Plus500 Bundle

How Does Plus500 Thrive in the Online Trading Arena?

Plus500, a leading fintech firm, has become a significant force in online trading, especially known for its Contracts for Difference (CFDs). In 2024, the company's revenue reached $768.3 million, reflecting a 6% increase and solidifying its market influence. Listed on the London Stock Exchange and part of the FTSE 250 Index, Plus500's established presence demands a closer look.

This Plus500 SWOT Analysis reveals the inner workings of a company that has consistently shown robust financial performance. Understanding the Plus500 platform and its operational model is crucial for anyone involved in financial trading. Whether you're a seasoned investor or new to CFD trading, exploring how Plus500 operates provides valuable insights into its strategies, competitive advantages, and potential risks.

What Are the Key Operations Driving Plus500’s Success?

The core operations of Plus500 center around its proprietary, technology-driven trading platforms, designed for online trading. This approach allows the company to deliver its services globally to a wide customer base. The primary offering is Contracts for Difference (CFDs) across various financial instruments, including shares, forex pairs, commodities, options, and indices.

Plus500's value proposition is built on providing an accessible and user-friendly trading experience. This includes a wide range of tradable assets and responsive customer support. The company's operational efficiency, with a lean and flexible business model, allows it to adapt quickly to market changes.

The company has expanded its offerings beyond CFDs to include market infrastructure services and proprietary trading platforms for futures and options on futures markets, as well as a share dealing platform. This diversification supports its growth strategy. The platforms are accessible across multiple operating systems and web browsers. The company has a localized approach, tailoring services to retail traders in regions like Japan and the UAE. The company's supply chain and distribution networks are primarily digital, leveraging its technology to provide direct market access. The company's lean and flexible business model, with 70% of its costs being variable in FY 2024, provides significant agility.

Plus500 offers Contracts for Difference (CFDs) on a range of financial instruments. These include shares, forex pairs, commodities, options, and indices. The company also provides market infrastructure services.

The company uses its proprietary technology to power its trading platforms. These platforms are accessible on multiple operating systems and web browsers. This ensures broad reach and user convenience for CFD trading.

Plus500 focuses on providing an easy-to-use platform with a wide range of tradable assets. It offers responsive 24/7 chat support. The company aims to provide a seamless experience for its users in financial trading.

Plus500's business model is lean and flexible, with a high percentage of variable costs. This allows the company to respond quickly to market and regulatory changes. The company's focus on efficiency translates into customer benefits.

The Plus500 platform offers a wide variety of financial instruments for online trading. The platform is designed to be user-friendly, with a focus on customer support and accessibility. The company's operational efficiency is a key factor in its ability to provide competitive services.

- Proprietary trading platforms.

- Wide range of tradable assets (over 2,800 CFD instruments).

- Responsive 24/7 chat support.

- Localized services for different regions.

Plus500 SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Plus500 Make Money?

Understanding how Owners & Shareholders of Plus500 generates revenue is key to grasping its business model. The company primarily profits from spreads, the difference between the buying and selling prices of Contracts for Difference (CFDs). This approach is central to its financial trading operations.

In FY 2024, Plus500 demonstrated a robust financial performance. The company's total revenue reached $768.3 million, marking a 6% increase from the previous year. This growth reflects the effectiveness of its monetization strategies within the online trading sector.

The revenue streams of Plus500 are multifaceted, with spreads being the primary source. However, the company has expanded into other areas to diversify its income sources. This diversification is crucial for sustaining growth and adapting to market changes within the financial trading industry.

The company's revenue model includes several key components. The primary revenue source is trading income derived from CFDs, which accounted for $711.6 million in FY 2024. Interest income also contributes, reaching $56.7 million in the same period. Customer income, a critical measure of underlying performance, was $667.6 million in FY 2024.

- Spreads: The core revenue generator, representing the difference between buy and sell prices in CFD trading.

- Non-OTC Business: Expansion into non-Over-the-Counter businesses, such as share dealing and futures trading, contributes to the revenue mix. In FY 2024, this segment accounted for approximately 10% of total Group revenue and 15% of new customer acquisition.

- Customer Focus: Attracting and retaining higher-value customers is a key strategy. The average deposit per active customer increased by 17% to approximately $12,000 in FY 2024, indicating a focus on customer value.

- Cost Structure: The company operates with a high proportion of variable costs, which was 70% in FY 2024, providing flexibility in its cost base.

Plus500 PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Plus500’s Business Model?

The evolution of Plus500 from a single-product provider to a diversified, multi-asset global fintech group marks a significant milestone. This transformation involves strategic expansion into new markets and continuous product development. The company's ability to adapt and innovate has been crucial in navigating dynamic market conditions and maintaining its competitive edge in the financial trading sector.

In January 2025, Plus500 launched its multi-asset offering for the Japanese market, including new OTC products based on Indices, Equities, and ETFs, demonstrating its commitment to structural growth. Further expansion included securing regulatory approvals and clearing memberships to broaden its global reach. These strategic moves highlight Plus500's proactive approach to growth and its dedication to meeting the evolving needs of its customers.

Plus500's strategic focus on technology and customer acquisition has led to impressive results. Investing in marketing technology resulted in a 30% year-on-year increase in new customer acquisition in FY 2024, reaching 118,010 new users. The company's commitment to returning capital to shareholders, with $200 million announced in February 2025, underscores its strong financial health and strategic vision.

Plus500's journey includes significant milestones, such as its multi-asset launch in Japan in January 2025 and securing regulatory approvals in new regions. These achievements reflect the company's strategic expansion and its ability to adapt to new market opportunities. The company's focus on innovation and regulatory compliance has been key to its growth.

Strategic moves include investments in marketing technology, which boosted customer acquisition, and obtaining clearing memberships. These actions demonstrate Plus500's commitment to enhancing its platform and expanding its global presence. The company's focus on technology and customer engagement is central to its strategy.

Plus500's competitive advantages include its proprietary technology, extensive regulatory licenses, and strong financial position. The company's cash-generative business model and commitment to returning capital to shareholders further solidify its position. This combination of factors provides a robust foundation for continued success in the financial trading market.

Plus500's financial strength is evident in its $890.0 million in cash and cash equivalents at the end of FY 2024. The company's commitment to returning capital to shareholders, with $200 million announced in February 2025, demonstrates its financial health. Plus500's debt-free status since inception further highlights its robust financial standing.

Plus500's success is driven by its proprietary technology, which enables efficient customer acquisition and an intuitive trading experience. Its global portfolio of 14 regulatory licenses provides a solid foundation for international operations. The company's financial strength, including a debt-free status and significant cash reserves, supports its strategic initiatives.

- Market-leading proprietary technology.

- Extensive global regulatory licenses.

- Strong financial position and cash-generative business model.

- Commitment to returning capital to shareholders.

Plus500 Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Plus500 Positioning Itself for Continued Success?

The company, operating under the name, holds a strong position in the online trading industry. It is recognized as a global multi-asset fintech group, utilizing proprietary technology-based trading platforms. Listed on the London Stock Exchange and part of the FTSE 250 Index, the company has established a significant presence in the financial trading sector.

By the end of 2024, the customer base had grown to over 30 million registered customers worldwide. In FY 2024, the number of active customers increased by 9% to 254,138, and total customer deposits reached a record $3.0 billion, highlighting its financial trading capabilities.

The company is a major player in the online trading space. It operates globally, offering a proprietary technology-based trading platform. It is listed on the London Stock Exchange, indicating a strong market presence.

Regulatory changes pose a significant risk, given the highly regulated nature of CFD trading. Technological disruption is another ongoing risk that the company addresses through continuous investment. The company's operations are also subject to risks associated with the financial markets.

The company plans to expand into new markets and develop new products. Entry into the Japanese market with a multi-asset offering in January 2025 is a key step. The company aims to focus on higher-value customers and leverage its technological marketing capabilities.

The company is focused on expanding its global footprint and enhancing its product offerings. It is committed to technological advancements to improve its trading platform. The company is also focused on customer engagement and retention.

The company's strategy involves expanding into new markets and developing new products to drive growth. The entry into the Japanese market in January 2025 with a multi-asset offering is a prime example of this expansion. The company is also focused on increasing customer engagement to boost its revenue and market share.

- Focus on higher-value customers to increase profitability.

- Leverage technological marketing capabilities to drive customer acquisition.

- Continuous investment in proprietary technology for platform improvement.

- Expansion into new markets to diversify revenue streams.

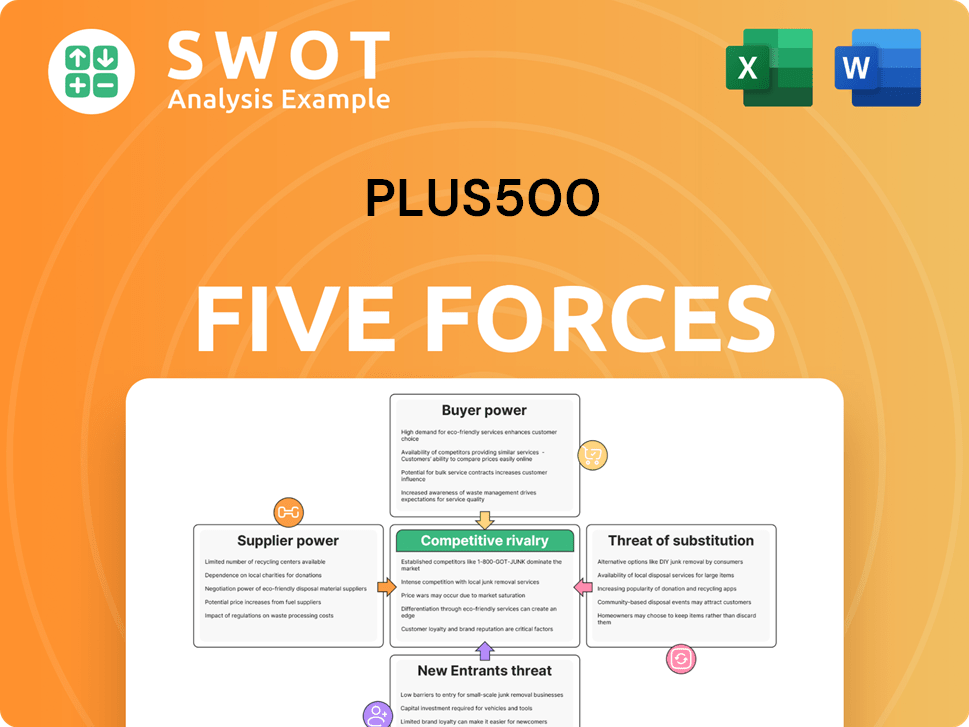

Plus500 Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Plus500 Company?

- What is Competitive Landscape of Plus500 Company?

- What is Growth Strategy and Future Prospects of Plus500 Company?

- What is Sales and Marketing Strategy of Plus500 Company?

- What is Brief History of Plus500 Company?

- Who Owns Plus500 Company?

- What is Customer Demographics and Target Market of Plus500 Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.