Plus500 Bundle

Who Really Owns Plus500?

Ever wondered who steers the ship at one of the leading online trading platforms? Unraveling the Plus500 SWOT Analysis is just the beginning. Understanding the Plus500 owner and Plus500 ownership structure is critical for investors and anyone interested in the financial markets. This exploration delves into the Plus500 company's journey, from its origins to its current status as a publicly traded entity.

From its IPO on the London Stock Exchange in 2013, the Plus500 stock has seen significant shifts in ownership. This examination of Plus500's history will uncover the key players, from the initial founders to the institutional investors who now hold sway. Discover the answers to questions like "Who owns Plus500?" and "Who is the CEO of Plus500?" as we dissect the Plus500 ownership details.

Who Founded Plus500?

The origins of the financial trading platform, are rooted in 2008, with its inception by six alumni from the Technion – Israel Institute of Technology. Initially operating under the name Investsoft Ltd., the company later rebranded to its current name in June 2012.

Alon Gonen, one of the founders, played a crucial role in the company's development. He served as managing director, focusing on financial risk management and strategic planning. This early leadership set the stage for the platform's growth in the competitive CFD trading market.

The early ownership structure of the company reflects the vision of its founders for a technology-driven trading platform. This structure allowed them to monetize a portion of their investment while maintaining a substantial stake in the company's future.

Founded in 2008 by six Technion – Israel Institute of Technology alumni.

Initially known as Investsoft Ltd. before rebranding in June 2012.

Alon Gonen, instrumental in development, focused on financial risk and strategy.

Completed an IPO on the London Stock Exchange's AIM market in July 2013.

Raised $75 million, with $25 million going to the company and $50 million to shareholders.

Founders retained a significant aggregate ownership of 22.2% after the IPO.

The initial years of the company saw the founders maintain significant ownership. The IPO in July 2013 marked a pivotal moment, raising $75 million. Of this, $25 million went to the company, while $50 million was distributed among existing shareholders. Following the IPO, the founders collectively retained a substantial 22.2% ownership stake, a decrease from the 53% they held before the listing. For instance, Alon Gonen sold shares for $78 million during the IPO, while still retaining stock holdings valued at $177 million. This demonstrates the founders' ability to capitalize on their investment while remaining committed to the company's long-term success. To learn more about the company's expansion, you can read about the Growth Strategy of Plus500.

The founders initially held the majority of the shares. The IPO allowed them to monetize their investments while maintaining a significant stake.

- Founders' initial ownership was dominant.

- IPO in July 2013 raised $75 million.

- Founders' ownership decreased to 22.2% post-IPO.

- Alon Gonen sold shares for $78 million during the IPO.

- Gonen's remaining holdings were valued at $177 million.

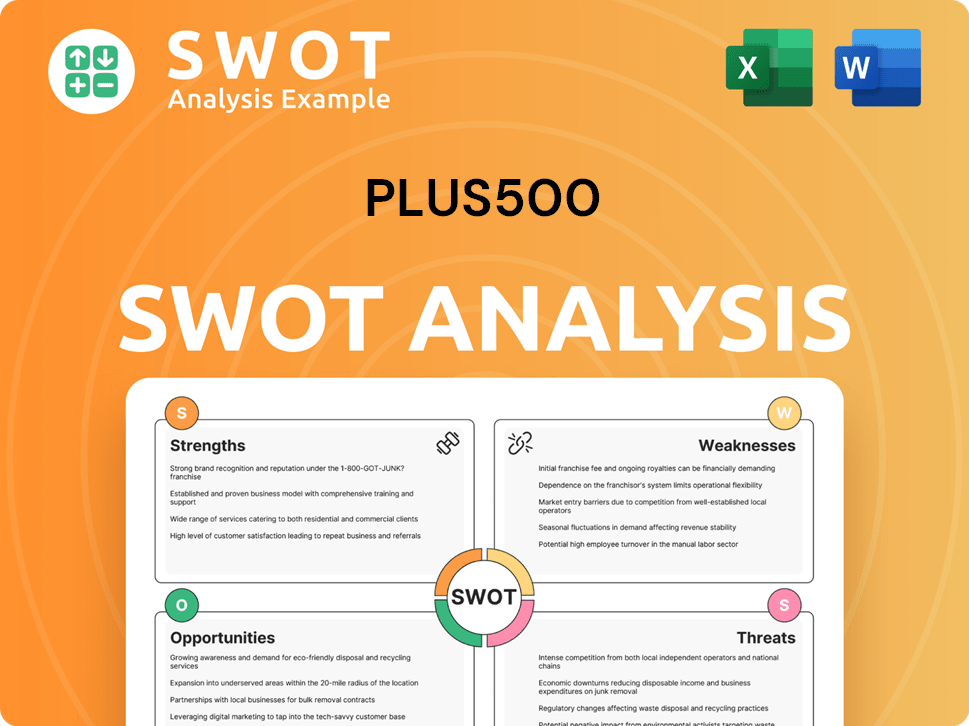

Plus500 SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Plus500’s Ownership Changed Over Time?

The ownership structure of the Plus500 company has seen significant changes since its initial public offering (IPO) in 2013. The IPO, which occurred on the London Stock Exchange, initially valued the company at $202 million. By December 2024, the total market value of Plus500 peaked at $2.49 billion, reflecting substantial growth and market confidence in the company.

Since its IPO, Plus500 has provided impressive returns to its shareholders. By the end of 2024, the company had returned approximately $2.5 billion to shareholders through dividends and share buybacks. Over the same period, Plus500 generated around $3.5 billion in cash from its operations. This has resulted in a total return to shareholders of about 6,000% since its 2013 listing up to December 31, 2024, making it the best-performing share in the FTSE All-Share Index based on total return.

| Shareholder | Percentage of Voting Rights (March 2025) | Notes |

|---|---|---|

| BlackRock | 6.7% | Major institutional investor |

| JP Morgan | 5.5% | Significant shareholder |

| Capital Group | 5.44% | Recently acquired stake |

| The Vanguard Group | 5.41% | Notable institutional investor |

As of March 2025, the major institutional shareholders in Plus500 include BlackRock, holding 6.7% of the company's voting rights, and JP Morgan with 5.5%. Capital Group recently acquired a 5.44% stake, and The Vanguard Group controls a significant 5.41% of the shares. Other institutional investors, as of 2021 and 2024, include Rathbones Investment Management Ltd. (3.19%), Norges Bank Investment Management (2.563%), and SEB Investment Management AB (2.004%). These shifts in major shareholding reflect a growing institutional interest in Plus500, influencing company strategy and governance through their significant voting power.

The ownership of Plus500 has evolved significantly since its IPO in 2013, with substantial returns to shareholders.

- Institutional investors like BlackRock, JP Morgan, and Capital Group hold significant stakes.

- The company's market capitalization has grown considerably, reflecting investor confidence.

- Understanding the ownership structure is crucial for assessing the company's strategic direction.

- The shift in major shareholding reflects a growing institutional interest in Plus500.

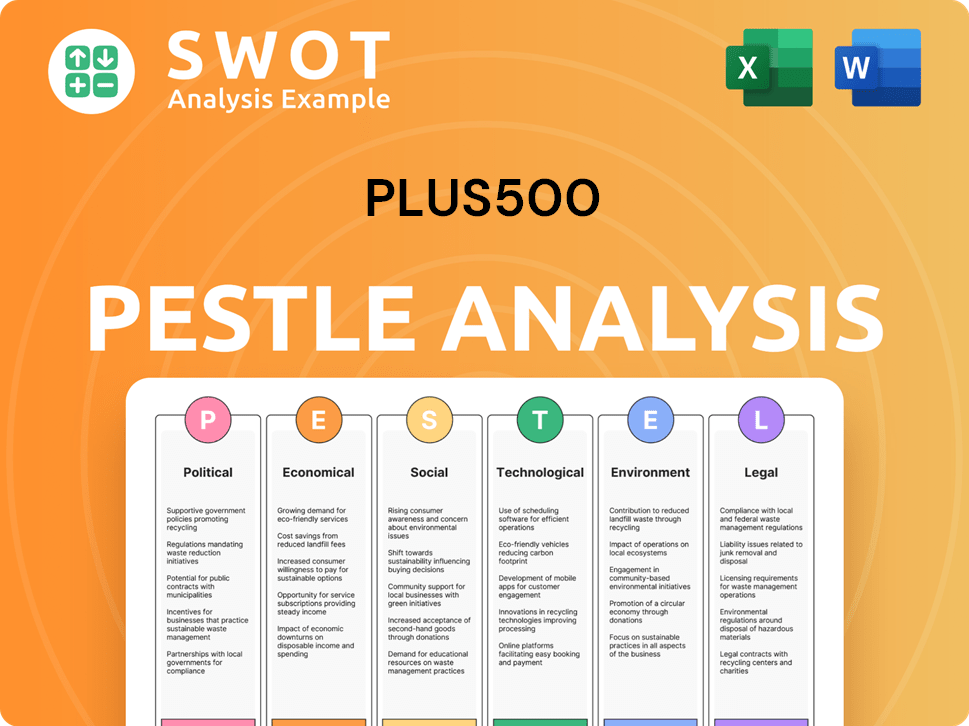

Plus500 PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Plus500’s Board?

The current board of directors of the Plus500 company is composed of key individuals who steer its strategic direction and ensure effective governance. The board includes Professor Jacob Frenkel as the Independent Non-Executive Director and Chairman, and David Zruia as the Group Chief Executive Officer and Director. Elad Even-Chen serves as the Group Chief Financial Officer and Director. The board also benefits from the expertise of independent non-executive directors such as Professor Varda Liberman, Daniel King, Tami Gottlieb, and Steve Baldwin.

This structure reflects a mix of executive leadership, major shareholder representation, and independent oversight, which is crucial for maintaining investor confidence and ensuring the company's long-term success. The board's composition is a key aspect of understanding the Plus500 owner and its overall corporate governance framework. For more information about the company's background, you can read a Brief History of Plus500.

| Board Member | Role | Key Responsibility |

|---|---|---|

| Professor Jacob Frenkel | Independent Non-Executive Director and Chairman | Overseeing the board's activities and ensuring effective governance. |

| David Zruia | Group Chief Executive Officer and Director | Leading the company's strategic direction and daily operations. |

| Elad Even-Chen | Group Chief Financial Officer and Director | Managing the company's financial strategies and reporting. |

| Professor Varda Liberman | Senior Independent Non-Executive Director | Providing independent oversight and guidance. |

The voting structure at Plus500 follows a one-share-one-vote principle for ordinary shares. However, the company holds a significant number of treasury shares. As of December 31, 2024, Plus500 held 40,569,750 ordinary shares in treasury, representing approximately 35% of the company's issued share capital. This substantial holding of treasury shares impacts the overall voting dynamics, as these shares do not carry voting rights. Shareholder scrutiny over executive compensation has been a notable issue. At the Annual General Meeting (AGM) in May 2025, 51% of shareholders opposed the 2024 remuneration report.

The board's structure reflects a mix of executive leadership, shareholder representation, and independent oversight.

- The company's voting structure follows a one-share-one-vote principle.

- Shareholders expressed concerns over executive compensation at the 2025 AGM.

- The company held approximately 35% of its shares in treasury as of December 31, 2024.

- The board is committed to addressing shareholder feedback to improve corporate governance.

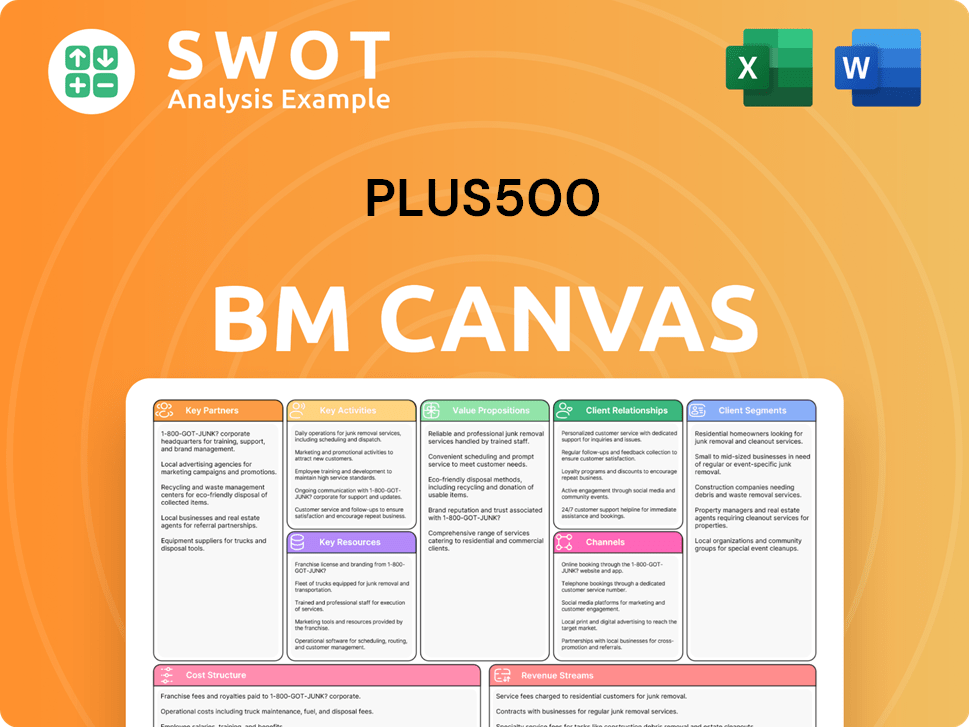

Plus500 Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Plus500’s Ownership Landscape?

In the past few years, the Plus500 company has actively managed its capital, which has influenced its ownership profile. In February 2025, Plus500 announced additional shareholder returns of $200 million, with $110 million allocated for share buyback programs and $90 million for dividends. This follows the $345.2 million returned to shareholders in FY 2024, including $195.0 million in share buybacks and $150.2 million in dividends. Since its IPO in 2013, the company has returned approximately $2.5 billion to shareholders through dividends and share buybacks. These share buybacks aim to increase value for shareholders and effectively utilize excess cash, while also consolidating ownership by reducing the number of outstanding shares.

The company's strategic acquisitions, such as the March 2025 acquisition of Mehta Equities for £20 million, have also shaped its ownership structure. This move into the Indian market aligns with its global expansion strategy. Furthermore, the increase in institutional ownership shows a shift in the Plus500 ownership. For example, Capital Group became the third-largest shareholder in June 2025 with a 5.44% stake, following BlackRock (6.7%) and JP Morgan (5.5%) as of March 2025. The company's focus on diversifying its product offerings beyond CFDs into futures and share dealing, particularly in the US and emerging markets like India, indicates a strategic shift. For 2025, Plus500's board anticipates its financial performance to be in line with or ahead of current market expectations, with a continued focus on strategic growth through investments and acquisitions.

The Plus500 company's management of capital, including share buybacks and dividends, has returned significant value to shareholders. The recent acquisition of Mehta Equities and the expansion into new markets like India demonstrate the company's strategic growth initiatives. Further insights into the company's approach can be found in the Marketing Strategy of Plus500.

Plus500 has actively managed its capital, leading to changes in its ownership. Share buybacks and dividends have returned billions to shareholders since 2013. This strategy aims to increase shareholder value and consolidate ownership.

Acquisitions like Mehta Equities have expanded Plus500's global footprint. These moves, along with new licenses and clearing memberships, are part of a broader strategy. The company is focusing on growth through investments and acquisitions.

Institutional investors are increasing their stakes in Plus500. Capital Group became a major shareholder in June 2025. This trend indicates confidence in the company's future.

Plus500 anticipates strong financial performance in 2025. The company is focused on strategic growth and expansion. This includes diversifying product offerings and entering new markets.

Plus500 Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Plus500 Company?

- What is Competitive Landscape of Plus500 Company?

- What is Growth Strategy and Future Prospects of Plus500 Company?

- How Does Plus500 Company Work?

- What is Sales and Marketing Strategy of Plus500 Company?

- What is Brief History of Plus500 Company?

- What is Customer Demographics and Target Market of Plus500 Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.