Microchip Technology Bundle

How Does Microchip Technology Thrive in the Semiconductor World?

Microchip Technology, a key player in the semiconductor industry, empowers a wide range of applications with its microcontrollers and integrated circuits. Serving approximately 123,000 clients across diverse markets, the Microchip Technology SWOT Analysis reveals the company's strategic positioning. Despite facing industry-wide inventory corrections, Microchip's commitment to innovation and strategic expansions, such as its move into the 64-bit mixed-signal microprocessor market, highlights its adaptability.

Understanding how microchips work and how the Microchip company operates is crucial for investors and industry observers. The company's focus on 'Total System Solutions' and key megatrends like AI/ML and e-mobility positions it as a vital player in the evolving technological landscape. This analysis will explore Microchip's core operations, revenue streams, and future outlook, providing insights into its ability to navigate both opportunities and challenges within the complex process of chip manufacturing.

What Are the Key Operations Driving Microchip Technology’s Success?

Microchip Technology, a key player in the semiconductor industry, creates value by providing smart, connected, and secure embedded control solutions. These solutions serve diverse markets including industrial, automotive, and consumer electronics. Their core offerings consist of microcontrollers (MCUs), mixed-signal, analog, and Flash-IP solutions, which are critical components in modern electronics.

The company's operations span technology development, manufacturing, sourcing, and sales. Microchip emphasizes technical support, dependable delivery, and quality, which are crucial for its diverse customer applications. This approach allows them to offer multiple products to a single customer, deepening relationships and increasing sales.

A central element of Microchip's strategy is its 'Total System Solution' (TSS) approach. This strategy aims to provide integrated offerings that leverage its extensive product portfolio to meet customer needs, reducing time to market. Microchip maintains a robust global supply chain, combining internal manufacturing with external partnerships. For instance, in January 2024, the U.S. government invested $162 million in Microchip's manufacturing projects in Colorado and Oregon, which is projected to nearly triple the output of semiconductors at these sites.

Microchip's primary offerings include microcontrollers (MCUs), mixed-signal, analog, and Flash-IP solutions. These components are essential for a wide range of applications. The company focuses on providing high-quality, reliable products to meet customer demands.

Microchip's operational processes include technology development, manufacturing, sourcing, logistics, and sales. The company emphasizes outstanding technical support and dependable delivery. They also focus on maintaining a resilient global supply chain.

The TSS strategy provides integrated offerings to meet customer needs and reduce time to market. This approach enables Microchip to offer multiple products to a single customer. This strategy is a key differentiator in the semiconductor industry.

Microchip maintains a robust and resilient global supply chain. They combine internal manufacturing with external foundry partnerships. In August 2024, they expanded their partnership with TSMC to build supply chain resiliency.

Microchip offers low-risk product development, lower total system cost, and faster time to market. Their design tools for MCUs make it costly for manufacturers to switch once a design is established, creating a competitive advantage. This translates into simplified design cycles and reduced development expenses for customers.

- Simplified design cycles.

- Reduced overall development expenses.

- Strong customer relationships due to the TSS approach.

- Resilient supply chain through strategic partnerships.

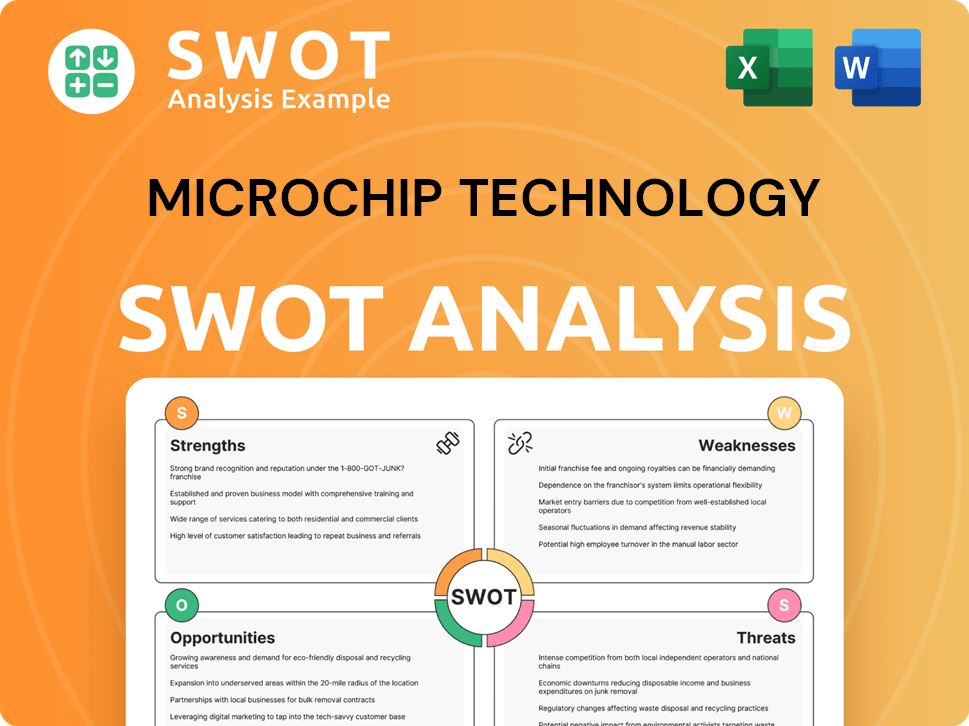

Microchip Technology SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Microchip Technology Make Money?

Microchip Technology's revenue streams primarily revolve around the sale of its semiconductor products. These products include microcontrollers, mixed-signal, analog, and Flash-IP solutions, which are essential components in a wide array of electronic devices. The company's financial performance is heavily influenced by the demand for these products and the overall health of the semiconductor industry.

The company also generates revenue by licensing its Flash-IP solutions. This diversification allows Microchip Technology to tap into different market segments and leverage its intellectual property. Understanding these revenue sources is crucial for assessing the company's financial stability and growth potential.

In fiscal year 2025, the company reported net sales of $4.402 billion, a decrease of 42.3% from $7.634 billion in the prior fiscal year. The mixed-signal microcontroller product line accounted for 51.1% of net sales, while the analog product line contributed 26.3%. The company's non-GAAP gross profit for fiscal year 2025 was 57.0%.

Microchip Technology's revenue model is multifaceted, with sales of semiconductor products forming the core. The company's ability to adapt to market changes and maintain profitability is key. To learn more about the strategies, read Marketing Strategy of Microchip Technology.

- Semiconductor Sales: This includes microcontrollers, mixed-signal products, analog products, and other offerings.

- Flash-IP Licensing: Licensing of intellectual property related to Flash memory technology.

- Geographical Sales: In fiscal year 2025, Asia represented 49.9% of net sales, the Americas 30.2%, and Europe 19.9%.

- Shareholder Returns: The company returns capital to shareholders through dividends and share repurchases. In fiscal year 2024, $1.89 billion was returned to shareholders.

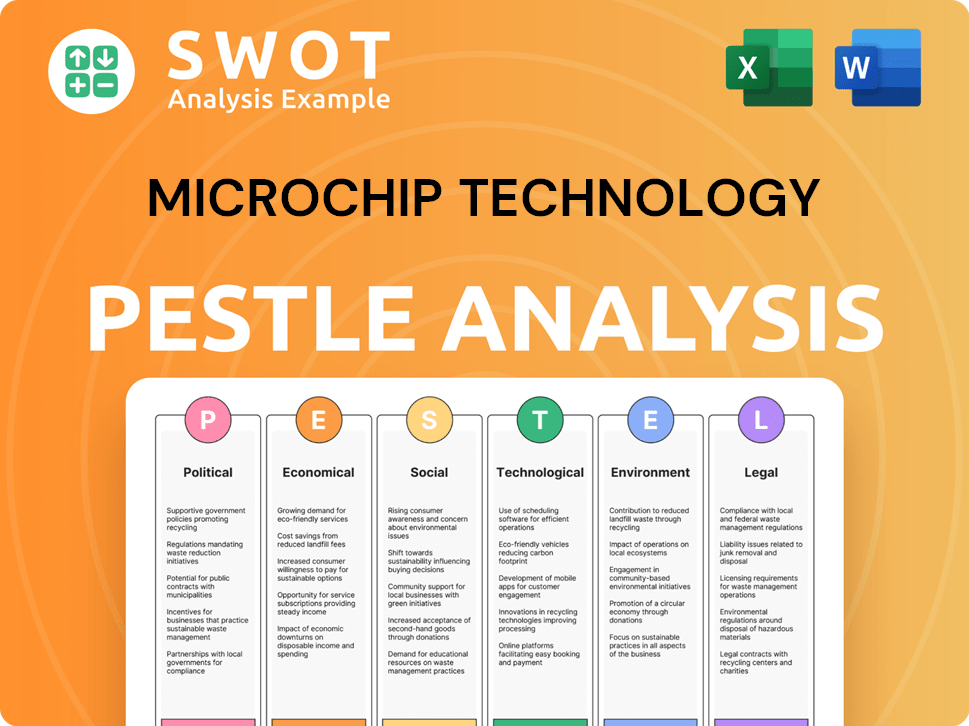

Microchip Technology PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Microchip Technology’s Business Model?

Microchip Technology has navigated significant milestones and strategic moves that have shaped its operational and financial trajectory. A notable recent challenge was the major inventory correction in fiscal year 2024, which led to a 9.5% decline in revenue to $7.6 billion. The company responded with a strategic plan to enhance operational capabilities and adapt to market dynamics.

Strategic partnerships and acquisitions have been crucial for Microchip, expanding its technological capabilities and market reach. Furthermore, the company has focused on strengthening its supply chain and aligning its product offerings with high-growth areas. These moves are designed to reinforce its competitive edge in the semiconductor industry.

Microchip's focus on key megatrends such as AI/ML, data centers, sustainability, networking/connectivity, e-mobility, and edge computing/IoT further reinforces its competitive edge by aligning its product offerings with high-growth areas. Microchip continues to adapt to new trends, such as launching an AI Coding Assistant in February 2025, which is expected to increase developer productivity by over 40%.

In fiscal year 2024, Microchip faced an inventory correction, resulting in a revenue decline. The company initiated a 'nine-point-plan' to improve operational efficiency. By March 31, 2025, the company reduced distribution inventory days by 4 days to 33 days.

Microchip acquired Neuronix AI Labs in August 2024 to enhance its AI-enabled edge solutions. The company also expanded its partnership with TSMC. In December 2024, Microchip announced the closure of its Tempe Fab 2 facility by September 2025, expecting annual savings of approximately $90 million.

Microchip's competitive advantages stem from its brand strength, technology leadership, and extensive product portfolio. The 'Total System Solution' approach offers a one-stop-shop for design engineers. Microchip's focus on key megatrends such as AI/ML and e-mobility further reinforces its competitive edge.

In July 2024, Microchip entered the 64-bit mixed-signal microprocessor market. The company launched an AI Coding Assistant in February 2025, expected to increase developer productivity by over 40%. These actions demonstrate its commitment to innovation and market expansion.

Microchip Technology's strategic moves and operational adjustments reflect its response to market challenges and its focus on future growth. The company's ability to adapt and innovate, as highlighted in Target Market of Microchip Technology, is crucial to its success in the competitive semiconductor industry.

- Inventory correction in fiscal year 2024 led to a revenue decline, prompting strategic responses.

- Acquisitions and partnerships are key to expanding technological capabilities and market reach.

- Focus on megatrends such as AI/ML and e-mobility enhances its competitive edge.

- Closure of Tempe Fab 2 and the launch of an AI Coding Assistant are recent strategic moves.

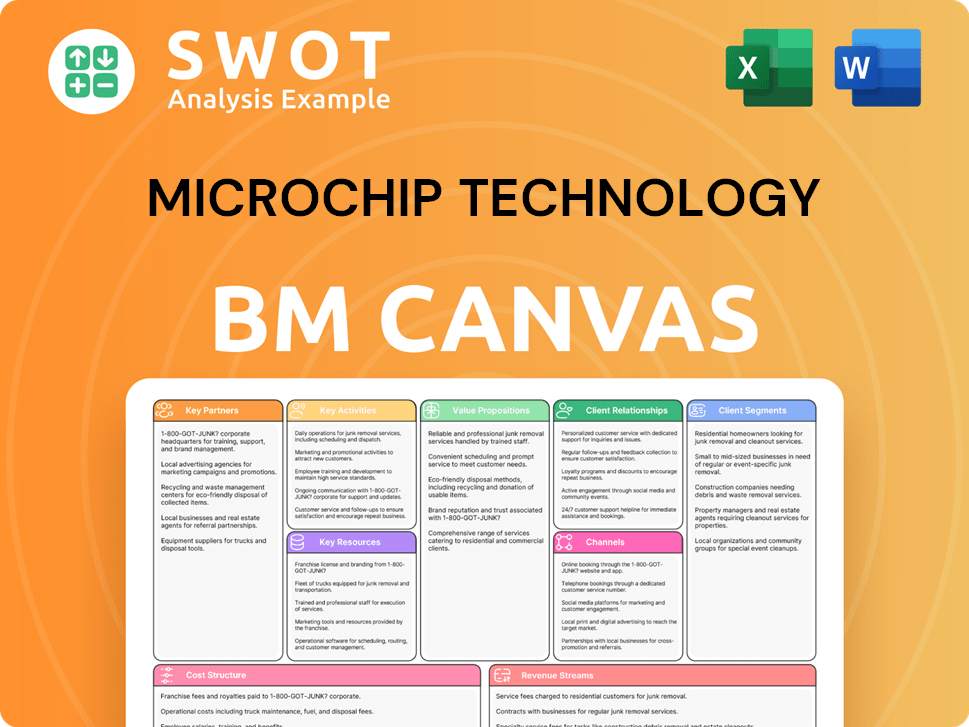

Microchip Technology Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Microchip Technology Positioning Itself for Continued Success?

Microchip Technology holds a significant position within the semiconductor industry, recognized for its expertise in microcontrollers, mixed-signal, analog, and Flash-IP solutions. The Microchip company serves over 100,000 customers globally, highlighting its broad reach and customer loyalty. Their diverse product portfolio spans industrial, automotive, consumer, aerospace and defense, communications, and computing markets, providing a solid foundation for its operations.

The future outlook for Microchip technology involves navigating several risks. Economic instability, including inflation and high interest rates, has impacted net sales, as seen in fiscal year 2025. Geopolitical tensions and trade disruptions also present challenges to global supply chains. While the semiconductor industry is poised for growth, particularly due to generative AI, demand from traditional markets may remain subdued. Supply chain issues, though well-managed in 2024, persist as a potential risk for 2025.

Microchip is a leader in microcontrollers and mixed-signal solutions. Their products are essential components in a wide array of electronic devices. The company's strong customer base and diversified product offerings contribute to its solid market position.

Economic instability, geopolitical tensions, and supply chain disruptions pose significant risks. These factors can impact sales and profitability. Demand fluctuations in key markets also present challenges.

Microchip aims to expand profitability through strategic initiatives, including resuming expansion efforts at Fab 4 and Fab 5. They anticipate fluctuations in gross margins but are focused on maintaining competitiveness through investments in new products. Revenue for the June 2025 quarter is projected between $1.02 billion and $1.07 billion.

The company plans to focus on solid growth in higher-end MCUs, analog, and FPGA products. Microchip aims for average mid-cycle sales growth of 6% per year. Returning 100% of adjusted free cash flow to shareholders through dividends and stock buybacks is also a priority.

Microchip's long-term strategy focuses on sustained growth and shareholder value. This involves strategic investments, product innovation, and disciplined financial management. These strategies aim to position the company for long-term success in the competitive semiconductor industry.

- Focus on higher-end MCUs, analog, and FPGA products for growth.

- Targeting an average mid-cycle sales growth of 6% annually.

- Commitment to returning 100% of adjusted free cash flow to shareholders.

- Investment in new product development and expansion of manufacturing capacity.

For a deeper understanding of the company's origins and evolution, consider reading a Brief History of Microchip Technology.

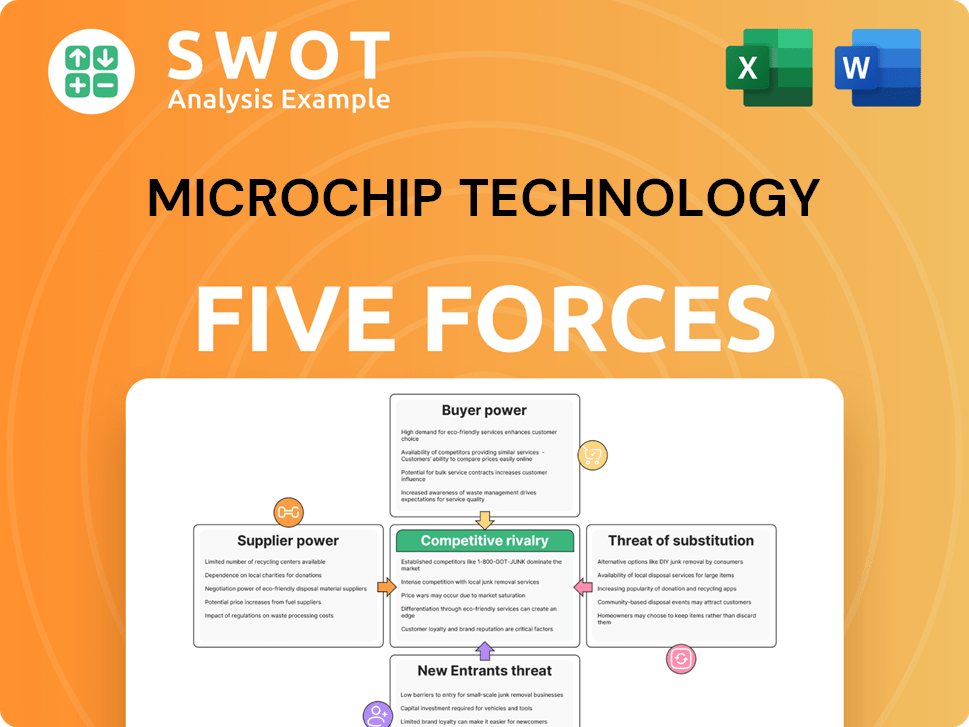

Microchip Technology Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Microchip Technology Company?

- What is Competitive Landscape of Microchip Technology Company?

- What is Growth Strategy and Future Prospects of Microchip Technology Company?

- What is Sales and Marketing Strategy of Microchip Technology Company?

- What is Brief History of Microchip Technology Company?

- Who Owns Microchip Technology Company?

- What is Customer Demographics and Target Market of Microchip Technology Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.