Vroom Bundle

Can Vroom Revive Its Engine?

Once a disruptor in the online car sales arena, Vroom, Inc. has undergone a dramatic transformation. From its initial mission to revolutionize the used car market, Vroom has pivoted, discontinuing its e-commerce operations. This strategic shift now focuses on its financial services and data analytics arms, presenting a fascinating case study in adaptability within the volatile automotive industry.

This Vroom SWOT Analysis delves into the evolving Vroom growth strategy, exploring its future prospects in the face of shifting market dynamics. We'll examine the company's recent strategic redirection, analyzing how it plans to leverage its core assets to navigate the complexities of the used car market and capitalize on emerging automotive industry trends. Understanding Vroom's new business model is crucial for investors and industry watchers alike.

How Is Vroom Expanding Its Reach?

Following a strategic pivot in January 2024, the expansion initiatives of the company are no longer centered on direct vehicle sales. Instead, the focus has shifted to growing its automotive finance and AI-powered analytics businesses. This strategic redirection aims to diversify revenue streams beyond vehicle sales, expanding financing options, and exploring partnerships that enrich the customer experience.

The company's primary focus is now on United Auto Credit Corporation (UACC), a leading automotive lender serving the independent and franchise dealer market nationwide, and CarStory, which provides AI-powered analytics and digital services for automotive retail. This shift reflects an adaptation to the evolving automotive industry trends and the used car market dynamics.

This strategic realignment is a direct response to financial challenges and market shifts, as highlighted in a recent Owners & Shareholders of Vroom article. The goal is to leverage existing assets to enhance business profitability and adapt to the competitive landscape.

The company plans to build a world-class lending program through UACC. This involves improving operational excellence in originations and servicing. The goal is to achieve pre-COVID cumulative net losses and reduce operating costs. The focus is on strengthening its position in the automotive finance sector.

The company intends to enhance sales and marketing efforts for both UACC and CarStory. This includes targeted campaigns and digital strategies to increase market penetration. The aim is to drive revenue growth within these segments, leveraging the power of AI-powered analytics.

The company will leverage technology to drive growth and profitability within the UACC and CarStory segments. This includes investments in data analytics, AI, and digital platforms. The focus is on innovation and efficiency to improve customer experience and operational performance.

The company is exploring opportunities to monetize its intellectual property and tech stack. This includes asset sales, licensing, and a SaaS model. The goal is to create additional revenue streams and maximize the value of its technological assets.

Although the company discontinued its e-commerce operations, its strategic plan still outlines geographic expansion and investment in logistics and distribution networks. This is intended to strengthen its presence in key markets for its finance and analytics offerings. This expansion is crucial for the company's long-term growth potential.

- Expanding the geographic reach of UACC's lending services.

- Increasing the deployment of CarStory's AI-powered analytics in new markets.

- Investing in logistics to support finance and analytics offerings.

- Exploring partnerships to enhance service offerings.

Vroom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vroom Invest in Innovation?

The company has shifted its focus, leveraging technology to drive growth primarily through its automotive finance and AI-powered analytics businesses. This strategic pivot emphasizes the importance of innovation in maintaining a competitive edge within the evolving automotive industry. The company's current strategy is deeply rooted in technological advancements.

At the core of its current strategy is the integration of advanced technology. This involves harnessing data analytics to better understand customer preferences and optimize operations within its finance and analytics segments. The technological infusion extends to artificial intelligence (AI) and machine learning (ML), which are expected to simplify processes and improve customer satisfaction in its new business model. The company is focused on improving processes and technology, digitization, and automation across its remaining businesses.

The company's strategic focus on AI and data analytics is intended to drive growth and profitability in its transformed operations. The company is actively exploring opportunities to monetize its intellectual property and tech stack through asset sales, licensing, and a Software-as-a-Service (SaaS) model. This approach aims to leverage its technological assets for additional revenue streams.

The company's current strategy heavily relies on integrating advanced technology to optimize operations. This includes using data analytics to understand customer preferences and streamline processes within its finance and analytics segments. AI and ML are also key components, aimed at simplifying processes and enhancing customer satisfaction.

The company is concentrating on AI and data analytics to drive growth and profitability. This strategic focus is designed to improve decision-making and operational efficiency. The goal is to leverage these technologies to gain a competitive advantage in the market.

The company is actively exploring ways to monetize its intellectual property and tech stack. This includes potential asset sales, licensing agreements, and a SaaS model. By leveraging its technological assets, the company seeks to create additional revenue streams and maximize its value.

The company holds numerous patents and trademarks related to its technology and branding. Efforts are ongoing to protect and leverage these intellectual property rights. This IP portfolio supports its competitive positioning and future innovation.

Digital transformation is a key priority, with a focus on improving processes through digitization and automation. This includes streamlining operations across its remaining businesses. The company is committed to enhancing efficiency and customer experience through technology.

The company's future prospects are closely tied to its ability to execute its technology-driven strategy. Success depends on effectively integrating AI, data analytics, and monetizing its intellectual property. These initiatives are crucial for driving long-term growth and profitability.

The company is focused on several key technological initiatives to drive its Vroom growth strategy. These initiatives are designed to enhance operational efficiency, improve customer experience, and generate new revenue streams. The company's approach to technology is central to its future prospects in the automotive industry.

- AI-Powered Analytics: Utilizing AI to analyze data and improve decision-making.

- Data Analytics: Leveraging data to understand customer preferences and optimize operations.

- Digital Transformation: Improving processes through digitization and automation.

- Intellectual Property Monetization: Exploring opportunities to generate revenue from its tech stack.

- Focus on SaaS: Considering Software-as-a-Service models to expand service offerings.

Vroom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Vroom’s Growth Forecast?

The financial landscape for the company has been significantly altered by its strategic pivot, which included discontinuing its e-commerce operations. This shift has allowed the company to focus on its core strengths in automotive finance and AI-powered analytics. The company emerged from Chapter 11 bankruptcy on January 14, 2025, which has had a substantial impact on its financial structure.

The restructuring eliminated all long-term debt at the parent level, while its subsidiary, UACC, remains obligated to asset-backed securitizations and trust-preferred securities debt. This restructuring aimed to stabilize the company's financial position and set the stage for future growth. The company's focus now is on leveraging its core competencies to achieve long-term sustainability and profitability within the automotive sector.

As of December 31, 2024, the company had an estimated preliminary consolidated total cash and excess liquidity of approximately $58 million. This included $29 million in cash and cash equivalents, and $28 million of excess available liquidity on UACC's warehouse lines. By March 31, 2025, the consolidated total available liquidity had increased to $66.9 million, with $14.6 million in cash and cash equivalents. This indicates a positive trend in liquidity management, which is crucial for supporting its ongoing operations and strategic initiatives.

For the full year ended December 31, 2024, the company reported a net loss from continuing operations of $(138.2) million. The net loss was $(165.1) million, which was a substantial improvement compared to the $(364.6) million loss in the previous year. This improvement was largely due to reduced losses from discontinued operations. The net loss per share for 2024 was $(91.07), a notable improvement from $(209.17) in the prior year.

Interest income for 2024 was $201.8 million, reflecting a 12.7% increase from the previous year. This increase was primarily driven by new originations, which increased the average loan portfolio. Net interest income was $142.5 million, an increase of $5.9 million. These figures highlight the company's ability to generate revenue from its automotive finance operations despite the challenges.

The company reported a gross profit margin of 97.83%, which is a strong indicator of its operational efficiency and ability to manage costs. The successful completion of a UACC securitization transaction in April 2024 further supports its financial strategy. These financial achievements are crucial to the company's plan to navigate the challenges in the automotive industry.

The company's strategic shift and recapitalization are designed to position it for long-term growth. It aims to leverage its core strengths in automotive finance and analytics. The focus on these areas is expected to drive future profitability and market share. The company's ability to adapt and innovate will be key to its success in the evolving automotive industry.

Vroom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Vroom’s Growth?

The shift in focus to automotive finance and AI-powered analytics by Vroom, following the discontinuation of its e-commerce operations in January 2024, introduces several potential risks. The company's ability to generate sufficient liquidity is a primary concern. The subsidiary UACC's access to funding and capital for growth is crucial for the Revenue Streams & Business Model of Vroom. Furthermore, potential increases in credit losses at UACC could negatively affect its ability to securitize its loan portfolio.

Operational risks, including the potential loss of key personnel, also pose challenges to executing the refined strategy. Legal proceedings, such as the $3 million settlement with the Texas Attorney General's Office in December 2023, highlight the need for robust compliance. Market risks, such as interest rate fluctuations and credit losses within UACC's portfolio, present significant hurdles, especially in an inflationary environment.

Emerging from Chapter 11, although a step towards financial stability, presents risks to business operations and relationships. Cybersecurity risks, especially with increased AI integration, are also a concern. Vroom has a history of net losses, with an accumulated deficit of approximately $2,125.8 million as of December 31, 2024, and may not achieve profitability in the future.

Vroom's strategic pivot requires sufficient liquidity to operate its remaining businesses. The company's subsidiary, UACC, needs continued access to funding sources. The ability to renew these sources and obtain capital is essential for maintaining and expanding its operations in the used car market.

Increased credit losses at UACC could impact its ability to securitize its loan portfolio. Fluctuations in interest rates and credit losses pose significant challenges, especially in a sustained inflationary environment. These market risks could affect Vroom's financial performance and future prospects.

Operational risks include potential loss of key personnel, which could impair strategy execution. Legal proceedings, such as the settlement with the Texas Attorney General's Office, highlight the need for robust compliance. These factors can influence Vroom's ability to maintain customer satisfaction and market share.

Cybersecurity risks are a significant concern, particularly with the integration of AI in operations. Threats from cyber-attacks, malicious software, and data breaches can disrupt business and compromise sensitive customer data. Protecting data is crucial to maintaining customer trust.

Vroom has a history of net losses, with an accumulated deficit of approximately $2,125.8 million as of December 31, 2024. The company's ability to achieve profitability remains uncertain. Management focuses on operational excellence and cost reduction to mitigate financial challenges.

Emerging from Chapter 11 introduces risks to business operations and relationships. Restructuring can impact customer, vendor, and employee confidence. Navigating these relationships is critical for long-term growth potential and stability within the automotive industry trends.

Management's approach to mitigating these risks involves focusing on operational excellence and cost reduction initiatives. Leveraging technology is crucial, particularly with AI, to improve efficiency and reduce expenses. These strategies are essential for navigating the competitive landscape.

The used car market is highly competitive, with companies like Carvana and traditional dealerships posing significant challenges. Vroom must differentiate itself through innovative financing options and superior customer service. Understanding the competitive landscape is key to success.

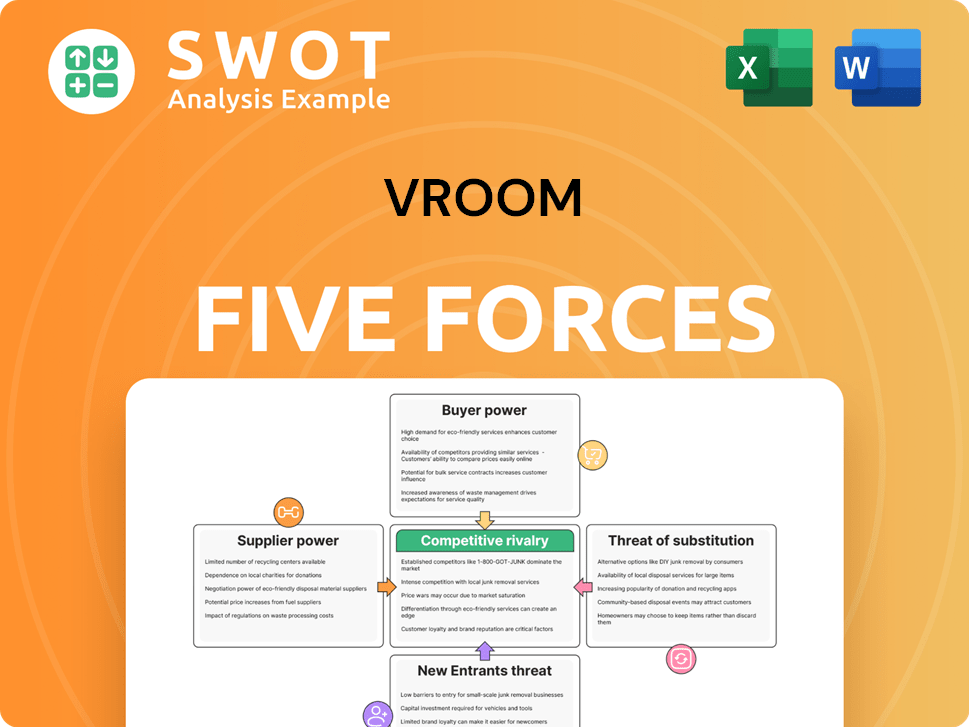

Vroom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vroom Company?

- What is Competitive Landscape of Vroom Company?

- How Does Vroom Company Work?

- What is Sales and Marketing Strategy of Vroom Company?

- What is Brief History of Vroom Company?

- Who Owns Vroom Company?

- What is Customer Demographics and Target Market of Vroom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.