Credicorp Bundle

Can Credicorp Continue Its Ascent in Latin America?

Credicorp, a financial powerhouse born in the heart of Peru, has consistently demonstrated a knack for strategic growth. From its humble beginnings to its current stature as a regional leader, Credicorp's journey offers a compelling case study in financial services dominance. This analysis dives deep into the Credicorp SWOT Analysis, exploring the company's ambitious plans for expansion, innovation, and overall market positioning.

Understanding the Credicorp growth strategy is crucial for investors and strategists alike. We'll explore how Credicorp's strategic planning is shaping its future, analyzing its Credicorp financial performance and assessing its Credicorp market position. This comprehensive Credicorp company analysis will provide insights into the Credicorp future prospects and long-term growth potential, offering a clear view of its ability to navigate economic challenges and capitalize on opportunities in the dynamic Latin American market.

How Is Credicorp Expanding Its Reach?

Credicorp's expansion initiatives are primarily focused on deepening its presence in existing markets and exploring opportunities for inorganic growth through mergers and acquisitions. The company aims to consolidate its leadership in Peru while strategically expanding its footprint in other Latin American countries where it sees high growth potential. This Credicorp growth strategy is designed to leverage its existing strengths and capitalize on emerging opportunities in the region.

A key component of Credicorp's strategy involves integrating recent acquisitions, such as its increased stake in Banco de Crédito de Bolivia (BCP Bolivia). This integration allows Credicorp to leverage synergies and expand its regional service offerings. The company is also focused on enhancing its digital channels to reach a broader customer base and improve accessibility, particularly in underserved segments. These efforts are crucial for maintaining and improving Credicorp's market position.

In terms of product expansion, Credicorp is continuously developing new financial products and services tailored to the evolving needs of its diverse clientele. This includes digital payment solutions, specialized lending products for SMEs, and enhanced wealth management offerings. These initiatives are designed to diversify revenue streams away from traditional banking and stay ahead of the rapid changes in the financial services industry. For a deeper understanding of the company's origins, consider reading Brief History of Credicorp.

Credicorp is actively expanding its presence in key Latin American markets, focusing on countries with high growth potential. This expansion includes strategic mergers and acquisitions to strengthen its regional footprint. The company is particularly focused on leveraging its existing infrastructure and expertise to drive growth in these markets.

Credicorp is heavily investing in digital transformation to enhance customer experience and operational efficiency. This involves upgrading digital platforms, introducing new digital financial products, and expanding online services. The goal is to improve accessibility and reach a broader customer base, especially in underserved areas.

Credicorp is diversifying its product offerings to meet the evolving needs of its customers and reduce reliance on traditional banking services. This includes developing new digital payment solutions, specialized lending products for SMEs, and enhanced wealth management offerings. This diversification is crucial for long-term sustainability.

Credicorp actively seeks strategic partnerships and acquisitions to accelerate growth and expand its market reach. These initiatives allow the company to enter new markets, acquire new technologies, and enhance its service offerings. Recent acquisitions, such as the increased stake in BCP Bolivia, exemplify this strategy.

Credicorp's strategic plan for 2024-2026 emphasizes sustainable growth through digital transformation and regional consolidation. The company aims to achieve this by focusing on several key areas.

- Digital Transformation: Investing in digital platforms to enhance customer experience and operational efficiency. In 2024, Credicorp plans to allocate approximately $200 million towards digital initiatives.

- Regional Consolidation: Strengthening its presence in Latin America through strategic acquisitions and partnerships. The integration of BCP Bolivia is expected to generate $50 million in synergies by 2026.

- Product Innovation: Developing new financial products and services tailored to the evolving needs of its diverse clientele. The launch of new digital payment solutions is projected to increase the number of digital transactions by 30% in the next two years.

- Market Penetration: Expanding into underserved segments and increasing its market share in existing markets. Credicorp aims to increase its SME lending portfolio by 25% by 2026.

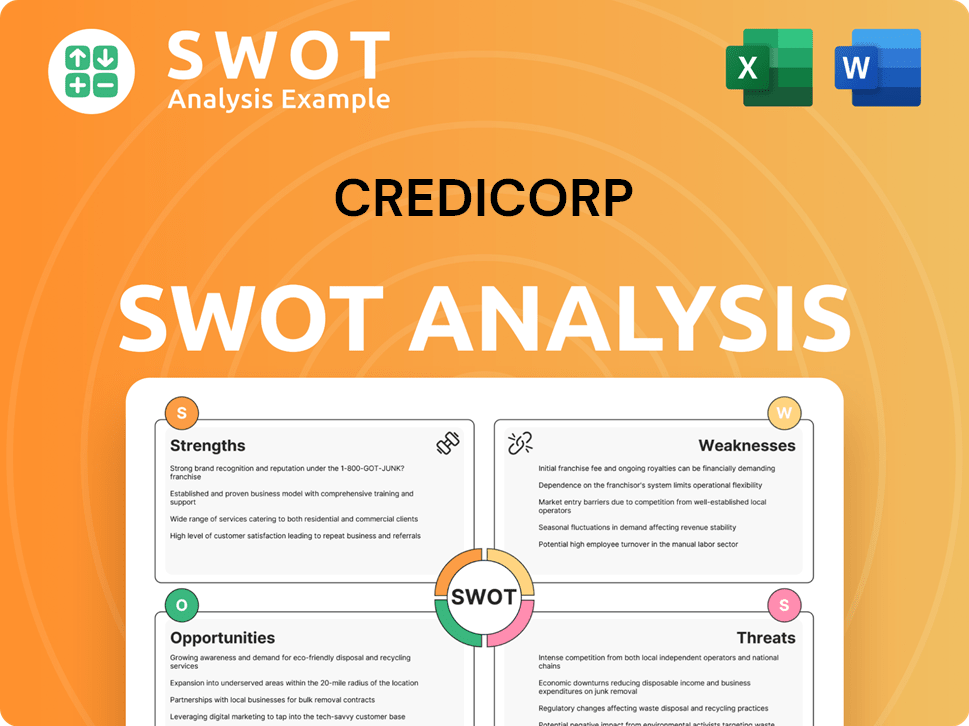

Credicorp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Credicorp Invest in Innovation?

The company's Credicorp growth strategy heavily relies on technological innovation to maintain its competitive edge. This approach involves significant investments in digital transformation and the adoption of cutting-edge technologies. The company focuses on enhancing customer experience, reducing operational costs, and launching new financial products.

Credicorp is actively leveraging technology to improve its services and expand its market reach. This includes the automation of internal processes, enhancement of customer-facing platforms, and the use of data analytics. The company's commitment to technological leadership is evident in its efforts to maintain its competitive edge in the rapidly evolving digital financial landscape.

Credicorp's future prospects are closely tied to its ability to innovate and adapt to the changing financial landscape. The company's strategic planning includes continuous investments in research and development, in-house development capabilities, and strategic collaborations with external innovators and fintech companies. These efforts aim to drive sustainable growth and enhance its market position.

Credicorp allocates substantial resources to research and development. These investments are critical for fostering innovation and staying ahead of the competition. This approach supports the development of new products and services.

The company is undergoing a significant digital transformation to improve operational efficiency and customer experience. This includes automating internal processes and enhancing customer-facing platforms. This transformation is key to Credicorp's financial performance.

Credicorp utilizes artificial intelligence (AI) and data analytics to personalize services and improve decision-making. AI is used for predictive analytics and enhanced customer service. Data analytics helps in understanding customer behavior and market trends.

Cloud computing is implemented to improve operational efficiency and scalability. This technology allows the company to manage its resources more effectively. Cloud solutions support the launch of new products and services.

Credicorp is focused on developing new digital products and platforms to meet evolving customer needs. The company aims to enhance financial inclusion and offer innovative payment solutions. This is a key element of Credicorp's market position.

The company engages in strategic collaborations with external innovators and fintech companies. These partnerships help Credicorp integrate new technologies and expand its service offerings. These collaborations are essential for long-term growth.

The company's digital wallet, Yape, is a prime example of its innovation in payment systems. Yape has become a widely adopted mobile payment solution in Peru, demonstrating Credicorp's commitment to financial inclusion and technological advancement. For a broader understanding of the competitive environment, consider exploring the Competitors Landscape of Credicorp. These technological advancements contribute directly to growth objectives by improving customer experience, reducing operational costs, and enabling the launch of new, competitive financial products and services. Credicorp's continuous pursuit of technological leadership is evident in its efforts to maintain its competitive edge in a rapidly evolving digital financial landscape.

Credicorp has implemented several key technological initiatives to drive growth and improve operational efficiency. These initiatives are central to the company's strategic planning.

- Artificial Intelligence (AI): Used for predictive analytics and enhanced customer service.

- Cloud Computing: Improves operational efficiency and scalability.

- Digital Wallets: Development and promotion of digital wallets like Yape to enhance financial inclusion.

- Data Analytics: Utilized to personalize services and improve decision-making.

- Automation: Automating internal processes to reduce costs and improve efficiency.

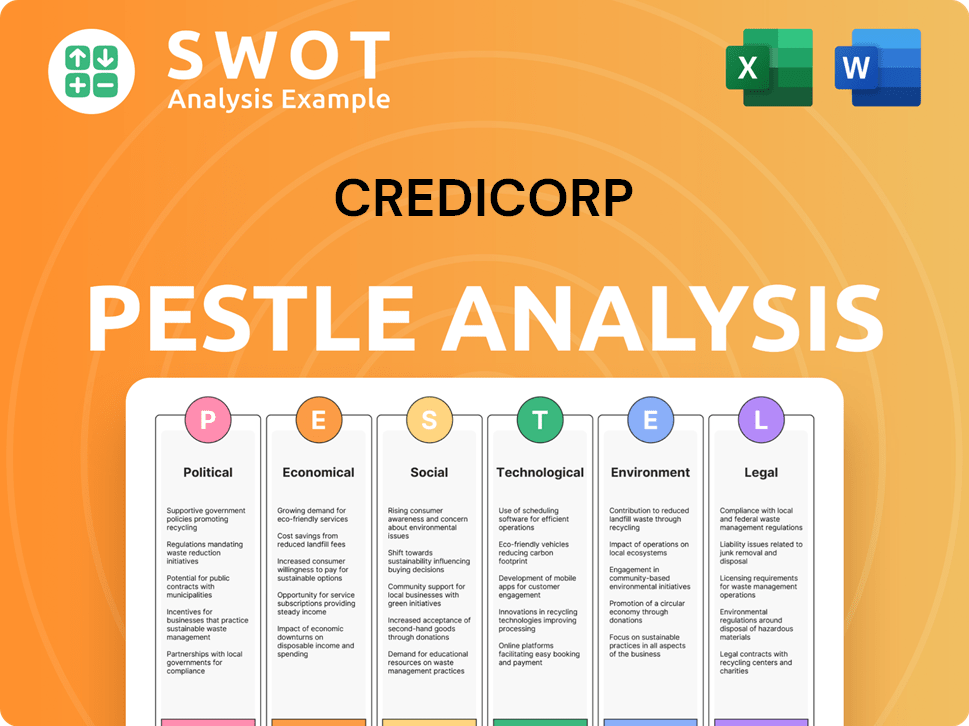

Credicorp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Credicorp’s Growth Forecast?

The financial outlook for Credicorp, a key player in Latin America's financial sector, points towards sustained growth, driven by strategic initiatives and a strong market position. This positive trajectory is supported by the company's robust financial performance and its proactive approach to adapting to market dynamics. Understanding the Owners & Shareholders of Credicorp is crucial for assessing the company's long-term viability and growth potential.

Credicorp's strategic investments in digital transformation, expansion into new segments, and enhancement of technological infrastructure are key drivers of its future growth. These investments are designed to improve operational efficiency, enhance customer experience, and capture new market opportunities. The company's commitment to these areas underscores its focus on innovation and its ability to maintain a competitive edge in the evolving financial landscape.

Credicorp's financial strategy emphasizes optimizing its funding structure and maintaining a healthy liquidity position. This approach is designed to navigate potential market volatilities and ensure financial stability. The company's focus on capital adequacy provides a solid foundation for future expansion and potential acquisitions, further solidifying its market position.

Credicorp reported a net income of S/1,399.7 million in Q4 2023, marking a 20.2% year-over-year increase. This strong performance reflects the company's ability to generate robust earnings and manage its financial resources effectively. This financial strength underpins the company's ability to pursue its growth strategy.

The company's return on equity (ROE) for the full year 2023 stood at 19.8%, demonstrating strong profitability. This high ROE indicates that Credicorp is efficiently utilizing shareholder equity to generate profits, a key indicator of its financial health and investment appeal. This efficiency supports the company's future prospects.

Credicorp's management anticipates continued growth in its loan portfolio and deposits. This expectation reflects confidence in the economic recovery of its primary markets and the company's ability to attract and retain customers. This growth is a critical component of Credicorp's strategic planning.

Credicorp's capital adequacy remains strong, providing a solid foundation for future expansion and potential acquisitions. This financial strength allows the company to pursue strategic opportunities and navigate economic challenges effectively. This strong capital position is a key factor in the company's competitive advantages in the banking sector.

Credicorp's strategic planning includes several key initiatives to drive growth. These initiatives focus on digital transformation, expansion into new segments, and enhancement of technological infrastructure. These efforts are designed to improve operational efficiency and enhance customer experience.

- Digital Transformation: Investing in digital platforms and services to improve customer experience and operational efficiency.

- Expansion into New Segments: Targeting underserved markets and expanding product offerings to diversify revenue streams.

- Technological Infrastructure: Enhancing IT infrastructure to support innovation and improve security.

- Strategic Partnerships and Acquisitions: Pursuing partnerships and acquisitions to expand market share and capabilities.

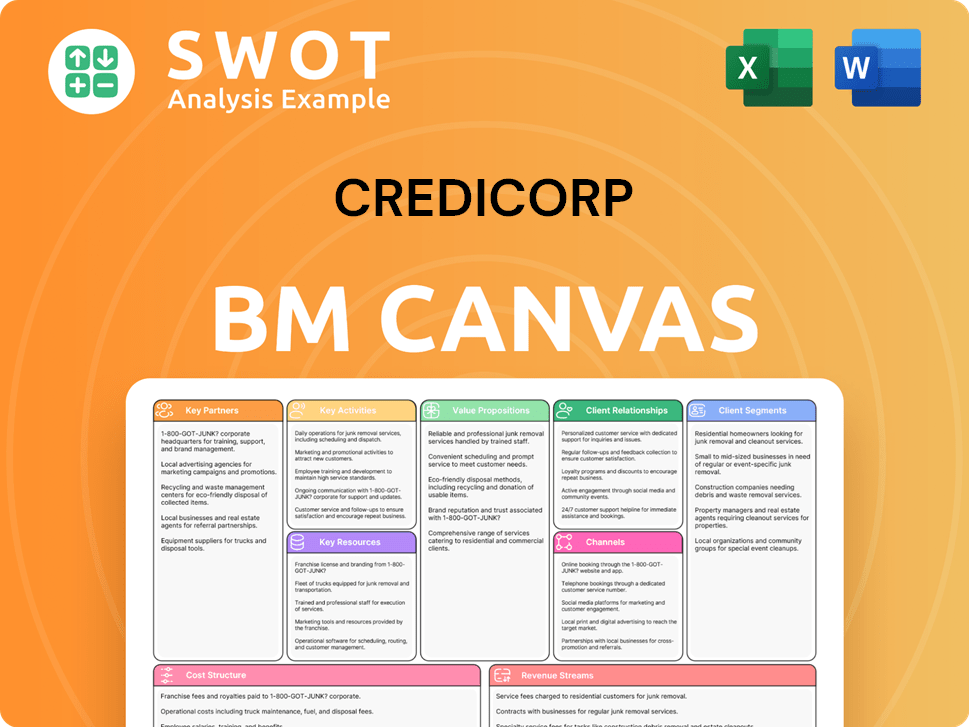

Credicorp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Credicorp’s Growth?

The path to growth for Credicorp, like any major financial institution, is not without its hurdles. Several potential risks and obstacles could impact the company's Credicorp growth strategy and overall Credicorp financial performance. Understanding these challenges is crucial for assessing the Credicorp future prospects.

Market dynamics and regulatory changes present significant challenges. The competitive landscape, with the rise of fintech companies, adds pressure. Additionally, economic and political instability in key markets and technological disruptions pose threats that Credicorp must navigate effectively. These factors directly influence Credicorp's market position.

Internal resource constraints, particularly in attracting and retaining skilled talent, can also impede innovation and expansion. It's important to consider how Credicorp strategic planning addresses these issues to ensure sustained growth and stability. The company's ability to manage these risks will be pivotal for its long-term success.

Credicorp faces intense competition from both traditional banks and fintech companies. These fintech firms offer innovative digital solutions, putting pressure on Credicorp to continually adapt and improve its services. This competitive environment requires constant innovation to maintain market share.

Regulatory changes, especially those related to data privacy and anti-money laundering, can significantly impact Credicorp. Compliance with these regulations can increase operational costs and potentially affect profitability. Credicorp must stay updated to ensure compliance.

Economic downturns or political instability in key markets, such as Peru, pose risks to Credicorp. These conditions can affect loan quality and overall financial performance. Credicorp needs to have strategies in place to manage these risks effectively.

Technological advancements require continuous investment in cybersecurity and IT infrastructure. Cyber threats and system instability are constant risks. Credicorp must invest in technology to protect against these risks.

Internal resource constraints, such as the availability of skilled talent in digital and technology fields, can hinder innovation. Attracting and retaining skilled professionals is crucial for Credicorp's ability to adapt to the changing market. This can impact Credicorp's expansion plans and strategies.

Cybersecurity threats are a significant concern for financial institutions. Credicorp must invest in robust cybersecurity measures to protect customer data and maintain operational stability. This is key for Credicorp's competitive advantages in the banking sector.

Credicorp employs several strategies to mitigate risks. These include robust risk management frameworks, diversified revenue streams, and proactive engagement with regulatory bodies. For instance, the company prioritizes cybersecurity and data protection as critical components of its operational resilience. These efforts are crucial for Credicorp's long-term growth potential.

Adapting to evolving market dynamics is essential for Credicorp's success. This involves continuous innovation, investment in technology, and a focus on customer needs. The company's ability to adapt and effectively manage these risks will be crucial for sustaining its long-term growth trajectory. To learn more, explore a detailed Credicorp company analysis.

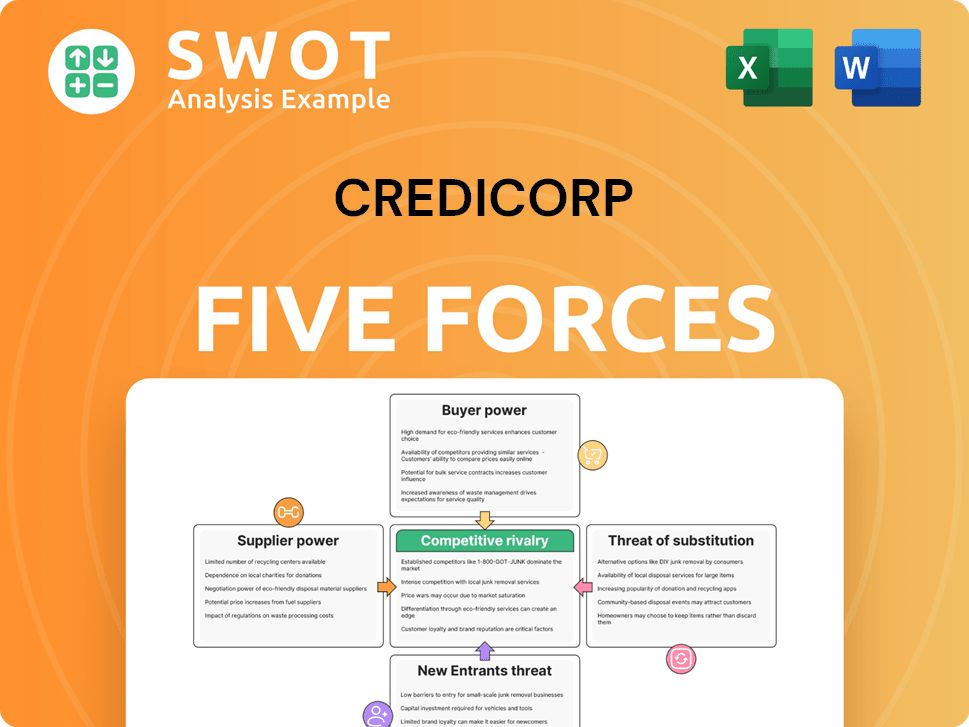

Credicorp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Credicorp Company?

- What is Competitive Landscape of Credicorp Company?

- How Does Credicorp Company Work?

- What is Sales and Marketing Strategy of Credicorp Company?

- What is Brief History of Credicorp Company?

- Who Owns Credicorp Company?

- What is Customer Demographics and Target Market of Credicorp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.