Wells Fargo Bundle

How Does Wells Fargo Navigate the Financial World?

Wells Fargo & Company, a giant in the U.S. banking sector since 1852, offers a vast array of financial services. With nearly $2 trillion in assets as of early 2025, understanding Wells Fargo SWOT Analysis is crucial for investors and anyone interested in the financial landscape. This exploration will uncover the inner workings of this financial powerhouse.

This deep dive into How Wells Fargo Works will explore its core operations, diverse revenue streams, and strategic moves. We'll examine how Wells Fargo banking services, from community banking to investment management, contribute to its overall success. Whether you're curious about Wells Fargo account types and fees or the latest Wells Fargo stock price, this analysis provides valuable insights into a leading financial institution.

What Are the Key Operations Driving Wells Fargo’s Success?

The Wells Fargo Company creates and delivers value by providing a wide array of financial products and services. These offerings cater to various customer segments, including consumers, small businesses, corporate clients, and high-net-worth individuals. Understanding How Wells Fargo Works involves examining its core operational segments and the value proposition it offers to its diverse clientele.

Its core operations are structured across several key segments: Community Banking, Corporate and Investment Banking, Wealth and Investment Management, and Consumer Lending. Each segment provides specialized financial products and services, from traditional banking to investment solutions. This structure allows the company to address a broad spectrum of financial needs, aiming to be a comprehensive financial services provider.

The operational processes are extensive and technologically driven. The company leverages technology, advanced analytics, and strategic partnerships to deliver its services. Its integrated approach and extensive network contribute to customer convenience, a broad range of product choices, and integrated financial planning, solidifying its position in the financial industry. To learn more about the company's strategic goals, consider reading about the Growth Strategy of Wells Fargo.

The company operates through key segments: Community Banking, Corporate and Investment Banking, Wealth and Investment Management, and Consumer Lending. Community Banking offers traditional services, while Corporate and Investment Banking serves corporate and institutional clients. Wealth and Investment Management provides investment solutions, and Consumer Lending focuses on mortgages and loans.

Operational processes are extensive and technologically driven, with a focus on digital platforms and advanced analytics. Technology development is crucial across all segments, enhancing services like mobile banking and trading platforms. The company uses data to understand customer needs and manage risk effectively.

The value proposition centers on being a 'one-stop shop' for diverse financial needs, offering convenience and a broad range of products. This integrated model allows for significant cross-selling and deeper customer relationships. Customers benefit from integrated financial planning and a wide array of choices.

Customers benefit from convenience, a wide range of product choices, and integrated financial planning. The company's extensive physical and digital footprint ensures accessibility. This comprehensive approach, combined with its established brand, translates into significant customer advantages.

In recent years, Wells Fargo has focused on improving its operational efficiency and customer service. As of the latest reports, the company manages significant assets and serves millions of customers. The company's performance metrics, including revenue and profitability, reflect its market position and operational effectiveness.

- Reported revenue of $20.86 billion in Q1 2024.

- Total deposits were around $1.3 trillion as of the end of Q1 2024.

- The company has a vast network of branches and ATMs across the United States.

- Wells Fargo continues to invest in digital banking to enhance customer experience.

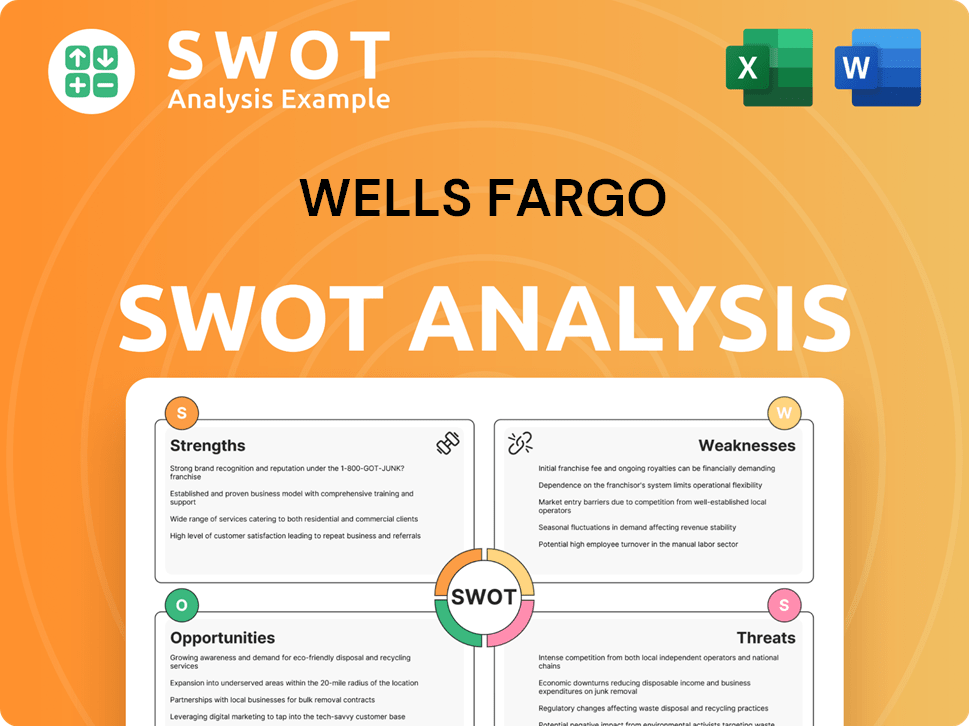

Wells Fargo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Wells Fargo Make Money?

The Wells Fargo Company generates revenue through a diverse range of financial services. Understanding how Wells Fargo works involves examining its primary income sources and the strategies it uses to monetize its offerings. This includes both interest and noninterest income streams, along with various fee-based services.

The Wells Fargo Company's revenue model is built on a foundation of net interest income and noninterest income. These streams are supported by a variety of financial products and services, reflecting its extensive presence in the banking sector. The company's financial performance is significantly influenced by these revenue components.

Revenue streams and monetization strategies are critical to understanding how Wells Fargo operates and maintains its financial health. The company's approach involves leveraging its diverse service offerings to maximize revenue and customer value. This includes strategies such as cross-selling, tiered pricing, and investment in digital platforms.

The primary revenue streams for Wells Fargo include net interest income and noninterest income. Net interest income is the difference between the interest earned on assets, such as loans, and the interest paid on liabilities, like deposits. Noninterest income is derived from various fees and charges associated with banking services.

- Net Interest Income: This is a significant revenue source, driven by lending activities across consumer, commercial, and mortgage segments. For the first quarter of 2025, Wells Fargo reported net interest income of $12.23 billion.

- Noninterest Income: This includes service charges on deposit accounts, card fees, advisory fees, and mortgage banking income. In the first quarter of 2025, noninterest income was $7.93 billion.

Wells Fargo employs several strategies to monetize its services and enhance revenue. These strategies include cross-selling, tiered pricing, and investment in digital platforms. These methods help the company optimize its revenue mix and improve profitability.

- Cross-Selling: Offering multiple products to existing customers, such as providing mortgages or investment advisory services to checking account holders.

- Tiered Pricing: Using fee structures that vary based on the assets under management, particularly in wealth management.

- Digital Platforms: Investing in digital platforms to enhance efficiency and reduce the cost of service delivery.

For further insights into the company's marketing strategies, consider exploring the Marketing Strategy of Wells Fargo.

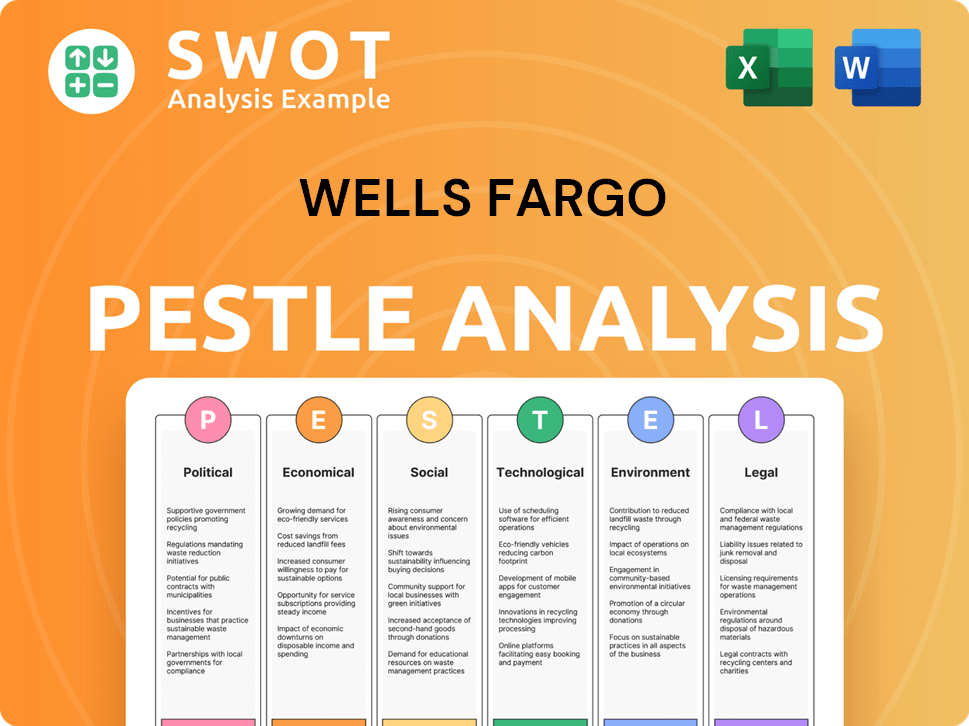

Wells Fargo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Wells Fargo’s Business Model?

The operational and financial trajectory of the Wells Fargo Company has been shaped by significant milestones and strategic shifts. A primary focus in recent years has been addressing historical regulatory issues and rebuilding trust, particularly following the sales practices scandal. This involved substantial investments in risk management, compliance, and technological infrastructure to enhance oversight and prevent future misconduct. The company has been under various consent orders from regulatory bodies, prompting a comprehensive overhaul of its internal controls and governance.

In the first quarter of 2025, Wells Fargo reported a decrease in noninterest expense, reflecting ongoing efforts to improve efficiency and manage operational costs. Operational challenges have included adapting to a rapidly evolving digital banking landscape and intense competition from fintech companies. The company has responded by investing heavily in digital transformation, including mobile banking enhancements and online self-service tools, aiming to provide a seamless omnichannel experience. Strategic partnerships with technology providers are also key to accelerating innovation.

The Wells Fargo Company's competitive advantages are rooted in several factors, including strong brand recognition, a long-standing history in the U.S. market, and a vast distribution network. The diversification of its business across community banking, corporate and investment banking, wealth management, and consumer lending provides a hedge against downturns in any single sector. The company continues to adapt by focusing on core strengths, divesting non-core assets, and prioritizing responsible growth.

Key milestones include navigating the aftermath of the sales practices scandal and implementing comprehensive regulatory reforms. The company has focused on improving its risk management and compliance frameworks. This has involved significant investments in technology and personnel to enhance oversight and prevent future misconduct.

Strategic moves include a strong emphasis on digital transformation, enhancing mobile banking capabilities, and expanding online self-service tools. The company is also focused on streamlining operations and improving efficiency through cost management initiatives. Furthermore, partnerships with technology providers are crucial for innovation.

The competitive edge stems from strong brand recognition, a vast distribution network, and a diversified business model. The company benefits from economies of scale and a broad customer base. It also leverages its extensive branch network and digital platforms to offer unparalleled reach.

In Q1 2025, Wells Fargo reported a decrease in noninterest expenses. The company continues to focus on improving operational efficiency and managing costs. The bank's financial performance is also influenced by its ability to adapt to the evolving financial landscape.

In 2024 and 2025, Wells Fargo has prioritized initiatives aimed at improving operational efficiency and enhancing customer experience. These include investments in digital banking platforms and streamlining internal processes. The company is also focused on divesting non-core assets to sharpen its focus on core banking activities.

- Ongoing efforts to address regulatory issues and enhance compliance.

- Investments in digital transformation and technology infrastructure.

- Focus on improving operational efficiency and managing costs.

- Strategic partnerships to accelerate innovation and enhance customer experience.

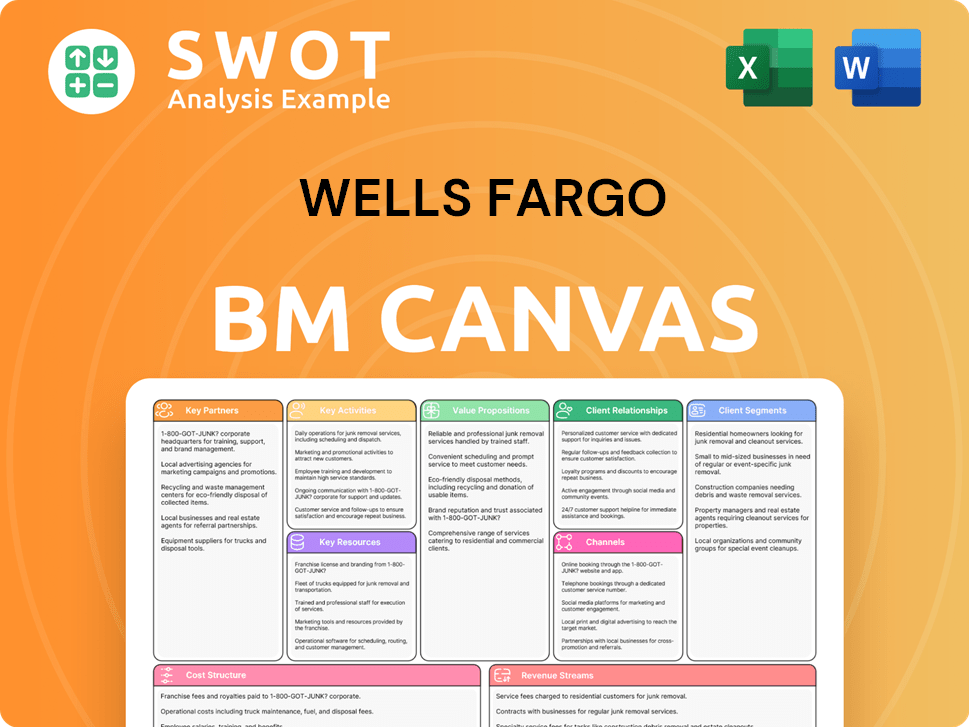

Wells Fargo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Wells Fargo Positioning Itself for Continued Success?

The Wells Fargo Company holds a prominent position in the U.S. financial services sector. Competing with major banks like JPMorgan Chase and Bank of America, it maintains a substantial customer base through its extensive branch network and digital capabilities. Despite facing challenges, its brand recognition continues to be a significant asset, particularly in consumer banking and mortgage lending. Understanding how Wells Fargo works involves recognizing its competitive landscape and operational strategies.

However, Wells Fargo encounters several risks. Regulatory scrutiny, intense competition from fintech companies, and economic downturns pose significant threats. Technological disruption necessitates continuous investment for competitiveness. Its future depends on navigating these challenges effectively.

Wells Fargo competes with major universal banks and various financial institutions. Its extensive branch network and digital services support a large customer base. The company's market share is significant in consumer banking and mortgage lending. Examining the Wells Fargo banking operations reveals its competitive strengths.

Regulatory scrutiny, particularly related to past issues, remains a major concern. Competition from fintech companies and the impact of economic cycles pose significant risks. Technological advancements require continuous investment to stay competitive. The Wells Fargo Company must address these risks to maintain profitability.

Wells Fargo is focused on enhancing digital capabilities and streamlining operations. The company is committed to responsible growth and rebuilding trust. Its success hinges on navigating regulations, adapting to technology, and managing credit cycles. The future of Wells Fargo services depends on these strategic initiatives.

The company is investing in technology to improve customer experience and efficiency. Leadership emphasizes responsible growth and delivering shareholder value. The focus is on disciplined expense management and returning capital to shareholders. For more context, see the Brief History of Wells Fargo.

In Q1 2024, Wells Fargo reported a net income of $4.6 billion. The company is actively managing its expenses and focusing on capital returns. Key strategies include digital transformation and risk management enhancements. These initiatives are crucial for long-term success.

- Focus on digital transformation to improve customer experience.

- Emphasis on disciplined expense management to boost profitability.

- Return of capital to shareholders through dividends and share repurchases.

- Strengthening risk management to ensure financial stability.

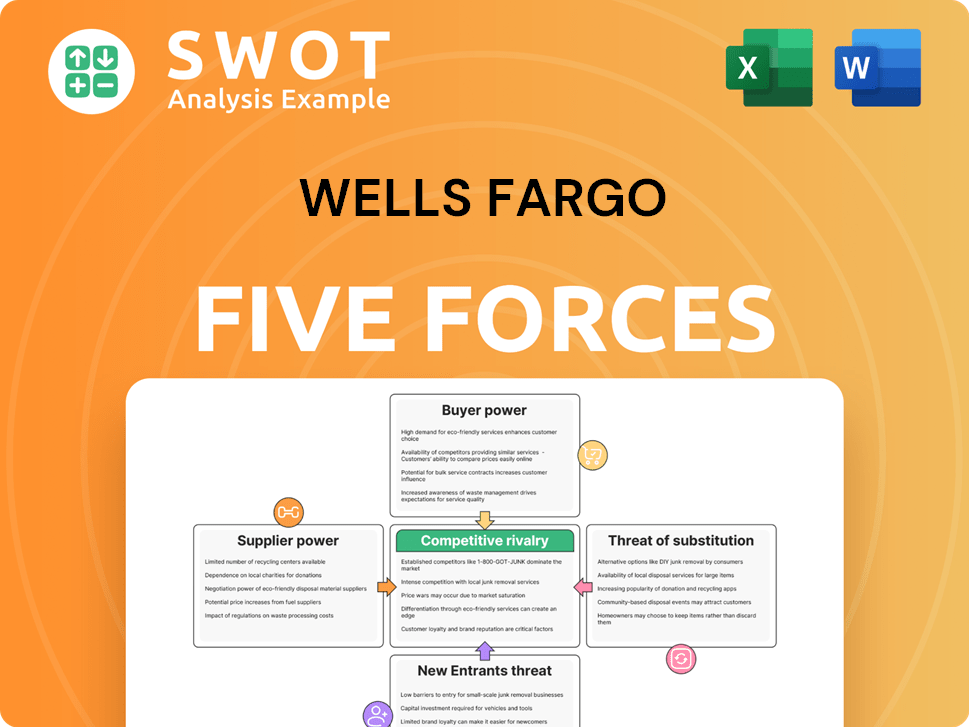

Wells Fargo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wells Fargo Company?

- What is Competitive Landscape of Wells Fargo Company?

- What is Growth Strategy and Future Prospects of Wells Fargo Company?

- What is Sales and Marketing Strategy of Wells Fargo Company?

- What is Brief History of Wells Fargo Company?

- Who Owns Wells Fargo Company?

- What is Customer Demographics and Target Market of Wells Fargo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.