XGD Bundle

Who Buys from XGD Company? Unveiling the Customer Demographics and Target Market

In the fast-paced world of digital payments, understanding who your customers are is paramount. For XGD Company, navigating the evolving landscape of financial technology requires a deep dive into its customer demographics and target market. This analysis is crucial for tailoring products and strategies to meet the specific needs of its diverse clientele.

This exploration of XGD Company delves into critical areas such as XGD SWOT Analysis, market segmentation, and ideal customer profiles. We'll examine the age ranges, income levels, and geographical locations of XGD's customers, alongside their interests and buying behaviors. By understanding the pain points and needs of its target market, XGD can refine its approach, ensuring it remains a leader in the competitive fintech arena and effectively reaches its desired customer base.

Who Are XGD’s Main Customers?

Understanding the Competitors Landscape of XGD requires a deep dive into its primary customer segments. The company, which focuses on business-to-business (B2B) solutions, has a customer base that mainly includes financial institutions, retailers, and businesses seeking advanced payment solutions. This focus allows for a more streamlined approach to understanding the customer demographics and tailoring strategies to meet specific needs within these sectors.

The target market for XGD Inc. is primarily defined by businesses with high transaction volumes, those expanding into e-commerce or mobile sales, and those looking to adopt innovative payment technologies. The company's shift toward integrated solutions, including software and technical services, reflects a response to market demand for comprehensive digital payment ecosystems. This strategic evolution helps the company better serve its core customer segments.

The segment focused on digital currency technical services represents a growing area for XGD Inc. This is driven by the increasing adoption of cryptocurrencies and central bank digital currencies (CBDCs). This customer base includes fintech startups, blockchain companies, and traditional financial institutions. The company's expansion into artificial intelligence, blockchain, and intelligent driving further indicates its growth into new B2B verticals, targeting businesses needing advanced technological infrastructure.

Key characteristics include businesses with high transaction volumes and those expanding into e-commerce or mobile sales. This segment also includes businesses looking to adopt innovative payment technologies. The company is also targeting fintech startups and traditional financial institutions.

Factors such as company size (small, medium, enterprise), industry (retail, hospitality, financial services), and technological readiness are crucial for market segmentation. The company's focus on integrated solutions is a response to market demand. This approach helps to better serve its core customer segments.

The digital currency technical services segment is a growing area for XGD Inc. This is driven by the increasing adoption of cryptocurrencies and CBDCs. The company's expansion into AI, blockchain, and intelligent driving indicates growth into new B2B verticals.

The company has likely shifted its emphasis from hardware-centric sales to a more integrated solutions-based approach. This includes software, platforms, and technical services. This shift is prompted by market demand for comprehensive digital payment ecosystems.

The ideal customer profile for XGD Company includes businesses with significant transaction volumes and those exploring digital currency integration. It also includes companies looking to enhance their payment infrastructure and adopt innovative technologies. Understanding the ideal customer profile allows the company to tailor its services.

- Financial institutions seeking advanced payment solutions.

- Retailers of various sizes looking to integrate new payment technologies.

- Fintech startups and blockchain companies exploring digital asset strategies.

- Businesses needing advanced technological infrastructure and solutions.

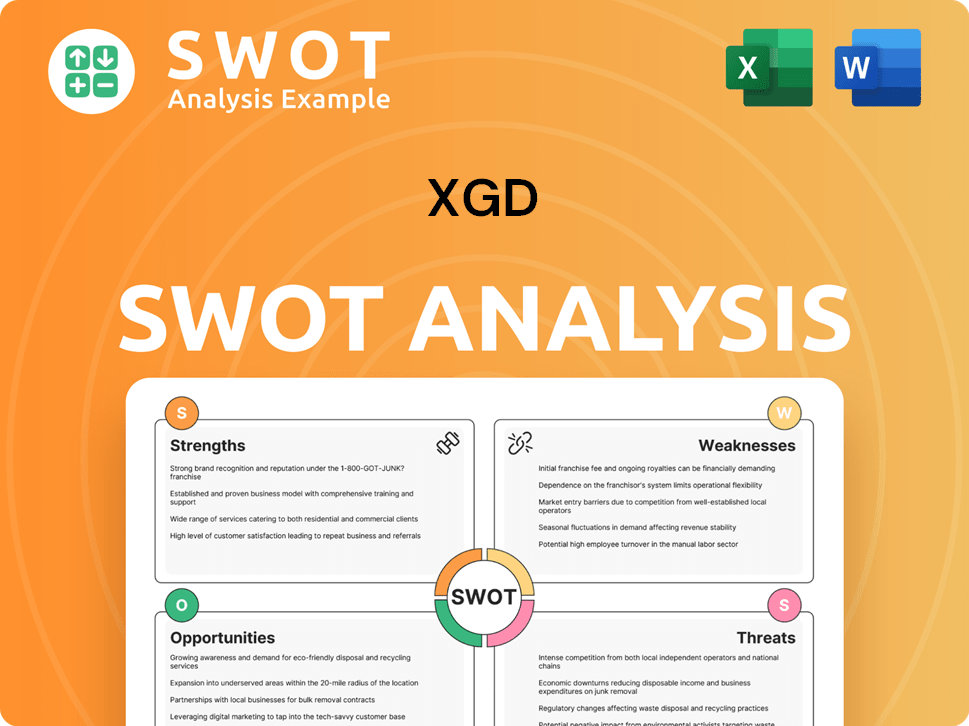

XGD SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do XGD’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, and for the XGD Company, this is especially true. The company's success hinges on its ability to meet the demands of its diverse customer base, which spans various industries and business sizes. This involves not only providing efficient and secure payment solutions but also understanding the specific pain points and preferences of different customer segments.

The primary focus for XGD Company is to ensure seamless transaction experiences, robust security, and compliance with financial regulations. This focus shapes the company's product development, service offerings, and overall customer experience. By addressing these core needs, XGD Company can foster customer loyalty and drive business growth in a competitive market.

For XGD Company, the key needs of its customers revolve around efficiency, security, reliability, and innovation in payment processing. Businesses prioritize seamless transaction experiences, robust fraud prevention, and compliance with evolving financial regulations. Purchasing decisions are often influenced by the total cost of ownership, ease of integration, scalability, and vendor reputation. For payment terminal equipment, physical durability and user-friendliness are critical. For mobile payment platforms, accessibility, real-time reporting, and compatibility across devices are paramount.

Customers of XGD Company seek payment solutions that streamline transactions. This includes fast processing times and minimal disruptions. According to a 2024 survey, businesses that prioritize transaction efficiency see a 15% increase in customer satisfaction.

Security is a top priority for XGD Company's customers. They need robust fraud prevention and data protection. A 2024 report indicates that data breaches cost businesses an average of $4.45 million, emphasizing the need for secure payment systems.

Customers require payment solutions that are consistently reliable. Downtime can lead to lost revenue and dissatisfied customers. Industry data from 2024 shows that even short periods of downtime can result in significant financial losses.

Businesses need payment solutions that adapt to changing market trends and technological advancements. This includes support for new payment methods and integration with emerging technologies. The adoption of new payment methods grew by 20% in 2024.

Customers are always looking for cost-effective solutions. This involves competitive pricing, transparent fees, and a good return on investment. A 2024 study revealed that businesses that optimize payment costs see a 10% improvement in profitability.

Easy integration with existing systems is crucial. This reduces implementation time and minimizes disruptions. A 2024 survey showed that businesses prefer payment solutions that can be integrated within a week.

The XGD Company target market is driven by the need for secure, compliant, and efficient infrastructure to manage and process digital assets. This segment often seeks expertise in blockchain technology and digital wallet solutions. The company addresses pain points such as the complexity of managing diverse payment methods and the threat of cyber-attacks. Feedback from financial institutions and retailers influences product development, leading to features like enhanced encryption and customizable payment workflows. For instance, XGD Company might tailor its mobile payment platforms to specific retail environments, offering features like inventory management integration or loyalty program capabilities, to cater to the unique needs of that segment. To learn more, read the Growth Strategy of XGD.

- Security: Customers require robust security measures to protect against fraud and data breaches.

- Efficiency: Businesses want payment solutions that streamline transactions and reduce processing times.

- Compliance: Adherence to financial regulations is a must, ensuring legal and operational integrity.

- Integration: Easy integration with existing systems is crucial to minimize disruption and reduce implementation time.

- Scalability: Solutions must be able to handle increasing transaction volumes as the business grows.

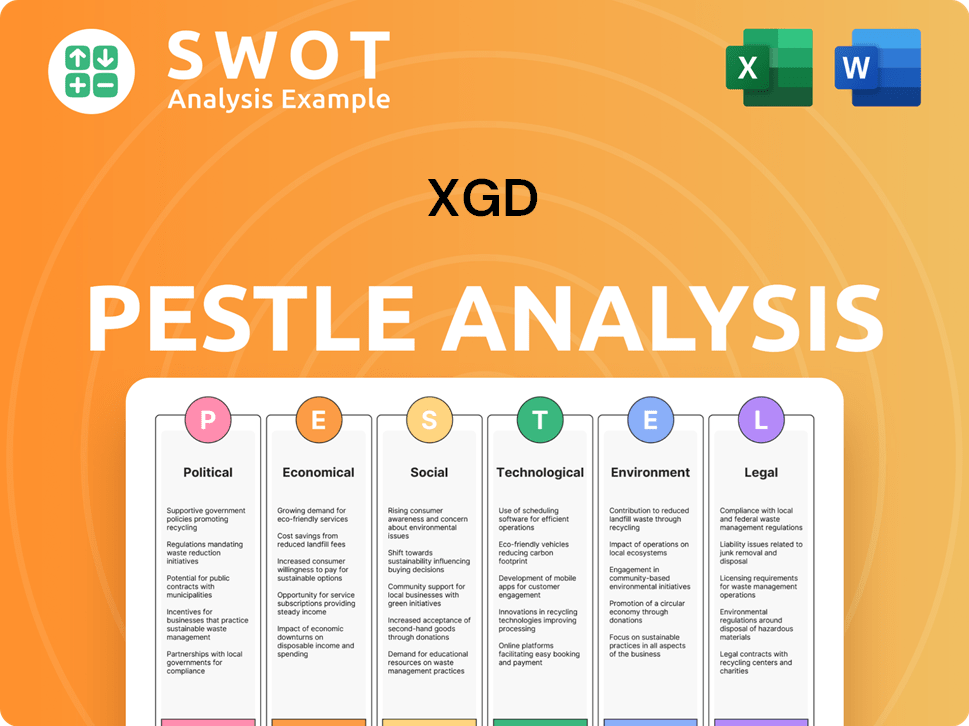

XGD PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does XGD operate?

The geographical market presence of XGD Company is likely concentrated in regions with robust digital payment infrastructures and high adoption rates. This includes economically developed areas in North America, Europe, and parts of Asia. These regions offer significant demand for advanced payment terminal equipment and digital payment platforms, making them key targets for XGD's expansion and market penetration.

Specific countries such as the United States, China, and those within the European Union are often strong contenders due to their large consumer bases, technological advancements, and supportive regulatory environments for digital payments. These markets are crucial for XGD Company's growth, as they represent substantial opportunities for revenue generation and market share expansion. The company likely tailors its strategies to meet the specific needs of each region, considering factors like local regulations and consumer preferences.

XGD Company's market segmentation strategy likely involves localizing its offerings to meet the diverse needs of different regions. For example, in emerging markets, the focus might be on providing affordable mobile payment solutions, while in developed markets, the emphasis could be on sophisticated, integrated systems. This approach allows XGD to cater to a wide range of customers and maximize its market reach. Understanding the ideal customer profile in each region is essential for effective marketing and product development.

XGD likely prioritizes markets with high GDP per capita and a strong inclination towards digital financial services. This strategic focus allows the company to capitalize on the increasing demand for digital payment solutions. The company's geographic distribution of sales reflects this concentration, with a significant portion of revenue generated in regions with advanced digital payment ecosystems.

To effectively reach its target market, XGD Company probably employs localized strategies. This includes multi-language support, compliance with regional payment standards (e.g., SEPA in Europe, PCI DSS globally), and partnerships with local financial institutions or telecom providers. These efforts help XGD to build trust and establish a strong presence in each market.

Recent expansions might target regions with burgeoning digital economies and increasing smartphone penetration, while strategic withdrawals, if any, could be due to intense competition or unfavorable regulatory landscapes. XGD Company continuously assesses market conditions to optimize its geographical presence. For more details, see Brief History of XGD.

Regulatory compliance is crucial for XGD Company's operations in various markets. Adhering to local payment standards and regulations ensures that the company can operate legally and build trust with its customers. This includes obtaining necessary licenses and certifications to facilitate seamless transactions.

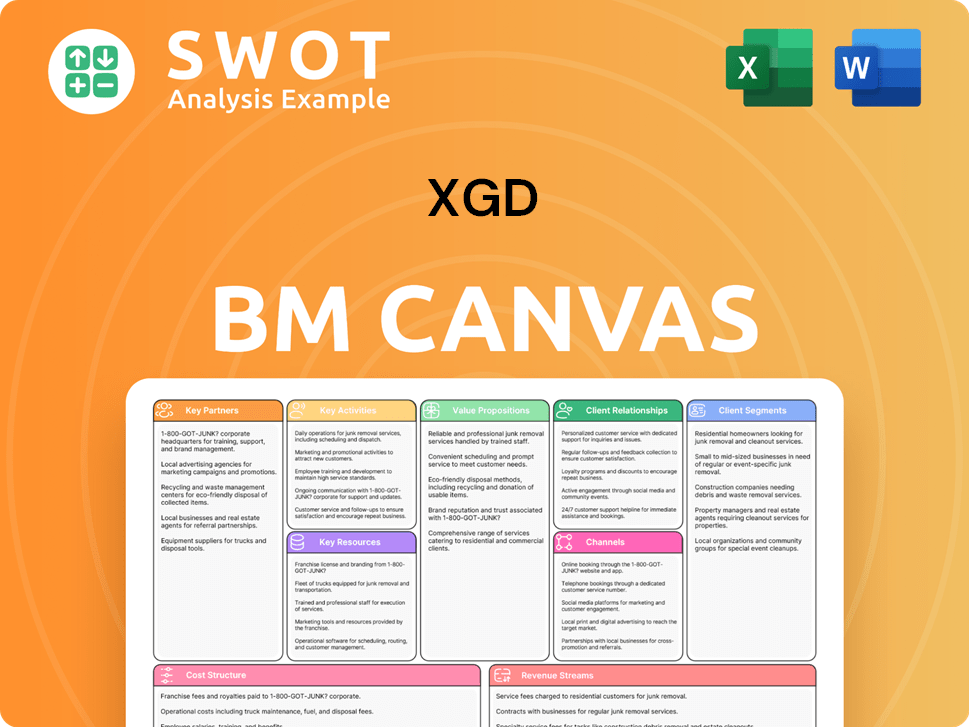

XGD Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does XGD Win & Keep Customers?

The success of XGD Inc. hinges on effective customer acquisition and retention strategies, which are crucial for sustained growth in the competitive payment technology market. These strategies are carefully designed to identify, attract, and retain clients, focusing on long-term relationships and recurring revenue streams. By understanding the needs and behaviors of its target market, XGD Inc. aims to provide tailored solutions that drive customer loyalty and increase customer lifetime value.

For customer acquisition, XGD Inc. likely employs a multi-channel approach, leveraging both digital and traditional marketing methods. This approach includes targeted advertising, industry events, and content marketing to reach potential clients. The company also focuses on building strategic partnerships to expand its reach and acquire new business, reflecting a comprehensive strategy to penetrate the market effectively.

Retention strategies are equally important, with XGD Inc. focusing on exceptional after-sales service, technical support, and continuous product innovation. These efforts help build strong customer relationships and ensure long-term partnerships. The company's use of data analytics and CRM systems allows for personalized solutions, leading to increased customer satisfaction and retention rates. The ability to target campaigns based on customer data is a key factor in XGD Inc.'s success.

XGD Inc. utilizes targeted digital advertising campaigns on platforms like LinkedIn. These campaigns are designed to reach B2B decision-makers, focusing on specific industries and roles. This approach ensures that marketing efforts are efficient and effective, reaching the most relevant potential customers. The company aims to maximize ROI by focusing on channels that yield the best results.

Participation in industry trade shows and conferences, such as Money20/20 and Sibos, is a key acquisition strategy. These events provide opportunities for XGD Inc. to showcase its products and services to a targeted audience. Networking with potential clients and partners at these events is crucial for business development and expansion. Attending these events is a great way to stay updated with the latest trends in the financial technology sector.

Content marketing is used to establish thought leadership in payment technology, AI, and blockchain. This involves creating valuable content such as blog posts, white papers, and webinars. This strategy helps XGD Inc. attract and engage potential customers by providing them with useful information and insights. By sharing expertise, the company positions itself as a trusted authority in the industry.

Direct sales teams engage with prospective clients, offering customized solutions tailored to their specific needs. This approach includes demonstrating the ROI of XGD Inc.'s payment systems. By providing personalized service and addressing individual client requirements, the company aims to convert leads into long-term customers. The company focuses on building relationships through personalized interactions.

Partnerships with financial institutions, software providers, and system integrators are crucial for expanding reach. These collaborations allow XGD Inc. to access new markets and acquire new customers. Strategic partnerships help XGD Inc. to increase brand visibility and gain credibility within the industry. The company actively seeks out collaborations to increase its market presence.

Customer retention is prioritized through strong after-sales service and technical support. This includes dedicated account managers and prompt resolution of technical issues. By providing excellent customer service, XGD Inc. aims to build trust and loyalty. The company ensures that clients receive the support they need to maximize the value of their investment.

Continuous product innovation and regular software updates are essential for enhancing security and functionality. These updates ensure that XGD Inc.'s solutions remain competitive and meet evolving customer needs. By staying ahead of industry trends, the company aims to provide cutting-edge solutions. The company is committed to providing the latest and most secure technology.

Loyalty programs, such as tiered service agreements and preferential pricing, are utilized to reward long-term customers. These programs foster customer loyalty and encourage repeat business. Early access to new features is offered as an incentive to retain customers. The company focuses on building long-term relationships with its clients.

Customer data and CRM systems are paramount in targeting campaigns and personalizing solutions. This allows XGD Inc. to segment its client base and offer tailored services. Data analytics are used to identify clients who could benefit from upgrades or additional services. By leveraging data, the company aims to improve customer satisfaction and retention rates.

Successful acquisition campaigns highlight case studies of businesses that have achieved significant gains using XGD Inc.'s solutions. Demonstrating ROI is a key factor in attracting new clients. By showcasing the benefits of its products, the company aims to convert potential customers. The company focuses on providing measurable results to its clients.

XGD Inc. employs market segmentation to tailor its strategies to different customer groups. This involves dividing the market into segments based on industry, company size, and specific needs. This allows the company to offer personalized solutions and target its marketing efforts more effectively. Understanding market segmentation helps to identify the ideal customer profile.

The ideal customer profile for XGD Inc. includes businesses that require secure and efficient payment solutions. These businesses typically have high transaction volumes and a need for advanced features. The company focuses on clients who value innovation and are willing to invest in cutting-edge technology. The company focuses on clients who would benefit from the company's services.

Creating buyer personas helps XGD Inc. understand the motivations, challenges, and behaviors of its target customers. These personas provide insights into the decision-making processes of potential clients. By understanding their needs and pain points, XGD Inc. can tailor its marketing messages and sales strategies. The company creates detailed profiles of its target clients.

Analyzing customer buying behavior helps XGD Inc. understand how customers make purchasing decisions. This includes factors such as research, evaluation, and the final purchase. The company uses this information to optimize its sales processes and improve customer experience. By understanding how customers make decisions, the company can improve its sales strategies.

XGD Inc. uses a variety of channels to reach its target market, including digital advertising, industry events, and direct sales. The company focuses on channels that are most effective in reaching its target market. This multi-channel approach ensures that XGD Inc. can reach a wide audience and generate leads. The company has a multi-channel approach.

Analyzing the demographics of XGD Company's competitors' customers helps XGD Inc. understand its competitive landscape. This involves identifying the strengths and weaknesses of competitors and finding opportunities to differentiate its offerings. By understanding its competitors' customer base, XGD Inc. can improve its marketing strategies. The company is committed to doing a competitive analysis.

The evolution of XGD Inc.'s strategy reflects a shift towards a service-oriented model, emphasizing long-term partnerships. This includes platform subscriptions and technical support contracts, which positively impact customer lifetime value. The company’s focus on recurring revenue streams and customer retention is a key driver of its financial performance. For more details, you can read about the Owners & Shareholders of XGD to understand how these strategies influence the company's long-term value.

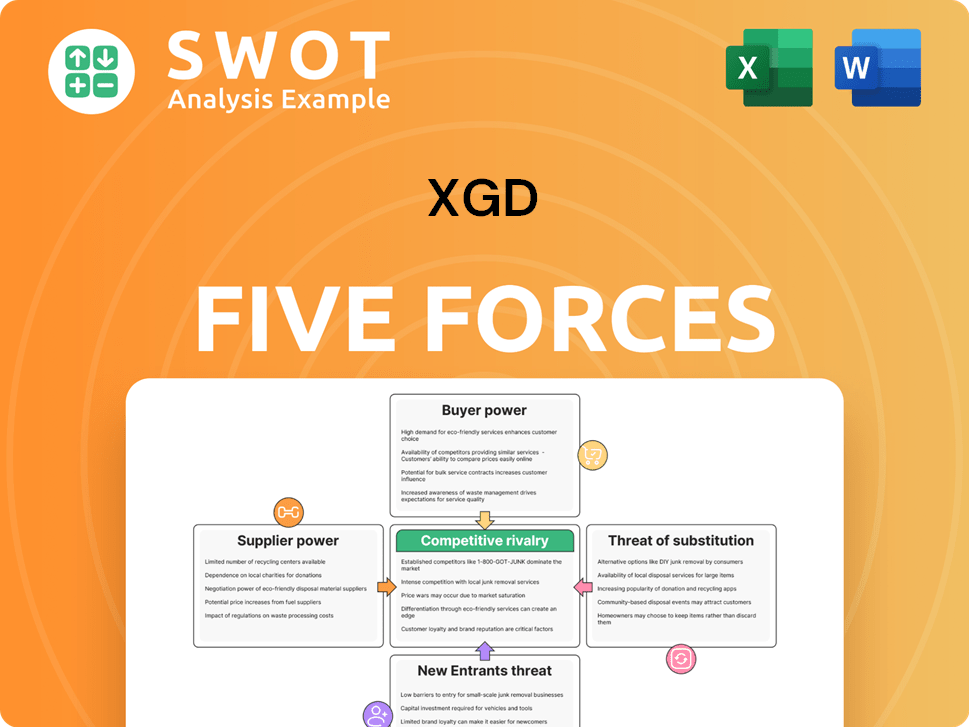

XGD Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.