Santos Bundle

How Does Santos Navigate the Choppy Waters of the Energy Market?

The energy sector is a battlefield of innovation, geopolitical maneuvering, and the relentless push for sustainability. As a major player in the Asia-Pacific, Santos, a leading oil and gas company, faces a complex web of rivals and market pressures. Understanding the Santos SWOT Analysis is critical to grasping its position.

This exploration of the Santos company competitive landscape provides a detailed Santos company market analysis, identifying its key industry rivals and evaluating its strategic positioning. We'll dissect the company's business strategy, examining its financial performance and assessing its competitive advantages and disadvantages in the current market. Furthermore, we'll investigate its current market position and future growth prospects within the dynamic energy sector, including its response to market challenges.

Where Does Santos’ Stand in the Current Market?

The Growth Strategy of Santos highlights its strong market position within the Australian and Asian oil and gas sectors. The company is a significant player, especially in natural gas and LNG. In 2024, Santos anticipates producing between 89-93 million barrels of oil equivalent (mmboe), which underscores its substantial presence in the regional energy market.

Santos's core operations involve the production and sale of natural gas, LNG, crude oil, and ethane. These products serve a diverse customer base, including residential, commercial, and large industrial clients. The company's geographical footprint is extensive, with key assets across Australia, including Queensland, New South Wales, South Australia, and Western Australia, alongside operations in Papua New Guinea and Alaska. This widespread presence supports its competitive edge.

Over time, Santos has strategically repositioned itself, focusing on gas as a transition fuel and investing in carbon capture and storage (CCS) projects. This strategic shift aligns with evolving energy demands and sustainability goals. For 2023, Santos reported an underlying profit of $1.424 billion, reflecting its financial resilience amidst fluctuating commodity prices. This financial performance is crucial for understanding the Santos company market analysis.

Santos holds a considerable market share in the East Coast Australian gas market. However, in the broader Asia-Pacific LNG market, it competes with global energy giants. This competitive landscape shapes the Santos company competitive landscape.

The primary products offered by Santos include natural gas, LNG, crude oil, and ethane. These products cater to various customer segments. The diversification of its product portfolio supports its financial performance.

Santos has a strong presence across Australia, including key assets in Queensland, New South Wales, South Australia, and Western Australia. It also operates in Papua New Guinea and Alaska. This broad geographic reach supports its market position.

Santos is focusing on gas as a transition fuel and investing in carbon capture and storage (CCS) projects. This strategic focus helps the company adapt to changing energy demands. These initiatives are part of the Santos company business strategy.

Santos benefits from its extensive asset base and strategic investments in key energy projects. Its focus on natural gas and LNG positions it well for future growth. To understand how the company performs, it's important to analyze the Santos company's strengths and weaknesses analysis.

- Strong presence in Australia and Asia-Pacific.

- Diversified product portfolio including natural gas, LNG, crude oil, and ethane.

- Strategic investments in carbon capture and storage.

- Robust financial performance with an underlying profit of $1.424 billion in 2023.

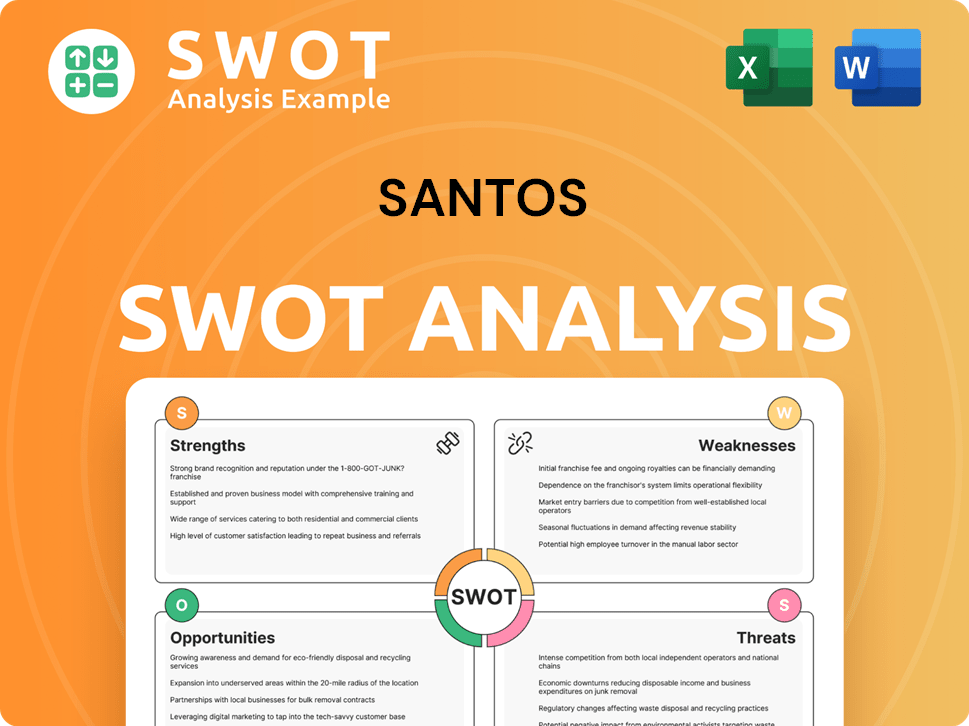

Santos SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Santos?

The competitive landscape for the Santos company is shaped by a mix of global and regional players in the oil and gas sector. This analysis of the Santos company competitive landscape reveals a dynamic environment where market share, technological advancements, and strategic alliances play crucial roles. Understanding the Santos company market analysis is essential for evaluating its position and future prospects.

Santos faces competition from major international oil companies and regional specialists. These rivals challenge Santos through their extensive resources, integrated operations, and technological capabilities. Analyzing the Santos company industry rivals provides insights into the competitive dynamics and potential threats.

The Santos company's business strategy is significantly influenced by its competitors' actions and market trends. Analyzing the Santos company's financial performance requires considering the impact of these competitive pressures. The company's ability to navigate this environment will determine its success.

Major international oil companies like Shell, ExxonMobil, and Chevron are direct competitors. These companies have vast global resources, integrated operations, and significant market share, especially in LNG and crude oil. They compete with Santos through extensive distribution networks and technological advantages.

Woodside Energy is a key regional rival, particularly in the Australian gas and LNG sectors. Woodside's projects, such as the Pluto LNG facility, directly compete with Santos. The proposed merger between Woodside and BHP's petroleum assets has reshaped the competitive landscape.

Emerging renewable energy companies pose an indirect competitive threat. These companies attract increasing investment and policy support, potentially reducing long-term demand for hydrocarbons. The shift towards renewables influences the Santos company's strategic decisions.

Santos's competitive advantages include its established position in the Australian market and its expertise in LNG. Disadvantages may include the need to compete with larger, more diversified companies. A detailed analysis of Santos company's rivals is crucial for understanding its strengths and weaknesses.

Market share analysis for 2024 indicates the relative positions of Santos and its competitors. The competitive environment analysis reveals how each company's strategies impact its market share. The Santos company's current market position is influenced by its ability to compete effectively.

Strategic alliances and partnerships can significantly impact the competitive landscape. These collaborations can enhance market access, share risks, and leverage complementary strengths. The formation of larger entities through mergers, such as the Woodside-BHP deal, is a key trend.

The competitive environment for Santos is characterized by several key factors. These include access to resources, technological innovation, and financial strength. The ability to adapt to changing market dynamics is crucial. The Santos company's future growth prospects depend on its ability to address these factors.

- Resource Access: Securing and developing new oil and gas reserves is critical.

- Technological Advancement: Implementing advanced exploration and production technologies.

- Financial Performance: Maintaining strong financial health to fund projects and compete effectively.

- Market Dynamics: Adapting to fluctuations in global energy demand and prices.

- Strategic Initiatives: Investing in renewable energy and forming strategic alliances.

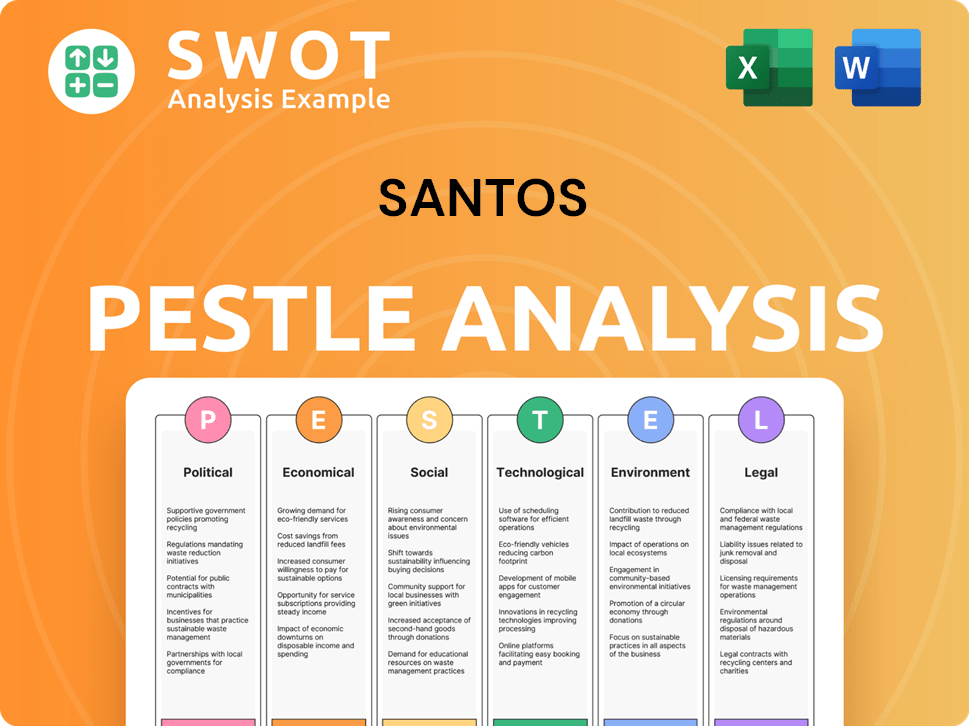

Santos PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Santos a Competitive Edge Over Its Rivals?

Analyzing the Owners & Shareholders of Santos reveals a company with several key competitive advantages. These strengths are crucial for understanding the Santos company competitive landscape and its ability to compete within the dynamic energy sector. The company's strategic moves and focus on operational efficiency are vital for its sustained success.

Santos's competitive edge is built on a foundation of substantial natural gas reserves and a strategic location in Australia. This positioning allows for efficient operations and access to key Asian markets, providing a logistical advantage for LNG exports. Furthermore, the company's diversified asset portfolio helps mitigate risks and creates multiple avenues for growth, making it a strong player in the Santos company market analysis.

The company's commitment to cost management and investments in technologies like carbon capture and storage (CCS) further enhance its competitive position. These initiatives are increasingly important in attracting environmentally conscious investors and customers. These factors collectively contribute to its sustained competitive edge, enabling it to navigate evolving market dynamics effectively.

Santos benefits from substantial natural gas reserves. These reserves are a cornerstone of its long-term production capabilities. This strong resource base is critical for its sustained success in the energy market.

The company's strategic location in Australia, with established infrastructure, is a key advantage. Proximity to Asian markets provides a logistical edge for LNG exports. This strategic positioning supports efficient operations and market access.

Santos maintains a diversified portfolio, including mature fields, development projects, and exploration acreage. This diversification helps mitigate risks and provides multiple avenues for growth. This approach supports long-term sustainability and resilience.

Operational efficiency and cost management are crucial in the commodity-driven industry. Santos has demonstrated a strong commitment to these areas. This focus enhances profitability and competitiveness.

Santos's competitive advantages are multifaceted, including its resource base, strategic location, and operational efficiency. The company's investments in CCS technology, such as the Moomba CCS project, position it as a leader in decarbonization efforts. These strengths enable Santos to maintain a strong position in the Santos company competitive landscape and respond to market challenges effectively.

- Resource Base: Significant natural gas reserves support long-term production.

- Strategic Location: Proximity to Asian markets and established infrastructure.

- Operational Efficiency: Commitment to cost management and efficient operations.

- Decarbonization Efforts: Investments in CCS technology like the Moomba CCS project.

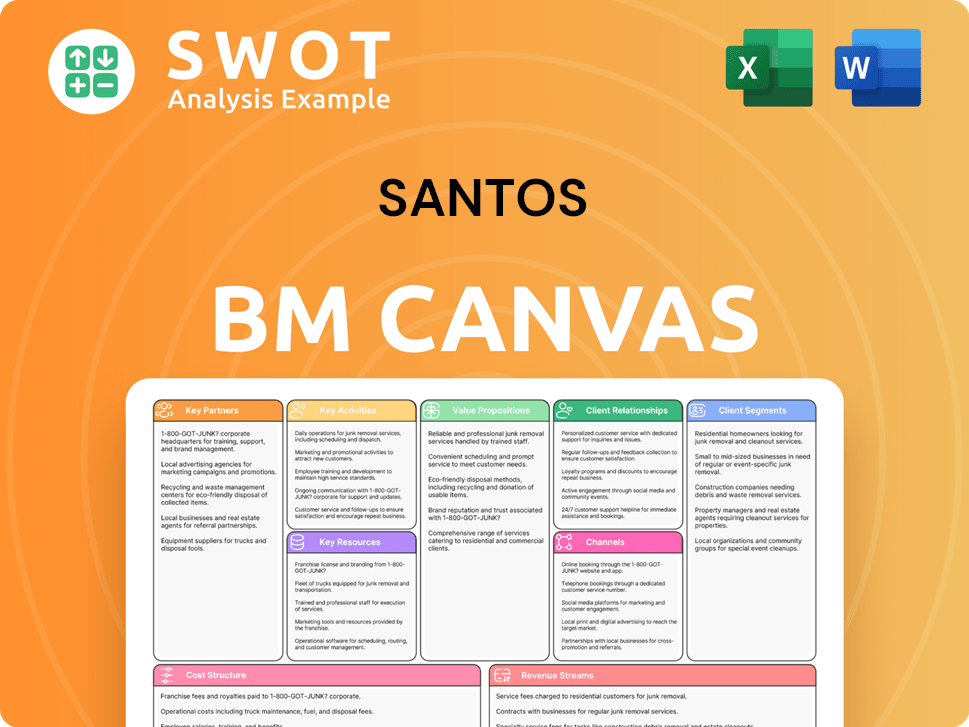

Santos Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Santos’s Competitive Landscape?

The Santos company competitive landscape is significantly influenced by global energy trends and the shift towards cleaner energy sources. This impacts its market analysis and strategic decisions. Understanding the current market dynamics is crucial for Santos company's business strategy and future growth.

Santos company industry rivals are adapting to evolving environmental regulations and technological advancements. The company’s financial performance is closely tied to its ability to manage these changes and capitalize on opportunities in the energy sector. The company's strategic alliances and partnerships play a key role in navigating these challenges.

The oil and gas industry is undergoing a transformation driven by the global energy transition and geopolitical instability. There's increasing pressure to decarbonize operations and reduce emissions. Simultaneously, the demand for natural gas as a transition fuel is rising, particularly in Asia.

Key challenges include managing the decline in fossil fuel demand in some markets and adapting to stricter environmental regulations. The company must also navigate geopolitical risks affecting energy supply chains. Competition from renewable energy sources presents a significant long-term threat.

Opportunities for Santos include the growing demand for natural gas and LNG, especially in Asia, and the development of carbon capture and storage (CCS) projects. Strategic investments in new gas supply projects can also drive growth. The company's ability to embrace new technologies is key.

Santos must adapt to evolving environmental regulations, embrace new technologies, and strategically manage its portfolio. A focus on decarbonization and investments in CCS are critical. The company's resilience depends on its ability to navigate a rapidly changing energy landscape.

Santos company's current market position is influenced by its existing natural gas and LNG assets. Its competitive strategy in the energy sector involves balancing its hydrocarbon portfolio with investments in lower-carbon technologies. The company is focused on maintaining its market share and exploring new opportunities.

- Santos company's strengths and weaknesses analysis reveals a strong position in natural gas but faces challenges in decarbonization.

- The company’s response to market challenges includes strategic investments in CCS projects and renewable energy.

- Santos company's key performance indicators (KPIs) include production volumes, cost management, and emissions reduction targets.

- Understanding the detailed analysis of Santos company's rivals is crucial for strategic planning.

The Santos company's competitive advantages and disadvantages are shaped by its asset base, operational efficiency, and ability to innovate. The company faces scrutiny regarding its environmental impact, but it also has a strong foundation in natural gas. For more insights, explore Brief History of Santos. Santos company's market share analysis 2024 will be crucial in understanding its position relative to Santos company competitors and who are Santos company's main competitors in Australia. Santos company's future growth prospects depend on its ability to adapt to the changing energy landscape and capitalize on new opportunities.

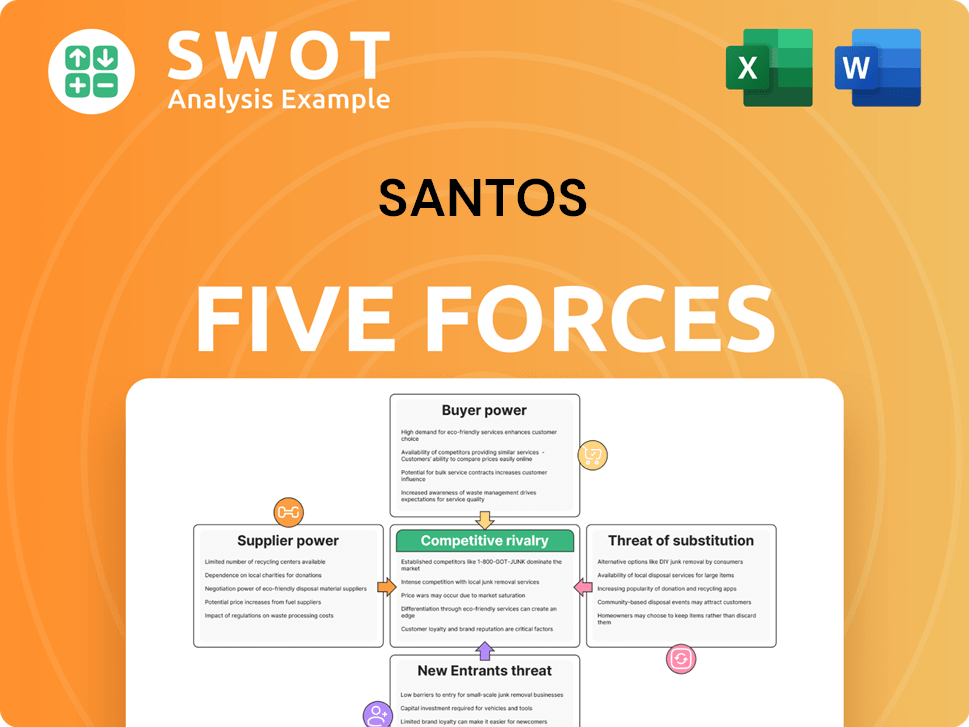

Santos Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Santos Company?

- What is Growth Strategy and Future Prospects of Santos Company?

- How Does Santos Company Work?

- What is Sales and Marketing Strategy of Santos Company?

- What is Brief History of Santos Company?

- Who Owns Santos Company?

- What is Customer Demographics and Target Market of Santos Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.