Casey's General Stores Bundle

Can Casey's General Stores Continue Its Remarkable Ascent in the Retail Industry?

Casey's General Stores, a cornerstone of the convenience store landscape, has been rapidly evolving. With a strategic focus on customer loyalty and digital engagement, highlighted by the expansion of its Casey's Rewards program to over 7 million members, the company is signaling its commitment to innovation. This growth, coupled with impressive digital sales figures, underscores the importance of a robust growth strategy in a competitive market.

From its origins in Boone, Iowa, Casey's has become the third-largest convenience store chain in the U.S., operating over 2,600 stores. This impressive Casey's General Stores SWOT Analysis reveals the company's ability to adapt and scale while maintaining its community-focused approach. Understanding Casey's future prospects requires a deep dive into its growth strategy, including its focus on business expansion, technological advancements, and disciplined financial management within the retail industry.

How Is Casey's General Stores Expanding Its Reach?

The expansion initiatives of Casey's General Stores are centered on a multi-pronged approach to boost its market presence and exploit new growth prospects. This strategy blends strategic acquisitions with disciplined new store construction. The company's focus is on organic growth, particularly in its core Midwestern and Southern markets.

Casey's aims to deepen its penetration in existing regions and enter adjacent small to mid-sized communities. This approach aligns with its operational model. The acquisition strategy is opportunistic, focusing on smaller chains or independent stores that can be seamlessly integrated into the Casey's network.

In fiscal year 2024, Casey's aimed to construct approximately 100 new stores. The company's success in integrating acquired locations has contributed significantly to its overall store count growth. The company is also focused on enhancing its prepared food offerings and digital engagement to drive sales, which is a key component of its Growth Strategy.

Casey's actively builds new stores and strategically acquires existing ones. This dual approach allows for both organic growth and rapid expansion. The company targets locations that fit its operational model, focusing on both existing markets and new, smaller communities.

Upgrading kitchen equipment is a key focus to meet the demand for prepared foods. The expansion of the Casey's Rewards loyalty program is another critical initiative. Digital sales saw a 20% increase in the third quarter of fiscal year 2024, driven by enhanced mobile app and online ordering capabilities.

Casey's is implementing several key strategies to drive growth and strengthen its market position. These include expanding its store network through both new construction and acquisitions. The company is also investing in its prepared food offerings and digital platforms.

- New store construction in core markets.

- Strategic acquisitions of smaller chains.

- Upgrading kitchen equipment for prepared foods.

- Enhancing the Casey's Rewards loyalty program.

- Improving mobile app and online ordering.

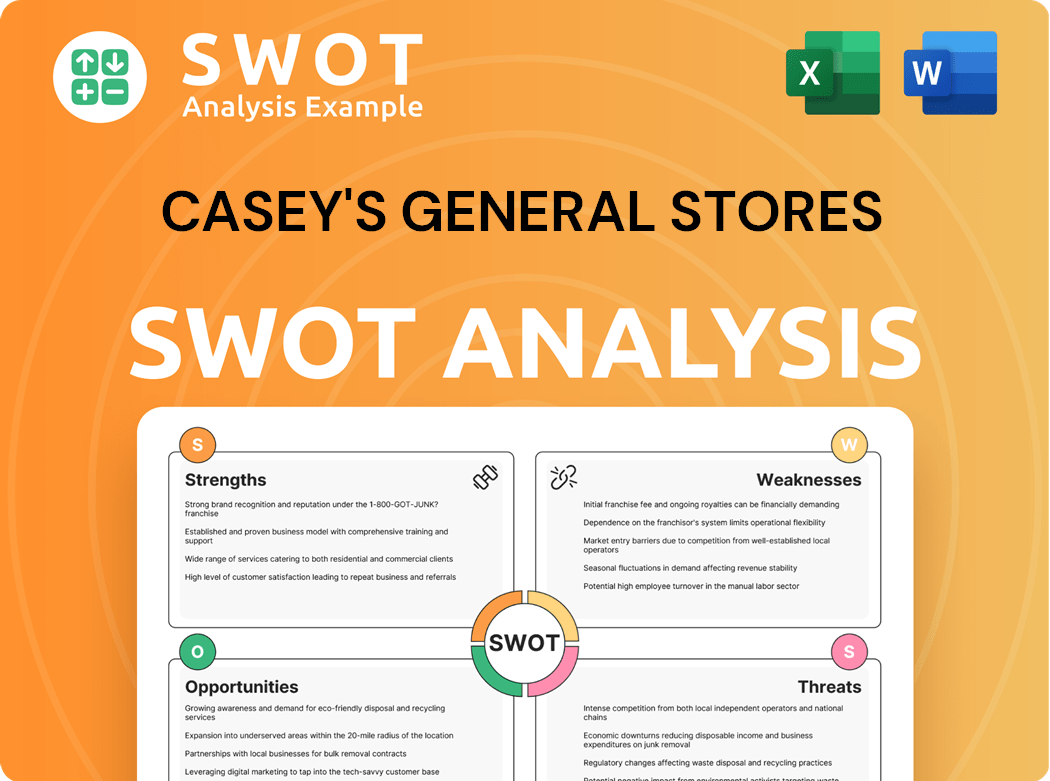

Casey's General Stores SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Casey's General Stores Invest in Innovation?

The innovation and technology strategy of Casey's General Stores is a key component of its overall growth strategy. The company focuses on leveraging technology to improve operational efficiency and enhance the customer experience within the convenience stores and retail industry. This approach supports Casey's future prospects by driving customer engagement and expanding service offerings.

A significant aspect of Casey's strategy involves digital transformation, particularly through its Casey's Rewards loyalty program and mobile app. These digital platforms are designed to provide a seamless and personalized experience for customers, including features like mobile ordering and personalized promotions. This focus on technology is part of Casey's broader strategy to maintain and grow its market share.

In the third quarter of fiscal year 2024, Casey's digital sales saw a notable 20% increase, highlighting the success of these initiatives. This growth demonstrates the effectiveness of the company's investment in digital platforms and its ability to adapt to changing consumer preferences. The company's expansion plans for 2024 and beyond are heavily influenced by these technological advancements.

The expansion and refinement of the Casey's Rewards loyalty program and mobile app are central to the digital strategy. These platforms offer mobile ordering, personalized promotions, and other features to enhance customer engagement. This strategy directly supports Casey's General Stores customer loyalty programs.

Automation is being explored to streamline operations and improve service speed within Casey's store locations near me. Investments in new kitchen equipment enhance the efficiency of prepared food offerings, such as pizza and donuts. This initiative aims to improve operational efficiency.

Data analytics derived from the loyalty program helps optimize inventory, personalize marketing, and improve store layouts. This data-driven approach is key to understanding customer behavior and preferences. Understanding Casey's General Stores competitive advantages is also a focus.

The introduction of E15 fuel at over 300 locations by late 2023 demonstrates a commitment to environmental responsibility. This aligns with Casey's General Stores sustainability initiatives and supports long-term growth. This also impacts Casey's growth strategy in the fuel market.

The focus on digital platforms and in-store innovation aims to improve the overall customer experience. Personalized promotions and mobile ordering are designed to enhance customer satisfaction. This is a key factor in Casey's key strategies for success.

Automation and data analytics are used to streamline operations and improve efficiency. These efforts help reduce costs and improve service speed. This is a key aspect of Casey's General Stores revenue growth drivers.

By focusing on digital transformation, in-store automation, data analytics, and sustainability, Casey's is strategically positioned to drive growth. These initiatives are designed to enhance customer engagement, improve operational efficiency, and expand service offerings. For more information, you can read about the Owners & Shareholders of Casey's General Stores.

- Enhancing the Casey's Rewards program to increase customer loyalty.

- Implementing automation in stores to improve efficiency and service.

- Utilizing data analytics to optimize inventory and personalize marketing.

- Expanding the availability of sustainable fuel options, such as E15.

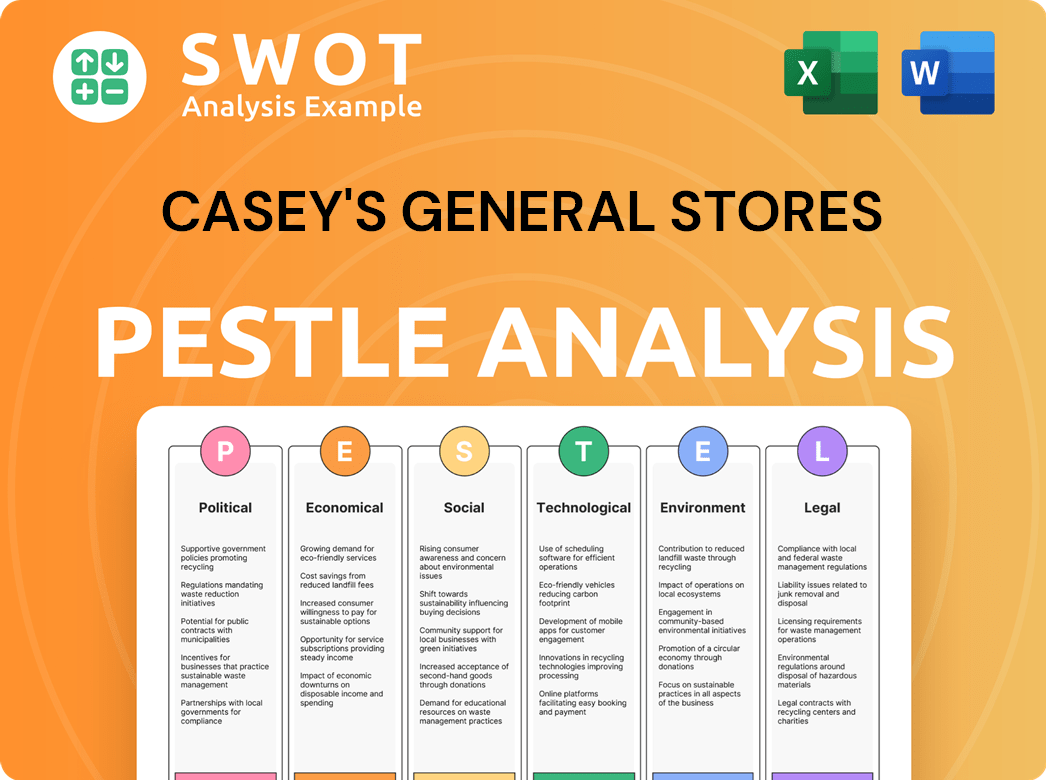

Casey's General Stores PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Casey's General Stores’s Growth Forecast?

The financial outlook for Casey's General Stores is notably robust, reflecting consistent performance and strategic growth initiatives. The company's financial health is underscored by its ability to generate strong earnings and manage its resources effectively. This financial stability supports its expansion plans and commitment to shareholder returns, making it a compelling case for investors and stakeholders.

In the third quarter of fiscal year 2024, the company demonstrated its strong financial position by reporting diluted earnings per share of $1.65. This indicates steady profitability and effective operational management. The company's focus on key growth areas, such as prepared food and dispensed beverages, is paying off, with gross profit in this segment increasing by 11.2% during the same period. The total inside gross profit also saw a healthy increase, reaching $749.6 million, which highlights the effectiveness of its retail strategy.

Casey's has provided optimistic guidance for fiscal year 2024, projecting inside same-store sales growth to be at the upper end of its 4% to 6% range. The company anticipates a total inside gross profit dollar growth between 8% and 10%. This positive outlook is supported by strategic investments and a focus on enhancing the customer experience, which is expected to drive further revenue growth.

Looking ahead, Casey's anticipates capital expenditures for fiscal year 2024 to be at the higher end of its $500 million to $550 million range. This reflects significant investments in new store construction and store remodels. These investments are crucial for expanding its store network and improving existing locations to meet growing customer demand.

The company's long-term financial goals include expanding its store count by approximately 3% annually through a mix of new builds and acquisitions. This growth strategy is designed to increase its market share and strengthen its presence in the convenience stores and retail industry. It also aims to maintain a strong balance sheet to support these growth ambitions.

Casey's share repurchase program, with $300 million remaining under authorization as of March 2024, further signals management's confidence in the company's financial health and commitment to shareholder returns. This program reduces the number of outstanding shares, increasing the value for existing shareholders. This is a key component of Casey's strategy for success.

These financial projections and strategic capital allocations underscore Casey's commitment to sustained growth and profitability in the coming years. By focusing on both organic growth and strategic investments, Casey's is well-positioned to capitalize on future market trends and maintain its competitive advantage within the convenience store sector.

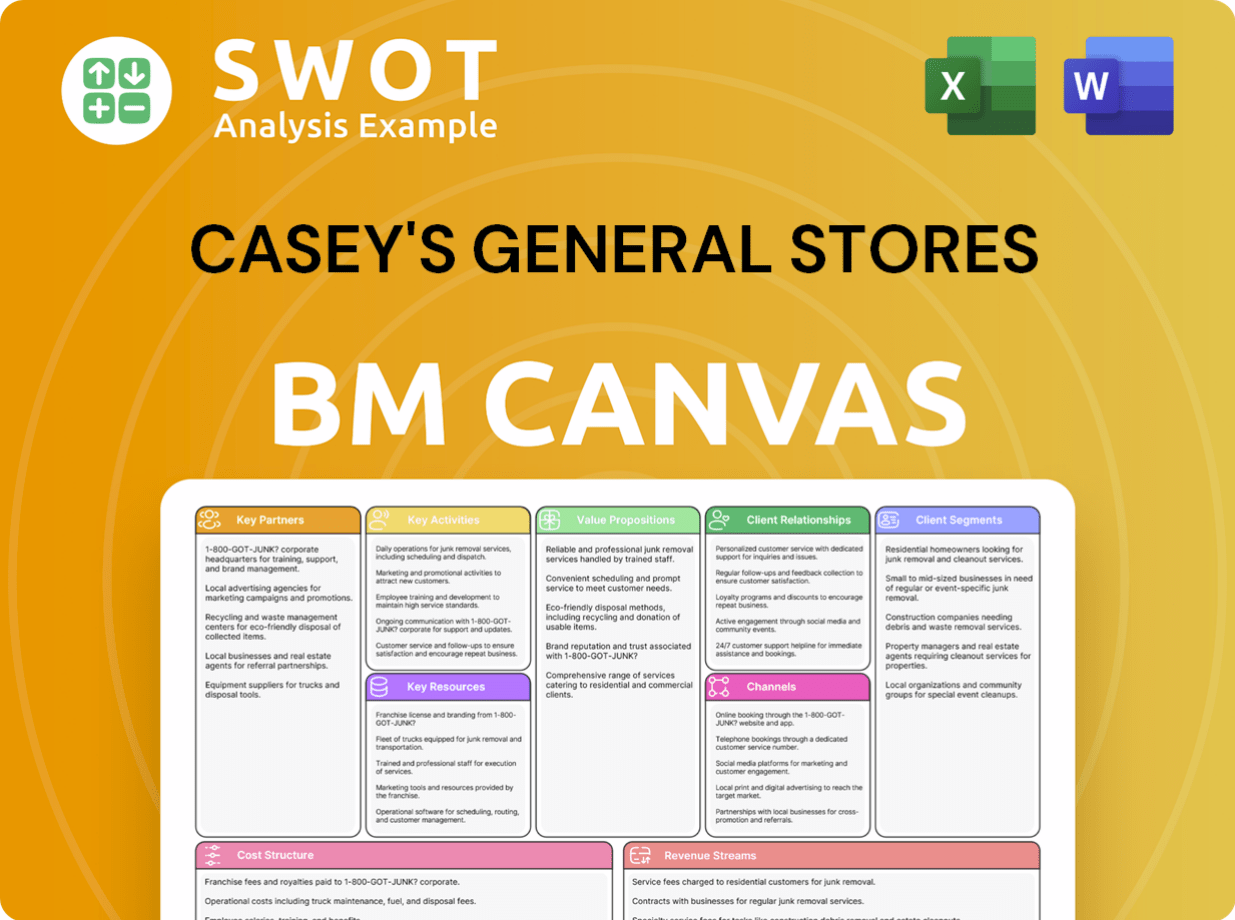

Casey's General Stores Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Casey's General Stores’s Growth?

The future of Casey's General Stores, while promising, is subject to various risks. These challenges stem from market dynamics, regulatory changes, and operational constraints that could affect the company's Growth Strategy and overall success. Understanding these potential obstacles is crucial for assessing Casey's Future Prospects.

One major hurdle is the competitive landscape within the convenience store and Retail Industry. The market is highly fragmented, with many players vying for market share. Additionally, the increasing presence of larger retail chains that offer similar products and services can lead to intense pricing pressures and challenges in maintaining its market share. For a deeper look, explore the Competitors Landscape of Casey's General Stores.

Regulatory changes pose another risk, particularly those related to fuel standards, environmental regulations, and labor laws. These changes could increase operational costs or require significant investments for compliance. Supply chain vulnerabilities, as demonstrated by recent global events, also present a potential challenge. Disruptions in fuel, food products, or other merchandise could impact profitability and product availability.

The convenience store sector is highly competitive, with numerous smaller players and larger retail chains. This competition can lead to pricing wars and challenges in retaining customers. Strategies to counter this include enhancing customer loyalty programs and focusing on unique offerings.

Changes in fuel standards, environmental regulations, and labor laws can increase operational costs. For example, evolving regulations around E15 fuel could require infrastructure upgrades. Compliance costs can be significant and may impact profitability.

Disruptions in the supply chain, especially for fuel and food products, pose a risk to profitability and product availability. Diversifying suppliers and maintaining robust inventory management are critical for mitigating these risks. Recent events have highlighted these vulnerabilities.

Competitors adopting new digital platforms or in-store technologies could impact Casey's General Stores. Continuous investment in digital platforms and loyalty programs is essential to enhance customer experience and operational efficiency. Digital innovation is key.

Labor shortages and difficulties in attracting and retaining staff, particularly in smaller towns, can affect store operations and service quality. Competitive compensation and training programs are essential for attracting and retaining qualified staff.

Economic downturns can reduce consumer spending, impacting sales volumes and profitability. Casey's General Stores needs to adapt its offerings and pricing strategies to remain competitive during economic uncertainties. Diversification is key.

Casey's General Stores addresses these risks through a strategy of disciplined Business Expansion, diversified offerings, and investments in technology and human capital. The company focuses on operational efficiency, customer loyalty, and strategic acquisitions to mitigate the impact of these challenges. The company's focus on its growth strategy is crucial.

Casey's has demonstrated resilience by focusing on its core strengths and adapting to market changes. Analyzing Casey's financial performance analysis helps understand its ability to overcome challenges. The company's ability to manage costs and maintain profitability is a key factor in its success. In 2024, the company's revenue reached approximately $16 billion.

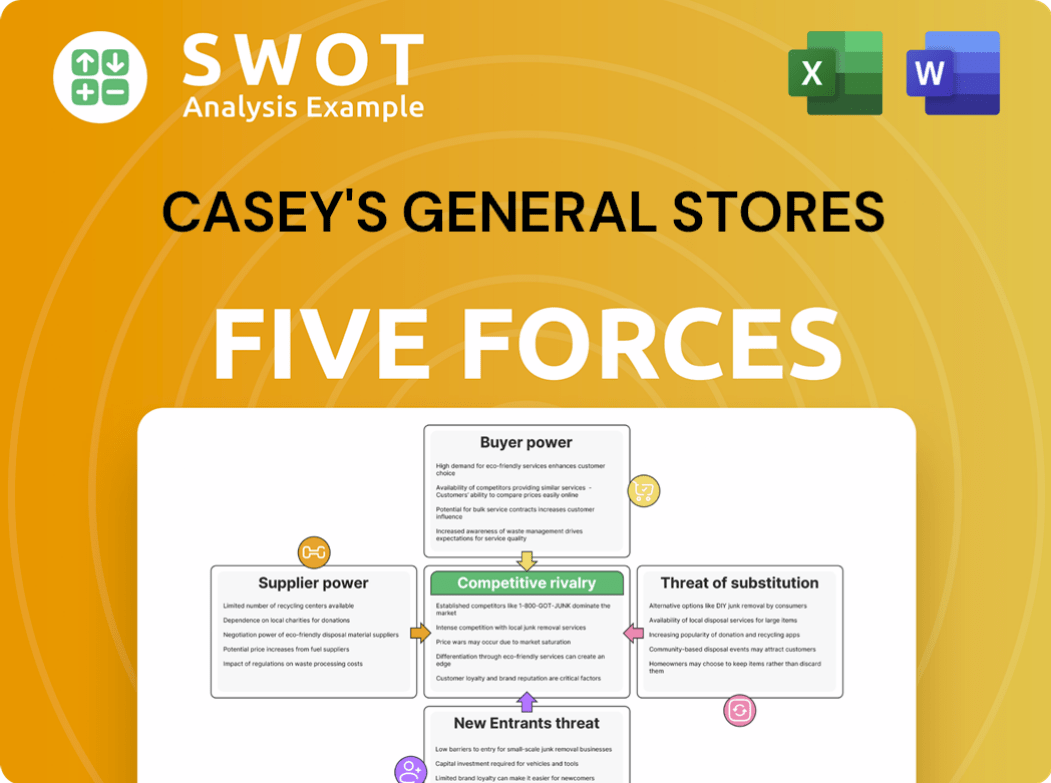

Casey's General Stores Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Casey's General Stores Company?

- What is Competitive Landscape of Casey's General Stores Company?

- How Does Casey's General Stores Company Work?

- What is Sales and Marketing Strategy of Casey's General Stores Company?

- What is Brief History of Casey's General Stores Company?

- Who Owns Casey's General Stores Company?

- What is Customer Demographics and Target Market of Casey's General Stores Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.