Vroom Bundle

How Has Vroom Company Changed?

Vroom, once a major player in the online used car market, has undergone a significant transformation. Shifting away from direct-to-consumer sales in early 2024, Vroom now focuses on automotive finance and AI-driven analytics. This strategic pivot is crucial for understanding the current Vroom SWOT Analysis and the company's future.

This shift impacts investors, customers, and the automotive industry. The evolution of the Vroom company highlights the changing dynamics of the used car market, especially regarding Vroom car buying. Understanding how Vroom works now, with its focus on lending and data, is key to assessing its potential and the future of Vroom online car sales, Vroom used cars, and the overall car buying experience.

What Are the Key Operations Driving Vroom’s Success?

Following the discontinuation of its e-commerce used vehicle dealership business in January 2024, the core operations of the Vroom company now primarily revolve around its two subsidiaries: UACC and CarStory. UACC focuses on indirect lending, providing vehicle financing through a network of third-party dealers, especially targeting the non-prime market. CarStory, on the other hand, offers AI-powered analytics and digital services to automotive dealers and financial services companies. This shift represents a strategic pivot towards a capital-light model, emphasizing higher-margin finance and analytics segments.

UACC, acquired in February 2022, originates and services retail installment sales contracts, with approximately 78,000 contracts and an aggregate principal outstanding balance of $1.0 billion as of December 31, 2024. CarStory leverages a comprehensive database of vehicle information to enhance customer experience and drive vehicle purchases. The company is positioning itself to capitalize on the growing demand for sophisticated lending solutions and data-driven insights within the automotive sector.

The value proposition of UACC lies in offering accessible financing solutions, particularly for non-prime consumers, facilitating vehicle purchases through dealerships. CarStory's value proposition centers on its AI-powered analytics, which help automotive businesses make data-driven decisions, optimize inventory management, and improve customer targeting. This strategic direction allows Vroom to differentiate itself from its former e-commerce competitors by focusing on financial services and data insights.

UACC's operations include loan originations, underwriting, and servicing. These are supported by warehouse credit facilities and securitization transactions to maintain liquidity. The focus is on providing financing solutions to a specific market segment, which is a key part of how Vroom works. This approach allows Vroom to leverage the existing dealer network.

CarStory's operations involve technology development, data analysis, and providing digital services to its clients. The company uses AI to enhance the customer experience and drive vehicle purchases. The expanding digital automotive market, projected to reach $1.33 trillion in revenue in the U.S. in 2024, provides significant growth opportunities for CarStory.

Vroom's strategic shift to focus on financial services and data analytics, rather than direct vehicle sales, allows it to capitalize on the growing demand for sophisticated lending solutions and data-driven insights in the automotive sector. This approach is a key part of how Vroom works, differentiating it from competitors and focusing on higher-margin segments.

- Focus on non-prime lending through UACC.

- Leveraging AI-powered analytics with CarStory.

- Capital-light business model.

- Targeting the expanding digital automotive market.

Vroom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vroom Make Money?

Following its strategic shift, the core of the Vroom company's revenue generation centers on its automotive finance subsidiary, United Auto Credit Corporation (UACC), and its AI-driven analytics platform, CarStory. This structure reflects a move towards more stable and diversified income streams. The financial health of Vroom is significantly influenced by these key components.

UACC plays a crucial role, generating income primarily through interest from its loan portfolio. CarStory contributes by providing AI-powered services to the automotive sector. Vroom also aims to monetize its technology through various methods, including asset sales and licensing, thereby expanding its revenue sources within the evolving digital automotive market. The company's financial strategy is designed to support its operations and growth.

Vroom's financial performance in early 2025 showed a net income of $45.1 million from continuing operations for the period of January 1 to January 15, 2025, followed by a net loss of $6.5 million from January 15 to March 31, 2025. The company's full-year 2024 net loss was $(165.1) million, an improvement from the prior year's $(364.6) million. These figures reflect the company's ongoing efforts to streamline operations and improve profitability. Understanding the competitive landscape of Vroom offers further insights into its market position.

UACC's loan originations in 2024 reached $1.2 billion, demonstrating its strong financial standing. As of December 31, 2024, UACC managed approximately 78,000 retail installment sales contracts, with an outstanding balance of $1.0 billion. CarStory's contribution is positioned within a digital automotive market estimated to reach $80 billion in 2024 for e-commerce technology and intellectual property.

- UACC generates revenue through interest income from its loan portfolio.

- CarStory provides AI-powered services to automotive dealers and financial services companies.

- Vroom aims to monetize its e-commerce technology through asset sales, licensing, and SaaS models.

- Securitization and warehouse agreements are key for funding UACC's loan portfolio.

Vroom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Vroom’s Business Model?

The evolution of the Vroom company has been marked by significant strategic shifts and operational adjustments. A pivotal moment was the announcement of its Value Maximization Plan in January 2024. This plan involved discontinuing e-commerce operations and winding down its used vehicle dealership business. This decision was a direct response to financial pressures and a need to preserve liquidity.

In early 2024, the company's stock price reflected market concerns about these changes. However, Vroom has since taken steps to strengthen its financial position. A key move was the successful recapitalization of its unsecured convertible senior notes, which has improved its financial health. The company continues to adapt and focus on its core strengths in automotive finance and AI-powered analytics.

Vroom's current strategy centers on automotive finance through UACC and AI-driven analytics via CarStory. UACC focuses on the non-prime market, providing financial solutions to independent and franchise dealerships. CarStory leverages AI to provide analytics and digital services, positioning Vroom in the growing digital automotive market, which is estimated to reach $80 billion in 2024.

The Value Maximization Plan, announced in January 2024, led to the discontinuation of e-commerce and the used vehicle dealership business. This strategic shift was driven by financial pressures. The company also successfully recapitalized its unsecured convertible senior notes on January 14, 2025, strengthening its balance sheet.

Recapitalization of unsecured convertible senior notes in January 2025 was a major move. The company completed its 17th securitization transaction in March 2025, issuing $324 million of fixed-rate asset-backed notes. Additionally, Vroom extended $400 million of warehouse capacity since year-end 2024.

Vroom's competitive edge lies in its focus on automotive finance through UACC and the use of AI-powered analytics via CarStory. UACC targets the non-prime market, and CarStory provides digital services. The automotive e-commerce market is estimated to reach $80 billion in 2024, presenting significant opportunities.

The company's focus on streamlining operations and reducing costs is evident. The successful recapitalization and securitization transactions demonstrate efforts to improve financial health. For more insights into Vroom's strategic direction, consider reading about the Growth Strategy of Vroom.

Vroom is adapting by streamlining operations and reducing costs. The company aims to improve its loan portfolio performance at UACC. The company is focusing on technology and customer experience within its remaining business units.

- Focus on automotive finance and AI-driven analytics.

- Streamlining operations and reducing costs.

- Exploring monetization opportunities for e-commerce technology and IP.

- Adapting to the evolving digital automotive market.

Vroom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Vroom Positioning Itself for Continued Success?

The market position of the Vroom company has significantly evolved. It has shifted its focus from online used car sales to automotive finance and AI-driven analytics. This strategic change, effective from January 2024, means Vroom is no longer directly competing in the online used car market, setting it apart from rivals like Carvana and CarGurus. Its current standing is now assessed within the automotive lending and analytics sectors, with a focus on its subsidiaries, United Auto Credit Corporation (UACC) and CarStory.

Key risks for Vroom include financial challenges tied to the wind-down of its e-commerce operations, such as severance costs and inventory liquidation. The company has a history of losses, with a substantial accumulated deficit. Liquidity remains a concern, although the company reported available liquidity as of March 31, 2025. Market risks involve interest rate fluctuations, potential credit losses within UACC's portfolio, and constraints in the securitization market. Furthermore, the company is exposed to economic downturns and shifts in consumer demand.

Vroom now operates primarily in automotive finance and AI-powered analytics. UACC, as an indirect lender, serves third-party dealers, especially in the non-prime market. CarStory is positioned in the growing automotive analytics market. This transition marks a significant shift from its original business model of Owners & Shareholders of Vroom.

The company faces financial risks from its e-commerce wind-down, including costs from severance and inventory liquidation. It has a history of losses, with an accumulated deficit of approximately $2,125.8 million as of December 31, 2024. Liquidity and market risks, such as interest rate fluctuations and credit losses, also pose challenges.

Vroom aims for profitability through UACC's lending program, enhanced sales efforts, and leveraging technology. The company plans to reduce credit losses and increase market share in its finance segment. It also intends to monetize its e-commerce technology. Expectations for adjusted net income (loss) range from $(30) million to $(45) million for the full year 2025.

As of December 31, 2024, UACC held approximately $1.0 billion in aggregate principal outstanding balance. The automotive analytics market, where CarStory operates, was valued at approximately $2.5 billion in 2024. Consolidated total available liquidity was reported at $66.9 million as of March 31, 2025. Year-end total available liquidity is projected between $35 million and $50 million.

Vroom is focused on several key initiatives to achieve its goals. These include building a strong lending program at UACC, enhancing sales and marketing, and improving operational efficiency. The company is also leveraging technology to drive growth and reduce credit losses.

- Focus on UACC's lending program to drive profitability.

- Enhancement of sales and marketing efforts.

- Improvement of operational excellence in originations and servicing.

- Leveraging technology to foster growth and innovation.

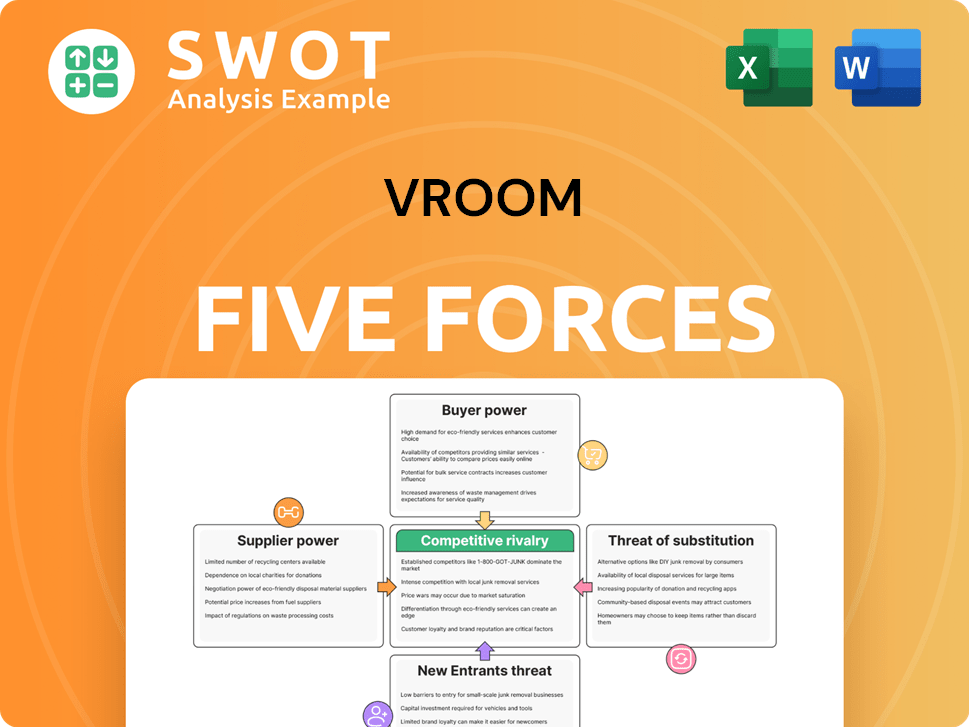

Vroom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vroom Company?

- What is Competitive Landscape of Vroom Company?

- What is Growth Strategy and Future Prospects of Vroom Company?

- What is Sales and Marketing Strategy of Vroom Company?

- What is Brief History of Vroom Company?

- Who Owns Vroom Company?

- What is Customer Demographics and Target Market of Vroom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.