S.F. Holding Bundle

Can S.F. Holding Company Maintain Its Dominance?

From humble beginnings to a global powerhouse, S.F. Holding Company has dramatically reshaped the logistics sector. This article examines the S.F. Holding SWOT Analysis, market position, and strategic moves that have propelled its ascent. We'll dissect the SF Holding market analysis to understand its current standing and future trajectory within the SF Holding industry.

Understanding the competitive landscape is crucial to assess S.F. Holding Company's long-term viability. This analysis will identify SF Holding competitors, evaluate its competitive advantages of SF Holding, and explore the challenges and opportunities shaping its future. Furthermore, we'll explore the SF Holding Company financial performance and SF Holding China market dynamics to provide actionable insights for investors and strategists.

Where Does S.F. Holding’ Stand in the Current Market?

S.F. Holding Company holds a commanding position in the logistics sector, recognized as the largest integrated logistics service provider in China and Asia. Globally, it ranks as the fourth-largest based on total revenue as of 2023. The company's core operations encompass a wide range of services, including express delivery, freight, cold chain logistics, and supply chain solutions, catering to a diverse customer base.

The company's value proposition centers on providing comprehensive logistics solutions, leveraging a robust network that spans across China and extends internationally. This network supports a vast customer base, including both individual consumers and businesses. With a focus on efficiency and reliability, S.F. Holding Company aims to meet the evolving needs of its customers in a competitive market, as detailed in Owners & Shareholders of S.F. Holding.

In the first quarter of 2025, S.F. Holding Company reported an operating revenue of RMB 69.85 billion, reflecting a 6.9% year-on-year increase. Net profit attributable to shareholders reached RMB 2.23 billion, marking a 16.9% year-on-year increase. The total parcel volume for Q1 2025 surged by 19.7% year-on-year to 13.56 billion pieces, demonstrating strong growth in its core business.

S.F. Holding Company leads in five logistics sub-segments in China: express, freight, cold chain, intra-city on-demand delivery, and supply chain. This strong domestic presence is a key factor in its overall market position. The company's extensive infrastructure and service offerings contribute to its dominant market share within the country.

The company's dominance extends across Asia, where it leads in four sub-segments: express, freight, intra-city on-demand delivery, and international business. Its strategic focus on the Asian market has driven significant growth and expansion. S.F. Holding's efficient logistics network is a major competitive advantage in the region.

S.F. Holding Company continues to expand its international presence, particularly in Asia. This expansion is supported by its efficient logistics network and its ability to secure international supply chain projects. In 2024, the company won bids for over 100 overseas supply chain projects.

The company serves approximately 2.3 million active monthly customers and 730 million individual members. This extensive customer base highlights its broad market reach and the trust it has built over time. Over 45% of Fortune China 500 companies utilize S.F. Holding's international logistics services.

S.F. Holding Company's financial health is robust, with free cash flow surging 70% year-over-year to RMB 22.3 billion in 2024. The company has demonstrated a strong commitment to shareholders, returning a total of RMB 10.7 billion in 2024 through cash dividends and share repurchase programs. This financial strength supports its strategic initiatives and expansion plans.

- Focus on mid-to-high-end express delivery market.

- Development of a nationwide cold chain logistics network.

- Digital transformation efforts for intelligent and green supply chains.

- Strategic international expansion, especially in Asia.

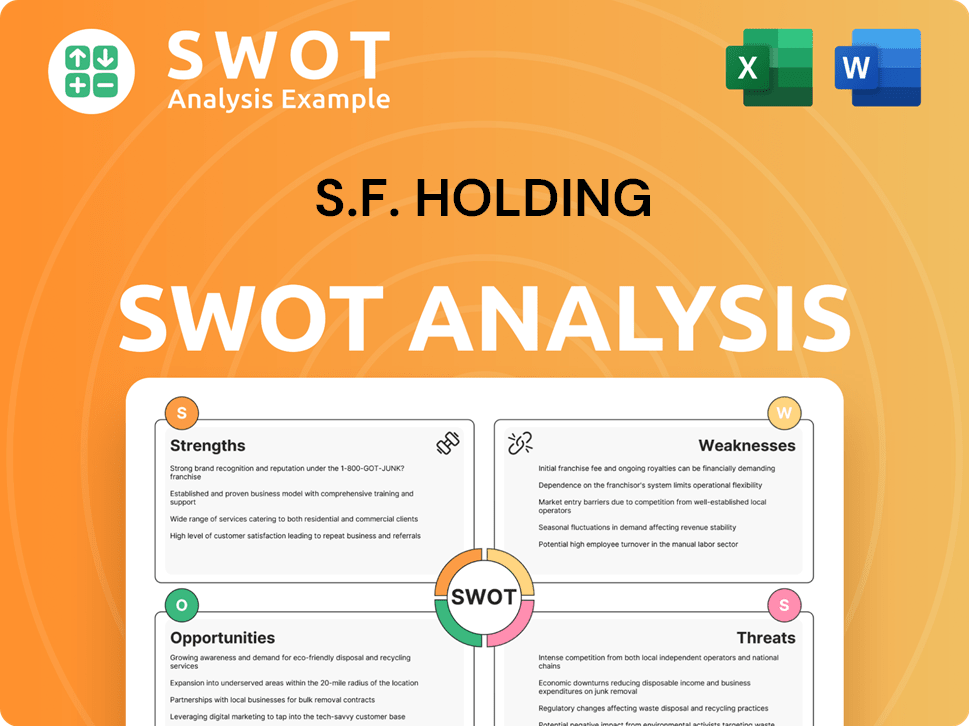

S.F. Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging S.F. Holding?

The competitive landscape for S.F. Holding Company (SF Holding) is dynamic, shaped by both domestic and international players vying for market share in the logistics sector. Understanding the SF Holding market analysis requires a close look at its direct and indirect competitors, as well as the evolving industry trends impacting its operations. This analysis is crucial for assessing SF Holding's competitive environment and its ability to maintain and expand its market position.

SF Holding's position in the market is influenced by various factors, including its service offerings, geographical reach, and technological capabilities. The company faces intense competition in different segments of the logistics industry, requiring it to continuously innovate and adapt to stay ahead. A comprehensive understanding of the competitive landscape is essential for stakeholders, including investors and business strategists, to make informed decisions regarding SF Holding's future prospects.

In China's express delivery market, SF Holding's main rivals include ZTO Express, YTO Express, STO Express, and Best Inc. These companies compete fiercely for market share, especially in the e-commerce sector. They often focus on price and network coverage to attract customers.

Globally, DHL, FedEx, and UPS pose significant challenges to SF Holding. They leverage their extensive global networks and brand recognition to compete in international express and freight forwarding. The acquisition of DHL's supply chain operations in China, Hong Kong, and Macau has strengthened SF Holding's international presence.

Indirect competition comes from regional logistics providers, specialized niche players in areas like cold chain, and large e-commerce platforms developing their own logistics capabilities. The rise of live streaming and social e-commerce is increasing demand for small parcel delivery, creating new pressures.

Mergers and alliances, such as SF Holding's cooperation with Kerry Logistics, reshape the competitive landscape. These partnerships create larger, more integrated entities capable of offering comprehensive logistics solutions. This strategic move helps SF Holding to expand its international business operations.

New and emerging players leveraging advanced technologies or innovative business models could disrupt the traditional landscape. These companies often focus on efficiency and customer experience, putting pressure on established players to adapt. This technological advancement is a key aspect of the SF Holding industry.

The logistics market is constantly evolving, with changes driven by e-commerce growth, technological advancements, and shifting consumer demands. The competitive landscape is shaped by these ongoing changes. For further insights, you can read a Brief History of S.F. Holding.

Several factors drive competition in the logistics industry, influencing SF Holding's market position. These factors include network coverage, pricing strategies, service quality, technological integration, and strategic partnerships. Understanding these elements is crucial for assessing SF Holding's performance and potential for future growth.

- Network Coverage: The extent and efficiency of a logistics network, including domestic and international reach.

- Pricing Strategies: Competitive pricing models that attract customers while maintaining profitability.

- Service Quality: Reliability, speed, and customer service, which are crucial for retaining customers.

- Technological Integration: Use of technology for tracking, automation, and supply chain management.

- Strategic Partnerships: Alliances that enhance capabilities and expand market reach.

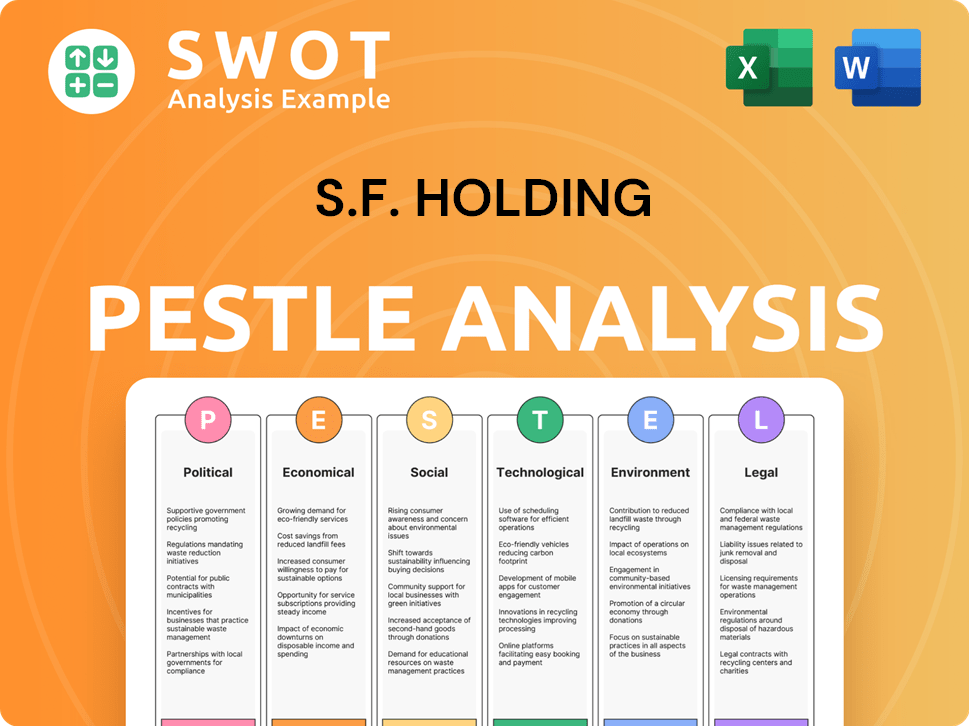

S.F. Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives S.F. Holding a Competitive Edge Over Its Rivals?

Analyzing the competitive landscape of S.F. Holding Company (SF Holding) reveals several key strengths that position it favorably within the logistics industry. The company has strategically built a robust infrastructure and a customer-centric approach, which has allowed it to capture a significant market share. These advantages, combined with continuous innovation, are crucial for its sustained success in a dynamic market.

SF Holding's strategic moves, including investments in technology and network expansion, have been pivotal in its growth. The company's focus on providing high-quality services, such as its time-definite express offerings, has enhanced its brand reputation. This focus, along with operational efficiency, has enabled it to maintain a competitive edge against its rivals.

The competitive edge of SF Holding is evident in its financial performance and market position. The company's ability to adapt to changing market conditions and leverage technological advancements underscores its resilience and future potential. Understanding these strengths is essential for investors and stakeholders assessing the company's long-term prospects.

SF Holding's integrated logistics network, combining air and ground transportation, is a primary competitive advantage. SF Airlines, a subsidiary, operates the largest cargo airline in China with 99 cargo aircraft. This extensive network allows for greater control over delivery speed and reliability, particularly in the express market.

SF Holding leads in technology and R&D. As of June 30, 2024, it held 4,199 patents and patent applications, ranking first among the top four global integrated logistics service providers. The company utilizes AI, big data, and automation to optimize operations, increasing production capacity at key locations by over 8%.

SF Holding has a strong brand and high customer loyalty, ranking first in overall customer satisfaction for 15 consecutive years (2009 to 2023). Its 'SF Shangpai' service exemplifies its commitment to premium service. The company's brand reputation supports its ability to attract and retain customers.

Economies of scale, derived from high parcel volumes (13.3 billion parcels in 2024, a 11.3% year-over-year increase), contribute to cost advantages. The direct operations model provides greater control over service quality. These factors enable competitive pricing and consistent service standards.

SF Holding's competitive advantages are multifaceted, enabling it to maintain a strong position in the market. Its integrated network, technological leadership, brand strength, and operational efficiency are key differentiators. These strengths are further enhanced by a customer-centric approach and continuous innovation, as highlighted in this analysis of the Growth Strategy of S.F. Holding.

- Extensive and integrated logistics network with a large cargo airline.

- Leading technology and R&D capabilities, optimizing operations through AI and automation.

- Strong brand equity and high customer loyalty, reflected in consistent satisfaction rankings.

- Economies of scale and a direct operations model, ensuring cost advantages and service control.

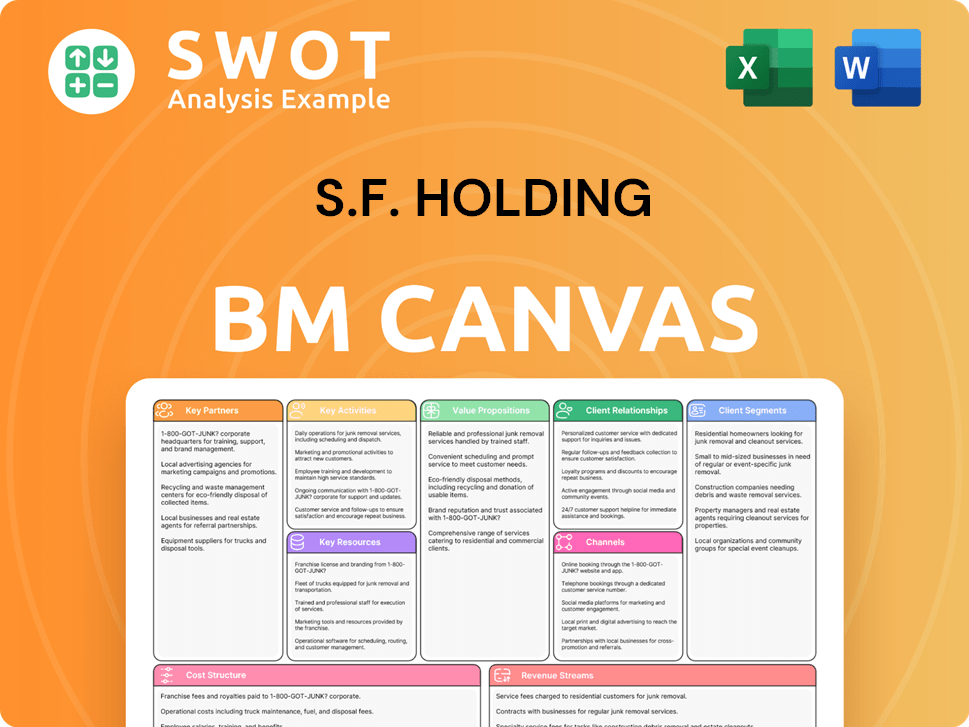

S.F. Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping S.F. Holding’s Competitive Landscape?

The logistics industry, where S.F. Holding Company (SF Holding) operates, is experiencing significant shifts driven by technological advancements, evolving consumer expectations, and global economic factors. The SF Holding market analysis reveals a dynamic environment with intense competition and opportunities for growth. Understanding the competitive landscape is crucial for assessing SF Holding's position and future prospects.

SF Holding faces both risks and opportunities. Intense price competition, geopolitical uncertainties, and the emergence of new market entrants pose challenges. However, the growth of e-commerce, emerging markets, and strategic partnerships provide avenues for expansion. The company's ability to adapt to these changes will determine its long-term success in the SF Holding industry.

Technological advancements, including AI, big data, and automation, are key trends in the logistics sector. Consumer demand for faster and more personalized delivery services is increasing. Regulatory changes, particularly concerning environmental sustainability, also influence the industry. SF Holding leverages these trends to enhance its services.

Intense price competition in the express delivery market, particularly in the economy segment, is a significant challenge. Geopolitical uncertainties and global economic shifts can disrupt supply chains. The emergence of new market entrants and evolving e-commerce business models also pose threats. These factors can impact SF Holding's market share analysis.

The growth of e-commerce, especially cross-border e-commerce, presents substantial opportunities. Emerging markets, particularly within Asia, offer considerable growth potential. Strategic partnerships and innovation in specialized logistics segments can further expand market reach. SF Holding's growth potential is significant.

SF Holding focuses on integrated end-to-end logistics solutions and aims to become a leading digital intelligence logistics provider. The company is strengthening organizational vitality and improving network efficiency. SF Holding invests in R&D (USD 347 million in 2024) to enhance its competitive edge. The company's strategy is crucial for its future.

The logistics industry is rapidly evolving due to technological advancements and changing consumer demands. SF Holding faces challenges like price competition and geopolitical risks but also benefits from e-commerce growth and emerging markets. SF Holding's strategic focus on integrated solutions and digital intelligence positions it for success. For more insights, consider reading a detailed analysis of SF Holding Company.

- Technological innovation is a key driver.

- E-commerce growth offers significant opportunities.

- Strategic partnerships are essential for global reach.

- SF Holding's focus on digital intelligence is crucial.

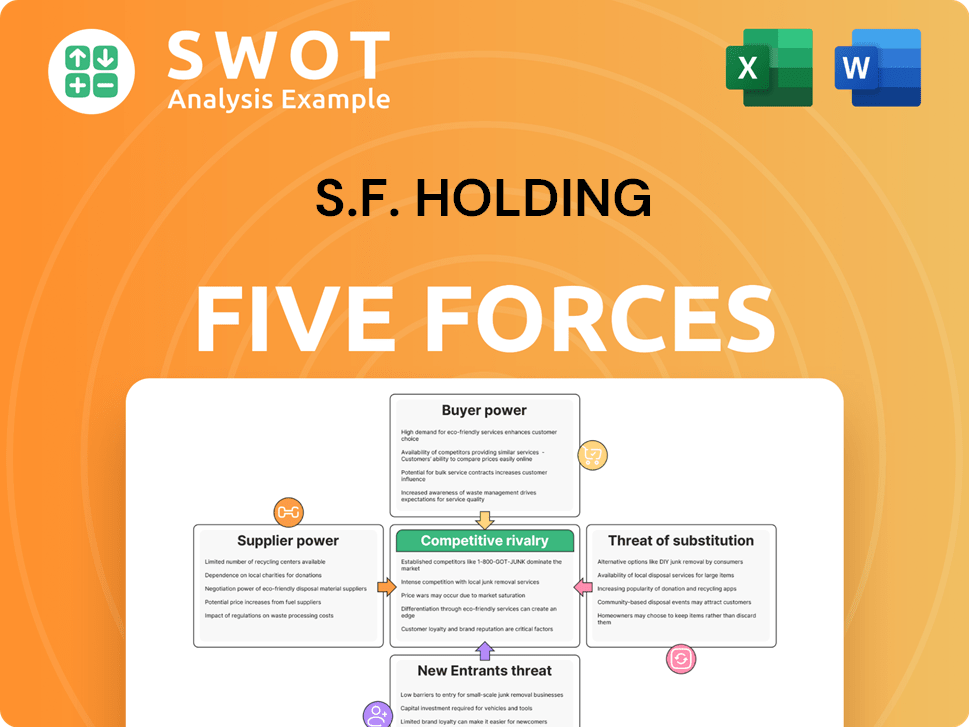

S.F. Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of S.F. Holding Company?

- What is Growth Strategy and Future Prospects of S.F. Holding Company?

- How Does S.F. Holding Company Work?

- What is Sales and Marketing Strategy of S.F. Holding Company?

- What is Brief History of S.F. Holding Company?

- Who Owns S.F. Holding Company?

- What is Customer Demographics and Target Market of S.F. Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.