XGD Bundle

Can XGD Inc. Outmaneuver Its Rivals in the Payment Terminal Arena?

The payment terminal industry is a battlefield of innovation, where companies constantly vie for dominance amidst evolving consumer behaviors and technological leaps. XGD Inc., a prominent player since 2001, has transformed from a hardware provider to a diversified force in the digital payment space. This article dissects the XGD SWOT Analysis, and examines its strategic positioning within this dynamic market.

This deep dive into the XGD Company Competitive Landscape will reveal the company's XGD Company Competitors, market share, and strategic advantages. We'll explore the XGD Company Market Analysis to understand its position in the XGD Company Industry, uncovering its strengths, weaknesses, and the challenges it faces. Furthermore, we'll analyze the XGD Company Business Strategy to assess its potential for sustained growth and its ability to capitalize on emerging opportunities within the competitive environment.

Where Does XGD’ Stand in the Current Market?

The XGD Company holds a significant position in the payment terminal and broader fintech sector. While precise global market share data for 2024-2025 isn't readily available, the company's financial scale and strategic moves indicate a substantial presence. The company's focus on smart POS systems, mobile payment platforms, and digital currency services positions it within a rapidly evolving market. This includes a strategic shift towards a diversified group focusing on mobile payment platforms and artificial intelligence, demonstrating its commitment to innovation.

As of March 31, 2025, XGD reported trailing 12-month revenue of $426 million, with a market capitalization of $2.21 billion as of May 29, 2025. The company's revenue in 2024 was 3.15 billion CNY, which was a decrease of 17.20% from the previous year. Despite this, the company reported a net income of 0.156 billion CNY in the first quarter of 2025, indicating a degree of resilience and strategic adaptation. The company's focus on cross-border payments and digital currency technical services suggests a strong emphasis on expanding its international footprint and adapting to global digital payment trends. For a deeper understanding of its target audience, you can read more in the Target Market of XGD.

XGD Company's primary product lines include smart POS, MINI POS, Wireless POS, Desktop POS, MPOS, and PINPPAD, along with mobile payment platforms and digital currency technical services. The company's financial performance and strategic initiatives highlight its competitive position within the XGD Company Competitive Landscape. XGD Company's Market Analysis reveals its focus on both domestic and international markets, with strategic moves to diversify its offerings and embrace emerging technologies such as artificial intelligence and blockchain. The company's focus on cross-border payments and digital currency technical services suggests a strong emphasis on expanding its international footprint and adapting to global digital payment trends.

XGD offers a range of payment solutions, including smart POS, MINI POS, Wireless POS, Desktop POS, MPOS, and PINPPAD. These products cater to various business needs, from small retailers to larger enterprises. The company also provides mobile payment platforms and digital currency technical services, demonstrating its commitment to innovation in the fintech sector.

XGD distributes its products within the domestic Chinese market and to overseas markets. This dual focus indicates a strategic approach to both consolidating its presence in its home market and expanding its reach globally. The company's emphasis on cross-border payments supports its international expansion efforts.

Since 2015, XGD has undergone a strategic upgrade and transformation. This shift moves beyond hardware to establish a diversified group focusing on mobile payment platforms and artificial intelligence. This transformation is crucial for adapting to evolving market demands and maintaining a competitive edge.

JLPay, a subsidiary of XGD, won Mastercard's '2024 Excellence Partner Award' for its innovative practices in the payment sector. Additionally, XGD's brand Paykka secured a Money Service Operator (MSO) license in Hong Kong, which lays the foundation for global business expansion. XGD's Macau subsidiary was also recognized as a 'Potential Technology Enterprise' in 2024.

Analyzing XGD Company's position in the market involves understanding its strengths and weaknesses. Its strengths include a diversified product portfolio and strategic focus on emerging technologies. However, the company faces challenges, including a decrease in revenue in 2024. Understanding these aspects is crucial for a comprehensive XGD Company SWOT Analysis.

- Strengths: Diversified product lines, strategic focus on emerging technologies like AI and blockchain, and a growing international presence.

- Weaknesses: Revenue decline in 2024, and the need to navigate a competitive market landscape.

- Opportunities: Expansion in cross-border payments, adapting to global digital payment trends, and leveraging strategic partnerships.

- Threats: Intense competition from other players in the fintech industry, and the need to continuously innovate to stay ahead.

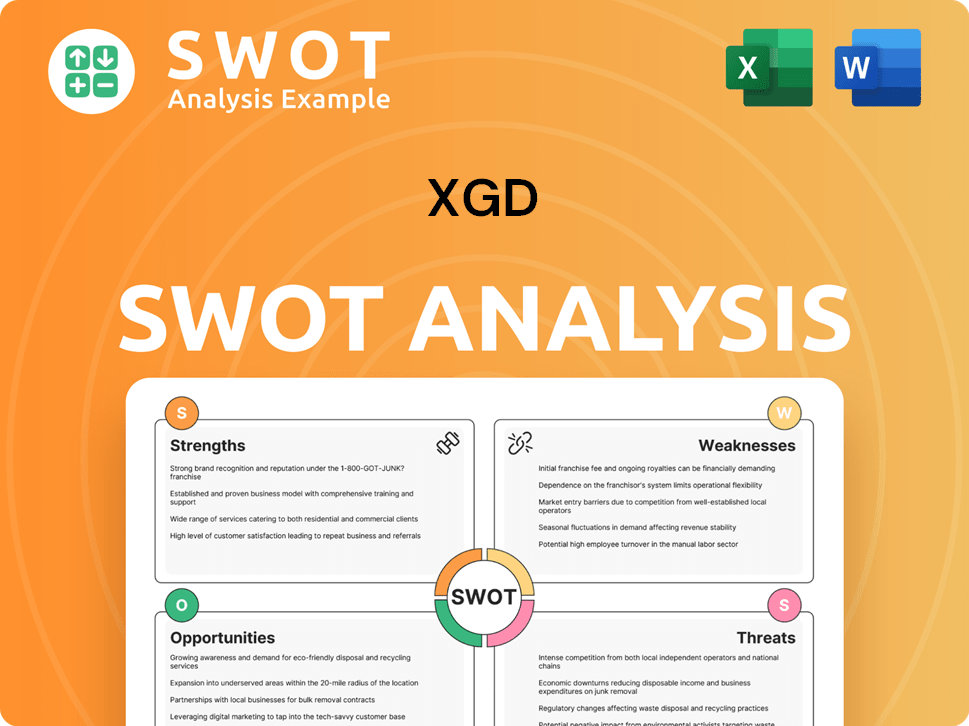

XGD SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging XGD?

The XGD Company Competitive Landscape is complex, with rivals spanning hardware, payment services, and emerging technologies. Understanding the competitive dynamics is crucial for XGD Company Market Analysis and strategic planning. This overview identifies key players and market trends affecting XGD Company Competitors.

The competitive environment includes both direct and indirect competitors. Direct competitors focus on payment terminal equipment, while indirect competitors operate in the broader fintech space, including mobile payment platforms and digital currency services. This landscape is constantly evolving, with new technologies and market shifts influencing the competitive dynamics.

In the payment terminal equipment market, XGD Company's direct competitors include established companies such as Ingenico, Verifone, and PAX Technology. These companies are actively developing biometric security solutions for point-of-sale (POS) systems. The global payment terminal market was valued at approximately USD 75 billion in 2023 and is projected to reach USD 130 billion by 2032, growing at a CAGR of 6.5%, indicating a highly competitive environment. These competitors are focused on increasing security, preventing fraud, and enabling smooth transactions.

Ingenico, Verifone, and PAX Technology are major players in the payment terminal market. They compete directly with XGD Company by offering similar hardware solutions. These companies have established market shares and extensive distribution networks.

Companies like Stripe, Adyen, and PayPal compete in the digital payments market. They offer mobile payment platforms and digital currency services. These competitors present challenges and opportunities for XGD Company.

The digital payments market is expected to grow significantly. This growth creates a competitive environment for XGD Company. The integration of digital wallets and alternative payment methods is also driving competition.

AI-integrated biometric payment terminals and smartphone-based solutions are emerging. These technologies represent new competitive challenges and opportunities. These innovations are reshaping the payment landscape.

Mergers and alliances impact the competitive dynamics. Consolidation in the payment orchestration space is anticipated. Embedded finance solutions also present competitive challenges and opportunities.

The digital payments market is projected to grow from $119.40 billion in 2024 to $578.33 billion by 2033. This growth signifies a competitive environment. The CAGR is expected to be 19.16%.

Beyond hardware, XGD Company faces competition from fintech companies in mobile payment platforms and digital currency services. In the digital payments market, major players like Stripe, Adyen, and PayPal are key competitors. These companies offer innovative solutions and strategic partnerships. For more insights, consider reading about the Growth Strategy of XGD. Intense competition also comes from new players focusing on AI-integrated biometric payment terminals and smartphone-based biometric payment solutions.

The industry is rapidly evolving, with high-profile 'battles' and market share shifts. The increasing integration of digital wallets and alternative payment methods creates intense competition. Mergers and alliances impact competitive dynamics.

- Market Share Shifts: Constant changes in market share are common.

- Digital Wallets: Integration of digital wallets increases competition.

- Alternative Payments: Growing demand for alternative payment methods.

- Embedded Finance: Rise of embedded finance solutions.

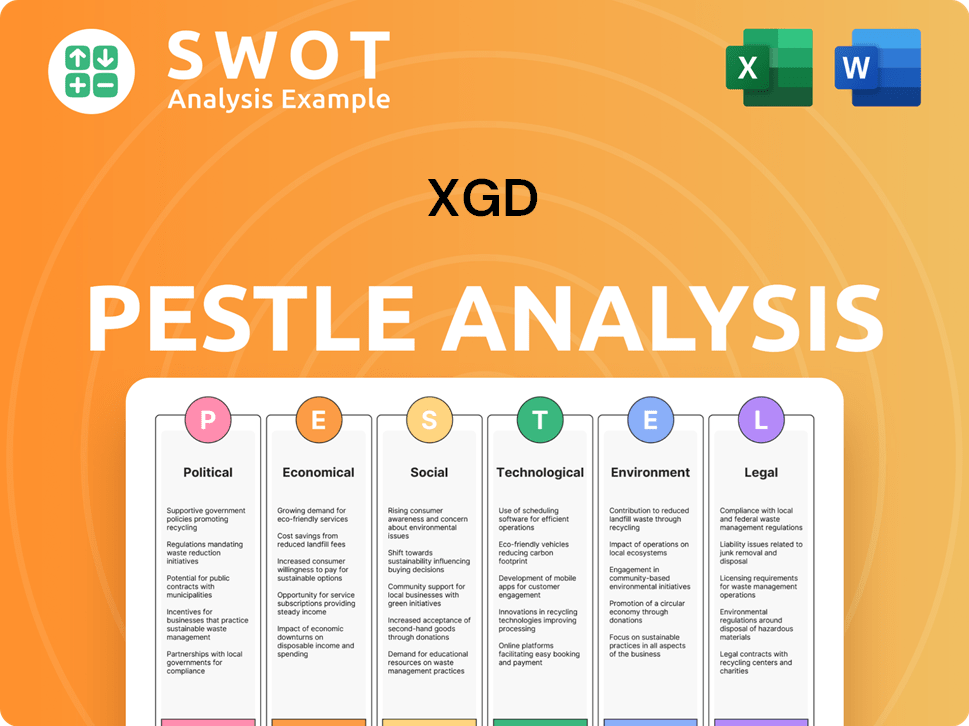

XGD PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives XGD a Competitive Edge Over Its Rivals?

The Brief History of XGD reveals a company that has strategically positioned itself within the competitive payment technology sector. XGD Inc. has cultivated several key competitive advantages, allowing it to differentiate from rivals. These advantages are crucial for understanding the XGD Company Competitive Landscape and its strategic positioning in the market.

XGD's approach involves a comprehensive strategy, encompassing the entire lifecycle of payment solutions. This includes design, research and development, production, sales, and service of payment terminal equipment. Furthermore, XGD offers mobile payment platforms and digital currency technical services. This integrated model enhances customer loyalty and operational efficiency, which is a critical aspect of the XGD Company Market Analysis.

The company's proactive adoption of cutting-edge technologies, such as artificial intelligence, blockchain, and intelligent driving, provides a significant edge. The launch of its AI Agent digital product by its subsidiary, District 12, showcases XGD's commitment to AI innovation. This focus on advanced technologies is crucial for the XGD Company's Business Strategy and its ability to adapt to industry trends.

XGD provides end-to-end payment solutions, including hardware, software, and services. This comprehensive approach enhances customer stickiness and streamlines operations. This integrated model is a key aspect of its competitive advantage.

The company invests heavily in AI, blockchain, and intelligent driving technologies. The launch of AI Agent digital product demonstrates its commitment to innovation. This technological focus is crucial for staying ahead in the industry.

JLPay, a subsidiary, received the Mastercard '2024 Excellence Partner Award' for two consecutive years. This recognition enhances XGD's reputation and builds trust among its clientele. These partnerships are vital for market penetration and customer loyalty.

XGD has obtained a Money Service Operator (MSO) license in Hong Kong for its Paykka brand. This strategic move expands its global business and cross-border payment capabilities. This global expansion is essential for growth.

XGD's competitive advantages include its integrated solutions, technological innovation, brand recognition, and global expansion strategies. These elements are critical for understanding XGD Company's strengths and weaknesses within the XGD Company Industry.

- Integrated Solutions: End-to-end payment solutions enhance customer loyalty and operational efficiency.

- Technological Innovation: Investments in AI, blockchain, and intelligent driving provide a competitive edge.

- Brand Recognition: Awards and partnerships build trust and enhance reputation.

- Global Expansion: Strategic moves like obtaining licenses support growth in new markets.

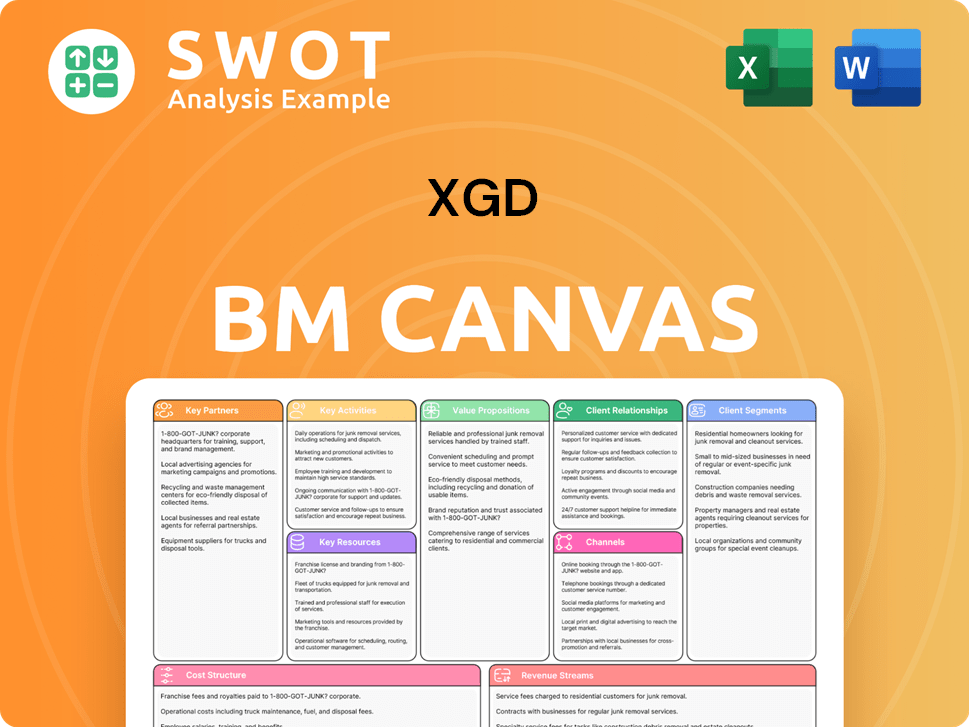

XGD Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping XGD’s Competitive Landscape?

The competitive landscape for XGD Inc. is dynamic, influenced by rapid technological advancements and shifting consumer behaviors. The company's position in the XGD Company Industry is shaped by its ability to adapt to these changes. Understanding XGD Company's market analysis requires a close examination of the current trends and future projections within the financial technology sector.

XGD Company's SWOT Analysis reveals both strengths and weaknesses, which are crucial for formulating an effective XGD Company Business Strategy. This strategy must consider the challenges and opportunities presented by new market entrants and evolving regulatory frameworks. The company's ability to navigate these complexities will determine its long-term success and market share.

Technological innovation is a major driver in the financial sector, with AI, blockchain, and real-time payments leading the way. The digital payments market is rapidly expanding, projected to reach $578.33 billion by 2033. Digital wallets are increasingly popular, accounting for a significant portion of e-commerce transactions globally.

Regulatory scrutiny and cybersecurity threats pose significant challenges. Companies must adapt to new regulations, such as PSD3 and DORA. Competition from new market entrants and consolidation within the fintech sector also presents challenges for XGD Company's competitors.

The growth of internet penetration in developing regions offers opportunities for virtual POS solutions. Embedded finance, expected to reach $7 trillion by 2026 in the US, and the increasing demand for recurring billing provide avenues for growth. Integrating AI and blockchain can enhance payment security and efficiency.

XGD is launching its AI Agent product and securing licenses for cross-border payment operations. The company is evolving into a more integrated service provider, leveraging its hardware expertise with advanced software and AI capabilities. This approach aims to capture new market segments and enhance customer experience. For more insights, check out the analysis provided by Owners & Shareholders of XGD.

To succeed in the competitive environment, XGD must focus on several key areas. These include adapting to regulatory changes, investing in cybersecurity, and leveraging emerging technologies.

- Enhance payment security with AI and blockchain.

- Expand into developing markets with mobile-first solutions.

- Develop partnerships and strategic alliances to strengthen market position.

- Focus on customer experience and personalized financial solutions.

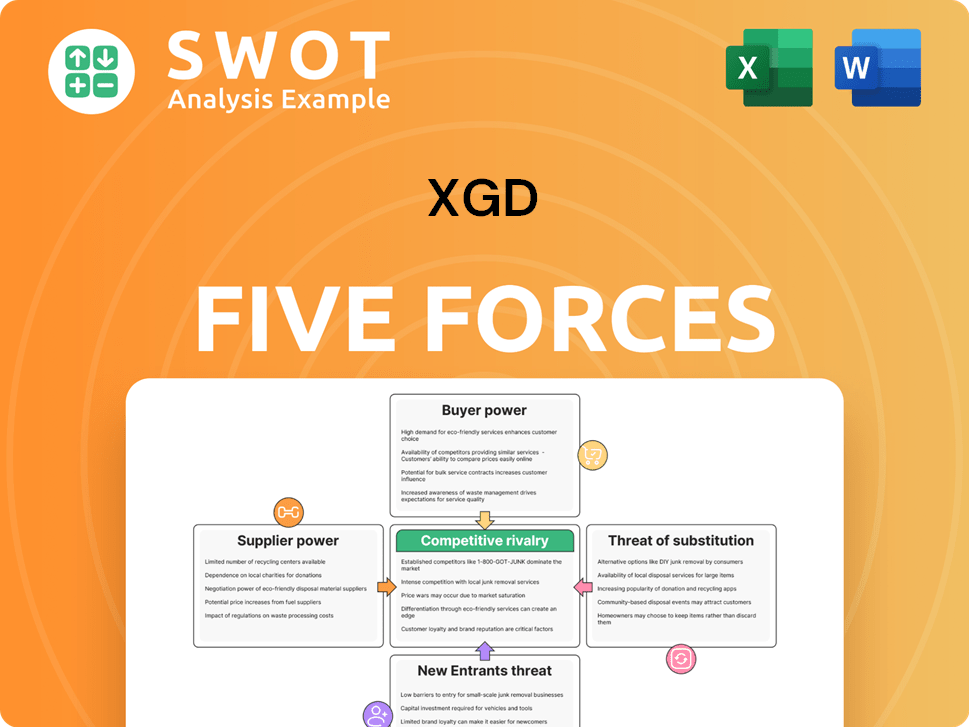

XGD Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of XGD Company?

- What is Growth Strategy and Future Prospects of XGD Company?

- How Does XGD Company Work?

- What is Sales and Marketing Strategy of XGD Company?

- What is Brief History of XGD Company?

- Who Owns XGD Company?

- What is Customer Demographics and Target Market of XGD Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.