Ross Stores Bundle

Can Ross Stores Continue Its Retail Dominance?

The off-price retail sector offers compelling value in today's market, and Ross Stores, Inc. has become a major player. Founded in 1957, the company has grown from a small department store to a retail giant. This report examines the Ross Stores SWOT Analysis to understand its growth trajectory.

This in-depth analysis explores the Ross Stores growth strategy, examining its evolution from a regional operation to the largest off-price apparel and home fashion chain in the United States. We'll delve into the company's Ross Stores future prospects, considering its expansion plans and adaptation to evolving retail industry trends. Furthermore, a comprehensive Ross Stores company analysis will reveal its competitive advantages and potential for long-term growth within the dynamic off-price retail landscape, making it a must-read for anyone interested in the discount retailer sector.

How Is Ross Stores Expanding Its Reach?

The future growth of Ross Stores is significantly tied to its expansion initiatives, primarily through new store openings and optimizing its existing store base. The company's strategy centers on increasing its physical presence across the United States. This approach is designed to capitalize on the sustained consumer demand for value and expand its market share.

A key element of Ross Stores' strategy is its commitment to opening new stores. The company has a long-term goal of operating a total of 2,900 stores, encompassing both Ross Dress for Less and dd's DISCOUNTS locations. This ambitious target showcases a clear dedication to expanding its footprint across the country.

In fiscal year 2023, Ross Stores opened 94 new stores. For fiscal year 2024, the company plans to open approximately 90 new stores, including 75 Ross and 15 dd's DISCOUNTS, alongside relocating or remodeling about 10 existing stores. These expansion efforts are strategically aimed at penetrating underserved markets and increasing market share.

Ross Stores focuses heavily on opening new stores to drive growth. The company's disciplined approach to real estate involves identifying prime locations that align with its target demographics and operational efficiencies. This strategy is a key component of their mission to provide value to customers.

The expansion strategy is designed to penetrate underserved markets and strengthen its presence in existing regions. This approach allows the company to reach new customers and capitalize on the ongoing demand for off-price retail. The company's growth is driven by its ability to offer value.

In addition to opening new stores, Ross Stores focuses on optimizing its existing store base. This includes relocations and remodels to improve store layouts and enhance the shopping experience. These efforts are aimed at increasing operational efficiency and customer satisfaction.

Currently, Ross Stores concentrates its expansion efforts within the domestic market. This strategic focus allows the company to leverage its established expertise and infrastructure. This concentration on the U.S. market is a key part of their growth strategy.

Ross Stores' expansion strategy is a key driver of its future prospects, focusing on new store openings and optimizing existing locations. This strategy aims to increase market share and customer convenience. The company's disciplined real estate approach and domestic focus support its long-term growth strategy.

- Target of 2,900 stores across both brands.

- 94 new stores opened in fiscal year 2023.

- Approximately 90 new stores planned for fiscal year 2024.

- Focus on domestic market expansion.

Ross Stores SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ross Stores Invest in Innovation?

The innovation and technology strategy of Ross Stores is centered on enhancing operational efficiency, supply chain management, and the in-store customer experience. Unlike many retailers, the company's technological investments are primarily geared towards optimizing its brick-and-mortar operations. This approach supports its off-price retail model, which depends on rapid inventory turnover and competitive pricing.

Their focus is on leveraging technology to streamline processes within existing stores and improve the efficiency of moving merchandise from vendors to stores. This strategy is key to maintaining its competitive edge in the discount retail sector. The company's investment in technology is a critical component of its overall strategy to offer value to its customers.

The company's investment in technology is crucial for maintaining its competitive advantage in the off-price retail market. This includes systems for efficient receiving, pricing, and replenishment of merchandise, which are critical for an off-price model that thrives on rapid inventory turns and opportunistic buying. Their approach to technology supports their value proposition by ensuring that merchandise is efficiently processed and displayed, thereby contributing to sustained growth by maximizing sales per square foot and optimizing operational costs.

Ross Stores utilizes technology to streamline inventory management. This includes systems for efficient receiving, pricing, and replenishment of merchandise.

Technology is used to improve merchandise allocation to stores. This ensures that the right products are available in the right locations.

The company focuses on enhancing in-store processes through technology. This includes efficient receiving, pricing, and display of products.

Investments in supply chain technology aim to improve the speed and cost-effectiveness of moving merchandise. This is crucial for the off-price model.

The primary goal of technological advancements is to enhance operational efficiency. This supports the company's lean operational structure.

Technology helps Ross Stores offer competitive pricing. Efficient operations allow for cost savings that are passed on to customers.

The company's approach to technology directly contributes to its ability to offer competitive pricing and maintain profitability, which is a key component of its Brief History of Ross Stores. While specific details on R&D investments or patents are not publicly emphasized, the company's continuous improvement in its operational technology directly contributes to its ability to offer competitive pricing and maintain profitability. These efforts support the company's long-term growth strategy and its ability to adapt to retail industry trends. In 2024, Ross Stores opened a net of 67 new stores, demonstrating its continued expansion and commitment to its growth strategy.

Ross Stores prioritizes technology investments that directly support its core business model. These investments are critical for maintaining its competitive advantage in the off-price retail market.

- Inventory Management: Implementing systems for efficient tracking and management of merchandise.

- Supply Chain Optimization: Improving the speed and cost-effectiveness of moving goods.

- In-Store Operations: Enhancing processes such as receiving, pricing, and replenishment.

- Data Analytics: Utilizing data to make informed decisions about merchandise allocation and store performance.

Ross Stores PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ross Stores’s Growth Forecast?

The financial outlook for Ross Stores reflects a strategy focused on sustained, albeit measured, growth. The company's off-price model continues to be a key driver, allowing it to navigate the retail industry with a degree of resilience. This approach, combined with strategic expansion plans, contributes to the overall Owners & Shareholders of Ross Stores confidence in its financial trajectory.

For fiscal year 2023, Ross Stores reported total sales of $19.9 billion, which is a testament to its market position and operational efficiency. The company's ability to maintain profitability, with net earnings of $1.7 billion, is another positive indicator. These financial results underscore the effectiveness of its business model in the competitive discount retailer landscape.

Looking ahead to fiscal year 2024, Ross Stores projects total sales growth of approximately 2% to 3%. The company anticipates diluted earnings per share for fiscal 2024 to be between $5.64 and $5.89. These projections suggest continued, steady growth, supported by disciplined inventory management and expense control, which are hallmarks of the off-price retail sector.

In fiscal year 2023, Ross Stores achieved total sales of $19.9 billion. This represents a solid performance, reflecting the company's ability to attract customers and maintain its market share. The sales figures are a key indicator of the company's overall financial health and consumer demand.

Ross Stores reported net earnings of $1.7 billion for fiscal year 2023, with diluted earnings per share of $4.98. These figures demonstrate the company's profitability and its ability to generate value for shareholders. The earnings performance is a critical factor in assessing the company's financial stability.

For fiscal year 2024, Ross Stores projects total sales growth of approximately 2% to 3%. The company anticipates diluted earnings per share to be between $5.64 and $5.89. These projections reflect a cautious but optimistic outlook, indicating continued growth and profitability.

The company's capital expenditure plan for fiscal year 2024 is approximately $800 million. These funds will primarily be allocated to new store openings, store remodels, and supply chain investments. This investment strategy supports the company's long-term growth objectives.

Ross Stores' financial performance is characterized by consistent execution and strategic investments. The company's focus on profitable growth, supported by a strong balance sheet, positions it well for future success. The following points summarize key financial aspects:

- Sales Growth: Projected sales growth of 2% to 3% in fiscal 2024.

- Earnings per Share: Anticipated diluted earnings per share between $5.64 and $5.89 in fiscal 2024.

- Capital Expenditure: Approximately $800 million allocated for new stores, remodels, and supply chain improvements.

- Dividend: A 10% increase in the quarterly cash dividend to $0.3675 per share, announced in February 2024.

Ross Stores Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ross Stores’s Growth?

Analyzing the potential risks and obstacles is crucial when evaluating the Ross Stores growth strategy and its future prospects. The company faces challenges from intense competition within the off-price retail sector and shifts in consumer behavior. Understanding these risks is essential for a comprehensive Ross Stores company analysis.

The retail landscape presents several hurdles that could influence Ross Stores’ trajectory. Economic downturns, inflation, and changing fashion trends can significantly impact consumer spending habits. While the off-price model offers some resilience, prolonged economic instability could still affect discretionary purchases.

Supply chain disruptions and the evolving digital landscape are additional factors to consider. Geopolitical events, natural disasters, or labor shortages can disrupt the timely delivery of merchandise. Furthermore, the increasing importance of e-commerce poses a long-term strategic risk, potentially requiring significant investment in digital capabilities.

Ross Stores competes directly with major players in the off-price retail sector, such as TJX Companies (T.J. Maxx, Marshalls, HomeGoods), and Burlington Stores. These competitors vie for a similar customer base and merchandise. This can lead to price wars and difficulties in acquiring desirable inventory, potentially affecting profitability and Ross Stores’ market share analysis.

Consumer spending habits are subject to economic fluctuations, inflation, and changing trends. Retail industry trends can significantly impact the demand for discretionary items. A recession or a shift in consumer preferences towards online shopping or value-oriented products could negatively affect Ross Stores’ financial performance review.

Disruptions in the supply chain, whether due to geopolitical events, natural disasters, or labor shortages, can hinder the timely delivery of merchandise. These disruptions can lead to inventory imbalances and missed sales opportunities. Ross Stores mitigates this risk through a flexible buying strategy and strong vendor relationships, as highlighted in a recent article about the company's strategies.

The increasing prevalence of e-commerce presents a long-term strategic risk for Ross Stores, which has a limited online presence. A significant shift in consumer preference towards online shopping could necessitate substantial investments in digital capabilities. This could impact profitability and require Ross Stores to adapt its business model to compete effectively.

Changes in labor laws, trade policies, or environmental regulations can introduce compliance costs and operational complexities. Ross Stores must navigate these regulatory environments to maintain its value proposition and operational efficiency. These changes could affect Ross Stores’ long-term growth strategy and investment potential.

Economic downturns can reduce consumer spending on discretionary items, impacting Ross Stores' sales. While the off-price model is more resilient than traditional retail, a severe or prolonged recession could still affect sales. In 2023, Ross Stores reported sales of approximately $19.7 billion, demonstrating its resilience, but future performance is always subject to economic conditions.

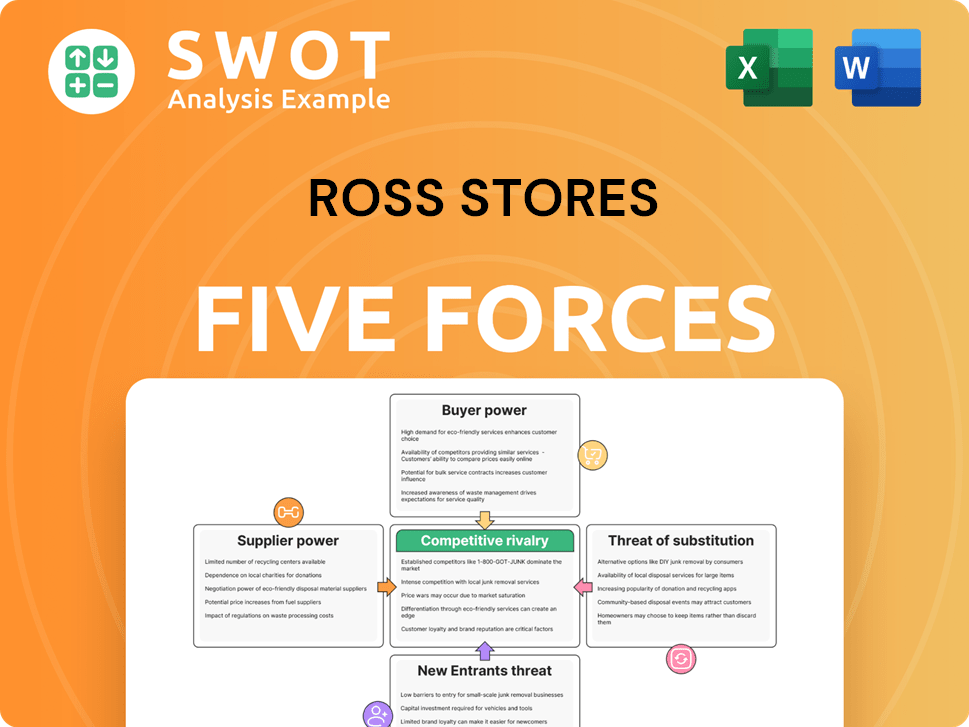

Ross Stores Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ross Stores Company?

- What is Competitive Landscape of Ross Stores Company?

- How Does Ross Stores Company Work?

- What is Sales and Marketing Strategy of Ross Stores Company?

- What is Brief History of Ross Stores Company?

- Who Owns Ross Stores Company?

- What is Customer Demographics and Target Market of Ross Stores Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.