S.F. Holding Bundle

Who Does SF Holding Company Serve?

In the fast-paced world of logistics, understanding the S.F. Holding SWOT Analysis is crucial for any company aiming for success. For SF Holding Company, a deep dive into its customer demographics and target market reveals the core of its strategic prowess. This analysis is essential for investors, strategists, and anyone seeking to understand the company's trajectory in the global market.

This exploration of SF Holding Company's customer base will uncover the intricacies of its market segmentation and customer profile. We'll delve into the demographic analysis, identifying the typical customers and their geographic locations. Furthermore, we'll explore customer buying behavior and how SF Holding Company adapts to meet the evolving needs and preferences of its target market, including insights into customer age range, income levels, and the industries it serves, providing a comprehensive understanding of its operational strategies.

Who Are S.F. Holding’s Main Customers?

Understanding the customer demographics and target market of S.F. Holding Company is crucial for grasping its market position and growth trajectory. The company caters to a diverse customer base, spanning both individual consumers (B2C) and businesses (B2B). This dual approach is common in the courier, express, and parcel (CEP) sector, where the B2C segment often holds a significant market share.

The company's success is closely tied to the burgeoning e-commerce industry, a primary driver of growth in the CEP market. This market is projected to reach a staggering US$595.32 billion globally by 2031, with an impressive 8.5% compound annual growth rate (CAGR) from 2025 to 2031. S.F. Holding's economy express segment, focused on e-commerce clients, saw a substantial increase in parcel volume, with an 18% year-over-year rise in 2024, and revenue growth of 11.8%.

For the B2B segment, S.F. Holding serves various industries, including high-tech, automotive, and industrial manufacturing. Revenue in these sectors experienced robust growth in 2024, with increases exceeding 20% year-over-year. The company's strategic focus on enterprise-level clients is evident, with approximately 95% of China's Top 500 Enterprises and over 45% of Fortune China 500 companies utilizing its international logistics services.

The primary customer demographics for S.F. Holding's B2C segment are largely influenced by the e-commerce boom. This includes a broad range of consumers who frequently purchase goods online. The company's economy express services are tailored to meet the needs of these customers, offering efficient and cost-effective delivery solutions.

S.F. Holding's B2B customer base is diverse, encompassing industries like high-tech, automotive, and industrial manufacturing. These businesses require comprehensive logistics solutions for supply chain management. The company's focus on enterprise-level clients, including a significant portion of China's top companies, underscores its commitment to providing integrated services.

S.F. Holding strategically expands its market share by diversifying its product mix. While it leads in China's time-definite express segment, its broader express delivery market share was 9.06% in 2023. The company is focused on increasing its high-end market share by penetrating customers' upstream and downstream supply chain scenarios, offering integrated logistics services.

- The company's target market analysis reveals a focus on both B2C and B2B segments.

- Customer segmentation strategies include offering economy express services for e-commerce and comprehensive logistics for businesses.

- Demographic analysis shows a strong presence among China's top enterprises.

- The ideal customer profile includes both individual consumers and businesses needing reliable and efficient delivery solutions.

For more insights into the company's structure, you can read about the Owners & Shareholders of S.F. Holding.

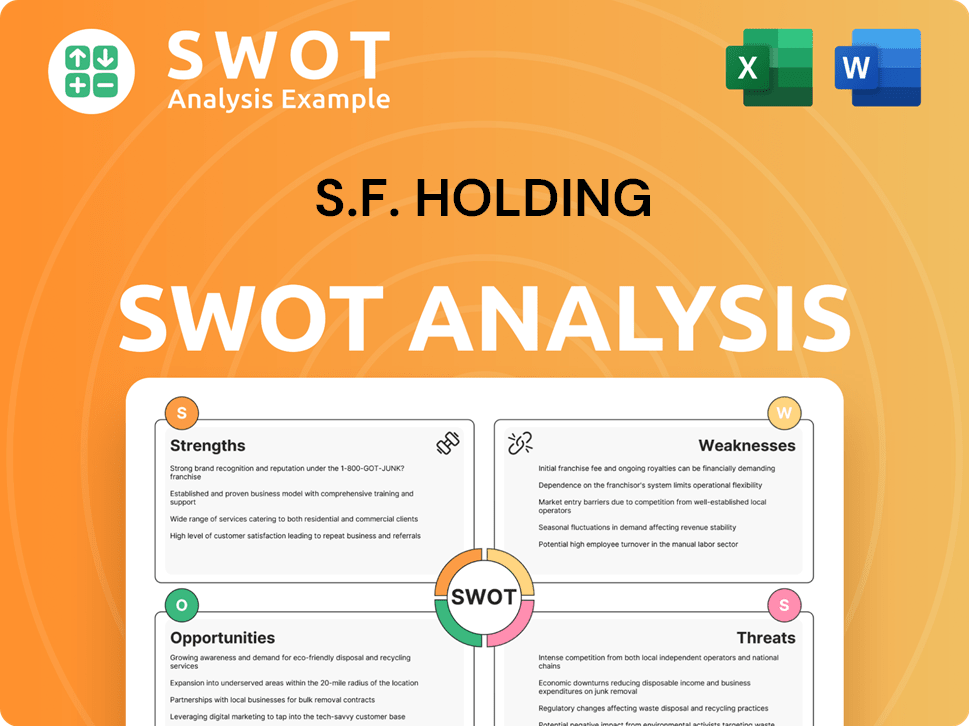

S.F. Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do S.F. Holding’s Customers Want?

Understanding the customer needs and preferences is crucial for S.F. Holding Company to maintain its market position and drive growth. The company's customer base primarily values speed, accuracy, and reliability in delivery services. These factors are essential in the competitive logistics industry, influencing customer satisfaction and loyalty.

The demand for time-sensitive express services highlights the importance of timeliness and rapid delivery. S.F. Holding's focus on these aspects is evident in the performance of its time-definite express segment. In the e-commerce sector, customers seek competitive pricing and efficient delivery, which is a key driver for the economy express business.

Customers of S.F. Holding, including both B2C and B2B clients, increasingly require integrated, end-to-end logistics solutions. This includes a range of services such as warehousing, transportation, sorting, and distribution. The company's ability to adapt to these needs is crucial for maintaining its competitive edge.

Customers prioritize timeliness, frequent parcel pick-ups, and rapid delivery. This segment recorded 5.8% revenue growth to RMB122.2 billion in 2024. Annual parcel volume increased by 12%.

Customers in this sector seek competitive pricing and efficient delivery. The economy express business saw an 18% year-over-year increase in parcel volume in 2024.

Both B2C and B2B customers demand end-to-end logistics services, including warehousing and distribution. This is particularly important for industries like e-commerce, retail, and manufacturing.

S.F. Holding continuously enhances its portfolio to cover freight, cold chain, pharmaceutical logistics, and more. This expansion aims to meet diverse customer needs across various sectors.

These factors significantly influence product development and service tailoring. The company's goal is to meet diverse customer needs by leveraging its extensive product portfolio.

Structural cost-saving initiatives enable competitive pricing strategies. The freight segment experienced over 20% annual growth in shipment volume in 2024 due to these strategies.

The primary needs of customers are fast, accurate, and reliable delivery services. The company aims to meet the diverse needs of its customer base by continuously enhancing its product and service capabilities.

- Speed and Timeliness: Essential for express services.

- Competitive Pricing: Crucial for the e-commerce sector.

- Integrated Solutions: Demand for end-to-end logistics services.

- Reliability: Ensuring accurate and dependable delivery.

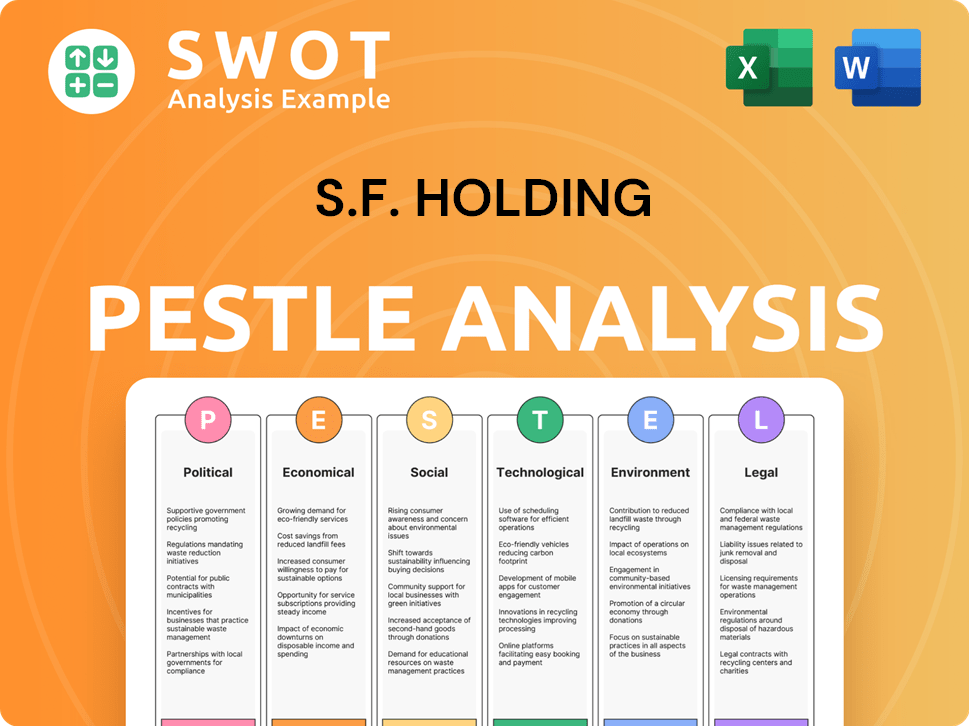

S.F. Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does S.F. Holding operate?

The geographical market presence of S.F. Holding Company is primarily rooted in China, where it has established a robust and efficient logistics network. This strong domestic foundation is critical, especially given the rapid growth of the Chinese express logistics industry, which continues to set new records in volume and revenue as of 2024. The company's dominance in China's time-definite express segment and leadership across five logistics sub-segments highlight its strategic importance in the region.

Beyond its strong presence in China, S.F. Holding is significantly expanding its international footprint, particularly across Asia. The company aims to become 'The One In Asia' by building comprehensive service capabilities that cover international express delivery, freight forwarding, supply chain management, and last-mile logistics in key Asian markets. This strategic focus on Asia is part of a broader global expansion plan designed to connect Asia with the rest of the world.

The Asia Pacific region is a key area for the courier, express, and parcel market, leading globally in revenue share in 2024 and is projected to have the highest CAGR during the forecast period. This aligns with S.F. Holding's aggressive international expansion, which saw its supply chain and international business revenue grow by 17.5% year-over-year in 2024, reaching RMB70.5 billion. The company’s strategy includes customizing its offerings and marketing efforts to provide integrated end-to-end logistics solutions that offer both cost-efficiency and premium services to its customers.

S.F. Holding Company's primary market is China, where it leads in the time-definite express segment. It also holds a leading position across express, freight, cold chain, intra-city on-demand delivery, and supply chain logistics. The growth in the Chinese express logistics industry continues to be strong, reaching new heights in 2024.

Asia is a top priority for S.F. Holding's international growth, with a goal to become 'The One In Asia'. The company is building comprehensive service capabilities for international express delivery, freight forwarding, supply chain management, and last-mile logistics in key Asian markets. This expansion includes '0-to-1-to-N breakthroughs' in international supply chain projects across various countries.

Over 45% of Fortune China 500 companies use S.F. Holding's international logistics services. In 2024, the company won bids for more than 100 overseas supply chain projects. This highlights the company's ability to secure significant contracts and serve major clients globally.

The Asia Pacific region leads the global courier, express, and parcel market in revenue share in 2024 and is expected to have the highest CAGR. This supports S.F. Holding's strategic focus on expanding its international presence in this region. This expansion is key to the company's growth.

S.F. Holding's supply chain and international business revenue grew by 17.5% year-over-year in 2024, reaching RMB70.5 billion. This growth is driven by its strategic expansion and localization efforts. The company focuses on providing customized solutions to deliver both cost-efficiency and premium services.

S.F. Holding aims to become a leading global logistics company connecting Asia and the world. By focusing on customized solutions and strategic expansion, the company is well-positioned for continued growth. This strategic vision drives its operations and market approach.

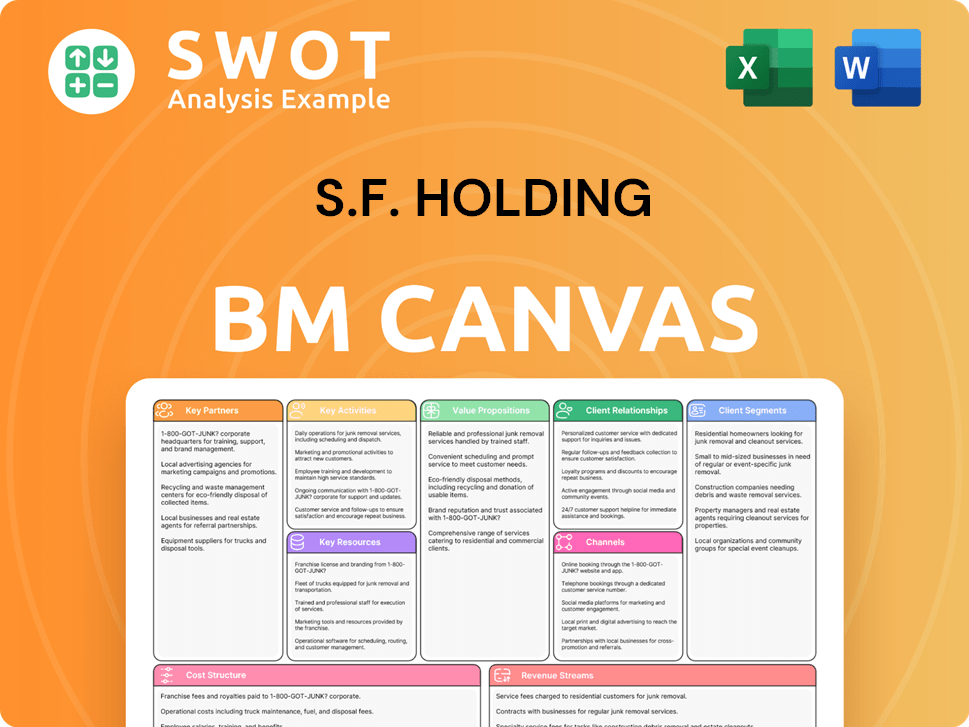

S.F. Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does S.F. Holding Win & Keep Customers?

S.F. Holding Company employs a strategic, multi-faceted approach to both acquire and retain customers. Their customer acquisition strategy focuses on enhancing the competitiveness of time-sensitive services while expanding into emerging industries and new business scenarios. This involves penetrating broader production and consumer logistics markets with cost-effective services to meet diverse business needs. The company’s economy express segment is a key acquisition channel.

Customer retention is a critical focus for S.F. Holding, as it is more cost-effective than acquiring new customers and significantly boosts brand loyalty. The company aims to improve retention by continuously enhancing its backbone logistics network efficiency and operational model reforms, which drive cost reductions and efficiency improvements. High customer satisfaction, reported to be over 99% in China for express services, directly contributes to retention.

S.F. Holding leverages its extensive network and integrated service offerings to achieve its customer acquisition and retention goals. This includes providing personalized experiences and tailored solutions to meet specific customer needs, a key factor in fostering customer loyalty. The company's full-chain technology, such as SF Intra-city's City Logistics System (CLS), is used to optimize order matching and rider allocation across industries and multi-scenarios, enhancing service experience and operational efficiency. For more insights, see Growth Strategy of S.F. Holding.

S.F. Holding focuses on strengthening the competitiveness of its time-sensitive services. They aim to expand their customer base in emerging industries and new business scenarios. Penetrating broader production and consumer logistics markets with cost-efficient services is a key strategy.

The economy express segment, catering to e-commerce customers, is a significant acquisition channel. This segment demonstrates a competitive edge. In 2024, parcel volume (excluding Fengwang) increased by 18%.

Emphasis is placed on continuous improvement of the backbone logistics network. Operational model reforms are implemented to drive cost reductions and efficiency enhancements. High customer satisfaction is a primary focus.

Customer satisfaction for express services in China is reported to be over 99%. Personalized experiences and tailored solutions are provided to meet specific customer needs. Full-chain technology enhances service experience and operational efficiency.

The economy express segment is a vital channel for acquiring new customers. This segment's growth highlights its importance. The company's focus on e-commerce customers drives this channel's success.

Efficiency improvements are central to S.F. Holding's retention strategy. Backbone logistics network enhancements are continuously implemented. These improvements lead to cost reductions.

The intra-city segment showcases successful strategies. In 2024, this segment achieved 22.4% revenue growth. Net profit for this segment surged by 162%.

Full-chain technology enhances service delivery. The City Logistics System (CLS) optimizes operations. This technology improves both service and efficiency.

Customer satisfaction is a key performance indicator. High satisfaction rates contribute to retention. S.F. Holding prioritizes customer feedback.

Tailored solutions are provided to meet specific customer needs. This personalized approach builds customer loyalty. This strategy is a key part of retention efforts.

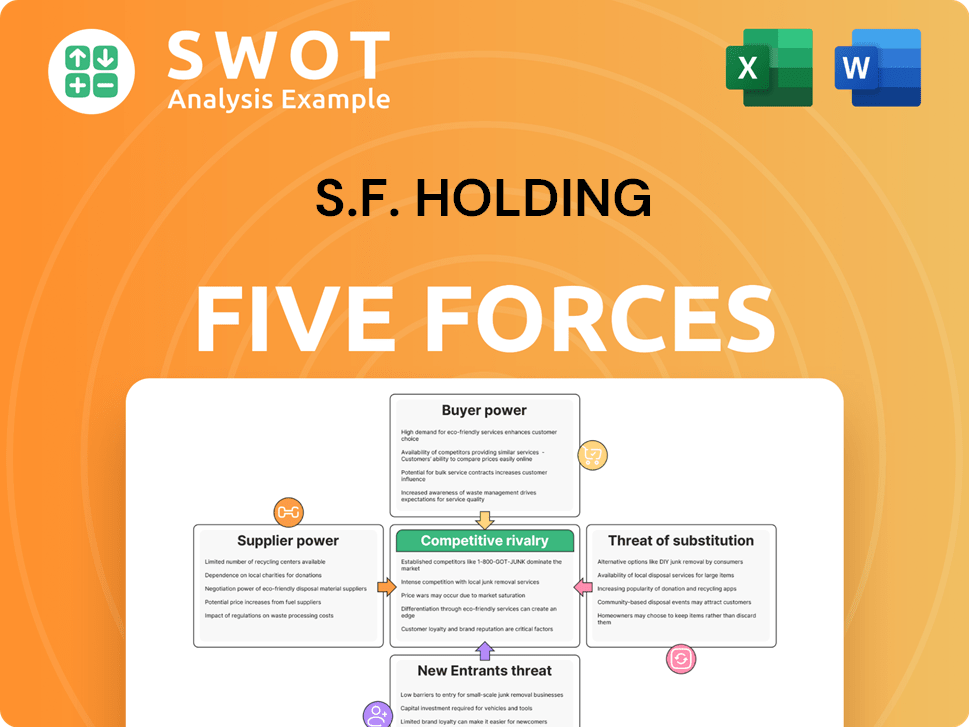

S.F. Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of S.F. Holding Company?

- What is Competitive Landscape of S.F. Holding Company?

- What is Growth Strategy and Future Prospects of S.F. Holding Company?

- How Does S.F. Holding Company Work?

- What is Sales and Marketing Strategy of S.F. Holding Company?

- What is Brief History of S.F. Holding Company?

- Who Owns S.F. Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.