Ross Stores Bundle

Who Really Owns Ross Stores?

Uncover the ownership secrets of Ross Stores, Inc., the retail giant behind Ross Dress for Less. From its humble beginnings to its current status as a publicly traded company, understanding who owns Ross is crucial for grasping its strategic moves and market dominance. Delve into the fascinating history and evolution of this off-price retail leader.

The Ross Stores SWOT Analysis provides valuable insights into the company's internal and external factors. The company's transformation, marked by the 1982 acquisition, reshaped its trajectory, leading to its current success. This exploration will dissect the Ross Stores ownership structure, revealing the key players and their influence on this retail powerhouse, including the Ross Dress for Less owner and major shareholders.

Who Founded Ross Stores?

The initial establishment of the company began in 1950 with Morris Ross, who opened the first store in San Bruno, California. He was the sole owner and managed all aspects of the business. By 1958, Morris Ross had expanded the business to a nine-unit chain before selling it.

Later, William Isackson acquired the company and expanded it to six stores in the San Francisco Bay Area. However, the most significant transformation occurred in 1982.

The off-price retail model was adopted in August 1982, marking a strategic shift. This change fundamentally redefined the company's trajectory, leading to rapid expansion.

Morris Ross founded the first store in 1950. He managed all aspects of the business, working long hours. By 1958, he had grown the chain to nine stores.

William Isackson acquired the company from Morris Ross. Isackson expanded the business to six stores in the San Francisco Bay Area. This expansion set the stage for future growth.

A group of investors, including Stuart Moldaw and Mervin Morris, acquired the chain in August 1982. This acquisition was a pivotal moment. The group transitioned to the off-price retail model.

The shift to the off-price model was a key strategic decision. This new strategy drove rapid expansion. The company grew to 107 stores within three years.

The 1982 acquisition was funded through private investment. Details of early equity splits are not widely available. The investors' vision led to significant growth.

The company's expansion was a direct result of the off-price model. The chain grew quickly after the 1982 acquisition. This growth solidified its market position.

The early history of the company shows a transition from a single-store operation to a multi-store chain under Morris Ross. The company then changed hands, leading to further expansion. The pivotal acquisition in 1982, spearheaded by Stuart Moldaw, marked the beginning of the off-price retail strategy. This strategic shift, along with the initial investment, fueled rapid growth. For more insights into the company's growth, you can read about the Growth Strategy of Ross Stores.

The company's early ownership involved Morris Ross, William Isackson, and a group of investors led by Stuart Moldaw.

- Morris Ross founded the company in 1950.

- William Isackson expanded the chain.

- The 1982 acquisition marked a shift to the off-price model.

- The off-price model led to rapid expansion.

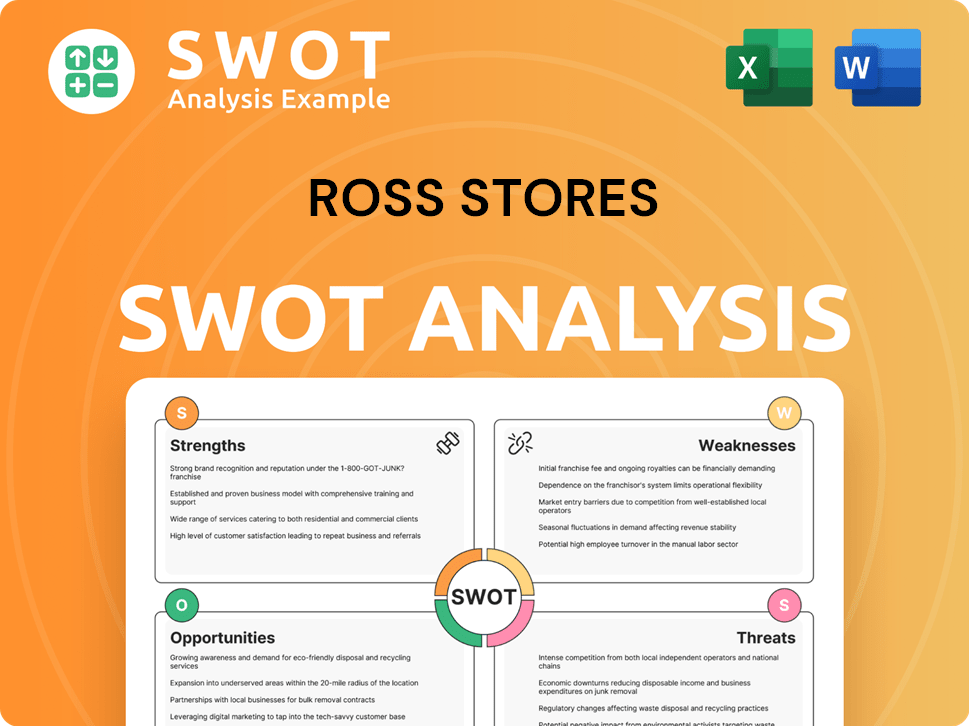

Ross Stores SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Ross Stores’s Ownership Changed Over Time?

The evolution of Ross Stores, Inc. from a private entity to a publicly traded company on August 8, 1985, marked a significant shift in its ownership structure. The initial public offering (IPO) at $17.00 per share, listed on the NASDAQ under the ticker symbol ROST, opened the door for a diverse shareholder base, moving away from private investors. This transition was pivotal, influencing the company's strategic direction and operational capabilities, as it became subject to public market dynamics and increased scrutiny.

The company's ownership structure is now largely dominated by institutional investors, reflecting a common pattern among large-cap retail entities. This transition to public ownership has been crucial for fueling the company's growth, including the launch of dd's DISCOUNTS in 2004. Public status has also allowed for capital raising and broader market presence. As of the end of fiscal year 2024, the company demonstrated financial strength, ending the year with $4.7 billion in cash after funding its growth and capital needs.

| Event | Impact | Date |

|---|---|---|

| Initial Public Offering (IPO) | Transitioned from private to public ownership, broadening the shareholder base | August 8, 1985 |

| Launch of dd's DISCOUNTS | Expanded market presence and growth, supported by public capital | 2004 |

| Fiscal Year 2024 Financial Performance | Demonstrated financial stability with $4.7 billion in cash | End of Fiscal Year 2024 |

As of June 2025, the ownership of Ross Stores is primarily held by institutional investors, accounting for approximately 90% of the shares. Key institutional shareholders include Vanguard Group Inc., BlackRock, Inc., and JPMorgan Chase & Co. Retail and insider investors hold the remaining 10%. The market capitalization of Ross Stores was $46.1 billion with 327 million shares as of June 10, 2025. This structure shows that the company's strategic direction is influenced by these major institutional holders. To understand the competitive environment, you can read about the Competitors Landscape of Ross Stores.

Ross Stores' ownership has evolved significantly since its IPO in 1985.

- Institutional investors hold a dominant position.

- The company's financial health is robust, with substantial cash reserves.

- The public status has facilitated growth and expansion.

- Understanding the Ross Stores ownership structure is crucial for investors.

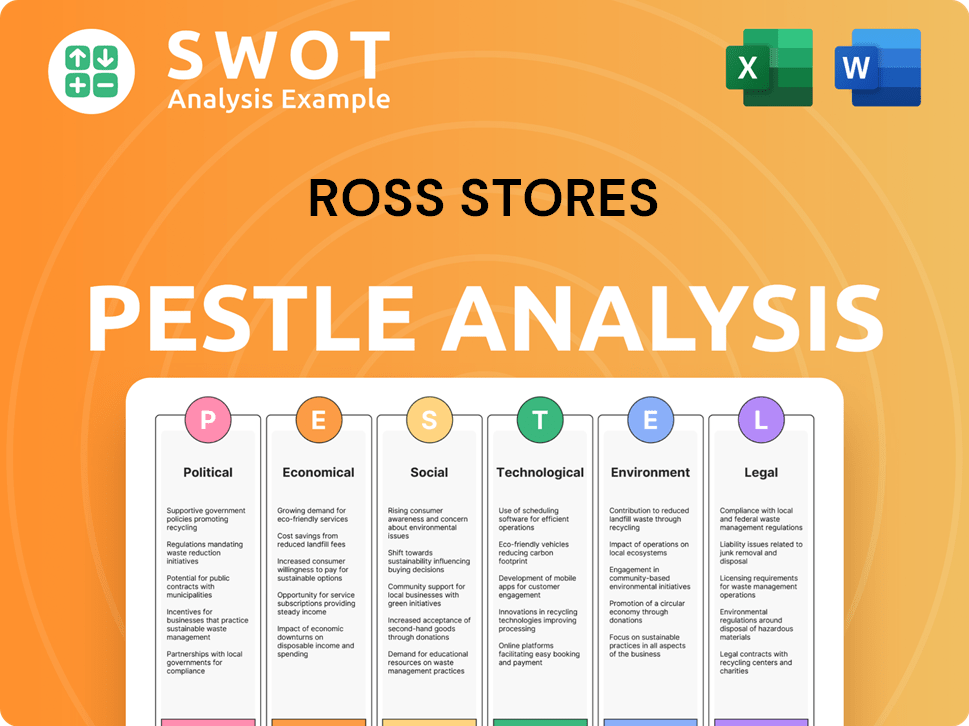

Ross Stores PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Ross Stores’s Board?

As of April 8, 2025, the Board of Directors of Ross Stores, Inc. comprises 11 members, each serving a one-year term. James Conroy, who became CEO on February 2, 2025, joined the Board on December 2, 2024. Michael Balmuth holds the position of Executive Chairman, providing strategic leadership. Key executives include Michael J. Hartshorn as Group President and Chief Operating Officer, and Adam Orvos as Executive Vice President and Chief Financial Officer, although Mr. Orvos is scheduled to retire on September 30, 2025, with William Sheehan set to take over his role.

The Board's composition and leadership are crucial for guiding the company's strategic direction. The presence of both seasoned executives and new appointees ensures a blend of experience and fresh perspectives. Understanding the structure of the Ross Stores board of directors is essential for investors and stakeholders looking to understand the company's governance and decision-making processes. This structure directly impacts the company's ability to adapt to market changes and maintain its competitive edge, as detailed in the Revenue Streams & Business Model of Ross Stores.

| Director | Title | Since |

|---|---|---|

| Michael Balmuth | Executive Chairman | 2002 |

| James Conroy | CEO | 2024 |

| Michael J. Hartshorn | Group President and Chief Operating Officer | 2019 |

The voting structure for Ross Stores' common stock is straightforward: one share equals one vote. This means that shareholders with a majority of the shares can elect all directors. The company's bylaws can be amended by a two-thirds vote of outstanding shares or a majority vote by the Board. In May 2024, DWS Investment GmbH raised concerns regarding the independence of the Board and the Compensation Committee, given the tenure of some directors. This highlights the importance of understanding Ross Stores ownership and its impact on governance.

The Board of Directors oversees the strategic direction and operations of Ross Stores. Shareholders have one vote per share, with no cumulative voting. Amendments to bylaws require a two-thirds vote or a majority vote by the Board.

- Board composition of 11 members.

- One-share-one-vote structure.

- Concerns raised about board independence.

- Shareholder proposal withdrawn in February 2025.

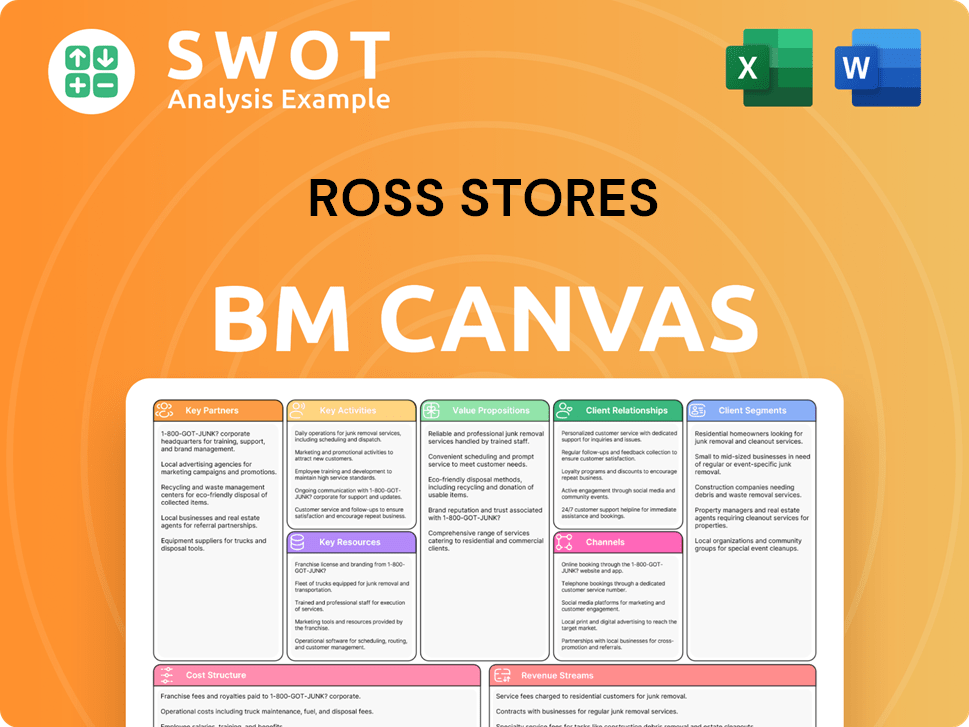

Ross Stores Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Ross Stores’s Ownership Landscape?

Recent developments in the ownership of Ross Stores reflect a company focused on returning value to its shareholders and strategic leadership transitions. Over the past few years, the company has actively repurchased its shares. In fiscal year 2024, it bought back 7.3 million shares for $1.05 billion. The company has also increased its dividends, with a 10% rise in the quarterly cash dividend to $0.405 per share, payable on March 31, 2025.

Leadership changes are also notable. James Conroy became the new Chief Executive Officer on February 2, 2025, succeeding Barbara Rentler, who transitioned to an advisory role. Furthermore, Adam Orvos will retire as CFO on September 30, 2025, to be succeeded by William Sheehan. These changes, along with insider trading activity by key executives, highlight the dynamic nature of Ross Stores' ownership and management. Institutional ownership remains high, approximately 90% as of late 2024. The company plans to open around 90 new stores in fiscal 2025, reflecting continued growth and expansion strategies.

The company's financial strategy includes ongoing share buybacks and dividend increases, indicating a commitment to shareholder value. The share repurchase program, with the remaining $1.05 billion expected to be completed in fiscal 2025, and the dividend increase, are key elements of this strategy. These actions, combined with leadership changes and store expansion, shape the current ownership narrative of Ross Stores.

In fiscal 2024, Ross Stores repurchased 7.3 million shares. The total cost of these repurchases was $1.05 billion. The company plans to complete the remaining $1.05 billion under the authorization in fiscal 2025.

James Conroy became CEO on February 2, 2025. Barbara Rentler transitioned to an advisory role. Adam Orvos will retire as CFO on September 30, 2025. William Sheehan is expected to succeed Orvos.

The Board of Directors authorized a 10% increase in the quarterly cash dividend. The new dividend is $0.405 per share. The dividend was payable on March 31, 2025.

The company plans to open approximately 90 new stores in fiscal 2025. This expansion reflects the company's growth strategy. The new stores will contribute to the company's overall revenue.

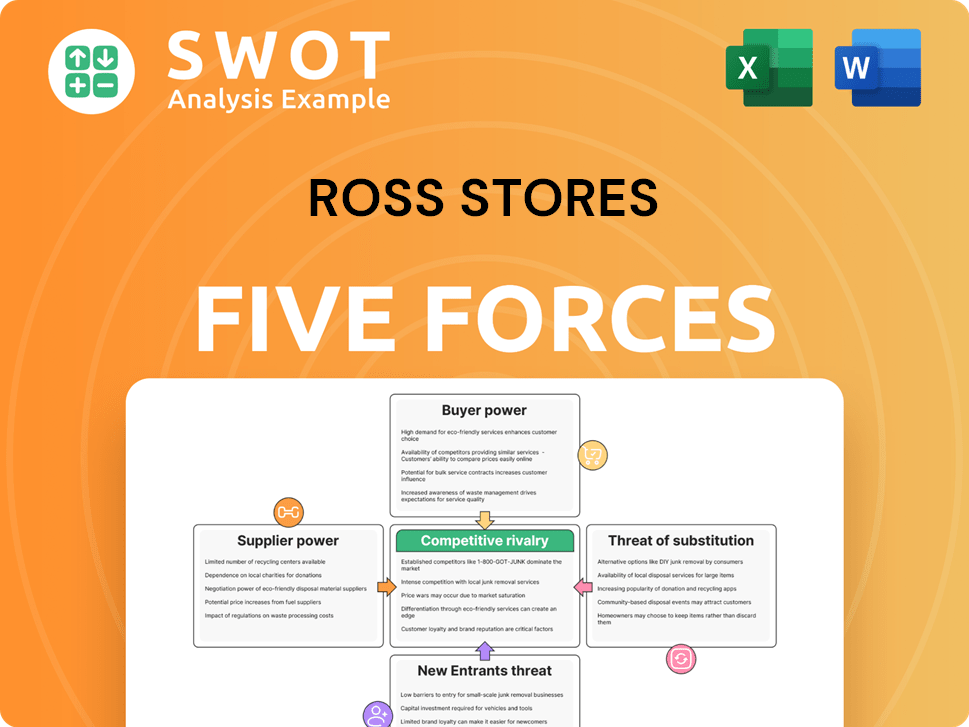

Ross Stores Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ross Stores Company?

- What is Competitive Landscape of Ross Stores Company?

- What is Growth Strategy and Future Prospects of Ross Stores Company?

- How Does Ross Stores Company Work?

- What is Sales and Marketing Strategy of Ross Stores Company?

- What is Brief History of Ross Stores Company?

- What is Customer Demographics and Target Market of Ross Stores Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.