Microchip Technology Bundle

Can Microchip Technology Continue Its Ascent in the Semiconductor Realm?

Microchip Technology, a titan in the semiconductor industry, has consistently demonstrated the power of a well-defined growth strategy. From its inception in 1989, the Microchip Technology SWOT Analysis shows the company's evolution from a microcontroller provider to a comprehensive solutions partner. This strategic journey, highlighted by key acquisitions like Atmel Corporation, underscores its commitment to sustained expansion and innovation within the digital landscape.

This exploration delves into the core of Microchip company's future prospects, dissecting its strategic initiatives, technological advancements, and financial outlook. We'll analyze the growth strategies for microchip companies, examine the impact of market trends and the challenges facing Microchip Technology. Understanding the future of microchip manufacturing and Microchip technology investment opportunities is critical for anyone looking to navigate the complexities of the semiconductor industry.

How Is Microchip Technology Expanding Its Reach?

The growth strategy of Microchip Technology, a key player in the semiconductor industry, is heavily reliant on its expansion initiatives. These initiatives are designed to broaden its market reach and diversify its revenue streams, ensuring the company remains competitive and adaptable to the ever-changing technological landscape. The focus is on entering new markets and expanding its product offerings to meet evolving customer needs.

Microchip Technology's approach includes both organic growth and strategic acquisitions. The company continuously evaluates opportunities to strengthen its position in the market and enhance its capabilities. This proactive strategy is crucial for navigating the complexities of the semiconductor industry and capitalizing on emerging trends.

A comprehensive market analysis of Microchip Technology reveals a strategic focus on areas with high growth potential, such as automotive, industrial automation, and the Internet of Things (IoT). These sectors are driving significant demand for advanced microcontrollers, analog solutions, and connectivity technologies.

Microchip Technology actively expands its footprint globally, targeting regions with high growth potential. This includes strengthening its presence in established markets and exploring opportunities in emerging economies. The company aims to increase its market share and customer base by strategically positioning itself in key geographic areas.

The company continually diversifies its product portfolio to cater to a wider range of applications and customer needs. This involves investing in research and development to introduce new products and solutions. The goal is to offer comprehensive solutions that meet the evolving demands of various industries.

Microchip Technology forms strategic partnerships with key industry players to develop integrated solutions. These collaborations facilitate market adoption and accelerate innovation. By working with other companies, Microchip can offer more comprehensive and competitive products.

Microchip Technology has a history of strategic mergers and acquisitions to expand its capabilities and market reach. While specific M&A activities in early 2025 have not been announced, the company continually evaluates opportunities. These acquisitions are aimed at strengthening its position in the semiconductor industry.

Microchip Technology is focusing on several key areas for expansion, including the automotive sector, industrial automation, and IoT. These sectors are experiencing significant growth, driven by technological advancements and increasing demand for sophisticated electronic components. The company is investing in product development and strategic partnerships to capitalize on these opportunities.

- Automotive: Solutions for ADAS and electrification. The automotive semiconductor market is projected to reach $82.6 billion by 2028.

- Industrial Automation: New products for automation, smart energy, and IoT applications. The industrial automation market is expected to reach $300 billion by 2027.

- IoT: Low-power microcontrollers for edge computing and AI applications. The IoT market is forecast to reach $1.8 trillion by 2030.

- M&A: Evaluating strategic acquisitions to enhance market presence and technology portfolio.

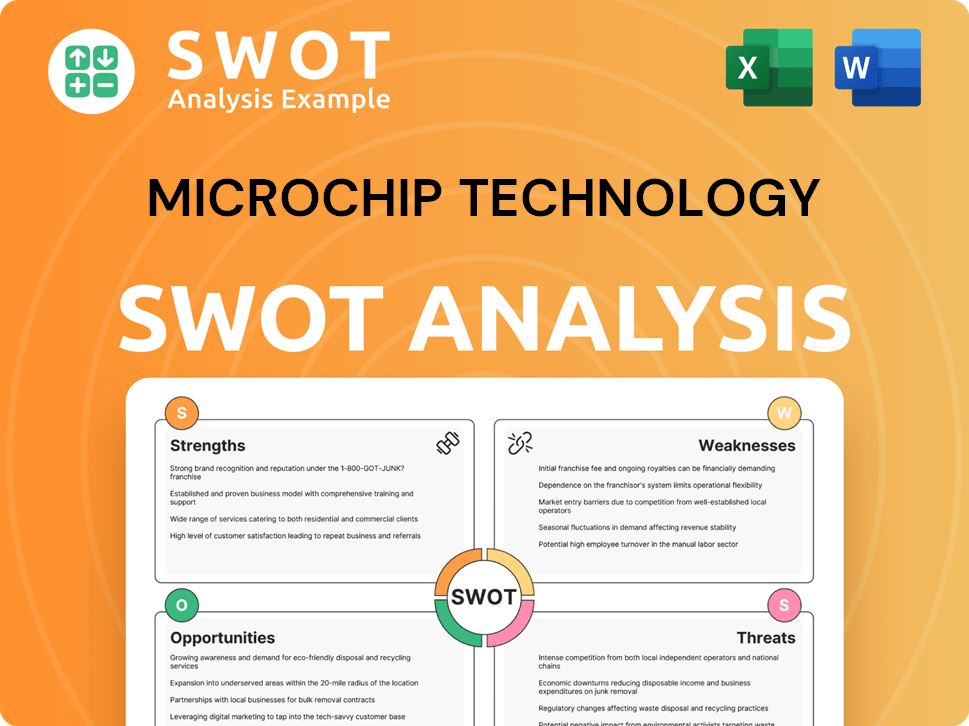

Microchip Technology SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Microchip Technology Invest in Innovation?

The innovation and technology strategy of the Microchip Technology is crucial for its sustained growth within the semiconductor industry. The company's approach emphasizes continuous investment in research and development (R&D) to create cutting-edge solutions. This commitment allows Microchip to maintain a competitive edge and adapt to the evolving demands of the market.

Microchip's strategic focus on innovation is evident in its substantial R&D investments, which consistently represent a significant portion of its revenue. These investments drive the development of new products and platforms, particularly in areas such as embedded control, connectivity, and power management. The company's ability to integrate advanced technologies like artificial intelligence (AI) and machine learning (ML) further enhances its product offerings.

The company's dedication to digital transformation and sustainability also shapes its technology strategy. By embracing advanced design methodologies and automation tools, Microchip enhances efficiency and accelerates product development cycles. Furthermore, the company is increasingly focused on developing energy-efficient products and optimizing its manufacturing processes.

Microchip consistently allocates a significant portion of its revenue to research and development, which is a key element of its growth strategy. This investment supports the creation of new products and platforms, ensuring the company remains competitive in the semiconductor industry.

Microchip embraces advanced design methodologies and automation tools to enhance efficiency and accelerate product development cycles. This approach is crucial for adapting to the rapid pace of technological advancements and market demands.

The company actively integrates cutting-edge technologies into its offerings, such as AI and ML capabilities in its microcontrollers. This integration allows Microchip to provide innovative solutions that meet the evolving needs of its customers.

Sustainability is a growing focus, with Microchip developing more energy-efficient products and optimizing manufacturing processes. This commitment not only reduces environmental impact but also aligns with the increasing demand for sustainable solutions in the market.

Microchip's portfolio includes key patents in secure embedded systems and advanced analog circuitry, showcasing its leadership in innovation. These patents directly contribute to its growth objectives by enabling new applications and expanding market opportunities.

Microchip's technology finds applications in a wide range of industries, including automotive, industrial automation, and consumer electronics. This diversification helps the company mitigate risks and capitalize on various market opportunities.

Microchip's innovation strategy focuses on several key areas to drive growth and maintain its competitive position. These advancements are crucial for the company's future prospects in the semiconductor industry.

- Embedded Control: Development of advanced microcontrollers and microprocessors for various applications.

- Connectivity: Focus on expanding IoT solutions and supporting a wider array of connected devices.

- Power Management: Creation of energy-efficient products and optimization of manufacturing processes.

- AI and ML Integration: Incorporating AI and ML capabilities into microcontrollers for edge inference.

- Secure Embedded Systems: Emphasis on developing secure solutions to protect against cyber threats.

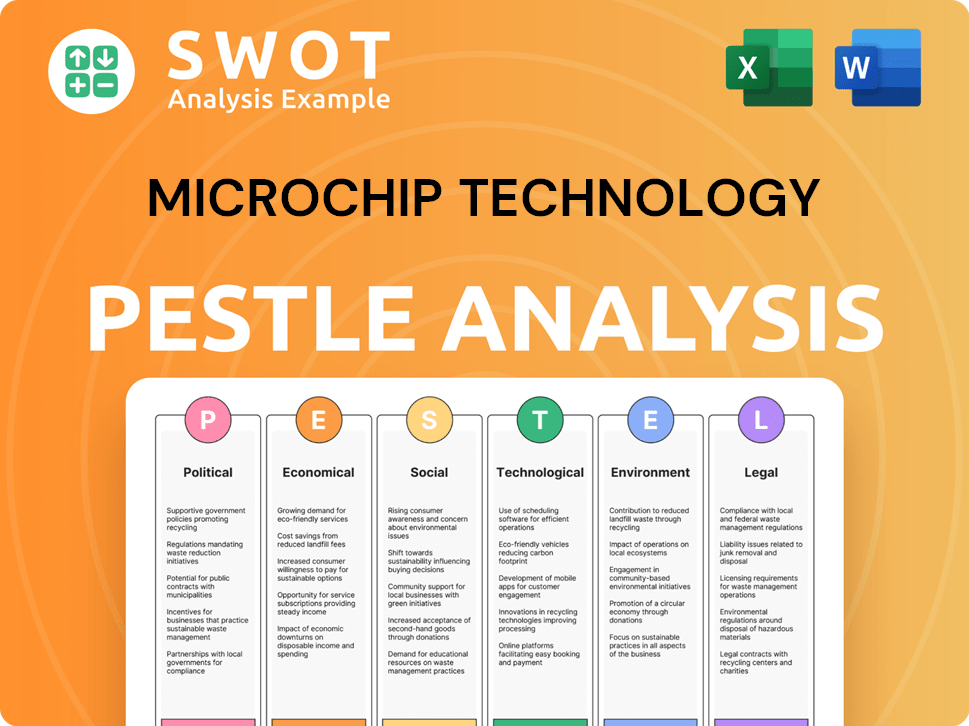

Microchip Technology PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Microchip Technology’s Growth Forecast?

The financial outlook for Microchip Technology reflects a strategic focus on sustainable growth and profitability. The company's performance is driven by robust revenue targets and healthy profit margins, positioning it well within the competitive landscape of the Microchip Technology's competitors. This outlook is supported by strategic capital allocation and a commitment to innovation.

For fiscal year 2024, Microchip reported net sales of approximately $7.63 billion. This financial achievement lays a solid foundation for future growth. The company's financial strategy is designed to maintain a healthy balance sheet, enabling flexibility for strategic investments.

Looking ahead to fiscal year 2025, analysts project continued growth as the semiconductor market recovers. Microchip’s long-term financial goals emphasize consistent free cash flow generation to support both organic growth and potential acquisitions. This approach helps maintain a strong financial position.

Microchip Technology anticipates continued revenue growth, driven by the recovery of the semiconductor industry. The company's strategic initiatives and product portfolio are designed to capitalize on market opportunities. This growth is essential for the company's long-term financial health.

Microchip's financial performance is characterized by strong gross margins, which were approximately 62.6% in fiscal year 2024. These margins reflect efficient operations and a valuable product portfolio. Maintaining healthy gross margins is crucial for profitability.

Investment levels remain robust, with capital expenditures directed towards expanding manufacturing capacity and advancing R&D. These investments support future product development and innovation. This strategic focus ensures Microchip's long-term competitiveness.

The company's financial strategy focuses on maintaining a healthy balance sheet with manageable debt levels and ample liquidity. This approach provides flexibility for strategic investments and navigating market fluctuations. This financial discipline supports sustainable growth.

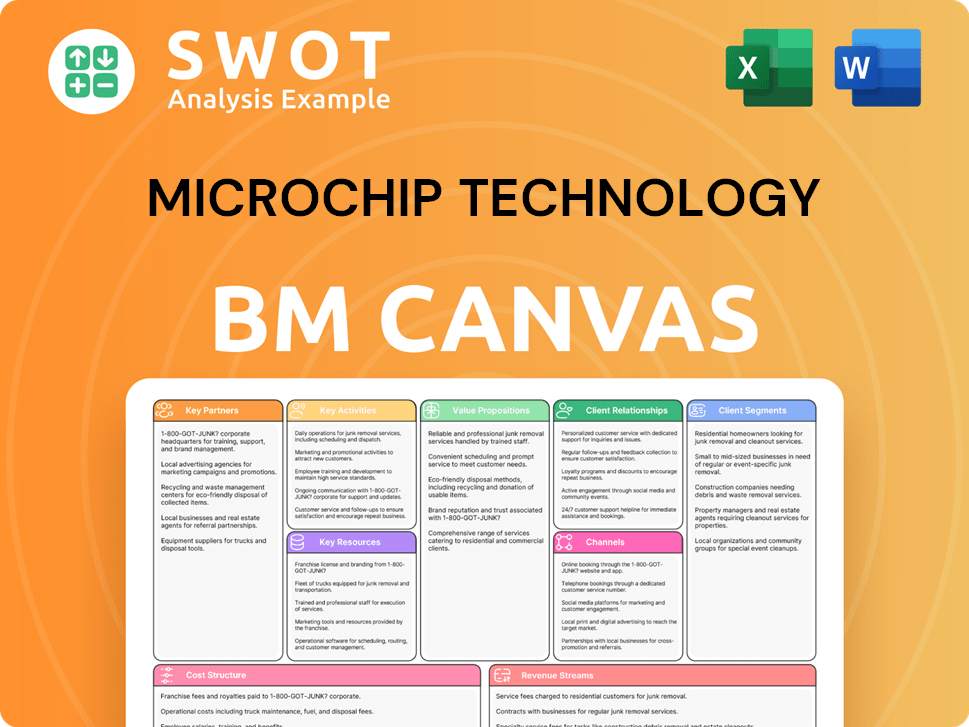

Microchip Technology Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Microchip Technology’s Growth?

The Microchip company faces several significant risks and obstacles that could influence its growth strategy and future prospects. Navigating the complex semiconductor industry requires careful management of various challenges. Understanding these potential pitfalls is essential for investors and stakeholders.

One primary concern is intense market competition, with numerous established and emerging players vying for market share. This competitive landscape can lead to pricing pressures and the necessity for continuous innovation. Additionally, regulatory changes and supply chain vulnerabilities pose ongoing risks, particularly in the current global environment.

Technological disruption is another inherent risk, as rapid advancements by competitors or the emergence of new technologies could render existing products less competitive. Internally, constraints such as the availability of skilled engineering talent could limit innovation and expansion. These challenges underscore the need for proactive strategies to ensure long-term success in the microchip technology sector.

The Microchip company operates in a highly competitive market. Numerous companies compete in the microcontroller, analog, and mixed-signal sectors. This competition can lead to price wars and the need for constant innovation.

Recent global events have highlighted the vulnerability of supply chains. Disruptions in raw materials, manufacturing, or logistics can cause delays. Diversifying manufacturing and supplier relationships is crucial to mitigate these risks.

Rapid advancements in the semiconductor industry pose a constant threat. Competitors' innovations or new technologies can make existing products obsolete. Continuous investment in research and development is essential.

The availability of skilled engineering talent can limit innovation. Expansion may also be constrained by resource limitations. Attracting and retaining top talent is vital for driving growth.

Changes in international trade policies and environmental regulations can impact operations. These changes may affect supply chains and increase costs. Adapting to new regulations is a constant challenge.

Increasing geopolitical tensions affect global trade. The rising cost of advanced semiconductor manufacturing also poses a risk. These factors will continue to shape the company's future.

Microchip technology addresses these risks through diversification. This includes diversifying its product portfolio and customer base. Robust risk management frameworks and proactive scenario planning are also essential. The company's strategies focus on adaptability and resilience.

While specific examples of overcoming obstacles are not always public, the company's performance demonstrates its ability to adapt. The Microchip company consistently performs well through various economic cycles. This resilience is a key strength in a dynamic market.

For more insights into the core values guiding the company, you can explore Mission, Vision & Core Values of Microchip Technology.

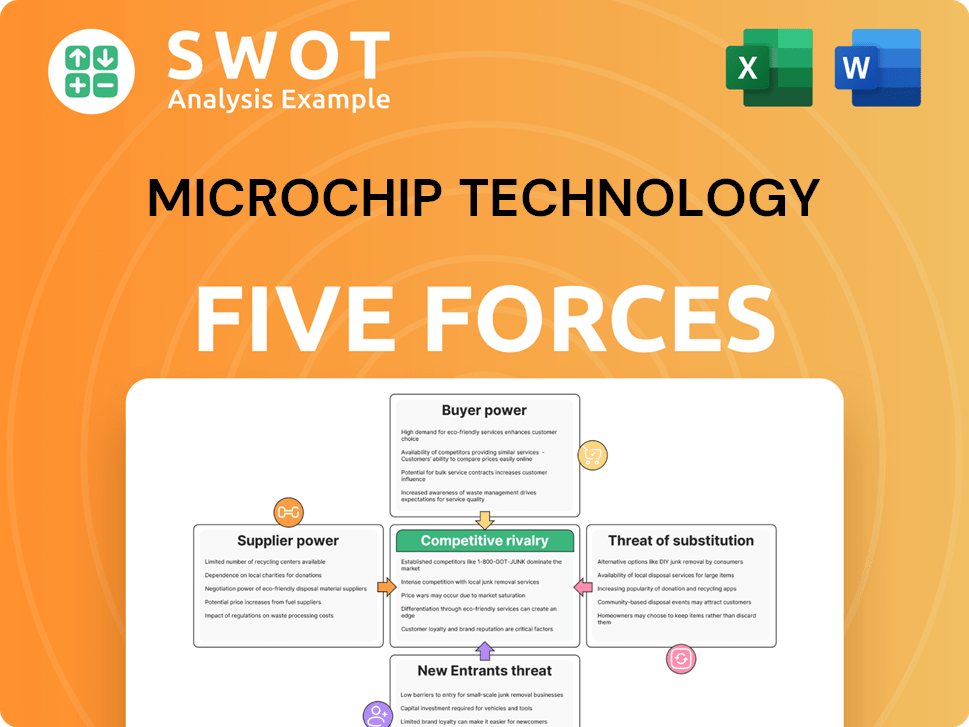

Microchip Technology Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Microchip Technology Company?

- What is Competitive Landscape of Microchip Technology Company?

- How Does Microchip Technology Company Work?

- What is Sales and Marketing Strategy of Microchip Technology Company?

- What is Brief History of Microchip Technology Company?

- Who Owns Microchip Technology Company?

- What is Customer Demographics and Target Market of Microchip Technology Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.