Kesko Bundle

Can Kesko Conquer the Future of Retail?

Kesko, a Northern European retail giant with over 80 years of experience, is at a pivotal moment. With a reported €16 billion in retail sales in 2024 and a vast network of stores, Kesko's Kesko SWOT Analysis reveals the strategies driving its next phase of expansion. Discover how this Finnish conglomerate plans to navigate the evolving retail landscape and capitalize on future opportunities.

This comprehensive analysis of Kesko's growth strategy will explore its ambitious strategic initiatives for 2024 and beyond, including detailed insights into its market position and financial performance. We'll examine Kesko's business model, focusing on revenue growth drivers and expansion plans within the retail sector, alongside its commitment to sustainability and digital transformation. Investors and strategists alike will gain valuable perspectives on Kesko's long-term growth potential and investment opportunities.

How Is Kesko Expanding Its Reach?

The Kesko growth strategy centers on solidifying its presence across Northern Europe, focusing on organic expansion and strategic mergers and acquisitions (M&A) to boost its market share and financial performance. This approach is primarily implemented across three core divisions: grocery trade, building and technical trade, and car trade. The company's strategic initiatives are designed to enhance profitability and drive sustainable growth in a competitive market environment.

Kesko's future prospects are largely tied to its ability to successfully execute its expansion plans and adapt to changing market conditions. The company is investing heavily in its store network, particularly in the grocery sector, and actively pursuing M&A opportunities in the building and technical trade. These efforts, combined with a focus on customer experience and supply chain optimization, are expected to contribute to long-term growth potential.

A detailed Kesko company analysis reveals a commitment to both internal development and external acquisitions. The company's business model is designed to leverage its diverse portfolio to navigate economic fluctuations and capitalize on growth opportunities. The company's focus on sustainability goals and progress further enhances its long-term value proposition, making it an interesting case study for investors and business strategists alike. You can learn more about the company by reading an article about Owners & Shareholders of Kesko.

In the grocery trade, Kesko is focused on maintaining profitability and increasing market share. This involves developing its store network and improving price competitiveness. The company plans to invest between €200-250 million annually in store site investments.

The building and technical trade division prioritizes securing profitability and generating cash flow. M&A is a key strategy, particularly in Denmark. Recent acquisitions include Roslev Trælasthandel (January 2025) and CF Petersen & Søn (April 2025).

The car trade division is pursuing a growth strategy across new and used cars, and services. The goal is to outperform the market in all segments. A comprehensive product and service portfolio is expected to support good performance.

The company's strategy for 2024-2026 emphasizes maintaining and developing current businesses. The focus is on growth and improving profitability, especially as the construction sector outlook strengthens. Kesko aims to leverage its strong market position.

Kesko's expansion plans include significant investments in store development and strategic acquisitions. The company's financial performance is closely tied to the success of these initiatives. For example, Tømmergaarden A/S, acquired in June 2025, had net sales of approximately €191 million in 2024.

- Grocery Trade: New K-Citymarket stores in Lempäälä and Lahti (2025), and Kivistö, Vantaa (spring 2026).

- Store Remodeling: Plans to remodel 48 stores and open 15 new ones in 2025.

- Building and Technical Trade: Acquisitions in Denmark, including Roslev Trælasthandel and CF Petersen & Søn.

- Tømmergaarden A/S: Acquisition doubles the size of Davidsen, Kesko's Danish subsidiary.

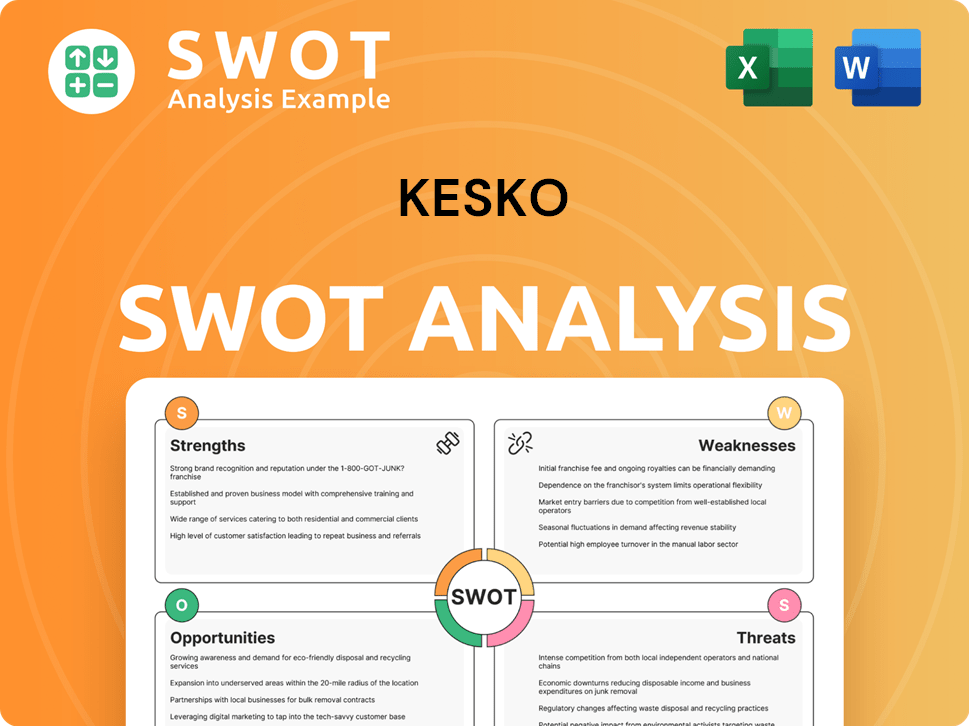

Kesko SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kesko Invest in Innovation?

The innovation and technology strategy of Kesko is centered on leveraging data and digital services. This approach aims to enhance customer value and fuel profitable growth for both Kesko and its partners. The company is heavily investing in digital transformation to achieve its growth objectives.

Kesko's strategy involves a significant increase in data utilization, aiming to double its rate from 25% to 50% by 2025. This is being achieved through a modern data platform and a cross-functional DataOps team. This focus allows K-retailers to develop personalized business ideas based on customer insights.

Digitalization and AI are key enablers in Kesko's strategy. The company is focused on utilizing AI to improve process efficiency and personalize the customer experience. Digitally-assisted services are also crucial for providing a more individual customer experience and personalized benefits.

Kesko's strategy is heavily reliant on data. The goal is to increase data utilization from 25% to 50% by 2025. This will be facilitated by a modern data platform and a DataOps team.

K-retailers will create personalized business ideas. This is based on customer insights gathered through data analysis. The aim is to deliver a personalized shopping experience across all channels.

Digitalization and AI are crucial for improving efficiency. AI will be used to personalize the customer experience further. Digitally-assisted services will provide individual customer experiences.

Kesko is making substantial investments in data platforms. This signifies a strong commitment to technological advancement. The goal is to achieve growth objectives through these investments.

The use of AI aims to improve process efficiency. This will help streamline operations. The focus is on making the customer experience better.

Digitally-assisted services offer personalized benefits. These services enhance the individual customer experience. The aim is to provide relevant personalized offers.

The company's dedication to digital transformation supports its Kesko growth strategy. For more insights into Kesko's future prospects and its strategic initiatives, consider reading a detailed Kesko company analysis. This analysis provides a comprehensive view of the company's operations and strategies.

Kesko is focused on enhancing customer value through technology. The company is investing in data platforms and digital transformation. The goal is to increase data utilization from 25% to 50% by 2025.

- Implementation of a modern data platform.

- Establishment of a cross-functional DataOps team.

- Utilization of AI to improve process efficiency.

- Personalization of customer experience through digital services.

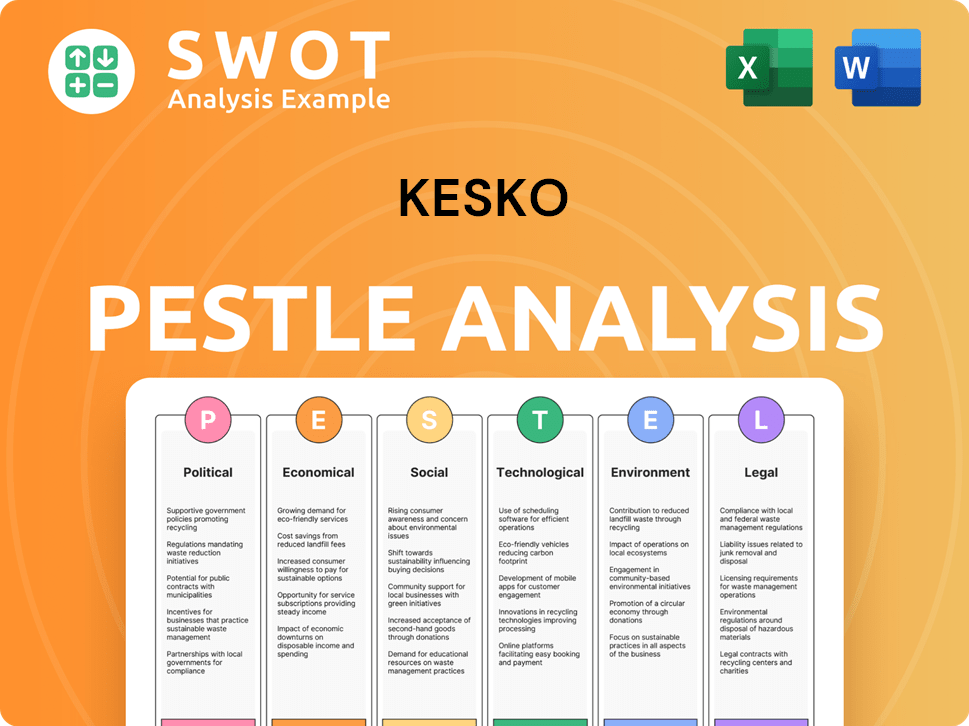

Kesko PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Kesko’s Growth Forecast?

The financial outlook for Kesko in 2025 anticipates an improvement in its operating environment, though it's expected to remain somewhat challenging. The company's Kesko growth strategy is focused on adapting to these conditions while pursuing opportunities for expansion and enhanced profitability. This involves strategic initiatives across its various business segments, with a keen focus on efficiency and customer satisfaction.

Kesko's Kesko future prospects are tied to its ability to navigate economic cycles and leverage its market position. The company's diversified business model, encompassing grocery trade, building and technical trade, and car trade, provides a degree of resilience. Kesko company analysis reveals a commitment to sustainable practices and digital transformation, which are key drivers for long-term value creation.

In the first quarter of 2025, Kesko reported a 2.5% year-on-year increase in net sales, or 1.1% in comparable terms, demonstrating its ability to maintain revenue growth. The company's comparable operating profit for Q1 2025 was €95.6 million, indicating solid financial performance amidst ongoing investments and market dynamics. For a deeper understanding of the company's origins and evolution, consider reading a Brief History of Kesko.

Kesko's comparable operating profit for 2025 is estimated to be in the range of €640-740 million. This represents an improvement compared to the €650.1 million reported for the full year 2024. The company's focus on Kesko financial performance remains a key priority.

Net sales for Q1 2025 reached €2,827.7 million. The grocery trade saw a decrease in comparable operating profit due to a price program investment of nearly €50 million. The car trade division's comparable operating profit was €17.9 million.

The comparable operating margin for the grocery trade in 2025 is estimated to remain clearly above 6%. Profitability in building and technical trade is expected to improve from 2024, with Q1 2025 comparable operating profit increasing to €11.7 million. Kesko market position is supported by these results.

Capital expenditure for Q1 2025 was €138.0 million. Kesko's net debt to EBITDA ratio was 1.6% at the end of Q1 2025. The Board of Directors proposed a dividend of €0.90 per share for 2024, paid in four installments. The strong financial position supports Kesko's business model.

Kesko's Kesko strategic initiatives 2024 and beyond are focused on sustainable growth and operational efficiency. These initiatives drive revenue growth and enhance profitability across all segments.

Kesko sustainability goals and progress are integral to its business strategy. The company is committed to reducing its environmental impact and promoting sustainable practices throughout its operations.

Kesko revenue growth drivers include strategic investments, market expansion, and innovation in customer experience. These factors are crucial for long-term success.

Kesko expansion plans in the retail sector involve both organic growth and potential acquisitions. The company is constantly evaluating opportunities to strengthen its market presence.

Kesko market share analysis Finland reveals its strong position in the grocery, building, and car trade sectors. The company aims to maintain and grow its market share through strategic initiatives.

Kesko competitive landscape analysis highlights the importance of differentiation and customer focus. The company consistently seeks to improve its competitive edge.

Kesko's gross profit margin for fiscal years ending December 2020 to 2024 averaged 14.4%, with the latest twelve months' gross profit margin at 14.5%. Analysts' forecasts project an average one-year price target of €19.86 by April 2026. Kesko investment opportunities are viewed positively by analysts.

- Kesko stock performance forecast is influenced by market conditions and company performance.

- The company's Kesko digital transformation strategy is crucial for enhancing customer experience and operational efficiency.

- Kesko customer experience initiatives are aimed at improving customer loyalty and satisfaction.

- Kesko supply chain optimization is a key factor in cost management and efficiency.

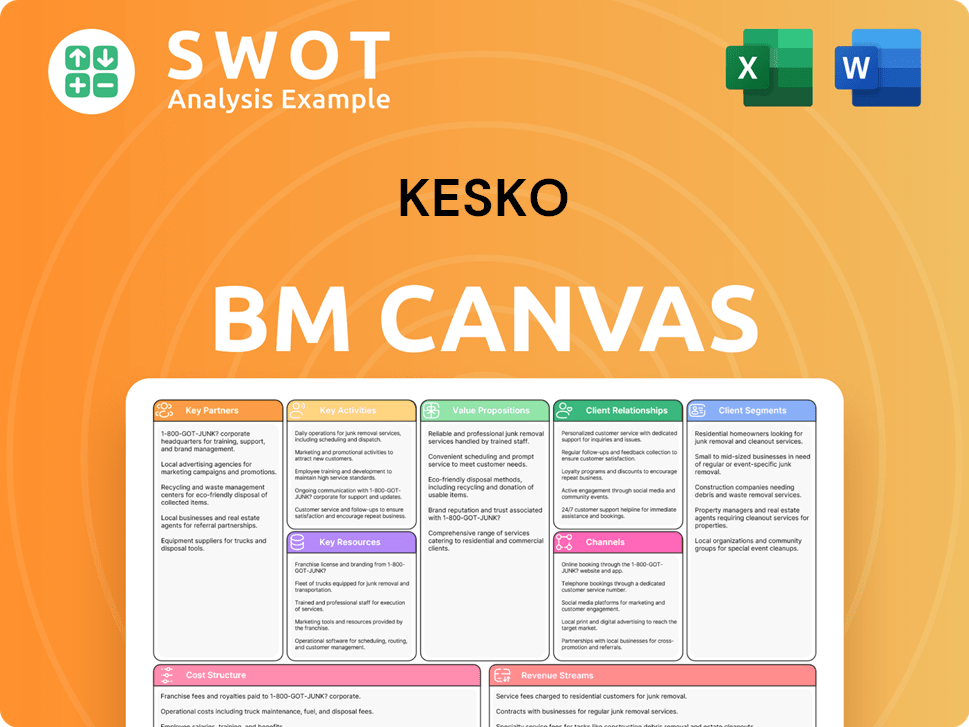

Kesko Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Kesko’s Growth?

The Kesko growth strategy faces potential risks stemming from an uncertain operating environment. Key uncertainties include shifts in consumer confidence, investment levels, and geopolitical tensions. These factors can significantly impact the company's performance.

Price competition, especially within the Finnish grocery trade, remains intense. This pressure can affect Kesko's market position and profitability. Regulatory changes and increasing sustainability regulations also pose challenges.

Supply chain vulnerabilities and technological disruptions are additional concerns. Internal resource constraints, particularly related to employee availability and skill development, can also hinder growth. Understanding these risks is crucial for a thorough Kesko company analysis.

Consumer confidence levels directly influence spending patterns, which in turn affect retail sales. Economic downturns or periods of uncertainty can lead to decreased consumer spending, impacting Kesko's financial performance. Monitoring economic indicators and adapting to changing consumer behaviors are essential.

The Finnish grocery market is highly competitive, with price being a major factor for customers. Competitors' investments in larger stores and aggressive pricing strategies can erode Kesko's market share. The company must balance competitive pricing with maintaining profitability.

Changes in regulations and increasing sustainability requirements can present operational challenges. Compliance with new environmental standards, such as those related to packaging and waste management, can increase costs. Adapting to stricter regulations requires proactive planning and investment.

Supply chain disruptions, whether due to geopolitical events, natural disasters, or logistical issues, can impact product availability and increase costs. Diversifying supply chains and implementing robust risk management strategies are crucial. The company must proactively address potential disruptions to ensure a consistent supply of goods.

Rapid advancements in technology, particularly in e-commerce and digital customer experiences, require continuous adaptation. Failure to keep pace with evolving digital trends can result in a loss of market share. Investing in digital transformation and enhancing the online customer experience are critical.

Internal resource constraints, such as workforce availability and the need for continuous skill development, can limit growth. Attracting and retaining skilled employees is essential. Investing in employee training and development programs is crucial for supporting long-term growth. For more insights, explore the Target Market of Kesko.

Kesko employs proactive risk management as an integral part of its operations. Divisions and common operations are responsible for identifying, assessing, handling, and managing risks. Scenario planning helps in developing strategies to navigate future uncertainties, increasing flexibility and responsiveness. This approach supports continuous improvement and the identification of new opportunities.

Kesko's extensive price program, launched in January 2025, aims to strengthen customer flows, even though it impacts profit. The focus on profitable growth and strengthening its market position across its core divisions provides a buffer against market fluctuations. This strategy, combined with a strong financial position, supports resilience. In 2024, the grocery market share decreased from 34.3% to 33.7% due to competitor investments.

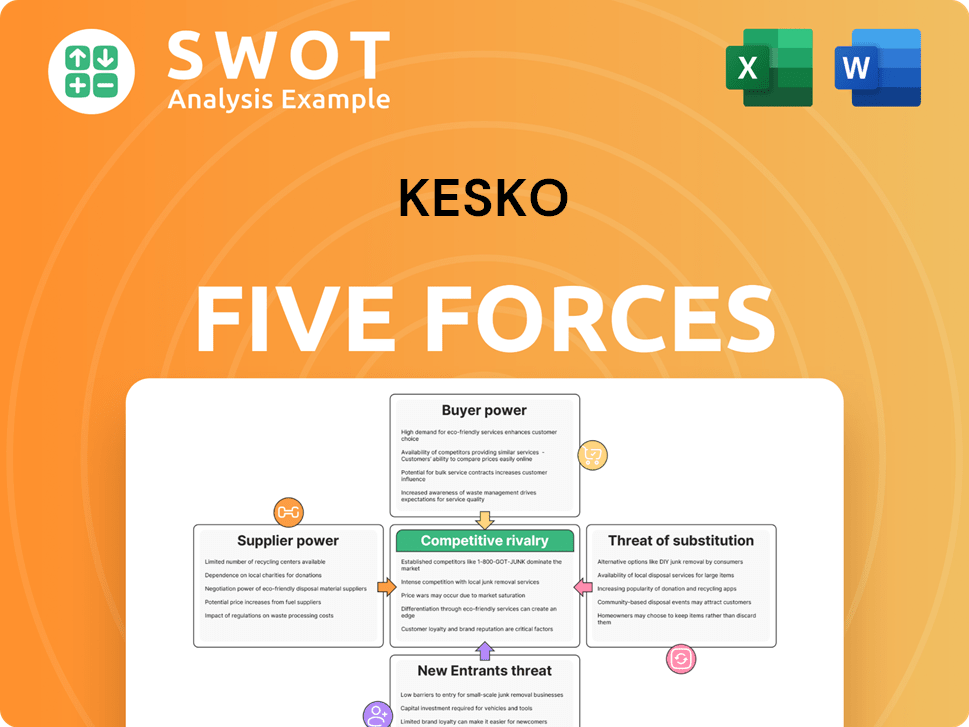

Kesko Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kesko Company?

- What is Competitive Landscape of Kesko Company?

- How Does Kesko Company Work?

- What is Sales and Marketing Strategy of Kesko Company?

- What is Brief History of Kesko Company?

- Who Owns Kesko Company?

- What is Customer Demographics and Target Market of Kesko Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.