Rivian Bundle

Can Rivian Conquer the EV Adventure Market?

The electric vehicle market is rapidly evolving, with competition intensifying as consumer demand for sustainable transportation grows. Rivian, a key player in this transformation, is making waves with its focus on adventure-oriented electric trucks and SUVs. Founded in 2009, Rivian aims to redefine mobility with innovative vehicles and related services.

Rivian's Rivian SWOT Analysis reveals its strengths and weaknesses within the dynamic EV industry. This analysis will dissect the Rivian competitive landscape, providing a comprehensive Rivian market analysis and identifying key Rivian competitors. Understanding Rivian's strategy and its position relative to rivals is crucial for anyone looking to navigate the complexities of the EV market.

Where Does Rivian’ Stand in the Current Market?

Rivian has established a distinct position in the electric vehicle market, primarily focusing on the adventure-oriented segment with its R1T pickup truck and R1S SUV. The company's core operations revolve around the design, manufacturing, and sale of these consumer vehicles, alongside electric commercial vans (EDVs), notably for its partnership with Amazon. This strategic focus allows Rivian to target a specific niche within the broader EV industry.

The value proposition of Rivian centers on providing premium, all-electric vehicles designed for both on-road and off-road adventures. This appeals to a customer base seeking sustainable transportation solutions without compromising performance or lifestyle. The company differentiates itself through its unique product design, emphasis on adventure, and strategic partnerships, such as the one with Amazon, providing a strong foundation for growth.

As of Q1 2025, Rivian held a market share of 0.24% based on total revenues, indicating a relatively small but growing presence in the EV market. This is significantly lower compared to established automakers like Toyota Motor Corp (12.55% in Q1 2025) and Volkswagen Group (13.71% in Q1 2025). The Rivian competitive landscape is characterized by intense competition from both established automakers and other EV startups.

Rivian achieved its first gross profit in Q4 2024, reporting $170 million. For Q1 2025, Rivian reported a gross profit of $206 million, marking its second consecutive quarter of positive gross profit. Despite this, the company continues to operate with negative gross and operating profit margins overall and is still burning through cash. Rivian reported a net loss of $541 million in Q1 2025.

Rivian delivered 51,579 vehicles in 2024. For 2025, Rivian initially projected deliveries between 46,000 and 51,000 vehicles, but revised its outlook to a range of 40,000-46,000 vehicles due to anticipated tariff impacts. Rivian's production in Q1 2025 was 14,611 vehicles, exceeding its own guidance, but deliveries were lower at 8,640 units, attributed to a motor component shortage and a 'challenging demand environment.'

Rivian maintains a robust liquidity with $7.7 billion in cash reserves as of Q4 2024, and access to a $6.6 billion U.S. Department of Energy loan and a strategic partnership with Volkswagen worth up to $5.8 billion. These resources are expected to provide sufficient capital to fund operations through the ramp-up of its R2 model. The company's strategic partnerships are crucial for its long-term success.

The EV industry faces various challenges, including intense competition, supply chain disruptions, and the need for significant capital investment. Rivian must navigate these challenges to achieve profitability and increase market share. Understanding the Rivian market analysis is crucial for investors and stakeholders.

- Competition: Facing competition from established automakers like Ford and Tesla, as well as other EV startups.

- Production Scaling: Successfully scaling production to meet demand and achieve economies of scale.

- Financial Performance: Improving financial metrics, including gross and operating margins, to achieve profitability.

- Market Expansion: Expanding into new markets and increasing brand awareness. For more insights, explore Owners & Shareholders of Rivian.

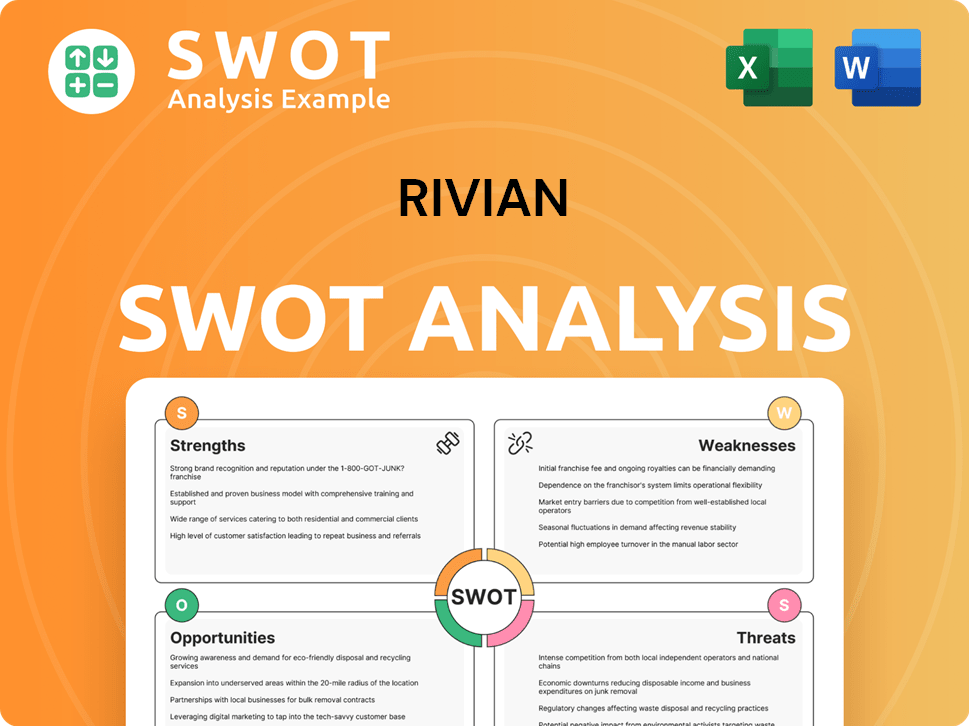

Rivian SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Rivian?

The electric vehicle (EV) market is fiercely competitive, and the Rivian competitive landscape is no exception. The company faces challenges from both established automakers and emerging EV companies. Understanding Rivian's competitors is crucial for assessing its position and future prospects in the EV industry.

Rivian market analysis reveals a complex web of rivals, each with its strengths and strategies. This analysis considers direct competitors, such as those offering similar electric trucks and SUVs, and indirect competitors, including companies with broader EV portfolios or those targeting different market segments. The competitive dynamics are constantly evolving, influenced by technological advancements, consumer preferences, and strategic partnerships.

Rivian's strategy involves targeting the premium electric truck and SUV market, which puts it in direct competition with several major players. The following sections provide a detailed look at Rivian's main rivals and how they stack up against each other.

Tesla is a dominant force in the EV market, making it a formidable competitor. Tesla's expansive Supercharger network gives it a significant advantage. Despite facing demand and production issues, Tesla maintains a strong market position.

General Motors (GM) competes directly with Rivian through its Chevrolet Silverado EV and BrightDrop commercial vans. GM's established manufacturing capabilities and brand recognition are significant advantages. GM's diverse EV offerings pose a challenge to Rivian.

Ford's F-150 Lightning directly competes with Rivian's electric truck offerings. Ford's strong brand loyalty and extensive dealer network are key strengths. The F-150 Lightning's popularity puts pressure on Rivian's market share.

NIO is a Chinese EV manufacturer that competes in the premium EV market. NIO's focus on battery swapping technology and innovative features sets it apart. NIO's expansion into international markets could increase competition for Rivian.

Lucid Motors, like Rivian, targets the premium EV segment. Lucid's focus on luxury and high-performance vehicles makes it a direct competitor. Lucid's technological advancements and design are key competitive factors.

Oshkosh specifically challenges Rivian in the electric truck segment, particularly in the heavy-duty work truck market. Oshkosh's expertise in commercial vehicles provides a competitive edge. Oshkosh's focus on specialized vehicles differentiates it from Rivian.

Other significant competitors and alternatives to Rivian in 2024 and 2025 include XPeng, Polestar Automotive Holding UK, and Li Auto. XPeng is known for its advanced technology in EVs. The impact of mergers and alliances, such as Rivian's own joint venture with Volkswagen, further shapes competitive dynamics. Rivian's stock competitors include these and other companies vying for market share. Emerging players like Canoo, Lightyear, and Bollinger Motors also contribute to the evolving competitive landscape. For a deeper dive into Rivian's position, consider reading about the company's overall performance and strategy, which you can find in this article: Rivian's Performance and Strategic Outlook.

- Rivian's competitive advantages include its focus on electric trucks and SUVs and its brand image.

- Rivian's production capacity compared to rivals is a key factor influencing its market share.

- Challenges faced by Rivian in the EV market include supply chain issues and increasing competition.

- Rivian's target market and competition are primarily in the premium electric vehicle segment.

- Rivian's strategic partnerships and competition are evolving, with alliances like the Volkswagen joint venture impacting the market.

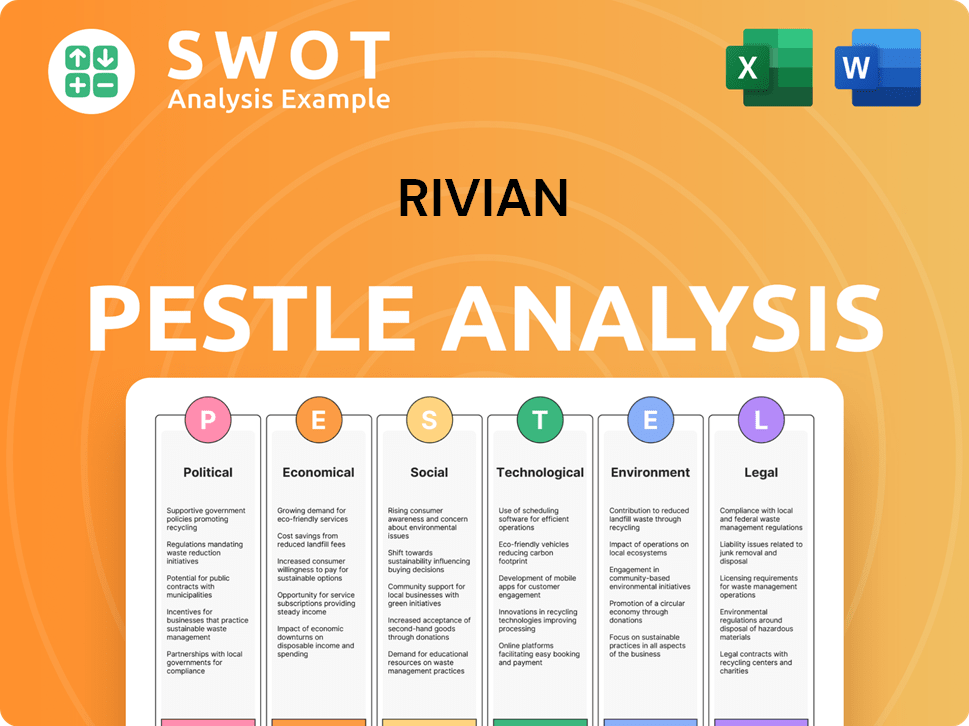

Rivian PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Rivian a Competitive Edge Over Its Rivals?

The Growth Strategy of Rivian showcases a robust competitive landscape in the electric vehicle market. Rivian's strategic moves and innovative product line, including the R1T and R1S, have positioned it as a key player. The company's focus on adventure-oriented vehicles and technological advancements are central to its competitive edge in the EV industry.

Rivian's competitive advantages are multifaceted, from its distinctive brand identity to its strategic partnerships. The company has cultivated a strong reputation for quality and customer satisfaction, which is essential in a competitive market. Furthermore, Rivian's collaborations with major corporations and its technological leadership contribute significantly to its market position.

The electric vehicle market is intensely competitive, and Rivian's ability to navigate challenges and capitalize on opportunities will be critical for its long-term success. The company's financial performance, production capacity, and cost-efficiency measures are crucial factors in its ability to compete effectively against established automakers and other EV startups.

Rivian differentiates itself with its adventure-focused electric trucks and SUVs, the R1T and R1S. These vehicles offer unique features and designs, attracting environmentally conscious consumers. The R1T and R1S are known for their innovative features and performance, setting them apart in the EV market.

Rivian's strong brand image and reputation for quality and reliability have cultivated a loyal customer base. The company was ranked #1 in customer satisfaction in 2023 and 2024. This loyalty may allow Rivian to have more pricing authority over time, a significant advantage in the EV industry.

Rivian is at the forefront of innovation in the automotive sector, particularly in battery technology and autonomous driving. The 2025 R1S models feature an all-new electrical architecture. The upcoming R2 platform is expected to incorporate advanced technology, further enhancing Rivian's competitive position and solidifying its place in the electric vehicle market.

Strategic partnerships provide significant support for Rivian. The backing of major corporations like Amazon, with a large order for electric delivery vans, provides a stable revenue stream. A strategic partnership with Volkswagen, involving an investment of up to $5 billion, strengthens Rivian's capital position and technological capabilities.

Rivian is focused on cost efficiencies to improve its competitive position. The company achieved a $31,000 reduction in cost of goods sold (COGS) per vehicle in Q4 2024 compared to Q4 2023. The expansion of Rivian's Normal, Illinois plant to produce up to 215,000 units/year by 2026 is expected to slash per-unit costs.

- Rivian aims for over $2.25 billion in cost savings with the R2 launch.

- The R2's material costs are projected to be approximately half that of the R1 models.

- Economies of scale are expected to reduce costs by approximately 34%.

- The Rivian Adventure Network, with a target of 2,500 sites, aims to alleviate range anxiety.

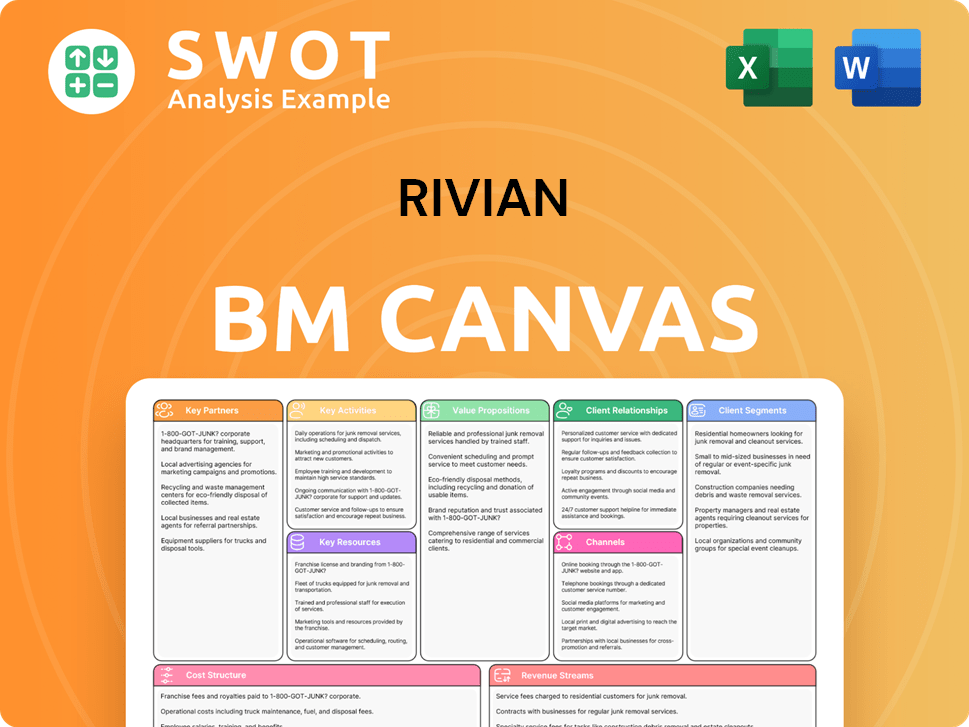

Rivian Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Rivian’s Competitive Landscape?

The Marketing Strategy of Rivian involves navigating a dynamic electric vehicle market, shaped by technological advancements, evolving consumer preferences, and regulatory changes. The company faces intense competition from established automakers and new entrants, requiring strategic agility. This analysis examines industry trends, potential challenges, and future opportunities for Rivian within the evolving EV landscape.

Rivian's competitive landscape is characterized by a mix of established automotive giants and emerging EV startups, all vying for market share. The company's success hinges on its ability to innovate, manage costs, and adapt to changing market conditions. Understanding these dynamics is crucial for assessing Rivian's long-term viability and growth potential.

The EV industry is experiencing rapid growth, driven by advances in battery technology and increasing consumer interest. Government incentives and stricter emissions regulations are also boosting EV adoption. The shift towards mass-market EVs, rather than luxury models, is a notable trend influencing product development strategies.

Intensifying competition from both traditional automakers and new EV entrants poses a significant challenge. Slowdowns in EV demand growth, regulatory uncertainties, and supply chain disruptions, particularly for batteries, could impact Rivian. Navigating these challenges requires strategic adaptability and operational efficiency.

Rivian has significant growth opportunities, including the upcoming R2, R3, and R3X models set to launch starting in early 2026. Strategic partnerships, like the one with Volkswagen, provide capital and technological collaboration. Cost reduction strategies and investments in charging infrastructure further position Rivian for future success.

Rivian's strategy focuses on expanding its product lineup, entering new markets, and improving operational efficiency. The R2 model, priced around $45,000, targets the mid-sized SUV market. Partnerships, cost reduction, and increased production capacity are all key components of Rivian's strategic plan for long-term viability.

Rivian aims for modest positive gross profit for the full year 2025 and breakeven EBITDA by 2027. The expansion of its Normal, Illinois plant to increase production capacity to 215,000 vehicles annually by 2026 is a key enabler for scaling. The R2 is designed for global sales, marking Rivian's entry into the European market.

- The R2 is priced at around $45,000, targeting a broader audience.

- The Volkswagen partnership provides capital and technological collaboration.

- Cost reduction strategies include optimizing manufacturing processes.

- Investments in charging infrastructure, like the Adventure Network, are ongoing.

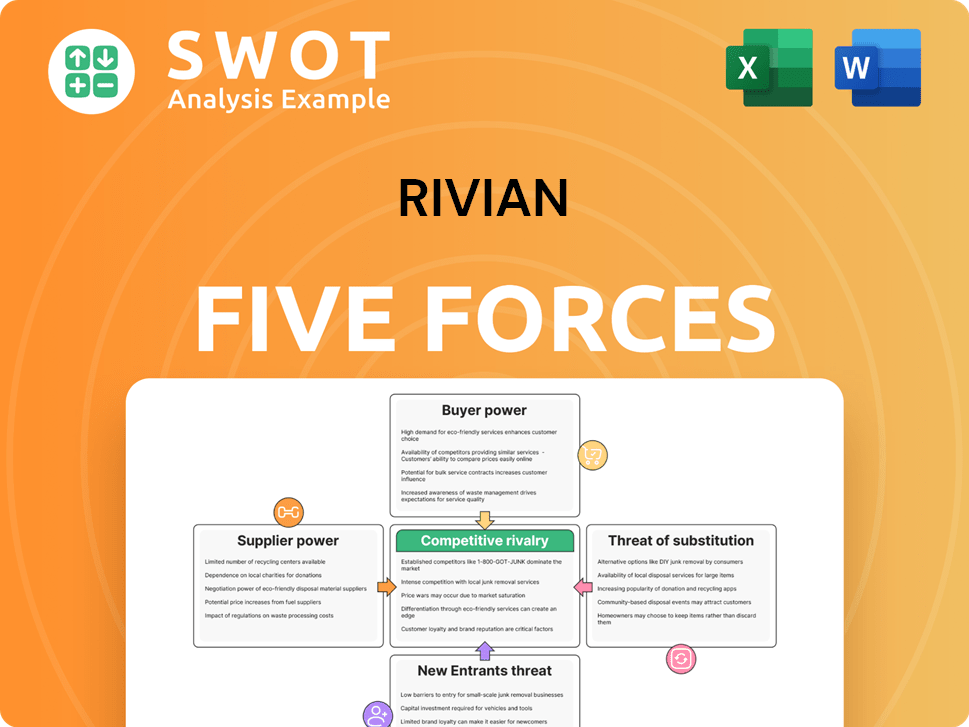

Rivian Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rivian Company?

- What is Growth Strategy and Future Prospects of Rivian Company?

- How Does Rivian Company Work?

- What is Sales and Marketing Strategy of Rivian Company?

- What is Brief History of Rivian Company?

- Who Owns Rivian Company?

- What is Customer Demographics and Target Market of Rivian Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.