XGD Bundle

How Does XGD Company Thrive in the Fintech Arena?

XGD Inc., a prominent player in the global payment technology sector, is transforming how transactions happen. From its roots as Shenzhen Xinguodu Technology Company, XGD company has expanded to offer comprehensive solutions, including mobile payment terminals and digital currency services. Understanding XGD SWOT Analysis is key to unlocking the company's potential.

This deep dive into XGD operations will explore the core of its business model, revealing how XGD services and its platform contribute to its success. We'll analyze the intricacies of How XGD works, examining its revenue streams, strategic initiatives, and competitive advantages. This comprehensive analysis is vital for anyone seeking to understand the evolving landscape of financial technology and make informed decisions about XGD company.

What Are the Key Operations Driving XGD’s Success?

The core of XGD company operations revolves around electronic payment technology. This includes designing and developing both software and hardware for financial payment terminals. The company's offerings span a variety of POS devices, catering to card organizations, commercial banks, and third-party service institutions.

XGD Inc. focuses on research and development in financial Point-of-Sale (POS) terminal software and hardware. They also provide technical services for electronic payments, including electronic funds transfer and debit card services. Their expertise in commercial cryptography and security, highlighted by their PCI PIN 3.0 certification, sets them apart.

The value proposition of XGD Inc. lies in providing secure, stable, convenient, and efficient mobile payment terminals and related services. This translates into enhanced customer benefits and market differentiation. Their strategic expansion into mobile payment platforms, digital currency services, and technologies like AI and blockchain further strengthens their market position.

XGD's operational focus is on creating and delivering electronic payment technology, including software and hardware for financial payment terminals. They offer a range of POS devices like smart POS, MINI POS, and MPOS, serving card organizations and banks. Their services extend to technical support for electronic payments and related areas.

The company specializes in financial POS terminal software and hardware, providing associated technical services. They have a strong emphasis on commercial cryptography and security, holding the PCI PIN 3.0 certification. XGD has also expanded into mobile payment platforms and digital currency services.

XGD aims to provide secure, stable, convenient, and efficient mobile payment terminals and services. Their value is in enhancing customer benefits and differentiating themselves in the market. The company's expansion into AI, blockchain, and intelligent driving demonstrates a broader technological vision.

XGD's supply chain and distribution networks enable it to serve customers within China and internationally. This global reach allows them to provide industry-leading mobile payment solutions. The company's ability to adapt and expand its services is a key element of its success.

XGD's strategic direction involves a focus on secure and efficient payment solutions, with a commitment to innovation. The company's expansion into diverse technologies like AI and blockchain indicates a forward-thinking approach to meet evolving market demands.

- Emphasis on secure payment solutions to maintain customer trust.

- Expansion into mobile payment platforms and digital currency services.

- Diversification into AI, blockchain, and intelligent driving.

- Global distribution networks to serve customers internationally.

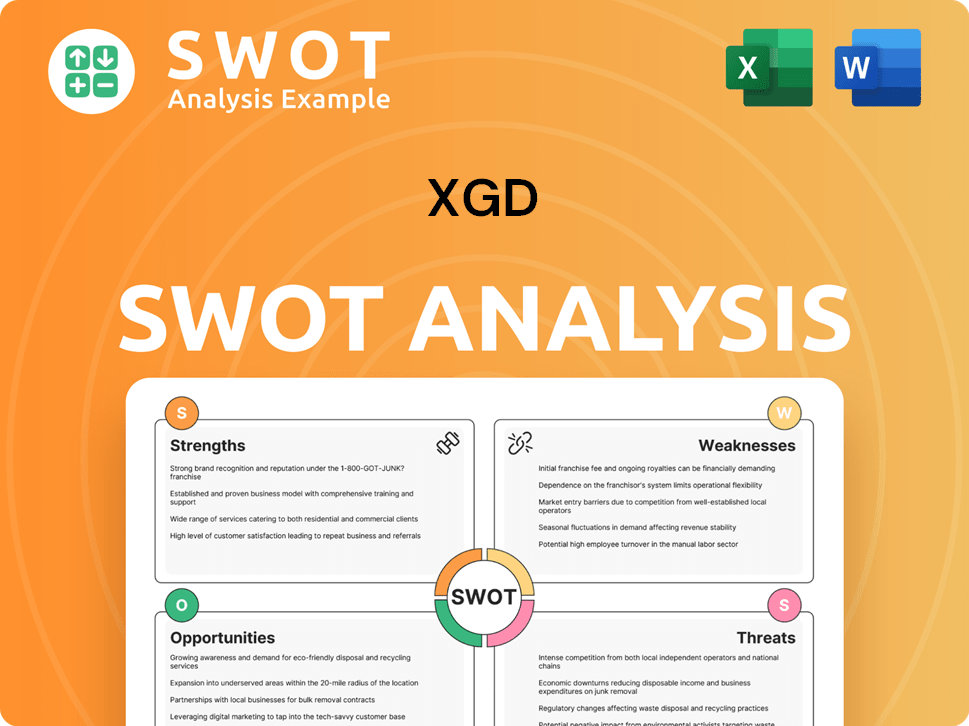

XGD SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does XGD Make Money?

Understanding the revenue streams and monetization strategies of the XGD company is crucial for grasping its operational framework. The company generates revenue primarily through the sale and leasing of payment terminal products and the provision of electronic payment technology services. This diverse approach allows XGD to tap into multiple facets of the financial technology market, ensuring a robust business model.

XGD Inc. reported a total revenue of $426 million for the trailing 12 months as of March 31, 2025. In 2024, the company's revenue reached CNY 3.15 billion. These figures highlight the company's financial performance and its ability to generate substantial income through its various offerings. The company's strategic focus on both product sales and service provision underscores its commitment to sustained growth and market leadership.

XGD's monetization strategies are multifaceted, combining upfront product sales with recurring service fees and project-based revenue. The continuous launch of new products and services, such as the LiShua Micro Smart Terminal and Scan-to-Pay Device, demonstrates XGD's commitment to expanding and diversifying its revenue sources. This approach enables the company to adapt to market changes and maintain a competitive edge in the rapidly evolving fintech landscape.

XGD's revenue streams are diversified, ensuring multiple income sources. The company's business model focuses on both product sales and service provision, catering to a wide range of customer needs. This diversification allows XGD to mitigate risks and capitalize on various market opportunities.

- Product Sales: Direct sales of payment terminals, including Smart POS, MINI POS, Wireless POS, Desktop POS, MPOS, and PINPPAD.

- Electronic Payment Technology Services: Comprehensive technical services for electronic payments, including electronic funds transfer and debit card services.

- Mobile Payment Platforms: Revenue generated through transaction fees, service charges, or subscription models for businesses utilizing the platform.

- Digital Currency Technical Services: Technical services in digital currency, potentially including development, integration, and transactional support.

- Artificial Intelligence, Blockchain, and Intelligent Driving Services: Potential revenue streams through licensing, service fees, or development contracts.

- Business Process Outsourcing (BPO) Services: Services such as internet marketing, commercial debt management, software development, and after-sales services.

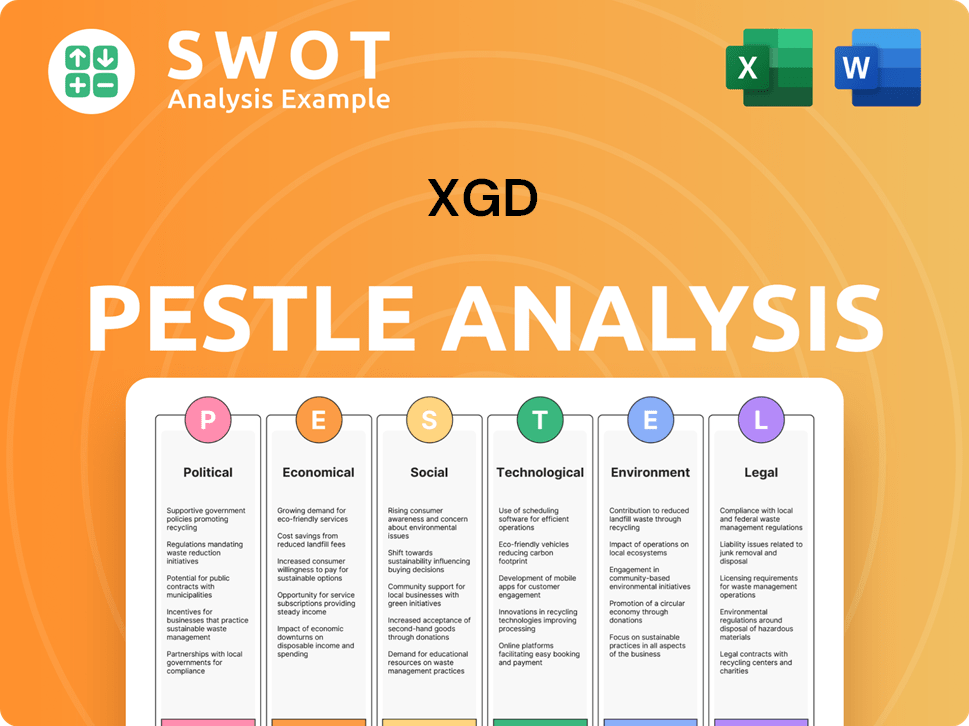

XGD PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped XGD’s Business Model?

The evolution of the XGD company showcases a strategic shift from payment terminal equipment to a diversified group focused on mobile payment platforms and artificial intelligence. This transition is marked by significant milestones and strategic moves that have reshaped XGD operations and its market position. The company's ability to adapt and innovate has been crucial in navigating the dynamic financial technology landscape.

A key aspect of how XGD works involves continuous product development and service launches to meet market demands. This approach is exemplified by the introduction of new products at the 2024 Partners Product Launch Conference. Despite facing operational challenges, the company leverages its brand strength and technological leadership to maintain a competitive edge. The strategic direction is further underscored by its expansion into AI and global payment solutions.

The company's subsidiary, JLPay, winning Mastercard's '2024 Excellence Partner Award' for the second consecutive year highlights its innovative practices and operational strength. The securing of a Money Service Operator (MSO) license in Hong Kong by its Paykka brand in 2025 is a strategic move to expand into cross-border payments. The launch of its first AI Agent digital product by subsidiary District 12 further illustrates its commitment to embracing new technologies.

The company's subsidiary, JLPay, won Mastercard's '2024 Excellence Partner Award' for the second consecutive year. Paykka brand secured a Money Service Operator (MSO) license in Hong Kong in 2025. The launch of its first AI Agent digital product by subsidiary District 12.

Diversification into mobile payment platforms and artificial intelligence. Continuous launch of new products and services to meet market needs. Expansion into global payment solutions, exemplified by the MSO license in Hong Kong.

Brand strength and technology leadership, particularly in financial payment terminals. First company in China to pass the PCI PIN 3.0 certification. Focus on innovation in hardware manufacturing, merchant services, and global payment solutions.

2024 revenue decreased by -17.20% compared to the previous year. Earnings decreased by 68.98% in 2024. Strategic investments in new technologies and expansion initiatives.

The XGD services are evolving, incorporating AI and global payment solutions. The XGD business model is adapting to market demands through new product launches and strategic partnerships. The XGD platform is expanding its reach, as evidenced by the MSO license in Hong Kong.

- The company's focus on innovation allows it to adapt to evolving trends.

- The strategic shift towards AI and global payments enhances its market position.

- The company's history and background are detailed in Brief History of XGD.

- Despite financial challenges, the company maintains a competitive edge through technological leadership.

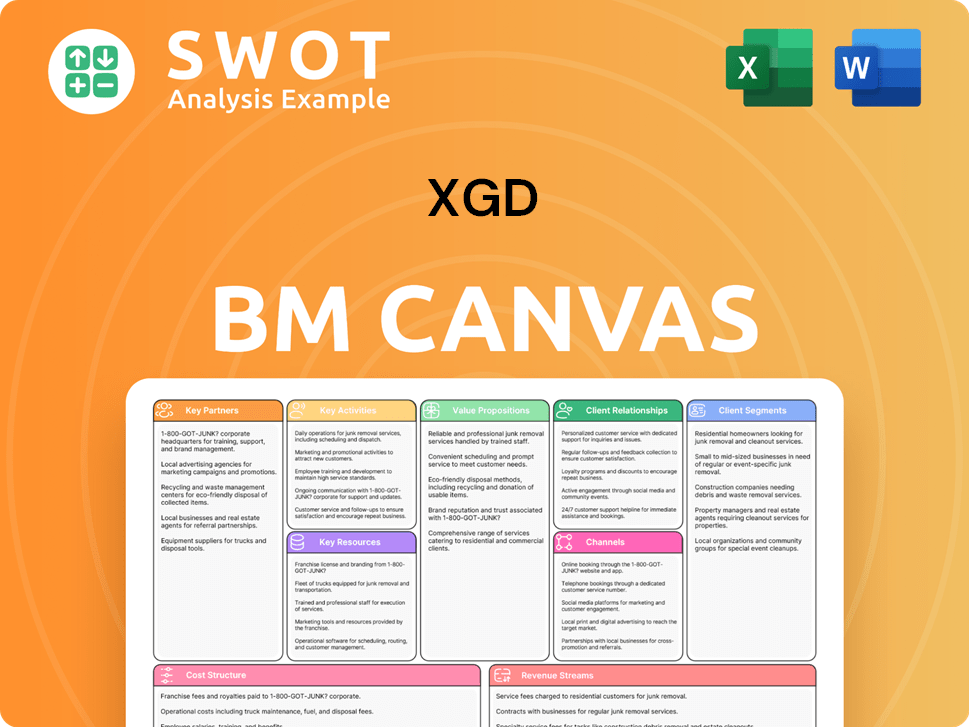

XGD Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is XGD Positioning Itself for Continued Success?

The XGD company holds a strong position in the payment technology sector, primarily offering payment services and electronic payment equipment. Its global reach is evident through international distribution and the acquisition of a Money Service Operator license in Hong Kong. The company's subsidiary, JLPay, has received recognition from Mastercard, showing its strong standing in the acquiring services industry. For more information, consider reading Owners & Shareholders of XGD.

However, the XGD operations face certain risks. Financial performance in 2024 indicated a decrease in revenue by 17.20% and earnings by 68.98% compared to the previous year. The payment technology and software industries are highly competitive, with rapid technological changes and evolving regulations posing ongoing challenges. Changes in consumer preferences could also impact its traditional payment terminal business.

The XGD company is a leading provider of payment technology services. It has a global presence, distributing payment terminals internationally. Its subsidiary, JLPay, has been recognized by Mastercard, highlighting its strong position in acquiring services.

The company faces risks including decreased revenue and earnings in 2024. The payment technology industry is highly competitive, and rapid technological advancements and regulatory changes pose challenges. Changes in consumer preferences towards new payment methods could also impact its traditional payment terminal business.

The XGD company is focused on expanding its revenue-generating capabilities through strategic initiatives and innovation. It is committed to launching new products and services and embracing new technologies. The company is planning to launch a stock options incentive plan in 2025.

The XGD business model centers on providing payment solutions, electronic payment equipment, and exploring areas like AI. The company processes transactions through its payment platform, offering services to merchants and businesses. The company's mission is to build a more robust payment ecosystem.

The company is focused on continuous innovation and global expansion. This includes launching new products and services to meet market demands. The company's strategic transformation since 2015 to diversify into mobile payment platforms and artificial intelligence demonstrates a forward-looking approach.

- Continued focus on innovation.

- Global expansion efforts.

- Commitment to ESG goals, including carbon neutrality by 2025.

- Launch of a stock options incentive plan in 2025.

XGD Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of XGD Company?

- What is Competitive Landscape of XGD Company?

- What is Growth Strategy and Future Prospects of XGD Company?

- What is Sales and Marketing Strategy of XGD Company?

- What is Brief History of XGD Company?

- Who Owns XGD Company?

- What is Customer Demographics and Target Market of XGD Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.