Wells Fargo Bundle

What Drives Wells Fargo's Strategy?

Understanding a company's core principles is crucial for assessing its potential. This exploration delves into the Wells Fargo SWOT Analysis, revealing the essence of its strategic direction. Discover the driving forces behind one of the largest financial institutions in the United States.

Wells Fargo's mission, vision, and core values are not just words; they are the foundation upon which the company builds its strategies and interacts with its stakeholders. Examining these elements provides valuable insights into Wells Fargo's long-term goals and its commitment to its customers and employees. Learn how Wells Fargo defines success through its core principles and strategic vision.

Key Takeaways

- Wells Fargo's mission and vision guide its strategic direction and operations.

- Core values like customer focus and ethics shape Wells Fargo's identity.

- Investments in digital transformation and service expansion reflect the mission.

- Navigating challenges and maintaining trust are vital for future success.

- A clear corporate purpose is crucial for long-term sustainability in finance.

Mission: What is Wells Fargo Mission Statement?

Wells Fargo's mission is 'to satisfy our customers' financial needs and help them succeed financially.'

Let's delve into the heart of Wells Fargo's purpose. Understanding the Wells Fargo Mission provides crucial insights for investors, analysts, and anyone evaluating the company's strategic direction. This mission statement is more than just words; it's a guiding principle that shapes the company's actions and influences its long-term goals. It directly impacts how the company interacts with its customers, develops its products, and measures its success.

The core of the Wells Fargo Mission is its customer-centric approach. This means that all decisions, from product development to service delivery, are made with the customer's needs and financial well-being in mind. This focus is a key element in understanding Wells Fargo's commitment to customers.

The mission encompasses a wide array of financial products and services. From basic banking to complex wealth management solutions, Wells Fargo aims to be a comprehensive financial partner. This broad scope is essential to achieving their Wells Fargo Goals.

The mission emphasizes building lasting relationships with customers. This commitment goes beyond short-term transactions, focusing on providing value and support throughout customers' financial journeys. This is a crucial aspect of Wells Fargo's long-term goals.

Wells Fargo actively invests in initiatives to improve customer satisfaction. This includes technology upgrades, employee training, and streamlined processes. In 2024, the company allocated over $1 billion to customer-centric programs. This reflects Wells Fargo's values and ethics.

The company's wealth and investment management division, managing $2.1 trillion in assets in 2024, is a testament to its dedication to helping customers grow their wealth. This division offers a wide range of services, including financial planning. This showcases Wells Fargo's strategic vision.

Wells Fargo provides financial planning services and resources to empower customers with financial knowledge. This helps customers make informed decisions and achieve their financial goals. This aligns with Wells Fargo's mission statement explained.

The Wells Fargo Mission is a critical element in understanding the company's operational focus and its commitment to its customers. Analyzing this statement, along with the company's actions, helps investors and stakeholders assess its long-term viability and strategic direction. Further insights can be gained by examining the Wells Fargo Vision and Wells Fargo Core Values, which complement the mission statement and provide a more comprehensive view of the company's guiding principles. To understand who Wells Fargo is trying to serve, you can read about the Target Market of Wells Fargo.

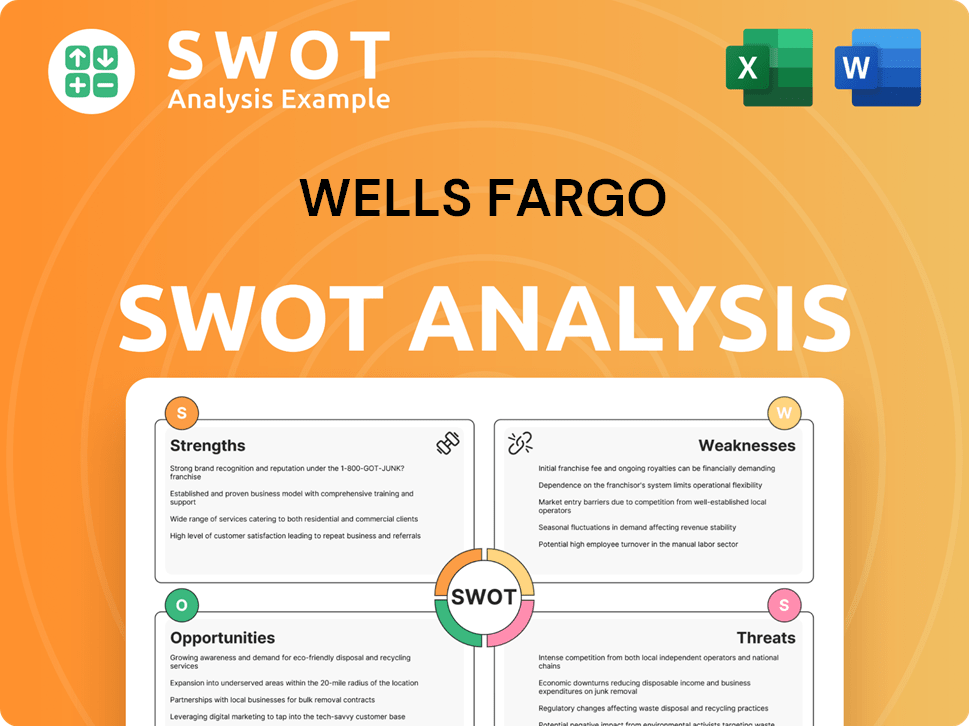

Wells Fargo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Wells Fargo Vision Statement?

Wells Fargo's vision is 'to satisfy all our customers' financial needs and help them succeed financially.'

Delving into the Wells Fargo Vision, we uncover a commitment to comprehensive customer financial well-being. This aspirational goal positions the Wells Fargo Company as more than just a financial service provider; it aims to be a trusted partner in customers' financial journeys. Understanding this vision is crucial for investors, as it shapes the company's strategic direction and influences its long-term performance. The Wells Fargo Mission is closely intertwined with this vision, driving the daily operations and strategic initiatives of the company.

The core of the Wells Fargo Vision revolves around satisfying all customer financial needs. This includes a wide array of services, from basic banking to complex investment strategies. This customer-centric approach is a key element of the company's strategy.

The vision extends beyond simply meeting needs; it aims to help customers succeed financially. This implies a proactive role in providing guidance, resources, and tools to help customers achieve their financial goals. This is a key component of Wells Fargo Goals.

By striving to be the primary financial partner, Wells Fargo implicitly aims for market leadership. This requires continuous innovation, a robust service network, and a strong brand reputation. The Wells Fargo Principles guide this ambition.

While a single, explicit vision statement might not always be readily available, Wells Fargo's actions speak volumes. Their focus on customer service, innovation, and risk management, as seen in their strategic reports, directly aligns with their vision. Considering the Competitors Landscape of Wells Fargo, these priorities are crucial for maintaining a competitive edge.

Wells Fargo's extensive network of branches, ATMs, and digital platforms supports its vision. These assets provide the infrastructure needed to serve a vast customer base and offer a wide range of financial products. In 2024, Wells Fargo had approximately 4,500 branches and 11,000 ATMs across the United States.

Achieving this vision requires ongoing investment in technology and customer service. The evolving financial landscape demands continuous adaptation and innovation to stay competitive. Wells Fargo's ability to navigate these challenges will determine its long-term success. In 2024, Wells Fargo invested over $3 billion in technology and digital initiatives.

The Wells Fargo Vision is a powerful statement of intent, setting the stage for the company's strategic direction and commitment to its customers. It underscores the importance of understanding Wells Fargo's mission statement explained and how the company defines success. By focusing on customer needs and financial success, Wells Fargo aims to build a lasting relationship with its customers, supported by its Wells Fargo Core Values and dedication to ethical practices. Understanding the Wells Fargo's long-term goals is crucial for anyone seeking to invest in or partner with the company.

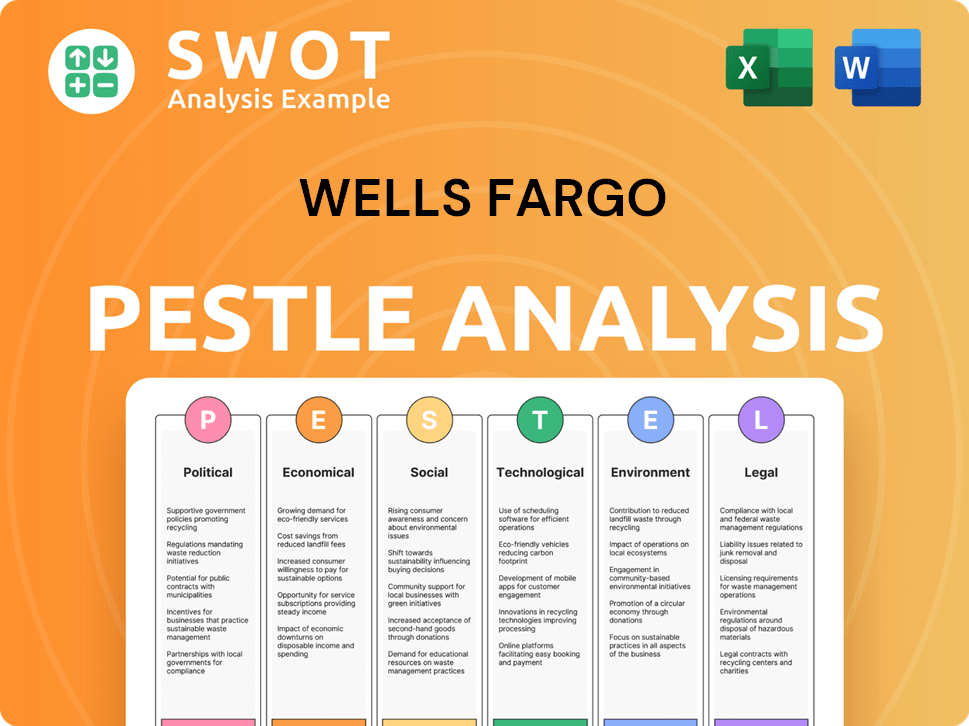

Wells Fargo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Wells Fargo Core Values Statement?

Understanding the core values of Wells Fargo is crucial for grasping its operational principles and its approach to the financial services landscape. These values are designed to guide employee behavior and shape the company's interactions with customers and stakeholders.

Wells Fargo emphasizes the importance of its people, focusing on attracting, developing, and retaining talented individuals. This value is reflected in the company's commitment to providing employees with the necessary tools, training, and fostering a culture of responsibility and accountability. For example, in 2023, Wells Fargo invested significantly in employee training programs, with over 1.5 million training hours completed, demonstrating its commitment to its workforce.

Ethical behavior and adherence to laws and regulations are fundamental to Wells Fargo's operations. The company stresses the importance of integrity in all dealings to maintain trust with customers and the public. This commitment is underscored by ongoing efforts to enhance compliance programs and internal controls, with significant investments in risk management and compliance infrastructure, totaling over $2 billion annually in recent years.

Wells Fargo prioritizes acting in the best interests of its customers across all business activities. This includes exceeding expectations, building long-term relationships, and ensuring customers feel valued. Recent data indicates that customer satisfaction scores have improved, with a 5% increase in positive customer feedback in the last year, signaling progress in this area.

Wells Fargo values diversity and inclusion, recognizing that varied perspectives contribute to better outcomes. While specific DEI policies may evolve, the principle of inclusion remains central to its stated values. The company continues to report on its diversity metrics, with ongoing efforts to increase representation across all levels of the organization. For instance, in 2024, the company has increased the representation of women and minorities in leadership positions by 3%.

These core values of the Mission, Vision & Core Values of Wells Fargo are designed to shape a customer-centric and ethical approach within the financial services industry. These core principles are intended to build a unique corporate identity based on trust and long-term relationships. The next chapter will explore how Wells Fargo's mission and vision influence its strategic decisions.

How Mission & Vision Influence Wells Fargo Business?

The Wells Fargo Mission and Wells Fargo Vision are not just aspirational statements; they are fundamental drivers of the company's strategic decisions. These guiding principles shape how Wells Fargo interacts with its customers, develops its products, and navigates the complexities of the financial landscape.

The Wells Fargo Mission, which emphasizes meeting customer needs, directly influences the company's business strategy. This customer-centric approach guides decisions related to product development, market expansion, and technological investments, ensuring that customer satisfaction remains a top priority.

- Investment in Mobile App: Wells Fargo is enhancing its mobile app to simplify account opening and improve user experience, aligning with its mission to provide accessible financial solutions.

- Digital Transformation: This focus on digital transformation is a key growth strategy for 2024 and beyond, aiming to meet evolving customer expectations.

- Wealth Management Expansion: The vision of helping customers succeed financially drives the expansion of services like wealth management and financial planning.

- Financial Planning Sessions: In 2024, the wealth and investment management division conducted over 1 million financial planning sessions.

Under CEO Charlie Scharf, Wells Fargo has focused on simplifying operations, improving risk management, and restoring trust, all influenced by the Wells Fargo Core Values of ethics and customer focus. The company is reallocating capital towards core, higher-return segments.

Wells Fargo has exited non-core businesses to reallocate capital towards core segments, such as Corporate and Investment Banking. This strategic shift aligns with the vision of satisfying a broad range of financial needs, showcasing the company's commitment to its core principles.

Customer satisfaction scores are actively tracked and improved, reflecting the impact of strategic decisions. Financial performance, such as the reported net income of $19.7 billion and return on tangible common equity of 13.4% in 2024, demonstrates the alignment of strategic decisions with the Wells Fargo Goals and values.

The company's commitment to customers is evident through its investments in enhancing customer experience and providing accessible financial solutions. This commitment is a key element of the Wells Fargo's commitment to customers, guiding the company's actions and decisions.

Wells Fargo's strategic vision is shaped by its mission and vision, influencing its long-term goals and strategic initiatives. The company's focus on digital transformation, wealth management, and core business segments reflects its commitment to its Wells Fargo's long-term goals.

The Wells Fargo Mission and vision directly influence its business strategy by placing customer needs and success at the forefront. This customer-centric approach guides strategic decisions related to product development, market expansion, and technology investments. For example, the company is investing in enhancing its mobile app to make it easier for customers to open accounts, aligning with the mission of satisfying financial needs through accessible platforms. This focus on digital transformation is a key growth strategy for 2024 and beyond.

By understanding how the Wells Fargo Mission and vision influence its strategic decisions, it becomes clear that the company is committed to its core values and principles. For more insights into Wells Fargo's strategic approach, consider reading about the Marketing Strategy of Wells Fargo. Next, we will delve into the Core Improvements to Company's Mission and Vision.

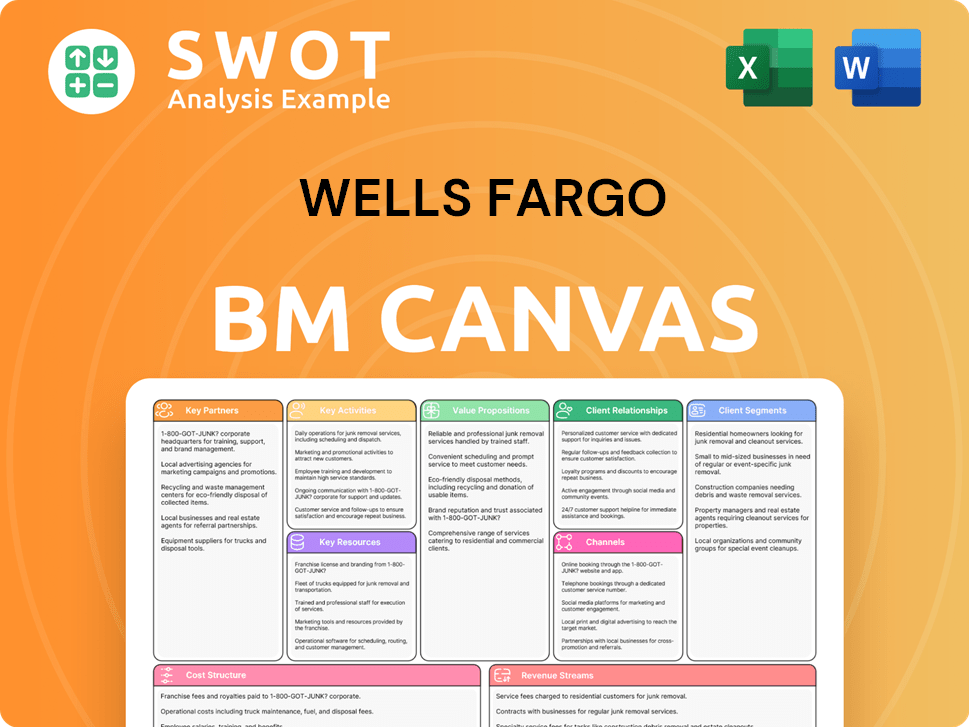

Wells Fargo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While the current Wells Fargo mission, Wells Fargo vision, and Wells Fargo core values provide a foundation, several areas could be enhanced to better reflect the evolving financial landscape. These improvements aim to solidify Wells Fargo Company's position in a competitive market and align with current trends in corporate social responsibility and technological advancement.

To remain competitive, Wells Fargo's formal vision statement could explicitly incorporate a commitment to technological innovation. This would underscore the importance of adapting to digital customer expectations and leveraging emerging technologies like AI and machine learning to enhance services and customer experiences. This is especially critical given that digital banking transactions have increased by over 30% in the past five years, according to recent industry reports.

A more prominent articulation of sustainability and environmental responsibility could resonate with environmentally conscious customers and investors. This could involve setting specific Wells Fargo Goals related to sustainable finance, reducing its carbon footprint, and investing in green initiatives. The sustainable finance market is projected to reach $50 trillion by 2025, highlighting the growing importance of this area.

Given the increased focus on stakeholder capitalism, Wells Fargo's mission or vision could be enhanced to explicitly acknowledge its broader impact on communities and society. This could involve a more defined commitment to addressing societal challenges, such as financial literacy, affordable housing, and community development, which are crucial for long-term success. This aligns with the growing expectation for companies to contribute positively to society, as seen in the rise of ESG (Environmental, Social, and Governance) investing.

While customer financial success is a core element, the Wells Fargo mission could be refined to explicitly include the creation of value for all stakeholders, including employees, shareholders, and the communities it serves. This broader perspective would reflect a more holistic approach to Wells Fargo's operations and align with the principles of stakeholder capitalism. To understand how Wells Fargo generates revenue to support its goals, you can read more about it in our article on Revenue Streams & Business Model of Wells Fargo.

How Does Wells Fargo Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for translating aspirational statements into tangible actions and outcomes. This involves integrating these guiding principles into the very fabric of the organization, from strategic initiatives to daily operations.

Wells Fargo actively implements its Wells Fargo Mission and Wells Fargo Vision through various business initiatives and a strong emphasis on digital platforms. The company’s commitment to satisfying customer financial needs is demonstrated through the enhancement of digital platforms, like its mobile app, ensuring accessibility and convenience for its customers.

- Mobile App Enhancements: Wells Fargo continuously updates its mobile app, with recent enhancements focusing on improved user experience and expanded functionalities, such as personalized financial insights and enhanced security features. In Q1 2024, mobile banking transactions increased by 12% year-over-year, reflecting the growing reliance on digital channels.

- Digital Adoption: The bank is focused on increasing digital adoption rates across its customer base. In 2023, over 60% of Wells Fargo's customer interactions occurred through digital channels, a significant increase from previous years.

- Investment in Technology: Wells Fargo invests billions annually in technology to modernize its infrastructure, improve cybersecurity, and enhance customer-facing digital tools. In 2023, the company allocated $3.5 billion to technology investments.

The Wells Fargo Company reinforces its Wells Fargo Goals by expanding financial coaching and support for small businesses. Programs like HOPE Inside for Small Business, in collaboration with Operation HOPE, provide personalized support and financial education to entrepreneurs, embodying the company's commitment to customer success.

Leadership plays a crucial role in reinforcing the Wells Fargo Mission and Wells Fargo Vision. CEO Charlie Scharf emphasizes building a well-controlled, faster-growing, and higher-returning company while improving customer service and efficiency, aligning with the core principles of customer focus and responsible growth.

The company's efforts to improve risk and control frameworks reflect a commitment to ethical conduct and doing what’s right for customers. This includes significant investments in compliance and risk management systems to address past issues and ensure adherence to regulatory standards.

Wells Fargo communicates its mission, vision, and Wells Fargo Core Values to stakeholders through annual reports, investor presentations, and corporate responsibility reports. The company states its values and ethics by aligning them with actual business practices, although it has faced challenges in this area in the past. Ongoing efforts to improve customer satisfaction, invest in employee training, and enhance risk management systems are part of the formal programs and systems Wells Fargo uses to ensure alignment with its guiding principles.

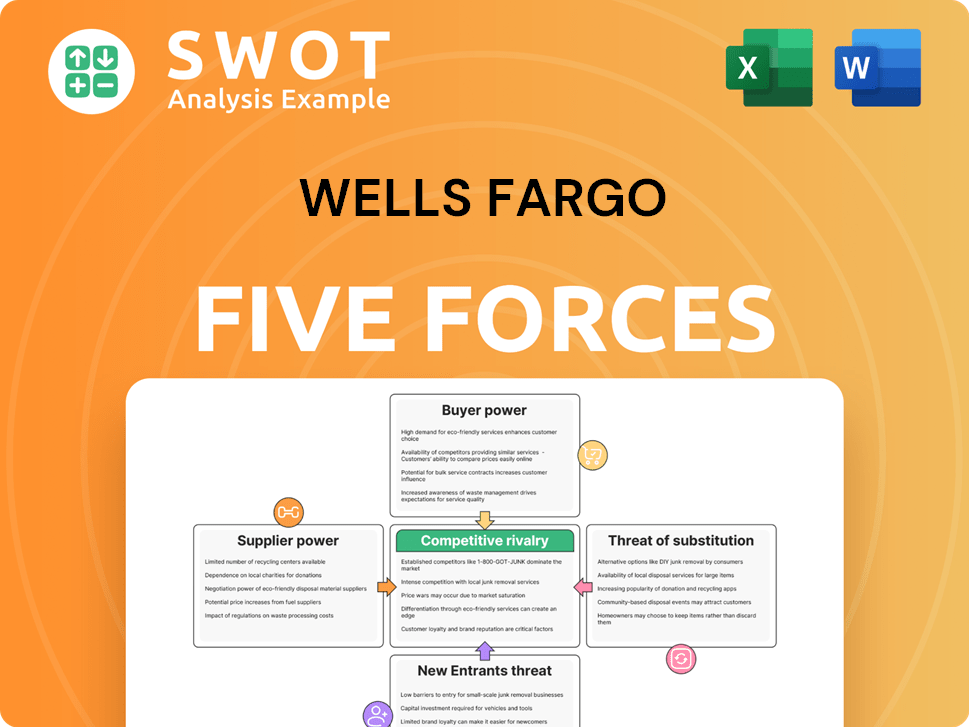

Wells Fargo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wells Fargo Company?

- What is Competitive Landscape of Wells Fargo Company?

- What is Growth Strategy and Future Prospects of Wells Fargo Company?

- How Does Wells Fargo Company Work?

- What is Sales and Marketing Strategy of Wells Fargo Company?

- Who Owns Wells Fargo Company?

- What is Customer Demographics and Target Market of Wells Fargo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.