Ally Financial Bundle

How Does Ally Financial Thrive in the Digital Age?

Ally Financial has revolutionized the financial landscape, especially within the Ally Financial SWOT Analysis. From its roots in auto financing to its expansion into a full suite of digital banking services, Ally has consistently challenged traditional banking models. This pioneering approach has not only reshaped the industry but also provided a compelling case study for understanding the future of finance.

Ally's success hinges on its innovative digital-first strategy, offering competitive rates and a user-friendly experience. Understanding Ally's operational framework is crucial for anyone looking to navigate the complexities of modern finance, whether you're exploring Ally auto financing options, considering an Ally Invest account, or simply curious about Ally Bank's competitive advantages. This analysis will break down how Ally generates revenue and maintains a competitive edge.

What Are the Key Operations Driving Ally Financial’s Success?

The core of Ally Financial's operations centers on its digital-first approach to financial services. This model allows the company to serve a diverse customer base, including consumers, auto dealers, and commercial clients. Ally's value proposition emphasizes convenience, competitive pricing, and efficient service delivery, all enabled by a strong digital infrastructure.

Ally offers a range of services, including auto finance, mortgage finance, insurance, and commercial banking. Ally Bank, its direct banking arm, provides deposit products like savings accounts and certificates of deposit, alongside credit cards and personal loans. This structure enables Ally to streamline operations and offer attractive terms to its customers.

The company's operational processes are heavily reliant on technology and digital platforms. For example, Ally collaborates with a vast network of auto dealers to provide financing solutions for new and used vehicles. This involves digital application and approval processes, efficient loan servicing, and risk management. In the mortgage sector, Ally simplifies the application experience from pre-approval to closing. The insurance segment provides vehicle protection products, further integrating with its auto finance operations. Commercial banking services cater to businesses with various lending and treasury management solutions. This operational efficiency allows Ally to maintain a competitive edge in the financial services market.

Ally partners with auto dealers to offer financing for new and used vehicles. This involves digital application processes and efficient loan servicing. In 2024, the auto finance segment was a significant contributor to Ally's revenue, reflecting the company's strong presence in this market.

Ally provides a streamlined mortgage application experience through its digital platform. This includes pre-approval and closing processes. The mortgage segment contributes to Ally's diversified financial offerings, providing customers with accessible home financing solutions.

The insurance segment offers vehicle protection products, integrated with auto finance operations. This integration enhances the customer experience and provides added value. The insurance offerings complement Ally's core financial services.

Ally offers commercial banking services, including lending and treasury management solutions for businesses. This segment diversifies Ally's revenue streams and supports business clients. Commercial banking services cater to businesses with various lending and treasury management solutions.

Ally's direct banking model allows it to reduce overhead costs, offering competitive interest rates on deposits and potentially lower fees. This lean structure and digital infrastructure provide significant advantages. For further insights into the company's structure, you can explore the details about Owners & Shareholders of Ally Financial.

- Competitive Pricing: Ally's operational efficiency allows it to offer attractive interest rates on savings accounts and other deposit products.

- Convenience: Customers benefit from easy-to-use digital platforms for managing their finances, applying for loans, and accessing customer service.

- Efficiency: Streamlined digital processes result in faster loan approvals, efficient servicing, and overall improved customer experience.

- Technological Advancement: Ally continuously invests in its digital infrastructure to enhance its services and meet evolving customer needs.

Ally Financial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ally Financial Make Money?

The revenue streams and monetization strategies of Ally Financial are built on a diversified approach, primarily focusing on lending, deposit products, and financial services. The company generates substantial income from net interest income, which is the difference between interest earned on loans and investments and interest paid on deposits and borrowings. In the first quarter of 2025, the company reported net financing revenue of $1.5 billion.

Ally's strategy involves multiple income sources, including auto finance, mortgage finance, insurance products, and commercial banking. The digital platform plays a crucial role in customer acquisition and efficient management of its lending and deposit portfolios. This integrated approach allows Ally to effectively monetize its financial product offerings.

The company's auto finance segment is a key revenue driver, generating interest income from retail installment contracts and leases. Mortgage finance also contributes through interest on residential mortgage loans. Additionally, revenue is earned from insurance products, such as vehicle service contracts. Commercial banking activities further contribute through interest income from loans to commercial clients. The deposit products of Ally Bank, while a source of funding, also support profitability by providing a stable and relatively low-cost funding base. Ally also generates non-interest income through various fees.

The main revenue streams for Ally Financial are diverse, including net interest income, auto financing, and various fees. Ally's strategic focus on digital platforms allows for efficient customer acquisition and management of its financial products. Learn more about the company's operations in this detailed overview of Ally Financial.

- Net Interest Income: The largest revenue component, derived from the difference between interest earned on loans and investments and interest paid on deposits and borrowings.

- Auto Finance: Interest income from retail installment contracts and leases.

- Mortgage Finance: Interest income from residential mortgage loans.

- Insurance Products: Revenue from vehicle service contracts and GAP waivers.

- Commercial Banking: Interest income from loans to commercial clients.

- Fees: Non-interest income from origination fees, servicing fees, and other transactional charges.

Ally Financial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Ally Financial’s Business Model?

The evolution of Ally Financial showcases a remarkable transformation, transitioning from its roots as GMAC, the financial arm of General Motors, into a leading digital financial services provider. This journey involved a strategic shift towards a direct-to-consumer banking model, spearheaded by Ally Bank, which allowed the company to diversify its customer base and lessen its dependence on a single corporate entity. A significant challenge during this period was navigating the aftermath of the 2008 financial crisis, which necessitated a government bailout and subsequent restructuring.

Ally Financial's recovery and subsequent success are notable, having repaid its government aid and re-established itself as an independent financial institution. This transition highlights the company's resilience and strategic adaptability. The company's ability to navigate such significant hurdles underscores its commitment to long-term sustainability and growth in the financial services sector. This period set the stage for its future digital-first approach and competitive advantages.

The company's competitive edge is rooted in its digital-first approach, which allows for lower operational costs compared to traditional banks. This efficiency enables Ally to offer competitive rates on deposits and loans, attracting a large customer base. Its strong brand recognition, particularly in auto finance, further solidifies its position. Ally has also strategically invested in technology and data analytics to enhance its customer experience, streamline operations, and improve risk management. For instance, in 2024, Ally continued to focus on digital innovation to enhance its customer-facing platforms. The company's ability to adapt to evolving customer preferences for digital banking and its diversified product offerings across auto, mortgage, and personal lending segments contribute to its sustained competitive advantage.

The transformation from GMAC to Ally Financial was a pivotal moment. This involved a strategic shift to digital banking, including the establishment of Ally Bank. Navigating the 2008 financial crisis and repaying government aid were significant achievements.

Ally's strategic moves include a focus on digital innovation, competitive rates, and diversified product offerings. Investments in technology and data analytics have enhanced customer experience. The company has expanded its services across auto financing, mortgages, and personal loans.

Ally's competitive advantage lies in its digital-first model, enabling lower operating costs. This allows for attractive rates on deposits and loans, and a strong brand presence. The company's ability to adapt to evolving customer preferences for digital banking and its diversified product offerings across auto, mortgage, and personal lending segments contribute to its sustained competitive advantage.

In 2024, Ally continued to focus on digital innovation to enhance its customer-facing platforms. This includes improvements to its online banking features and mobile app. The company's commitment to technology and data analytics is ongoing.

Ally Financial's performance is marked by consistent growth and strategic financial management. The company's digital banking model has allowed it to maintain competitive interest rates and attract a large customer base. Key statistics reflect its strong position in the market.

- Ally Bank offers competitive interest rates on savings accounts and CDs. For example, in early 2024, Ally Bank CD rates were highly competitive.

- Ally Invest provides investment options with low fees and commissions. Ally Invest account minimums are designed to be accessible.

- Ally auto financing continues to be a significant part of its business, offering competitive auto loan rates and terms. The Ally auto financing application process is streamlined.

- The Ally credit card rewards program is designed to attract and retain customers.

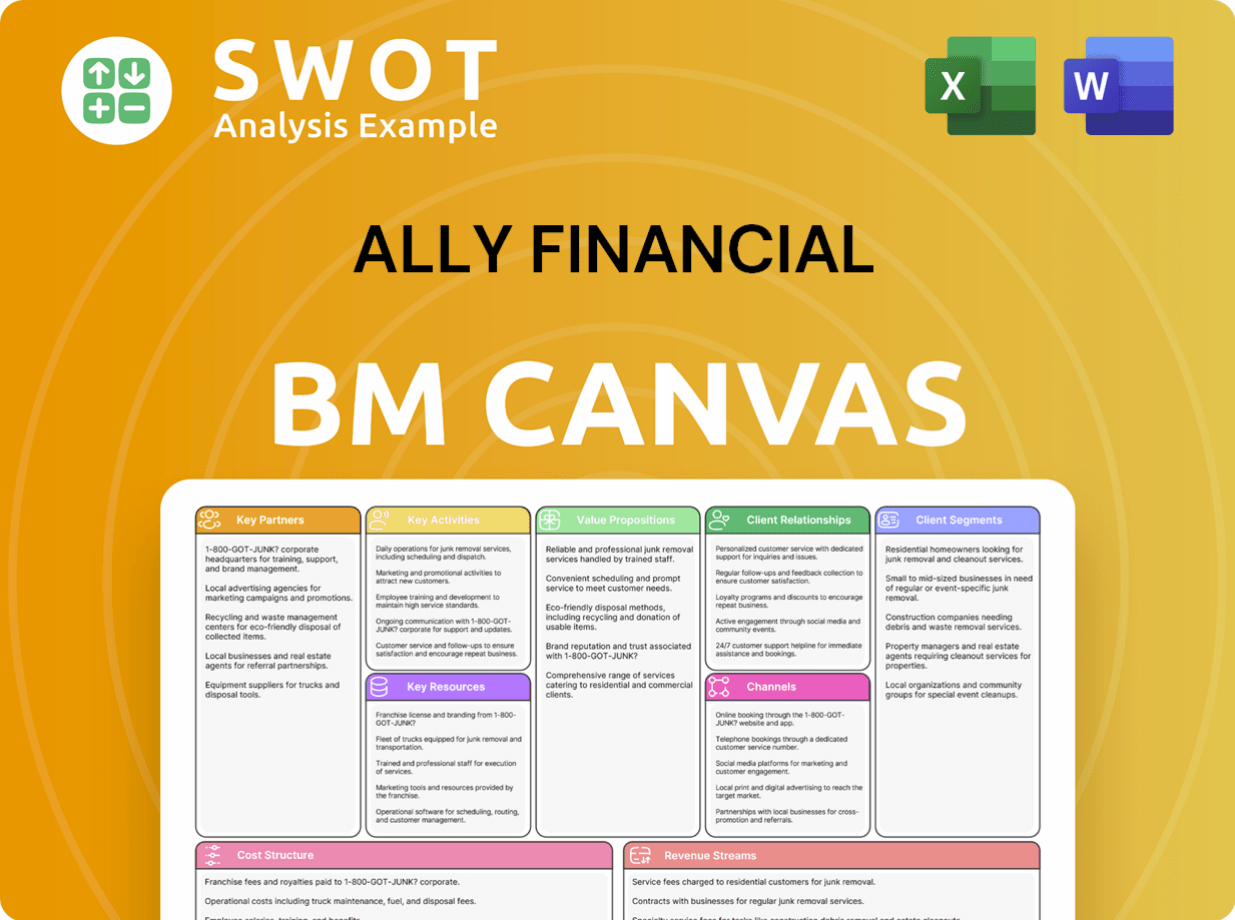

Ally Financial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Ally Financial Positioning Itself for Continued Success?

The financial services landscape sees Ally Financial positioned as a significant player, especially in the digital arena. Its strong presence in the U.S. auto finance market and its direct banking subsidiary, Ally Bank, underline its competitive edge. Customer loyalty is often fueled by competitive rates and user-friendly digital platforms.

However, Ally navigates several key risks. Regulatory changes, economic downturns, rising interest rates, and competition from traditional and fintech companies pose ongoing challenges. The dynamic interest rate environment in early 2025, for example, presented both opportunities and challenges for Ally's net interest margin.

Ally Financial is a key player in digital financial services, especially in auto financing. Ally Bank competes effectively in the online deposit space. Its customer loyalty is supported by competitive rates and user-friendly digital platforms, which have helped Ally attract and retain customers. This is crucial in a competitive market.

Ally faces risks from regulatory changes, economic downturns, and rising interest rates. Competition from traditional banks and fintech companies also presents challenges. A key risk involves managing credit quality within its loan portfolios, especially during economic fluctuations. These factors can significantly impact profitability.

Ally is focused on technology investment and digital innovation to enhance customer experience. The company aims to diversify its product offerings and expand commercial banking. Responsible growth, maintaining a strong capital position, and data analytics are key to their strategy. Ally's future depends on adapting to market changes, managing credit risk, and digital innovation.

Ally Financial is focusing on strategic initiatives to sustain revenue growth. This includes investing in technology and digital innovation. The company is also looking to diversify its product offerings. Leadership emphasizes responsible growth and leveraging data analytics to optimize lending and deposit strategies, according to the Growth Strategy of Ally Financial.

Ally's success hinges on several key factors. Adapting to market changes and effectively managing credit risk are crucial. The company must continue innovating its digital financial services to meet evolving customer demands. Furthermore, maintaining a strong capital position is essential for weathering economic uncertainties.

- Technological Innovation: Continuous investment in digital platforms.

- Risk Management: Effective management of credit risk in loan portfolios.

- Customer Experience: Providing competitive rates and user-friendly services.

- Strategic Diversification: Expanding product offerings and commercial banking.

Ally Financial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ally Financial Company?

- What is Competitive Landscape of Ally Financial Company?

- What is Growth Strategy and Future Prospects of Ally Financial Company?

- What is Sales and Marketing Strategy of Ally Financial Company?

- What is Brief History of Ally Financial Company?

- Who Owns Ally Financial Company?

- What is Customer Demographics and Target Market of Ally Financial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.