Vroom Bundle

Can Vroom Navigate the Shifting Sands of the Used Car Market?

The used car market is experiencing a digital revolution, with online platforms vying for dominance. Vroom, a pioneer in this space, aimed to revolutionize the car-buying experience. But how does Vroom stack up against the competition? This analysis dives deep into the Vroom SWOT Analysis and its rivals.

This exploration of the Vroom competitive landscape will dissect its position within the online car sales arena. We'll conduct a thorough Vroom market analysis, examining its key Vroom competitors, and assessing its strengths and weaknesses within the broader automotive industry. Understanding the dynamics of the used car market is crucial for investors and industry watchers alike, especially when considering Vroom's financial performance and future outlook.

Where Does Vroom’ Stand in the Current Market?

The core operations of Vroom have undergone a significant transformation. Initially, Vroom's value proposition centered on facilitating online car sales, providing a platform for buying and selling used vehicles with services like home delivery. This model aimed to disrupt the traditional used car market by offering convenience and transparency.

However, as of early 2024, Vroom shifted its focus. The company decided to cease its e-commerce operations and wind down its used vehicle dealership business, including the closure of its Texas dealership, effective February 6, 2024. This strategic pivot has redefined its market position, moving away from direct online used car sales to concentrate on its automotive finance and insurance business, United Auto Credit Corporation (UACC).

Prior to this shift, Vroom's competitive strategy involved competing with other online platforms and traditional dealerships. It offered a wide selection of vehicles, transparent pricing, and home delivery services across the United States. The company faced challenges in achieving profitability and scaling its e-commerce operations efficiently. Vroom's competitive landscape has changed dramatically.

Vroom entered the online car sales market with the aim of expanding its reach across the United States. The company's expansion plans included establishing a significant presence in the used car market. However, the challenges in scaling its e-commerce operations led to a change in strategy.

Vroom's financial performance in its e-commerce segment faced significant hurdles. In its Q3 2023 earnings report, Vroom reported a decrease in vehicle sales and gross profit compared to the previous year. The company reported substantial net losses in previous quarters, which contributed to the decision to exit the e-commerce business.

The decision to exit the e-commerce business marks a significant strategic shift for Vroom. The future outlook for Vroom will be primarily defined by the performance and growth of its UACC automotive finance business. This shift indicates a re-evaluation of the company's market position and a focus on a more sustainable business model.

The exit from the e-commerce segment will impact Vroom's market share in the online used car market. The company's market share will be reduced as it no longer directly participates in online car sales. This strategic change reflects the intense competition and operational complexities within the online used car retail market.

Vroom's market position has significantly changed due to its strategic shift away from e-commerce. The company's focus has moved to its automotive finance business, UACC. This transition highlights the challenges faced in the online used car market and the importance of adapting to market dynamics.

- Vroom ceased its e-commerce operations as of early 2024.

- The company is now focused on its automotive finance business, UACC.

- Financial challenges and intense competition drove this strategic shift.

- The future outlook depends on the performance of UACC.

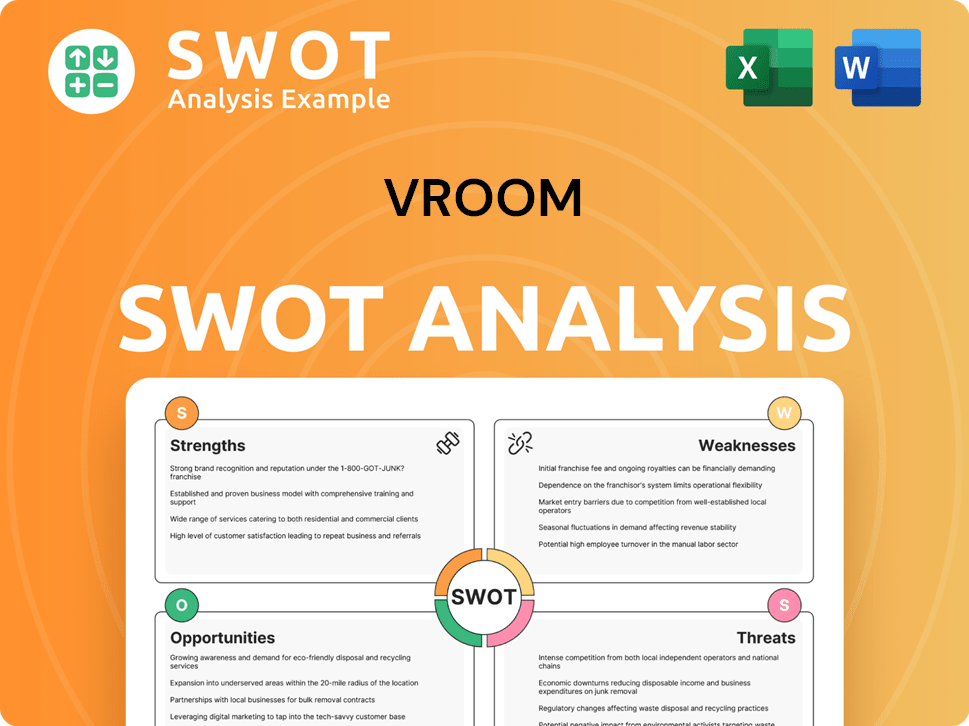

Vroom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Vroom?

The Owners & Shareholders of Vroom have seen a significant shift in the company's strategic direction, which has fundamentally altered its competitive landscape. Initially, Vroom competed directly with other online used car retailers and traditional dealerships. However, the focus has now shifted towards automotive finance and insurance, changing the nature of its key rivals.

This transformation means that a Vroom market analysis now needs to consider a different set of competitors. The company's strategic pivot to United Auto Credit Corporation (UACC) has placed it squarely in competition with a variety of financial institutions. The used car market is dynamic, and understanding these shifts is crucial for any Vroom competitor analysis in 2024.

Vroom's competitive landscape has evolved significantly. Here's a breakdown of its key competitors, considering the company's strategic shift.

Before the strategic shift, Vroom's primary rivals were in the online car sales sector. These competitors offered direct competition in the used car market, focusing on online sales and delivery.

A major player in online car sales, Carvana is known for its car vending machines and extensive online inventory. Carvana has a substantial market share in the online used car segment.

While primarily a brick-and-mortar retailer, CarMax has expanded its online presence, offering online purchasing and home delivery services. CarMax is a significant competitor due to its size and established brand.

Shift Technologies was another online used car platform. Shift, like Vroom, faced financial challenges and strategic adjustments in recent years.

Thousands of independent and franchised dealerships across the country also compete in the used car market. Many have enhanced their online sales capabilities.

With the focus on UACC, Vroom's key competitors are now in the automotive finance and insurance sector. Competition revolves around interest rates, loan terms, and customer service.

A wide array of financial institutions, including banks and credit unions, offer auto financing. These institutions compete on interest rates and loan terms.

Captive finance companies associated with auto manufacturers also provide financing options. These companies often offer competitive rates and incentives.

Other independent auto finance providers compete by offering specialized financing options and focusing on specific customer segments.

The shift to UACC has significantly changed Vroom's business model analysis and future outlook. The company's focus is now on providing financing solutions rather than direct car sales. This change impacts Vroom's market share and financial performance.

- Market Position: Vroom's market position is now more aligned with automotive finance providers.

- Revenue Streams: Revenue streams are primarily from interest earned on loans and fees.

- Customer Focus: The customer focus is on dealerships and consumers seeking financing.

- Competitive Advantage: The competitive advantage lies in offering attractive financing terms and building strong relationships with dealerships.

- Challenges: Challenges include navigating the complexities of the automotive finance industry and managing credit risk.

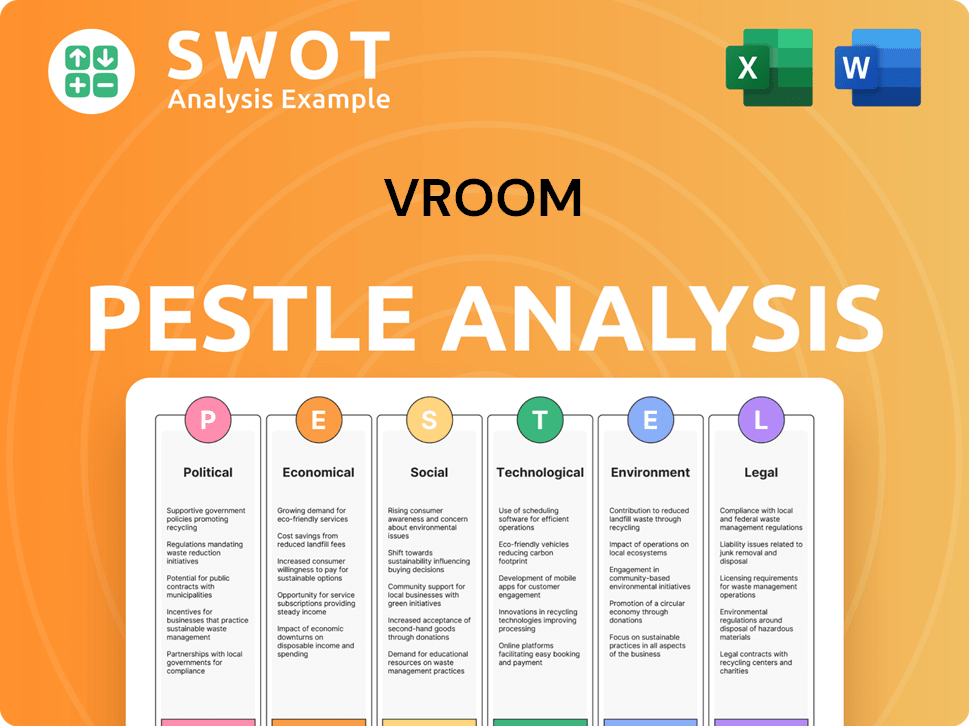

Vroom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Vroom a Competitive Edge Over Its Rivals?

Given the strategic shift, the competitive advantages of the company are now centered on United Auto Credit Corporation (UACC). The company's previous strengths in online car sales, such as its asset-light model and home delivery, are less relevant. This shift requires a focus on UACC's capabilities within the automotive finance and insurance sector.

UACC's position in the subprime and near-prime auto lending market is a key competitive advantage. Its underwriting expertise and established relationships with dealerships are crucial. The ability to assess risk and originate loans efficiently, particularly in the non-prime sector, is a significant strength. This focus allows for a deeper dive into the Vroom market analysis, highlighting its current operational strategy.

The integration of UACC's financing capabilities into the broader strategy aims to offer integrated solutions within the automotive ecosystem. The sustainability of these advantages depends on UACC's performance, its ability to manage credit risk, and the overall health of the automotive finance market, which influences the company's future outlook.

UACC, as a subsidiary, has a long operating history in auto lending. The company's established loan portfolio indicates a robust operational infrastructure. This provides a competitive edge in the used car market by offering financing options.

The focus has shifted towards leveraging UACC's financing capabilities. This move aims to offer integrated solutions within the automotive ecosystem, potentially through partnerships. The company is adapting its approach to the Vroom competitive landscape.

UACC's expertise in subprime and near-prime lending is a key advantage. Strong relationships with dealerships provide a stable source of business. This is crucial for the company's financial performance.

Managing credit risk effectively is crucial for UACC's success. The overall health of the automotive finance market impacts its performance. The company faces challenges in the Vroom vs Carvana comparison.

UACC's primary advantage lies in its established presence in the subprime and near-prime auto lending market. Its underwriting expertise and relationships with dealerships are critical assets. The ability to efficiently assess risk and originate loans to a diverse customer base, especially in the non-prime sector, is a significant differentiator. For more details on the company's strategic direction, see Growth Strategy of Vroom.

- Specialized Lending: Focus on subprime and near-prime auto loans.

- Underwriting Expertise: Efficient risk assessment and loan origination.

- Dealership Relationships: Strong partnerships for a stable business source.

- Integrated Solutions: Potential for partnerships within the automotive ecosystem.

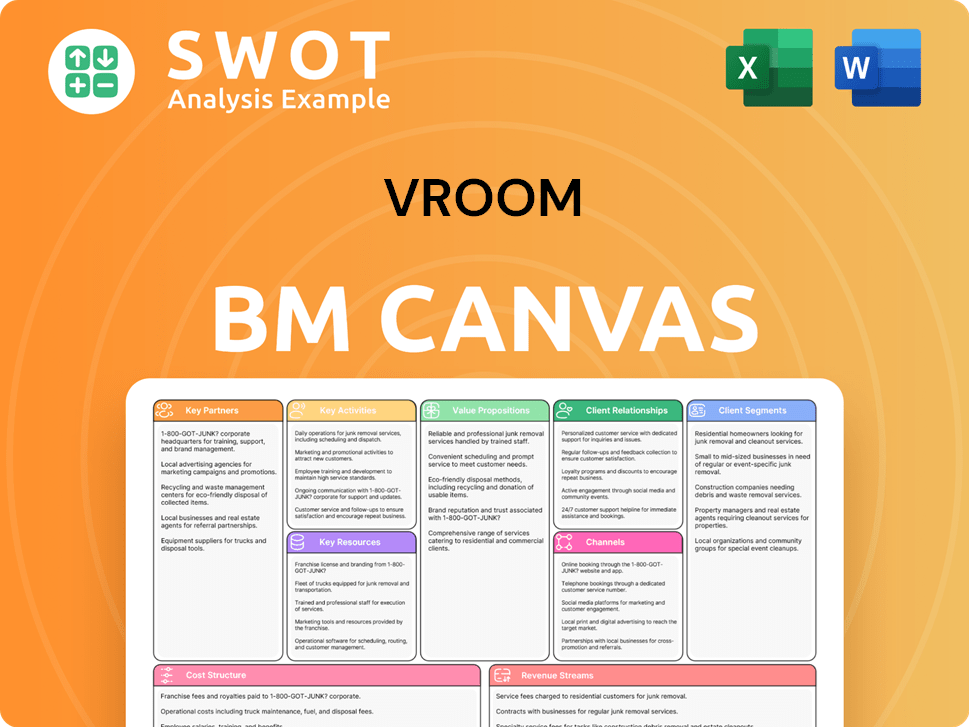

Vroom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Vroom’s Competitive Landscape?

The automotive industry, particularly the used car and auto finance sectors, is experiencing significant shifts. With a focus on its automotive finance business, United Auto Credit Corporation (UACC), the company faces challenges and opportunities shaped by these trends. Understanding the Vroom competitive landscape is crucial for navigating this evolving market.

The used car market is influenced by digital processes, used vehicle price volatility, interest rate fluctuations, and consumer credit availability. These factors directly impact auto finance. Rising interest rates can dampen demand for auto loans and increase the cost of capital for lenders like UACC. The company’s strategic focus on its core lending expertise and its ability to navigate industry dynamics will be critical for its resilience and growth.

Digitalization is transforming automotive transactions, including financing. The volatility of used vehicle prices affects loan collateral and lending risk. Economic factors like interest rates and consumer credit availability influence the auto finance market, as seen with the Federal Reserve's recent decisions.

Managing credit risk in an uncertain economic environment is a key challenge. Adapting to evolving financial services regulations and competing with established and emerging lenders are also significant hurdles. The subprime lending segment, where UACC operates, is particularly sensitive to economic downturns.

Expanding the network of dealership partners presents a key opportunity. Leveraging technology to enhance underwriting and loan servicing capabilities is also beneficial. Diversifying finance offerings within the automotive ecosystem could further drive growth. The continued demand for used vehicles suggests a persistent need for financing solutions.

The used car market is influenced by various factors, including consumer demand, economic conditions, and technological advancements. The shift towards online car sales and digital financing platforms is reshaping the industry. Understanding these dynamics is essential for strategic planning.

UACC’s success hinges on several strategic factors. Strengthening relationships with dealership partners is crucial for loan origination. Enhancing underwriting and loan servicing through technology can improve efficiency and reduce risk. Diversifying financial offerings can attract a broader customer base. For more insights, consider the Target Market of Vroom.

- Focus on Core Lending: Maintain expertise in automotive financing.

- Technology Integration: Use technology for underwriting and loan servicing.

- Risk Management: Implement robust credit risk management strategies.

- Partnership Expansion: Grow the network of dealership partners.

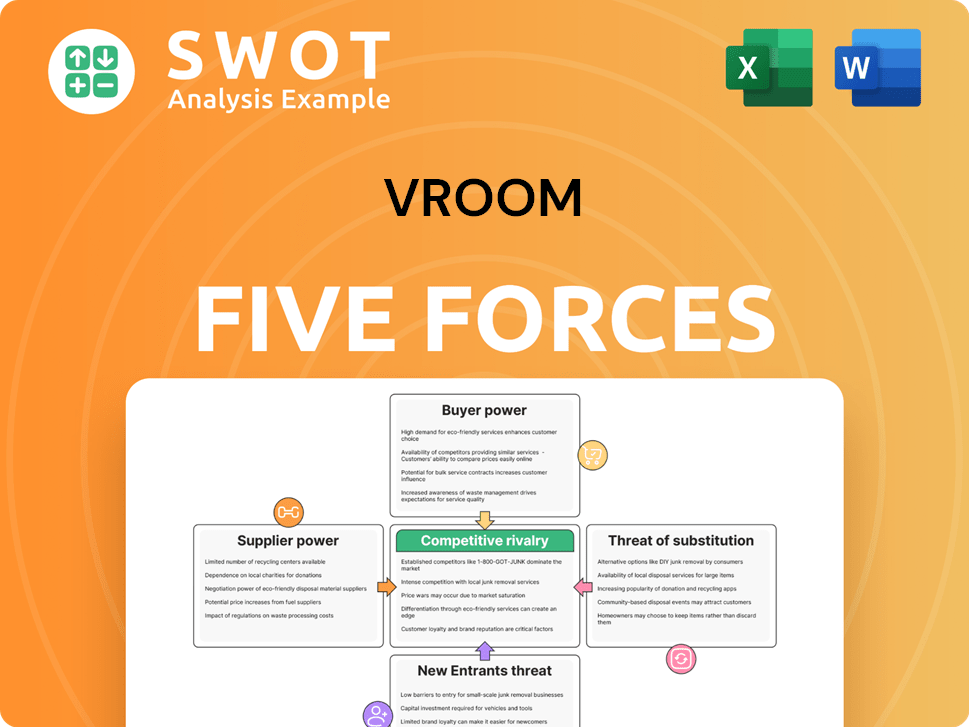

Vroom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vroom Company?

- What is Growth Strategy and Future Prospects of Vroom Company?

- How Does Vroom Company Work?

- What is Sales and Marketing Strategy of Vroom Company?

- What is Brief History of Vroom Company?

- Who Owns Vroom Company?

- What is Customer Demographics and Target Market of Vroom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.