Microchip Technology Bundle

Can Microchip Technology Maintain Its Edge in the Semiconductor Race?

The semiconductor industry is a high-stakes arena, and Microchip Technology SWOT Analysis reveals its position within it. As the demand for smarter devices surges, understanding the competitive landscape of chip manufacturers becomes crucial. This analysis dives deep into the forces shaping Microchip Technology's future, providing essential insights for investors and industry watchers alike.

This exploration of the microchip technology competitive landscape offers a vital market analysis, revealing the strategies of industry rivals and the factors driving growth. We'll examine microchip technology market share analysis, competitive advantages of microchip companies, and the latest microchip industry trends and challenges. By identifying who are the top microchip technology competitors, we aim to provide a comprehensive understanding of Microchip Technology's position and potential.

Where Does Microchip Technology’ Stand in the Current Market?

Microchip Technology holds a strong market position within the embedded control solutions sector, particularly in microcontrollers (MCUs) and analog components. The company is consistently recognized as a leading supplier in these areas, with a broad portfolio that includes MCUs (PIC and AVR families), analog products, FPGAs (through Microsemi), and memory solutions. This diverse product range serves various customer segments, including industrial, automotive, consumer, aerospace and defense, communications, and computing.

Geographically, Microchip has a significant global presence, with sales and support offices across North America, Europe, Asia, and other key regions. This global reach ensures broad market access and strong customer engagement. The company's strategic shift towards offering comprehensive system solutions, alongside individual components, allows it to capture greater value within the customer's design cycle. This approach enhances its competitive standing in the Brief History of Microchip Technology, enabling more robust customer relationships and driving long-term growth.

Microchip's financial health remains robust, with consistent generation of strong revenues and profitability. In fiscal year 2024, Microchip reported net sales of $7.59 billion. This financial strength, combined with strategic acquisitions, positions Microchip favorably within the semiconductor industry. The company's strong position in industrial and automotive applications is driven by reliable products and long-term customer relationships. While facing intense competition in high-volume consumer electronics, its focus on specialized, high-reliability applications provides a stable and profitable foundation.

Microchip is a top-tier supplier in the microcontroller (MCU) and analog component markets. While specific market share figures fluctuate, the company consistently ranks among the leaders. This strong market position is a key factor in its competitive landscape.

Microchip's product portfolio includes MCUs (PIC and AVR), analog products, FPGAs, and memory solutions. These products serve diverse customer segments, including industrial, automotive, and consumer electronics. This diversified approach helps mitigate risks and capitalize on various market opportunities.

Microchip has a robust global presence with sales and support offices across North America, Europe, and Asia. This extensive network ensures broad market reach and customer engagement. This global footprint is crucial for serving international clients and expanding market share.

Microchip consistently generates strong revenues and profitability. In fiscal year 2024, net sales reached $7.59 billion. Strategic acquisitions, such as Microsemi, have further strengthened its market position and expanded its product offerings.

Microchip's competitive advantages include a strong market position, a broad product portfolio, and a global presence. The company's focus on system solutions and software enablement enhances its value proposition. These factors contribute to its success in the semiconductor industry.

- Strong market position in MCUs and analog components.

- Diverse product portfolio serving multiple customer segments.

- Global presence with sales and support offices worldwide.

- Strategic focus on total system solutions.

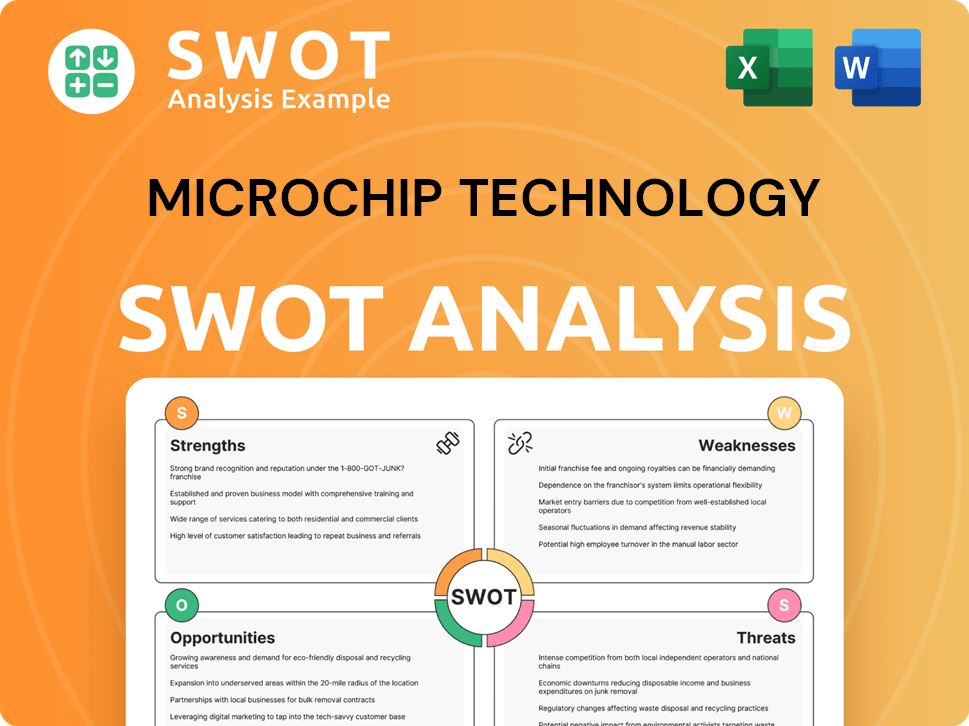

Microchip Technology SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Microchip Technology?

The microchip technology sector is fiercely contested, with numerous global entities vying for market share. Understanding the competitive landscape is crucial for investors and industry analysts alike. This analysis provides insights into the key players and their strategies within the semiconductor industry.

The market analysis reveals a dynamic environment where innovation, pricing, and distribution networks are critical. Companies constantly adapt to technological advancements and evolving customer demands. This overview examines the major industry rivals and their positions.

Microchip Technology faces both direct and indirect competition in the semiconductor market. Several companies offer similar products and services, creating a complex competitive environment. The following sections detail the key competitors and their strategies.

Renesas Electronics is a significant direct competitor, particularly in the microcontroller and analog segments. They have a strong presence in the automotive and industrial sectors. The company's broad product portfolio and customer relationships in Asia pose a challenge to Microchip Technology.

STMicroelectronics is another major competitor, with a robust presence in microcontrollers, sensors, and power management ICs. They focus on innovation and offer a diverse product range, especially in automotive and industrial applications. STMicroelectronics competes directly with Microchip Technology.

NXP Semiconductors is a leader in automotive, industrial, and communication infrastructure semiconductors. They offer a strong portfolio of MCUs, processors, and connectivity solutions. NXP directly competes with Microchip Technology in embedded control offerings.

Texas Instruments (TI) is a major competitor in analog and embedded processing, with an extensive product catalog and distribution network. TI challenges Microchip Technology on price, scale, and breadth of solutions, particularly in the industrial and automotive markets. The competition is intense.

Analog Devices and Maxim Integrated (now part of Analog Devices) present indirect competition, particularly in specialized analog markets. These companies offer alternative solutions that compete with Microchip Technology's offerings. Their focus on analog products creates a distinct competitive dynamic.

AMD (Xilinx) and emerging RISC-V architecture providers offer indirect competition in specific embedded applications. The flexibility and reconfigurability of FPGAs from AMD (Xilinx) challenge Microchip Technology. Additionally, new players focusing on RISC-V architectures could pose future challenges.

The microchip industry trends and challenges include constant innovation, supply chain issues, and geopolitical factors. Mergers and acquisitions, such as AMD's acquisition of Xilinx, continuously reshape the competitive dynamics. For a deeper dive into the strategies and growth of Microchip Technology, consider reading more about the Growth Strategy of Microchip Technology.

Several factors influence the competitive landscape within the microchip technology sector. These include product innovation, pricing strategies, distribution networks, and customer relationships. Understanding these factors is crucial for analyzing the competitive advantages of microchip companies.

- Product Breadth and Innovation: Companies with a wide range of products and a strong focus on innovation tend to have a competitive edge.

- Pricing and Cost Efficiency: Competitive pricing strategies and efficient cost management are critical for profitability and market share.

- Distribution Networks: A robust distribution network ensures products reach customers efficiently.

- Customer Relationships: Strong customer relationships provide valuable insights and foster loyalty.

- Market Segmentation: Focusing on specific market segments, such as automotive or industrial, allows companies to tailor their offerings.

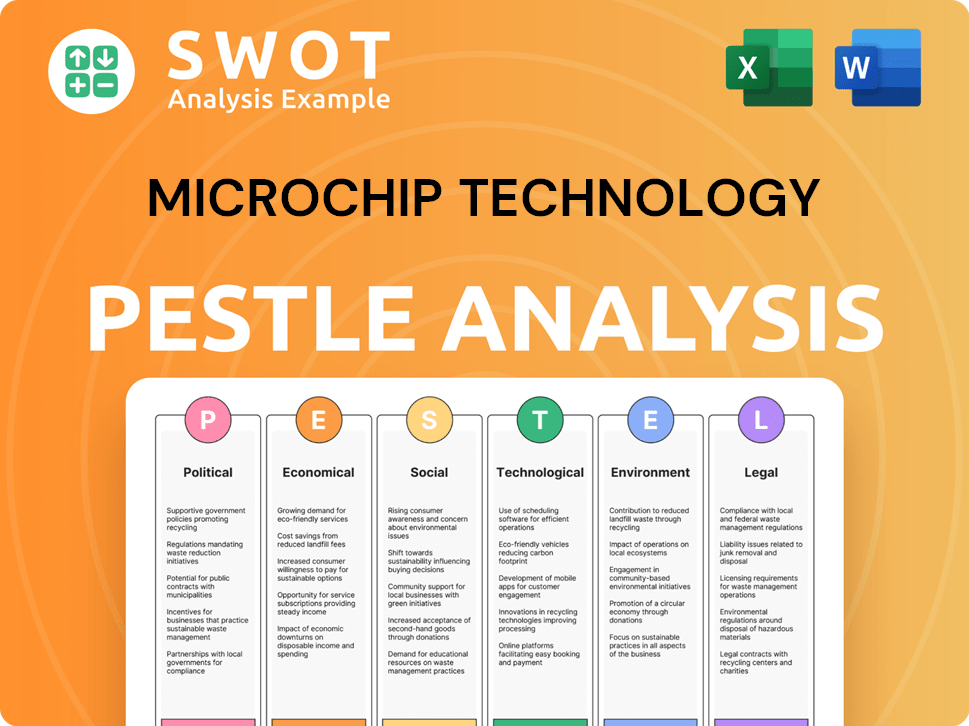

Microchip Technology PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Microchip Technology a Competitive Edge Over Its Rivals?

The competitive landscape of the microchip technology sector is shaped by innovation, strategic partnerships, and market dynamics. Microchip Technology, a key player, has cultivated a strong position through a combination of product breadth, proprietary technologies, and customer-focused strategies. Understanding the competitive advantages of companies like Microchip Technology is crucial for investors, analysts, and industry observers seeking to make informed decisions in the semiconductor industry.

Microchip Technology's success is built on several strategic pillars. These include a comprehensive product portfolio, extensive intellectual property, and a dedication to customer satisfaction. The company's ability to offer a wide range of solutions, coupled with its focus on long product lifecycles, differentiates it from competitors. This approach is critical in a market where technological advancements and industry standards are constantly evolving.

The company's competitive edge is also enhanced by its operational efficiencies and global distribution network. Microchip Technology's strategic moves, such as acquisitions and investments in R&D, are designed to maintain its technological lead and adapt to industry changes. For more insights, you can read about the competitive landscape of the company.

Microchip Technology's extensive product portfolio, including microcontrollers (PIC and AVR families) and analog solutions, offers a one-stop-shop for embedded control needs. This wide range allows for significant cross-selling opportunities and simplifies the design process for engineers. The company's diverse offerings cater to various applications, solidifying its market position in the semiconductor industry.

Proprietary technologies and intellectual property, including numerous patents related to its microcontroller architectures and Flash-IP, provide a significant barrier to entry for competitors. Microchip’s focus on ease of use, coupled with its MPLAB development ecosystem, fosters strong customer loyalty. This technological advantage helps Microchip maintain its competitive position.

Microchip Technology's focus on ease of use, coupled with its MPLAB development ecosystem, fosters strong customer loyalty. The company's strong brand equity, built over decades of reliable product delivery and excellent technical support, further reinforces customer retention. These factors contribute to the company's ability to maintain and grow its customer base.

Economies of scale in manufacturing and a well-established global distribution network contribute to cost efficiencies and widespread product availability. Microchip’s emphasis on long product lifecycles, particularly for industrial and automotive applications, is a key differentiator. This ensures stability and reduces obsolescence risks for customers, fostering long-term relationships.

Microchip Technology's competitive advantages include a broad product portfolio, proprietary technologies, strong customer relationships, and operational efficiencies. The company's focus on long product lifecycles, particularly in industrial and automotive applications, is a key differentiator. These advantages are crucial in a dynamic market, allowing Microchip to maintain its position. In fiscal year 2024, Microchip reported net sales of approximately $8.4 billion, demonstrating its strong market presence.

- Comprehensive product range including microcontrollers and analog solutions.

- Proprietary technologies and extensive intellectual property.

- Strong customer relationships, including technical support and loyalty programs.

- Economies of scale and a well-established global distribution network.

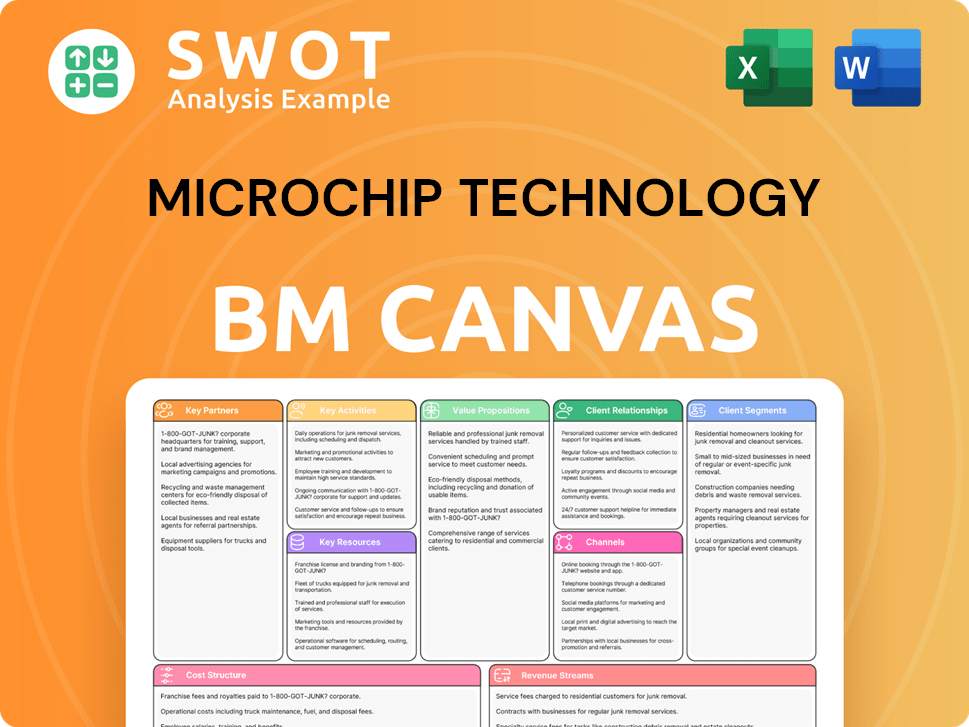

Microchip Technology Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Microchip Technology’s Competitive Landscape?

The Owners & Shareholders of Microchip Technology operates within the dynamic and competitive semiconductor industry. Understanding the competitive landscape, including industry trends, future challenges, and opportunities, is crucial for assessing the company's strategic position and potential for growth. Microchip Technology faces both internal and external pressures that shape its market performance.

The company's success hinges on its ability to adapt to rapidly evolving technological advancements, regulatory changes, and shifting market demands. This analysis provides a comprehensive overview of the microchip technology's competitive environment, highlighting key factors that influence its trajectory.

The semiconductor industry is experiencing significant transformations driven by the Internet of Things (IoT), artificial intelligence (AI), and the automotive sector's electrification. These trends fuel demand for specialized microcontrollers and mixed-signal solutions. The automotive industry's shift towards electric vehicles (EVs) and autonomous driving systems creates high-reliability semiconductor needs.

Regulatory changes, particularly regarding supply chain resilience and cybersecurity, pose challenges to consistent delivery and cost management. Geopolitical tensions and trade policies can disrupt global supply chains, impacting Microchip's operations. The need for energy-efficient solutions also presents a design challenge, requiring innovation in power-optimized products.

Microchip can capitalize on the growing demand in emerging markets and the development of 5G infrastructure and industrial automation. Strategic acquisitions and robust R&D, which accounted for approximately 19% of net sales in fiscal year 2024, support innovation and adaptation. Focusing on high-growth segments and continuously enhancing its product portfolio are key strategies.

Intensified competition from companies investing in next-generation architectures like RISC-V and aggressive pricing strategies in high-volume markets pose risks. Microchip's response involves expanding its presence in high-growth segments and investing in R&D to maintain a competitive edge. The company's strategic acquisitions and focus on high-margin segments are crucial.

Microchip Technology's strategic focus includes expanding its presence in emerging markets and developing innovative solutions for 5G infrastructure and industrial automation. The company is also investing in its FPGA capabilities and maintaining a robust R&D program. Recent financial data reveals that Microchip's commitment to R&D is a significant factor in its ability to adapt and innovate.

- Focus on high-growth, high-margin segments.

- Continuous enhancement of product portfolio.

- Strategic acquisitions and ongoing R&D efforts.

- Expanding presence in emerging markets.

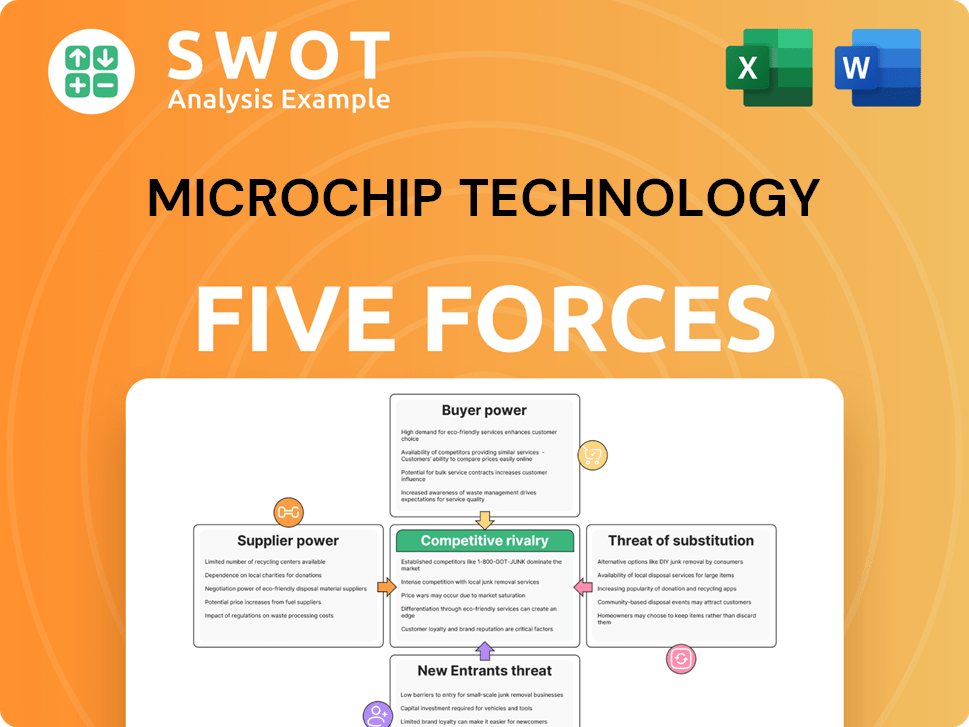

Microchip Technology Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Microchip Technology Company?

- What is Growth Strategy and Future Prospects of Microchip Technology Company?

- How Does Microchip Technology Company Work?

- What is Sales and Marketing Strategy of Microchip Technology Company?

- What is Brief History of Microchip Technology Company?

- Who Owns Microchip Technology Company?

- What is Customer Demographics and Target Market of Microchip Technology Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.