Owners & Shareholders of Kesko.

Kesko's success hinges on its ability to integrate digital and physical retail, respond to sustainability demands, and adapt to evolving consumer preferences. This includes managing operational costs and navigating competitive pressures. Understanding Kesko's competitive advantages and disadvantages is key.

- Focus on omnichannel strategies to integrate online and physical stores.

- Prioritize sustainability initiatives to meet consumer and regulatory demands.

- Innovate product offerings and pricing strategies to stay competitive.

- Explore strategic partnerships to expand market reach and capabilities.

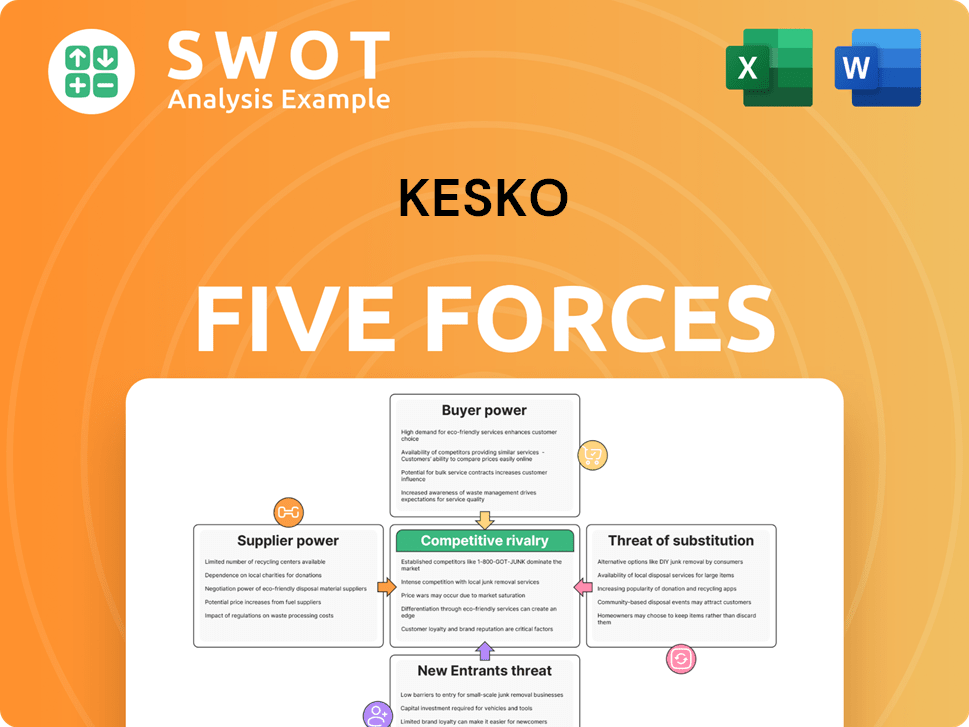

Kesko Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kesko Company?

- What is Growth Strategy and Future Prospects of Kesko Company?

- How Does Kesko Company Work?

- What is Sales and Marketing Strategy of Kesko Company?

- What is Brief History of Kesko Company?

- Who Owns Kesko Company?

- What is Customer Demographics and Target Market of Kesko Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.