XGD Bundle

Can XGD Inc. Revolutionize the Payment Industry?

XGD Inc., formerly Nexgo Inc., is rapidly evolving beyond traditional payment terminals, venturing into mobile platforms and digital currency services. With a market capitalization of $2.21 billion as of May 29, 2025, and a diverse product range including smart POS and MPOS, XGD is poised for significant growth. This report unveils XGD's XGD SWOT Analysis, strategic plans, and future projections within the dynamic payment and technology sectors.

This analysis explores XGD company growth strategy, examining its ambitious expansion plans and innovation strategy in the tech industry. We'll dissect XGD's market analysis and competitive landscape to forecast its financial performance and long-term growth potential. Investors and strategists alike will gain crucial insights into XGD's business plan, including its future revenue projections and strategic goals, to assess investment opportunities and understand XGD's future prospects.

How Is XGD Expanding Its Reach?

The XGD company growth strategy is actively evolving, with a strong focus on expanding its market presence and diversifying its service offerings. This strategic approach aims to capitalize on emerging opportunities within the payment solutions sector and related technological advancements. The company's future prospects are closely tied to its ability to execute these expansion initiatives effectively.

A key element of XGD's business plan involves broadening its footprint in the global payment solutions market. This is demonstrated by the introduction of the 'PayKKa' brand, designed to facilitate international expansion. The company's commitment to innovation and strategic investments reflects its proactive stance in a dynamic market.

XGD's market analysis reveals a landscape ripe with opportunities, particularly in the realm of digital payments and related technologies. The company's competitive landscape includes both established players and emerging innovators, driving the need for continuous adaptation and strategic foresight. The financial performance of XGD is expected to be significantly influenced by the success of its expansion initiatives and its ability to capture market share.

XGD is expanding its presence in global payment solutions. The 'PayKKa' brand is a key initiative for international growth, offering more convenient and secure payment options worldwide. This expansion aims to build a robust payment ecosystem.

In late 2024, XGD launched several new products, including the LiShua Micro Smart Terminal and LiShua Internet Treasure PRO. These products aim to create a 'one fish, multiple bites' business model, offering new growth opportunities for partners. This strategy is a direct response to market dynamics.

XGD is interested in strategic investments to enhance its technological capabilities and market reach. This includes a planned CNY 20 million funding for Shanghai Hinge Electronic Technology Co., Ltd. These investments support the company's long-term growth potential.

XGD is continuously innovating in payment terminal equipment and digital currency technical services. Ventures into AI, blockchain, and intelligent driving demonstrate a commitment to accessing new customer segments. This approach is key to XGD's strategic goals and objectives.

XGD's expansion plans and strategies are designed to leverage its strengths and address the challenges in the competitive landscape. The company's focus on new product launches and strategic investments, as highlighted in the Marketing Strategy of XGD, indicates a proactive approach to market dynamics. These initiatives are crucial for XGD's future revenue projections and long-term growth.

XGD's expansion strategy involves several key initiatives to drive growth. These include broadening its global payment solutions, launching new products, and making strategic investments. These initiatives are designed to enhance the company's market position and revenue streams.

- Global Expansion with 'PayKKa'

- New Product Launches (LiShua Micro Smart Terminal, etc.)

- Strategic Investments (e.g., Shanghai Hinge)

- Focus on AI, Blockchain, and Intelligent Driving

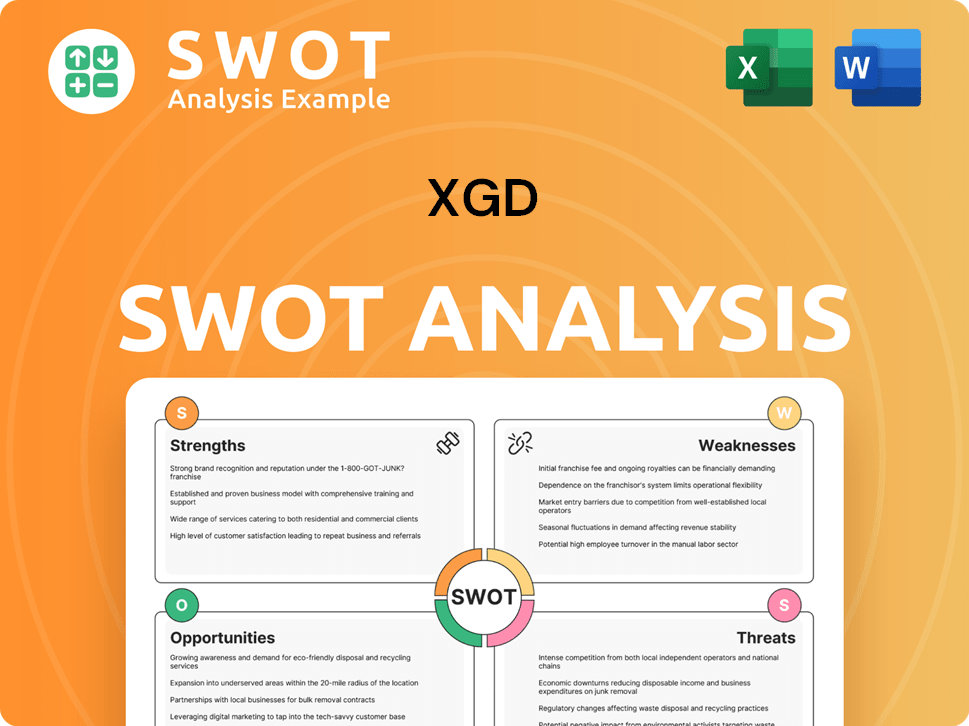

XGD SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does XGD Invest in Innovation?

The focus of the XGD company growth strategy centers on leveraging technology and innovation to drive sustained expansion. This approach involves continuous development and the launch of new products and services designed to meet evolving market demands, particularly in the realm of smart payment solutions. The company aims to deliver more convenient, efficient, and secure payment solutions globally, which necessitates continuous innovation in its core payment technology.

XGD's commitment to innovation is evident in its consistent introduction of new products, such as the LiShua Micro Smart Terminal and other smart devices in late 2024. While specific R&D investment figures for 2024-2025 are not explicitly detailed, the ongoing product development and technological advancements indicate significant investment in these areas. This strategy is crucial for maintaining a competitive edge and capturing market share in the rapidly evolving payment technology sector.

The company's strategic initiatives extend beyond traditional payment systems, encompassing digital currency technical services, artificial intelligence, blockchain, and intelligent driving. These ventures contribute to growth objectives by expanding technological capabilities and positioning the company in emerging high-growth sectors. Building a robust payment ecosystem through its PayKKa brand for international expansion also underscores its innovative approach to global market presence. For a deeper understanding of the competitive environment, consider reviewing the Competitors Landscape of XGD.

The company consistently introduces new products and services, such as the LiShua Micro Smart Terminal, to meet evolving market demands. This includes smart payment terminals and platforms designed for enhanced user experience.

XGD is investing in cutting-edge areas like artificial intelligence, blockchain, and intelligent driving. These advancements are crucial for expanding technological capabilities and positioning the company in emerging high-growth sectors.

The company's exploration and offerings in digital currency technical services and other related technologies signify a broader digital transformation strategy. This strategy aims to enhance its payment solutions and expand its market presence.

XGD is building a robust payment ecosystem through its PayKKa brand for international expansion. This innovative approach supports its global market presence and growth objectives.

While specific R&D investment figures for 2024-2025 are not explicitly detailed, the consistent introduction of new products indicates ongoing investment in product development and technological advancements. This investment is key to the company's future revenue projections.

XGD aims to deliver more convenient, efficient, and secure payment solutions globally. This focus drives continuous innovation in its core payment technology and related services, contributing to its overall XGD business plan.

XGD's technology strategy encompasses several key initiatives designed to drive growth and maintain a competitive edge in the market. These initiatives include:

- AI and Machine Learning: Integrating AI to enhance payment processing, fraud detection, and customer service.

- Blockchain Technology: Exploring blockchain for secure and transparent transactions, particularly in digital currency services.

- Intelligent Driving: Investing in technologies related to intelligent driving to diversify its portfolio and explore new market opportunities.

- Smart Payment Solutions: Developing and launching advanced payment terminals and platforms to meet evolving market demands.

- Digital Currency Services: Offering technical services related to digital currencies to capitalize on the growing demand for digital payment solutions.

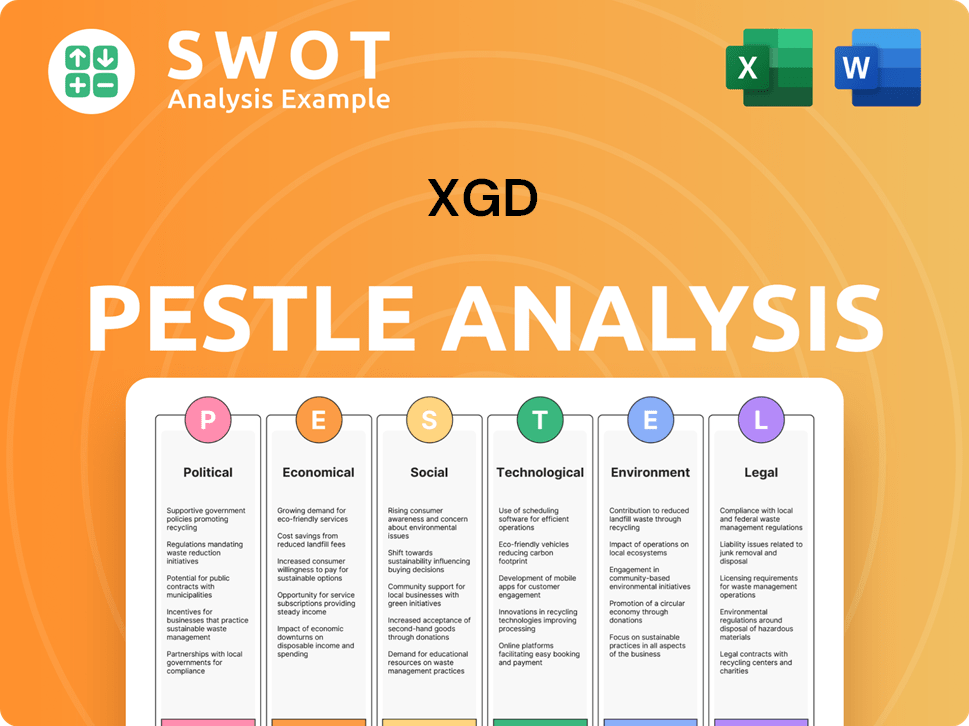

XGD PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is XGD’s Growth Forecast?

The financial outlook for XGD Inc. reveals a mixed picture. The company's recent performance, especially in early 2025, shows some declines in sales and net income compared to the previous year. However, analyst forecasts suggest a potential rebound, with projected revenue growth and increased earnings per share for 2025. Understanding these trends is crucial for assessing XGD's future prospects and its overall business plan.

In the first quarter of 2025, XGD reported a decrease in both sales and net income. Revenue for Q1 2025 was CNY 701.33 million, down from CNY 782.67 million in Q1 2024. Net income also decreased to CNY 156.42 million from CNY 220.77 million in the same period last year. These figures indicate challenges in maintaining the financial momentum seen in previous periods, necessitating a closer look at the XGD company growth strategy.

For the full year 2024, XGD Inc. reported a revenue of CNY 3.148 billion, reflecting a year-on-year decrease of 17.2%. The net income attributable to the parent company for 2024 was CNY 0.234 billion, representing a significant year-on-year decrease of 68.98%. This performance highlights the need for strategic adjustments to improve financial outcomes. Investors and stakeholders should consider these financial performance metrics when evaluating the company's future prospects.

Q1 2025 sales and revenue were down compared to the previous year. The company's revenue decreased from CNY 782.67 million in Q1 2024 to CNY 701.33 million in Q1 2025, reflecting a decline in sales performance. This downturn underscores the importance of a robust XGD business plan to address these challenges.

Net income also decreased in Q1 2025, from CNY 220.77 million to CNY 156.42 million. Basic earnings per share (EPS) from continuing operations also fell from CNY 0.4 to CNY 0.28. These changes highlight the need for strategies to improve profitability and earnings.

For the full year 2024, revenue was CNY 3.148 billion, a 17.2% year-on-year decrease. Net income attributable to the parent company was CNY 0.234 billion, a 68.98% year-on-year decrease. The company's financial forecast for 2025 will be critical for understanding future performance.

Analysts project revenues of CNY 3.3 billion for 2025, a 6.2% improvement. EPS is expected to increase by 198% to CNY 1.23. These forecasts, although revised downwards from previous estimates, still suggest potential growth. For more information on how the company generates income, see Revenue Streams & Business Model of XGD.

XGD plans to launch a stock options incentive plan in 2025, involving 19 million shares. This initiative, accounting for 3.35% of the total share capital, could align employee incentives with growth targets. Understanding XGD's market analysis and competitive landscape is essential for evaluating these strategies.

- Trailing 12-Month Data: As of March 31, 2025, trailing 12-month revenue was $426 million.

- Asset and Debt: Total assets were $801.67 million, and total debt was $31.47 million for the same period.

- P/E Ratio: The company's price-to-earnings (P/E) ratio of 43x as of early March 2024 indicates investor confidence.

- Growth Expectations: Analysts anticipate earnings to grow by 210% over the next year, exceeding the market's predicted 42% growth.

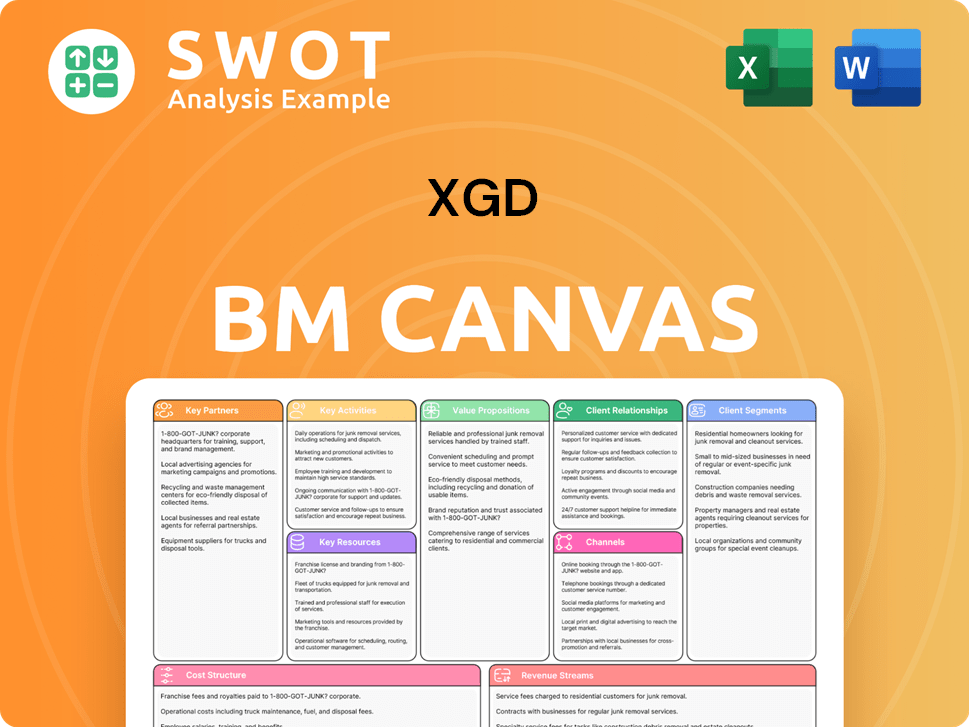

XGD Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow XGD’s Growth?

The XGD company growth strategy faces several potential risks and obstacles, particularly in the fast-paced payment and technology sectors. These challenges can significantly impact the company's XGD future prospects and overall success. Understanding these risks is crucial for investors and stakeholders evaluating the XGD business plan.

Market competition, regulatory changes, and technological disruptions are primary concerns. Furthermore, internal resource constraints and supply chain vulnerabilities can also pose significant challenges. These factors require careful management and strategic planning to navigate the competitive landscape effectively.

The payment terminal and digital payment market is highly competitive. According to recent financial reports, the company's revenue decreased by 17.2% in 2024, and net income attributable to the parent company decreased by 68.98%, indicating intensified competition or other market pressures. This XGD market analysis highlights the need for continuous innovation and differentiation to maintain or improve market share.

The payment industry is crowded with both domestic and international players. The XGD competitive landscape is intense, requiring constant innovation and strategic positioning to stay ahead. Understanding the competitors' strengths and weaknesses is essential for developing effective counter-strategies.

The financial technology sector is subject to evolving regulations. Changes in laws can impact business models and profitability, requiring companies to adapt quickly. Staying compliant and anticipating future regulatory shifts is crucial for long-term sustainability.

Rapid technological advancements pose a constant threat. The company's involvement in AI, blockchain, and intelligent driving requires continuous innovation. Failing to adapt to new technologies could lead to obsolescence and loss of market share.

Disruptions in the global supply chain can affect production and delivery. Ensuring a resilient supply chain is critical for maintaining operations and meeting customer demand. Diversifying suppliers and building buffer stocks can help mitigate these risks.

Attracting and retaining top talent is essential, especially in specialized fields. The company's plan to launch a stock options incentive plan in 2025, involving 19 million shares, shows efforts to attract and keep key employees. This is crucial for innovation and growth.

Management is actively addressing these risks through product development and diversification. Focusing on new growth areas like AI and overseas markets helps reduce reliance on traditional payment terminal sales. For more context, check out the Brief History of XGD.

The company's strategic goals and objectives include expanding into new technological areas and markets. This involves significant investment in research and development, as well as strategic partnerships. These initiatives are vital for long-term growth potential.

While specific XGD company financial forecast details are not available, the success of these strategies will significantly impact future revenue. These strategies include the XGD's expansion plans and strategies. The company needs to carefully monitor its financial performance.

XGD Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.