S.F. Holding Bundle

Who Really Owns S.F. Holding Company?

Unraveling the S.F. Holding SWOT Analysis reveals more than just market strategies; it exposes the very core of its operations: its ownership. Understanding the S.F. Holding Company ownership is crucial for investors and strategists alike. This analysis goes beyond surface-level financials to uncover the intricate web of stakeholders that shape the company's future. Knowing who owns S.F. Holding is the first step to informed decisions.

Founded by Wang Wei, S.F. Holding Company has evolved from a local express service to a global logistics leader. Its recent dual listing on the Hong Kong Stock Exchange underscores its ambition and the evolving ownership structure. This exploration will dissect the company's shareholder landscape, providing insights into the influence of key players and the impact of public offerings. Discover the details of the holding company and its stakeholders.

Who Founded S.F. Holding?

The story of S.F. Holding Company, a significant player in the logistics sector, begins with its founder, Wang Wei. Understanding the early ownership structure is key to grasping the company's trajectory. This chapter delves into the origins and initial ownership of S.F. Holding, offering insights into its foundational years.

Wang Wei established S.F. Holding on March 26, 1993, in Shunde, Guangdong. He started with a small team of six employees, focusing on express delivery services between Shunde, Lufeng, and Hong Kong. His entrepreneurial journey began with a HKD 100,000 loan from his father when he was just 22 years old.

Early operations faced regulatory challenges, as express delivery was considered an 'illegal business'. The company had to operate discreetly to avoid penalties. A pivotal shift occurred between 1999 and 2002, when S.F. Holding transitioned from a franchise model to direct operation, establishing its headquarters in Futian, Shenzhen, in 2002. This move aimed to improve control and service quality.

Wang Wei founded S.F. Holding Company. He was the driving force behind the company's early growth.

The initial capital came from a HKD 100,000 loan from Wang Wei's father. This seed funding was crucial for starting the business.

The company initially focused on express delivery services. These services connected key locations like Shunde, Lufeng, and Hong Kong.

Early operations faced regulatory hurdles. Express delivery was considered an 'illegal business' at the time.

A significant change was the move from a franchise model to direct operation. This shift aimed to improve control and service quality.

S.F. Holding pioneered the use of chartered air freight. This innovation set a new standard in the express delivery industry.

While specific details of the initial equity splits aren't widely available, Wang Wei is recognized as the founder and majority owner of S.F. Holding. The company's growth was driven by its unique operational model and expansion strategies. For more detailed information on the company's evolution, you can refer to this article about S.F. Holding Company. The company's early strategic decisions and ownership structure laid the groundwork for its future success in the competitive logistics market. The focus on direct operations and air freight further solidified its position. The company's ability to adapt and innovate has been key to its growth. The ownership of S.F. Holding Company has been a critical factor in its strategic decisions and market position.

S.F. Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has S.F. Holding’s Ownership Changed Over Time?

The ownership structure of S.F. Holding Company has seen significant shifts since its inception. A pivotal moment was the backdoor listing in January 2017 on the Shenzhen A-share market. Maanshan Dingtai Rare Earth & New Material Co., Ltd. acquired 100% of S.F. Holding for RMB 44.3 billion. Following this, Mingde Holding, controlled by founder Wang Wei, became the controlling shareholder, holding 64.58% of the shares. In February 2017, Maanshan Dingtai Rare Earth & New Material Co., Ltd. was officially renamed S.F. Holding Co., Limited.

In November 2024, S.F. Holding achieved a secondary listing on the Hong Kong Stock Exchange, making it the first logistics company with dual listings in China and Hong Kong. This move aimed to raise up to HKD 6.2 billion through the sale of 170 million shares. The IPO raised net proceeds of USD 727.49 million. These strategic moves have reshaped the company's financial capabilities and international expansion plans, particularly in Asia.

| Ownership Category | Percentage (as of August 2024) | Key Details |

|---|---|---|

| Private Companies | 51% | Largest stake; includes Shenzhen Mingde Holding Development Co., Ltd. |

| Individual Investors | 30% | Significant portion of ownership. |

| Institutional Investors | 17% | Includes Huatai-PineBridge Fund Management Co., Ltd., Bank of Communications Schroder Fund Management Co., Ltd., and E Fund Management Co., Ltd. |

As of August 2024, private companies hold the largest stake in S.F. Holding, with 51% ownership. Shenzhen Mingde Holding Development Co., Ltd., controlled by Wang Wei, remains the largest single shareholder, holding a 51% stake. Individual investors hold approximately 30%, while institutional ownership stands at 17%. This ownership structure significantly influences S.F. Holding's strategic decisions, including its international expansion and financial strategies. For more insights, exploring the Competitors Landscape of S.F. Holding can provide additional context.

Understanding the ownership structure of S.F. Holding is crucial for investors and stakeholders.

- Wang Wei, through Mingde Holding, maintains significant control.

- The Hong Kong IPO enhanced international expansion.

- Institutional investors play a key role in the company's financial strategy.

- Private companies have the largest ownership share.

S.F. Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on S.F. Holding’s Board?

As of June 2025, the Board of Directors of S.F. Holding Co., Ltd. includes both executive and independent non-executive directors. Mr. Wang Wei, the founder and de facto controller, serves as the chairman, executive director, general manager, and chief executive officer. His significant ownership through Shenzhen Mingde Holding Development Co., Ltd. gives him substantial control. Other executive directors include Mr. Ho Chit, Ms. Wang Xin, and Mr. Xu Bensong. Mr. Ho Chit also holds the position of Chief Financial Officer. The independent non-executive directors are Mr. Chan Charles Sheung Wai, Mr. Lee Carmelo Ka Sze, and Dr. Ding Yi.

The composition of the board and the S.F. Holding Company ownership structure are crucial for understanding the company's governance. The presence of independent directors is a positive sign, potentially ensuring a degree of oversight. However, Mr. Wang Wei's multiple roles and significant shareholding position him as a key decision-maker, influencing the company's strategic direction. For additional insights, consider reading about the Target Market of S.F. Holding.

| Director | Position | Details |

|---|---|---|

| Wang Wei | Chairman, Executive Director, General Manager, CEO | Founder and de facto controller |

| Ho Chit | Executive Director, CFO | |

| Wang Xin | Executive Director | |

| Xu Bensong | Executive Director | |

| Chan Charles Sheung Wai | Independent Non-Executive Director | |

| Lee Carmelo Ka Sze | Independent Non-Executive Director | |

| Ding Yi | Independent Non-Executive Director |

Regarding the voting structure and ownership structure, SF Holding operates with publicly traded A shares on the Shenzhen Stock Exchange and H shares on the Hong Kong Stock Exchange. While the principle of 'one share, one vote' is generally considered a hallmark of good corporate governance, the available information does not explicitly detail a dual-class share structure with differential voting rights beyond the general understanding that Shenzhen Mingde Holding Development Co., Ltd.'s significant stake grants Wang Wei outsized control. Shareholders holding shares of the same class generally enjoy the same rights and assume the same obligations. In 2024, SF Holding proposed a final cash dividend distribution of RMB 4.4 per 10 shares, representing a 40% dividend payout ratio.

Understanding the S.F. Holding Company ownership is critical for investors and stakeholders.

- Wang Wei, the founder, has significant control through Shenzhen Mingde Holding Development Co., Ltd.

- The board includes both executive and independent non-executive directors.

- The company has a dual listing, but the voting structure is not explicitly dual-class.

- Dividend payouts and share buyback programs are evidence of commitment to shareholder value.

S.F. Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped S.F. Holding’s Ownership Landscape?

Over the last few years (2022-2025), S.F. Holding has actively managed its ownership structure to boost shareholder value. A key strategy has been share repurchase programs. Since 2022, the company has dedicated RMB 4.8 billion to these initiatives, including RMB 1.8 billion in repurchases since 2024. Between April 30, 2024, and January 31, 2025, S.F. Holding repurchased 20,771,358 A shares for RMB 758 million under its 2024 plan. By April 7, 2025, it completed the repurchase of 23,270,358 shares, representing 0.48% of its total share capital, for RMB 859 million, as part of the buyback announced on April 29, 2024. These actions highlight the company's confidence and commitment to returns.

A significant development was the secondary listing on the Hong Kong Stock Exchange in November 2024 (Stock Code: 6936). This move made S.F. Holding the first logistics company to be dual-listed in both China's A-share and Hong Kong's H-share markets. This listing aimed to raise capital for international expansion and to strengthen its global brand. Cornerstone investors for the Hong Kong IPO included Xiaomi, Oaktree Capital Management, and a vehicle backed by the family of Henry Cheng Kar-shun. For more on the company's past, check out the Brief History of S.F. Holding.

| Ownership Category | Percentage | Details |

|---|---|---|

| Founder (Wang Wei via Shenzhen Mingde Holding Development Co., Ltd.) | 51% | Maintains a significant majority stake |

| Institutional Investors | 17% | Significant institutional investment |

| Individual Investors | 30% | Represents a substantial portion of ownership |

The company's ownership structure also reflects broader industry trends. There's a rise in institutional ownership, and the dual listing in Hong Kong aligns with Chinese companies seeking international capital and global presence. Public statements from S.F. Holding indicate a focus on internationalization, with the Hong Kong listing playing a key role in optimizing its international brand image. The 2024 annual report, approved in March 2025, and the 2025 first quarterly report, released in April 2025, provide more details on its financial performance and strategic direction.

S.F. Holding Company's ownership structure has evolved with strategic moves like share buybacks and a dual listing.

The company has allocated billions to share repurchase programs, showing confidence in future growth and returns.

The secondary listing on the Hong Kong Stock Exchange in November 2024 aimed to expand internationally.

Institutional ownership is rising, and the founder maintains a significant stake. This showcases the current ownership structure.

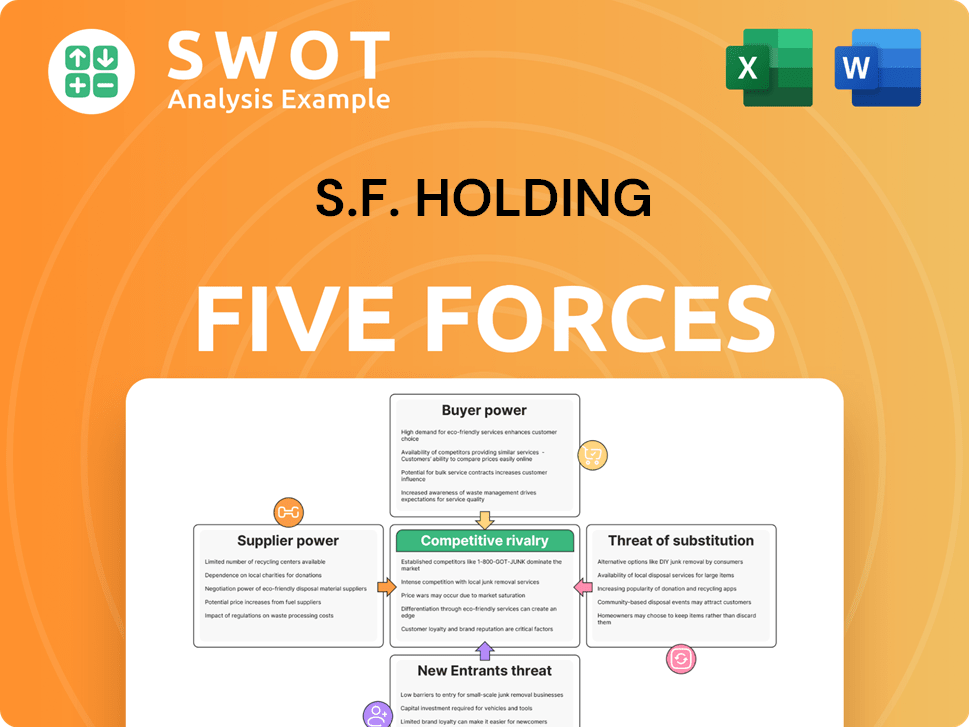

S.F. Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of S.F. Holding Company?

- What is Competitive Landscape of S.F. Holding Company?

- What is Growth Strategy and Future Prospects of S.F. Holding Company?

- How Does S.F. Holding Company Work?

- What is Sales and Marketing Strategy of S.F. Holding Company?

- What is Brief History of S.F. Holding Company?

- What is Customer Demographics and Target Market of S.F. Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.