Wells Fargo Bundle

Who Really Owns Wells Fargo?

Unraveling the ownership structure of a financial giant like Wells Fargo is crucial for understanding its trajectory and accountability. Given the bank's history of regulatory challenges, grasping who controls its direction is more important than ever. Founded in 1852 during the Gold Rush, Wells Fargo SWOT Analysis, has evolved into a global financial powerhouse.

This exploration of Wells Fargo's ownership delves into its history, from its founders to its current status as a publicly traded company. Understanding the roles of major Wells Fargo shareholders and the influence of its leadership is key. We'll examine the Wells Fargo ownership landscape, including institutional investors, and provide insights into the Wells Fargo parent company dynamics.

Who Founded Wells Fargo?

The establishment of Wells Fargo & Company on March 18, 1852, marked a pivotal moment in American financial history. Founded by Henry Wells and William G. Fargo, the company emerged to serve the burgeoning economy of the California Gold Rush, providing crucial banking and express services. This venture was a direct response to the absence of such services from American Express in the West.

Henry Wells, with experience in express delivery, and William G. Fargo, who had a background in mail and freight, brought complementary expertise to the new company. Their vision was to capitalize on the opportunities presented by the rapid expansion and economic activity in the Western United States. The early days of Wells Fargo were characterized by a focus on providing secure money transfer and banking services, crucial for the frontier economy.

While specific details about the initial equity split are not readily available in public records, it's clear that Wells and Fargo, along with other investors, saw the potential in the financial and express service needs of the rapidly growing West. The company quickly gained a reputation for reliability, which fueled its expansion through the consolidation of stagecoach lines and the establishment of a vast network. Understanding the Brief History of Wells Fargo is essential to grasp the evolution of its ownership.

The early success of Wells Fargo was significantly influenced by its ability to adapt to changing transportation methods, transitioning from stagecoaches to railroads. In 1872, Lloyd Tevis acquired a significant stake and became president, illustrating a notable shift in early control.

Henry Wells and William G. Fargo, the co-founders, brought essential experience to the company. Their previous work in the express delivery industry and mail services laid the groundwork for Wells Fargo's initial operations.

The primary focus was on secure money transfer and banking services, catering to the needs of the expanding Western frontier. This focus helped establish the company's reputation for trust and reliability.

The company's ownership structure evolved over time, with significant shifts occurring as the business grew. The acquisition of a large stake by Lloyd Tevis in 1872 marked a key change in leadership.

Early backers, who saw the potential in providing financial and express services, played a crucial role in the company's early growth. These investors helped fund the expansion of services across the West.

Wells Fargo's ability to adapt to changing transportation methods, from stagecoaches to railroads, was critical to its early expansion. This adaptability facilitated the establishment of a transcontinental express line.

The early ownership of Wells Fargo, including its founders and initial investors, set the stage for the company's long-term success. The company’s ability to adapt and expand its services, coupled with a focus on trust, allowed it to become a significant player in the financial landscape. While specific details on the initial equity distribution are limited, the impact of key figures like Henry Wells, William G. Fargo, and later, Lloyd Tevis, is undeniable. Understanding the early ownership provides a crucial context for analyzing the evolution of Wells Fargo's ownership structure and its current status. The company's history is a testament to the vision of its founders and the adaptability of its early leadership. As of early 2024, the largest institutional investors in Wells Fargo include major financial institutions, reflecting the company's continued significance in the financial sector. The Wells Fargo shareholders today are primarily institutional investors and the general public, as the company is a publicly traded company. The company's stock ticker symbol is WFC.

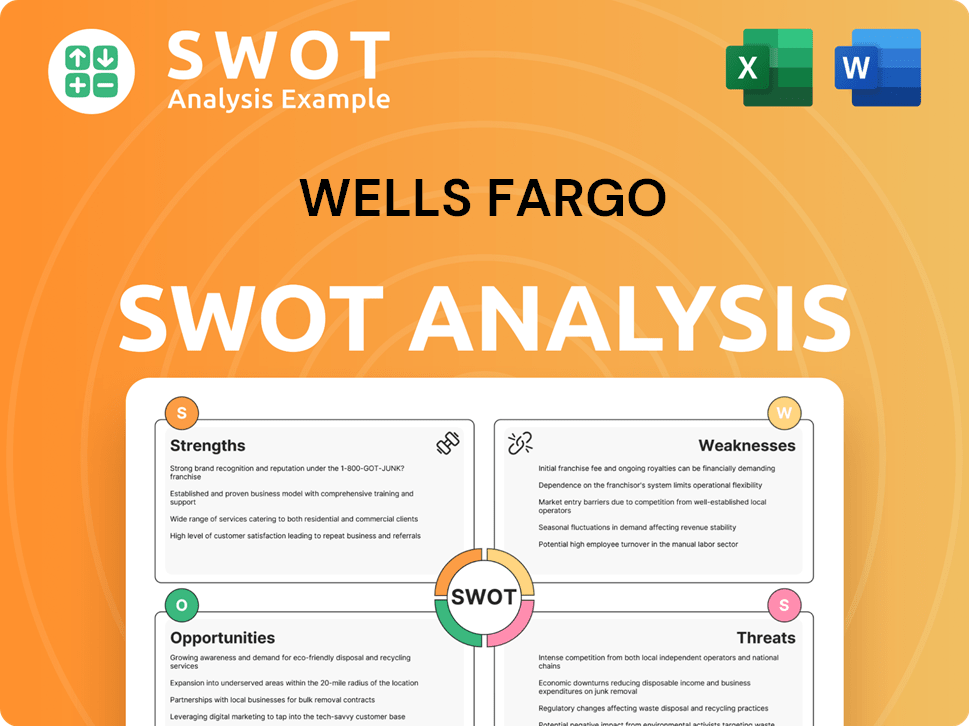

Wells Fargo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Wells Fargo’s Ownership Changed Over Time?

The evolution of Wells Fargo's ownership reflects its transformation from a private venture to a publicly traded corporation. Founded in 1852, the company initially focused on express and banking services. A significant shift occurred in 1962 when it began trading on the New York Stock Exchange (NYSE). The formation of a holding company, Wells Fargo & Company, in 1969, further shaped its ownership structure, consolidating control over Wells Fargo Bank, N.A. The 1998 acquisition of Wells Fargo Bank by Norwest Corporation marked a pivotal moment, leading to the combined entity adopting the Wells Fargo name and expanding its reach.

These changes highlight the company's growth and adaptation within the financial industry. The transition to public trading and subsequent mergers significantly broadened its investor base. The current ownership structure is primarily influenced by institutional investors, reflecting a broader trend in the market.

| Key Event | Year | Impact on Ownership |

|---|---|---|

| Founding of Wells Fargo | 1852 | Private venture, initial ownership by founders and early investors. |

| Listing on NYSE | 1962 | Transition to public ownership, allowing broader investor participation. |

| Formation of Wells Fargo & Company | 1969 | Creation of a holding company, centralizing control over the bank. |

| Acquisition by Norwest Corporation | 1998 | Merger, leading to expanded reach and a shift in the ownership base. |

Today, the majority of Wells Fargo shareholders are institutional investors. As of May 2025, these investors held approximately 77.28% of the outstanding shares. Major institutional holders include Vanguard Group, BlackRock, and Fidelity. Individual insiders, such as Wells Fargo executives, own a much smaller portion, around 0.09% as of May 2025. For example, CEO Charles Scharf held 1,056,234 shares as of March 4, 2025, representing 0.03% of the company's shares. Mutual funds held 69.99% of shares as of May 2025.

The ownership structure of Wells Fargo is primarily composed of institutional investors, with a smaller percentage held by individual insiders. This structure reflects the company's status as a publicly traded entity and the influence of major investment firms.

- Institutional investors hold the majority of shares.

- Major shareholders include Vanguard Group, BlackRock, and Fidelity.

- Individual insiders, such as executives, hold a small percentage.

- The company is a publicly traded entity on the NYSE.

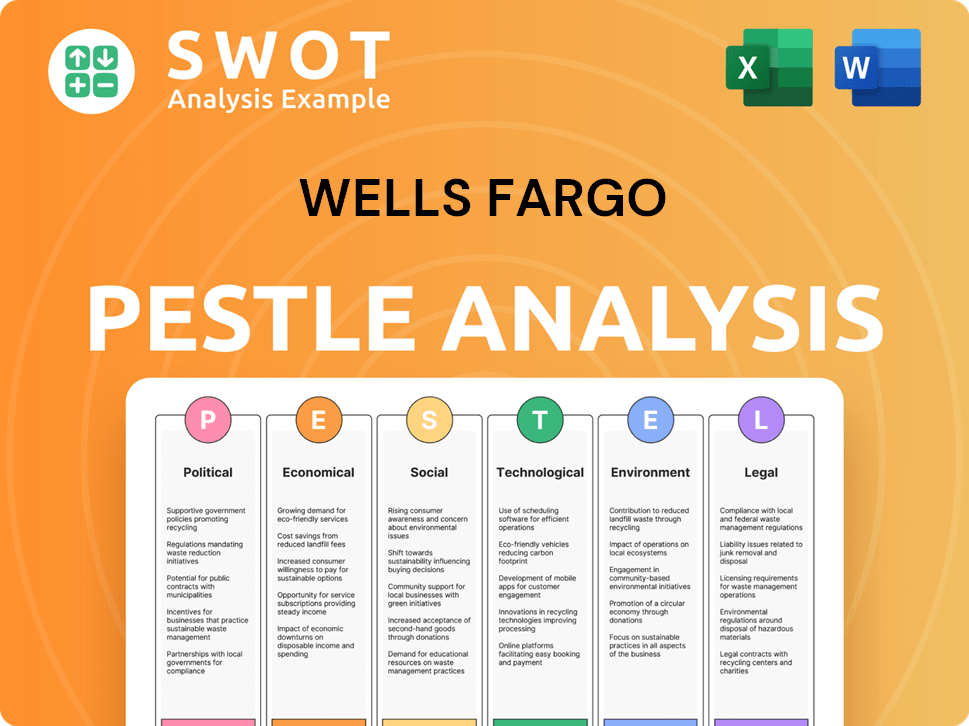

Wells Fargo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Wells Fargo’s Board?

The current Board of Directors of the company plays a critical role in its governance and oversight, representing the interests of its diverse ownership base. The board is structured to include both representatives of major shareholders, though primarily independent members, and the Chief Executive Officer. As of the 2025 annual meeting, all director nominees were existing directors and were elected by shareholders at the 2024 annual meeting. The board continues to be led by an independent chair, ensuring appropriate leadership and oversight. All nominees are independent, with the exception of the CEO, and all standing committee members are independent.

While specific details on individual board members representing major shareholders are not explicitly stated, the presence of institutional investors holding a significant majority of shares implies their indirect influence through the election of board members. The company's governance structure is designed to ensure accountability to its shareholders, with a focus on maintaining independence and effective oversight. The composition of the board and its committees reflects a commitment to sound corporate governance practices.

| Metric | Details | As of |

|---|---|---|

| Outstanding Shares | 3,288,186,582 | December 31, 2024 |

| Asset Cap | $1.95 trillion | Regulatory Order |

| Consent Order Termination (OCC) | 2018 order terminated | February 2025 |

The voting structure for the company is generally based on a one-share-one-vote principle, which is common for publicly traded companies. There are no indications of dual-class shares, special voting rights, or golden shares that would grant outsized control to specific individuals or entities beyond their proportional shareholding. Recent governance controversies and activist investor campaigns, particularly stemming from its past sales practices misconduct, have led to heightened scrutiny from regulators. For instance, the company has been working to address consent orders imposed by regulators like the Federal Reserve, which included an asset cap of $1.95 trillion. The termination of several consent orders since 2019, with the OCC terminating a 2018 consent order in February 2025 and the Fed terminating two consent orders dating to 2011, indicates progress in addressing these issues. These controversies have shaped decision-making within the company, pushing for more robust governance and accountability. Learn more about the strategies employed by the company in Marketing Strategy of Wells Fargo.

The company's Board of Directors oversees governance, with a mix of independent and shareholder-represented members.

- The company's voting structure is based on one-share-one-vote.

- The company has faced regulatory scrutiny, leading to enhanced governance practices.

- The company is working to address past issues and improve risk management.

- Institutional investors significantly influence the company's direction.

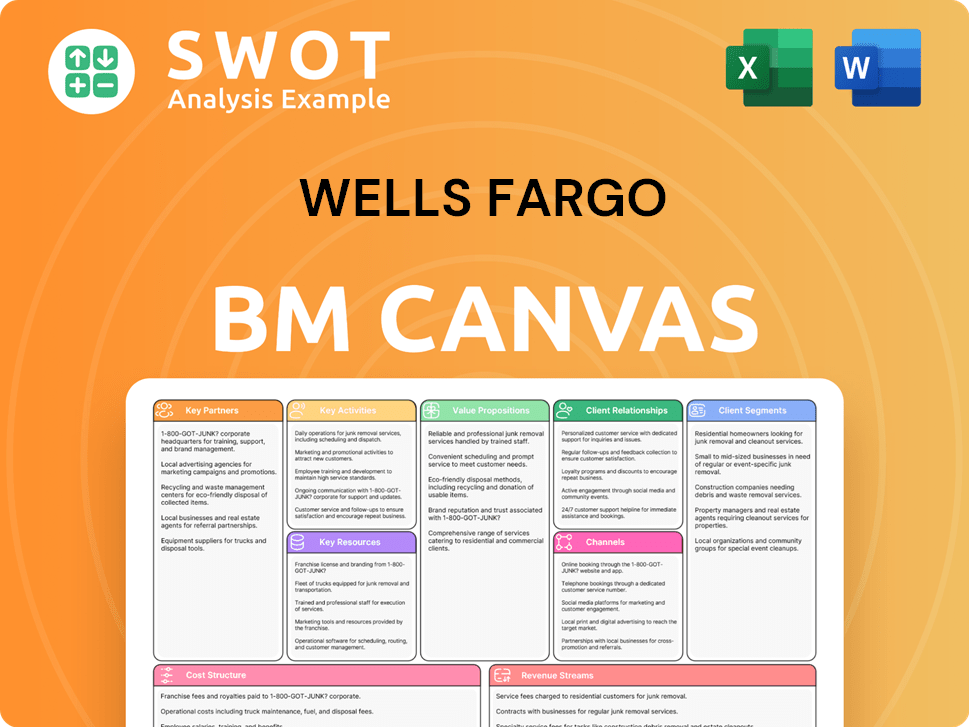

Wells Fargo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Wells Fargo’s Ownership Landscape?

In the past few years, significant changes have occurred in the ownership structure of Wells Fargo, reflecting strategic decisions and industry trends. The company has actively managed its capital structure, primarily through share buyback programs. For instance, in 2024, Wells Fargo repurchased approximately $20 billion of common stock, a substantial increase from the previous year, which resulted in a 21% decrease in average common shares outstanding since the fourth quarter of 2019. This commitment to returning capital to shareholders is further demonstrated by the board's authorization of a new $40 billion common stock repurchase program on April 29, 2025.

Leadership transitions and regulatory actions also influence the company's ownership landscape. In January 2025, Jon Weiss, Co-CEO of Corporate & Investment Banking (CIB), announced his retirement, with Fernando Rivas taking over as the sole CEO of CIB. Furthermore, the potential lifting of the Federal Reserve's asset cap, imposed in 2018, could be a major step forward for the bank. These developments, coupled with the company's focus on organic growth and improving earnings capacity, shape the outlook for Wells Fargo and its shareholders.

Institutional ownership remains a key factor, accounting for 77.28% as of May 2025. While insider ownership is low, there has been more insider selling than buying over the last year. These trends, combined with the strategic focus on shareholder value, provide insights into the dynamics of Wells Fargo's ownership.

| Metric | Value | Date |

|---|---|---|

| Share Repurchases (2024) | $20 billion | 2024 |

| Institutional Ownership | 77.28% | May 2025 |

| Dividend per Share | $0.40 | June 1, 2025 |

The company repurchased approximately $20 billion of common stock in 2024. This is a 64% increase from the previous year. This is a significant move to return capital to shareholders.

Institutional ownership remains high, at 77.28% as of May 2025. Insider ownership is low, with more selling than buying recently. The company is focused on increasing shareholder value.

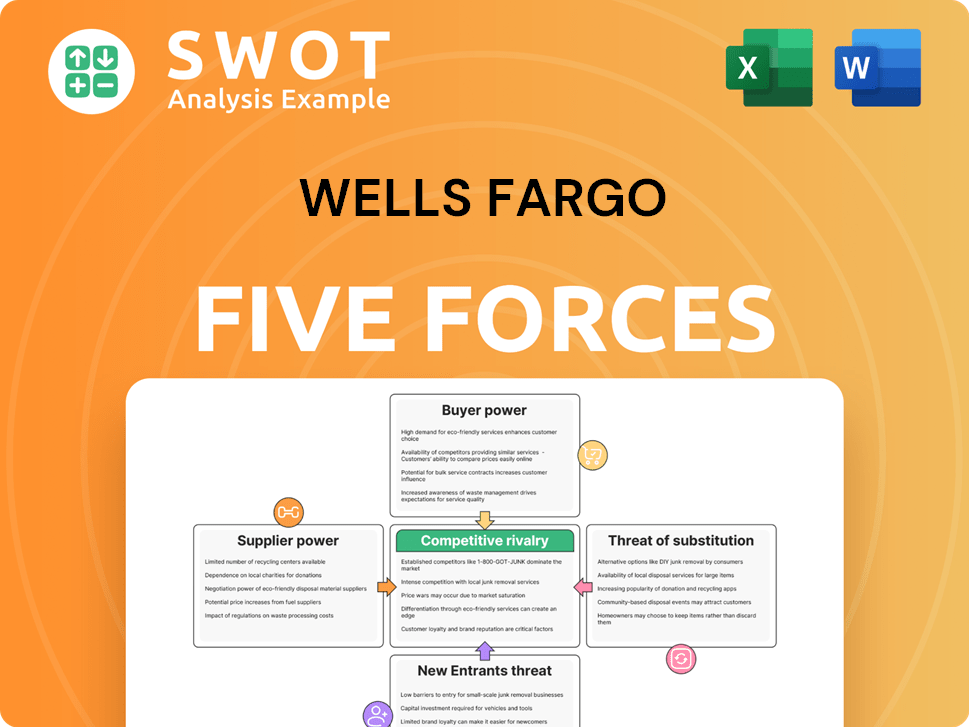

Wells Fargo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wells Fargo Company?

- What is Competitive Landscape of Wells Fargo Company?

- What is Growth Strategy and Future Prospects of Wells Fargo Company?

- How Does Wells Fargo Company Work?

- What is Sales and Marketing Strategy of Wells Fargo Company?

- What is Brief History of Wells Fargo Company?

- What is Customer Demographics and Target Market of Wells Fargo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.