S.F. Holding Bundle

How Does S.F. Holding Company Thrive in the Logistics World?

S.F. Holding Company, a powerhouse in integrated logistics, has rapidly ascended to become a dominant force, particularly in Asia. Founded in 1993, it now stands as the largest integrated logistics service provider in Asia and the fourth largest globally by revenue. This impressive growth trajectory makes understanding the S.F. Holding SWOT Analysis crucial for anyone seeking to navigate the complexities of the global logistics market.

This deep dive into SF Holding explores its core SF Holding operations, from express delivery to supply chain solutions, and examines its impressive financial performance. In the first quarter of 2025, the company demonstrated robust growth, achieving significant year-on-year increases in both revenue and parcel volume. We'll uncover how SF Holding logistics strategies, including its technological advancements and strategic expansions, contribute to its continued success and its impact on the Chinese e-commerce market.

What Are the Key Operations Driving S.F. Holding’s Success?

The core operations of S.F. Holding Company revolve around providing a comprehensive suite of logistics services. This includes express delivery, supply chain solutions, and e-commerce services, catering to both businesses and individual consumers. The company's business model is built on a foundation of diverse offerings designed to meet a wide range of logistical needs.

Key services offered by SF Holding include time-definite express, economy express, freight delivery, cold chain and pharmaceutical logistics, and intra-city on-demand delivery. These services are supported by a robust network and advanced technologies, ensuring efficient and reliable delivery solutions. This comprehensive approach allows SF Holding to serve various industries effectively.

The company's value proposition lies in its ability to offer fast, accurate, and efficient logistics solutions. This is achieved through a combination of a directly operated network, technological integration, and customized solutions. The focus on customer satisfaction and operational excellence positions SF Holding as a leader in the logistics industry. For more insights, you can explore the Growth Strategy of S.F. Holding.

The operational backbone of SF Holding is its 'triple play' network. This includes an aviation network, a ground network, and an information network. This integrated structure ensures high stability and control over service quality. This allows for comprehensive management of the entire logistics process.

SF Holding leverages advanced technologies such as big data, AI, and cloud computing. The company uses digital twin technology for real-time optimization. This has increased production capacity at key locations by over 8%, demonstrating their commitment to innovation. This enhances efficiency and smart logistics capabilities.

SF Holding's supply chain and international business have shown significant growth. Revenue increased by 9.9% year-on-year in Q1 2025. This growth is supported by strategic partnerships and robust distribution networks. This demonstrates the company's expanding global footprint.

The company serves a broad spectrum of customer segments. This includes businesses across various industries and individual consumers. This diversity in customer base helps SF Holding maintain a strong market position. This wide reach ensures stability and growth.

The uniqueness of SF Holding's operations stems from its directly operated network, advanced technological integration, and customized solutions. This combination results in fast and accurate delivery, enhanced efficiency, and improved customer satisfaction. This approach creates a competitive advantage in the logistics market.

- Extensive Directly Operated Network: Ensures control and reliability.

- Advanced Technological Integration: Enhances efficiency and optimization.

- Focus on Customized Integrated Solutions: Tailored to meet specific customer needs.

- Strategic Partnerships: Support end-to-end logistics solutions.

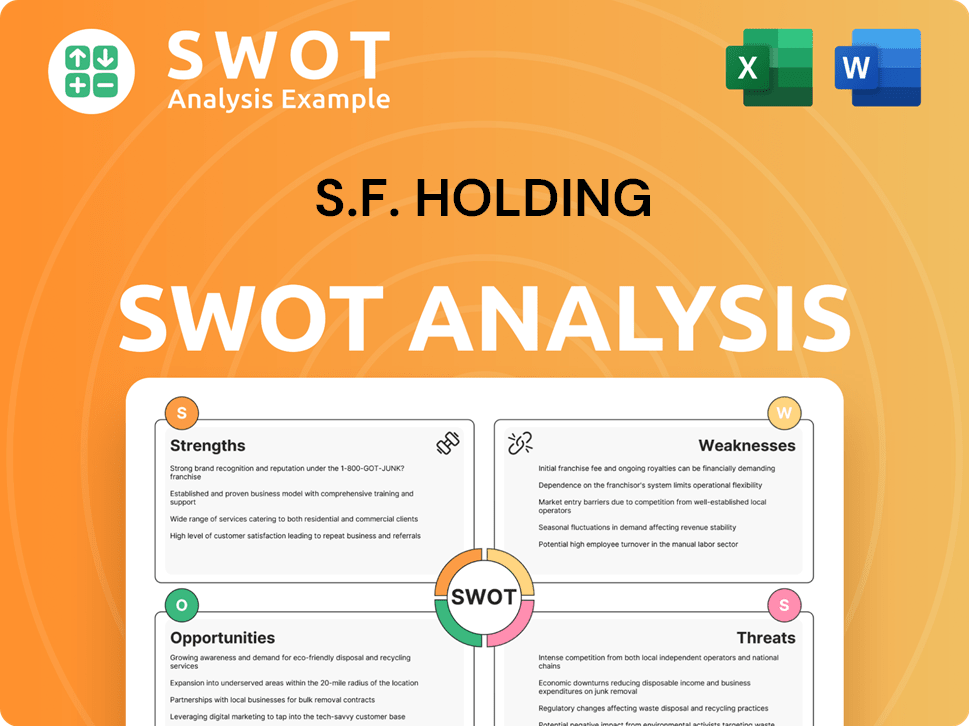

S.F. Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does S.F. Holding Make Money?

The revenue streams and monetization strategies of S.F. Holding Company are multifaceted, reflecting its extensive integrated logistics service model. The company generates revenue through several key segments, including express logistics, supply chain, and international business. This diversified approach allows SF Holding to cater to a broad range of customer needs and market demands.

In the first quarter of 2025, S.F. Holding reported a total operating revenue of RMB 69.85 billion, marking a 6.9% year-on-year increase. This growth indicates the company's strong performance and its ability to expand its business operations. The following sections will delve into the specifics of each revenue stream and the strategies employed to maximize revenue.

SF Holding operations are primarily driven by two major segments: express logistics and supply chain and international business. These segments are crucial for understanding the company's financial performance and its approach to the market. The express logistics business focuses on time-definite express, economy express, freight delivery, cold chain and pharmaceutical logistics, and intra-city on-demand delivery services. The supply chain and international business includes international express, international freight forwarding, and supply chain management.

The express logistics business is a significant revenue contributor for S.F. Holding. This segment saw a 7.2% year-on-year increase in revenue during Q1 2025, driven by enhanced product offerings and improved service competitiveness. As of April 2025, the express logistics business generated RMB 18.003 billion in revenue, an 11.85% year-on-year increase, with parcel volume growing by 29.99%. This growth is supported by the company's focus on expanding its service portfolio and ensuring high-quality delivery services. SF Holding services are designed to meet diverse customer needs, from standard deliveries to specialized logistics solutions.

- Time-definite express services ensure rapid delivery.

- Economy express offers cost-effective shipping options.

- Freight delivery handles larger shipments.

- Cold chain and pharmaceutical logistics provide temperature-controlled transport.

- Intra-city on-demand delivery caters to immediate needs.

The supply chain and international business segment is another crucial revenue stream, demonstrating robust growth. This segment achieved a 9.9% year-on-year increase in Q1 2025. In 2024, this segment generated RMB 70.5 billion in revenue, marking a 17.5% year-over-year increase. In April 2025, this business contributed RMB 5.912 billion, a 14.20% year-on-year increase. SF Holding logistics solutions in this segment include international express, international freight forwarding, and supply chain management services. The company's international expansion strategy and its ability to handle cross-border shipping are key drivers of this growth.

- International express services provide fast global shipping.

- International freight forwarding manages complex shipments.

- Supply chain business offers comprehensive logistics solutions.

SF Holding employs innovative monetization strategies to enhance its revenue streams. One key strategy is offering customized integrated end-to-end logistics solutions tailored to specific customer needs. This approach deepens business integration and fosters long-term partnerships. The company also focuses on penetrating various logistics scenarios within the manufacturing and consumer sectors, leading to steady business scale enlargement. For more insights into the company's marketing approach, consider reading Marketing Strategy of S.F. Holding.

- Customized solutions for specific customer requirements.

- Focus on manufacturing and consumer sectors.

- Expansion of service offerings.

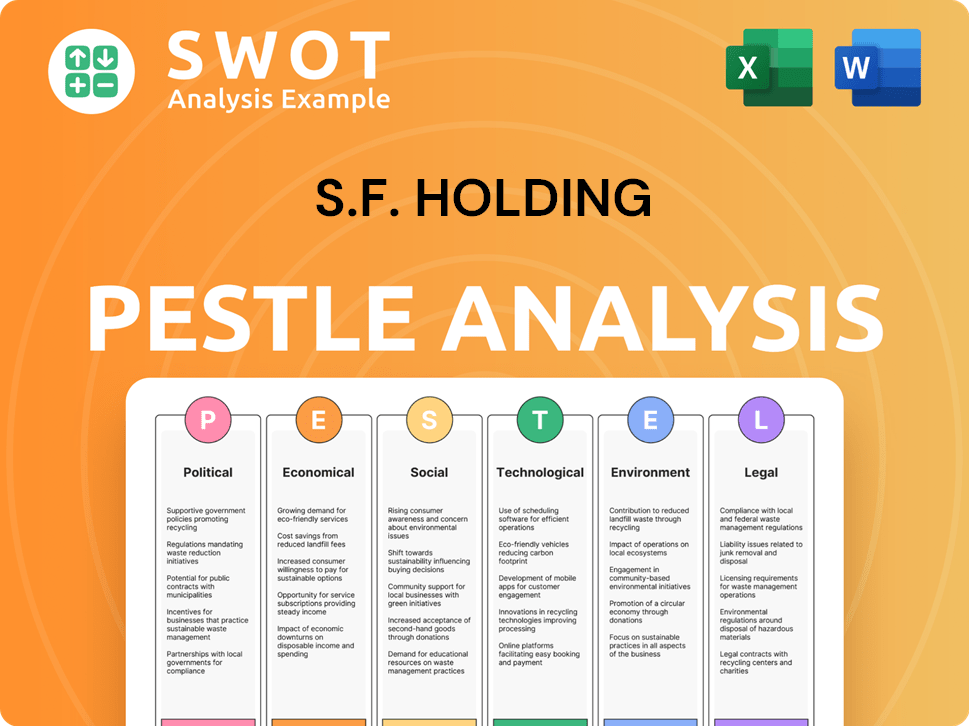

S.F. Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped S.F. Holding’s Business Model?

S.F. Holding Company has achieved significant milestones that have shaped its operational and financial performance. A key moment was its listing on the Shenzhen Stock Exchange, followed by a successful listing on the Hong Kong Stock Exchange in November 2024. These strategic moves have provided the company with the capital needed to expand its logistics capabilities and enhance its domestic and international networks.

The company's direct operation model, implemented since 2005, has been instrumental in standardizing customer service and operational management. This approach has enhanced brand reputation and customer loyalty. Despite facing challenges such as price wars in the express delivery sector, the company has adapted by strengthening lean operations and leveraging technology for efficiency.

S.F. Holding's competitive advantages are multifaceted, including its extensive 'triple play' logistics network and continuous investment in technology. The company's strategy of deepening its 'The One in Asia' approach and expanding internationally, coupled with its focus on tailored integrated logistics solutions, allows it to adapt to evolving market trends and competitive threats. For more details on the company's ownership structure, you can refer to Owners & Shareholders of S.F. Holding.

Listing on the Shenzhen Stock Exchange and the Hong Kong Stock Exchange in November 2024. The Hong Kong listing raised CNY 5.3 billion to strengthen international and cross-border logistics. The direct operation model, implemented since 2005, standardized customer service and operational management.

Continuous strengthening of lean operations and management. Enhancing efficiency through technological empowerment. In 2024, structural cost-saving initiatives drove over 20% annual growth in shipment volume for its freight segment. Expanding internationally and focusing on tailored integrated logistics solutions.

Extensive 'triple play' logistics network (aviation, ground, information). Strong brand strength and high customer satisfaction (over 99%). Continuous investment in technology, including AI and big data for demand forecasting and route planning. Focus on tailored integrated logistics solutions.

SF Holding's financial performance benefits from its strategic moves and competitive advantages. The company focuses on cost optimization through lean operations and technological advancements. These efforts have resulted in competitive pricing strategies, driving significant growth in shipment volume. The company's ability to adapt to market challenges and leverage its strengths has contributed to its overall financial success.

SF Holding's competitive advantages are crucial to its success in the logistics industry. Its integrated logistics service capabilities and brand strength are significant differentiators. The company's continuous investment in technology, including AI and big data, further enhances its ability to provide efficient and reliable services.

- Extensive 'triple play' logistics network.

- High customer satisfaction rates.

- Continuous investment in technology.

- Focus on tailored integrated logistics solutions.

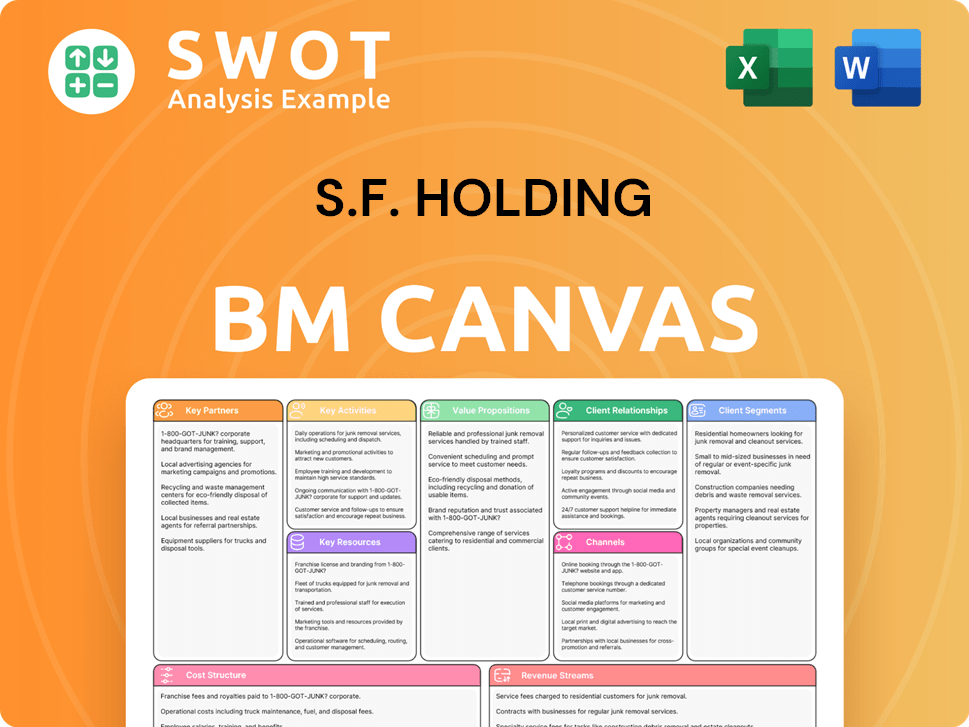

S.F. Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is S.F. Holding Positioning Itself for Continued Success?

S.F. Holding Company (SF Holding) holds a commanding position in the logistics industry. As of 2023, it was the largest integrated logistics service provider in China and Asia and the fourth largest globally by total revenue. This strong standing is supported by its extensive network and comprehensive service offerings, making it a key player in the market.

Despite its robust market position, SF Holding faces various challenges. Intense competition from rivals like JD Logistics and Cainiao, regulatory changes, and evolving consumer preferences are significant factors. The logistics sector is dynamic, and SF Holding must navigate these risks to maintain its leadership.

SF Holding serves approximately 2.3 million active monthly customers and 730 million individual members. Its services cover 100% of cities and 2,813 counties in China. The company's direct operation model and integrated services contribute to its high market share.

Key risks include competition from JD Logistics, Cainiao, and J&T Express, which erode SF Holding's dominance. Regulatory changes and technological disruptions also pose challenges. A decrease in the value per parcel was observed in Q1 2025, even with increased parcel volume, indicating market pressures.

SF Holding is focusing on revenue growth through strategic initiatives. These include expanding its 'The One in Asia' strategy and penetrating the supply chains of major industries. Technological advancements and a digitalized supply chain ecosystem are also central to its future plans.

SF Holding's business model is centered around an integrated logistics service, which includes express delivery, freight, cold chain, intra-city delivery, and supply chain solutions. This comprehensive approach allows them to serve a wide range of customers and maintain a strong market position. For more insights into SF Holding's growth strategy, see Growth Strategy of S.F. Holding.

SF Holding aims to deepen its presence in key Asian markets, offering international express delivery, freight forwarding, and supply chain management. The company is also focusing on accelerating its penetration into the supply chains of customers across major industries to expand market share.

- Expanding 'The One in Asia' strategy.

- Penetrating supply chains across major industries.

- Enhancing technological capabilities.

- Building a digitalized supply chain ecosystem.

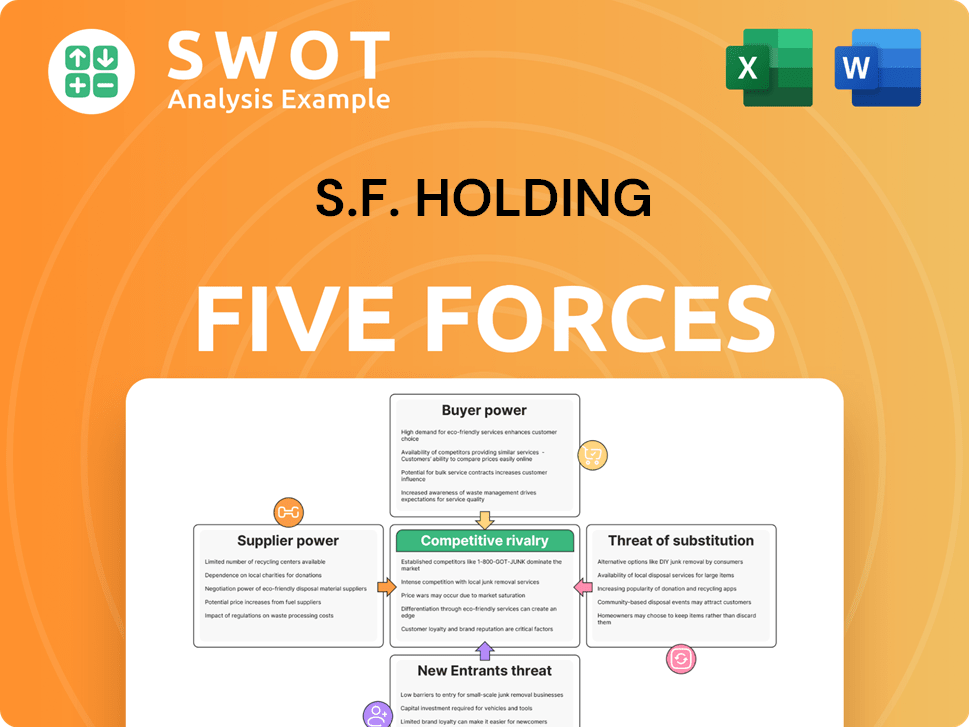

S.F. Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of S.F. Holding Company?

- What is Competitive Landscape of S.F. Holding Company?

- What is Growth Strategy and Future Prospects of S.F. Holding Company?

- What is Sales and Marketing Strategy of S.F. Holding Company?

- What is Brief History of S.F. Holding Company?

- Who Owns S.F. Holding Company?

- What is Customer Demographics and Target Market of S.F. Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.