Edward Jones Bundle

How Does Edward Jones Thrive in the Financial World?

Edward Jones stands out in the financial services landscape, but how does this firm truly operate? With a focus on personalized service and a vast network of advisors, Edward Jones has cultivated a unique approach to wealth management. Understanding its operational structure and revenue streams is key to grasping its value proposition and long-term viability.

Delving into the inner workings of Edward Jones, we'll explore its client-centric model, which emphasizes face-to-face interactions and tailored Edward Jones SWOT Analysis. This approach has allowed the firm to build strong relationships with individual investors, focusing on their Financial planning, Investment strategies, and Retirement planning needs. By examining its operations, revenue sources, and strategic positioning, we can gain a comprehensive understanding of how Edward Jones has become a significant player in the financial industry, and answer questions like "How does Edward Jones make money" and "Edward Jones fees explained."

What Are the Key Operations Driving Edward Jones’s Success?

At the heart of Edward Jones's operations lies its network of financial advisors, who are the primary touchpoint for clients. They offer personalized investment advice, retirement planning, and various financial solutions. The firm caters to a diverse clientele, from those new to investing to high-net-worth individuals seeking sophisticated wealth management. The Marketing Strategy of Edward Jones emphasizes building strong relationships through its advisors.

Edward Jones's operational model is centered around a localized, branch-office structure. Each financial advisor typically operates from a single-advisor office, fostering close relationships within the community. This localized approach is supported by a robust back-office infrastructure that handles research, compliance, and administrative functions. The firm's supply chain sources investment products, including mutual funds, stocks, and insurance, from various providers.

The distribution of services is primarily driven by the financial advisors, who build client relationships through referrals and community involvement. Edward Jones distinguishes itself through its commitment to one-on-one advisor-client relationships, emphasizing trust and long-term financial planning. This focus provides clients with tailored advice and consistent support, setting it apart from digital platforms.

Edward Jones offers investment advice, retirement planning, education savings strategies, and insurance solutions. These services are tailored to meet the individual needs of clients. The firm's focus is on building long-term financial strategies.

The firm operates through a network of branch offices, each typically staffed by a single financial advisor. This localized approach allows advisors to build strong relationships with their clients. A robust back-office supports the advisors with research, compliance, and administrative functions.

The value proposition centers on personalized advice, a deep understanding of individual financial goals, and consistent support. This approach differentiates Edward Jones from more generalized or purely digital platforms. The emphasis is on building trust and long-term financial planning.

Edward Jones serves a broad spectrum of individual clients, from those just starting their investment journey to high-net-worth individuals. The firm's services are designed to meet the diverse needs of its client base. This includes retirement planning, investment strategies, and wealth management.

Edward Jones distinguishes itself through its personalized approach and focus on long-term client relationships. This emphasis on individual attention and tailored advice sets the firm apart from competitors. The firm's localized branch model also fosters strong community ties.

- Personalized Advice: Tailored financial planning based on individual needs.

- Local Presence: Branch offices in communities across the country.

- Long-Term Focus: Emphasis on building lasting client relationships.

- Comprehensive Services: Offering investment, retirement, and insurance solutions.

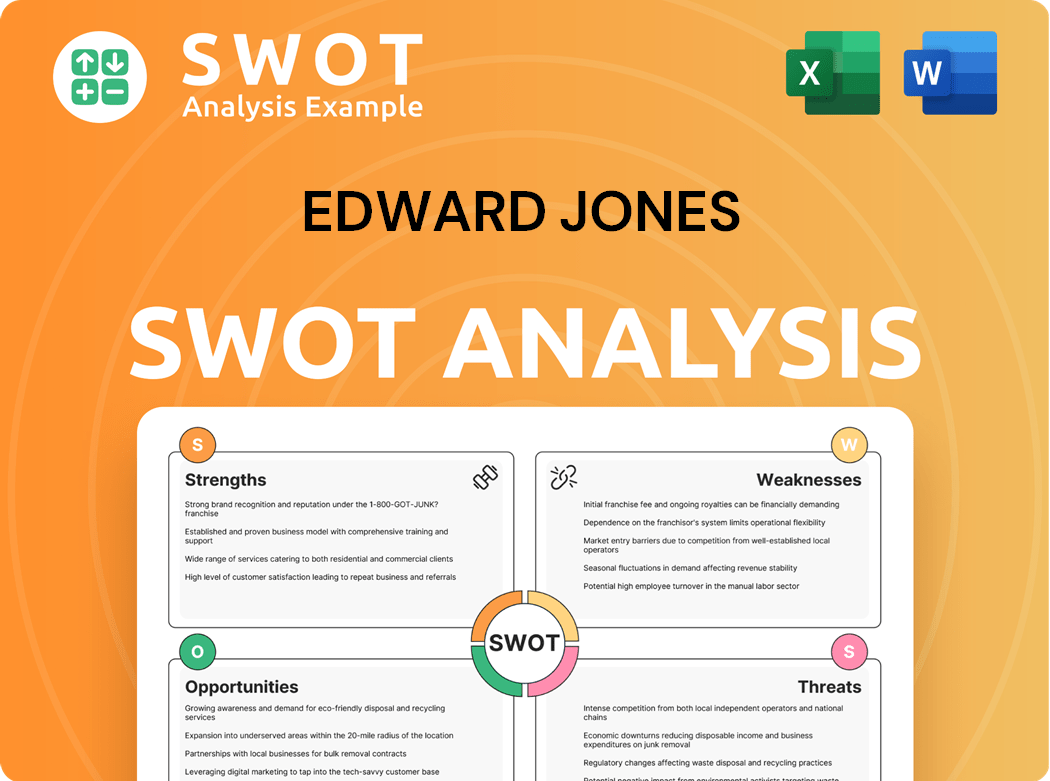

Edward Jones SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Edward Jones Make Money?

Edward Jones, a prominent player in the financial services sector, employs a multifaceted approach to generate revenue and monetize its services. Their financial model is primarily built around providing advisory services and selling financial products. This strategy allows them to cater to a broad range of client needs while ensuring a steady stream of income.

The firm's revenue streams are diversified, with a significant portion coming from asset-based fees. These fees are calculated as a percentage of the assets under management or care. In late 2024, Edward Jones reported approximately $1.9 trillion in total client assets, highlighting the substantial base from which these fees are derived. This asset base is a crucial indicator of the firm's financial health and its ability to generate revenue.

Commissions from the sale of investment products also contribute to Edward Jones's revenue. They offer a variety of investment options, including mutual funds, stocks, bonds, and insurance policies. Additionally, the firm earns revenue through service fees, such as account maintenance and transaction charges. This diversified approach helps Edward Jones maintain financial stability and adapt to changing market conditions.

Edward Jones's monetization strategy emphasizes building long-term client relationships and offering a comprehensive suite of financial products and services. This approach encourages clients to consolidate their assets with the firm, increasing asset-based fees over time. The firm's focus on financial planning and investment strategies is designed to meet various client needs, from retirement planning to estate considerations. For more insights into their target audience, you can explore the Target Market of Edward Jones.

- Asset-Based Fees: Earned as a percentage of assets under care or management.

- Commissions: Generated from the sale of investment products like mutual funds and stocks.

- Service Fees: Include account maintenance and transaction charges.

- Cross-Selling: Offering a wide range of financial products and services to meet diverse client needs.

- Long-Term Relationships: Encouraging clients to consolidate assets to increase fees.

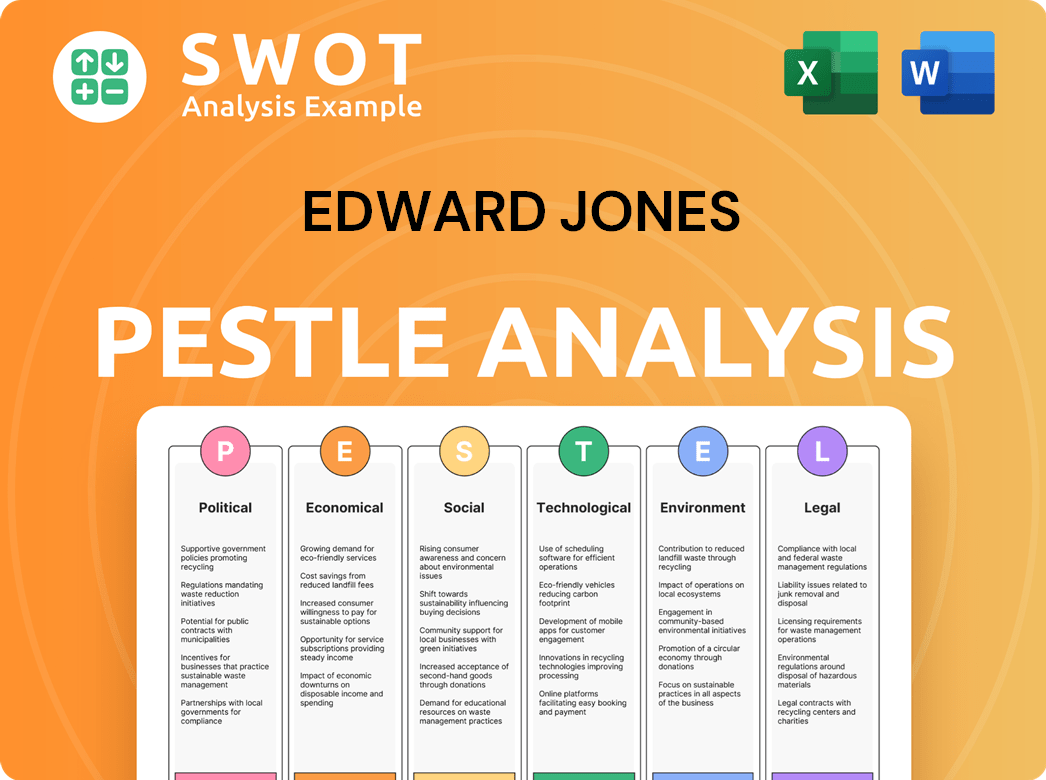

Edward Jones PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Edward Jones’s Business Model?

Edward Jones has a long history marked by significant milestones that have shaped its operational framework and financial performance. A key aspect of its growth has been the consistent expansion of its financial advisor network. This network is a cornerstone of its strategy, allowing the firm to reach a broad client base and provide personalized service.

The firm's strategic approach, which emphasizes a localized, single-advisor office model, has been a defining move. This model fosters deep client relationships and community integration. In recent years, Edward Jones has continued to invest in technology to improve client experience and advisor efficiency, adapting to the evolving digital landscape while maintaining its personal touch.

The company has faced operational challenges, including adapting to changing regulatory environments and navigating market downturns. Shifts in fee structures within the financial industry have prompted Edward Jones to evolve its offerings to remain competitive and compliant. The firm's response has often involved a blend of technological enhancements and a reinforcement of its core value proposition – personalized advice.

Edward Jones's history is marked by consistent growth and strategic adaptation. The firm has expanded its advisor network significantly over the years. This expansion has been crucial for reaching a wider audience and providing personalized financial advice.

A key strategic move for Edward Jones has been its localized, single-advisor office model. This approach allows for building strong client relationships. The firm has also invested heavily in technology to enhance client experience and advisor efficiency.

Edward Jones's competitive advantages include strong brand recognition and a large advisor network. Its extensive network provides a significant distribution advantage. The firm's economies of scale allow for efficient operations and investment in technology.

Edward Jones is adapting to new trends, such as the increasing demand for digital tools and sustainable investing options. The firm is integrating these into its established advisory model. This helps maintain its relevance in a changing financial landscape.

Edward Jones distinguishes itself through several competitive advantages. Its strong brand recognition, built on decades of client trust, is a significant asset. The firm's extensive network of financial advisors provides a strong local presence that many competitors lack. The firm's economies of scale, stemming from its large client base and assets under care, allow for efficient operations and investment in technology and support services. For a deeper understanding of how Edward Jones stacks up against its rivals, consider exploring the Competitors Landscape of Edward Jones.

- Strong Brand Recognition: Built on trust and a reputation for long-term investing.

- Extensive Advisor Network: Provides a significant distribution advantage.

- Economies of Scale: Efficient operations and investment in technology.

- Personalized Service: Focus on building relationships with clients.

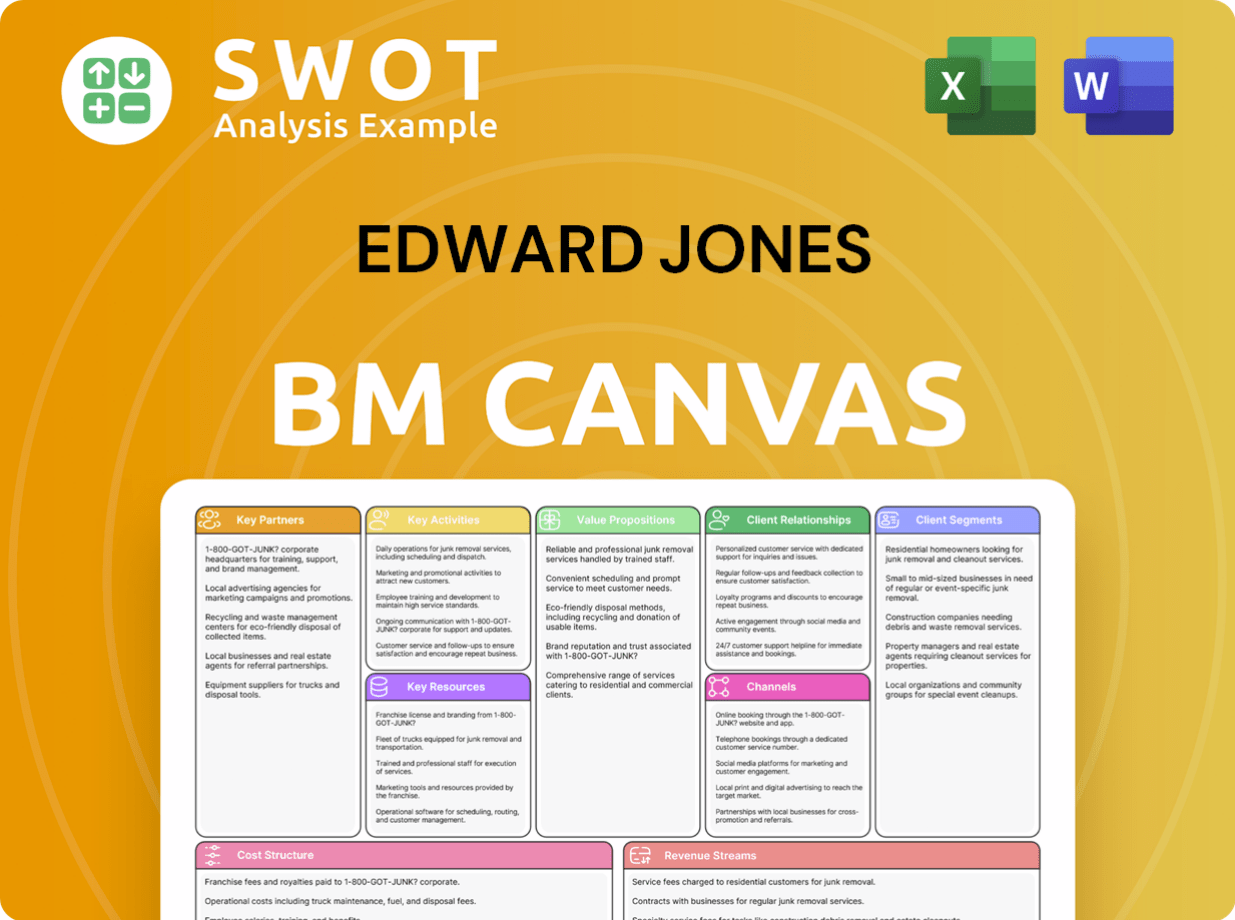

Edward Jones Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Edward Jones Positioning Itself for Continued Success?

Edward Jones holds a significant position in the wealth management sector, distinguished by its focus on individual investors and its extensive network of financial advisors. The firm consistently ranks among the largest financial services companies, with a strong presence in the United States and Canada. Its business model emphasizes personalized relationships, contributing to high customer loyalty. Owners & Shareholders of Edward Jones can see how the firm's structure supports this approach.

Despite its strengths, Edward Jones faces risks such as regulatory changes, competition from robo-advisors, and the need for technological adaptation. Changing consumer preferences, including demand for online self-service options, also present challenges. The firm must navigate these hurdles while maintaining its personalized service model and adapting to evolving client expectations.

Edward Jones is a major player in the wealth management industry, known for its extensive network of financial advisors and focus on individual investors. Its customer loyalty is a key strength, stemming from the personalized relationships fostered by its advisors. The firm's global reach is primarily concentrated in North America.

Edward Jones faces risks from regulatory changes, competition from robo-advisors, and the need for technological adaptation. Changing consumer preferences, such as a greater demand for online self-service options, also pose challenges to its traditional advisory model. Continuous investment in digital tools is crucial.

The future outlook for Edward Jones involves sustaining and expanding its ability to make money by leveraging its strong brand and advisor network, while strategically integrating digital capabilities and adapting to the evolving preferences of its client base. The firm aims to continue growing its assets under care and expanding its client relationships.

Ongoing strategic initiatives include continued investment in technology to enhance both the client and advisor experience. The firm is also broadening its service offerings to cater to a wider range of financial needs. Leadership emphasizes maintaining the firm's personalized approach while embracing innovation.

Edward Jones's success depends on adapting to changing market dynamics while maintaining its client-focused approach. The firm must balance its traditional model with the need for digital innovation to remain competitive. Key factors include regulatory compliance, technological advancements, and evolving client preferences.

- Regulatory Compliance: Navigating evolving regulations, particularly those concerning fiduciary standards and fee structures.

- Technological Integration: Investing in digital tools and platforms to meet evolving client expectations and compete with robo-advisors.

- Client Preferences: Adapting to changing consumer preferences, such as a greater demand for online self-service options and digital interaction.

- Competitive Landscape: Differentiating its services from those of competitors, including both traditional firms and digital platforms.

Edward Jones Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Edward Jones Company?

- What is Competitive Landscape of Edward Jones Company?

- What is Growth Strategy and Future Prospects of Edward Jones Company?

- What is Sales and Marketing Strategy of Edward Jones Company?

- What is Brief History of Edward Jones Company?

- Who Owns Edward Jones Company?

- What is Customer Demographics and Target Market of Edward Jones Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.