Rivian Bundle

How Does Rivian Conquer the EV Market?

Rivian, an American electric vehicle (EV) manufacturer, is making waves in the automotive world, especially with its focus on electric trucks and SUVs. Its unique "adventure vehicles," like the R1T pickup and R1S SUV, set it apart. Understanding how this Rivian SWOT Analysis shapes its strategy is key to grasping its potential.

Rivian's innovative designs and vertically integrated Rivian manufacturing approach are central to its strategy. Its business model, encompassing vehicle sales, charging solutions, and software, offers a comprehensive view of the electric mobility ecosystem. This exploration will delve into Rivian's operations, value proposition, and strategic moves, providing insights for investors and industry observers to assess its financial viability, including aspects like the Rivian R1T price and Rivian R1S range.

What Are the Key Operations Driving Rivian’s Success?

The core operations of the Rivian company center on designing, developing, and manufacturing electric adventure vehicles. This includes the R1T pickup truck, the R1S SUV, and the Electric Delivery Van (EDV) for commercial clients. These Rivian vehicles are designed to offer off-road capabilities, performance, and integrated technology, targeting customers seeking sustainable and rugged transportation solutions.

Rivian's value proposition focuses on delivering a premium EV experience. This combines adventure-ready performance with advanced technology and sustainable design. The company aims to differentiate itself in the competitive EV market by offering a cohesive brand experience, advanced vehicle capabilities, and a commitment to sustainability.

Operational processes at Rivian are highly integrated, encompassing in-house battery development, powertrain engineering, and vehicle assembly. The company operates manufacturing facilities, including its plant in Normal, Illinois, which is central to its production strategy. Rivian manages its supply chain closely, working with a network of suppliers for various components while also focusing on vertical integration for critical elements like battery modules and drive units. Logistics and distribution are handled through a direct-to-consumer sales model, complemented by a growing network of service centers and mobile service options to enhance customer support.

Rivian's primary manufacturing facility is located in Normal, Illinois. This plant is key to their production strategy, enabling them to control quality and streamline operations. The factory is designed to support the production of both consumer and commercial vehicles, showcasing Rivian's commitment to scaling up its manufacturing capabilities.

Rivian employs a direct-to-consumer sales model, allowing for a more controlled customer experience. This approach includes online ordering and a network of service centers. This model allows Rivian to manage customer relationships and gather feedback directly, which helps in product improvements and customer service enhancements.

Rivian focuses on in-house battery development and powertrain engineering. This vertical integration allows for greater control over vehicle performance and efficiency. In 2024, Rivian is investing heavily in battery technology to improve range and reduce costs, which is crucial for the long-term viability of their electric vehicles.

Software integration and over-the-air updates are central to Rivian's strategy. These updates provide ongoing value to customers through enhanced features and performance improvements. This approach ensures that Rivian vehicles stay current with the latest technological advancements, improving the customer experience over time.

Rivian's operations are unique due to its purpose-built 'skateboard' platform, which underpins both consumer and commercial vehicles. This platform allows for efficient production and adaptability across different vehicle types. The company's commitment to sustainability and innovative design sets it apart in the EV market. For more details, consider reading about the Brief History of Rivian.

- Purpose-Built Platform: The 'skateboard' platform allows for modularity and efficient production.

- Vertical Integration: In-house battery and powertrain development enhance control over performance and quality.

- Software Innovation: Over-the-air updates improve vehicle features and performance.

- Sustainability Focus: Commitment to sustainable practices and materials.

Rivian SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Rivian Make Money?

The Rivian company generates revenue primarily through the sale of its electric vehicles. This includes the R1T pickup truck, the R1S SUV, and the Electric Delivery Van (EDV). Vehicle sales are the main driver of their financial performance.

In addition to selling Rivian electric vehicles, the company also earns revenue from related services and accessories. These include charging solutions, vehicle accessories, and potentially, software updates and connectivity services. Strategic partnerships, such as the one with Amazon, also play a significant role in Rivian's revenue generation.

The Rivian business model focuses on direct-to-consumer sales, which allows the company to control the customer experience. Over time, Rivian may explore additional monetization strategies to diversify its revenue streams.

Vehicle sales are the core revenue stream for Rivian. This includes sales of the R1T, R1S, and EDV models. The revenue from vehicle sales is the largest contributor to the company's total revenue.

Rivian generates revenue from services and accessories. This includes sales of charging solutions like the Rivian Waypoints chargers and the Rivian Adventure Network, as well as vehicle accessories. Software updates and connectivity services also contribute to the overall value proposition.

Strategic partnerships are a key part of Rivian's monetization strategy. The agreement with Amazon for EDVs is a significant example, guaranteeing a substantial volume of vehicle sales. You can learn more about the Rivian target market by reading the article Target Market of Rivian.

Rivian uses a direct-to-consumer sales model. This allows the company to control the customer experience and potentially achieve higher margins compared to traditional dealership models. This approach is crucial for building brand loyalty.

In the first quarter of 2024, Rivian reported total revenue of $1.20 billion, with vehicle sales being the dominant contributor. The company continues to focus on increasing production and deliveries to grow its revenue. As Rivian expands, it may explore new revenue streams, such as expanded charging network access or subscription services.

Rivian PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Rivian’s Business Model?

The journey of the Rivian company has been marked by key milestones and strategic moves that have shaped its operational and financial trajectory. A significant achievement was the successful launch and delivery of the R1T pickup truck in late 2021, followed by the R1S SUV, establishing Rivian as a viable EV manufacturer. Securing a substantial order from Amazon for 100,000 Electric Delivery Vans (EDVs) was a crucial strategic move, providing a foundational commercial revenue stream and validating Rivian's technology.

The company has faced operational challenges, particularly related to ramping up production and navigating supply chain disruptions, which impacted its ability to meet initial delivery targets. For example, in 2022, Rivian produced 24,337 Rivian vehicles, falling short of its initial 50,000 unit projection due to supply chain constraints. Despite these hurdles, Rivian has demonstrated resilience by optimizing its Rivian manufacturing processes and securing key component supplies.

Rivian's competitive advantages stem from several factors. Its brand strength, particularly its focus on the 'adventure' lifestyle, resonates with a specific customer demographic. The company's vertically integrated approach to Rivian manufacturing, including in-house battery module and drive unit production, provides greater control over quality and cost. Furthermore, its proprietary 'skateboard' platform offers flexibility for various Rivian vehicles types and future innovations. Rivian also benefits from its direct-to-consumer sales and service model, allowing for a more controlled customer experience. The company continues to adapt to new trends by investing in charging infrastructure, enhancing its software capabilities, and exploring new vehicle platforms, such as the recently unveiled R2, R3, and R3X models, which aim to target a broader, more accessible market segment.

The launch of the R1T pickup truck and R1S SUV in 2021-2022 marked Rivian's entry into the EV market. Securing a large order from Amazon for EDVs provided significant early revenue. Production challenges and supply chain issues have been ongoing, affecting delivery targets.

Rivian focuses on a direct-to-consumer sales model, aiming for a controlled customer experience. Vertical integration in manufacturing, including battery and drive unit production, is a key strategy. Investment in charging infrastructure and new vehicle platforms like the R2, R3, and R3X are part of future plans.

Rivian's brand emphasizes an 'adventure' lifestyle, appealing to a specific market segment. The proprietary 'skateboard' platform offers flexibility for various vehicle types. The company's direct-to-consumer model allows for a controlled customer experience.

In Q1 2024, Rivian produced 13,980 vehicles and delivered 13,588. Revenue for Q1 2024 was $1.2 billion. The company is working on reducing costs and improving production efficiency. For more details, read the Growth Strategy of Rivian.

Rivian faces challenges in scaling production and managing costs while competing with established automakers. The company has opportunities in expanding its product line and increasing its charging infrastructure. Continued innovation in battery technology and vehicle platforms is critical for long-term success.

- Production ramp-up and supply chain management.

- Expanding the product lineup and market reach.

- Advancing battery technology and charging infrastructure.

- Improving profitability and cost efficiency.

Rivian Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Rivian Positioning Itself for Continued Success?

The Rivian company has carved a unique niche in the electric vehicle (EV) market, particularly in the electric truck and SUV segments. This positioning sets it apart from competitors like Tesla, which initially focused on sedans and crossovers. Rivian has cultivated a strong brand identity and customer loyalty, especially among adventure enthusiasts, and its partnership with Amazon for electric delivery vehicles (EDVs) gives it a significant foothold in the commercial fleet market. However, the company faces considerable challenges in a rapidly evolving and competitive industry.

The future outlook for Rivian depends heavily on its ability to navigate several key risks. These include intense competition from both established automakers and other EV startups, supply chain volatility, regulatory changes, and shifts in consumer preferences. The high capital expenditures needed for manufacturing scale-up and ongoing research and development also present significant financial risks. For example, the company is working on improving manufacturing efficiency and achieving profitability, with plans to launch new, more accessible vehicles, and diversify its commercial partnerships.

Rivian is a leader in the electric truck and SUV market. Its focus on adventure-oriented vehicles has built a strong brand image. The Amazon partnership provides a solid base in the commercial EV sector.

Faces intense competition from established automakers and EV startups. Supply chain issues, especially for batteries and semiconductors, pose risks. High capital expenditure and R&D costs are financial challenges.

Plans to expand its product line with the R2, R3, and R3X models. Focuses on improving manufacturing efficiency and achieving profitability. Aims to diversify commercial partnerships and develop new revenue streams.

Scaling production of existing models and launching new vehicles. Diversifying commercial partnerships beyond Amazon. Developing new revenue streams from software and charging services. Targeting positive gross margins by late 2024.

Rivian faces the challenge of scaling production while managing costs and competition. Opportunities exist in expanding its product range and partnerships. The company's success hinges on its ability to execute its strategic plan and adapt to market changes.

- Scaling production of existing models.

- Successfully launching new, more accessible vehicles.

- Diversifying commercial partnerships beyond Amazon.

- Developing new revenue streams from software and charging services.

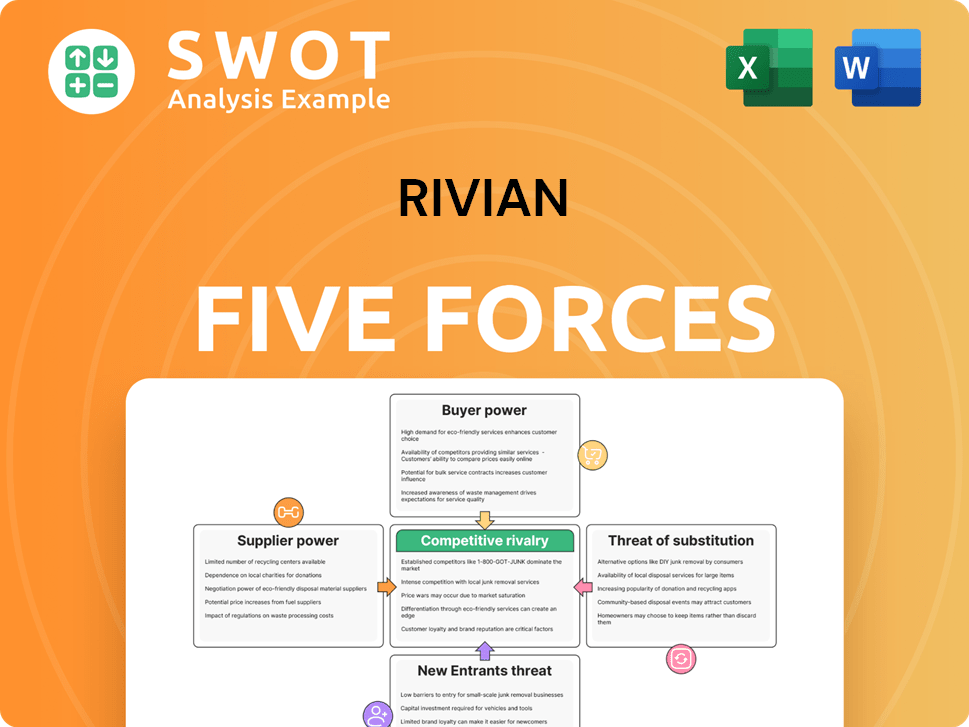

Rivian Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rivian Company?

- What is Competitive Landscape of Rivian Company?

- What is Growth Strategy and Future Prospects of Rivian Company?

- What is Sales and Marketing Strategy of Rivian Company?

- What is Brief History of Rivian Company?

- Who Owns Rivian Company?

- What is Customer Demographics and Target Market of Rivian Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.