S.F. Holding Bundle

Can S.F. Holding Company Maintain Its Dominance in the Logistics Industry?

S.F. Holding Company, spearheaded by SF Express, has revolutionized China's logistics industry, becoming a formidable player through relentless expansion and tech integration. Founded in 1993, its journey from a regional express delivery service to a logistics giant is a compelling story of strategic foresight and operational excellence. This exploration dives into the S.F. Holding SWOT Analysis, examining its ambitious growth strategy and future prospects.

Understanding the S.F. Holding Company’s Growth Strategy is crucial for anyone assessing the Future Prospects of this logistics leader. This comprehensive market analysis will dissect its expansion plans, technology investments, and financial outlook, providing actionable insights for investors and business strategists alike. We'll also examine the challenges and opportunities within the dynamic Logistics Industry, including the impact of e-commerce and the evolving Supply Chain landscape, to offer a complete picture of S.F. Holding Company's long-term potential.

How Is S.F. Holding Expanding Its Reach?

S.F. Holding Company is aggressively pursuing a multi-faceted expansion strategy. This strategy focuses on penetrating new markets, introducing innovative services, and engaging in strategic mergers and acquisitions. The company's approach is designed to capitalize on growth opportunities within the dynamic logistics industry.

A key element of S.F. Holding Company's growth strategy is international expansion. The company aims to strengthen its global logistics network to meet the increasing demands of cross-border e-commerce and supply chain solutions. This expansion is crucial for diversifying revenue streams and reducing reliance on the domestic market.

Domestically, S.F. Holding Company is continuously enhancing its service offerings. This includes expanding its cold chain logistics capabilities, a crucial area given the increasing demand for temperature-controlled transportation of goods like fresh produce and pharmaceuticals. The company is also investing in specialized services for specific industries, such as automotive and high-tech manufacturing, aiming to provide tailored supply chain solutions. Furthermore, S.F. Holding continues to explore strategic partnerships and potential acquisitions to integrate complementary services or gain market share in nascent segments.

S.F. Holding Company is actively expanding its global footprint, particularly in Southeast Asia and Europe. This expansion involves establishing new routes and partnerships to facilitate cross-border e-commerce and supply chain solutions. The goal is to access new customer bases and diversify revenue streams, reducing dependence on any single geographical area.

The company is focusing on enhancing its domestic service offerings to meet evolving market demands. This includes expanding cold chain logistics capabilities and providing specialized services for industries like automotive and high-tech manufacturing. Strategic partnerships and acquisitions are also being explored to integrate complementary services.

S.F. Holding Company is actively seeking strategic partnerships and potential acquisitions. These initiatives aim to integrate complementary services and gain market share in emerging segments. By forming alliances and acquiring other companies, S.F. Holding can enhance its service offerings and strengthen its competitive position.

In 2024, S.F. Holding Company continued to emphasize the integration of logistics with e-commerce platforms. This approach provides end-to-end solutions that encompass warehousing, fulfillment, and last-mile delivery. These initiatives are designed to stay ahead of industry changes, capture emerging market opportunities, and solidify S.F. Holding's competitive advantage.

The future prospects of S.F. Holding Company are closely tied to its ability to execute its expansion plans effectively. Market analysis indicates significant growth potential in both domestic and international markets, particularly within the logistics and supply chain sectors. The company's strategic initiatives are designed to capitalize on these opportunities and maintain a competitive edge. For more insights, consider exploring the Target Market of S.F. Holding.

- Continued investment in technology and automation to improve efficiency and reduce costs.

- Expansion into new geographical markets, especially in Southeast Asia and Europe.

- Development of specialized logistics solutions for high-growth industries.

- Strategic partnerships and acquisitions to enhance service offerings and market share.

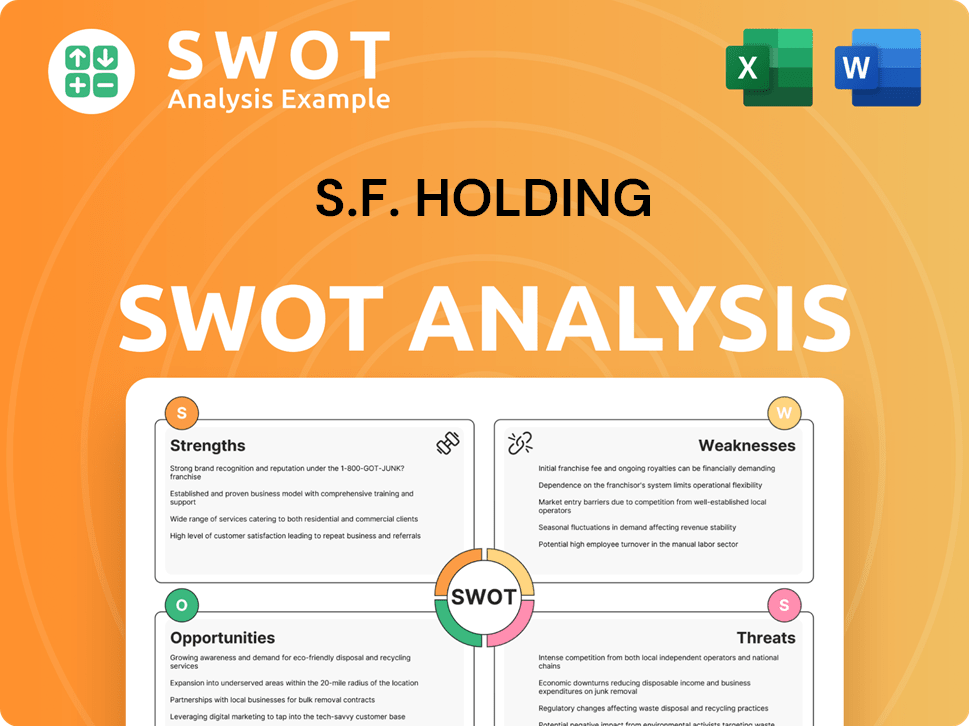

S.F. Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does S.F. Holding Invest in Innovation?

The S.F. Holding Company heavily invests in technology and innovation to drive its growth strategy within the logistics industry. This commitment is central to its future prospects, focusing on enhancing operational efficiency and improving customer experience. The company's approach involves a comprehensive digital transformation across all business operations.

Innovation at S.F. Holding Company includes the development of advanced logistics management systems and collaborations with external technology providers. This strategy is designed to reduce costs, improve service reliability, and adapt to the evolving demands of the market. The integration of cutting-edge technologies is a key aspect of their competitive advantage.

The company is at the forefront of adopting automation, including automated sorting systems and robotic warehouses. They utilize Artificial Intelligence (AI) for route optimization, demand forecasting, and customer service. The integration of Internet of Things (IoT) devices provides real-time tracking and monitoring of shipments. This focus on technology directly supports the company's growth strategy and helps in achieving its future prospects.

Digital transformation is a core element, integrating digital technologies across all operations. This includes cloud computing, data analytics, and digital platforms to streamline processes and enhance decision-making. This approach is crucial for maintaining a competitive edge in the logistics industry.

Extensive deployment of automation technologies, such as automated sorting systems and robotic warehouses, increases efficiency and reduces operational costs. Automation also improves accuracy and speed in handling shipments. These advancements support the company's growth strategy.

AI is used for route optimization, demand forecasting, and customer service, enhancing efficiency and customer satisfaction. IoT devices provide real-time tracking and monitoring of shipments, improving transparency and reliability. These technologies are vital for S.F. Holding Company's future prospects.

The company is exploring electric vehicles for last-mile delivery and optimizing logistics processes to reduce carbon emissions. This commitment to sustainability is becoming increasingly important in the logistics sector. These initiatives align with the company's long-term growth strategy.

Consistent investment in research and development (R&D) is a cornerstone of the company's innovation strategy. These investments support the development of new products, platforms, and technical capabilities. This approach is key to S.F. Holding Company's market analysis and long-term success.

The company prioritizes operational efficiency through technological advancements. This includes streamlining processes, reducing costs, and improving service delivery times. Efficiency is a key driver of S.F. Holding Company's financial performance and expansion plans.

The company's innovation and technology strategy directly contribute to its growth strategy by improving efficiency, reducing costs, and enabling more sophisticated services. While specific recent patents or industry awards for 2024-2025 were not broadly publicized, the consistent investment underscores its leadership in the logistics industry. For further insights into the company's history, consider reading Brief History of S.F. Holding.

- Market Share: The company aims to maintain and potentially increase its market share through technological advancements.

- Financial Performance: Technology investments are expected to enhance profitability and support strong financial performance.

- Competitive Advantage: Innovation provides a significant competitive edge in a dynamic supply chain.

- Expansion Plans: Technology supports the company's international expansion efforts by improving operational capabilities.

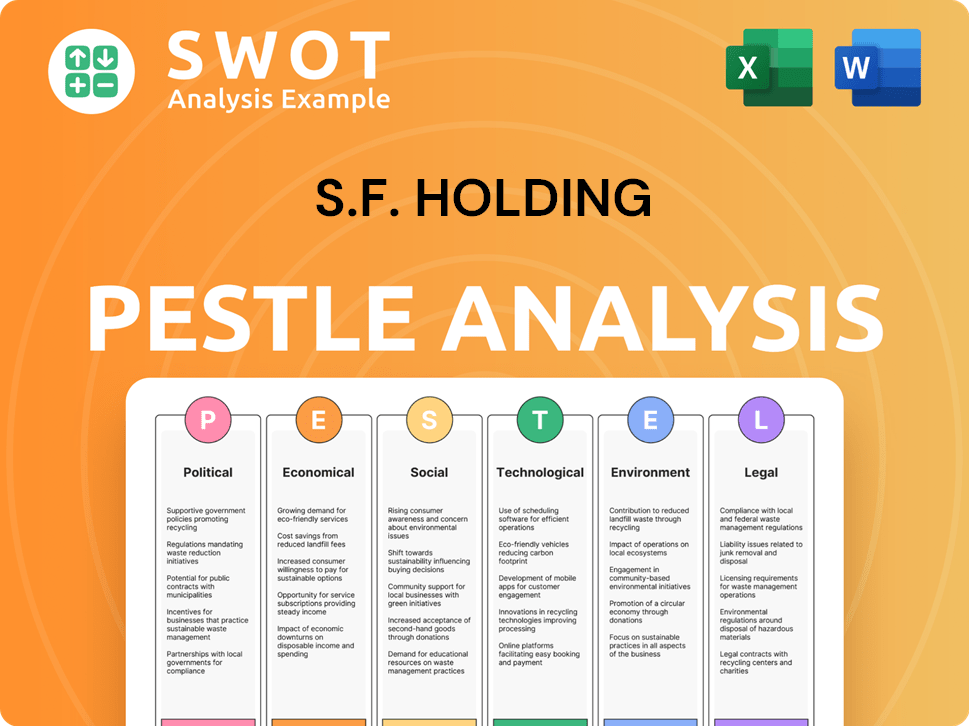

S.F. Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is S.F. Holding’s Growth Forecast?

The financial outlook for S.F. Holding Company is centered on sustained growth, supported by ambitious revenue targets and strategic investments. The company's consistent financial performance suggests an ongoing expansion in its top-line revenue, as indicated by analyst forecasts. The first quarter of 2024 saw a significant increase in business volume, demonstrating strong operational momentum.

S.F. Holding aims to maintain healthy profit margins through operational efficiency and network leverage. Substantial investments are expected in technology and infrastructure to support expansion and maintain its competitive edge. The company's commitment to increasing shareholder value is evident in its historical performance and market position. For instance, S.F. Holding's revenue for Q1 2024 reached approximately RMB 71.1 billion, showcasing its robust financial health within the logistics industry.

The company's financial ambitions are often compared favorably to industry benchmarks, given its dominant position in the Chinese express delivery market. The financial narrative underpinning S.F. Holding's strategic plans focuses on sustained investment in core competencies and expansion, aiming for long-term value creation. This approach is crucial for navigating the competitive landscape and capitalizing on future opportunities within the supply chain.

S.F. Holding's Q1 2024 revenue was approximately RMB 71.1 billion, demonstrating strong financial performance. The company's gross profit margin for Q1 2024 was reported at 11.8%, reflecting effective cost management. These figures highlight S.F. Holding's ability to maintain profitability while expanding its operations.

The company plans to continue significant investments in technology and infrastructure. These investments are crucial for supporting expansion initiatives and maintaining a competitive edge in the logistics industry. S.F. Holding's expansion plans are designed to capitalize on market opportunities and enhance its service offerings.

S.F. Holding holds a dominant position in the Chinese express delivery market. The company's competitive advantage is supported by its extensive network and operational efficiency. The company's strategic focus helps it compete effectively in the dynamic logistics industry.

Analysts generally forecast continued expansion in S.F. Holding's top-line revenue. The company's commitment to sustainable growth strategies is expected to drive future revenue. These projections reflect the company's strong market position and strategic initiatives.

The company's financial strategy is geared towards long-term value creation, which is critical for investors. For more information, you can explore the Owners & Shareholders of S.F. Holding.

S.F. Holding's growth strategy is focused on expanding its service offerings and geographical reach. The company leverages technology and infrastructure investments to enhance its capabilities. This approach supports sustainable growth within the competitive logistics market.

The growth of e-commerce significantly impacts S.F. Holding, driving demand for express delivery services. The company is well-positioned to capitalize on the e-commerce boom. This positions S.F. Holding to benefit from the evolving market dynamics.

S.F. Holding offers investment opportunities due to its strong financial performance and growth potential. The company's expansion plans and strategic investments make it an attractive option. Investors should consider the long-term investment strategy of S.F. Holding.

Challenges for S.F. Holding include intense competition and the need for continuous innovation. The company must navigate evolving market dynamics and regulatory changes. Effective risk management is crucial for ensuring the company's future prospects.

S.F. Holding is focused on logistics innovation to improve efficiency and service quality. The company invests in technology to streamline operations and enhance the supply chain. These innovations are vital for maintaining a competitive edge.

S.F. Holding is exploring international expansion to diversify its revenue streams. The company's global strategy aims to capture new market opportunities. This expansion supports the company's long-term growth objectives.

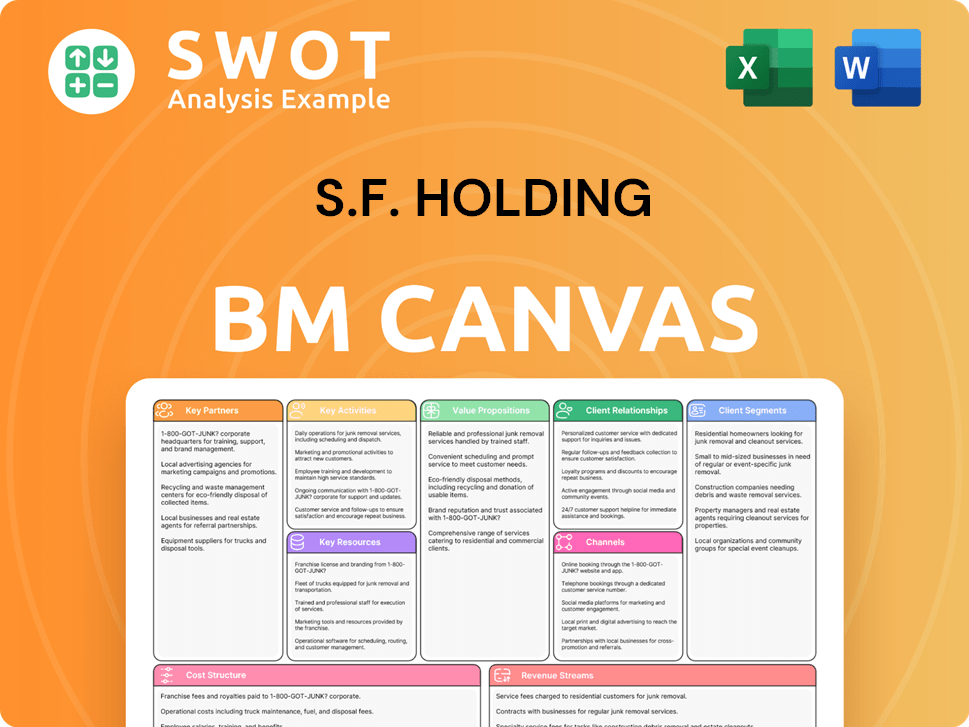

S.F. Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow S.F. Holding’s Growth?

The S.F. Holding Company, despite its strong position in the Logistics Industry, faces several potential risks and obstacles that could impact its Growth Strategy and Future Prospects. These challenges range from intense competition and regulatory changes to supply chain vulnerabilities and internal resource constraints. Understanding these risks is crucial for investors and stakeholders assessing the company's long-term viability and potential for sustainable growth.

One of the major hurdles for S.F. Holding Company is the highly competitive nature of the express logistics market in China. Numerous domestic and international players are vying for market share, which can lead to pricing pressures and reduced profit margins. Furthermore, the company must navigate evolving regulatory landscapes, particularly regarding data privacy, cross-border logistics, and environmental standards, which can increase operational costs and require significant adjustments.

Supply chain disruptions, exacerbated by global events or natural disasters, also pose a significant risk. Disruptions to transportation networks or labor shortages can severely impact delivery times and service quality, potentially affecting customer satisfaction and financial performance. Technological advancements and the emergence of new logistics models could also challenge the company's established operations.

The express logistics sector in China is highly competitive, with many players vying for market share. This can lead to pricing wars and squeezed profit margins for S.F. Holding Company. The company must continually innovate and improve efficiency to maintain its competitive edge.

Changes in regulations, particularly in data privacy, cross-border logistics, and environmental standards, can create obstacles. These changes may necessitate significant operational adjustments and increased compliance costs for S.F. Holding Company. Adapting to these changes is essential for continued operations.

Supply Chain disruptions due to geopolitical events or natural disasters are a significant risk. Disruptions to transportation networks or labor shortages can impact delivery times and service quality. S.F. Holding Company needs robust risk management to address these issues.

Technological advancements and new entrants in logistics technology could disrupt established models. S.F. Holding Company must invest in innovation and adapt to changing technological landscapes to stay competitive. This includes exploring new technologies like AI and automation.

Internal resource constraints, such as the availability of skilled labor or infrastructure capacity, could hinder expansion. Managing internal resources effectively is critical for S.F. Holding Company to support its rapid growth. This requires strategic workforce planning and infrastructure investment.

An economic slowdown in China or globally could impact demand for logistics services. Economic downturns can lead to decreased shipping volumes and reduced revenue. S.F. Holding Company must be prepared to adjust to these economic shifts.

To mitigate these risks, S.F. Holding Company employs several strategies. These include diversifying its service offerings, expanding its geographical presence, and implementing robust risk management frameworks. For instance, the company has been investing in segments beyond traditional express delivery, such as supply chain management and cold chain logistics. This diversification helps reduce reliance on a single revenue stream and provides resilience against market fluctuations. For an in-depth look at the company's strategies, you can read more about the S.F. Holding Company growth strategy analysis.

S.F. Holding Company is diversifying its service offerings beyond express delivery to include supply chain management and cold chain logistics. This strategy aims to reduce reliance on a single revenue stream and capture new market opportunities. Diversification helps to mitigate risks associated with market volatility.

Expanding its geographical footprint is another key strategy for S.F. Holding Company. This includes both domestic and international expansion to tap into new markets and reduce dependence on any single region. International expansion can diversify revenue streams and provide growth opportunities.

Implementing robust risk management frameworks is crucial for addressing potential challenges. This includes proactive scenario planning and continuous monitoring of market trends and regulatory changes. Effective risk management helps to identify and mitigate potential issues before they impact operations.

Investing in technology and network resilience is a core part of S.F. Holding Company's strategy. This includes investments in automation, data analytics, and other technologies to improve efficiency and service quality. Technological advancements are essential for maintaining a competitive edge.

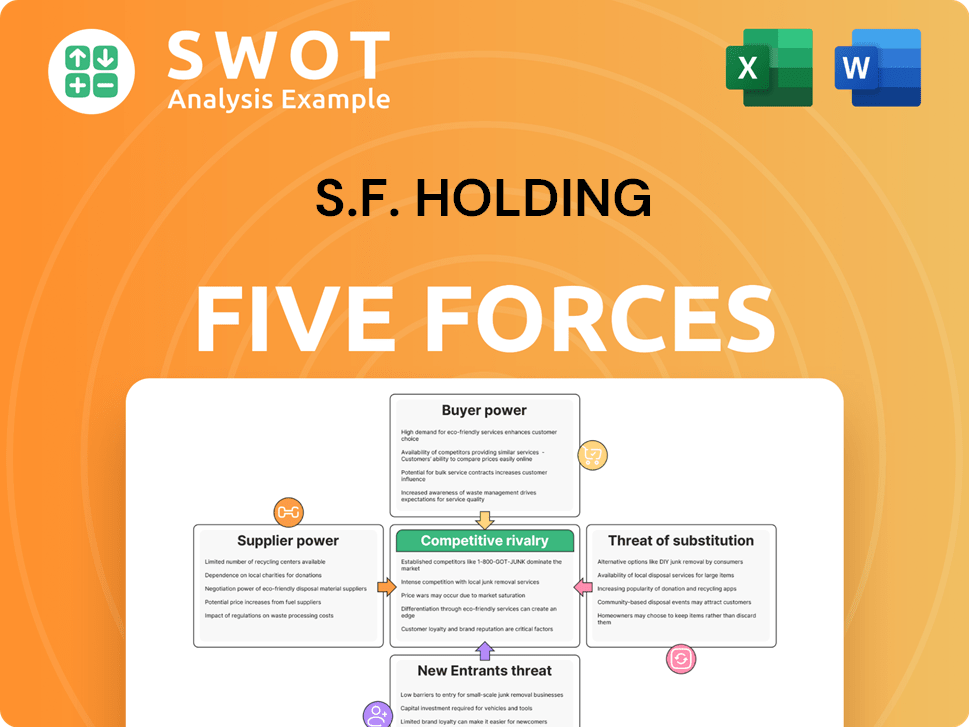

S.F. Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of S.F. Holding Company?

- What is Competitive Landscape of S.F. Holding Company?

- How Does S.F. Holding Company Work?

- What is Sales and Marketing Strategy of S.F. Holding Company?

- What is Brief History of S.F. Holding Company?

- Who Owns S.F. Holding Company?

- What is Customer Demographics and Target Market of S.F. Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.