Wells Fargo Bundle

How has Wells Fargo Rebuilt its Sales and Marketing Strategy?

Founded in 1852, Wells Fargo & Company has a rich history in the financial services industry, evolving from its roots in the California Gold Rush to a modern financial powerhouse. Understanding the Wells Fargo SWOT Analysis is crucial to grasping its current position. The company's sales and marketing strategy has undergone significant transformations, especially after facing challenges.

This analysis delves into the intricacies of Wells Fargo's current approach, examining its sales and marketing tactics, brand positioning strategy, and digital marketing initiatives. We'll explore how Wells Fargo acquires customers, its target market segmentation, and the impact of its customer relationship management. Furthermore, this piece provides insights into Wells Fargo's competitive advantage and market share growth strategies, offering a comprehensive look at its business strategy and the effectiveness of its recent advertising campaigns.

How Does Wells Fargo Reach Its Customers?

The sales channels of the company, a major player in the financial services sector, are multifaceted, designed to cater to a diverse customer base. This approach encompasses both physical and digital avenues, ensuring broad accessibility and a comprehensive customer experience. The company's strategy focuses on integrating these channels to provide seamless interactions, reflecting the evolving preferences of its customers.

Physical branches remain a cornerstone, with approximately 4,390 locations as of December 31, 2023, serving as hubs for community banking and financial advice. Digital channels, including the company website and mobile banking platforms, are also pivotal, facilitating a wide range of banking operations. This omnichannel strategy is crucial for customer acquisition and retention, adapting to the increasing demand for digital convenience.

The company's sales strategy is designed to reach a broad audience through a mix of physical and digital channels. Direct sales teams play a significant role, especially in areas like corporate and investment banking. The company's digital adoption is noteworthy, with 79% of consumer and small business customers actively using digital channels in 2023. This reflects a strategic shift towards omnichannel integration, where customers can seamlessly transition between online and offline interactions.

The company's extensive network of physical branches provides in-person services and advice. These branches, numbering around 4,390 as of December 2023, are crucial for community banking and building customer relationships. The company is shifting these branches towards financial advice centers.

Digital platforms, including the company's website and mobile banking apps, are essential e-commerce channels. These platforms facilitate account opening, loan applications, and self-service banking. Digital adoption is high, with 79% of customers using digital channels in 2023, highlighting the importance of Growth Strategy of Wells Fargo.

Direct sales teams are vital for corporate and investment banking, and wealth management. They offer tailored solutions and direct client engagement for complex financial products. These teams are key to providing specialized services.

Strategic partnerships, particularly in mortgage lending, extend market reach. These partnerships connect with real estate professionals and homebuilders. This approach supports market growth and customer acquisition.

The company's sales strategy focuses on an omnichannel approach, integrating physical and digital channels. This integration aims to provide a seamless customer experience, catering to evolving consumer preferences. The company's digital initiatives are continuously evolving to enhance customer convenience and accessibility.

- Optimizing branch networks for financial advice and customer service.

- Enhancing digital platforms for ease of use and expanded functionality.

- Leveraging direct sales teams for specialized financial products.

- Developing strategic partnerships to broaden market reach.

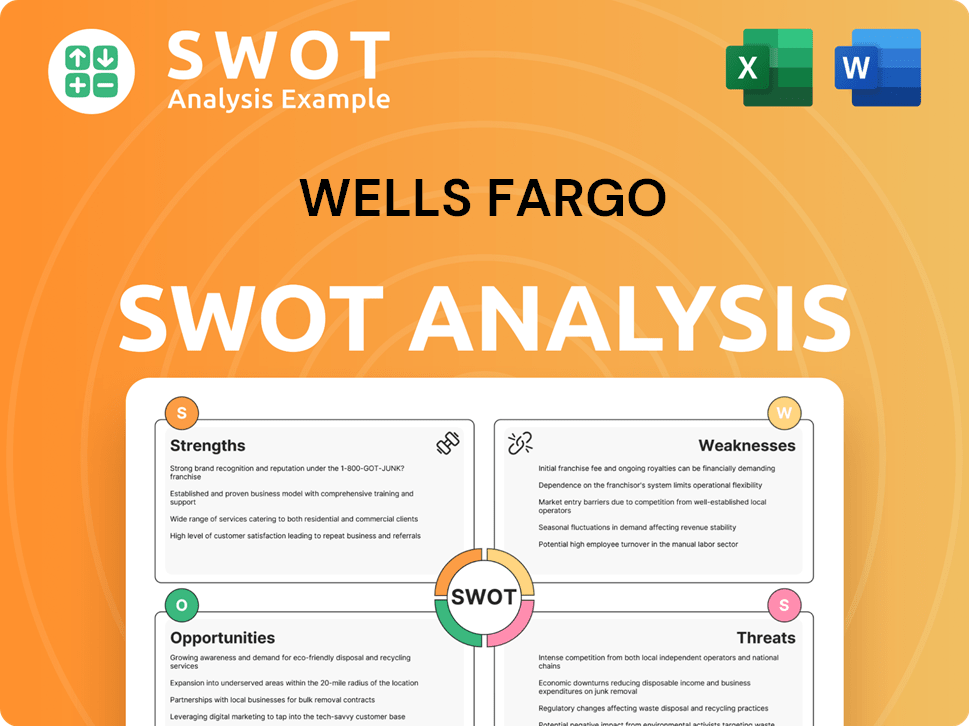

Wells Fargo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Wells Fargo Use?

The marketing tactics employed by the company, are comprehensive, blending digital and traditional methods to enhance brand recognition, generate leads, and boost sales. This approach is crucial for the company's overall Wells Fargo sales strategy and its ability to compete effectively in the financial services sector. The company's marketing efforts are designed to reach a broad audience while also targeting specific customer segments with tailored messaging.

Digital marketing plays a significant role, with the company using content marketing to provide financial education and insights. Search Engine Optimization (SEO) and paid advertising are key for online visibility, while email marketing is used for customer engagement. Traditional methods, such as television and print media, are still utilized for broad awareness campaigns. The company's strategy is heavily data-driven, using customer segmentation and advanced analytics to optimize marketing spend and personalize customer experiences, which is a core component of its Wells Fargo marketing strategy.

The company's marketing mix is evolving towards a more integrated, digitally-focused approach, reflecting changes in how its target audience consumes media. Recent innovations include increased investment in personalized digital experiences and real-time customer support through AI-powered chatbots, ensuring that it maintains a competitive edge in the market. This comprehensive approach supports the company's Wells Fargo business strategy by ensuring it remains relevant and accessible to its diverse customer base.

The company's digital marketing strategy is multifaceted, focusing on content creation, SEO, and targeted advertising. Content marketing provides financial education and market insights, while SEO ensures visibility in online searches. Paid advertising campaigns on search engines and social media platforms target specific customer segments with tailored offers, which is a key aspect of their Wells Fargo financial services marketing.

Content marketing is a cornerstone of the company's strategy, with a focus on providing valuable financial education and market analysis. This approach helps establish the company as a thought leader and builds trust with potential customers. The company uses its website and various online platforms to disseminate this content, which supports its Wells Fargo brand positioning strategy.

Social media platforms, such as LinkedIn, Facebook, and X (formerly Twitter), are used for brand building and customer service. The company leverages these platforms to disseminate company news, financial tips, and engage with customers. This strategy helps enhance customer relationships and supports the company's overall marketing objectives, which is a part of its Wells Fargo sales and marketing tactics.

Email marketing is used for customer engagement, product promotion, and personalized communications. Targeted email campaigns are designed to reach specific customer segments with relevant offers and information. This approach helps nurture leads and drive conversions, which is a key element in their Wells Fargo customer relationship management efforts.

The company places a strong emphasis on data-driven marketing, leveraging customer segmentation to personalize marketing messages. Advanced analytics tools are used to track campaign performance, understand customer behavior, and optimize marketing spend. This data-driven approach is crucial for maximizing the effectiveness of their marketing efforts, which is essential for Wells Fargo market analysis.

Traditional marketing channels, such as television, radio, and print media, are still used for broad awareness campaigns. Event sponsorships and community engagement initiatives also reinforce the company's local presence and commitment. This multi-channel approach ensures the company can reach a wide audience, which is part of their Wells Fargo advertising campaigns analysis.

The company's marketing strategy includes a mix of digital and traditional methods to reach its target audience effectively. The focus is on providing valuable content, using data to personalize customer experiences, and leveraging various channels for brand building and customer engagement. This approach supports the company's overall business objectives and enhances its Wells Fargo competitive advantage.

- Customer Segmentation: The company segments its customer base to tailor marketing messages and product recommendations, improving relevance and engagement.

- SEO and Paid Advertising: Investing in SEO and paid advertising campaigns to ensure high visibility in online searches and target specific customer segments.

- Content Marketing: Providing financial education and market insights through its website and other platforms to establish thought leadership and build trust.

- Social Media Engagement: Using social media to build brand awareness, offer customer service, and disseminate company news and financial tips.

- Data Analytics: Utilizing advanced analytics to track campaign performance, understand customer behavior, and optimize marketing spend.

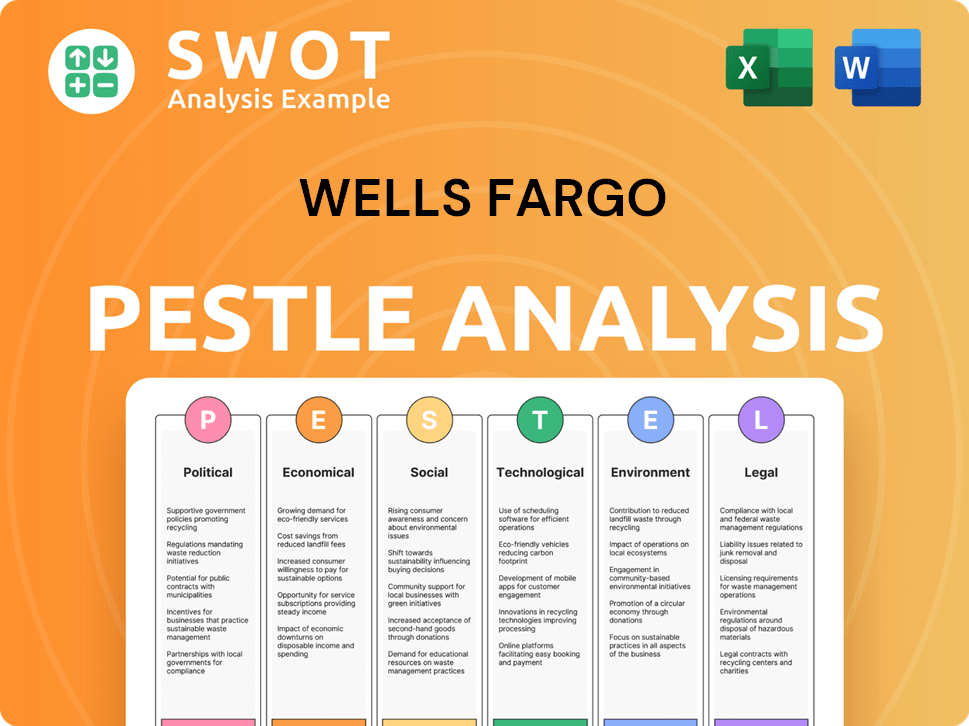

Wells Fargo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Wells Fargo Positioned in the Market?

The brand positioning of the company, a key aspect of its Wells Fargo sales strategy, centers on a heritage of providing comprehensive financial services. Its core message emphasizes re-establishing trust and ethical conduct, aiming to differentiate itself in the competitive financial services landscape. This approach is crucial for attracting and retaining customers, forming the foundation of its Wells Fargo marketing strategy.

The visual identity, featuring the iconic stagecoach, evokes reliability and a pioneering spirit. The tone of voice aims to be informative, empathetic, and reassuring, particularly in the wake of past controversies. This branding strategy is essential for building and maintaining customer relationships, directly impacting the company's Wells Fargo business strategy.

The company's target audience includes individuals, small businesses, and large corporations, offering a wide range of products and services. This approach aims to convey a sense of security and partnership, particularly for customers seeking long-term financial relationships. For a detailed understanding of how the company is structured and its financial performance, consider exploring insights from Owners & Shareholders of Wells Fargo.

The company is actively working to improve its standing in customer satisfaction surveys and brand trust indices. This includes increased transparency in its operations and communications. The focus is on regaining customer confidence through ethical practices and clear communication, which is a vital part of its Wells Fargo financial services strategy.

The company maintains brand consistency across its physical branches, digital platforms, and marketing materials. This ensures a unified customer experience, reinforcing its brand message. Consistent branding is crucial for building a strong brand identity and enhancing customer loyalty, which is a key element of its Wells Fargo market analysis.

The company continuously monitors shifts in consumer sentiment and competitive threats. It adjusts its messaging and service offerings to remain relevant and competitive. This adaptive approach is essential for maintaining a Wells Fargo competitive advantage in the dynamic financial services industry.

The company offers a wide range of products and services to meet diverse financial needs. This includes everyday banking, investment strategies, and specialized services. This customer-centric approach helps the company cater to a broad audience, supporting its Wells Fargo sales and marketing tactics.

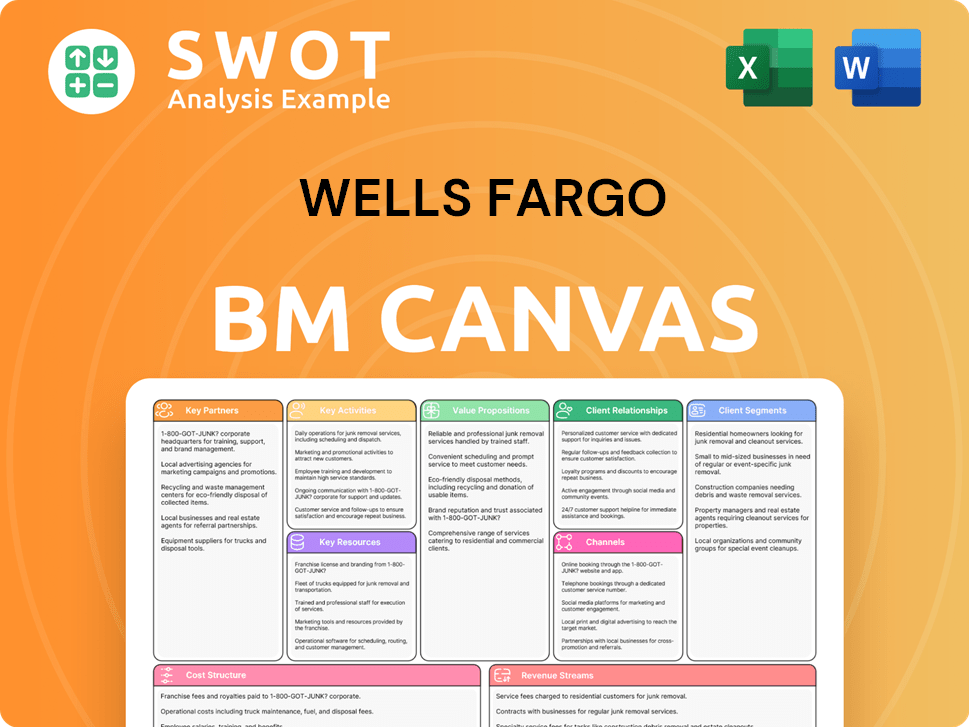

Wells Fargo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Wells Fargo’s Most Notable Campaigns?

Following past issues, the company has launched key campaigns to rebuild trust and reaffirm its commitment to customers. The 'Re-establishing Trust' campaign, initiated in 2018, aimed to address past issues transparently. It highlighted internal reforms and showcased a renewed customer-first approach. These initiatives utilize a mix of traditional and digital media.

The company's marketing efforts also focus on promoting digital banking capabilities and mobile app features. These campaigns highlight convenience, security, and user-friendliness, aiming to drive digital engagement. Channels include targeted digital ads and social media content demonstrating app functionalities. This reflects a strategic shift towards digital adoption.

The ongoing challenge for the company's sales and marketing is to balance aggressive growth strategies with a strong ethical framework. The company's Competitors Landscape of Wells Fargo shows that the company needs to maintain a competitive edge while rebuilding customer trust.

This campaign, ongoing since 2018, aims to rebuild trust by addressing past issues transparently. It features employees discussing their dedication to customers and internal changes. The campaign uses traditional and digital media to reach a broad audience.

Focused on promoting digital banking and mobile app features. These campaigns highlight the convenience, security, and user-friendliness of its online platforms. The goal is to increase digital engagement and self-service among customers.

The company's sales strategy and marketing strategy are closely aligned with its business strategy. These campaigns are measured by brand perception improvements and customer retention rates. The company reported 79% active digital usage among consumer and small business customers in 2023.

- Customer Satisfaction: The company reported positive trends in customer satisfaction scores in Q4 2023, indicating success in rebuilding trust.

- Digital Engagement: The focus on digital banking reflects the company's adaptation to changing customer preferences and technological advancements.

- Brand Positioning: Marketing efforts emphasize customer-centricity and transparency to rebuild the brand's reputation and maintain a competitive advantage.

- Sales Performance: While direct sales lift numbers are difficult to isolate, the campaigns aim to support long-term growth and customer loyalty.

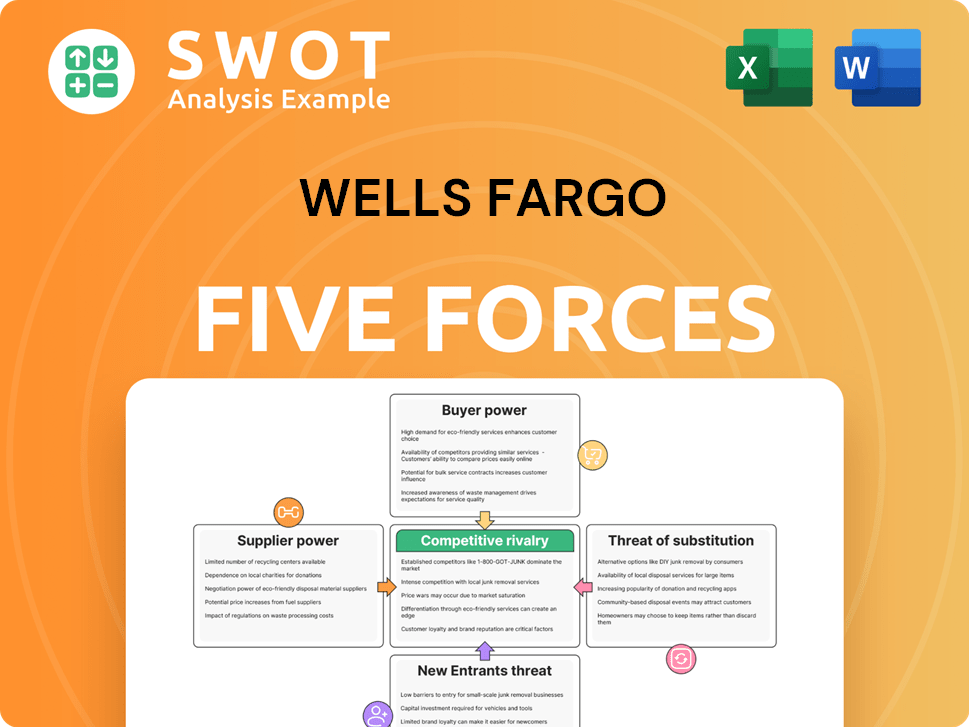

Wells Fargo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wells Fargo Company?

- What is Competitive Landscape of Wells Fargo Company?

- What is Growth Strategy and Future Prospects of Wells Fargo Company?

- How Does Wells Fargo Company Work?

- What is Brief History of Wells Fargo Company?

- Who Owns Wells Fargo Company?

- What is Customer Demographics and Target Market of Wells Fargo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.