Wells Fargo Bundle

How Does Wells Fargo Navigate the Cutthroat Banking World?

In today's dynamic Wells Fargo SWOT Analysis, the financial services industry is a battlefield, and Wells Fargo & Company is a major player. Established in 1852, the company has evolved from its roots to become a diversified financial giant. This exploration dives into the core of Wells Fargo's competitive landscape, offering insights into its strategic positioning.

Understanding the Wells Fargo competitive landscape is crucial for investors and strategists alike. This analysis will identify Wells Fargo competitors, assess its market analysis, and explore how it maintains its competitive advantage within the banking sector. We'll examine Wells Fargo's main rivals, compare its market share, and discuss Wells Fargo's challenges and opportunities to provide a comprehensive view of its position in the market and its current competitive strategy.

Where Does Wells Fargo’ Stand in the Current Market?

The company maintains a significant market position within the U.S. financial services industry, particularly in its Community Banking segment. As of early 2025, it remains one of the 'Big Four' U.S. banks, alongside JPMorgan Chase, Bank of America, and Citigroup. This places the company in a strong position within the highly competitive financial services industry.

The company's primary product lines include community banking, wealth and investment management, corporate and investment banking, and consumer lending. Geographically, it has a strong presence across the United States, with a vast branch network and extensive ATM access. This broad reach allows it to serve a wide range of customers, from individuals and families to large institutions. The company's financial health, as evidenced by its net income of $3.5 billion in the fourth quarter of 2024, underscores its scale and profitability.

The company continues to adapt its strategies to address competitive pressures and evolving customer preferences, especially in areas like digital payments and specialized lending. The company's commitment to digital transformation and customer experience improvements reflects a broader industry trend. To understand the company's journey, you can read more in the Brief History of Wells Fargo.

The company holds a substantial market share in consumer banking, including deposits, mortgages, and auto loans. While specific figures fluctuate, the company's presence remains significant. In the fourth quarter of 2024, the company reported strong deposit growth, indicating its continued strength in core banking services. This solidifies its position in the banking sector.

The company serves a broad spectrum of customers, from individuals and families to middle-market businesses and large institutions. Its extensive branch network and ATM access across the U.S. support this wide reach. This diverse customer base contributes to its overall competitive advantage.

The company's financial performance, including a net income of $3.5 billion in the fourth quarter of 2024, highlights its profitability. Its return on average tangible common equity of 10.3% further underscores its financial health relative to industry averages. These figures are crucial for the company's Wells Fargo market analysis.

The company is actively involved in digital transformation initiatives to enhance digital offerings and improve customer experience. This reflects a broader industry trend and is critical for maintaining its competitive edge. This focus on digital offerings is key to its Wells Fargo competitive landscape.

The company faces competitive pressures and evolving customer preferences, especially in digital payments and specialized lending. The company's ability to adapt and innovate is crucial for its long-term success. Understanding these dynamics is essential for analyzing Wells Fargo competitors.

- Strong deposit growth in Q4 2024 indicates continued strength in core banking services.

- Digital transformation initiatives are a key focus to improve customer experience.

- The company operates within a highly competitive environment, including JPMorgan Chase and Bank of America.

- Adapting to evolving customer preferences in digital payments and lending is critical.

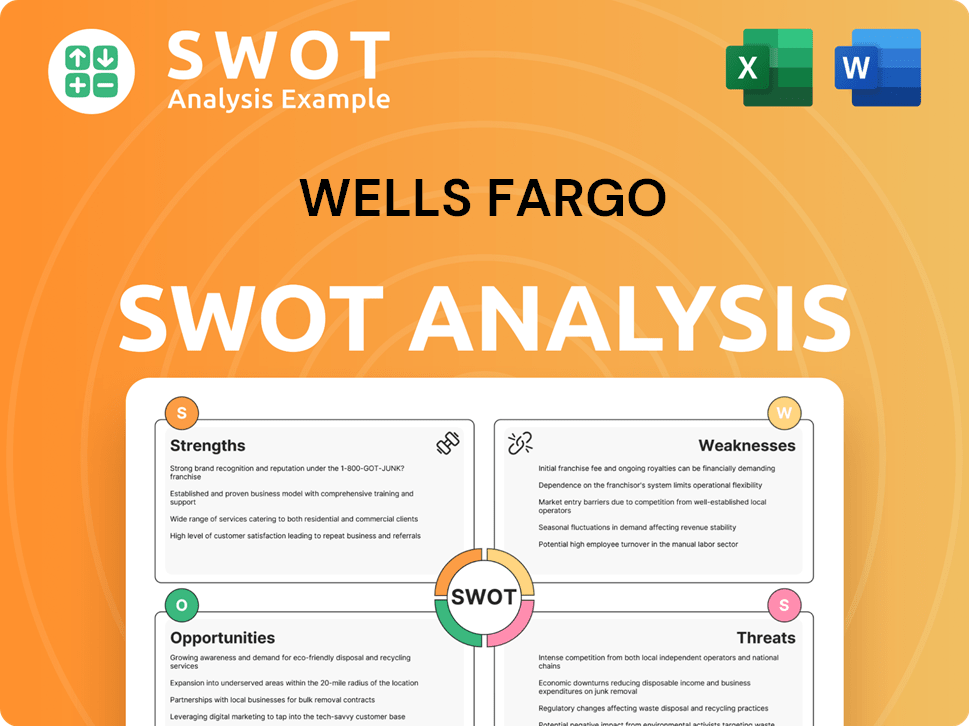

Wells Fargo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Wells Fargo?

The Growth Strategy of Wells Fargo is significantly shaped by its competitive environment. Understanding the Wells Fargo competitive landscape is crucial for assessing its market position and future prospects. The financial services industry is highly competitive, with numerous players vying for market share across various segments, making Wells Fargo market analysis essential.

Wells Fargo faces a diverse array of competitors, ranging from large national banks to specialized financial institutions and emerging fintech companies. These competitors challenge Wells Fargo on multiple fronts, including pricing, product innovation, and customer experience. Evaluating the strengths and weaknesses of these rivals is vital for understanding Wells Fargo's competitive advantage and formulating effective business strategies.

In the community banking and consumer lending sectors, Wells Fargo's main rivals include the other 'Big Four' U.S. banks: JPMorgan Chase, Bank of America, and Citigroup. These institutions compete directly across all major banking segments, often leveraging their investment banking arms and digital capabilities. For example, in the first quarter of 2024, JPMorgan Chase reported a net revenue of $41.9 billion, highlighting its strong performance and competitive position.

JPMorgan Chase is a formidable competitor, particularly in investment banking and digital services. It consistently ranks among the top banks globally by assets. JPMorgan Chase's robust financial performance, with a net income of $14.9 billion in Q1 2024, reflects its strong market position.

Bank of America is a key rival, especially in consumer and small business banking. It boasts a vast branch network and a strong focus on customer relationships. In Q1 2024, Bank of America reported a net income of $7.3 billion, demonstrating its significant presence in the market.

Citigroup, with its international footprint, competes directly in U.S. consumer and corporate banking. Citigroup's global presence and diverse financial offerings make it a significant player. Citigroup reported a net income of $3.4 billion in Q1 2024.

U.S. Bank is a major regional bank with strong local market penetration. It offers competitive rates and personalized services, posing a challenge to Wells Fargo. In 2023, U.S. Bank's total revenue was approximately $26.9 billion.

PNC Financial Services is another strong regional competitor, known for its comprehensive banking services. PNC's focus on customer service and strategic acquisitions has strengthened its market position. PNC's total revenue for 2023 was around $22.6 billion.

Truist Financial, formed from the merger of BB&T and SunTrust, is a significant regional player. Truist's broad geographic reach and diverse financial offerings make it a key competitor. Truist reported total revenue of approximately $23.9 billion in 2023.

In the wealth and investment management space, Wells Fargo competes with major wirehouses like Morgan Stanley and Merrill Lynch, as well as independent financial advisors and fintech platforms. The mortgage lending segment sees competition from both traditional banks and non-bank lenders like Rocket Mortgage. Emerging fintech companies are also disrupting the market.

- Morgan Stanley: A major player in wealth management, with assets under management (AUM) of approximately $6.8 trillion as of Q1 2024.

- Merrill Lynch: Another significant competitor in wealth management, part of Bank of America.

- Rocket Mortgage: A leading non-bank mortgage lender, known for its digital platform and innovative offerings.

- Fintech Companies: These companies, such as Chime and SoFi, are disrupting traditional banking with innovative digital platforms, lower fees, and specialized offerings.

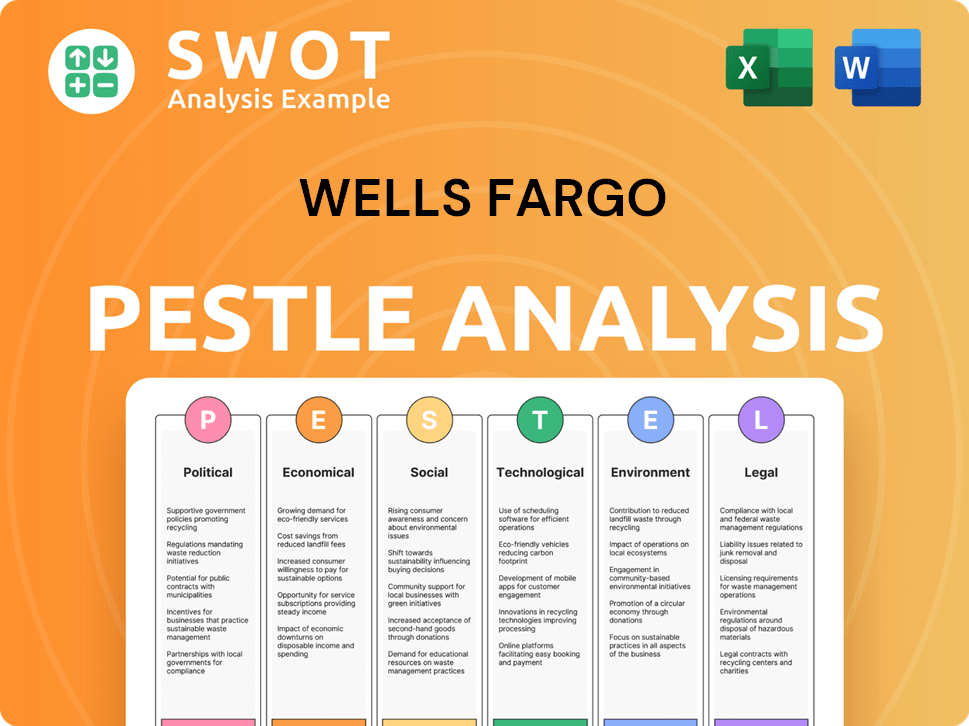

Wells Fargo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Wells Fargo a Competitive Edge Over Its Rivals?

Understanding the competitive landscape is crucial for any financial institution, and for Wells Fargo, this involves a deep dive into its strengths, weaknesses, and strategic positioning within the financial services industry. Examining its competitive advantages provides insights into how it maintains its market share and navigates the challenges of a dynamic sector. A thorough Wells Fargo market analysis is essential for investors and stakeholders alike.

The company's competitive advantages are multifaceted, stemming from its extensive market presence, diversified business model, and established brand. One of its core strengths lies in its vast distribution network, encompassing thousands of branches across the U.S. and a substantial ATM footprint. This physical presence, while increasingly complemented by digital channels, still provides a significant advantage for customers who prefer in-person interactions or require complex financial services. Coupled with this is strong brand equity, built over more than 170 years, which fosters a degree of customer trust and loyalty, particularly in its traditional banking segments.

Furthermore, Wells Fargo's competitive landscape is shaped by its ability to offer a broad range of products and services, benefiting from significant economies of scale. Its diversified revenue streams across community banking, wealth and investment management, and corporate and investment banking provide a degree of resilience against downturns in any single sector. The company's extensive customer base generates valuable data and insights, which can be leveraged for targeted marketing, product development, and risk management.

With thousands of branches and a vast ATM network, Wells Fargo maintains a significant physical presence. This extensive network supports customer access and service, especially for those preferring in-person banking. This network is a key component of its competitive advantage, differentiating it from competitors with fewer physical locations.

Built over 170 years, the brand fosters customer trust and loyalty. This long-standing reputation is a valuable asset, particularly in the traditional banking sector. This brand recognition provides a stable foundation for customer retention and acquisition, which is crucial in the banking sector.

Wells Fargo's diversified revenue streams across community banking, wealth and investment management, and corporate and investment banking provide resilience. This diversification helps mitigate risks associated with downturns in any single sector. This strategy enhances its overall financial stability and market position.

The company benefits from significant economies of scale, enabling it to offer a broad range of products and services at competitive prices. This operational efficiency allows for heavy investment in technology and infrastructure. This scale advantage is a crucial factor in its competitive advantage.

Wells Fargo's strengths include its extensive distribution network, strong brand equity, and diversified revenue streams. The company is actively working to rebuild its reputation and strengthen its risk management framework. Ongoing investments in digital transformation and AI-driven solutions are aimed at enhancing operational efficiencies and improving the customer experience, further solidifying its competitive standing in a digitally evolving financial landscape.

- Market Presence: Extensive branch and ATM network provides broad customer access.

- Brand Reputation: Over 170 years of operations have built significant customer trust.

- Diversification: Revenue streams across multiple banking sectors enhance resilience.

- Digital Transformation: Investments in technology to improve customer experience and efficiency.

The Wells Fargo competitors include major players like JPMorgan Chase and Bank of America, which also have extensive branch networks and diversified service offerings. A comparison of Wells Fargo market share with these rivals reveals its standing in the financial services industry. Furthermore, understanding Wells Fargo's strengths and weaknesses is crucial for a comprehensive Wells Fargo SWOT analysis. For more insights, consider the Marketing Strategy of Wells Fargo.

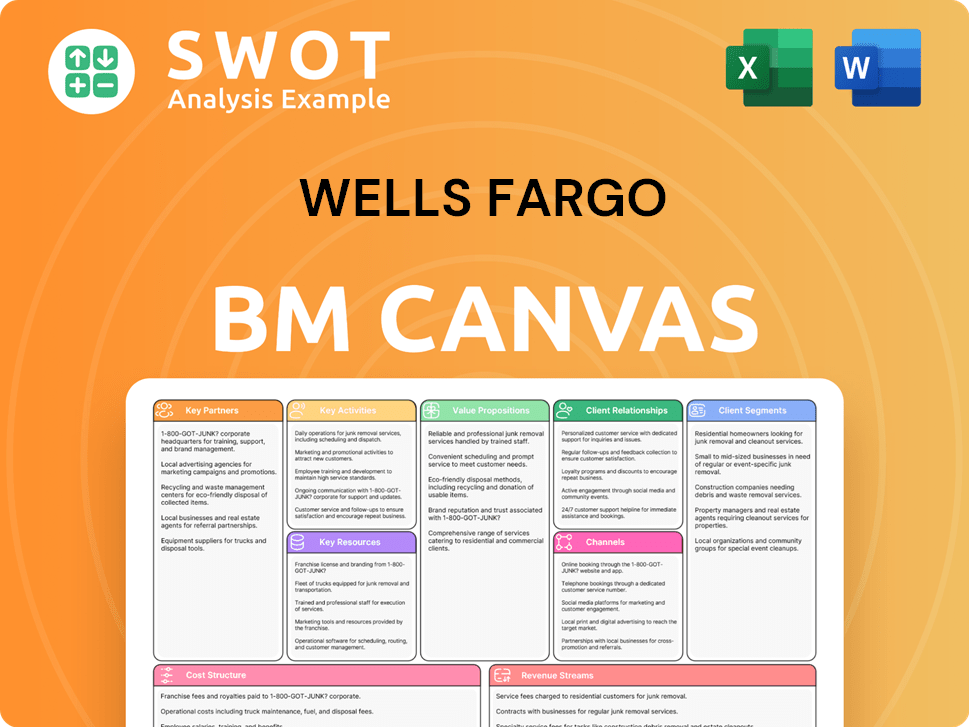

Wells Fargo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Wells Fargo’s Competitive Landscape?

The financial services industry is undergoing significant transformation, shaping the Wells Fargo competitive landscape. Technological advancements, regulatory changes, and evolving consumer preferences are key drivers. Understanding these trends is crucial for Wells Fargo market analysis and strategic planning.

The Wells Fargo competitive environment is dynamic, with both established players and new entrants vying for market share. Assessing Wells Fargo's strengths and weaknesses, along with its opportunities and challenges, is essential for long-term success. The banking sector is highly competitive, requiring constant adaptation.

Digital transformation is reshaping banking, with AI, machine learning, and blockchain gaining prominence. Regulatory scrutiny, particularly regarding consumer protection, continues to increase. Consumers increasingly demand personalized and digitally-enabled banking experiences. These trends impact all players in the financial services industry.

Overcoming legacy issues and restoring public trust remains a key challenge for Wells Fargo. Competition from fintech firms and challenger banks is intensifying, potentially impacting market share. Economic uncertainties, such as inflation and interest rate fluctuations, could affect loan demand and credit quality. Addressing these challenges is vital for Wells Fargo's future.

Significant opportunities exist in digital transformation, including enhanced mobile banking and AI-powered tools. Expansion into underserved markets and strategic partnerships with fintech firms could drive growth. Wells Fargo's substantial capital allows for strategic investments. These opportunities are crucial for Wells Fargo's future success.

Prioritizing digital innovation, enhancing customer experience, and managing regulatory compliance are essential. Building strategic partnerships and focusing on operational efficiency are also critical. Proactive measures are necessary to strengthen the Wells Fargo competitive landscape.

Wells Fargo must navigate a complex landscape to maintain its competitive advantage. This involves addressing past issues, embracing innovation, and adapting to customer needs. The ability to execute these strategies will determine its future success. For more insights, explore the Growth Strategy of Wells Fargo.

- Focus on digital transformation and enhance mobile banking capabilities.

- Strengthen customer relationships through personalized services.

- Improve operational efficiency and manage regulatory compliance.

- Explore strategic partnerships to accelerate innovation.

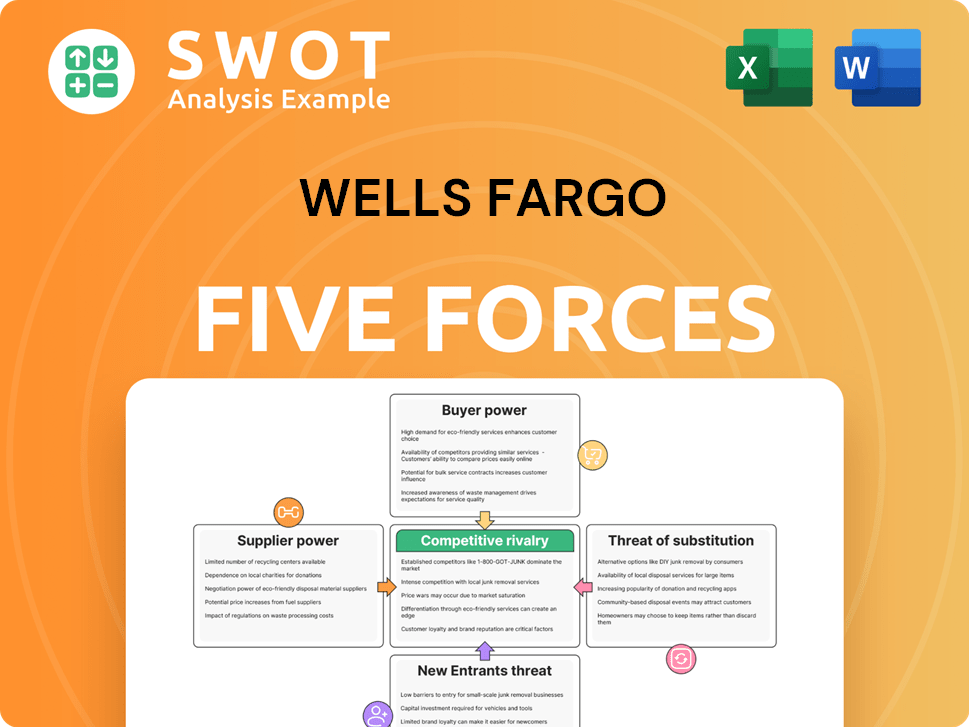

Wells Fargo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wells Fargo Company?

- What is Growth Strategy and Future Prospects of Wells Fargo Company?

- How Does Wells Fargo Company Work?

- What is Sales and Marketing Strategy of Wells Fargo Company?

- What is Brief History of Wells Fargo Company?

- Who Owns Wells Fargo Company?

- What is Customer Demographics and Target Market of Wells Fargo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.