Plus500 Bundle

Who Trades with Plus500?

In the fast-paced world of online trading, understanding the Plus500 SWOT Analysis is crucial for success. Plus500, a prominent player in the FinTech sector, offers a platform for trading various financial instruments. But who exactly are the individuals and groups that make up the Plus500 target market? This deep dive explores the customer demographics Plus500 and the evolving Plus500 customer profile.

From seasoned professionals to novice investors, the Plus500 traders represent a diverse group. This analysis examines the characteristics of these online trading platform users, including their age, location, income, and trading experience. By understanding the financial trading demographics, we can better grasp how Plus500 tailors its services and strategies to meet the needs of its global clientele and maintain its competitive edge in the market.

Who Are Plus500’s Main Customers?

The primary customer segment for Plus500 consists of individual retail traders. These are typically consumers who use the online platform to trade Contracts for Difference (CFDs) on various financial instruments. While specific details on the exact customer demographics are not always publicly disclosed, the nature of CFD trading suggests a target market comfortable with online financial transactions and a certain level of risk tolerance. The company's platform is designed to be accessible, potentially attracting both novice and experienced traders.

The company's customer base is global, reflecting its international presence and the accessibility of its online platform. The target market includes individuals seeking to participate in financial markets, with the platform's user-friendly interface and diverse range of instruments likely appealing to a broad audience. Plus500's focus on regulated markets and risk management tools also attracts clients who prioritize security and compliance. The company's customer acquisition strategy is likely multi-faceted, encompassing digital marketing and partnerships to reach its target demographic.

Understanding the customer demographics Plus500 serves is crucial for assessing its market position. The platform's appeal extends to individuals interested in financial trading, from those with limited experience to seasoned investors. The company's approach to risk management and regulatory compliance is likely to attract a segment of the market that values security and transparency. The user base analysis suggests a diverse group of traders, united by their interest in online financial trading.

The platform attracts a wide range of Plus500 traders, from beginners to experienced investors. The user base includes individuals interested in trading CFDs on various financial instruments. The platform's accessibility and user-friendly interface make it attractive to those new to online trading, while its range of instruments caters to more experienced traders.

The Plus500 customer profile typically includes individuals comfortable with online financial transactions and a certain level of risk tolerance. These users are interested in trading CFDs on various financial instruments. The platform's focus on regulated markets and risk management tools also attracts clients who prioritize security and compliance.

The Plus500 target market is global, with a focus on individual retail traders. These traders use the platform to trade CFDs on various financial instruments. The platform's accessibility and user-friendly interface appeal to a broad audience, including both novice and experienced traders. The company's strategic focus on regulated markets also indicates a significant portion of its revenue comes from these regions.

Online trading platform users who are interested in financial markets are the primary users of the platform. These users are interested in trading CFDs on various financial instruments. The platform's accessibility and user-friendly interface appeal to a broad audience. The company's focus on regulated markets and risk management tools also attracts clients who prioritize security and compliance.

Plus500's customer base is primarily composed of individual retail traders who engage in online CFD trading. These traders are typically comfortable with online financial transactions and have a certain level of risk tolerance. The platform's appeal extends to both novice and experienced traders, with a global reach facilitated by its accessible interface and diverse range of trading instruments. For more insights into the company's structure, you can read about the Owners & Shareholders of Plus500.

- User Demographics: While precise data on Plus500 customer age range, Plus500 gender demographics, Plus500 customer income levels, and Plus500 education levels of users are not publicly available, the platform likely attracts a diverse group.

- Geographic Distribution: The user base is global, with strong performance in key markets such as Europe and Australia.

- Trading Experience: The platform caters to traders with varying levels of experience, from beginners to seasoned investors.

- Customer Behavior: Plus500 customer behavior patterns are influenced by market conditions, risk management tools, and the availability of trading instruments.

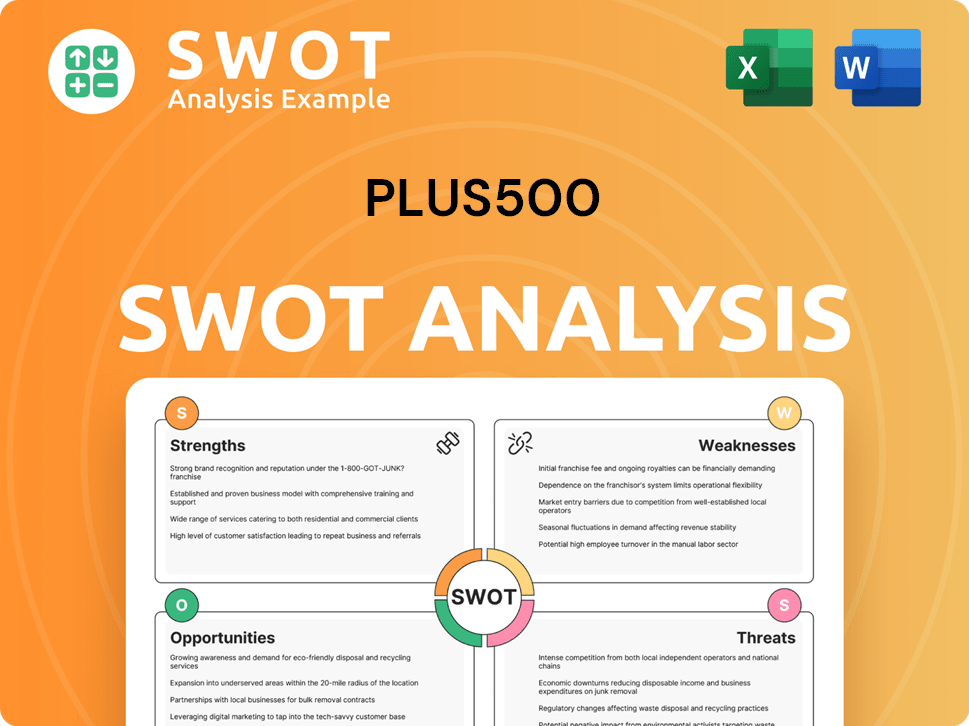

Plus500 SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Plus500’s Customers Want?

Customers choosing the platform are driven by a combination of practical, psychological, and aspirational needs. They seek a platform for leveraged trading across various financial instruments, including forex, indices, commodities, shares, and cryptocurrencies. Key factors in their decisions often include competitive spreads, a user-friendly interface, reliability, and strong regulatory compliance.

Psychologically, traders are motivated by the potential for financial gain and the excitement of market participation. Aspirational drivers include achieving financial independence or supplementing income through trading. The platform provides real-time market data and a platform that allows for quick execution of trades, catering to these needs.

The company's revenue model, primarily based on spreads, directly addresses the need for clear pricing in trading. The provision of risk management tools, such as stop-loss and guaranteed stop-loss orders, caters to the need for managing potential losses and provides a sense of security. The company's commitment to regulatory compliance also addresses a crucial need for trust and security in the often-volatile world of online trading.

Customers need a reliable platform for leveraged trading. They require access to a diverse range of financial instruments. Competitive spreads and a user-friendly interface are essential.

Traders are motivated by the potential for financial gain and the excitement of market participation. They seek platforms that offer real-time market data and quick trade execution. Risk management tools are crucial for security.

Customers aspire to achieve financial independence or supplement their income. They look for platforms that offer educational resources and diversified investment options. Regulatory compliance builds trust.

Competitive spreads, a user-friendly interface, reliability, and robust regulatory compliance are key. Clear pricing and risk management tools are also important. The platform continually updates and introduces new features.

The company's revenue model is primarily based on spreads. This directly addresses the need for clear pricing in trading. This model helps in attracting and retaining customers.

Risk management tools, like stop-loss orders, are provided. These tools cater to the need for managing potential losses. This provides a sense of security for traders.

The platform continually updates its platform and introduces new features, such as the Plus500 Invest platform for stock trading and the Plus500 Trading Academy, which indicates a response to evolving customer preferences for diversified investment options and educational resources. Understanding the needs and preferences of the Growth Strategy of Plus500 is crucial for the platform's success.

The platform's customers are driven by practical, psychological, and aspirational needs. They seek a reliable and user-friendly platform for leveraged trading. The company addresses these needs through competitive pricing, risk management tools, and educational resources.

- Diverse Trading Instruments: Customers need access to a wide range of financial instruments, including forex, indices, commodities, shares, and cryptocurrencies.

- Competitive Spreads: Traders prioritize platforms with competitive spreads to maximize potential profits.

- User-Friendly Interface: A simple and intuitive interface is essential for ease of use and quick trade execution.

- Risk Management Tools: Tools like stop-loss and guaranteed stop-loss orders are crucial for managing potential losses.

- Regulatory Compliance: Customers value platforms that are compliant with regulations to ensure trust and security.

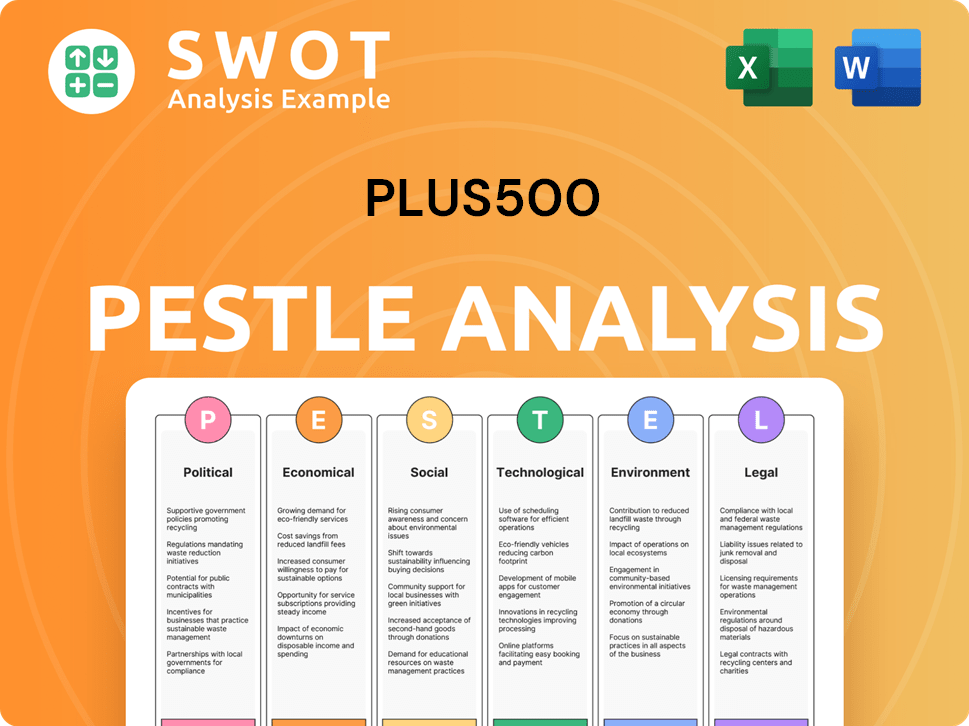

Plus500 PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Plus500 operate?

The geographical market presence of Plus500 is extensive, spanning across multiple continents. Key markets for the company include Europe, Australia, and Asia. This global footprint is a crucial aspect of its business strategy, enabling it to reach a diverse customer base and capitalize on opportunities in various regions.

Plus500's operations are particularly strong in regulated jurisdictions. The company holds licenses and maintains a significant market share in countries like the UK, Cyprus, Australia, and Singapore. These regulated environments are essential for building trust and ensuring compliance with local financial regulations, which is critical for attracting and retaining customers.

To cater to its global audience, Plus500 employs localized strategies. These include offering its trading platform in multiple languages and providing customer support tailored to regional time zones. Additionally, the company adapts to specific regulatory requirements in each country it operates in, ensuring compliance and maintaining its operational integrity. Recent expansions, such as the acquisition of a Japanese FX license in 2024, highlight the company's commitment to diversifying its geographical reach and tapping into new growth markets.

Plus500's primary markets are concentrated in Europe, Australia, and Asia. These regions represent the core of its operational activity and revenue generation.

The company operates under licenses from financial authorities such as the FCA, CySEC, ASIC, and MAS. Compliance with these regulatory bodies is paramount.

Plus500 offers its platform in multiple languages and provides customer support tailored to regional time zones. This approach helps to meet the needs of its diverse customer base.

Recent acquisitions, such as a Japanese FX license in 2024, demonstrate Plus500's strategy to diversify its geographical footprint and explore new growth opportunities. For more insights, explore the Competitors Landscape of Plus500.

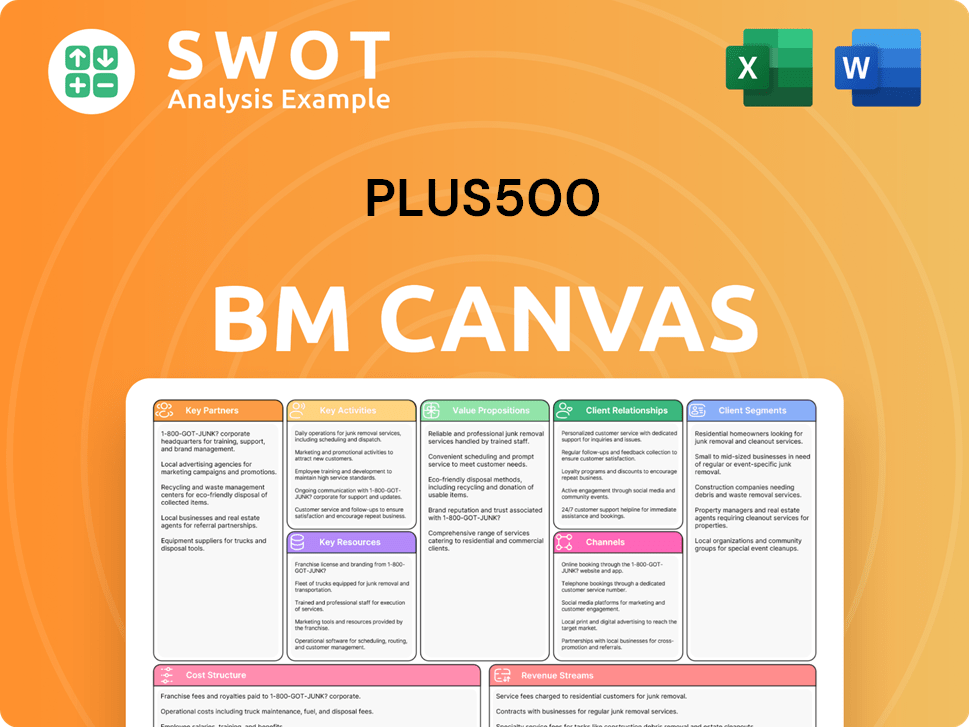

Plus500 Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Plus500 Win & Keep Customers?

The company's customer acquisition and retention strategies are pivotal for its sustained success in the competitive online trading market. These strategies are geared toward attracting new Plus500 traders while also fostering loyalty among existing users. The firm employs a data-driven approach to understand and cater to its Plus500 customer profile, ensuring that marketing and platform features align with the needs of its diverse user base.

Customer acquisition is primarily achieved through digital marketing channels, including online advertising, search engine marketing (SEM), and strategic partnerships. These efforts are designed to reach a broad audience of potential online trading platform users. The company emphasizes its user-friendly platform, competitive spreads, and the wide array of instruments available for trading to attract new customers. Social media and affiliate marketing also contribute to expanding its reach.

Retention strategies focus on providing a superior trading experience, robust customer support, and continuous platform enhancements. The availability of diverse financial instruments, including shares on the Invest platform, encourages users to remain active. The company's commitment to regulatory compliance and transparent pricing builds trust, which is crucial for long-term customer relationships. Customer data and CRM systems are undoubtedly utilized to segment clients and tailor marketing messages and product offerings.

The company heavily relies on digital marketing strategies, including online advertising and SEM, to attract new customers. These channels are essential for reaching a broad audience interested in online trading. These efforts are designed to reach a broad audience of potential online trading platform users.

Continuous platform improvements and the addition of new financial instruments, such as shares on the Invest platform, are key for keeping users engaged. Regular updates and new features enhance the trading experience and encourage user retention. This approach helps in maintaining a competitive edge in the market.

Robust customer support is a cornerstone of the company's retention strategy. Providing excellent support helps build trust and ensures customer satisfaction. Prompt and helpful support addresses user queries and resolves issues efficiently.

The company's commitment to regulatory compliance and transparent pricing builds trust with its customers. This transparency is crucial for establishing long-term customer relationships. This builds trust and encourages customer loyalty.

The company's consistent profitability and strong customer base, as evidenced in its 2024 trading updates, suggest effective acquisition and retention strategies, with a focus on sustainable growth through regulated markets. The understanding of customer demographics Plus500 allows for targeted marketing efforts and the tailoring of product offerings to meet the needs of its diverse user base. For a deeper dive into the strategies, consider exploring the Marketing Strategy of Plus500.

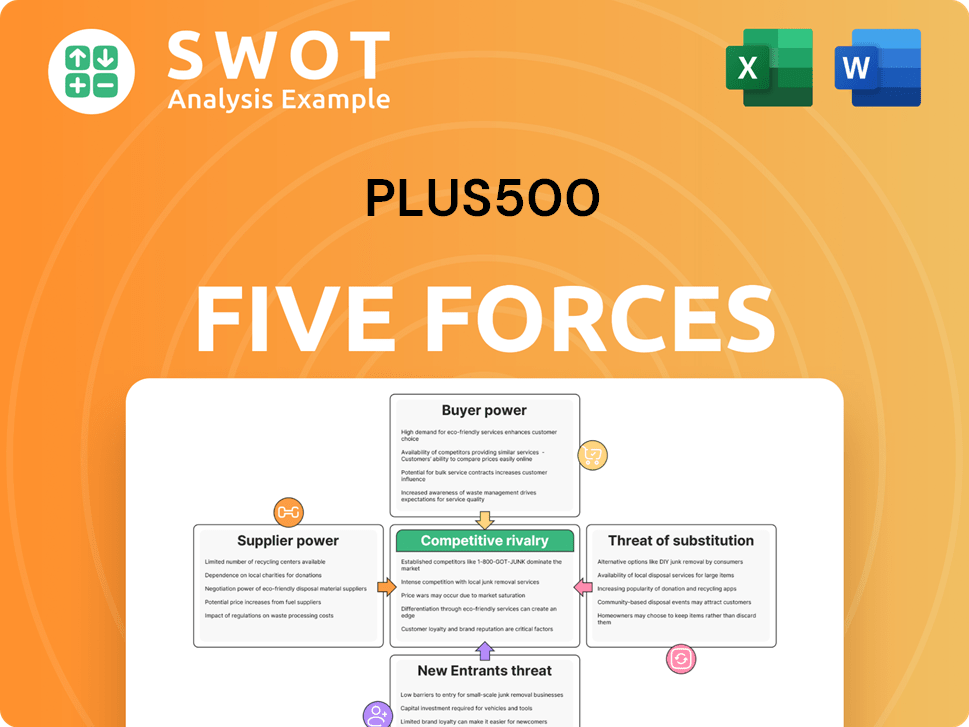

Plus500 Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Plus500 Company?

- What is Competitive Landscape of Plus500 Company?

- What is Growth Strategy and Future Prospects of Plus500 Company?

- How Does Plus500 Company Work?

- What is Sales and Marketing Strategy of Plus500 Company?

- What is Brief History of Plus500 Company?

- Who Owns Plus500 Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.