Plus500 Bundle

Can Plus500 Conquer the Future of Online Trading?

Plus500, a titan in the financial technology arena, is reshaping the landscape of online trading. Founded in 2008, the company has rapidly evolved, primarily offering Contracts for Difference (CFDs) and expanding through strategic acquisitions like Cunningham. This Plus500 SWOT Analysis provides insights into the firm's strengths and weaknesses.

This comprehensive analysis delves into Plus500's growth strategy and future prospects, examining its journey from a CFD trading platform to a global financial player. We'll explore its business model, market share, and competitive landscape, providing a detailed Plus500 company analysis to understand its potential for investors. Furthermore, we will assess its expansion plans, user base growth, and new product development to gauge its long-term viability in the dynamic world of online trading platform and financial technology, particularly in the realm of CFD trading.

How Is Plus500 Expanding Its Reach?

The growth strategy of the company centers on global expansion and product diversification. This approach aims to capitalize on the increasing demand for diverse trading instruments and to reach a broader customer base. By focusing on these areas, the company seeks to strengthen its market position and drive future growth within the competitive landscape of online trading platforms.

A key element of the company's expansion strategy involves penetrating new regulated markets. The acquisition of Cunningham Futures LLC in 2021 was a strategic move, enabling the company to offer futures trading in the highly regulated US market. This diversification beyond CFD trading is crucial for attracting a wider range of traders and enhancing the company's financial technology offerings.

The company's commitment to innovation is also evident in its efforts to develop new trading tools and features for its platform. This focus on improving the user experience is designed to attract both retail and professional clients. Strategic partnerships and sponsorships are also utilized to enhance brand visibility and attract new clients globally. For instance, the continued association with the Chicago Bulls aims to boost its presence in key markets.

The company is actively expanding into new regulated markets, with a strong focus on the US market. This expansion includes offering futures trading through the acquisition of Cunningham Futures LLC. This move allows the company to diversify its product offerings and reach a broader customer base in North America.

The company is enhancing its product portfolio by continuously adding new financial instruments available for CFD trading. It is also exploring new asset classes to cater to a wider range of traders. This strategy aims to provide more trading options and attract both retail and professional clients.

The company is dedicated to improving its trading platform by developing new tools and features. These enhancements aim to improve the user experience and attract a wider range of traders. The focus is on making the platform more user-friendly and competitive in the market.

Strategic partnerships and sponsorships are key to enhancing brand visibility and attracting new clients globally. For example, the continued association with the Chicago Bulls helps to increase brand awareness. These partnerships are crucial for expanding the company's reach.

The company reported a significant increase in customer income, reaching $203.3 million in Q1 2024. The average revenue per user also increased to $3,212 in Q1 2024, indicating successful client acquisition and engagement strategies. These figures reflect the effectiveness of the company's growth strategy and its ability to attract and retain clients. For more insights into the company's core values, consider reading about Mission, Vision & Core Values of Plus500.

- The company's expansion into new markets, particularly the US, is a key driver of growth.

- Product diversification, including the addition of new financial instruments, enhances the company's appeal.

- Platform enhancements and strategic partnerships contribute to increased user engagement and brand visibility.

- The financial results from Q1 2024 demonstrate the success of these strategies.

Plus500 SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Plus500 Invest in Innovation?

The core of the Plus500 growth strategy is its commitment to technology and innovation. The company focuses heavily on in-house development to control its trading platform and ensure a smooth user experience. This approach is key to maintaining a competitive edge in the dynamic world of financial technology.

Significant investments are made in research and development (R&D) to enhance its technological infrastructure. This includes improvements to trading functionalities and the introduction of new features. The goal is to stay ahead in the competitive online trading platform market.

Plus500 is actively engaged in digital transformation to boost operational efficiency. This involves using advanced analytics and potentially artificial intelligence (AI) to optimize customer support, personalize marketing, and improve risk management. The company's platform processes millions of transactions monthly, highlighting its robust technological infrastructure.

Plus500 prioritizes in-house development to maintain control over its trading platform. This allows for quicker updates and the ability to tailor the platform to user needs. This approach is crucial for staying competitive in the online trading sector.

The company continuously invests in research and development. These investments enhance trading functionalities and introduce new features. This ensures the platform remains user-friendly and technologically advanced.

Plus500 is undergoing digital transformation to improve operational efficiency. This includes using advanced analytics and AI. The aim is to optimize customer support and enhance risk management systems.

A mobile-first approach is a key element of Plus500's strategy. The platform is designed to be intuitive and accessible on mobile devices. This caters to a broad range of users, reflecting the trend towards mobile trading.

Plus500's platform handles a high volume of transactions. This underscores the robustness of its technological infrastructure. The ability to process millions of transactions monthly is a testament to its technological capabilities.

Advancements in algorithmic trading capabilities are a focus for Plus500. This helps improve trading efficiency and provides users with more sophisticated tools. The company is always looking to provide new features.

Plus500's technological strategy involves continuous platform upgrades and new product introductions. This helps the company maintain its position in the competitive CFD trading market.

- In-House Development: Maintaining control over the platform.

- R&D Focus: Investing in new features and functionalities.

- Digital Transformation: Using AI and advanced analytics.

- Mobile-First Design: Ensuring accessibility and user-friendliness.

Plus500 PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Plus500’s Growth Forecast?

The financial outlook for Plus500 is robust, supported by strong performance indicators and strategic initiatives. The company's financial health is reflected in its Q1 2024 results, which demonstrate a solid foundation for future expansion. This positive trajectory is further reinforced by the company's strategic focus on capital allocation and market expansion, positioning it well within the competitive landscape of the online trading platform sector.

In Q1 2024, Plus500 reported impressive figures, with customer income reaching $203.3 million. This performance, coupled with an increase in Average Revenue Per User (ARPU) to $3,212, highlights the company's ability to generate substantial revenue from its user base. The company’s commitment to enhancing shareholder value is evident through its share buyback program, further signaling confidence in its financial stability and future prospects.

The company's financial strategy is designed to support its growth ambitions through disciplined capital allocation. This approach focuses on both organic growth initiatives and strategic acquisitions, aiming to maintain strong profit margins while investing in technology and expanding into new markets. The company's consistent profitability and robust balance sheet provide a solid foundation for executing its long-term strategic plans, which is crucial for navigating potential market fluctuations. For a detailed look at the company's target audience, you can read more about the Target Market of Plus500.

Plus500's growth strategy centers on expanding its user base and increasing revenue through enhanced trading platform offerings. This includes continuous investment in technology to improve user experience and expand its product range. The company focuses on strategic acquisitions to enter new markets and consolidate its position in the financial technology sector.

The company's financial results for Q1 2024 showcase its strong performance, with customer income of $203.3 million and an ARPU of $3,212. The EBITDA for the same period was $96.0 million, with an EBITDA margin of 47%. These figures highlight Plus500's ability to generate significant profits, which supports its expansion plans.

Plus500 maintains a significant market share within the CFD trading industry, driven by its user-friendly platform and competitive offerings. The company continuously works on improving its market position through strategic marketing and product development. Its market share is supported by its strong financial performance and regulatory compliance.

The competitive landscape for Plus500 includes other major online trading platforms, which necessitates continuous innovation and strategic differentiation. The company competes by offering a wide range of financial instruments and ensuring a secure and reliable trading environment. The company's focus on technology and customer service helps it stand out.

The future prospects for Plus500 are positive, with analysts anticipating continued revenue growth driven by increased customer engagement and expansion into new markets. The company's strategic investments in technology and market expansion are expected to drive further growth. The company's focus on regulatory compliance ensures it can operate effectively in various markets.

- Expansion into new markets.

- Continued investment in technology.

- Strategic acquisitions.

- Focus on shareholder returns.

Plus500 Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Plus500’s Growth?

The path for Plus500, while promising, is not without its hurdles. Several potential risks and obstacles could influence the company's future. Understanding these challenges is crucial for a comprehensive analysis of Plus500's growth strategy and future prospects.

Market dynamics, regulatory changes, and technological advancements all pose significant threats. Successfully navigating these areas will be key to sustaining Plus500's growth trajectory. A thorough Plus500 company analysis must consider these factors.

Intense competition, evolving regulations, and rapid technological shifts are key areas of concern for Plus500. Addressing these challenges proactively will be critical for the company's continued success in the online trading platform space.

The online trading platform market is highly competitive. Numerous established and emerging platforms compete for market share. This competition can lead to pressure on spreads, potentially impacting profitability, and increased marketing costs.

Regulatory changes pose a significant risk. The online trading industry, especially CFD trading, is subject to evolving regulations across different jurisdictions. Stricter regulations, such as leverage restrictions or product bans, could negatively impact revenue and operational flexibility.

Technological disruption is a continuous threat. Rapid advancements in areas like blockchain and decentralized finance could introduce new business models that challenge traditional online trading platforms. Staying ahead in this area is crucial.

Attracting and retaining top talent in a competitive tech landscape can hinder innovation and growth. Internal resource constraints, such as securing skilled personnel, could affect Plus500's ability to adapt and innovate. The company needs to invest in its human capital.

Plus500 mitigates risks through geographical diversification. Operating under multiple regulatory licenses helps to spread risk. This strategy is crucial to reduce the impact of any single regulatory change or market downturn. Diversification is key for a stable performance.

Maintaining a robust risk management framework is essential. Plus500 continuously monitors the regulatory landscape and adapts its offerings to ensure compliance. This proactive approach helps in navigating the complex regulatory environment.

For instance, Plus500's expansion into the US futures market demonstrates a strategic move to diversify revenue streams away from potentially more restrictive CFD markets. To better understand how Plus500 approaches marketing in this competitive landscape, you can read about the Marketing Strategy of Plus500.

The online trading sector is highly competitive, with numerous platforms vying for market share. This competition can lead to lower profit margins. Marketing expenses are also likely to increase to attract and retain customers.

The regulatory environment for CFD trading is constantly evolving, with varying rules across different regions. Stricter regulations, such as leverage limits, could impact revenue. Maintaining compliance requires significant resources and constant monitoring.

Rapid technological changes could introduce new business models that challenge traditional platforms. Investments in technology are essential for staying competitive. The company must continuously innovate to avoid obsolescence.

Attracting and retaining skilled employees in a competitive tech environment can be difficult. Internal resource constraints, such as securing top talent, could impact innovation. Efficient operations and management are key to success.

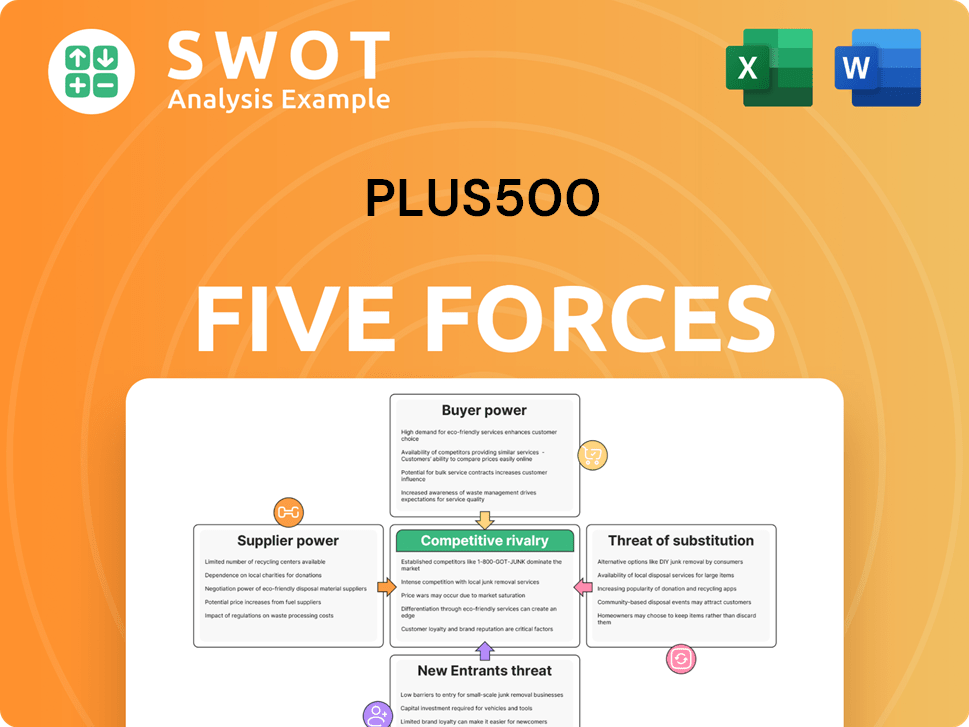

Plus500 Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Plus500 Company?

- What is Competitive Landscape of Plus500 Company?

- How Does Plus500 Company Work?

- What is Sales and Marketing Strategy of Plus500 Company?

- What is Brief History of Plus500 Company?

- Who Owns Plus500 Company?

- What is Customer Demographics and Target Market of Plus500 Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.