Ross Stores Bundle

Unveiling the Secrets of Ross Stores' Success: How Does It Work?

Ever wondered how Ross Stores, the powerhouse off-price retailer, consistently offers such incredible deals? This in-depth analysis will pull back the curtain on Ross Dress for Less and its sister brand, dd's DISCOUNTS, revealing the strategies that fuel their remarkable growth. Discover how this retail giant thrives in a competitive market, delivering value to millions of customers nationwide.

From its strategic sourcing to its efficient operations, Ross Stores has mastered the art of discount shopping. This exploration will examine the company's core value proposition, revenue streams, and competitive advantages, providing a comprehensive understanding of its business model. To further your understanding, consider exploring a detailed Ross Stores SWOT Analysis to gain deeper insights into its strengths, weaknesses, opportunities, and threats within the retail industry.

What Are the Key Operations Driving Ross Stores’s Success?

Ross Stores, an off-price retailer, creates value by offering a 'treasure hunt' shopping experience. It provides first-quality, in-season, name-brand, and designer apparel, accessories, footwear, and home fashions. Customers enjoy substantial discounts, typically ranging from 20% to 60% off regular prices.

The company caters to a broad range of value-conscious customers. Its core offerings are primarily through two store formats: Ross Dress for Less and dd's DISCOUNTS. This strategy allows Ross Stores to capture a wide market segment with varied price points and merchandise selections.

The operational model is built on efficiency and flexibility. Ross Stores capitalizes on excess inventory from other retailers. This approach enables the company to secure quality merchandise at discounted prices, providing a significant competitive advantage.

Ross Stores employs a sophisticated sourcing strategy. It cultivates strong relationships with vendors to acquire goods that other retailers may struggle to sell. This is particularly crucial during economic uncertainties or periods of tariff increases. This approach ensures a consistent flow of desirable merchandise.

The 'packaway' approach is key to prompt inventory deployment. This enhances competitive pricing and ensures that merchandise is available quickly. This efficient inventory management is a cornerstone of the company's success in the retail industry.

Ross Stores manages its supply chain to adapt to changing trade conditions. It minimizes the impact of external factors like tariffs by diversifying its sourcing base and negotiating with vendors. This adaptability helps maintain profitability and competitiveness.

As of February 1, 2025, Ross Stores operated a total of 2,186 stores across 43 states, the District of Columbia, and Guam. This includes 1,831 Ross Dress for Less locations and 355 dd's DISCOUNTS stores. The company continues to invest in its supply chain infrastructure.

The robust distribution network and strategic sourcing capabilities enable Ross Stores to consistently offer a wide assortment of merchandise at compelling prices. This differentiation from traditional retailers makes its operations unique and effective. For more details, you can read a Brief History of Ross Stores.

- Efficient Sourcing: Securing merchandise at discounted prices.

- Flexible Inventory: Adapting to market changes and minimizing external impacts.

- Strategic Store Network: Expanding its reach across multiple states.

- Value Proposition: Offering significant discounts on quality products.

Ross Stores SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ross Stores Make Money?

The primary revenue stream for Ross Stores, also known as Ross Dress for Less, stems from the direct sale of discounted apparel and home fashion merchandise within its physical store locations. This off-price retailer model allows the company to offer significant savings to customers, driving high sales volumes.

For the fiscal year 2024, Ross Stores reported total sales of approximately $21.1 billion, marking a 3.7% increase compared to the previous year. The company's revenue model is designed to capitalize on the value fashion market, providing consumers with access to quality goods at reduced prices.

In the first quarter of fiscal 2025, sales reached $5.0 billion, demonstrating the company's continued performance. This ongoing success highlights the effectiveness of Ross Stores' strategy in the competitive retail industry.

Ross Stores generates revenue primarily through the sale of discounted merchandise. The company's diverse merchandise mix helps to attract a broad customer base and mitigate risks associated with reliance on a single product category. Understanding the Target Market of Ross Stores is crucial for appreciating its business model.

- Home Accents and Bed and Bath: 26% of sales in fiscal 2024.

- Ladies: 22% of sales in fiscal 2024.

- Men's: 16% of sales in fiscal 2024.

- Accessories, Lingerie, Fine Jewelry, and Cosmetics: 15% of sales in fiscal 2024.

- Shoes: 12% of sales in fiscal 2024.

- Children's: 9% of sales in fiscal 2024.

Ross Stores PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Ross Stores’s Business Model?

The journey of Ross Stores (also known as Ross Dress for Less) has been marked by consistent growth and a strong off-price business model. The company's expansion strategy and ability to adapt to market changes have been key to its success. This includes navigating operational challenges and maintaining a competitive edge in the retail industry.

Ross Stores' strategic moves include aggressive store expansion and supply chain optimization. The company's focus on providing value to consumers is evident in its merchandise mix and pricing strategies. This focus has allowed it to attract and retain customers in a competitive market. The company's ability to adapt to economic shifts has been crucial for maintaining profitability.

Ross Stores' competitive advantages stem from its brand strength, efficient off-price model, and economies of scale. The company's ability to offer first-quality, in-season, name-brand and designer apparel at 20% to 60% off department and specialty store regular prices creates a compelling value proposition that attracts and retains value-conscious consumers. Its 'packaway' approach, which enables prompt inventory deployment, further enhances its competitive pricing. The company's focus on cost management and strategic sourcing is crucial in maintaining profitability, especially during economic uncertainties.

In fiscal 2024, Ross Stores opened 89 new stores, resulting in a net increase of 77 stores after closures. As of February 1, 2025, the company operated a total of 2,186 locations. The company plans to open approximately 90 new locations in fiscal year 2025, including about 80 Ross and 10 dd's DISCOUNTS stores.

Ross Stores focuses on expanding its store network, targeting underserved markets. The company is actively diversifying its sourcing base to mitigate the impact of tariffs. It also negotiates with vendors and considers selective price adjustments. The company's flexible supply chain allows it to adapt to changing trade conditions.

Ross Stores offers a compelling value proposition by providing name-brand and designer apparel at significantly reduced prices. This attracts value-conscious consumers. The company's efficient off-price model and economies of scale are key competitive advantages. Cost management and strategic sourcing are crucial for maintaining profitability, especially during economic uncertainties.

The company's financial performance is influenced by its ability to manage costs and source merchandise effectively. Ross Stores continues to adapt to new trends by optimizing its merchandise mix to appeal to value-conscious consumers and investing in supply chain enhancements. The company's strategic focus on value and efficiency is key to its financial success.

Ross Stores operates by offering discounted merchandise, primarily apparel and home goods, sourced from various vendors. The company's off-price model allows it to provide significant discounts compared to traditional retailers. This model, combined with strategic store locations, helps Ross Stores attract a wide customer base.

- Off-Price Model: Offers name-brand products at 20% to 60% off regular prices.

- Store Expansion: Continuously opens new stores to broaden its reach.

- Supply Chain Management: Focuses on efficient inventory management and sourcing.

- Customer Value: Provides value to consumers through competitive pricing and a wide selection of merchandise.

Ross Stores Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Ross Stores Positioning Itself for Continued Success?

As the largest off-price apparel and home fashion chain in the United States, Ross Stores holds a dominant position in the retail industry. As of March 2025, the company operates a vast network of 2,205 Ross Dress for Less and dd's DISCOUNTS stores across 44 states, Washington, D.C., and Guam. Their proven business model, focused on offering competitive bargains, continues to attract a large customer base, reinforcing their leadership in the off-price retail sector.

Despite its strong market position, Ross Stores faces several risks and headwinds. These include the impact of tariffs and trade wars, declining consumer confidence, and increased competition. The reemergence of high tariffs on imported goods, particularly from China, where over 50% of Ross' merchandise is sourced, poses a significant financial strain. Further, the company has observed a softening in consumer demand, with average customer visits to Ross locations dropping by 2.7% year-over-year in Q1 2025. This decline is attributed to prolonged inflation and a shift in consumer spending towards more functional items versus discretionary ones. Unseasonable weather and macroeconomic volatility also impact customer traffic.

Looking ahead, Ross Stores is adopting a cautious approach for fiscal 2025. The company plans to navigate the uncertain economic environment by focusing on strategic expansion and operational efficiencies. Their commitment to maintaining its core identity as a value-driven retailer, along with its flexible business model, are key strategies to sustain profitability and navigate the uncertain environment.

Ross Stores is focused on several key initiatives. These include expanding its store network, enhancing its supply chain, and maintaining its value proposition. These initiatives are designed to support long-term growth and adapt to changing consumer preferences. You can learn more about their plans in this article about the Growth Strategy of Ross Stores.

For the 52 weeks ending January 31, 2026, Ross Stores anticipates comparable store sales to be down 1% to up 2%, building on a 3% gain in 2024. Fiscal 2025 earnings per share are projected to be $5.95 to $6.55, compared to $6.32 for fiscal 2024. The company plans to continue its strategic expansion by opening approximately 90 new stores in fiscal year 2025.

- Comparable Store Sales: Projected to be down 1% to up 2% in fiscal 2025.

- Earnings Per Share (EPS): Forecasted to be $5.95 to $6.55 for fiscal 2025.

- New Store Openings: Approximately 90 new stores planned for fiscal year 2025.

- Long-Term Growth Goal: Aiming for 2,900 Ross locations and 700 dd's DISCOUNTS stores.

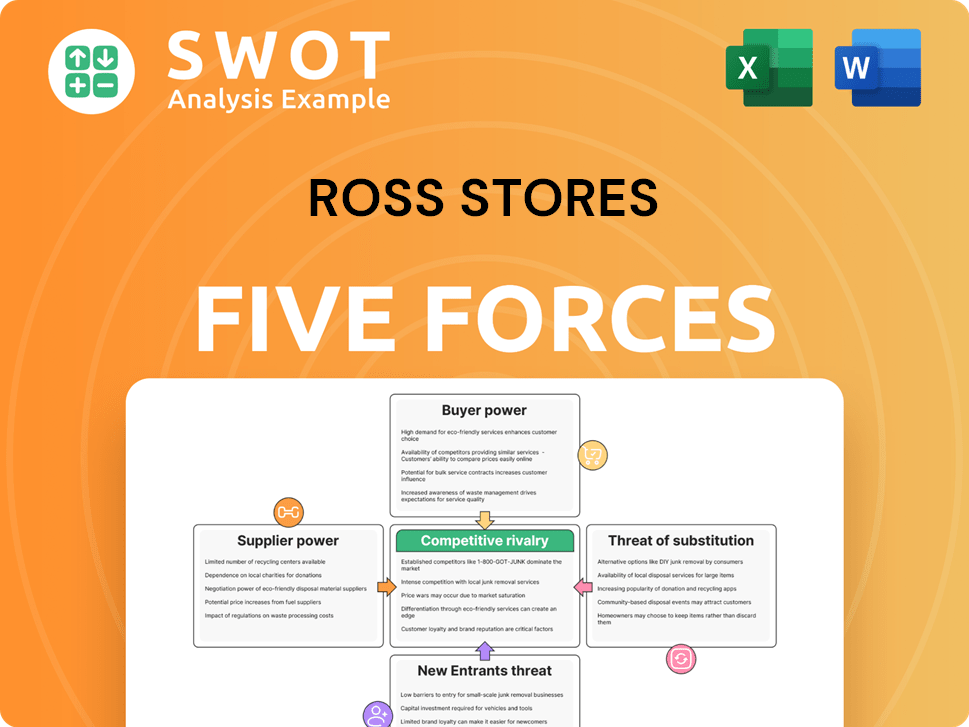

Ross Stores Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ross Stores Company?

- What is Competitive Landscape of Ross Stores Company?

- What is Growth Strategy and Future Prospects of Ross Stores Company?

- What is Sales and Marketing Strategy of Ross Stores Company?

- What is Brief History of Ross Stores Company?

- Who Owns Ross Stores Company?

- What is Customer Demographics and Target Market of Ross Stores Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.