Paytm Bundle

Can Paytm Conquer the Ever-Evolving Digital Payments Arena?

Paytm, a fintech giant born in India, has revolutionized how the nation handles digital transactions. From its humble beginnings in 2010, it has grown into a comprehensive platform, offering everything from mobile wallets to e-commerce. But in the fast-paced Paytm SWOT Analysis, how does this Indian powerhouse stack up against its rivals?

With over 300 million users and millions of merchants, Paytm has solidified its position within the digital payments landscape. However, the Paytm competition is fierce, and understanding its Paytm competitors is vital to grasping its future. This analysis will explore Paytm's market position, dissect its competitive advantages, and examine the industry trends shaping its trajectory within the Indian fintech market.

Where Does Paytm’ Stand in the Current Market?

Paytm's core operations revolve around providing digital payment solutions and financial services in India. The company's value proposition lies in offering a comprehensive ecosystem that includes mobile payments, financial services, and e-commerce functionalities. This approach aims to create a one-stop platform for various financial and transactional needs, targeting both consumers and merchants.

Paytm's market position has seen shifts, particularly in the competitive digital payments landscape. While it has been a major player, its market share in the UPI segment has fluctuated. This dynamic reflects the intense competition and evolving regulatory environment within the Indian fintech market.

Paytm's market share in UPI transactions by volume was approximately 6.87% in December 2024, a decrease from 7.03% in November 2024. This decline is partly due to regulatory restrictions on Paytm Payments Bank. Despite these challenges, Paytm remains a significant player in the digital payments space.

Paytm offers a wide range of services, including mobile payments, Paytm Wallet, and financial services like insurance and lending. It also facilitates online recharges, bill payments, and ticket bookings. This diversified portfolio helps Paytm maintain a strong presence in the Indian digital economy.

Paytm has a strong merchant base exceeding 20 million and a user base of over 300 million. This extensive network supports its revenue generation through device subscriptions, payment commissions, and loan disbursals. The large user base and merchant network are crucial for Paytm's competitive edge.

Paytm achieved its first full year of EBITDA profitability in FY2024 with ₹559 crore. This financial milestone indicates a strategic focus on core operations and improved financial standing. For Q2FY25, Paytm had 71 million monthly transacting users (MTU).

Paytm's market position is influenced by its competitive landscape, regulatory environment, and strategic initiatives. The company's ability to adapt and innovate is essential for maintaining its market share. Understanding the Marketing Strategy of Paytm is crucial for assessing its future prospects.

- Market Share Fluctuation: Paytm's UPI market share has seen fluctuations, indicating intense competition.

- Diverse Service Portfolio: The company offers a wide array of services, including payments, financial services, and e-commerce.

- Strong Merchant and User Base: Paytm has a large merchant and user base, which supports its revenue generation.

- Geographic Focus: Primarily focused on the Indian market, with some international ventures.

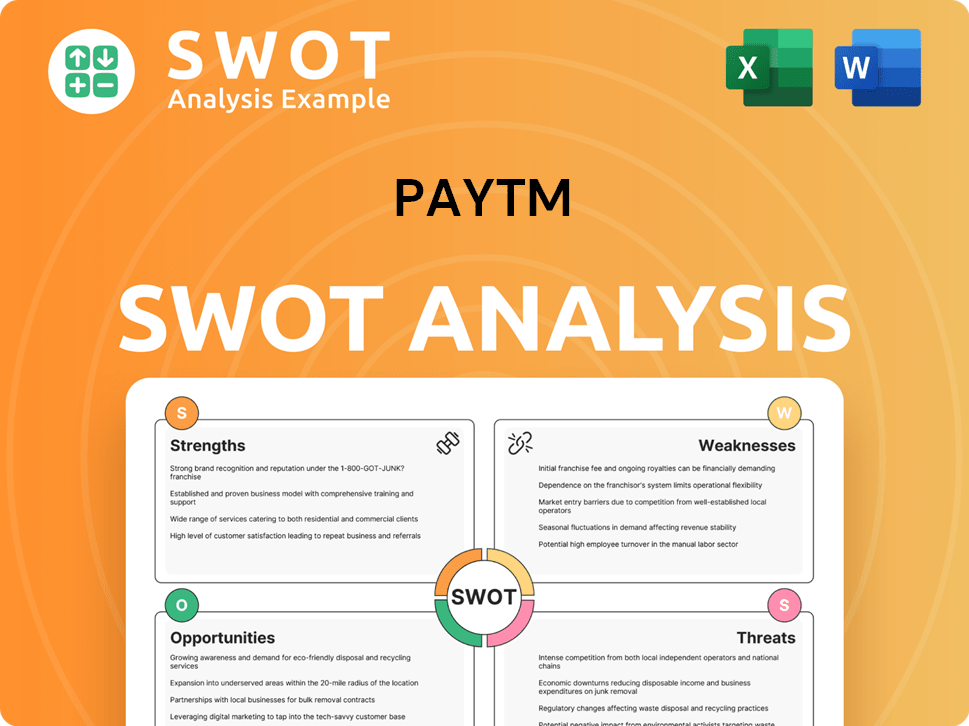

Paytm SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Paytm?

The Indian digital payments and financial services market is highly competitive, with numerous players vying for market share. This competitive landscape poses both challenges and opportunities for companies like Paytm. Understanding the key competitors and their strategies is crucial for assessing Paytm's market position and future prospects.

Paytm faces a variety of competitors across its different service offerings, including direct rivals in the UPI payments space and other players in e-commerce, digital wallets, and financial services. The competitive dynamics are shaped by factors such as pricing, innovation, brand recognition, and regulatory environments. Analyzing these factors helps in understanding the strengths and weaknesses of Paytm compared to its competitors.

The competitive landscape for Paytm is dynamic and constantly evolving, influenced by technological advancements, changing consumer preferences, and regulatory changes. The ability to adapt to these changes and innovate is critical for Paytm to maintain and grow its market share. For a deeper dive into the company's origins, check out this Brief History of Paytm.

PhonePe and Google Pay are the dominant players in the UPI payments segment, representing the most significant direct competition for Paytm. They have established strong market positions through user-friendly interfaces and extensive distribution networks.

Amazon Pay, FreeCharge, and MobiKwik offer digital wallet and payment services, competing with Paytm in mobile recharges, bill payments, and online transactions. These competitors aim to capture a share of the growing digital payments market.

BharatPe focuses on merchant payments and financial services for small businesses, directly competing with Paytm's merchant ecosystem. This segment is crucial for driving transaction volumes and revenue growth.

The broader fintech landscape includes PayU, Razorpay, PayPal, Navi, and Cred, all vying for a share of the rapidly expanding digital finance market in India. These companies offer various financial services, increasing the competitive intensity.

Paytm's strengths include its extensive merchant network, brand recognition, and diversified service offerings. However, it faces challenges from regulatory restrictions and the dominance of competitors like PhonePe and Google Pay.

In December 2024, PhonePe held a 47.7% market share by transaction volume, while Google Pay had 36.7%. Paytm's share was 6.87%. In January 2025, PhonePe maintained its lead with 47.67%, and Google Pay with 36.38%. Paytm had 6.78%.

The competitive landscape is shaped by various factors, including pricing strategies, product innovation, brand recognition, distribution networks, and technological advancements. The ability to adapt to regulatory changes and market dynamics is crucial for success.

- Pricing Strategies: Competitive pricing and incentives to attract and retain users.

- Product Innovation: Continuously introducing new features and services.

- Brand Recognition: Building and maintaining a strong brand presence.

- Distribution Networks: Expanding reach through partnerships and marketing.

- Technological Advancements: Leveraging technology to improve user experience and security.

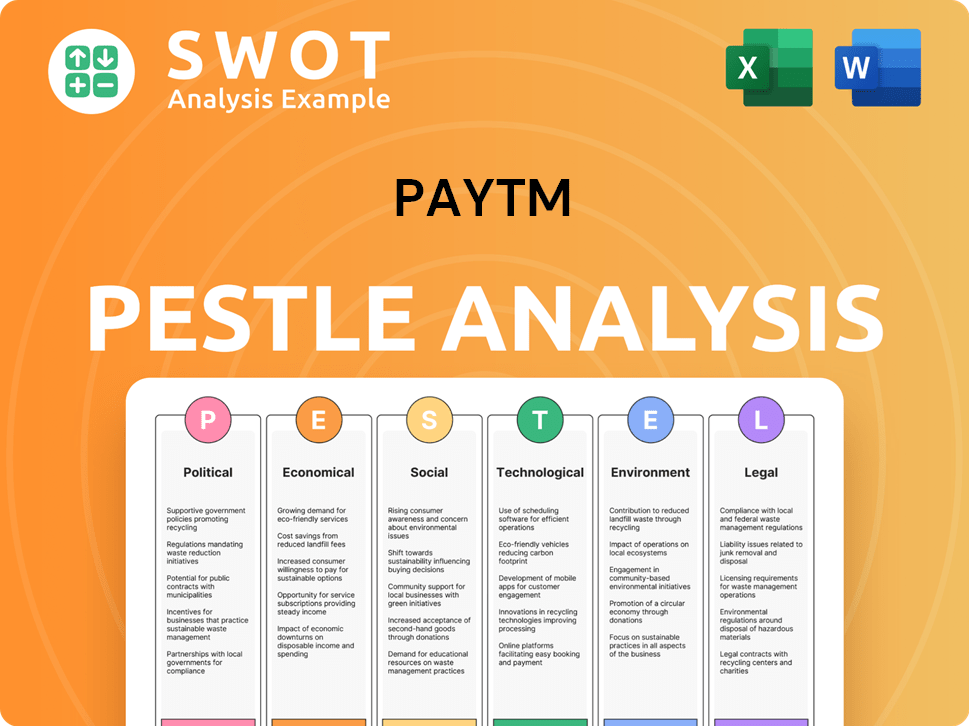

Paytm PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Paytm a Competitive Edge Over Its Rivals?

Established in 2010, the company quickly became a pioneer in India's digital payments landscape, capitalizing on the growing adoption of smartphones. This early entry allowed it to build a strong brand and customer loyalty. Over the years, strategic moves, including diversification into financial services and strategic partnerships, have shaped its competitive position. The company has navigated the competitive Indian fintech market by focusing on user experience and continuous innovation.

The company's competitive edge is driven by its extensive user and merchant network, a diversified product portfolio, and strategic investments. The company has a vast user base and a large merchant network, facilitating widespread digital payment acceptance. The company's 'super app' strategy, with its diverse offerings, aims to increase user engagement and retention. The company faces challenges from competitors like PhonePe and Google Pay, but it leverages its established brand and network to maintain its market position.

The company's competitive advantages include its early mover status, extensive user and merchant base, diversified services, strategic investments, and a focus on user experience. The company's ability to adapt to regulatory changes and maintain user trust is also crucial. The company's strategies focus on leveraging its established brand, network, and diversified services to maintain its competitive edge. The company's market position in the Indian digital economy is constantly evolving, influenced by factors such as UPI adoption and the strategies of its competitors.

The company was a first-mover in the Indian digital payments market. This allowed it to establish a strong brand identity and build a loyal customer base. The company capitalized on the early adoption of smartphones to introduce online payments and digital wallets.

The company boasts a significant user base and a large merchant network, which facilitates widespread acceptance of digital payments. This extensive network creates a powerful ecosystem, simplifying transactions for both consumers and businesses. The company's network effect is a key driver of its market share.

Beyond its core mobile wallet and UPI payments, the company offers a comprehensive suite of financial services. These include Paytm Payments Bank (despite restrictions), Paytm Money for investments, Paytm Insurance, and lending services. This broad offering aims to increase user engagement and stickiness.

Strategic investments and acquisitions, such as those in Plustxt, LogiNext, and XpressBees, have strengthened the company's capabilities. The company benefits from significant funding and financial support from major investors. These partnerships and investments contribute to its market valuation.

The company's competitive advantages are multifaceted, stemming from its early entry into the market, its extensive network of users and merchants, and its diverse product offerings. The company's strategic investments and partnerships have also played a crucial role in expanding its capabilities and market reach. The company's focus on user experience and strategic incentives further enhances its competitive edge.

- Early Mover Advantage: Established a strong brand and loyal customer base.

- Extensive Network: Large user and merchant base facilitating widespread acceptance.

- Diversified Services: Comprehensive suite of financial services beyond core payments.

- Strategic Investments: Strengthened capabilities and expanded product offerings.

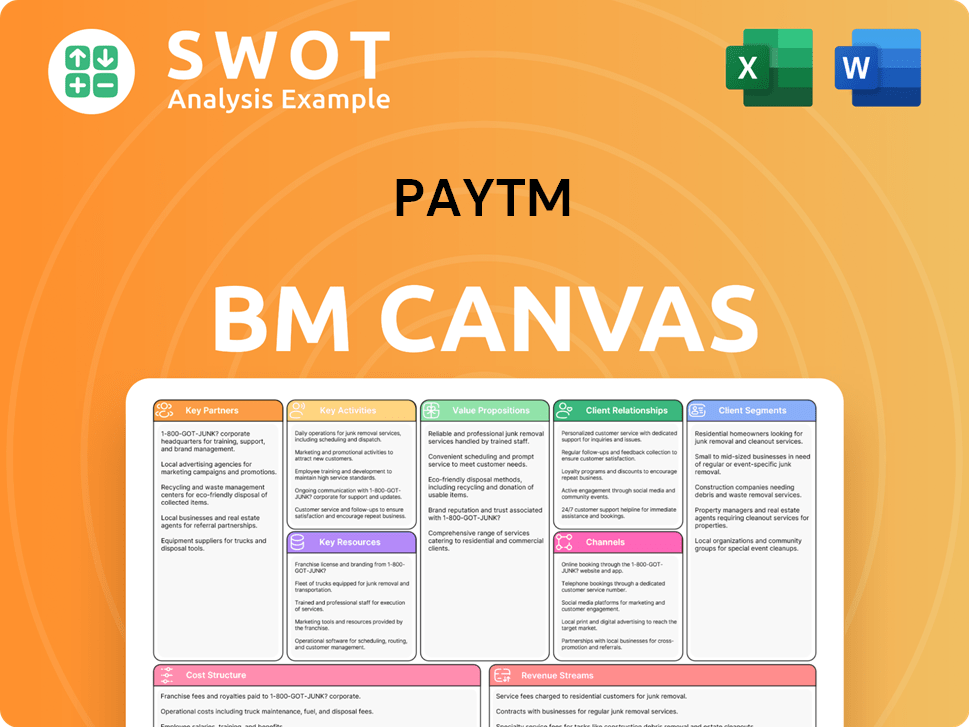

Paytm Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Paytm’s Competitive Landscape?

The Indian fintech sector is experiencing rapid growth, driven by digital payments and evolving consumer behavior. This creates both opportunities and challenges for companies like Paytm. Understanding the current market dynamics and future trends is crucial for assessing Paytm's competitive position and future prospects.

Paytm's competitive landscape is shaped by significant industry trends and regulatory changes. The company faces challenges from well-established competitors and must adapt to maintain its market share. A strategic approach to innovation and partnerships is essential for Paytm's sustained growth in the dynamic Indian fintech market.

Key trends include the expansion of UPI, increasing adoption of AI and ML for fraud detection, and the rise of embedded finance. The RBI's Payments Vision 2025 aims for significant growth in digital payment transactions. The overall India fintech market is projected to reach a value of USD 155.67 billion in 2025 and USD 990.45 billion by 2032, growing at a CAGR of 30.26% from 2024 to 2032.

Paytm faces regulatory scrutiny and restrictions from the RBI, impacting its Payments Bank. Intense competition from PhonePe and Google Pay, who together command over 85% of the UPI market share, poses a significant challenge. General risks associated with fraud and hackers also exist due to extensive operations. The restrictions have led to a decline in Paytm's UPI market share.

India's shift to a digital economy provides a vast opportunity for Paytm to expand its services. Paytm can leverage its large user base to cross-sell financial services. The increasing adoption of AI and ML can enhance fraud detection and customer service. The extension of the UPI market share cap deadline to December 31, 2026, also provides a temporary reprieve for Paytm to strategize and adapt to the evolving regulatory landscape.

Paytm's strategies will likely include strengthening partnerships with other banks for UPI services. Further diversifying its financial product offerings and investing in advanced technologies like AI will be crucial. The company's ability to innovate and adapt to the dynamic regulatory environment and aggressive competition will be crucial for its sustained resilience and growth in the Indian fintech sector.

The Paytm competition in the digital payments landscape is intense, with major players like PhonePe and Google Pay dominating the UPI market. Paytm's market share has been affected by regulatory issues and competition. However, Paytm still has opportunities to leverage its existing user base and expand into new financial services. For more details, read the Growth Strategy of Paytm.

- Paytm competitors must contend with the company's established brand and user base.

- The Paytm market share faces pressure from competitors, especially in the UPI space.

- Paytm's ability to innovate and adapt to the changing market will be key to its success.

- The company's strategic focus on core payments and financial services is expected to boost investor confidence.

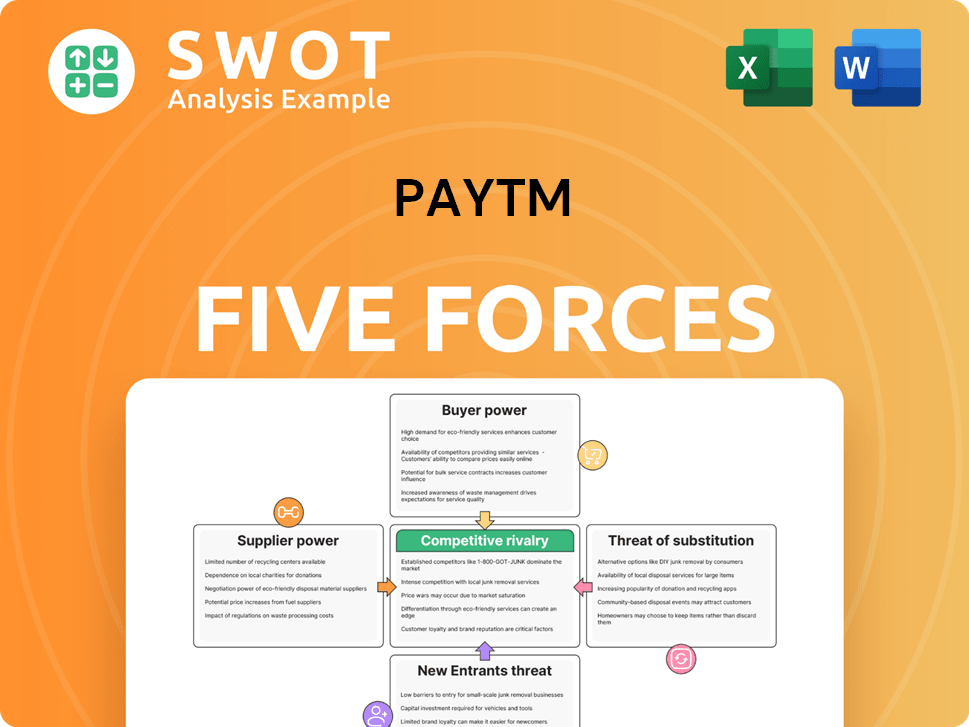

Paytm Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Paytm Company?

- What is Growth Strategy and Future Prospects of Paytm Company?

- How Does Paytm Company Work?

- What is Sales and Marketing Strategy of Paytm Company?

- What is Brief History of Paytm Company?

- Who Owns Paytm Company?

- What is Customer Demographics and Target Market of Paytm Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.