Paytm Bundle

Who are Paytm's Customers?

In the fast-paced world of fintech, understanding your customer is key. For Paytm, a leading player in India's digital payments arena, knowing its customer demographics and target market is essential for sustained growth. This deep dive explores the evolution of Paytm's user base, from its early days to its current position as a financial services powerhouse. Paytm SWOT Analysis can provide further insights.

Understanding the nuances of the Paytm user base, including their age range, income levels, and location within India, is crucial for effective market analysis. This analysis will delve into Paytm's target audience segmentation, customer behavior analysis, and demographics by gender to paint a comprehensive picture. We'll also examine how Paytm attracts users and their spending habits to understand its ideal customer profile and target market strategy.

Who Are Paytm’s Main Customers?

Understanding the primary customer segments of a company like Paytm involves examining both its business-to-consumer (B2C) and business-to-business (B2B) strategies. The company has cultivated a substantial user base, making it a significant player in the digital payments landscape. This comprehensive approach allows Paytm to cater to a wide array of users and merchants across India.

Paytm's customer demographics are diverse, spanning various age groups, income levels, and locations, with a significant presence in both urban and rural areas. The company's success is rooted in its ability to provide accessible and convenient financial solutions. This wide reach is a testament to its effective market analysis and customer segmentation strategies.

As of April 2024, Paytm had over 500 million registered users, showcasing its extensive reach across India. Its monthly transacting users (MTU) reached 72 million in December 2024, a growth from 68 million in September 2024, after receiving approval to onboard new UPI users. The company also boasts over 42 million registered merchants, with 11.2 million device subscriptions as of Q2 FY25. These figures highlight Paytm's strong position in the market and its ability to attract and retain a large customer base.

Paytm's B2C segment primarily focuses on urban and semi-urban customers who are comfortable with digital transactions. These users frequently utilize services like Paytm Wallet, UPI, and QR codes for everyday payments, including bill payments, recharges, and online shopping. Paytm has also expanded its reach to rural areas, with 120 million rural users actively using its services as of April 2024.

In the B2B segment, Paytm Business serves small and large businesses, enabling them to accept payments through various methods. This includes UPI, credit/debit cards, and digital wallets, with features like instant settlements. The merchant loan segment is a key growth driver, with over 1 million merchants availing loans through the platform by March 2025, and a 70% CAGR in repeat loans over the past two years.

Paytm's financial services, including investments through Paytm Money, target individuals seeking reliable banking and investment solutions. Paytm Money had 6.89 lakh active clients in April 2025 and over 21 million users for investment-related needs. The financial services revenue rose by 9% sequentially to ₹545 crore in Q4 FY25, driven by merchant loans and other financial products.

Paytm's target market strategy involves attracting users through convenience, accessibility, and a wide range of services. The company focuses on customer acquisition through various marketing initiatives and partnerships. The company's focus on merchant loans, particularly under the Default Loss Guarantee (DLG) model, is expected to fuel profitability. To understand more about the company's journey, you can read a Brief History of Paytm.

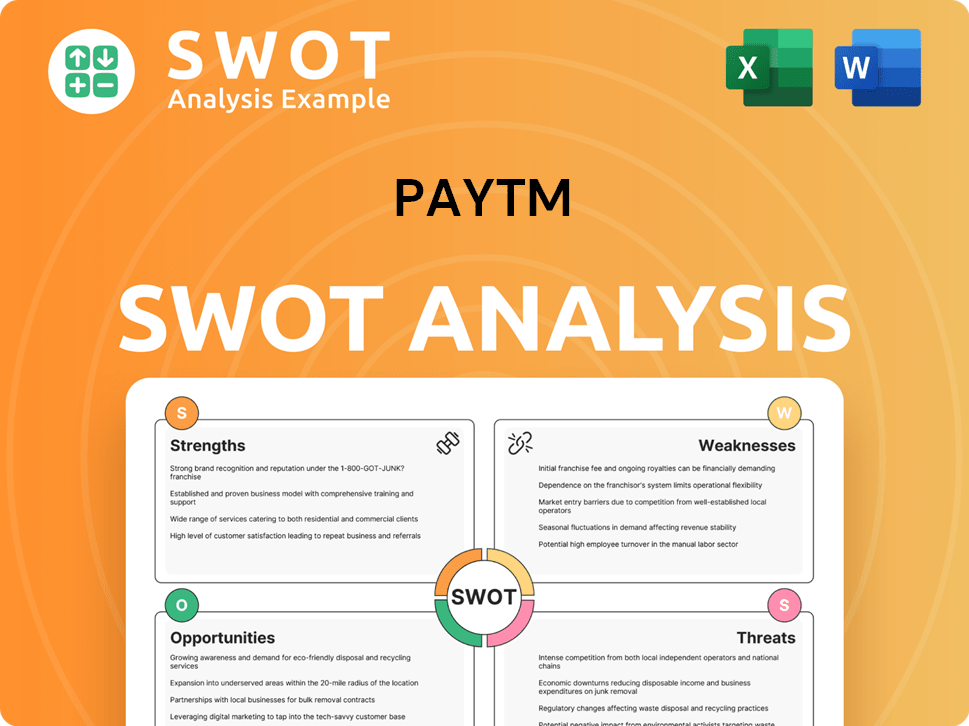

Paytm SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Paytm’s Customers Want?

The core of the customer base for the digital payments platform is driven by the need for convenience, speed, and security in their financial transactions. The platform caters to this by offering a variety of payment options, including UPI, credit and debit cards, net banking, and its digital wallet. This comprehensive approach aims to simplify and streamline the payment process for its users.

Customers appreciate the platform's user-friendly design, which allows them to manage various financial activities from one place. This 'super app' strategy is designed to increase user engagement and retention by providing a seamless experience. The platform also focuses on affordability, providing options like EMIs and bank offers to make transactions more accessible.

The platform addresses common customer pain points, such as the need for instant settlements for merchants and transparent refund processes for consumers. Customer feedback and market trends heavily influence product development. For instance, the company has tailored its offerings to specific segments, such as introducing 'Trader Mode' and 'Options Scalper' on Paytm Money to appeal to more active investors, alongside a streamlined onboarding experience for new users. In Q1 2024, over 5 million new users were onboarded through the platform's cashback campaigns, highlighting the effectiveness of incentives in attracting customers.

The platform offers multiple payment methods including UPI, cards, net banking, and its digital wallet. This variety ensures that users have a wide range of choices to complete their transactions. Real-time UPI payments are particularly popular for their convenience and speed.

Customers value the platform's user-friendly design, which consolidates various financial activities into a single application. This 'super app' approach aims to increase user engagement and retention. The platform's ease of use is a key factor in attracting and retaining users.

The platform focuses on affordability by enabling customers to break payments into EMIs or leverage bank offers. This approach makes the platform accessible to a wider audience. These features help customers manage their finances effectively.

The platform addresses common pain points such as the need for instant settlements for merchants and transparent refund processes for consumers. It aims to provide a reliable and efficient service for both parties. The platform's focus on these areas enhances customer satisfaction.

Customer feedback and market trends heavily influence product development. The company tailors its offerings to specific segments, such as introducing 'Trader Mode' and 'Options Scalper' on Paytm Money. This ensures that the platform remains relevant and meets the evolving needs of its users.

Cashback campaigns are effective in attracting new users. In Q1 2024, over 5 million new users were onboarded through the platform's cashback campaigns. These incentives play a significant role in the platform's user acquisition strategy.

The platform's customers are driven by a strong preference for convenience, speed, and security in their digital transactions. The platform addresses these needs by offering various features and services. The average ticket size for transactions on the platform increased by 20%, reaching ₹420 per transaction as of April 2024.

- Convenience: The platform offers multiple payment options, including UPI, credit and debit cards, net banking, and its digital wallet.

- Speed: Real-time UPI payments are a popular choice due to their convenience and speed.

- Security: The platform prioritizes secure transactions to build trust among its users.

- User-Friendly Design: The platform’s design allows users to manage various financial activities from a single application.

- Affordability: The platform enables customers to break payments into EMIs or leverage bank offers.

The platform is also focused on personalized services and improved customer handling, utilizing AI and machine learning for better customer service management. To understand more about the platform's business model, you can read about Revenue Streams & Business Model of Paytm.

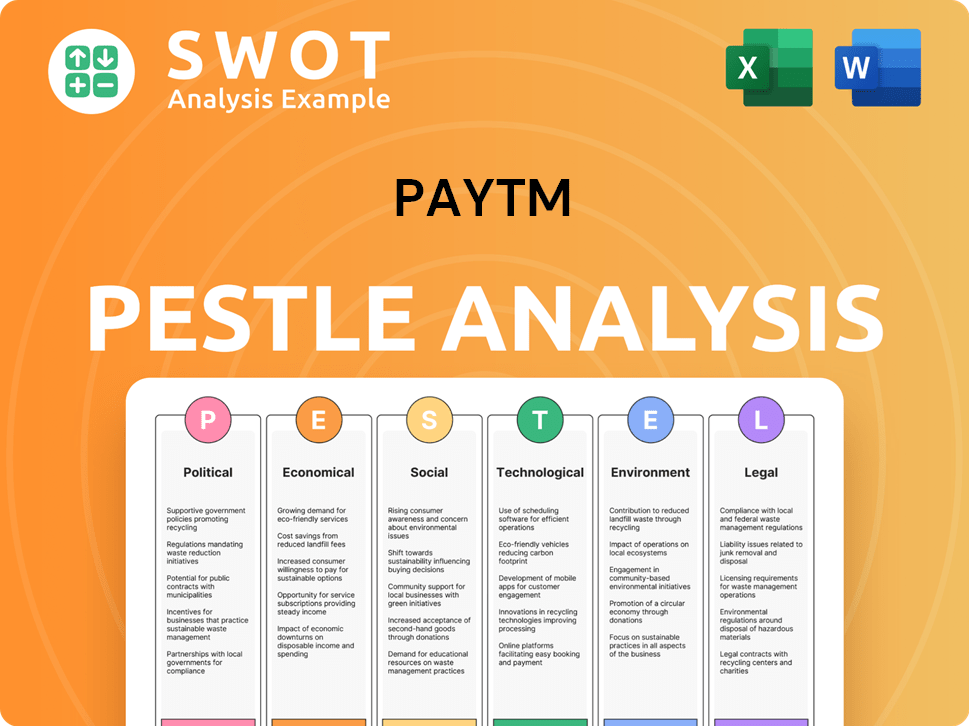

Paytm PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Paytm operate?

The primary geographical market for Paytm is India, where it has established itself as a leading digital payments and financial services provider. The company's strong brand recognition and market leadership extend across both urban and rural areas. This widespread presence is a key factor in understanding the customer demographics Paytm serves.

Paytm's QR code-based payments have expanded to over 20 million merchants, increasing its reach, especially in tier-2 and tier-3 cities. The company's strategy includes further expanding its distribution network to onboard more merchants from these markets, recognizing their significant growth potential. This expansion is crucial for capturing a broader Paytm user base.

While the majority of Paytm's revenue comes from India, with approximately 99% in 2024, the company is exploring opportunities in select international geographies for long-term growth, with potential results anticipated after three years. Despite regulatory challenges in 2024, Paytm has maintained its merchant base through strategic retention measures. Understanding the geographical market presence is vital for a comprehensive Paytm market analysis.

In January 2025, Paytm held around 6.87% of the UPI market share, although this represented a decline from previous months. This figure reflects the dynamic nature of the digital payments landscape.

From a merchant-side perspective, Paytm is a significant player, accounting for over 35% of the market share in merchant acquiring. This highlights the company's strong position in facilitating transactions for businesses.

Paytm has localized its offerings and marketing to suit the Indian context. Promotions of UPI money transfers, scan and pay, and soundbox have been widely adopted across the country.

Paytm's focus on expanding its distribution network and retaining its merchant base underscores its commitment to maintaining and growing its market presence. This is a key element of its Paytm target market strategy.

To understand the broader picture, exploring the Growth Strategy of Paytm can provide additional insights into its market approach and expansion plans.

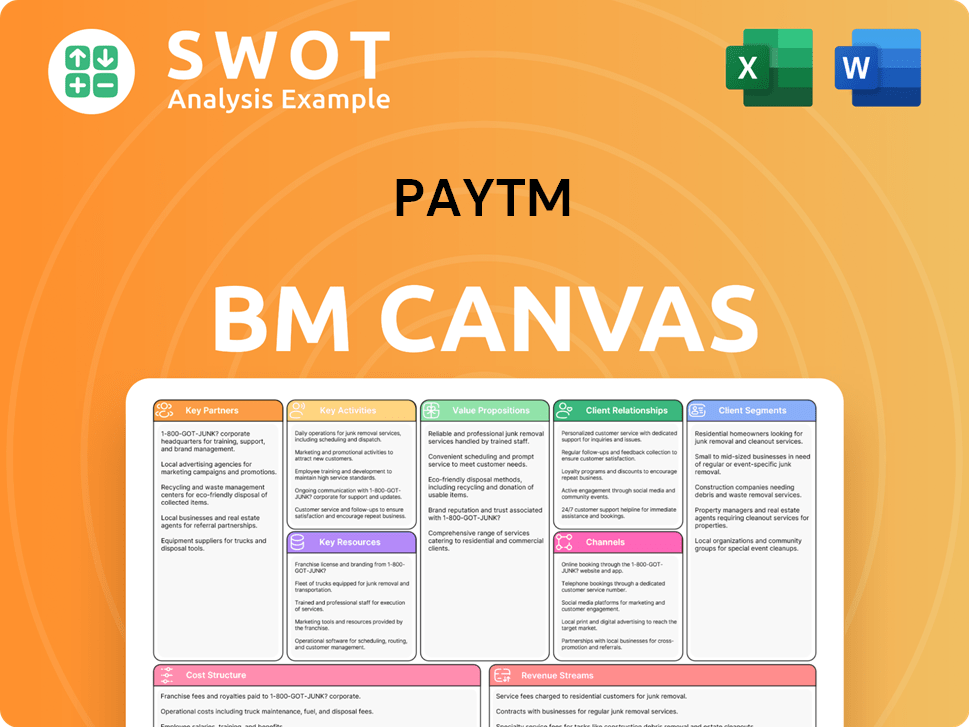

Paytm Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Paytm Win & Keep Customers?

Paytm's approach to customer acquisition and retention is multifaceted, focusing on digital marketing, promotional campaigns, and leveraging its extensive merchant network. The company uses various marketing channels, including social media and television, to enhance user engagement and promote its payment products. A key part of its strategy involves offering cashback campaigns and attractive promotions to draw in new users and encourage existing ones to continue using the platform.

The company's strategy includes a focus on providing a seamless user experience, offering a wide array of services within its 'super app' ecosystem. This aims to increase customer lifetime value. Paytm also emphasizes a simple registration process, secure verification, and a variety of payment options to ensure user satisfaction. Furthermore, the company uses customer data and insights to tailor its marketing and product features.

In Q1 2024, Paytm onboarded over 5 million new users through its cashback campaigns, demonstrating the effectiveness of its promotional strategies. The company's marketing efforts are supported by a vast merchant network, with over 3 crore registered merchants, and a growing device subscription base, which reached 12.4 million as of March 2025, adding 800,000 in Q4 FY25. The Soundbox is also being utilized for advertising services. Despite regulatory challenges, Paytm has focused on reactivating its existing user base and aggressively acquiring new UPI customers following NPCI approval in October 2024.

Paytm actively uses digital marketing, including social media and personalized services, to acquire and retain customers. This involves targeted advertising and content to engage with the Paytm user base. Recent ad campaigns focus on showcasing Paytm's payment products and user experience to enhance engagement.

Cashback campaigns and attractive promotions are key to attracting new users and incentivizing existing ones. These campaigns have proven effective, as evidenced by the onboarding of over 5 million new users in Q1 2024. These strategies help in Paytm customer acquisition.

Paytm leverages its extensive merchant network, with over 3 crore registered merchants, to expand its reach. The growing device subscription base of 12.4 million as of March 2025, adds to the company's customer base. The Soundbox is also a tool for advertising.

Paytm focuses on a seamless user experience by offering a wide range of services within its 'super app'. A simple registration process, secure verification, and varied payment options are also emphasized. The company maintains a high retention rate of 91% among users who transacted within the last six months.

Paytm's strategy is heavily customer-focused, utilizing data and insights to tailor its marketing and product features. This data-driven approach helps in understanding Paytm customer profile and preferences. The company aims to understand Paytm's target market and enhance user satisfaction.

- Personalized Services: Tailoring features and marketing based on user data.

- High Retention Rate: Maintaining a 91% retention rate among active users.

- Continuous Improvement: Adapting strategies based on user behavior and feedback.

- Focus on UPI: Aggressively acquiring new UPI customers following recent approvals.

To understand the competitive landscape and how Paytm positions itself in the market, further insights can be found in the Competitors Landscape of Paytm article, which provides a broader view of the industry.

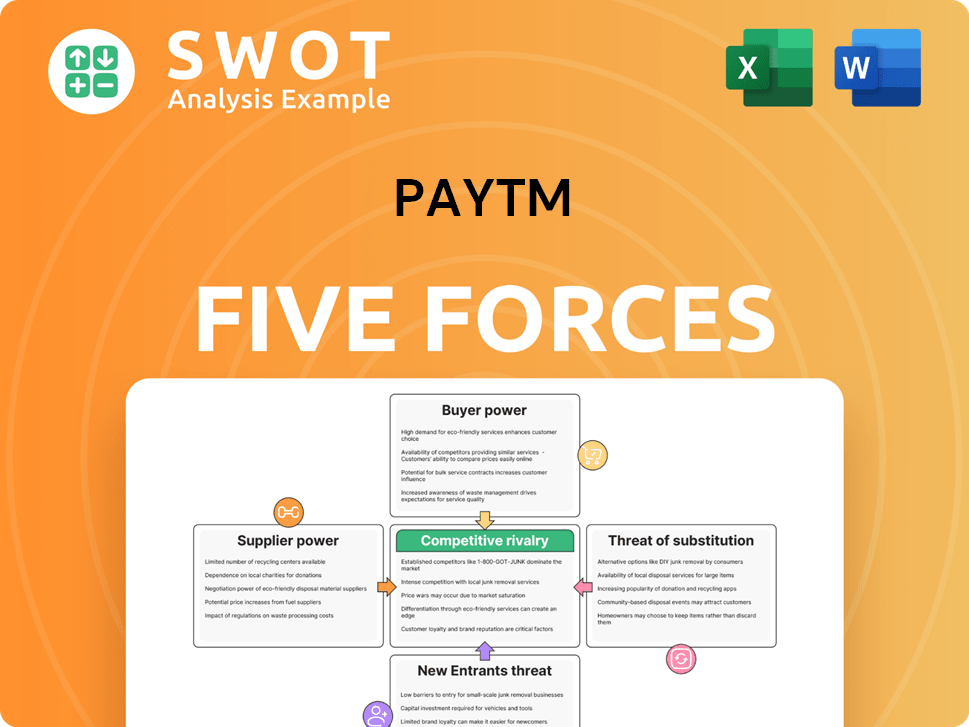

Paytm Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Paytm Company?

- What is Competitive Landscape of Paytm Company?

- What is Growth Strategy and Future Prospects of Paytm Company?

- How Does Paytm Company Work?

- What is Sales and Marketing Strategy of Paytm Company?

- What is Brief History of Paytm Company?

- Who Owns Paytm Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.