Ross Stores Bundle

Can Ross Stores Maintain Its Dominance in the Off-Price Retail Arena?

The off-price retail sector is a battleground of value, and Ross Stores, Inc. has long been a major player. Offering deep discounts on brand-name merchandise, Ross has cultivated a loyal customer base. Understanding the Ross Stores SWOT Analysis is crucial to grasping its position.

This analysis delves into the Ross Stores competitive landscape, examining its key rivals and the strategies that have fueled its success. We'll explore the Ross Stores market analysis to understand its position within the off-price retail sector, comparing it to other discount retailers. Furthermore, we'll assess its financial performance and growth strategy within the context of the broader retail industry analysis.

Where Does Ross Stores’ Stand in the Current Market?

The company, a prominent player in the off-price retail sector, has cultivated a robust market position. Its core operations revolve around offering branded apparel, accessories, footwear, and home fashions at discounted prices. This value proposition resonates strongly with consumers seeking quality merchandise at affordable prices, a strategy that has fueled its consistent growth and market leadership.

As of early 2025, the retailer continues to be the largest off-price apparel and home fashion chain in the U.S. This dominant position is a result of its strategic focus on providing value, managing inventory efficiently, and maintaining a broad merchandise selection. The company's ability to adapt to changing consumer preferences and economic conditions further strengthens its market standing.

The company's success is also reflected in its financial performance. For fiscal year 2023, net sales reached $19.9 billion, and net earnings were $1.7 billion, showcasing its financial health and operational efficiency. The company's performance is frequently assessed by analysts, who often highlight its effective inventory management and ability to meet consumer demand for value. The retailer's strategic location in suburban and urban areas also plays a crucial role in attracting a wide range of shoppers.

The company maintains a leading market share within the off-price retail segment. While specific 2025 market share data is still emerging, it has historically held a substantial share, often leading the pack alongside key competitors. This strong market position is a direct result of its successful business model and consumer loyalty.

The company boasts an extensive presence across the United States, with a significant number of stores strategically located in various regions. This widespread physical footprint is a key aspect of its market penetration and accessibility for its target customer segments. The company's presence in both suburban and urban areas allows it to capture a diverse customer base.

The retailer consistently reinforces its positioning as a value-oriented retailer, emphasizing deep discounts on branded merchandise. This strategy appeals to a broad customer base, from budget-conscious shoppers to those seeking designer brands at a discount. The company's focus on providing quality products at affordable prices is a key driver of its success.

The company demonstrates strong financial health and scale relative to industry averages. For fiscal year 2023, the company reported net sales of $19.9 billion and net earnings of $1.7 billion. Analyst assessments in early 2025 generally reflect a positive outlook on the company's financial performance, attributing it to effective inventory management and consumer demand for value.

The company's competitive advantages include its extensive store network, strong brand recognition, and efficient supply chain. These factors enable it to offer competitive pricing and maintain a loyal customer base. The company's ability to adapt to changing market conditions and consumer preferences further enhances its market position.

- Extensive store network across the United States.

- Strong brand recognition and customer loyalty.

- Efficient supply chain management.

- Focus on value and discounted pricing.

Ross Stores SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Ross Stores?

The competitive landscape for Ross Stores is intense, shaped by both direct and indirect rivals in the retail sector. Understanding the Ross Stores competitive landscape is crucial for evaluating its market position and strategic direction. The company's success hinges on its ability to differentiate itself and maintain a strong value proposition in a dynamic market.

Ross Stores competitors range from established off-price retailers to traditional department stores and online platforms. This diverse competitive set demands continuous adaptation and innovation to retain and grow market share. A thorough Ross Stores market analysis must consider the strategies and performance of these key players.

TJX Companies, operating TJ Maxx and Marshalls, is a primary competitor, offering similar off-price merchandise. Burlington Stores also competes directly, often with slightly lower price points. These competitors directly challenge Ross Stores for market share.

Department stores like Macy's and Nordstrom indirectly compete through sales and clearance events. Specialty retailers and online retailers also pose competition, especially regarding product assortment and convenience. The retail landscape is constantly evolving.

TJX Companies leverages buying power and a diverse brand portfolio. Burlington often competes on price, aiming for deeper discounts. Ross Stores focuses on securing desirable branded merchandise at low costs and efficiently moving it through the supply chain.

Online retailers present a growing challenge due to convenience and competitive pricing. The shift to online shopping could impact Ross Stores' traditional customer base. The company must adapt to this changing environment.

Emerging players in recommerce and resale markets offer alternative avenues for acquiring discounted goods. These platforms pose a nascent threat to traditional retailers. This trend requires strategic consideration.

Mergers and alliances in the retail sector can alter competitive dynamics. The key battleground remains securing branded merchandise at low costs. Efficient supply chain management is critical for success.

The competitive environment for off-price retail is dynamic, with constant shifts in consumer preferences and market trends. Understanding the strategies of discount retailers is crucial for retail industry analysis. For more insights into how Ross Stores approaches its marketing, consider reading about the Marketing Strategy of Ross Stores.

The success of Ross Stores depends on several key factors. These include securing desirable branded merchandise, efficient supply chain management, and adapting to the rise of e-commerce.

- Merchandise Procurement: Securing high-quality, branded merchandise at low costs is essential.

- Pricing Strategy: Offering compelling value to consumers through competitive pricing is vital.

- Store Experience: Maintaining an appealing in-store experience to attract and retain customers.

- E-commerce Adaptation: Developing a strong online presence to compete with online retailers.

Ross Stores PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Ross Stores a Competitive Edge Over Its Rivals?

The competitive landscape for Ross Stores is shaped by its distinct advantages in the off-price retail sector. The company's success hinges on its ability to offer substantial discounts, typically ranging from 20% to 60% off regular prices, attracting a value-conscious customer base. This strategy, coupled with a robust supply chain and strong vendor relationships, allows Ross Stores to maintain a competitive edge in the retail industry.

Key to Ross Stores' strategy is its efficient off-price business model, which enables it to procure first-quality merchandise at below-wholesale prices. The company's vast store network and established brand equity further solidify its position. The company's focus on in-store browsing and the constant influx of new merchandise drive frequent customer visits, reinforcing its value proposition within the discount retailers market.

Ross Stores' competitive strengths are evident in its operational efficiencies and economies of scale, which are difficult for smaller players to replicate. These advantages have evolved over time, with Ross continuously refining its buying strategies and supply chain logistics to maintain its price leadership. For a deeper dive into the company's operational strategies, consider reading an article about Ross Stores by clicking here: 0.

Ross Stores' core advantage lies in its ability to offer significant discounts. This is achieved through a highly efficient off-price business model. The company's supply chain is designed to capitalize on opportunistic purchases of excess inventory from manufacturers and other retailers.

Over the years, Ross Dress for Less has become synonymous with value and treasure hunt shopping. This has fostered a dedicated customer base that consistently seeks out its discounted offerings. Constant inventory rotation encourages frequent visits.

Ross Stores operates a large number of stores strategically located across the U.S. This extensive network provides widespread accessibility and convenience for its target customers. Many customers prefer the in-store browsing experience for off-price shopping.

As one of the largest off-price retailers, Ross benefits from its sheer size in terms of purchasing power, operational efficiencies, and marketing reach. This scale allows it to negotiate better deals with vendors and spread its operational costs over a larger sales volume.

Ross Stores' competitive advantages are generally sustainable due to its established infrastructure and relationships. The company's ability to efficiently procure merchandise and manage its supply chain contributes to its strong financial performance. However, the company faces ongoing threats from competitors and industry shifts.

- Efficient Supply Chain: Ross excels at purchasing and distributing merchandise.

- Strong Vendor Relationships: The company leverages its relationships to secure deals.

- Strategic Store Locations: Widespread store network enhances accessibility.

- Customer Loyalty: The value proposition drives repeat visits.

Ross Stores Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Ross Stores’s Competitive Landscape?

The competitive landscape for Ross Stores is shaped by the dynamic off-price retail industry, where value and convenience are key drivers. The company faces a complex interplay of industry trends, future challenges, and opportunities. A thorough understanding of these factors is crucial for assessing Ross Stores' strategic positioning and potential for future growth. Analyzing the Ross Stores competitive landscape involves evaluating its strengths against those of its rivals, understanding market dynamics, and anticipating future shifts in consumer behavior and the retail environment.

The retail industry analysis reveals that Ross Stores operates within a sector defined by intense competition and evolving consumer preferences. Its ability to navigate these challenges and capitalize on emerging opportunities will determine its success. The company's strategic decisions regarding store expansion, online presence, and merchandise mix are critical in maintaining its competitive edge and achieving sustainable growth. Understanding the Ross Stores market analysis requires a look at its financial performance, growth strategies, and competitive advantages.

The off-price retail sector is experiencing a surge in demand for value, particularly during economic uncertainties. Consumers are increasingly seeking discounts on branded merchandise. The shift towards e-commerce is also reshaping the industry, with online shopping gaining popularity. Technological advancements, like AI-driven inventory management, are offering opportunities for operational optimization.

Increased competition from online off-price retailers and aggressive expansion by existing rivals pose significant threats. Economic downturns can reduce consumer spending, impacting sales. Adapting to evolving consumer preferences, particularly regarding sustainability and ethical sourcing, presents challenges. Regulatory changes concerning supply chain practices and labor laws could also increase operational costs.

Expanding into underserved geographic markets and refining the merchandise mix to align with fashion trends present growth opportunities. Strategic partnerships can enhance online presence and supply chain capabilities. Product innovations, such as improvements to the in-store experience and new product categories, can attract customers. The company can enhance its competitive advantages through these strategic moves.

Ross Stores must leverage its core strengths while strategically investing in technology and supply chain resilience. Adapting to evolving consumer demands, including sustainability, is crucial. The company's ability to navigate these trends will determine its ability to maintain its dominance in the value-driven retail landscape. The competitive environment is constantly shifting.

Ross Stores must focus on enhancing its online presence and fulfillment capabilities to compete effectively with online retailers. The company should explore strategic partnerships to improve its supply chain and expand its market reach. Investing in technology and data analytics is essential for optimizing inventory management and personalizing customer experiences. For more insights, explore the Revenue Streams & Business Model of Ross Stores.

- Adapt to E-commerce: Improve online presence and fulfillment capabilities to capture online sales.

- Strategic Partnerships: Explore collaborations to strengthen supply chain and expand market reach.

- Technological Investments: Utilize technology and data analytics for inventory and customer experience optimization.

- Sustainable Practices: Consider incorporating sustainable and ethical sourcing practices into procurement.

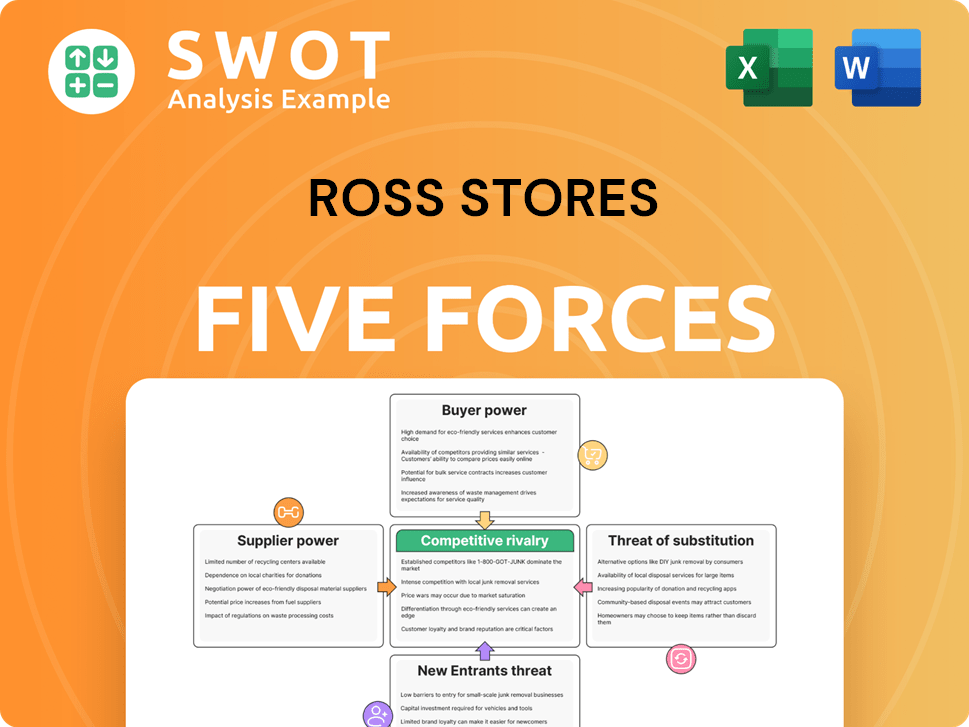

Ross Stores Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ross Stores Company?

- What is Growth Strategy and Future Prospects of Ross Stores Company?

- How Does Ross Stores Company Work?

- What is Sales and Marketing Strategy of Ross Stores Company?

- What is Brief History of Ross Stores Company?

- Who Owns Ross Stores Company?

- What is Customer Demographics and Target Market of Ross Stores Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.