Ally Financial Bundle

How Does Ally Financial Dominate the Digital Finance Realm?

Ally Financial, a titan in the digital finance space, has dramatically transformed from its roots as GMAC, a company deeply embedded in the traditional automotive industry. Today, it's a financial powerhouse with a laser focus on digital innovation and customer satisfaction. Discover how Ally Financial's strategic shifts have redefined its market presence and customer engagement.

This article explores the evolution of Ally Financial SWOT Analysis, from its early days in auto financing to its current status as a leading digital bank. We'll dissect its Ally Financial sales strategy and Ally Financial marketing strategy, analyzing how the company leverages digital channels to reach its target audience and build brand awareness. Learn about the Ally Financial strategy and the innovative marketing campaigns that drive its growth, providing actionable insights for financial professionals and business strategists alike.

How Does Ally Financial Reach Its Customers?

The sales channels of Ally Financial are primarily centered around digital platforms, complemented by strategic partnerships. This approach allows the company to offer a range of financial products and services, including deposits, credit cards, personal loans, and mortgage financing through Ally Home. This digital-first strategy is a key component of its business model, enabling competitive rates and efficient operations.

Ally's sales strategy leverages its company website and mobile applications to provide a seamless customer experience. The company's digital-first approach has been pivotal in its growth, allowing it to reach a broad customer base and streamline its operations. The evolution of these channels reflects a strategic shift toward digital adoption and omnichannel integration, which is crucial for maintaining a competitive edge in the financial industry.

Beyond its direct digital engagement, Ally maintains a strong presence in auto finance through collaborations with automotive dealerships and manufacturers. These strategic partnerships are crucial for expanding its reach and providing comprehensive financial solutions within the automotive sector. This diversified channel strategy extends beyond individual consumers, encompassing corporate finance and dealer financing.

Ally's core sales channels include its website and mobile applications. These platforms offer a seamless experience for various financial products. The digital-first approach allows for lower overhead costs and competitive rates.

Ally collaborates with automotive dealerships and manufacturers for auto finance. These partnerships are vital for expanding reach within the automotive sector. They also provide financing solutions for over 20,000 automotive dealerships.

Ally's auto finance business is a significant part of its sales strategy. In Q1 2025, they highlighted record levels of consumer originations at $10.2 billion. This reflects a market-leading position and strong dealer relationships.

Ally's corporate finance business provides capital for equity sponsors and middle-market companies. This demonstrates a diversified channel strategy extending beyond individual consumers. This diversification supports the overall Ally Financial sales strategy.

Ally Financial's sales strategy focuses on digital platforms and strategic partnerships. This approach allows the company to reach a broad customer base and offer competitive financial products. Understanding the Ally Financial marketing strategy is crucial for investors.

- Digital Banking: Utilizes website and mobile apps for direct customer engagement.

- Auto Finance: Partners with dealerships and manufacturers to expand reach.

- Corporate Finance: Provides capital to equity sponsors and middle-market companies.

- Direct-to-Consumer: Ally Bank deposit customers account for over 70% of direct-to-consumer origination volume.

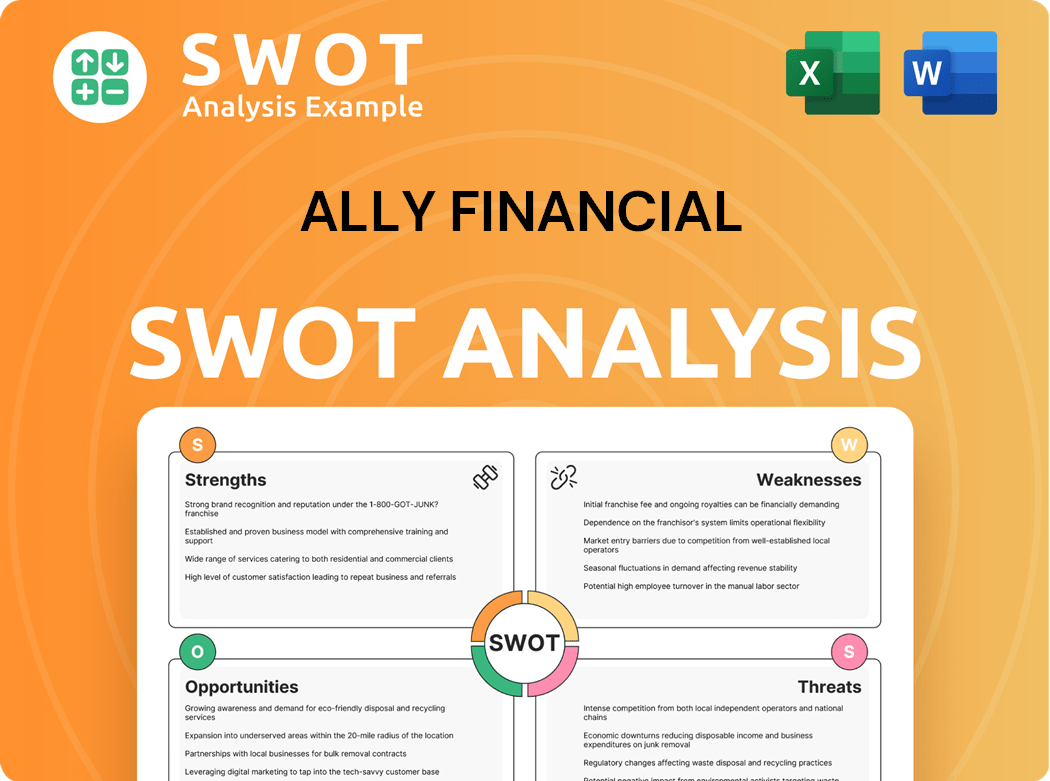

Ally Financial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Ally Financial Use?

The marketing tactics employed by Ally Financial, a prominent financial services provider, are multifaceted, focusing on digital strategies while also incorporating traditional media. This approach is designed to build brand awareness, generate leads, and drive sales. The company's strategy is a blend of modern digital methods and established marketing practices, demonstrating a commitment to reaching its target audience effectively.

Ally Financial's marketing efforts are heavily data-driven, leveraging customer insights to personalize communications and tailor products and services. They use customer data to understand behaviors and preferences, enabling personalized marketing campaigns. This customer-centric approach is a key element of their overall strategy, ensuring that marketing efforts are relevant and resonate with their target audience.

A significant portion of Ally Financial's strategy involves digital marketing. This includes Search Engine Optimization (SEO) to enhance website visibility and attract organic traffic, content marketing to educate and engage the target audience, and social media marketing to reach wider audiences and generate leads. Paid advertising and email marketing are also key components of their digital strategy.

Ally Financial's digital marketing strategy is comprehensive, with SEO playing a crucial role in driving organic traffic. Content marketing, including blog posts, articles, and videos, is used to educate and engage the target audience. Social media marketing on platforms like Facebook, Twitter, and TikTok helps reach wider audiences.

Ally Financial actively uses social media platforms to engage with customers and generate leads. A notable example is the partnership with Hispanic influencers on TikTok, which resulted in significant engagement, including 25 million views and 140 million impressions for one campaign. This demonstrates the company's ability to create culturally relevant content.

Paid advertising, including programmatic advertising and targeted audience segments, is used to reach specific consumer groups. Email marketing is also a vital digital tactic, with experiments using AI-generated language for cross-selling campaigns, leading to improvements in customer engagement.

Ally Financial emphasizes data-driven marketing, customer segmentation, and personalization. Customer data is collected and analyzed to understand behavior and preferences, enabling personalized communication and marketing campaigns. This approach ensures that marketing efforts are highly targeted and relevant.

The company is exploring and implementing Generative AI (GenAI) through its in-house platform, 'Ally.ai,' in partnership with OpenAI and experimenting with Amazon's Bedrock. These GenAI efforts have shown promising results in marketing, reducing the time needed for creative campaigns and content by 34%, saving approximately 3,000 hours of human work.

Traditional media, such as TV, radio, and print, continues to be part of Ally's marketing mix. The 2024 streaming-only Super Bowl ad emphasized savings. Event-based marketing and strategic alliances, like the multi-year partnership with the WNBA, enhance brand visibility and market reach.

Ally Financial is focusing on customer referral programs, which have proven highly efficient. These programs account for about 15% of the bank's account volume and are three to four times more efficient than other marketing avenues. The cost to acquire a customer through these programs is less than $100. For more information on the company's ownership and financial structure, you can read about the Owners & Shareholders of Ally Financial.

- SEO is used to enhance website visibility and attract organic traffic.

- Content marketing is used to educate and engage the target audience.

- Social media marketing is used to reach wider audiences and generate leads.

- Paid advertising and email marketing are key components of their digital strategy.

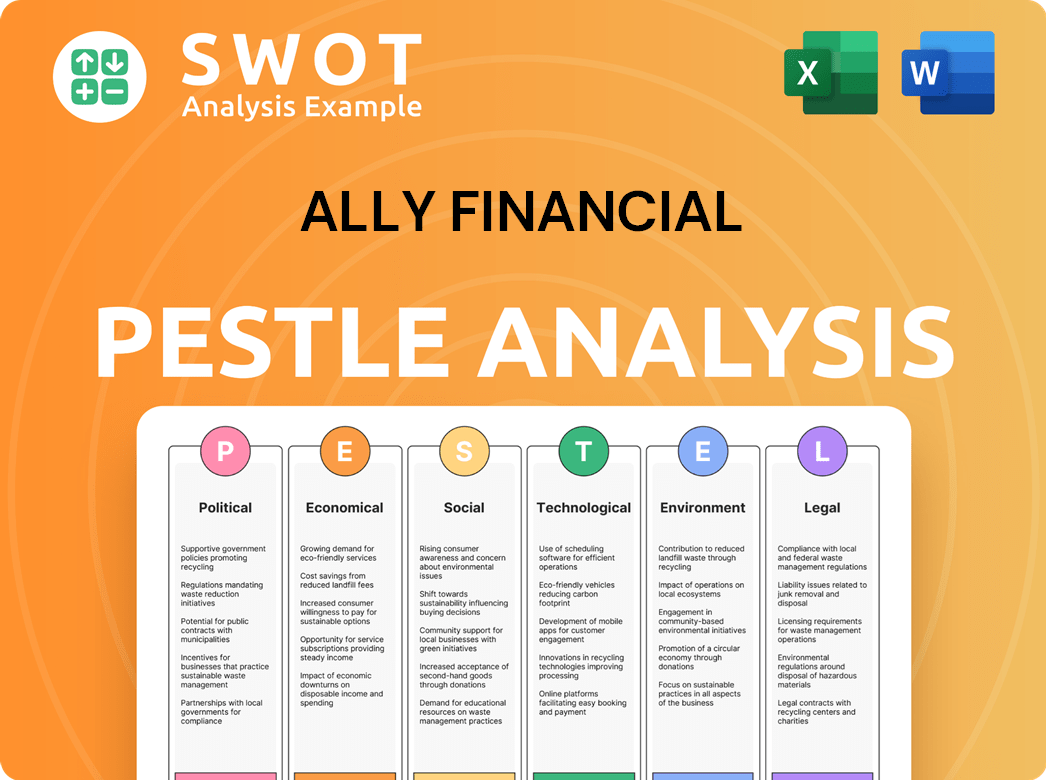

Ally Financial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Ally Financial Positioned in the Market?

The brand positioning of Ally Financial centers on being a customer-centric, digital-first financial institution. Their core message, 'Do. It Right,' emphasizes transparency, simplicity, and a commitment to being a reliable partner for customers and communities. This approach aims to distinguish Ally from traditional banks by offering a modern, tech-savvy experience.

Ally's visual identity reflects its digital-native nature, employing a minimalist design that conveys confidence and reliability. This brand identity is consistently maintained across all channels, from online platforms to marketing campaigns. The focus on customer satisfaction is evident in personalized service and responsive customer support, which has earned them numerous awards.

Ally Financial's strategy also involves adapting to consumer trends and competitive pressures. They continuously innovate their products and services, leveraging technology to enhance the customer experience. An example of this is the elimination of overdraft fees, demonstrating a dedication to supporting financially vulnerable customers. To learn more about their overall strategy, you can read about the Growth Strategy of Ally Financial.

Ally Financial places a strong emphasis on customer satisfaction and loyalty. This is reflected in their personalized service and responsive customer support. This approach has led to positive brand perception and numerous industry awards.

Ally's brand identity is built around being a digital-first organization. Their minimalist logo and modern tone of voice reflect this. This digital focus allows them to offer competitive rates and lower fees.

A key part of Ally's value proposition is offering competitive rates and lower fees. This is made possible by the absence of physical branches. This strategy appeals to financially savvy consumers.

Ally is committed to supporting communities through financial education, affordable housing, and workforce preparedness. This commitment enhances their brand image and resonates with a broader audience. They focus on being a 'relentless ally' to their customers.

Ally Financial's Ally Financial marketing strategy focuses on specific demographics. They target online banking users and tech-savvy individuals. Younger demographics, like millennials and Gen Z, are a significant part of their customer base.

- In a recent quarter, millennials and Gen Z comprised 74% of new deposit customers.

- This demonstrates the appeal of digital banking to younger generations.

- Their Ally Financial sales strategy is tailored to attract and retain these customers.

- Ally Financial marketing efforts are optimized for digital channels.

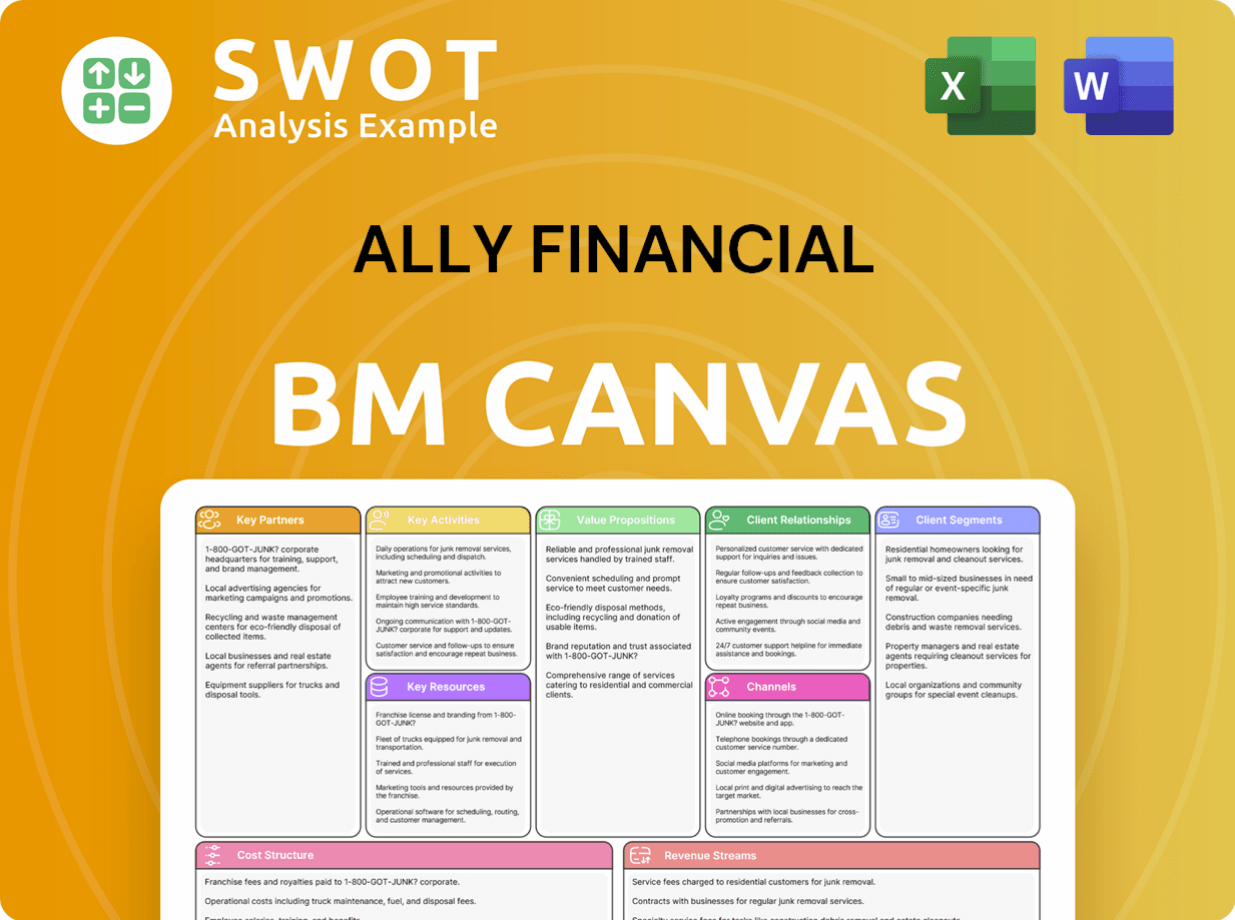

Ally Financial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Ally Financial’s Most Notable Campaigns?

The Ally Financial sales strategy and marketing strategy are consistently focused on driving financial literacy, enhancing product awareness, and building brand recognition. These initiatives often leverage digital channels and strategic partnerships to reach a broad audience. The company's approach emphasizes a customer-centric model, utilizing innovative campaigns to resonate with consumers and highlight the benefits of its online-only banking experience.

Ally Financial's marketing campaigns are carefully designed to underscore its commitment to digital innovation and a customer-first approach. These campaigns frequently involve social media engagement, influencer partnerships, and high-profile events to promote practical financial solutions. The company's focus on financial equity and social impact is also evident in its marketing initiatives.

The company's 'Letter to America' campaign, a historical initiative, aimed to capitalize on consumer dissatisfaction with traditional banking. It highlighted the advantages of Ally's online-only model, indirectly encouraging consumers to seek better deals and a more customer-centric experience. This campaign was a significant step in establishing Ally's brand in the financial services sector.

In 2024, Ally ran a streaming-only Super Bowl ad, emphasizing how consumers could use Ally to save for items seen during the game. This campaign was designed to promote practical financial solutions and reinforce Ally's savings-focused messaging. This approach highlighted Ally's commitment to helping consumers achieve their financial goals.

The 'Confessiongrams' campaign on Instagram challenged users to play a virtual 'truth or dare' game focused on financial questions, aiming to destigmatize conversations about money. This campaign used user-generated content and partnered with influencers to extend its reach and spark conversation, gathering insights that showed a high percentage of young adults prioritizing personal happiness over higher pay in career moves.

In 2022, Ally launched a first-of-its-kind TikTok Creator Ambassador Program, partnering with genuine Ally customers as influencers to create culturally relevant financial education content, particularly targeting the Hispanic demographic. This initiative resulted in over 202 million video views and a 53% increase in Ally's TikTok followers, demonstrating its effectiveness in fostering emotional connections and promoting financial literacy.

Launched around November 2024, Ally's '50/50 Pledge' committed equal media dollars to men's and women's sports. This initiative aimed to address the pay gap and lack of revenue in women's sports. It boosted brand visibility and reinforced Ally's commitment to financial equity and social impact, aligning with its 'Do It Right' brand purpose.

In Q1 2025, Ally highlighted its multi-year partnership with the WNBA as a key alliance that leverages its brand and extends market reach. These collaborations demonstrate Ally's strategy of engaging with diverse audiences and aligning its brand with meaningful causes. This partnership is part of Ally's broader strategy to support women's sports and promote financial equity.

- Digital Marketing Strategy: Focuses on enhancing online presence and customer engagement through targeted campaigns.

- Social Media Strategy: Utilizes platforms like TikTok and Instagram to connect with audiences and promote financial literacy.

- Brand Awareness Strategies: Leverages partnerships and high-profile events to increase visibility and brand recognition.

- Marketing Channel Optimization: Continuously evaluates and refines its marketing channels to maximize effectiveness.

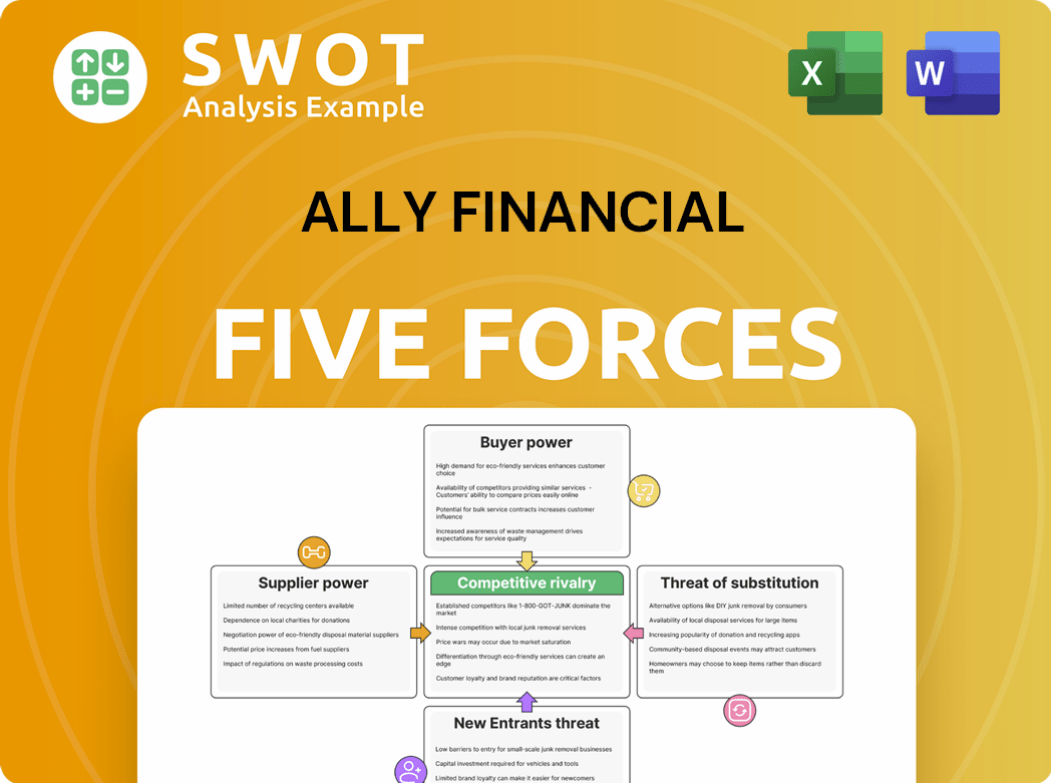

Ally Financial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ally Financial Company?

- What is Competitive Landscape of Ally Financial Company?

- What is Growth Strategy and Future Prospects of Ally Financial Company?

- How Does Ally Financial Company Work?

- What is Brief History of Ally Financial Company?

- Who Owns Ally Financial Company?

- What is Customer Demographics and Target Market of Ally Financial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.