Vroom Bundle

Who are Vroom's Customers Today?

Understanding the Vroom SWOT Analysis is crucial for grasping its current position. The Vroom company has dramatically shifted its focus, making it essential to understand its evolving customer demographics and target market. This shift demands a deep dive into who Vroom serves now and how its strategies align with the needs of its current business model.

This analysis will explore the target market for United Auto Credit Corporation (UACC) and CarStory, examining their market segmentation and the buyer persona they target. We'll investigate the Vroom customer age range, Vroom customer income level, and Vroom target audience location to understand their financial services and data analytics needs. Furthermore, we'll look at Vroom customer buying behavior and Vroom market share analysis to give a complete picture of the company's current landscape, including the impact of its strategic transformation away from online car sales.

Who Are Vroom’s Main Customers?

Following its strategic pivot in January 2024, the focus of the Vroom company has shifted significantly. The customer demographics and target market are now centered on the automotive industry, specifically serving businesses rather than individual consumers. This transition marks a substantial change in its operational model and customer base.

The primary customer segments now include independent and franchise car dealerships across the United States. This shift is largely due to the operations of United Auto Credit Corporation (UACC), a subsidiary providing automotive financing. Additionally, CarStory, another core asset, targets automotive retailers by offering AI-powered analytics and digital services. This B2B approach allows the company to focus on providing data-driven solutions and financial services to dealerships, aiming for financial stability and higher-margin opportunities.

Since the company exited direct-to-consumer sales, specific demographic breakdowns like age, gender, and income are no longer directly applicable. Instead, the focus is on the characteristics of its business clients, including dealerships and automotive retailers seeking advanced analytics and financing solutions. This strategic change is reflected in its financial performance, with UACC's loan originations reaching $1.2 billion in 2024.

The main customer base consists of independent and franchise car dealerships. These dealerships utilize UACC for automotive financing, particularly focusing on the non-prime market. This segment includes dealerships that cater to consumers with varying credit profiles.

Automotive retailers are another key segment, leveraging CarStory's AI-powered analytics and digital services. These retailers use data-driven insights for inventory management, pricing strategies, and enhancing their digital retail operations. This focus supports their ability to compete effectively in the evolving market.

The target market is defined by the needs of dealerships and automotive retailers looking for financial and analytical support. These businesses are seeking solutions to improve their operational efficiency and customer service. The company's strategic shift aims to capitalize on the B2B market, providing services that enhance dealership performance.

- Focus on the non-prime market, indicating a focus on dealerships serving customers with diverse credit histories.

- Emphasis on data-driven solutions for inventory management and pricing.

- Goal of providing financial stability and higher-margin opportunities through its capital-light model.

- The financial success of UACC, with loan originations of $1.2 billion in 2024, highlights the strength in this segment.

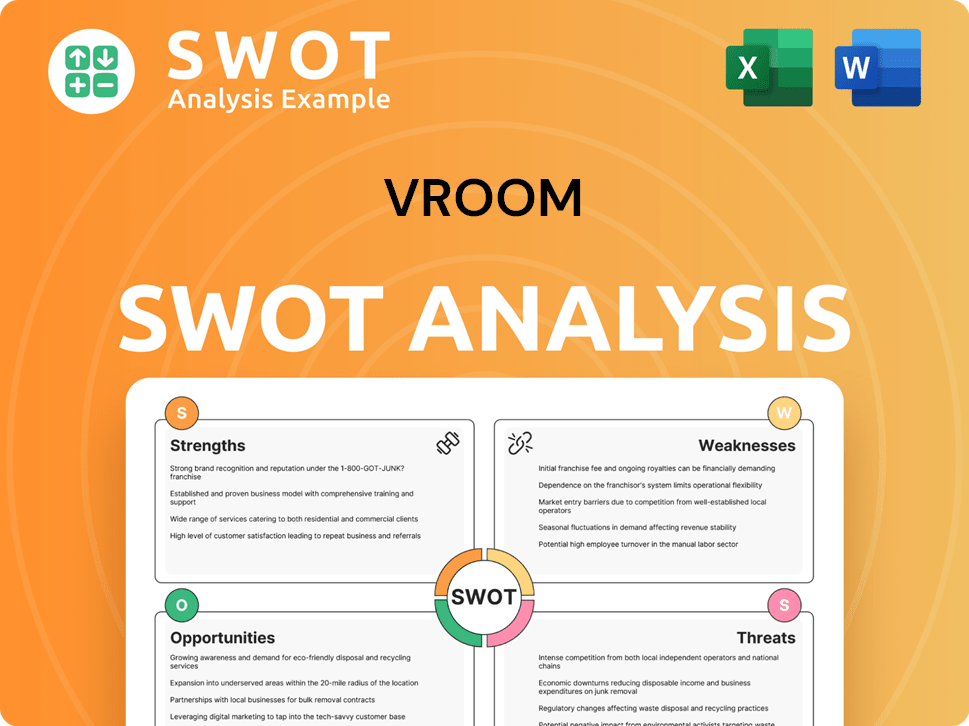

Vroom SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Vroom’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of the Vroom company. This involves analyzing the specific requirements of its primary customer bases: automotive dealerships utilizing UACC and CarStory. Tailoring services to meet these needs directly influences customer satisfaction and business performance.

Dealerships using UACC seek robust financial solutions, particularly for non-prime customers. CarStory customers, on the other hand, prioritize data-driven insights and technological advancements to optimize their operations. By focusing on these distinct needs, the Vroom company can enhance its offerings and maintain a competitive edge in the market.

The Vroom company's ability to meet the needs of its customers is essential for its success. By focusing on the financial solutions and data-driven insights that dealerships require, the company can improve customer satisfaction and drive business growth.

Dealerships using UACC require flexible and reliable automotive financing options. They need efficient loan origination processes and competitive terms to close sales, especially within the non-prime market. UACC focuses on building a strong lending program to meet these needs.

CarStory customers prioritize advanced AI-powered analytics and digital services. They seek insights to understand customer preferences, optimize inventory, and streamline the vehicle purchasing process. This includes leveraging technology and data analytics.

The automotive analytics market was valued at approximately $2.5 billion in 2024. This indicates significant growth potential for CarStory. The focus on customer experience through technology and data analytics is key to success.

For UACC, the key drivers are efficient loan origination and competitive financing. For CarStory, it's the need for data-driven insights to improve profitability and customer satisfaction. Both segments require tailored solutions.

The Vroom company aims to build a world-class lending program and enhance operational excellence. For CarStory, the focus is on leveraging technology and data analytics. These efforts are designed to meet the specific needs of each customer segment.

Customer experience is a core aspect of how the Vroom company tailors its offerings. The company's commitment to customer experience through technology and data analytics is a core aspect of how it tailors its offerings to these business segments.

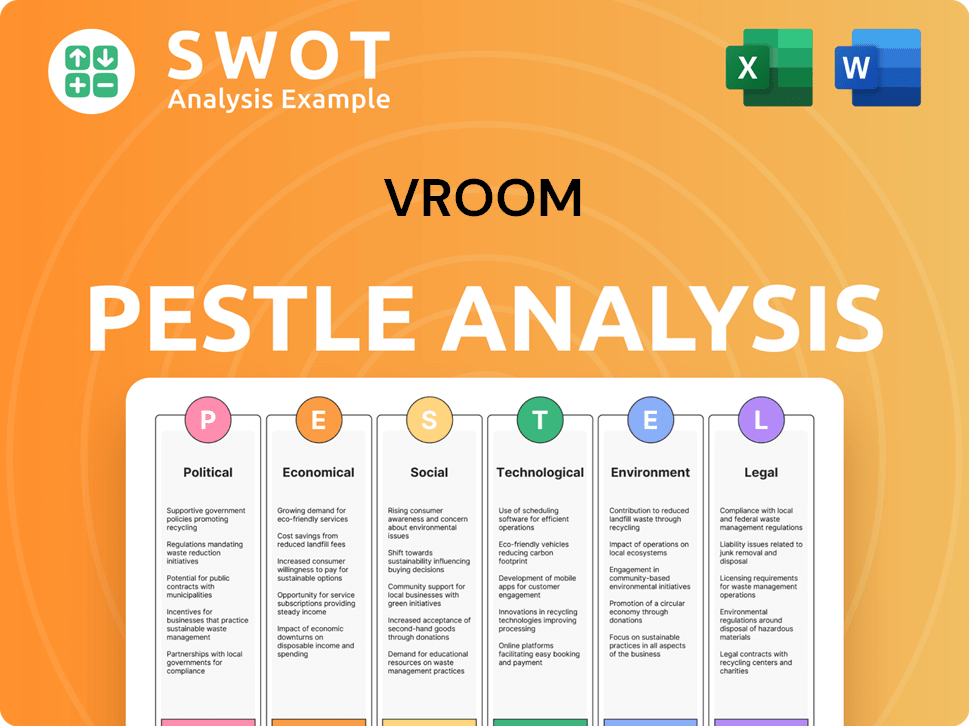

Vroom PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Vroom operate?

The current geographical market presence of the Vroom company is primarily nationwide across the United States. This extensive reach is facilitated through its subsidiary, United Auto Credit Corporation (UACC), which focuses on serving the independent and franchise dealer market. While Vroom previously had a direct-to-consumer e-commerce model, its current strategy emphasizes business-to-business (B2B) services.

UACC's operations span the entire U.S., providing vehicle financing solutions to consumers through a network of third-party dealerships. CarStory, another key component, offers AI-powered analytics and digital services that support automotive retail businesses across the nation. This shift to a capital-light model means Vroom no longer manages physical inventory or direct vehicle delivery logistics in specific cities or regions as it did with its e-commerce business.

Instead, its market presence is now defined by the adoption of its financial and analytical services by dealerships nationwide. This strategic adjustment allows for a broader reach and a more scalable business model. The long-term strategic plans also include a focus on geographic expansion, indicating ongoing efforts to strengthen its presence in key markets and drive sales and brand recognition within the automotive ecosystem.

Vroom's market presence is nationwide within the United States, leveraging UACC and CarStory to support dealerships across the country. This broad reach allows Vroom to serve a wide array of dealerships and their customers. This strategy allows Vroom to maintain a strong presence in the automotive market.

The company's strategic shift to a B2B model means it primarily serves dealerships. This focus allows Vroom to provide financial and analytical services to dealerships, supporting their operations and customer service. This approach allows Vroom to focus on a more scalable business model.

The capital-light model means Vroom does not manage physical inventory or direct vehicle delivery. This approach reduces operational costs and increases scalability. This shift allows Vroom to focus on its core competencies of financing and analytics.

Vroom's long-term strategy includes plans for geographic expansion. This indicates ongoing efforts to strengthen its presence in key markets and drive sales. This expansion will enhance brand recognition within the automotive ecosystem.

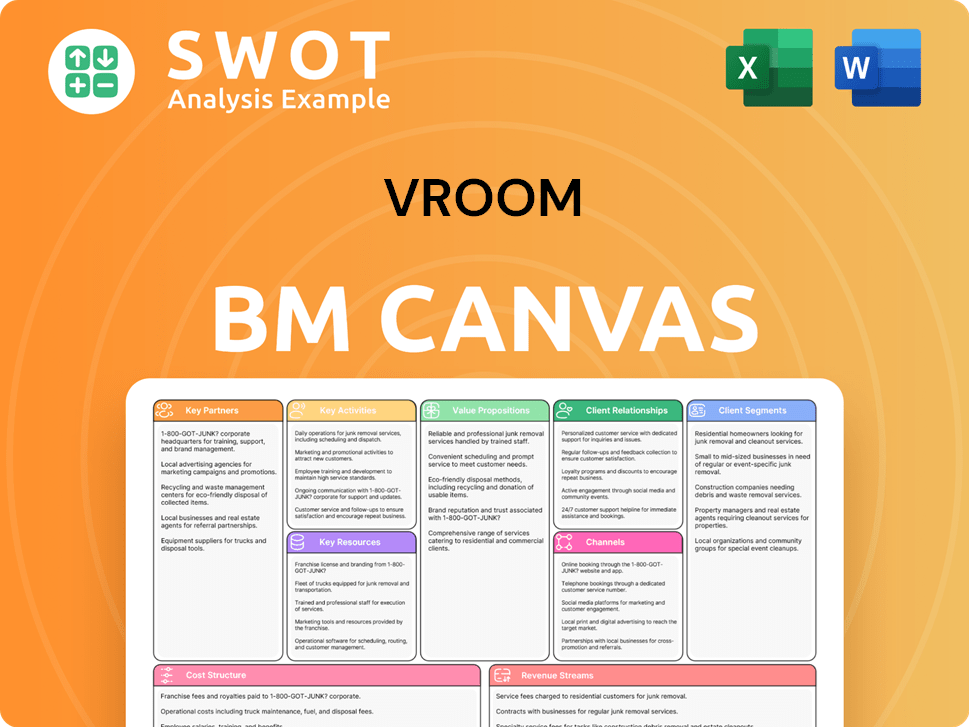

Vroom Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Vroom Win & Keep Customers?

The focus of customer acquisition and retention strategies for the company has shifted entirely to its B2B operations, specifically through UACC and CarStory. This strategic pivot reflects a move away from direct-to-consumer sales and towards providing services and solutions to automotive dealers. This approach allows the company to leverage its expertise in financing and data analytics to serve a different, yet related, customer base.

For UACC, the customer acquisition strategy centers on building relationships with automotive dealers. This involves direct sales teams, industry partnerships, and showcasing its competitive financing options, especially for the non-prime market. CarStory, on the other hand, focuses on acquiring customers by marketing its AI-powered analytics and digital services to automotive retailers. The key here is demonstrating the value of data-driven insights for inventory optimization and improving the customer experience. This dual approach allows the company to diversify its revenue streams and cater to different segments within the automotive industry.

Retention strategies for both UACC and CarStory are crucial for long-term success. UACC aims to retain customers by providing excellent service, consistent financing approvals, and fostering long-term relationships. CarStory emphasizes the ongoing value of its analytics, continuous product development, and strong customer support. The company’s long-term goal is to build a world-class sales and marketing program for both entities, emphasizing operational excellence and leveraging technology to drive growth and profitability. A solid customer acquisition and retention strategy is essential in the current competitive landscape. For more insights on competitors, consider exploring the Competitors Landscape of Vroom.

Focuses on building relationships with independent and franchise automotive dealers. This involves direct sales, industry partnerships, and highlighting competitive financing solutions.

Involves marketing AI-powered analytics and digital services to automotive retailers. The emphasis is on demonstrating the value of data-driven insights.

Provide excellent service, ensure consistent financing approvals, and foster long-term relationships with dealerships. UACC’s loan originations reached $1.2 billion in 2024.

Depend on the ongoing value and accuracy of its analytics, continuous product development based on feedback, and strong customer support. This ensures seamless integration and utilization of services.

The company aims to achieve pre-COVID cumulative net losses or lower and lower operating costs, which indirectly supports customer retention by enabling more competitive offerings. The long-term strategic initiatives include building a world-class sales and marketing program for both UACC and CarStory, emphasizing operational excellence and leveraging technology to drive growth and profitability.

- Building strong relationships with dealers (UACC).

- Demonstrating the value of data analytics (CarStory).

- Providing excellent customer service and support.

- Continuous product development based on customer feedback.

- Focusing on operational excellence to reduce costs.

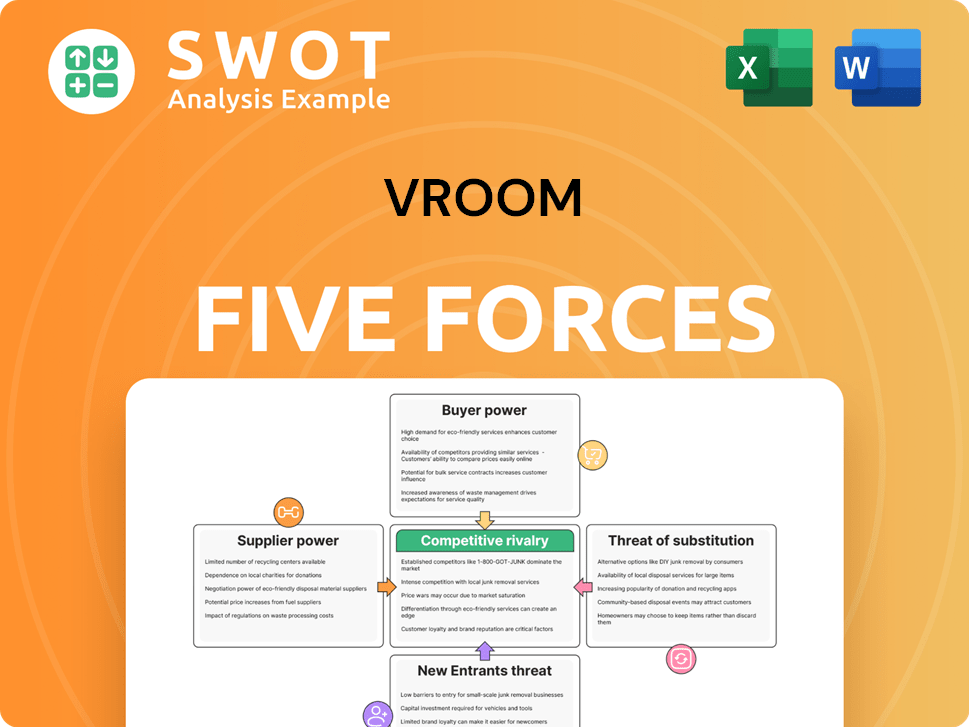

Vroom Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vroom Company?

- What is Competitive Landscape of Vroom Company?

- What is Growth Strategy and Future Prospects of Vroom Company?

- How Does Vroom Company Work?

- What is Sales and Marketing Strategy of Vroom Company?

- What is Brief History of Vroom Company?

- Who Owns Vroom Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.