United Parcel Service Bundle

Can UPS Maintain Its Dominance in the Logistics Arena?

The logistics industry is undergoing a dramatic transformation, fueled by e-commerce, technological leaps, and changing consumer needs. United Parcel Service (UPS), a global leader with a century-long legacy, is at the forefront of this evolution. Understanding the United Parcel Service SWOT Analysis is crucial for understanding its position in a complex market.

This in-depth examination of the UPS competitive landscape will explore its strategies, key UPS rivals, and UPS market share within the dynamic delivery sector. We'll analyze UPS competition to understand how UPS leverages its strengths and navigates challenges in a market shaped by intense competition and technological disruption. This UPS industry analysis will provide insights into the company's competitive advantages, global presence, and strategies for future success, considering factors like Who are UPS's main competitors in the US and How does UPS compare to FedEx in terms of pricing.

Where Does United Parcel Service’ Stand in the Current Market?

United Parcel Service (UPS) holds a significant market position within the global logistics and package delivery industry. Its core operations revolve around providing a wide array of services, including time-definite package delivery, freight forwarding, contract logistics, and customs brokerage. UPS's value proposition centers on reliable and efficient delivery solutions, catering to a diverse customer base ranging from individual consumers to large multinational corporations.

In 2023, UPS reported revenue of $91.0 billion, demonstrating its substantial scale and financial health. The company's extensive global presence, serving over 220 countries and territories, underscores its commitment to providing comprehensive logistics solutions worldwide. This widespread network allows UPS to offer consistent service and reach to its customers.

UPS's market share fluctuates, but it consistently dominates the express and ground package delivery segments, especially in key markets like North America. The company's strong brand recognition and established infrastructure provide a competitive edge. The company's ability to adapt to changing market demands, such as the growth of e-commerce, has been crucial for maintaining its market position, as discussed in the Marketing Strategy of United Parcel Service.

UPS maintains a strong position in the package delivery sector. While exact figures vary, UPS and FedEx collectively control a significant portion of the market, particularly in the express and ground delivery segments. Understanding UPS's market share is crucial for assessing its competitive standing.

UPS operates in over 220 countries and territories, with particularly strong positions in North America and Europe. This extensive global network allows UPS to offer comprehensive logistics solutions worldwide. Its widespread reach is a key competitive advantage.

UPS serves a diverse customer base, including individual consumers, small and medium-sized businesses (SMBs), and large multinational corporations. This broad customer reach allows UPS to diversify its revenue streams and adapt to various market needs. UPS caters to industries like retail, healthcare, and manufacturing.

UPS offers a comprehensive range of services, including time-definite package delivery, freight forwarding, contract logistics, and customs brokerage. This diverse portfolio enables UPS to meet a wide array of customer needs. The company's ability to provide integrated solutions is a key differentiator.

UPS faces dynamic market conditions, including the growth of e-commerce and increasing competition. The company is adapting by focusing on healthcare logistics and e-commerce fulfillment. In 2023, average daily package volume was 24.3 million, highlighting its significant operational scale.

- The company is investing in digital transformation.

- UPS focuses on customer experience and operational efficiency.

- UPS is strategically positioning itself to meet evolving market demands.

- Sustainability initiatives are also a part of UPS's strategy.

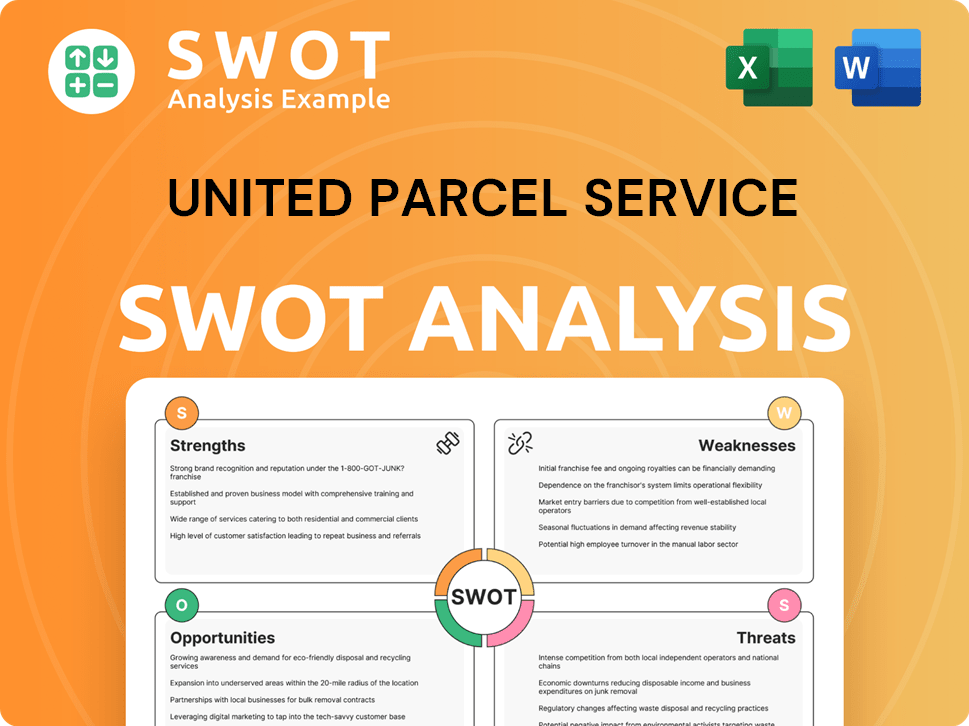

United Parcel Service SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging United Parcel Service?

The UPS competitive landscape is characterized by intense rivalry across its diverse service offerings. Understanding UPS competition is crucial for assessing its market position and strategic direction. This analysis considers both direct and indirect competitors impacting UPS market share and overall performance.

Direct competitors like FedEx and DHL, along with regional players and emerging tech-driven firms, challenge United Parcel Service across various segments. The evolving e-commerce sector and the rise of innovative delivery solutions further shape the competitive dynamics. These factors require continuous adaptation and strategic innovation from UPS to maintain its position.

UPS faces significant competition from FedEx, a major player in the global express and ground package delivery market. FedEx's extensive air-ground network allows it to compete directly with UPS on speed, reliability, and global reach. Both companies frequently engage in price wars and service enhancements to gain market share. According to recent reports, FedEx's revenue for fiscal year 2024 was approximately $87.6 billion, demonstrating its strong market presence. In contrast, UPS reported revenues of around $91 billion in 2024, highlighting the close competition between the two giants.

DHL is another significant competitor, particularly strong in international shipping and logistics. It offers a comprehensive suite of services that challenge UPS's global presence. DHL's global network and strong brand recognition make it a formidable opponent.

The United States Postal Service (USPS) offers competitive pricing for certain parcel services, especially for e-commerce last-mile delivery. USPS poses a significant challenge, particularly in the domestic market, due to its extensive infrastructure and reach.

UPS competes with a fragmented landscape of third-party logistics (3PL) providers like XPO Logistics, C.H. Robinson, and DSV. These companies often challenge UPS through niche expertise, customized solutions, or aggressive pricing strategies.

Major online retailers like Amazon are developing their own logistics capabilities, directly impacting last-mile delivery volumes. Amazon's increasing dominance in e-commerce poses a significant challenge.

Emerging players leveraging technology for same-day delivery or crowd-sourced logistics platforms present an evolving threat. These new entrants disrupt traditional competitive landscapes, forcing established players to innovate.

UPS also competes with regional and national postal services, which offer competitive pricing for certain parcel services. These services can be particularly strong in specific geographic areas.

In the freight forwarding and contract logistics segments, UPS faces competition from a diverse group. This includes large 3PL providers and smaller, specialized logistics companies. These competitors often use niche expertise and customized solutions to gain an advantage. The e-commerce sector's rapid growth has also introduced new competitive dynamics, with major online retailers like Amazon developing their own logistics capabilities, directly impacting last-mile delivery volumes. For a deeper dive into the company's performance, you can read this article about United Parcel Service.

Several factors drive competition in the logistics and delivery market, influencing UPS's competitive landscape. These include pricing strategies, service quality, global reach, technological innovation, and customer service.

- Pricing: Competitive pricing is essential to attract and retain customers.

- Service Quality: Reliability, speed, and package handling are critical.

- Global Reach: Extensive networks and international capabilities are vital.

- Technological Innovation: Investments in technology for tracking, automation, and efficiency.

- Customer Service: Providing excellent customer support and building strong relationships.

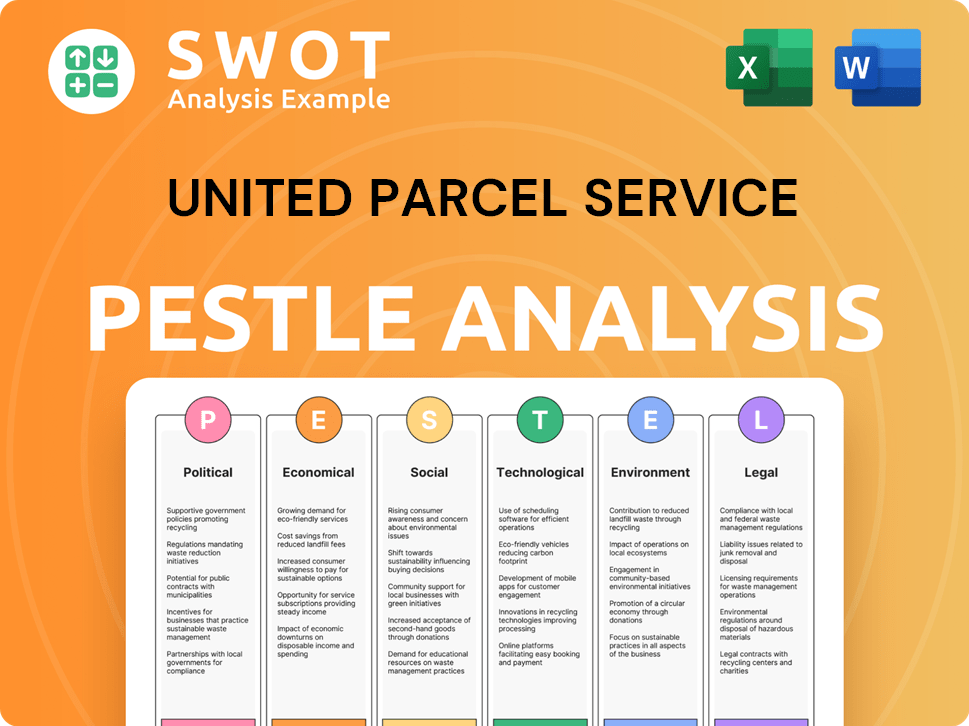

United Parcel Service PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives United Parcel Service a Competitive Edge Over Its Rivals?

When examining the UPS competitive landscape, several key factors contribute to its strong market position. The company has built a robust global network and infrastructure over many years. This includes a massive fleet of aircraft and vehicles, strategically located hubs, and advanced sorting facilities. These elements enable UPS to offer a wide range of services and reach almost every part of the world.

UPS also benefits significantly from its brand recognition and customer loyalty. The company's recognizable brown uniforms and logo are globally recognized symbols of reliability. This strong brand image helps retain customers and attract new business. The diverse service portfolio, encompassing express, ground, freight, and supply chain solutions, allows it to offer integrated logistics solutions, catering to a wide array of customer needs and fostering deeper relationships.

UPS continually invests in technology and infrastructure to maintain its leadership position. This includes data analytics, automation, and investments in electric vehicles. These advantages have evolved over time, with UPS continuously investing in technology and infrastructure to maintain its leadership position and leverage them for strategic partnerships and new service development. While these advantages are substantial, they face threats from rapid technological advancements and aggressive expansion by competitors, necessitating continuous innovation and adaptation.

UPS operates one of the largest transportation networks globally, with a significant presence in over 220 countries and territories. This extensive network includes a vast fleet of aircraft, over 500 owned and leased, and a massive ground fleet. This allows UPS to offer a wide range of services, including express, ground, and freight delivery. This infrastructure provides significant economies of scale and scope, making it difficult for competitors to match.

UPS invests heavily in technology to enhance operational efficiency and customer experience. This includes sophisticated package tracking systems, route optimization software, and automated sorting facilities. These technologies help reduce costs, improve delivery times, and provide real-time visibility for customers. The company's focus on data analytics and automation further enhances its operational capabilities.

UPS's brand is synonymous with reliability and trust. The iconic brown uniforms and shield logo are instantly recognizable worldwide. This strong brand image fosters high customer retention and attracts new business. UPS has a long history of consistent service, building a loyal customer base that values its dependability.

UPS offers a wide range of services, including express, ground, freight, and supply chain solutions. This allows the company to cater to a broad spectrum of customer needs. The ability to provide integrated logistics solutions enhances customer relationships and creates a competitive advantage. This diverse service portfolio helps UPS compete effectively in various market segments.

UPS maintains its competitive edge through a combination of infrastructure, technology, and brand strength. Its global network and advanced technology provide operational efficiencies. The company's strong brand and diverse service offerings contribute to customer loyalty and market share.

- Global Network: UPS has a vast global network that allows it to reach customers worldwide.

- Technology: Advanced tracking and route optimization technologies improve efficiency.

- Brand Reputation: The UPS brand is recognized and trusted globally.

- Service Portfolio: A diverse range of services caters to various customer needs.

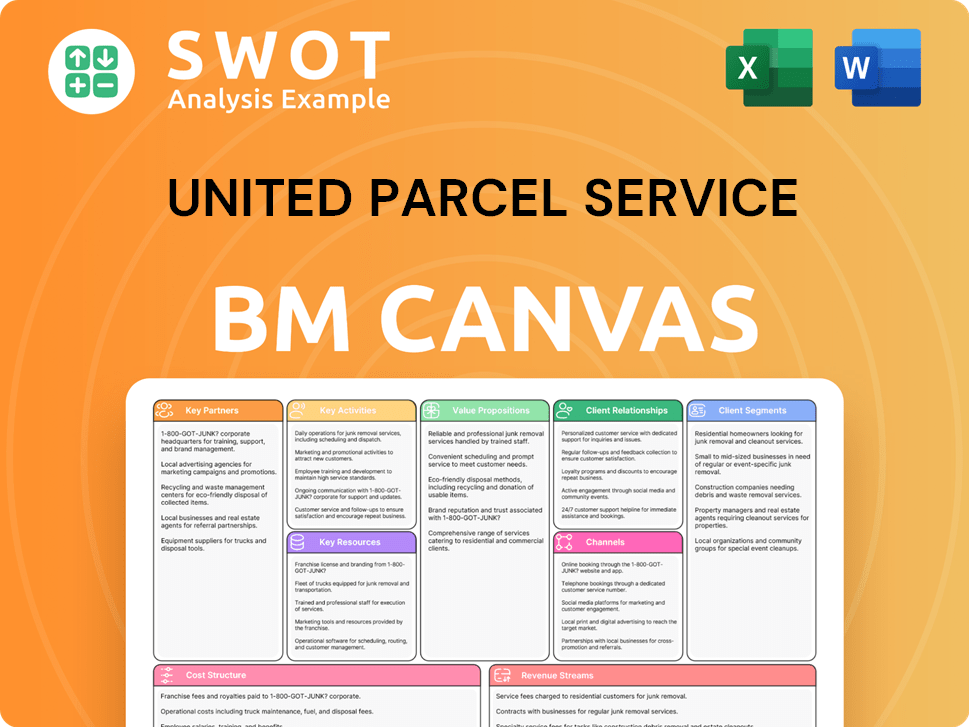

United Parcel Service Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping United Parcel Service’s Competitive Landscape?

The logistics industry, and consequently the UPS competitive landscape, is currently undergoing significant transformation. Several trends are reshaping how goods are moved, creating both challenges and opportunities for major players like United Parcel Service. These changes include technological advancements, the rise of e-commerce, and increasing demands for sustainable practices. Understanding these factors is crucial for assessing UPS's market share and its ability to maintain a competitive edge.

UPS competition faces various risks, from economic fluctuations and geopolitical instability to the emergence of new competitors and evolving customer expectations. However, the company also has opportunities to capitalize on these trends, such as expanding its e-commerce fulfillment services and leveraging its global network. The future outlook for UPS depends on its ability to adapt, innovate, and form strategic partnerships to navigate these complex market dynamics. For more in-depth insights, you can review Owners & Shareholders of United Parcel Service.

Technological advancements, particularly in automation, artificial intelligence (AI), and predictive analytics, are reshaping the logistics industry. E-commerce growth continues to fuel demand for parcel delivery, but also increases competition and puts pressure on delivery speeds and costs. Sustainability is becoming increasingly important, with environmental concerns driving demand for green logistics solutions.

Managing peak volumes and last-mile delivery complexities remains a significant challenge, especially with the ongoing expansion of e-commerce. Geopolitical uncertainties and global economic shifts can impact trade volumes and supply chain stability. The emergence of new market entrants, particularly those focused on specialized or localized delivery solutions, intensifies competition.

Expanding e-commerce fulfillment services and partnerships represents a major opportunity for growth. Leveraging a robust global network and expertise in customs brokerage and supply chain management can help businesses navigate complex trade environments. Investing in sustainable logistics solutions, such as electric vehicles, can provide a competitive edge and align with environmental goals.

UPS's strategies for staying competitive involve a continued emphasis on technological integration, sustainability initiatives, and strategic partnerships. The company is investing in automation to optimize routes and enhance sorting capabilities. Furthermore, it has set ambitious sustainability goals, including achieving carbon neutrality by 2050. UPS is also expanding its e-commerce fulfillment services to meet growing demand.

In 2024, the logistics industry continues to be competitive, with UPS rivals like FedEx and Amazon vying for market share. UPS's competitive advantages in logistics include its extensive global network and integrated technology solutions. The company's financial performance is closely watched, with a focus on factors like revenue growth, operating margins, and capital expenditures.

- UPS's global market presence and competition are key factors.

- How does UPS compare to FedEx in terms of pricing, service offerings, and customer satisfaction?

- UPS's strategies for customer retention and innovation are crucial for maintaining its position.

- UPS's response to emerging delivery technologies, such as drone delivery and autonomous vehicles, will shape its future.

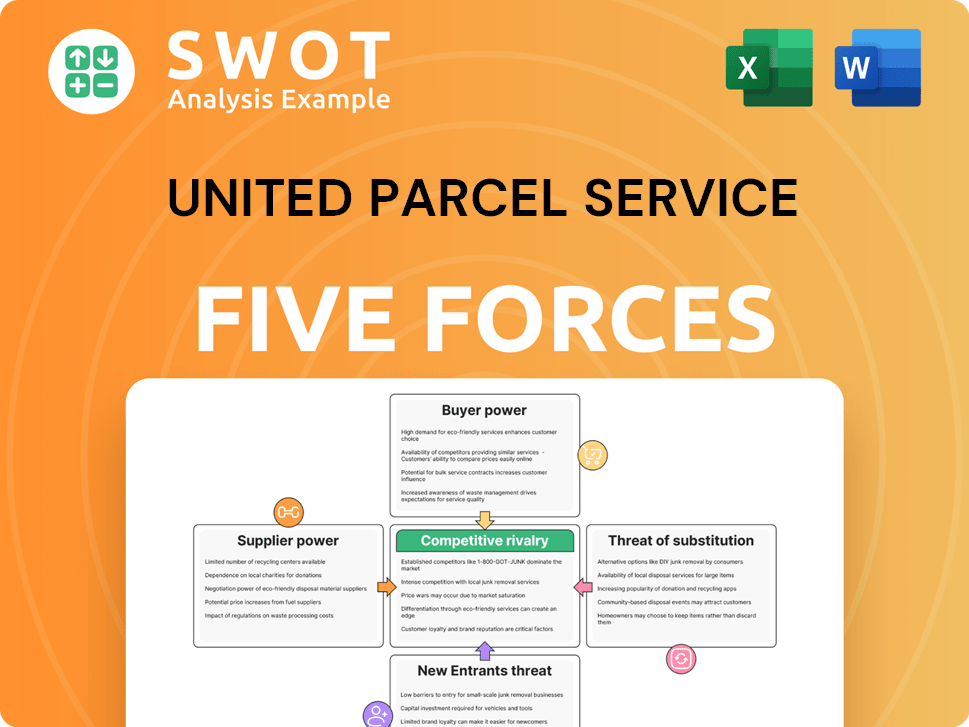

United Parcel Service Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of United Parcel Service Company?

- What is Growth Strategy and Future Prospects of United Parcel Service Company?

- How Does United Parcel Service Company Work?

- What is Sales and Marketing Strategy of United Parcel Service Company?

- What is Brief History of United Parcel Service Company?

- Who Owns United Parcel Service Company?

- What is Customer Demographics and Target Market of United Parcel Service Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.