Santos Bundle

Who Really Controls Santos Ltd?

Understanding Santos company ownership is crucial for anyone interested in the Australian energy sector. The recent Woodside Energy merger talks highlight how ownership influences strategic decisions and market valuation. This article explores the evolution of Santos, from its founding to its current status as a global energy leader. We'll uncover the key players shaping Santos's future.

From its humble beginnings to its current global footprint, Santos Australia's journey is a testament to the power of strategic ownership. Examining the Santos SWOT Analysis can provide further insights into its competitive landscape. This analysis will examine the company's major shareholders, the influence of Santos executives, and the impact of its board of directors. Discover the forces that drive this energy giant.

Who Founded Santos?

The story of the Santos company ownership began in 1954, thanks to the vision of Robert Francis 'Bob' Bristowe and John Langdon Bonython. These two school friends from Adelaide saw the potential for oil discoveries in South Australia. Their early efforts, along with a team of geologists, set the stage for what would become a major player in the energy sector.

The initial plan was brought to fruition with the help of geologists like Reg Sprigg and Helmut Wopfner. The company's original name was South Australian Northern Territory Oil Search, which was cleverly shortened to 'Santos'. Sir Douglas Mawson, a well-known explorer and geologist, also joined the first Santos Board, which led to the inclusion of the Northern Territory in the company's name.

The company's journey started with its public listing on the Adelaide Stock Exchange on October 1, 1954. Shares began trading on February 7, 1955. Early exploration began north of Port Augusta, with the first 24 wells drilled in the Wilkatana region in 1955. The company's first major gas discovery was at Gidgealpa in South Australia's Cooper Basin in 1963, followed by the Moomba 1 discovery in 1966, which solidified the region's potential as a significant energy resource. By 1969, Santos's Cooper Basin operations were supplying gas to Adelaide.

Robert Francis 'Bob' Bristowe and John Langdon Bonython founded the company in 1954.

They believed in the potential for oil discovery in South Australia.

The company was initially named South Australian Northern Territory Oil Search.

Listed on the Adelaide Stock Exchange on October 1, 1954.

The first major gas discovery was at Gidgealpa in 1963.

Exploration started north of Port Augusta with the drilling of the first wells.

The early years of the company were marked by significant milestones, including the initial public offering and the first major gas discoveries. These events laid the foundation for the company's future growth and success. For a deeper dive into the early days, check out the Brief History of Santos.

- 1954: Founded and listed on the Adelaide Stock Exchange.

- 1955: First shares traded and early exploration efforts began.

- 1963: Major gas discovery at Gidgealpa.

- 1966: Moomba 1 discovery.

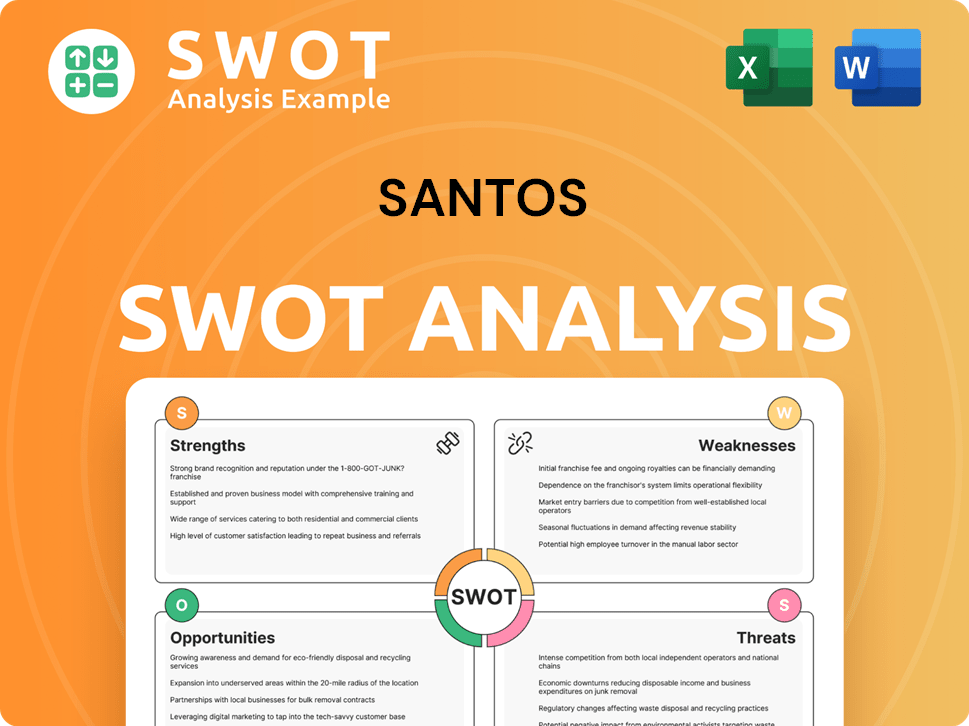

Santos SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Santos’s Ownership Changed Over Time?

The ownership structure of the Santos company has seen significant changes since its initial public offering (IPO) on January 31, 1988. As of June 2025, the company's market capitalization was approximately A$22.55 billion. This evolution reflects strategic shifts and market dynamics impacting the company's ownership over time.

Key events have reshaped Santos's ownership landscape. The merger with Oil Search Limited in late 2021 was a pivotal moment, broadening its portfolio and geographic reach, which included adding a North American project in Alaska. In September 2023, Santos agreed to sell a 2.6% stake in PNG LNG to Kumul Petroleum Holdings. The final payment of US$241 million was received in the fourth quarter of 2024, adjusting Santos's working interest in PNG LNG to 39.9%. These moves demonstrate a commitment to optimizing its asset portfolio and strategic positioning within the global energy market.

| Stakeholder Category | Approximate Ownership | Notes |

|---|---|---|

| Institutional Investors | ~13.96% | Includes Vanguard, iShares, and others |

| Public Companies and Individual Investors | ~85.96% | Majority ownership |

| Other Major Shareholders | Various | Perpetual, Colonial First State, State Street |

The current major stakeholders in Santos, also known as Santos Ltd, include a mix of institutional investors, mutual funds, and individual investors. Institutional investors collectively hold around 13.96% of the company's stock, while public companies and individual investors account for approximately 85.96%. Vanguard, through funds like Vanguard Total International Stock Index Fund Investor Shares and Vanguard Developed Markets Index Fund Admiral Shares, is among the largest institutional shareholders. Other significant institutional owners include iShares Core MSCI EAFE ETF, Dfa Investment Trust Co - The Dfa International Value Series, and Fidelity International Index Fund. Perpetual Investment Management Ltd., Colonial First State Investments Ltd., and State Street Global Advisors Trust Co. are also noted as major shareholders. This diverse ownership structure highlights the broad investor interest in the company.

The ownership of Santos is a blend of institutional and individual investors, reflecting its position in the energy sector.

- Institutional investors hold a significant portion of the shares.

- Public and individual investors make up the majority of the ownership.

- Key events, like the merger with Oil Search, have reshaped the ownership structure.

- The company's strategic moves impact its shareholder base.

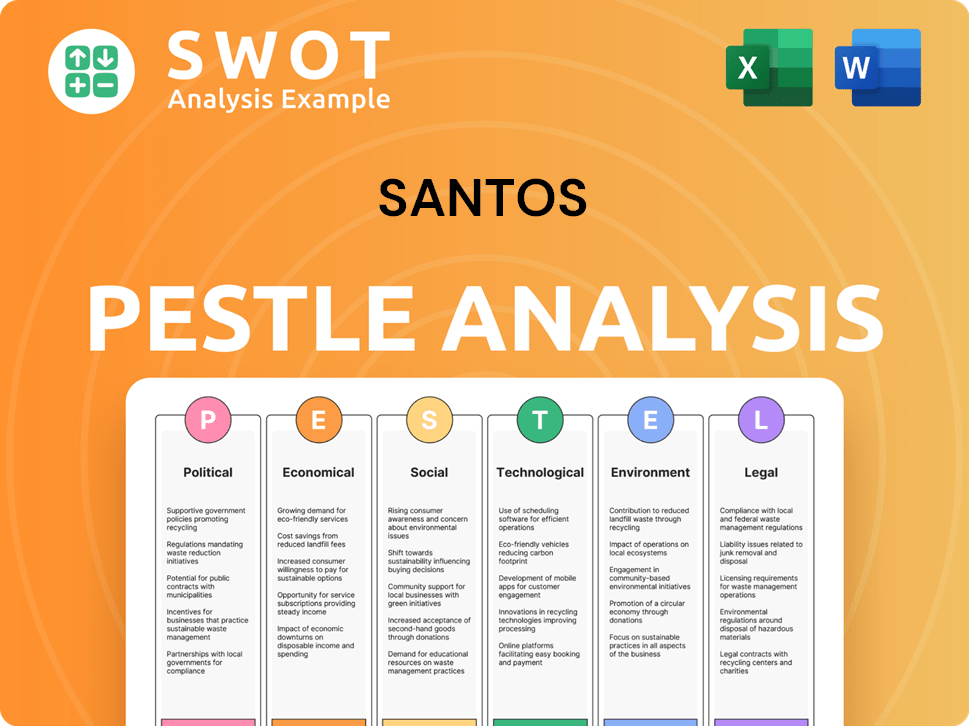

Santos PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Santos’s Board?

The current Board of Directors at Santos plays a critical role in the company's governance and strategic direction. As of June 2025, the board comprises Keith Spence (Independent Non-Executive Chairman), Kevin Gallagher (Managing Director & Chief Executive Officer), Yasmin Allen AM (Independent Non-Executive Director), Dr. Vanessa Guthrie AO (Independent Non-Executive Director), John Lydon (Independent Non-Executive Director), Vickki McFadden (Independent Non-Executive Director), Musje Werror (Independent Non-Executive Director), and Michael Utsler (Independent Non-Executive Director). This diverse board brings a wealth of experience to guide the company.

Vickki McFadden, who joined the Board on April 11, 2024, chairs the Audit and Risk Committee. John Lydon also became a Director on April 11, 2024, while Peter Hearl stepped down on the same date. The board's composition reflects an ongoing evolution in response to both internal and external factors, including shareholder interests and market dynamics. The average tenure of the board of directors is 5.7 years, indicating a stable and experienced leadership team.

| Director | Role | Shareholding (as of June 2025) |

|---|---|---|

| Keith Spence | Independent Non-Executive Chairman | Not specified |

| Kevin Gallagher | Managing Director & CEO | 0.076% (approx. A$17.07 million) |

| Yasmin Allen AM | Independent Non-Executive Director | Not specified |

| Dr. Vanessa Guthrie AO | Independent Non-Executive Director | Not specified |

| John Lydon | Independent Non-Executive Director | Not specified |

| Vickki McFadden | Independent Non-Executive Director | Not specified |

| Musje Werror | Independent Non-Executive Director | Not specified |

| Michael Utsler | Independent Non-Executive Director | Not specified |

In terms of voting structure, Santos operates under a one-share-one-vote system for its ordinary shares. Recent proxy battles and activist investor campaigns have influenced discussions and decisions within the company, particularly regarding climate change commitments. For example, the Australasian Centre for Corporate Responsibility (ACCR) has engaged with Santos for several years on climate change, filing resolutions related to reporting and lobbying practices. The board was granted another year to improve its share price, following discussions at the Annual General Meeting in April 2024. To understand more about the company's financial operations, you can explore Revenue Streams & Business Model of Santos.

Understanding who owns Santos and the structure of its board is crucial for investors and stakeholders.

- The board includes a mix of independent and executive directors.

- Kevin Gallagher, the CEO, holds a notable share of the company.

- Shareholder activism influences company decisions.

- The company operates under a one-share-one-vote system.

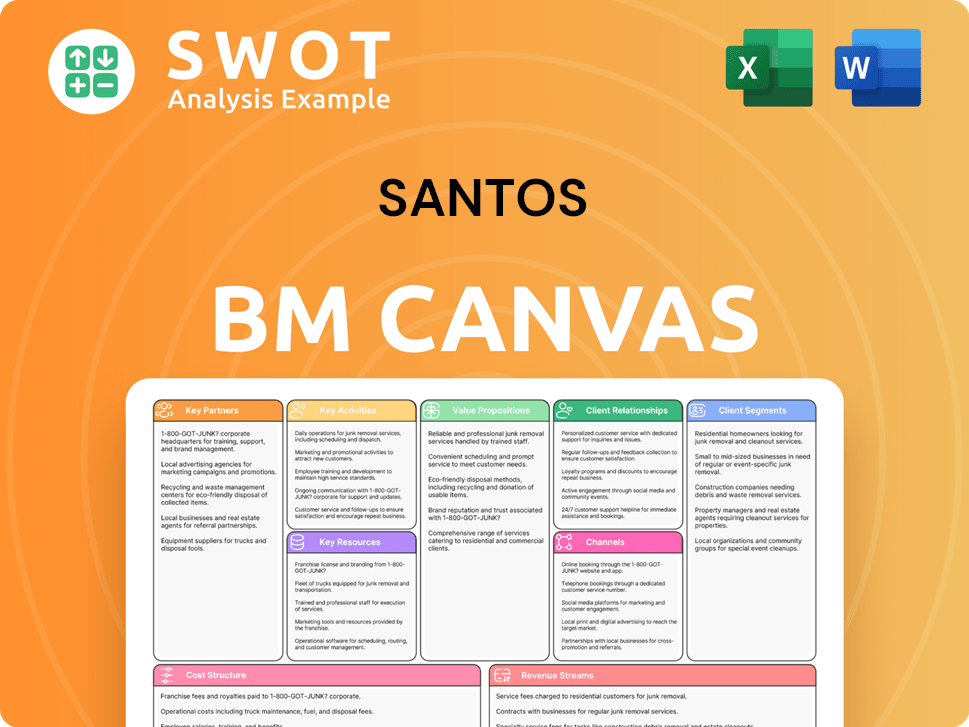

Santos Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Santos’s Ownership Landscape?

Over the last few years, the ownership landscape of the Santos company has seen significant developments. In early 2024, merger talks with Woodside Energy were called off due to a lack of clear benefits, highlighting the potential for consolidation in the Australian oil and gas sector. Later in July 2024, there was acquisition speculation, with Saudi Aramco and Abu Dhabi National Oil Company (ADNOC) reportedly considering a purchase. However, potential bidders face challenges related to the company's decommissioning liabilities.

Leadership changes have also influenced the company's trajectory. In October 2024, Sherry Duhe was appointed as Chief Financial Officer, succeeding Anthea McKinnell. This move has led some analysts to speculate about Duhe potentially becoming CEO in the future, especially given current CEO Kevin Gallagher's incentive package extends until the end of 2025. These shifts in leadership and potential ownership changes suggest a company in transition, navigating both financial performance and strategic partnerships.

| Metric | Year | Value |

|---|---|---|

| Revenue | 2024 | US$5.381 billion |

| Net Profit | 2024 | US$1.224 billion |

| Interim Dividend Increase | 2024 | 49% |

| Total Cash Return to Shareholders | 2024 | US$757 million |

| Emissions Reduction (Scope 1 & 2) | 2024 | 26% (vs. 2019-20 baseline) |

Financially, Santos reported a 9% decrease in revenue to US$5.381 billion and a 14% drop in net profit to US$1.224 billion for the full year 2024. Despite these figures, the company increased its interim dividend by 49% to 13.0 US cents per security, resulting in a total cash return to shareholders of US$757 million for 2024, representing 40% of free cash flow from operations. A key development was the start of the Moomba Carbon Capture and Storage (CCS) phase one project in September 2024, which helped to reduce net equity Scope 1 and 2 emissions by 26% compared to the 2019-20 baseline. The company anticipates significant free cash flow increases by 2026 as major project capital expenditure declines, indicating a focus on financial stability and shareholder returns.

The breakdown of merger talks with Woodside Energy and acquisition speculations with Saudi Aramco and ADNOC highlight potential changes in ownership structure.

Sherry Duhe's appointment as CFO in October 2024 suggests potential shifts in executive leadership, influencing the company's strategic direction.

Despite a decline in revenue and net profit in 2024, Santos increased its dividend and focused on emissions reduction through CCS projects.

The company anticipates increased free cash flow by 2026 as major project capital expenditure declines, indicating a focus on long-term financial health.

Santos Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Santos Company?

- What is Competitive Landscape of Santos Company?

- What is Growth Strategy and Future Prospects of Santos Company?

- How Does Santos Company Work?

- What is Sales and Marketing Strategy of Santos Company?

- What is Brief History of Santos Company?

- What is Customer Demographics and Target Market of Santos Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.