United Parcel Service Bundle

Can UPS Maintain Its Dominance in the Ever-Changing Logistics Landscape?

United Parcel Service (UPS) recently made headlines with its acquisition of MNX Global Logistics, signaling a strategic pivot towards time-critical and temperature-sensitive logistics. This move highlights UPS's commitment to not only adapt but to lead in the rapidly evolving logistics industry. From its humble beginnings in 1907, UPS has transformed into a global powerhouse, but what does the future hold for this industry giant?

This article dives deep into the United Parcel Service SWOT Analysis, exploring UPS's growth strategy and examining its future prospects in detail. We'll dissect UPS's expansion plans worldwide, analyze its financial performance review, and investigate how it leverages technology to stay ahead. Understanding UPS's competitive advantages and the challenges it faces is crucial for anyone looking to understand the future of package delivery and supply chain solutions.

How Is United Parcel Service Expanding Its Reach?

The UPS growth strategy is heavily focused on expanding its global footprint and enhancing its service offerings to meet the evolving demands of the logistics industry. This involves strategic investments in key markets and the development of innovative solutions to maintain its competitive edge. The company's approach is geared towards capturing new revenue streams and staying ahead of industry trends, ensuring long-term sustainability and growth.

UPS future prospects are closely tied to its ability to adapt to technological advancements and changing consumer behaviors. The company is actively exploring new technologies and business models, such as drone delivery and e-commerce solutions, to improve efficiency and customer satisfaction. These initiatives are crucial for navigating the dynamic landscape of the package delivery sector and securing its position as a market leader.

UPS market share analysis reveals a strong position in the global logistics market. The company's strategic initiatives are designed to further strengthen this position, particularly in high-growth areas like e-commerce and international shipping. By focusing on innovation and customer-centric solutions, UPS aims to increase its market share and maintain its competitive advantage.

UPS expansion plans worldwide include a significant focus on international markets. The company is investing heavily in regions with high growth potential, particularly in Asia and Europe. This expansion is supported by investments in infrastructure, technology, and strategic partnerships to enhance its global network and service capabilities.

Strategic acquisitions play a crucial role in UPS growth strategy. The acquisition of MNX Global Logistics is a prime example, enabling UPS to expand into specialized logistics segments like healthcare. This move allows UPS to offer enhanced capabilities in healthcare and life sciences, a sector projected for significant growth. The company continues to explore acquisitions to broaden its service offerings and reach new customer segments.

UPS e-commerce logistics solutions are a key area of focus. The company is continually enhancing its digital tools and services, such as UPS My Choice for Business and UPS eFulfillment, to meet the growing demands of e-commerce businesses. These solutions aim to simplify shipping and logistics for small and medium-sized businesses, driving revenue growth.

How does UPS use technology to drive growth? The company is investing heavily in technological advancements, including drone delivery and automation. UPS Flight Forward, its drone delivery subsidiary, is actively seeking regulatory approvals and expanding its operational scope. These innovations are designed to improve efficiency, reduce costs, and enhance service capabilities.

UPS revenue growth drivers are multifaceted, with international expansion, strategic acquisitions, and e-commerce solutions playing pivotal roles. The company's focus on innovation and customer-centric services is designed to drive sustainable growth. The company's strategic investments in infrastructure and technology are also crucial for long-term success.

- International Expansion: Focusing on high-growth markets in Asia and Europe to increase market share.

- Strategic Acquisitions: Expanding service offerings and entering new segments, such as healthcare logistics.

- E-commerce Solutions: Enhancing digital tools and services to support small and medium-sized businesses.

- Technological Advancements: Implementing drone delivery and automation to improve efficiency and reduce costs.

- UPS last-mile delivery strategies are being refined to meet the increasing demands of e-commerce.

For more insights into how UPS approaches its marketing efforts, consider reading this article on the Marketing Strategy of United Parcel Service.

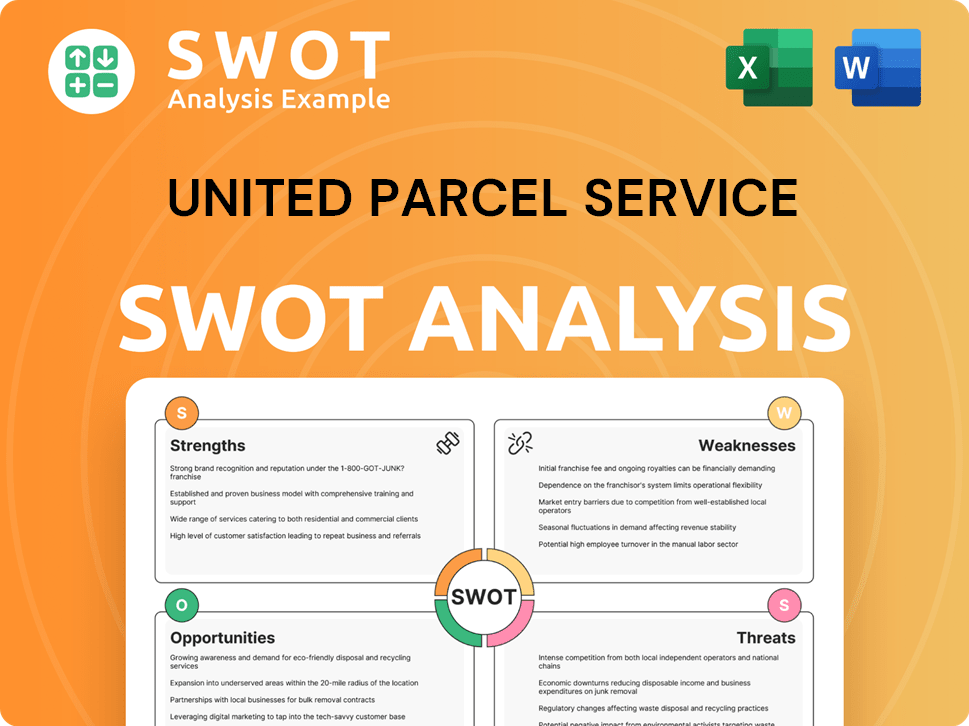

United Parcel Service SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does United Parcel Service Invest in Innovation?

As a key player in the package delivery and supply chain solutions sectors, United Parcel Service (UPS) heavily invests in innovation and technology to drive its growth strategy. This focus is critical in a rapidly evolving market where efficiency, speed, and sustainability are increasingly important. UPS's strategic investments in these areas are designed to enhance its competitive advantages and secure its future prospects.

The company's approach involves a blend of internal development, strategic partnerships, and acquisitions. This comprehensive strategy allows UPS to stay at the forefront of technological advancements, ensuring it meets the changing needs of its customers and maintains its leadership position in the logistics industry.

UPS continues to leverage technology and innovation as central elements of its growth strategy, with significant investments in research and development and strategic collaborations. A prime example of this is its commitment to digital transformation, which is evident in its smart logistics network. This network utilizes data analytics and artificial intelligence (AI) to optimize routing, improve delivery efficiency, and enhance the customer experience. The company's ORION (On-Road Integrated Optimization and Navigation) system, for instance, is constantly evolving, contributing to fuel savings and reduced emissions by optimizing delivery routes.

UPS uses data analytics and AI to optimize routing and improve delivery efficiency. This includes the implementation of advanced tracking systems and predictive analytics to anticipate and resolve potential delivery issues. The company is also focused on enhancing its customer experience through digital tools.

The ORION system is a prime example of UPS's innovation in route optimization. It helps to reduce fuel consumption and lower emissions by determining the most efficient delivery routes for drivers. This system is continuously updated to improve its effectiveness.

Automation is a crucial part of UPS's operational strategy, with an increasing deployment of automated sorting facilities and robotic process automation (RPA). This streamlines internal processes, boosts productivity, and reduces labor costs. The company is also exploring the use of drones for delivery.

UPS explores technologies like IoT for enhanced package tracking and supply chain visibility. This provides real-time data to customers and improves operational control. IoT enables more accurate and timely information about the location and status of packages.

Sustainability is deeply integrated into UPS's innovation strategy, with ongoing investments in alternative fuel vehicles, electric delivery trucks, and renewable energy sources. These initiatives align with environmental goals and enhance the company's brand image. UPS has set ambitious goals for reducing its carbon footprint.

UPS's dedication to innovation is underscored by its numerous patents in logistics technology and its recognition for leadership in sustainable practices. These achievements highlight the company's commitment to staying ahead in the industry. UPS continues to receive awards for its innovative solutions and sustainability efforts.

UPS's approach to technology and innovation is multifaceted, focusing on several key areas to drive efficiency, reduce costs, and enhance customer service. These strategies are critical for maintaining a competitive edge in the package delivery and logistics industry.

- Advanced Analytics and AI: UPS uses AI and machine learning to analyze vast amounts of data, optimizing routes, predicting demand, and improving operational efficiency. This includes predictive maintenance for vehicles and automated customer service.

- Automation and Robotics: The company continues to invest in automated sorting facilities and robotic process automation (RPA) to streamline operations. This reduces manual labor, speeds up processing times, and minimizes errors.

- Internet of Things (IoT): IoT technology is used for enhanced package tracking and supply chain visibility. Sensors and connected devices provide real-time data on package location and condition, improving transparency and control.

- Electric Vehicles and Alternative Fuels: UPS is expanding its fleet of electric vehicles and investing in alternative fuel sources. This supports sustainability goals and helps reduce emissions. In 2024, UPS announced plans to further expand its electric vehicle fleet.

- Drone Delivery: UPS is exploring drone delivery to improve last-mile delivery efficiency, especially in remote or underserved areas. This technology has the potential to reduce delivery times and costs.

- Cloud Computing and Digital Platforms: UPS leverages cloud computing for data storage, processing, and application delivery. Digital platforms provide customers with easy access to tracking information, shipping tools, and other services.

These technological advancements directly contribute to UPS's growth objectives by improving efficiency, reducing costs, enhancing service reliability, and creating new revenue streams through advanced logistics solutions. The company's commitment to innovation is further demonstrated by its numerous patents in logistics technology and its recognition for leadership in sustainable practices within the industry. For a deeper understanding of the competitive landscape, consider exploring the Competitors Landscape of United Parcel Service.

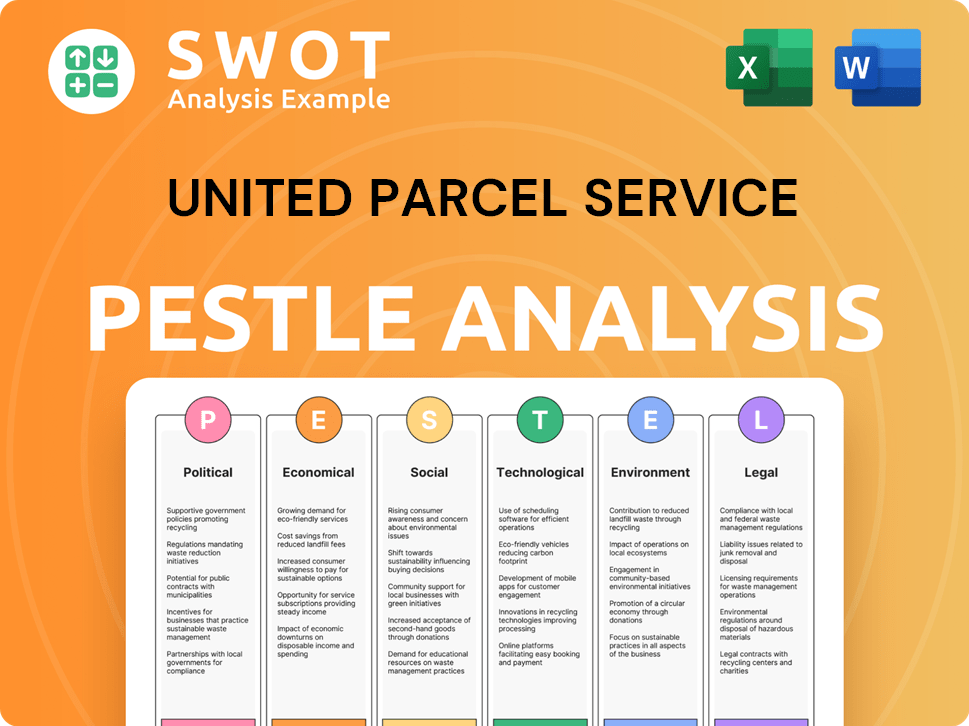

United Parcel Service PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is United Parcel Service’s Growth Forecast?

The financial outlook for United Parcel Service (UPS) reflects a strategic approach focused on sustainable growth and operational efficiency. For the full year 2024, UPS anticipates revenue to be in the range of approximately $92 billion to $94.5 billion. This forecast indicates a steady performance, building on its historical financial strength within the package delivery sector.

UPS's financial strategy emphasizes strong cash flow generation to support ongoing investments, debt reduction, and shareholder distributions. The company's financial health is underpinned by its expansive global network and diversified service offerings. UPS aims to deliver consistent revenue growth and enhance shareholder value through disciplined capital allocation and operational excellence. This approach is crucial for navigating the evolving landscape of the logistics industry.

The company's commitment to innovation and efficiency is evident in its projected capital expenditures of around $4.5 billion in 2024. These investments are directed towards network enhancements, technology upgrades, and fleet modernization. This proactive investment strategy is designed to maintain and improve its competitive position in the market, supporting its long-term goals. Read more about the company's core values in Mission, Vision & Core Values of United Parcel Service.

UPS's growth strategy is centered on expanding its global presence and enhancing its service offerings. The company focuses on leveraging technology to improve efficiency and customer experience. Key initiatives include investments in e-commerce logistics and supply chain solutions, aiming to capture a larger share of the market.

The future prospects for UPS are positive, driven by the growth of e-commerce and the increasing demand for global shipping services. UPS is well-positioned to capitalize on these trends. The company's ability to adapt to changing market dynamics and embrace technological advancements will be critical for its long-term success.

UPS maintains a significant market share in the global package delivery market. The company's strong brand recognition and extensive network contribute to its competitive advantage. UPS continues to compete effectively against rivals by focusing on service quality and innovation.

UPS has ongoing expansion plans worldwide, with a focus on emerging markets and strategic partnerships. The company aims to increase its capacity and improve its service offerings in key regions. These expansion efforts are designed to support its long-term growth objectives and enhance its global footprint.

UPS's financial performance is consistently strong, supported by its robust revenue streams and efficient operations. The company's financial strategies include disciplined cost management and strategic investments. These elements are critical for maintaining its financial health and delivering shareholder value.

UPS leverages technology across its operations to improve efficiency, enhance customer service, and optimize its network. The company uses data analytics, automation, and digital tools to streamline processes. These technological advancements are integral to UPS's competitive advantage.

UPS is committed to sustainability, with initiatives focused on reducing its environmental impact. The company invests in electric vehicles and alternative fuels. These efforts reflect UPS's dedication to environmental responsibility and sustainable business practices.

UPS's competitive advantages include its global network, brand recognition, and comprehensive service offerings. The company's strong relationships with customers and its ability to adapt to market changes are also key. These strengths allow UPS to maintain a leading position in the market.

UPS faces challenges such as increasing competition and evolving customer demands. The company has opportunities to expand its e-commerce logistics solutions and its international shipping services. Addressing these challenges and capitalizing on opportunities is essential for future growth.

UPS's revenue growth is driven by several factors, including the expansion of e-commerce, international shipping, and last-mile delivery strategies. The company's focus on these areas supports its growth objectives. These drivers are critical for sustained revenue growth.

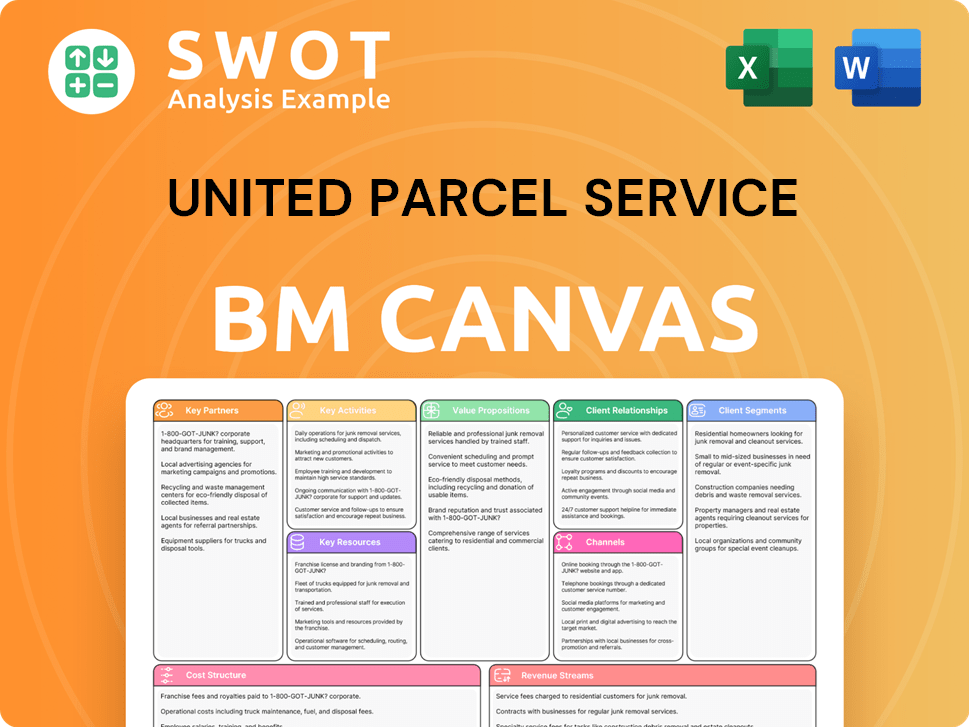

United Parcel Service Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow United Parcel Service’s Growth?

The growth strategy and future prospects of United Parcel Service (UPS) are subject to several potential risks and obstacles. These challenges can significantly impact the company's operational efficiency, financial performance, and ability to maintain its competitive position in the logistics industry. Understanding these risks is crucial for investors and stakeholders evaluating the long-term viability of UPS.

The logistics industry is highly competitive, with rivals such as FedEx and DHL, along with emerging regional carriers and e-commerce giants, constantly vying for market share. Regulatory changes, supply chain vulnerabilities, and technological disruptions also pose significant threats. Internal resource constraints, including labor availability and rising wage costs, further complicate UPS's path to sustainable growth.

Market competition presents a continuous challenge for UPS. The logistics industry is intensely competitive, with established players like FedEx and DHL, as well as regional carriers and e-commerce companies, all vying for market share. According to a 2024 report, the global logistics market is expected to reach over $12 trillion by 2027, indicating the scale of competition. UPS must innovate and improve its services to maintain its competitive advantage in this environment. Moreover, the company's Target Market of United Parcel Service is also evolving.

Changes in international trade policies, customs regulations, and environmental standards can significantly impact UPS's operational costs and market access. For example, evolving carbon emission regulations necessitate continuous investment in sustainable fleet technologies. Compliance with these regulations requires substantial financial investments and operational adjustments.

Recent global events, such as the COVID-19 pandemic and geopolitical tensions, have exposed supply chain vulnerabilities, posing risks to timely deliveries and operational stability. These events can lead to disruptions, increased costs, and reduced service levels. UPS has been working on network diversification and robust contingency planning to mitigate these risks.

Technological advancements, while also presenting opportunities, can be a risk if UPS fails to adapt quickly to new innovations or if competitors gain a significant technological edge. Investing in technology, such as automation and data analytics, is crucial for maintaining a competitive edge. The failure to do so could result in operational inefficiencies and lost market share.

Internal resource constraints, including labor availability and rising wage costs, can impact profitability and service levels. Proactive workforce planning, automation, and continuous process improvements are essential to address these challenges. The ability to manage labor costs and maintain a skilled workforce is critical for UPS's operational efficiency.

Cybersecurity threats and data privacy concerns pose significant risks to UPS's extensive digital infrastructure. Ensuring business continuity and protecting sensitive data requires robust cybersecurity measures and ongoing monitoring. Any breaches could result in significant financial and reputational damage.

Economic downturns can reduce demand for package delivery services, affecting UPS's revenue and profitability. Economic fluctuations can lead to decreased shipping volumes and increased price sensitivity among customers. Diversifying services and markets can help mitigate the impact of economic downturns.

UPS employs several strategies to mitigate these risks. These include network diversification to reduce reliance on any single region or route, robust contingency planning to address potential disruptions, and strategic inventory management to ensure efficient supply chain operations. Technological investments are also a key part of the strategy, with a focus on automation, data analytics, and sustainable fleet technologies. The company's risk management framework involves comprehensive scenario planning and ongoing assessment of emerging risks, such as cybersecurity threats and data privacy concerns, to ensure business continuity and protect its digital infrastructure. In 2024, UPS invested $1 billion in electric vehicles and alternative fuel technologies, demonstrating its commitment to sustainability and future-proofing its operations.

The combined effect of these risks can significantly impact UPS's financial performance. Increased operational costs due to regulatory compliance and supply chain disruptions, coupled with potential revenue declines during economic downturns, can affect profitability. The company's ability to adapt to technological advancements and manage labor costs will also influence its financial outcomes. In the first quarter of 2024, UPS reported a revenue of $21.7 billion, reflecting the ongoing challenges and the need for strategic risk management. The company’s net income was $1.1 billion, highlighting the importance of cost control and operational efficiency.

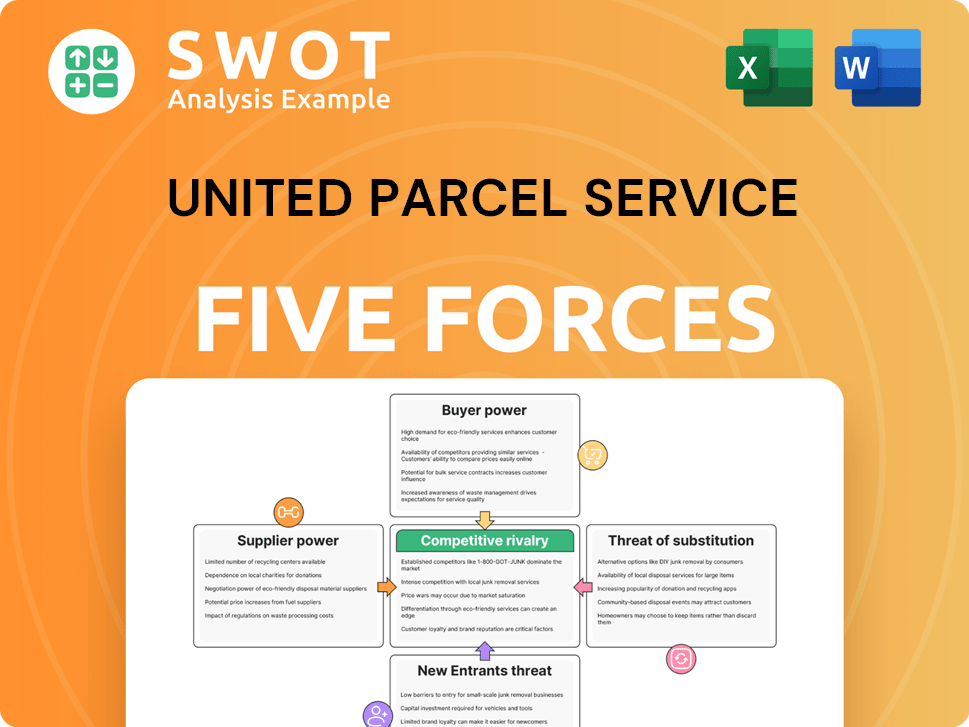

United Parcel Service Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of United Parcel Service Company?

- What is Competitive Landscape of United Parcel Service Company?

- How Does United Parcel Service Company Work?

- What is Sales and Marketing Strategy of United Parcel Service Company?

- What is Brief History of United Parcel Service Company?

- Who Owns United Parcel Service Company?

- What is Customer Demographics and Target Market of United Parcel Service Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.