Casey's General Stores Bundle

How Does Casey's Thrive in the Convenience Retail Market?

Casey's General Stores has become a household name, especially in the Midwest, but how does this Casey's General Stores SWOT Analysis contribute to its success? From its strategic placement in smaller communities to its diverse offerings, Casey's has cultivated a loyal customer base. But what are the core strategies that fuel its consistent growth and expansion in the competitive retail landscape?

Casey's Company operates a vast network of convenience stores and gas stations, making it a significant player in the retail sector. Understanding the inner workings of Casey's General Stores, from its revenue streams to its strategic market positioning, is key to appreciating its enduring success. Whether you're curious about Casey's General Stores SWOT Analysis, its fuel prices, or its store locations, this analysis offers valuable insights. This exploration provides a comprehensive look at how Casey's General Stores continues to thrive and expand its footprint.

What Are the Key Operations Driving Casey's General Stores’s Success?

The core operations of Casey's General Stores revolve around its extensive network of convenience stores, which serve as essential retail and food service hubs. These stores offer a wide array of products and services, including gasoline, groceries, and prepared foods. This diverse offering positions Casey's as a convenient 'one-stop shop' for customers, particularly in smaller communities.

The company's value proposition lies in its ability to combine the offerings of a gas station, a convenience store, and a quick-service restaurant. The focus on high-quality prepared foods, such as pizza and donuts, has cultivated a strong brand identity and customer loyalty. This model is particularly effective in areas where other retail options may be limited, making Casey's a primary destination for daily needs.

Operational efficiency is a key aspect of Casey's success. The company manages its own distribution centers, which ensures efficient inventory management and supply chain control. This allows stores to consistently stock fresh products and meet customer demands effectively. The integrated approach supports the company's ability to offer a broad range of products, creating a competitive advantage in the retail market.

The primary offerings include gasoline, a wide selection of groceries, and prepared foods. Prepared foods, such as pizza, donuts, and sub sandwiches, are a key differentiator. These offerings cater to the daily needs of residents and travelers.

The company manages its own distribution centers, ensuring efficient inventory management. This control allows for consistent stocking of fresh products. The integrated supply chain supports the company's ability to offer a broad range of products.

Casey's primarily serves residents and travelers in small to mid-sized towns across the Midwest and Southern United States. These locations often lack extensive retail options, making Casey's a primary destination. The company's strategic store placement caters to a specific demographic.

The value proposition lies in the 'one-stop shop' model, combining a gas station, convenience store, and quick-service restaurant. The focus on high-quality prepared foods cultivates brand loyalty. This model is particularly effective in areas with limited retail options.

The emphasis on prepared foods, particularly pizza, is a major differentiator for Casey's. This focus cultivates strong brand identity and customer loyalty, setting it apart from traditional convenience stores. The company's integrated operations and strategic store locations further enhance its competitive edge.

- High-quality prepared foods, especially pizza and donuts.

- Efficient supply chain management through company-owned distribution centers.

- Strategic store placement in small to mid-sized towns.

- Strong brand identity and customer loyalty.

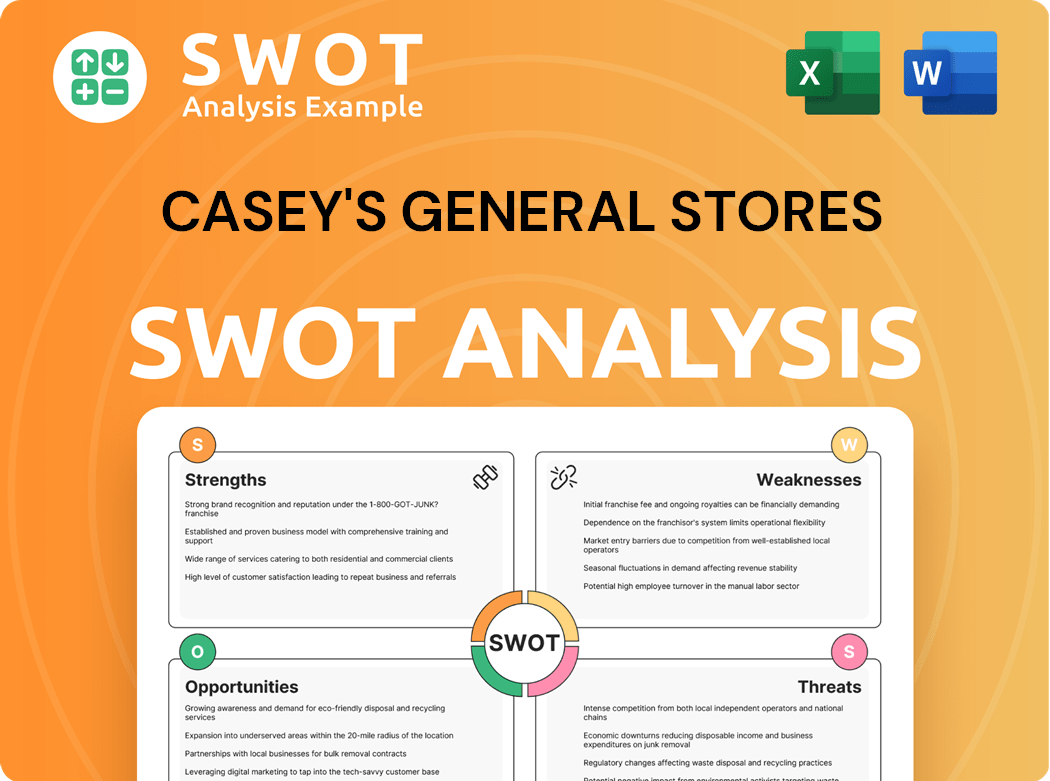

Casey's General Stores SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Casey's General Stores Make Money?

Casey's General Stores, a prominent player in the convenience store and gas station industry, employs several revenue streams to generate income. These streams include fuel sales, grocery and merchandise sales, and prepared food and dispensed beverage sales. The company's financial performance is a key indicator of its success in these areas.

For the fiscal year ending April 30, 2024, Casey's Company reported total revenues of approximately $15.1 billion. Fuel sales are a significant contributor, although their impact can vary with the price of crude oil. Grocery and general merchandise sales, which include a wide range of everyday items, also make up a substantial portion of the revenue mix.

A crucial and growing monetization strategy for Casey's involves its prepared food and dispensed beverage segment. This category, which includes popular items like pizza and donuts, directly contributes to revenue and boosts customer traffic and loyalty. The company actively expands its prepared food options and promotes digital ordering to enhance convenience and increase sales in this segment.

Casey's General Stores utilizes a multi-faceted approach to generate revenue and maximize profits. Key strategies include optimizing fuel sales, enhancing grocery and merchandise offerings, and expanding prepared food options. The company also leverages its loyalty program and focuses on strategic pricing to improve margins.

- Fuel Sales: This is a primary revenue source, though it's subject to fluctuations in crude oil prices. Casey's operates as a gas station, providing fuel to customers.

- Grocery and Merchandise Sales: A wide variety of everyday items contribute significantly to revenue. This includes snacks, beverages, and household goods available at their convenience store locations.

- Prepared Food and Dispensed Beverages: This segment is a key growth area, including pizza, donuts, and other hot foods. This also drives foot traffic and customer loyalty.

- Casey's Rewards Program: This loyalty program drives repeat business and offers personalized promotions.

- Pricing Strategies and Private Label Offerings: Casey's focuses on optimizing pricing and expanding its private label products to improve merchandise margins.

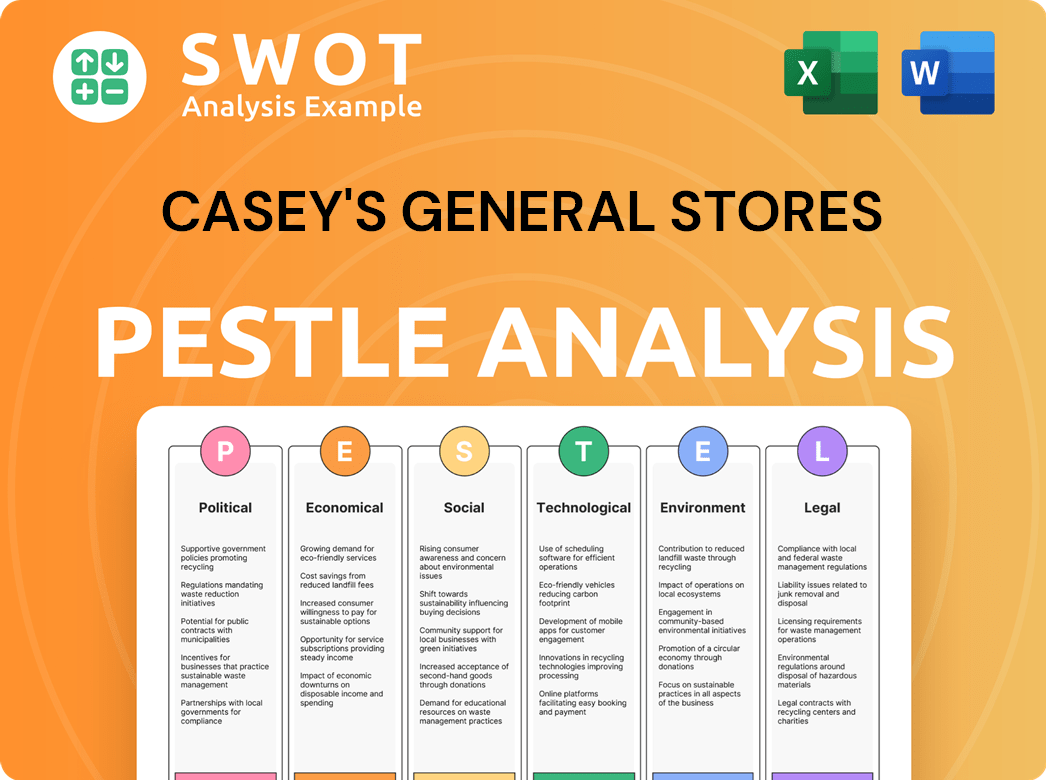

Casey's General Stores PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Casey's General Stores’s Business Model?

Casey's General Stores has a history marked by significant achievements that have shaped its operational and financial direction. Its strategic moves, including consistent market expansion and acquisitions of convenience store chains, have boosted its store count and geographical reach. These actions have been crucial for increasing market share and leveraging economies of scale, making Casey's a prominent player in the retail sector.

The company's ability to navigate challenges, such as fluctuating fuel prices and changing consumer preferences, highlights its adaptability. By focusing on its prepared food segment and investing in technology, Casey's has enhanced its digital platforms, including online ordering and the Casey's Rewards loyalty program, which is a key response to evolving retail trends and competitive pressures. These strategies have allowed Casey's to maintain a strong position in the market.

Casey's competitive advantages stem from its strong brand recognition, particularly for its prepared foods, and its deep roots in the communities it serves. Its efficient supply chain, supported by company-owned distribution centers, provides a cost advantage and ensures product availability. Furthermore, its focus on smaller, underserved markets often provides a competitive moat, as larger competitors may find these locations less appealing. For more details, you can check out Owners & Shareholders of Casey's General Stores.

Casey's has consistently expanded its footprint, strategically acquiring convenience stores to increase its market presence. The acquisition of 63 stores from EG America in late 2023 is a prime example, solidifying its presence in the Midwest and South. These expansions have been critical for growth.

The company emphasizes its prepared food segment and invests in technology to adapt to market changes. Enhancements to digital platforms, such as online ordering and the Casey's Rewards loyalty program, are key responses to evolving retail trends. These moves help Casey's stay competitive.

Casey's benefits from strong brand recognition, particularly for its prepared foods, and its deep community ties. Its efficient supply chain, supported by company-owned distribution centers, provides a cost advantage. The focus on smaller markets also provides a competitive advantage.

In fiscal year 2024, Casey's reported total revenue of approximately $16.5 billion. The company's focus on prepared foods and beverages has been a significant driver of sales, with these categories contributing substantially to overall revenue. Casey's continues to invest in digital initiatives, with digital sales representing a growing percentage of total sales, reflecting the success of its online ordering and rewards programs.

Casey's focuses on digital transformation, optimizing store formats, and expanding its food service offerings. These strategies help maintain a competitive edge in the gas station and convenience store market. The company's focus on smaller markets and efficient supply chain also provides a significant advantage.

- Expansion through acquisitions and new store openings.

- Emphasis on prepared foods and beverages to drive sales.

- Investment in digital platforms, including online ordering and the Casey's Rewards program.

- Efficient supply chain with company-owned distribution centers.

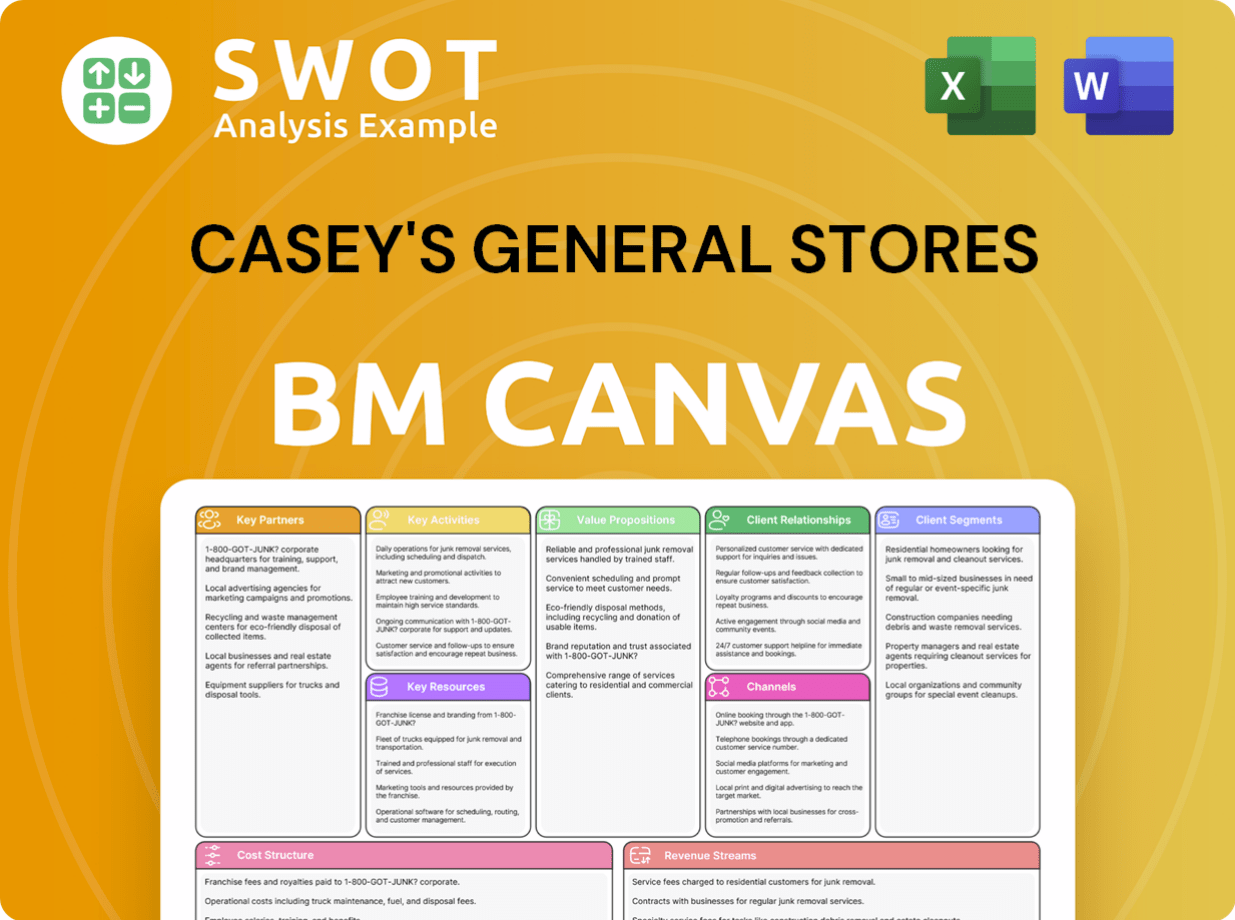

Casey's General Stores Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Casey's General Stores Positioning Itself for Continued Success?

The company, a major player in the convenience store and gas station sector, holds a solid industry position, particularly in the Midwest and Southern United States. As of early 2024, the company operated over 2,600 stores, making it one of the largest convenience store chains in the United States. It competes with large national chains, regional players, and local independent stores, maintaining a high level of customer loyalty.

However, the company faces several risks that could impact its operations. These include fuel price fluctuations, regulatory changes related to fuel storage or food safety, and intense competition from various retail formats. Furthermore, adapting to evolving consumer preferences, such as the shift towards electric vehicles, presents ongoing challenges.

The company is a significant player in the convenience store industry, especially in the Midwest and Southern regions. Its extensive network of stores, exceeding 2,600 locations, gives it a strong market presence. The company differentiates itself through a community-focused approach and popular prepared food offerings.

The company faces risks such as fluctuating fuel prices, which can affect revenue and profitability. Regulatory changes, particularly in environmental and food safety areas, also pose potential challenges. Intense competition from various retail formats necessitates continuous adaptation.

The company's future appears positive, with strategic initiatives focused on growth and enhanced offerings. Plans for fiscal year 2025 include opening 35 new stores and completing 100 remodels. The company's commitment to leveraging technology and improving the customer experience supports its long-term goals.

The company focuses on expanding its store network, enhancing its prepared food offerings, and boosting its digital capabilities. The company aims to increase inside sales through its loyalty program and optimize its product mix. The leadership is committed to using technology to improve operations and enhance customer satisfaction.

The company's strategy involves continued store expansion and modernization to maintain its competitive edge in the retail market. The company is focused on driving inside sales growth through its loyalty program and optimizing its product mix. To understand more about the company's strategic approach, explore the Growth Strategy of Casey's General Stores.

- Expansion: Plans to open 35 new stores and complete 100 remodels in fiscal year 2025.

- Customer Experience: Leveraging technology to improve operational efficiency and enhance the customer experience.

- Product Mix: Optimizing product offerings to meet evolving consumer preferences and drive sales.

- Financial Performance: The company's established market presence and strong brand position it to sustain and expand its ability to generate revenue.

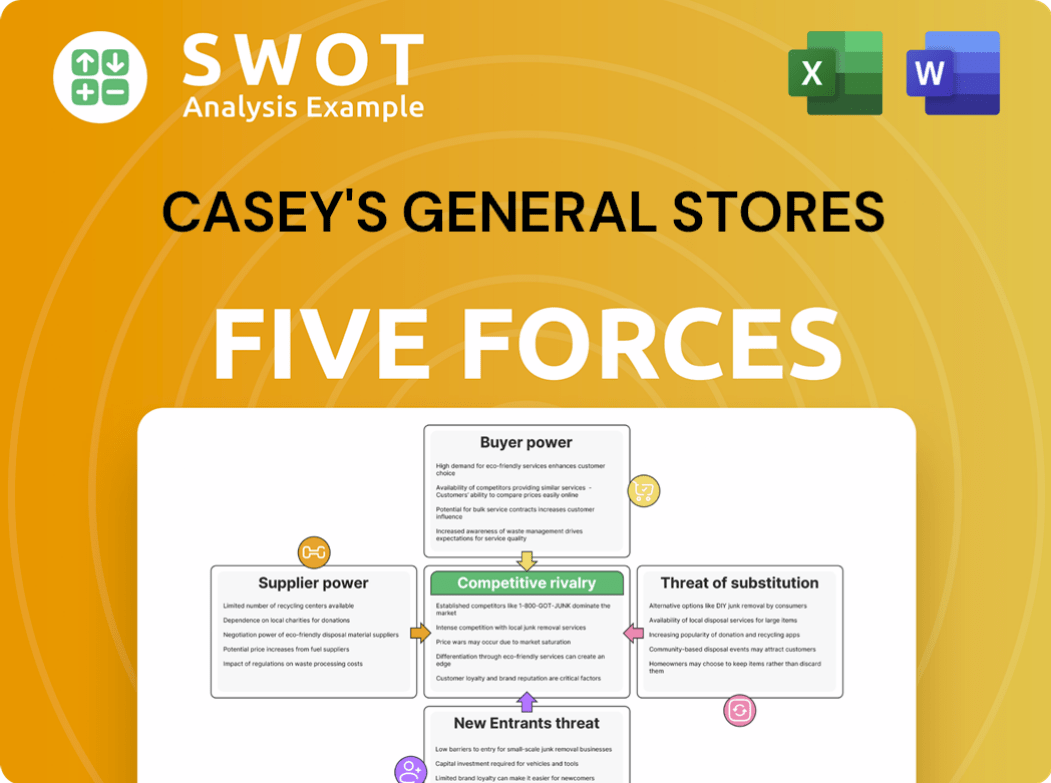

Casey's General Stores Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Casey's General Stores Company?

- What is Competitive Landscape of Casey's General Stores Company?

- What is Growth Strategy and Future Prospects of Casey's General Stores Company?

- What is Sales and Marketing Strategy of Casey's General Stores Company?

- What is Brief History of Casey's General Stores Company?

- Who Owns Casey's General Stores Company?

- What is Customer Demographics and Target Market of Casey's General Stores Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.